Collection supervisors play a vital role in many organizations, ensuring that debts are collected efficiently and balances are maintained. While the job description may vary from company to company, the core duties and responsibilities are usually the same. Writing a resume for this position can seem daunting, but with the right information and tips, you can make the process much simpler. This guide offers advice on how to write a collection supervisor resume and provides examples of resumes for the position. With this guide, you can be sure that your resume will be professional and effective in showcasing your experience and skills.

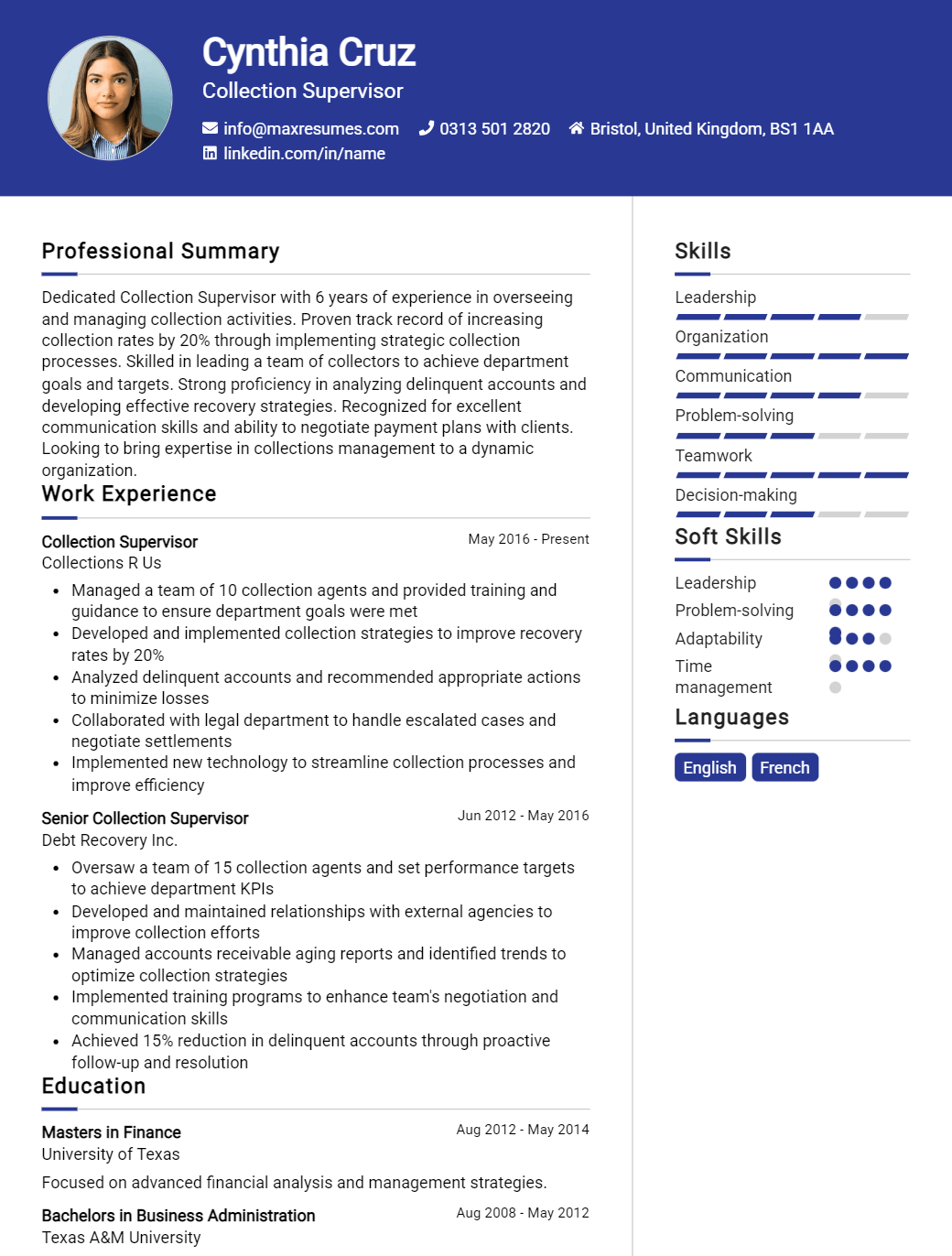

Collection Supervisor Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Collection Supervisor Resume Examples

John Doe

Collection Supervisor

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

Highly experienced Collection Supervisor with a comprehensive background in the financial services industry. Proven track- record of success in developing effective strategies and procedures to ensure positive customer relations and successful debt collection practices. Demonstrated expertise in successfully managing and coordinating staff to ensure optimal productivity and efficiency. Committed to providing compassionate customer service while ensuring compliance with applicable laws and regulations.

Core Skills:

- Advanced knowledge of debt collection process and procedures

- Excellent leadership and communication skills

- Strong negotiation and problem- solving ability

- Proficient in Microsoft Office Suite and customer service software

- Strong organizational and time- management skills

Professional Experience:

ABC Bank, Collection Supervisor, January 2016 – Present

- Managed and supervised a team of 12 customer service and debt collection personnel

- Developed and implemented policies and procedures for customer service and debt collection

- Conducted training sessions to ensure compliance with applicable laws and regulations

- Monitored team’s performance and provided feedback on areas of improvement

- Responded to customer inquiries and complaints in a timely manner

XYZ Financial, Senior Debt Collector, December 2013 – December 2015

- Collected overdue payments from customers in a timely and professional manner

- Negotiated payment arrangements and handled customer disputes

- Provided customer service and responded to customer inquiries

- Assisted in the preparation of monthly and quarterly reports

Education:

Bachelor of Science in Business Administration, University of California, San Diego, 2011

Collection Supervisor Resume with No Experience

Recent college graduate with a business degree and strong customer service skills looking to apply my education and experience to a role as Collection Supervisor. A quick learner with strong communication and organizational skills who is motivated to work hard and strive to exceed expectations.

Skills

- Strong communication skills

- Proficient in Microsoft Office Suite

- Excellent customer service skills

- Strong organizational skills

- Effective problem solving skills

- Ability to multitask

Responsibilities

- Provide excellent customer service to clients

- Maintain and update client information

- Manage collection activities and correspondence with clients

- Respond to customer inquiries and resolve disputes

- Monitor and track collection and payment activities

- Update collection and accounts receivable records

- Perform other duties as assigned

Experience

0 Years

Level

Junior

Education

Bachelor’s

Collection Supervisor Resume with 2 Years of Experience

Highly organized and detail- oriented Collection Supervisor with two years of experience in a high- volume collections environment. Proven ability to manage multiple accounts and prioritize tasks to ensure high performance standards. Excellent communication skills, with a strong background in customer service and problem resolution. Experienced in using recovery strategies to maximize account receivable.

Core Skills:

- Account reconciliation

- Accounts receivable management

- Collections

- Problem resolution

- Customer service

- Data entry

- Time management

- Organizational skills

- Recovery strategies

- Negotiation

Responsibilities:

- Developing and enforcing collection policies and procedures

- Monitoring collection activities and ensuring compliance

- Handling customer inquiries related to accounts and payment plans

- Performing internal audits to ensure compliance with applicable regulations

- Establishing contact with delinquent customers via phone, email, or other forms of communication

- Negotiating payment plans and other solutions to past due accounts

- Recording payments and other account related activities

- Maintaining accurate records of collection activities and customer interactions

- Reconciling accounts and preparing reports as needed

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Collection Supervisor Resume with 5 Years of Experience

A highly motivated and experienced Collection Supervisor with over 5 years of experience in the field of finance and collections. Possesses excellent communication and interpersonal skills, as well as problem- solving and organizational abilities. Demonstrates strong leadership and team- building skills, as well as the ability to motivate and manage a team of collection agents. Demonstrates excellent knowledge of collections processes, regulations and debt recovery methods.

Core Skills:

- Strong Leadership and Team- Building Skills

- Excellent Communication and Interpersonal Skills

- Problem- Solving and Organizational Abilities

- Expert Knowledge of Collections Regulations and Processes

- Proficient in Debt Recovery Methods

- Highly Experienced in Finance and Collections

Responsibilities:

- Manage a team of collection agents and motivate them to reach their goals.

- Develop and maintain effective relationships with customers and other stakeholders.

- Ensure compliance with all regulations and laws related to collections.

- Develop and implement effective strategies for debt recovery.

- Monitor and review performance of collection agents, providing feedback and support.

- Analyze data and reports to identify trends, opportunities and risks.

- Ensure prompt resolution of customer complaints and disputes.

- Generate and review monthly collection management reports.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Collection Supervisor Resume with 7 Years of Experience

A collection supervisor with 7 years of experience, a track record of successfully mitigating credit risks, and a proven ability to work with multiple stakeholders. Experienced in creating an effective and efficient collection process, managing a team of collection agents, and developing strategies to reduce credit losses. Possesses strong communication, interpersonal, and problem- solving skills.

Core Skills:

- Collection Process Management

- Risk Mitigation

- Team Supervision

- Credit Loss Reduction Strategies

- Communication & Interpersonal Skills

- Problem- solving

- Stakeholder Management

Responsibilities:

- Managed and supervised a team of collection agents and monitored their daily performance

- Developed strategies to reduce credit losses and mitigate credit risks

- Implemented an effective and efficient collection process to optimize the collection of past- due payments

- Investigated customer disputes and negotiated payment plans with customers

- Trained and mentored new collection agents on collection policies, procedures, and best practices

- Monitored and reported on sales activities and provided regular updates to department heads

- Maintained accurate records of customer accounts and collections data

- Processed and reviewed customer orders and payments

- Investigated and resolved customer complaints and inquiries

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Collection Supervisor Resume with 10 Years of Experience

A highly motivated and results- driven Collection Supervisor with 10 years of experience managing and leading teams in a fast- paced environment. Possesses great organizational skills, the ability to multitask and a keen eye for detail. Demonstrates a proven ability to build and maintain relationships with internal and external stakeholders, collect and analyze data and develop strategies that produce successful outcomes. Experienced in enforcing policies, resolving customer complaints and overseeing call center operations.

Core Skills:

- Leadership

- Relationship building

- Data analysis

- Problem solving

- Policy enforcement

- Training and development

- Team building

- Strategic planning

Responsibilities:

- Developing strategies and plans for collections and customer service operations

- Supervising and managing a team of collection representatives

- Developing and implementing best practices for customer service and collections

- Analyzing data to identify areas of improvement and making necessary changes as needed

- Monitoring compliance with policies and regulations

- Investigating customer complaints and resolving disputes

- Ensuring collection representatives adhere to laws, regulations and company policies

- Educating and training staff on customer service principles, collections procedures and compliance

- Developing and implementing effective strategies for collecting payments

- Creating and maintaining positive working relationships with internal and external stakeholders

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Collection Supervisor Resume with 15 Years of Experience

A highly experienced Collection Supervisor with 15 years of proven success in managing and leading collection teams in high- volume, high- pressure environments. Extensive knowledge of collection processes, laws, and regulations, as well as excellent communication, problem- solving and negotiation skills. Dedicated to delivering exceptional results and improving customer service.

Core Skills:

- Team Management

- Collection Processes

- Negotiation

- Regulatory Compliance

- Advanced Communication

- Problem Solving

- Customer Service

Responsibilities:

- Managed and supervised a team of 15 collection agents and ensured that all collections goals and objectives were met

- Developed, implemented, and monitored collection processes, policies, and procedures

- Ensured all collection activities were compliant with applicable laws and regulations

- Provided guidance and training to collection agents on account management, collection processes, and customer service

- Conducted regular performance reviews and provided feedback to collection agents

- Negotiated payment arrangements with customers to ensure that payments were received in a timely manner

- Analyzed collection trends and identified opportunities for improvement

- Resolved customer complaints and disputes in a timely and efficient manner

- Provided feedback and recommendations to management on changes to collection processes

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Collection Supervisor resume?

A Collection Supervisor resume should include the following information to help showcase the candidate’s qualifications and experience:

- Professional Summary: This section should provide a brief overview of the candidate’s experience in the collections field, along with any special skills and achievements.

- Education: The education section should include all relevant degrees, certifications, and training programs that the candidate has completed.

- Skills: This section should list any relevant technical, communication, or problem-solving skills that the candidate has obtained through their experience.

- Work Experience: This section should list any previous positions held by the candidate in the collections field, along with the name of the company and the dates of employment. It should also include a description of the responsibilities the candidate held in that position.

- Awards and Achievements: If the candidate has any special awards or achievements that are relevant to the collections field, these should be listed in this section.

- Professional Organizations: If the candidate belongs to any professional organizations related to the collections field, these should also be listed in this section.

- Additional Information: Finally, this section should include any other information that might be relevant to the position but doesn’t necessarily fit into one of the other sections. This could include the candidate’s volunteer experience or any special interests or hobbies.

What is a good summary for a Collection Supervisor resume?

A Collection Supervisor resume should present a summary of the candidate’s professional experience, qualifications, and abilities related to the collection of debts. The resume should showcase the individual’s skills in analyzing and resolving customer disputes and payment discrepancies. Additionally, it should provide an overview of their experience working with customer service, accounting and legal teams. The summary should also highlight the candidate’s ability to successfully manage a team, lead team members to meet collection goals and objectives, and implement strategies to improve collection performance. Finally, the summary should also include any relevant certifications or training that the candidate has completed.

What is a good objective for a Collection Supervisor resume?

Writing an effective resume for a Collection Supervisor requires an objective that clearly states what you bring to the table and how you can be an asset for the employer. A good objective should highlight your relevant experience, skills, and any certifications or qualifications.

Here are some objectives you can use in your Collection Supervisor resume:

- A dedicated professional with 7+ years of experience in debt collection and dispute resolution, seeking to leverage my skills and knowledge in a Collection Supervisor role at ABC Company.

- Experienced Collection Supervisor with an established track record of success in reducing debt and improving collection efficiency, looking to contribute at XYZ Company.

- Skilled Collections Supervisor with proven ability to increase customer satisfaction, manage accounts receivable and resolve disputes, looking to join ABC Company to help improve collection performance.

- Driven Collection Supervisor with a successful background in building relationships with customers, reducing past due accounts and maintaining compliance, seeking to join XYZ Company as a Collection Supervisor.

- Detail-oriented Collection Supervisor with a strong background in accounts receivable and credit management, seeking to join ABC Company to help improve collection efficiency.

How do you list Collection Supervisor skills on a resume?

A Collection Supervisor is an important position in any organization, as they monitor, analyze and manage all aspects of debt collection and accounts receivable. A comprehensive resume for a Collection Supervisor will include a detailed list of skills that demonstrate competency in this role. Here is a list of key skills and qualifications to include on your resume:

- Superior knowledge of debt collection/accounts receivable practices, laws, and regulations

- Ability to develop and enforce policies and procedures related to collections

- Excellent organizational and problem-solving skills

- Ability to effectively manage and motivate a team

- Excellent verbal and written communication skills

- Proficient in Microsoft Office, financial software and database systems

- Highly detail-oriented and able to multi-task

- Ability to interpret legal documents and data

- Excellent customer service skills

- Ability to interpret credit reports

- Knowledge of relevant accounting and financial principles

- Experience with core collection activities, including skip tracing, negotiation, and dispute resolution

- Ability to work independently and as part of a team

- Ability to handle difficult conversations tactfully and professionally

What skills should I put on my resume for Collection Supervisor?

When applying for the role of Collection Supervisor, it’s important to highlight the skills and qualities you can bring to the table. Here are some key skills to include on your resume:

- Financial Management: Collection Supervisors must possess strong financial management skills to plan, budget, and manage the collections process. This includes analyzing credit histories, setting payment terms, and determining appropriate payment amounts.

- Communication: Collection Supervisors must have excellent communication skills to work with customers and negotiate payment plans. They must be able to interpret customer financial information and explain repayment options in a clear and concise manner.

- Leadership: Collection Supervisors must have the ability to lead teams of collectors and motivate them to work to their fullest potential. They must have strong problem-solving skills to resolve customer disputes and develop new strategies for successful collections.

- Negotiation: This role requires strong negotiation skills to facilitate agreements between customers and the organization. The Collection Supervisor must be able to evaluate the customer’s unique circumstances and create repayment plans that are in both the customer’s and company’s best interest.

- Organization: Collection Supervisors must be highly organized to manage their team and ensure all tasks are completed on time. They must be able to prioritize tasks, create processes and procedures, and ensure compliance with collection laws and regulations.

By highlighting these skills on your resume, you can demonstrate to employers that you have the qualifications they are looking for in a Collection Supervisor.

Key takeaways for an Collection Supervisor resume

When drafting a resume for a collection supervisor position, there are a few key takeaways to keep in mind. These points will help ensure your resume is the best it can be and that it showcases your skills and experience in the best possible light.

- Include relevant experience. When crafting your resume, make sure to include any experience that is applicable to the collection supervisor role. This includes any previous collections experience, supervisory roles, or other relevant work history. Make sure to highlight any duties that demonstrate your ability to effectively manage collections and oversee the team.

- Detail your accomplishments. Your resume should be more than just a list of your duties. Be sure to include any accomplishments or successes that you achieved during your previous roles. This could include any awards or recognitions, how you increased the efficiency of collections, or any other accomplishments.

- Show your problem solving skills. As a collections supervisor, you will be expected to handle any problems or disputes that arise. Be sure to include any examples of how you effectively handled difficult situations in the past.

- Include relevant skills. Include any skills such as customer service, communication, or organizational skills that are applicable to the role. Showing that you have the necessary skills to be a successful collections supervisor can help you stand out from the rest of the candidates.

Following these key takeaways can help ensure your resume is the best it can be and that it highlights your qualifications and experience in the best possible light. By properly showcasing your skills and accomplishments, you can increase your chances of landing the collection supervisor role.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder