Writing a resume for a Collections Specialist position can be tricky. When preparing a resume, you want to make sure it stands out from the competition and accurately reflects your qualifications. The best way to do this is to make sure you include the right information and present it in a way that will make an employer take notice. This guide will provide tips and advice on how to craft a resume that will get you noticed and land you an interview for a Collections Specialist role. Additionally, you will be given resume examples that you can use as a guide in creating your own resume.

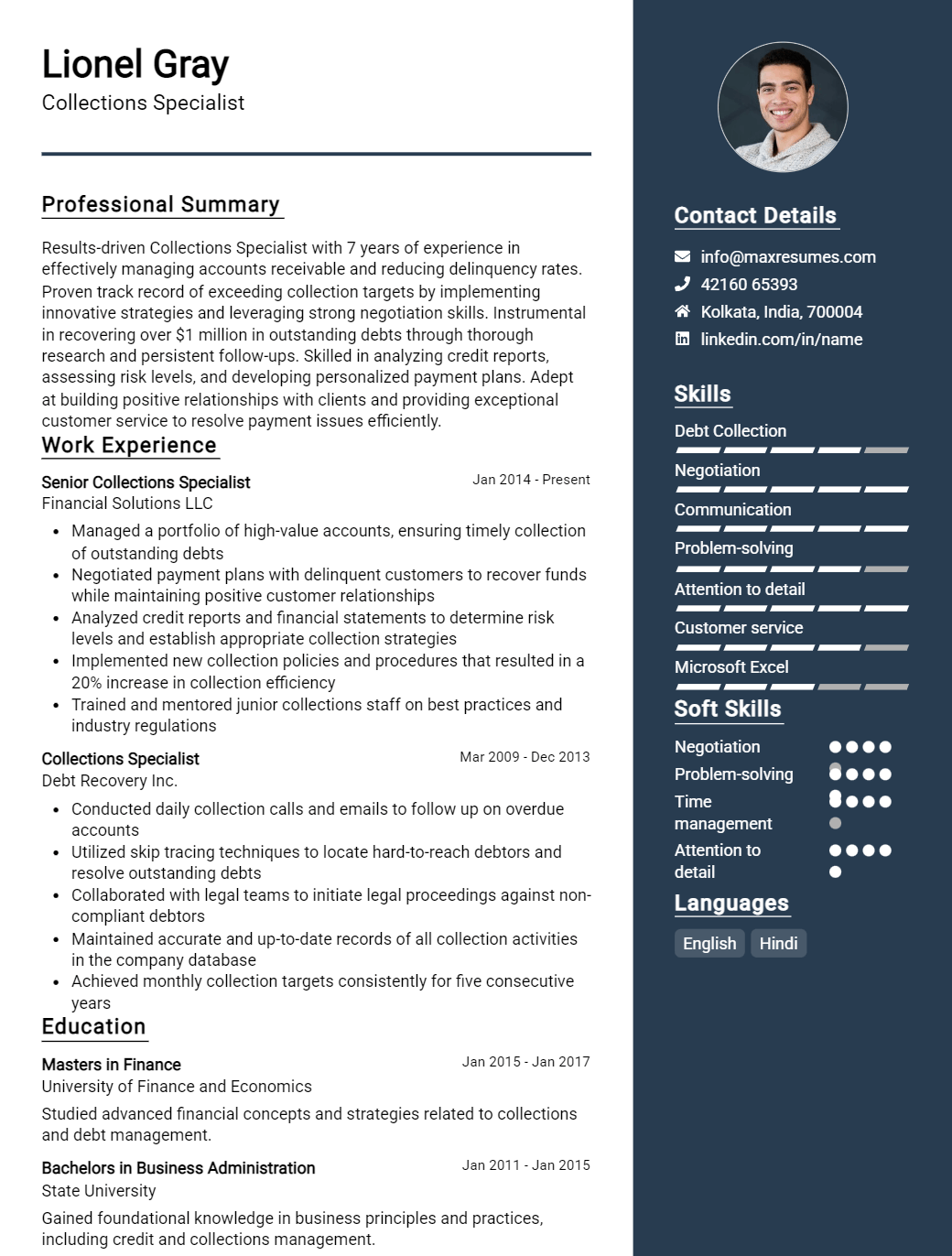

Collections Specialist Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Collections Specialist Resume Examples

John Doe

Collections Specialist

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

A detail- oriented and organized Collections Specialist with 6+ years of experience in the credit and collections industry. Skilled in utilizing collection techniques to reduce outstanding debt while providing excellent customer service. Proven ability to effectively manage multiple accounts while maintaining a high level of accuracy and professionalism. Possesses strong organizational and interpersonal skills, problem solving skills, and the ability to work independently with minimal supervision.

Core Skills:

- Knowledge of collections laws and practices

- Ability to problem- solve

- Excellent communication and customer service skills

- Proficient in Microsoft Office Suite

- Excellent organizational and time management skills

- Ability to multitask and prioritize tasks

Professional Experience:

- Credit and Collections Specialist, ABC Company, San Jose, CA (August 2020 – Present)

- Manage a portfolio of 90+ accounts, contact customers about overdue payments, and collect on delinquent accounts

- Resolve disputes and negotiate payment solutions with customers in a professional manner

- Utilize collection techniques such as skip tracing, phone calls, emails, letters, and other methods to collect unpaid debt

- Maintain detailed records of customer payments and activity in the collections system

- Monitor payment plans and ensure timely payments

- Follow internal policies and procedures related to collections

- Credit and Collections Representative, XYZ Company, San Francisco, CA (May 2017 – August 2020)

- Managed a portfolio of 60+ accounts and handled inbound and outbound customer calls

- Researched, resolved, and documented customer inquiries and requests

- Negotiated payment solutions with customers and maintained detailed records

- Worked with third party collection agencies to collect on overdue accounts

- Assisted in preparing financial reports, spreadsheets, and other documents related to collections

Education:

- Bachelor of Science in Finance, University of California, Los Angeles, CA (2013)

Collections Specialist Resume with No Experience

An enthusiastic and motivated professional with excellent customer service and communication skills. Possesses an ambition to learn and grow in the collections industry. Highly organized and detail- oriented, with a passion to excel in the field.

Skills

- Strong communication and customer service skills

- Ability to work independently and within a team

- Organizational and time- management skills

- Knowledge of collections software

- Proficient in Microsoft Office Suite

- Excellent problem- solving and research skills

Responsibilities

- Maintain accurate records and customer information

- Compile and analyze customer payment data

- Communicate with customers and resolve collection issues

- Identify and report any discrepancies in customer payments

- Develop and implement strategies to improve collections process

- Negotiate payment arrangements with customers

- Update customers on terms and conditions of payments

- Monitor customer accounts to ensure timely payments

Experience

0 Years

Level

Junior

Education

Bachelor’s

Collections Specialist Resume with 2 Years of Experience

Motivated and detail- oriented collections specialist with 2 years of experience. Skilled in problem- solving, negotiation, and dispute resolution. Proven ability to establish strong client relationships and create positive outcomes. Able to handle large volumes of accounts while maintaining accuracy and efficiency.

Core Skills:

- Debt collection

- Negotiation

- Dispute resolution

- Client relationship building

- Risk management

- Account reconciliation

- Customer service

- Database management

Responsibilities:

- Contacted customers to collect overdue payments, negotiate payment plans, and dispute resolution

- Analyzed customer accounts for risk and exposure

- Coordinated with outside agencies to ensure accurate and timely payment

- Reconciled customers accounts to prevent over payment of funds

- Maintained accurate database of customer accounts and payments

- Researched discrepancies and responded to customer inquiries

- Developed and maintained positive relationships with customers

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Collections Specialist Resume with 5 Years of Experience

I am a motivated Collections Specialist with 5 years of experience in the finance industry. I have a deep understanding of collection laws, customer service, and customer relations. With my skills and experience, I have successfully collected on past due accounts while still maintaining excellent customer relations. I am confident I can help your organization maximize its collection capabilities.

Core Skills:

- Strong knowledge of collection laws

- Excellent interpersonal and customer service skills

- Proficiency in Microsoft Office

- Effective organizational and time management skills

- Excellent communication and negotiation skills

Responsibilities:

- Developed collection plan for each assigned account

- Conducted customer outreach to encourage payment within the established timeline

- Analyzed customer accounts to determine payment arrangements

- Negotiated alternate payment plans with customers

- Researched and resolved disputes

- Maintained customer service and customer relations

- Ensured compliance with federal and state collection regulations

- Prepared detailed reports for management on collection activities

- Provided direct advice and assistance to customers on payment options.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Collections Specialist Resume with 7 Years of Experience

An experienced Collections Specialist with seven years of experience in credit and collections, accounts receivable, customer service, and debt negotiation. Demonstrates a deep understanding of collection laws and regulations, as well as an ability to effectively prioritize and manage multiple tasks. Highly adept at using collection software, Excel, and legal databases. An excellent communicator with the ability to resolve customer disputes in a professional, courteous, and timely manner.

Core Skills:

- Credit and Collections

- Accounts Receivable

- Customer Service

- Debt Negotiation

- Collection Laws and Regulations

- Collection Software

- Excel

- Legal Databases

Responsibilities:

- Managed daily collections activities from multiple accounts and customers.

- Negotiated timely payment plans with customers to avoid delinquency or default.

- Recorded and tracked all collection activities in collection software.

- Researched customers’ accounts to identify payment discrepancies and resolve disputes.

- Maintained up- to- date knowledge of the latest collection laws and regulations.

- Provided excellent customer service and maintained positive relationships with customers.

- Assisted customers with payment inquiries and updated accounts accordingly.

- Monitored accounts for delinquent payments and followed up accordingly.

- Utilized Excel to create reports of outstanding accounts and generate financial projections.

- Researched and reviewed legal databases to determine appropriate actions for delinquent accounts.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Collections Specialist Resume with 10 Years of Experience

A professional Collections Specialist with 10 years of experience in managing collections and resolutions in a fast- paced and demanding environment. Skilled in communicating with customers to ensure successful collections and resolution of debts. Experienced in utilizing legal procedures, and data entry and review to maintain accuracy and ensure compliance with the Fair Debt Collection Practices Act. Highly organized and efficient in handling a high volume of accounts on a daily basis.

Core Skills:

- Customer Service

- Effective Communication

- Negotiation & Resolution

- Data Entry & Review

- Legal Procedures

- Debt Collection Strategies

- High- Volume Activity

Responsibilities:

- Handled a large volume of accounts and tracked payments

- Negotiated payment plans and settlements to help customers pay down debts

- Reviewed customer accounts and identified the best course of action to recover payments

- Followed up on inquiries, complaints and overdue payments

- Maintained an organized database of customer accounts and payments

- Ensured compliance with the Fair Debt Collection Practices Act

- Contacted customers to explain payment options or discuss payment arrangements

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Collections Specialist Resume with 15 Years of Experience

A highly skilled and motivated Collections Specialist with 15 years of experience supporting a wide range of clients and businesses. With a strong track record of helping businesses and clients understand their financial situation and develop strategies for debt repayment, I am an expert in minimizing losses and resolving disputes. I am an organized and detail- oriented professional with strong communication, analytical and problem- solving skills.

Core Skills:

- Account reconciliation

- Financial reporting

- Debt and credit management

- Collections strategies

- Conflict resolution

- Problem- solving

- Excellent communication

- Customer service

- Data entry

Responsibilities:

- Developed and implemented effective collections strategies to reduce client debt.

- Assessed client financial situations, identified delinquent accounts and negotiated payment plans.

- Monitored accounts and contacted clients regarding payments, debts and other issues.

- Tracked payments, adjusted accounts and sent out reminder letters.

- Maintained database of all accounts, ensuring accuracy and timeliness of all entries.

- Investigated and resolved customer disputes.

- Researched and reconciled discrepancies in financial records.

- Provided assistance with collections inquiries and complaints.

- Ensured compliance with relevant regulations and laws.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Collections Specialist resume?

When creating a resume for a Collections Specialist position, it’s important to include information that demonstrates your understanding of collections and accounts receivable. A well-crafted resume should include the following:

- Professional summary: A concise yet powerful summary of your qualifications, special skills, and experience in collections.

- Education: List any relevant educational achievements, such as a degree in accounting or finance.

- Work experience: Include all relevant work experience in collections and accounts receivable, with a focus on accomplishments.

- Key skills: Highlight any special collections skills you have, such as organization, problem solving, and negotiation.

- Computer skills: Detail any computer skills you have that would be relevant to collections, such as proficiency in Excel and Word.

- Professional development: List any professional development courses you have taken, such as debt collection law or industry-specific training.

By including the above details in your resume, you can demonstrate that you are highly qualified for the role of a Collections Specialist.

What is a good summary for a Collections Specialist resume?

A collections specialist is a professional responsible for managing overdue accounts, supporting debt collection efforts and improving debt recovery processes. A successful summary on a collections specialist resume should highlight key skills and experiences in debt collection, communication and customer service, as well as any specialized certifications and training. It should also briefly describe the role the candidate has held and their overall achievements.

A good collections specialist summary should showcase the candidate’s ability to effectively manage delinquent accounts, establish payment plans and successfully collect on past due accounts. It should also show the candidate’s ability to communicate effectively with clients, handle difficult customer interactions and navigate complex legal and regulatory processes.

The summary may also mention any special skills the candidate has, such as familiarity with debt collection software, fluency in multiple languages or knowledge of relevant regulations. Finally, the summary should demonstrate the candidate’s commitment to compliance and ethics, as well as their ability to effectively manage their accounts and meet deadlines.

What is a good objective for a Collections Specialist resume?

A Collections Specialist is responsible for collecting payments from customers who are delinquent on their accounts. They often work within a third-party collections agency and must ensure their clients receive the money owed to them. Crafting a strong objective for a Collections Specialist resume is essential if you want to stand out from the competition. Here are some tips for creating an effective objective statement:

- Highlight your experience: When crafting your objective statement, make sure to emphasize your experience working in the collections field. Describe your experience in a concise manner and explain why you are an ideal candidate for the role.

- Detail your skills: In addition to emphasizing your experience in the field, also discuss the skills you have to offer. Mention any customer service, communication, and negotiation skills you possess that make you an effective Collections Specialist.

- Focus on results: Finally, be sure to include results-oriented language in your objective statement. Explain how your collections efforts have helped boost revenue or reduce customer delinquency rates in the past.

By incorporating these tips into your objective statement, you’ll have an effective summary of your qualifications that will help you stand out from the competition. This will increase your chances of getting an interview and ultimately landing the job.

How do you list Collections Specialist skills on a resume?

When looking for a Collections Specialist position, it is important that your resume accurately reflects your qualifications and job-related skills. Showcasing your experience in collections and customer service will help demonstrate your ability to handle difficult situations. Here are some tips on how to list Collections Specialist skills on a resume:

- Provide a clear summary of your professional qualifications and related experience. Briefly describe your career trajectory and any relevant certifications or degrees.

- Highlight your ability to remain organized and up-to-date on customer accounts. This will require demonstrating proficiency in records management, data entry, and customer service.

- Showcase any experience with collections and debt negotiation. Demonstrate your ability to work with clients to establish payment plans, track payments, and handle any customer inquiries.

- Demonstrate your ability to stay focused and organized in a fast-paced environment. Showcase any experience with large call volumes, data entry, and problem-solving.

- List any certifications, such as FCRA and FDCPA, that demonstrate your knowledge of the industry and compliance with regulations.

Properly listing your skills as a Collections Specialist on your resume will help ensure that you are considered for the position. Make sure to highlight your qualifications and experience so potential employers can see that you are the right candidate for the job.

What skills should I put on my resume for Collections Specialist?

A resume for a Collections Specialist should highlight the qualifications that make you an ideal candidate for this role. As this position requires extensive experience and knowledge of the collections industry, it is important to include all relevant skills that are applicable to the job you are applying for. Here are some skills that should be included on your resume when applying for a Collections Specialist role:

- Expertise in the Collections Industry: A successful Collections Specialist has a deep understanding of the collections industry and should possess the ability to effectively manage debt collections.

- Knowledge of Collection Laws and Regulations: A successful Collections Specialist also must understand the laws, regulations, and best practices related to debt collection.

- Attention to Detail: When dealing with debt collections, a successful Collections Specialist must be able to stay organized and demonstrate attention to detail to ensure accuracy in their records and reports.

- Research Skills: This role requires the ability to research and investigate delinquent accounts in order to effectively manage them.

- Problem-Solving Skills: Being able to think critically and come up with creative solutions to challenging scenarios is essential for this role.

- Interpersonal Skills: A successful Collections Specialist must be an effective communicator, both orally and in writing, as they will be interacting with customers and clients on a regular basis.

- Negotiation Skills: Negotiating payment arrangements is a key part of this job, so having strong negotiation skills is a must.

By including these key skills in your resume, you will be able to make a favorable impression on potential employers and demonstrate that you are the ideal candidate for their collections specialist position.

Key takeaways for an Collections Specialist resume

A Collections Specialist resume should demonstrate an individual’s experience in collecting past due debts and securing payments. This type of role requires an individual to have excellent problem-solving, interpersonal, and communication skills. If you are creating a Collections Specialist resume, here are a few key takeaways you should include:

- Experienced in all aspects of collections, including identifying debtors, establishing payment plans, and communicating with customers in a professional and courteous manner.

- Adept at using various software programs, such as Microsoft Excel and QuickBooks, to manage collections accounts.

- Knowledgeable in state and federal laws related to collections and able to apply them when necessary.

- Skilled negotiator with the ability to maintain positive customer relationships while collecting delinquent payments.

- Proven track record of successfully recovering overdue accounts.

- Ability to work independently or as part of a team.

By including these key takeaways in your Collections Specialist resume, you’ll show potential employers that you have the qualifications and experience they’re looking for. With a well-crafted resume and an impressive portfolio of previous successes, you’ll be sure to stand out from the competition!

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder