Writing a cover letter for a position as an insurance accountant can be an important part of the job application process. Whether you are new to the field or have many years of experience, crafting a well-written cover letter can help to set you apart from the competition. To help you get started, this guide will provide an overview of what to include in your cover letter, as well as an example cover letter to use as a reference. With this information, you will be well on your way to creating a cover letter that will allow you to effectively showcase your qualifications.

Download the Cover Letter Sample in Word Document – Click Below

If you didn’t find what you were looking for, be sure to check out our complete library of cover letter examples.

Start building your dream career today!

Create your professional cover letter in just 5 minutes with our easy-to-use cover letter builder!

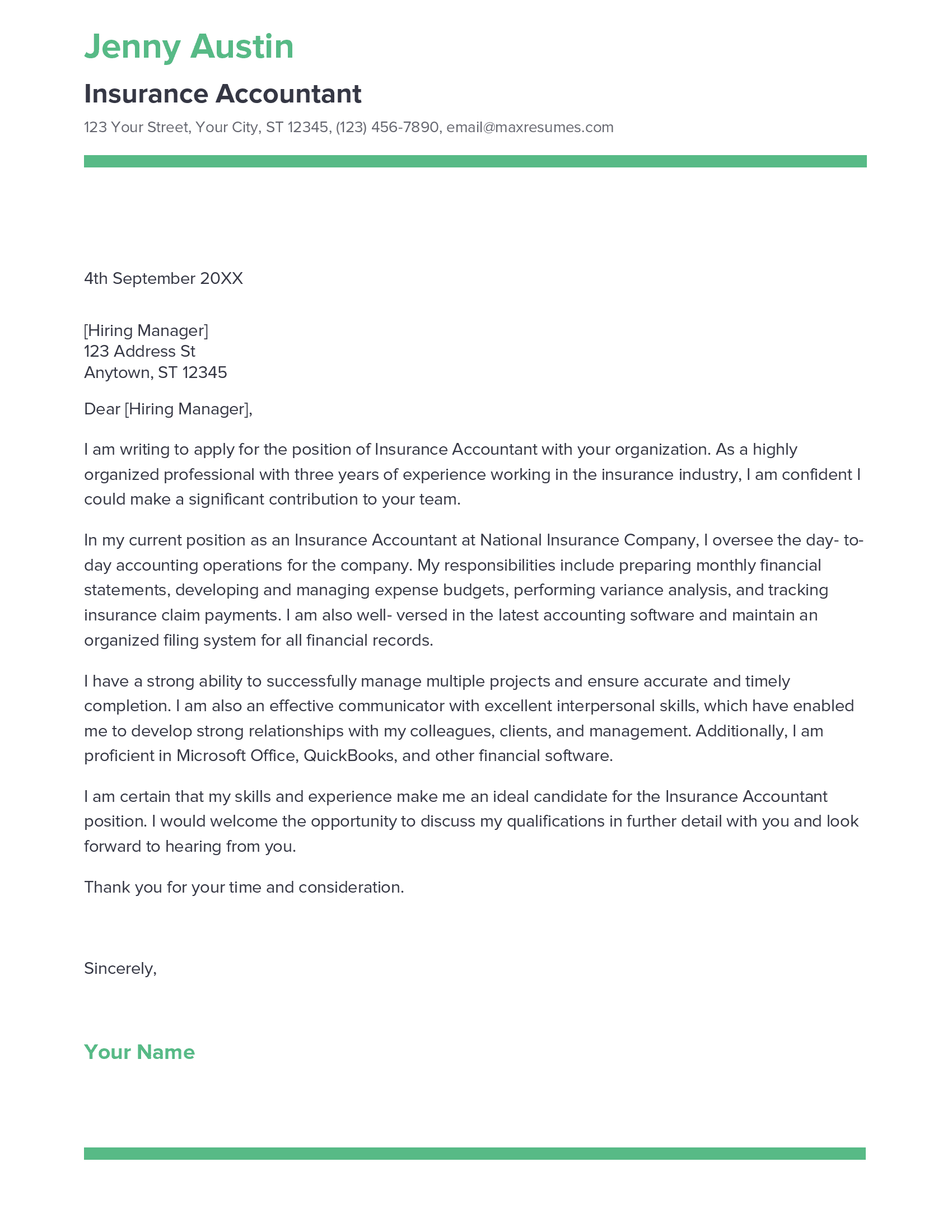

Insurance Accountant Cover Letter Sample

Dear [Hiring Manager],

I am writing to apply for the position of Insurance Accountant with your organization. As a highly organized professional with three years of experience working in the insurance industry, I am confident I could make a significant contribution to your team.

In my current position as an Insurance Accountant at National Insurance Company, I oversee the day- to- day accounting operations for the company. My responsibilities include preparing monthly financial statements, developing and managing expense budgets, performing variance analysis, and tracking insurance claim payments. I am also well- versed in the latest accounting software and maintain an organized filing system for all financial records.

I have a strong ability to successfully manage multiple projects and ensure accurate and timely completion. I am also an effective communicator with excellent interpersonal skills, which have enabled me to develop strong relationships with my colleagues, clients, and management. Additionally, I am proficient in Microsoft Office, QuickBooks, and other financial software.

I am certain that my skills and experience make me an ideal candidate for the Insurance Accountant position. I would welcome the opportunity to discuss my qualifications in further detail with you and look forward to hearing from you.

Thank you for your time and consideration.

Sincerely,

[Your Name]

Looking to improve your resume? Our resume examples with writing guide and tips offers extensive assistance.

What should a Insurance Accountant cover letter include?

A Insurance Accountant cover letter should include a brief introduction to the hiring manager, mentioning the position you are applying for and any relevant qualifications or experience you have that makes you a good fit for the role. Additionally, it should include a few sentences that explain your interest in the position and your enthusiasm for the company. You should also use the cover letter to highlight key areas of expertise that you possess that are necessary for the role, such as knowledge of insurance regulations, financial management, and accounting software. Finally, you should provide a call to action, such as suggesting a meeting to further discuss the position or to clarify any additional information to support your candidacy.

Insurance Accountant Cover Letter Writing Tips

If you are a qualified insurance accountant and looking to get hired, then you need to create a compelling cover letter to boost your chances of success. A cover letter gives you the opportunity to showcase your personality, skills, and qualifications that make you the right fit for the job. Here are some tips to help you write a winning cover letter for an insurance accountant position:

- Highlight your skills: Use your cover letter to highlight the skills and qualifications that make you the ideal candidate for the insurance accountant role. This includes your expertise in financial analysis, budgeting, bookkeeping, and risk management.

- Showcase your experience: Your cover letter should include information about your current or previous experience in accounting and finance. Include any jobs, internships, or volunteer work that relate to the insurance industry.

- Use a professional tone: Your cover letter should be written in a professional tone. Avoid using overly casual language or humor, and make sure to keep your language concise and to the point.

- Include references: Include references from past employers or colleagues that can speak to your qualifications and the quality of your work. This will help give potential employers confidence in your abilities.

- Proofread: Before sending your cover letter, it’s important to proofread it for any typos, grammatical errors, or awkward phrases. A polished and well- written cover letter can make a great first impression and help you stand out from other applicants.

Common mistakes to avoid when writing Insurance Accountant Cover letter

Cover letters can be an important part of the job search process, and it is important to craft one that stands out from the rest. As an insurance accountant, you will need to make sure your cover letter is as effective as possible in order to get the job you want. Here are some common mistakes to avoid when writing an insurance accountant cover letter:

- Not including relevant information: Your cover letter should be tailored specifically to the job you are applying for and should include relevant information about your experience and qualifications that make you the best candidate.

- Making the cover letter too long: You should aim to keep the cover letter to one page. Avoid going into too much detail or repeating yourself.

- Not proofreading your cover letter: Before sending your cover letter, be sure to read it thoroughly to make sure that there are no mistakes in spelling or grammar.

- Not addressing the letter to the right person: Make sure you research the company you are applying to and address the letter to the correct person.

- Not customizing your cover letter: Make sure you customize your cover letter to the job you are applying for. Do not just use a generic template.

- Not providing enough detail about your experience: Your cover letter should provide enough detail about your experience to convince the employer that you are the right fit for the job.

- Not including your contact information: Make sure to include your contact information in the cover letter so that the employer can get in touch with you.

By following these tips and avoiding these common mistakes, you can make sure that your cover letter stands out and makes a good impression on the employer.

Key takeaways

Writing an effective cover letter for insurance accountant positions can be a challenge. However, with some thoughtful preparation, you can easily stand out from the competition. Here are some key takeaways for writing an impressive cover letter for insurance accountant positions:

- Highlight your qualifications: Your cover letter should focus on your qualifications, experience, and achievements in the field of insurance accounting. Focus on why you are the best candidate for the position and what makes you stand out from the competition.

- Focus on the company: Make sure that you demonstrate your knowledge of the company, its industry, and its mission. Talk about how your skills and experience can be effectively used to help the company succeed.

- Showcase your communication skills: Insurance accounting is an area that requires strong communication skills. Showcase your ability to communicate effectively in your cover letter by providing clear and concise examples.

- Demonstrate your passion: Insurance accounting is a complex and demanding profession. Show that you are passionate about the profession and are eager to learn and grow.

- Proofread your letter: Before sending your cover letter, make sure to proofread it carefully. Ensure that it is error- free and reflects your best self.

Frequently Asked Questions

1. How do I write a cover letter for an Insurance Accountant job with no experience?

Writing a cover letter for an insurance accountant job without any experience can be a daunting task. However, there are still ways to make it stand out and be impactful. To start, focus on the skills and knowledge that you do have and emphasize how they could be beneficial to the company. Focus on areas such as communication, problem solving, and teamwork. You can also include any internships or volunteer work you have done in the past that you feel has prepared you for the job. A great way to demonstrate your enthusiasm for the position is to briefly explain why you are interested in the role and why you think you would be a good fit. Be sure to also include any additional certifications or educational achievements.

2. How do I write a cover letter for an Insurance Accountant job experience?

When writing a cover letter for an insurance accountant job with experience, the focus should be on what you have accomplished in your prior roles. Detail any successes and highlight the experience you have in working with insurance- related accounts. Make sure to highlight your ability to analyze data and create reports, as well as your knowledge of the insurance industry. Showcase your problem- solving skills, communication abilities, and any other relevant qualifications. Additionally, demonstrate your enthusiasm and passion for the role.

3. How can I highlight my accomplishments in Insurance Accountant cover letter?

Highlighting your accomplishments in an insurance accountant cover letter is essential to make it stand out. You should make sure to include any successes or awards you have received in your prior roles. For example, if you increased the efficiency of account processing, be sure to include that. Additionally, emphasize any certifications or educational achievements you have obtained. Include any technical skills you possess, such as proficiency in software programs. Showcase your ability to analyze data and create reports, as well as your knowledge of the insurance industry.

4. What is a good cover letter for an Insurance Accountant job?

A good cover letter for an insurance accountant job should be tailored to the role and emphasize your relevant qualifications. Start off by introducing yourself and explaining why you are interested in the role and why you think you would be a good fit. Make sure to highlight your experience in working with insurance- related accounts and emphasize your problem- solving skills, communication abilities, and any other relevant qualifications. Additionally, include any accomplishments or awards you have received in prior roles and any certifications or educational achievements you have obtained. Showcase your enthusiasm and passion for the role and be sure to check for any errors or typos. With this information, you should be able to craft a cover letter that will stand out and get the job.

In addition to this, be sure to check out our cover letter templates, cover letter formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

Let us help you build

your Cover Letter!

Make your cover letter more organized and attractive with our Cover Letter Builder