Are you a Collection Specialist looking to create an effective resume that will land you the job you’ve been hoping for? A resume is a key part of any job search, and crafting a successful one is a critical step on your way to success. This guide will provide insight and examples on how to create an effective resume as a Collection Specialist. Whether you are a beginner or an experienced professional, this guide will outline the best practices for creating a Collection Specialist resume that will make you stand out to potential employers.

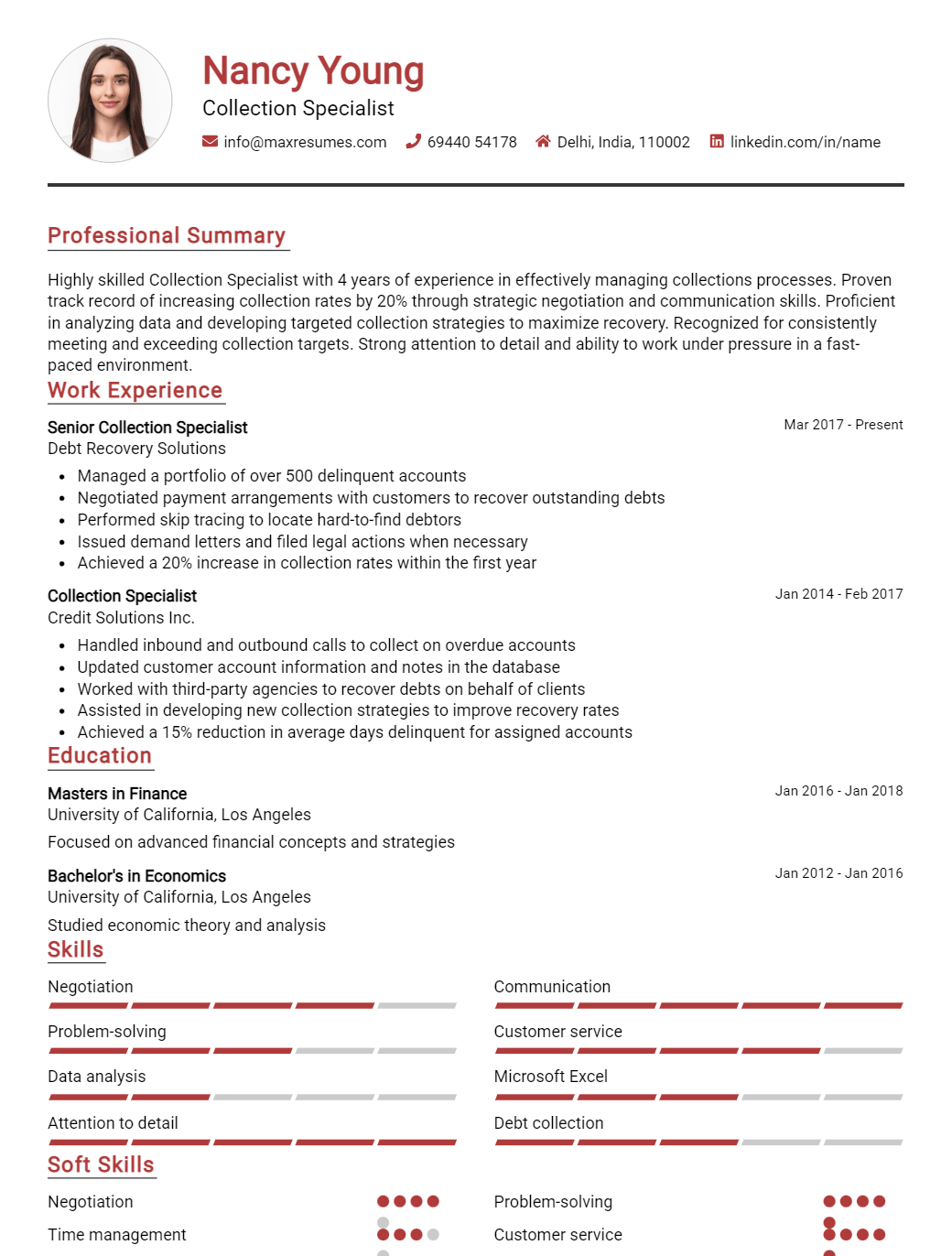

Collection Specialist Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Collection Specialist Resume Examples

John Doe

Collection Specialist

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am a Collection Specialist with over 10 years of experience in the industry. I have a proven track record of success in collecting and resolving overdue payments from customers. I am organized and detail- oriented, and prioritize customer satisfaction while maintaining professional working relationships. I am confident in my ability to effectively communicate with customers and ensure that their payments are made and collected on time. I am also experienced in creating and negotiating payment plans, dispute resolution, and other collection strategies.

Core Skills:

- Excellent customer service skills

- Ability to handle challenging customer conversations

- Excellent written and verbal communication skills

- Organized and detail- oriented

- Proficient in Microsoft Office

- Strong understanding of collections laws

- Understanding of data analysis and financial reports

Professional Experience:

Collection Specialist, ABC Collections, Inc. – 2015- Present

- Handle inbound and outbound calls to existing and past due customers

- Review and negotiate payment plans with customers, including dispute resolution

- Conduct data analysis on customer accounts and create financial reports

- Negotiate settlements with customers and business partners

- Ensure compliance with state and federal collection laws

- Develop relationships with customers to ensure timely payments

Education:

Bachelor of Business Administration, ABC University – 2011- 2015

Collection Specialist Resume with No Experience

Hardworking and highly organized Collection Specialist with strong attention to detail and excellent problem solving skills. Highly experienced in communications with customers to negotiate payment plans and resolve outstanding debts. Proven history of successfully meeting collection targets and improving customer satisfaction.

Skills:

- Excellent customer service and communication skills

- High level of accuracy and attention to detail

- Knowledgeable in accounting and financial principles

- Ability to maintain confidentiality

- Proficient in Microsoft Office

Responsibilities:

- Auditing accounts to ensure accuracy of information

- Contacting customers via phone and email to discuss payment plans

- Negotiating payment arrangements with customers

- Maintaining records of customer accounts and payments

- Assisting with customer inquiries and resolving customer complaints

- Providing feedback and suggestions to improve customer service processes

- Identifying debt collection strategies and setting appropriate timelines for collections

Experience

0 Years

Level

Junior

Education

Bachelor’s

Collection Specialist Resume with 2 Years of Experience

A seasoned Collection Specialist with over two years of experience in the industry and a proven track record of successful collections. Experienced in all aspects of debt collection, including customer negotiations, accounts receivable, and problem resolution. Possesses strong organizational, communication, and interpersonal skills, making it easy to manage and maintain customer relationships. Driven to exceed all expectations with an unwavering commitment to achieving goals.

Core Skills:

- Account Receivables

- Debt Collection

- Negotiation

- Problem Resolution

- Customer Service

- Interpersonal Skills

- Organizational Skills

- Time Management

Responsibilities:

- Identify delinquent accounts and initiate action to collect due payments

- Communicate with customers in a timely and effective manner regarding overdue payments and negotiate payment plans

- Maintain detailed records of customer accounts and payment history

- Resolve customer disputes, investigate and review accounts for accuracy

- Analyze customer credit and financial data to determine eligibility for payment plans

- Analyze past due accounts and formulate strategies for collection

- Make reminder calls to customers to ensure timely payment of debts

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Collection Specialist Resume with 5 Years of Experience

Experienced Collection Specialist with 5 years of professional experience in the financial services industry. Skilled in the use of various collection techniques, including early out, skip tracing, and third- party collections. Demonstrated strong ability to build and maintain relationships with customers, while working with them to ensure payment of delinquent accounts. Proven track record of successfully meeting or exceeding collection goals.

Core Skills:

- Customer Relationship Building

- Negotiation

- Skip Tracing

- Accounts Receivable Management

- Data Entry

- Early Out Collections

- Third- Party Collections

Responsibilities:

- Develop and maintain relationships with customers to ensure successful payment of delinquent accounts

- Negotiate payment plans and settlement arrangements with customers

- Engage in skip tracing activities to locate customers who are no longer at the address on file

- Advise customers of their options in order to collect delinquent debts

- Utilize data entry systems to document collected information

- Handle escalated customer issues and disputes

- Perform Early Out Collection activities to secure payment

- Work with Third- Party Collectors to ensure successful collection of delinquent accounts

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Collection Specialist Resume with 7 Years of Experience

Highly motivated and organized Collection Specialist with 7 years of experience in the financial services industry. Skilled in managing and overseeing the collection of delinquent payments, providing customer service to clients and utilizing different strategies in order to ensure maximum results in the collection process. Experienced in the review and analysis of accounts and developing effective strategies to recover delinquent debts. Possesses excellent organizational, communication and interpersonal skills.

Core Skills

- Customer service

- Negotiations

- Debt Collections

- Problem Solving

- Data Analysis

- Time Management

- Financial Analysis

Responsibilities

- Establish contact with debtors and attempt to arrange payment plans

- Negotiate payment plans and debt settlements

- Handle customer inquiries and complaints

- Utilize skip- tracing techniques to locate debtors

- Update customer accounts with payment and settlement information

- Maintain up- to- date records of customer accounts

- Analyze and review customer accounts for collection

- Develop and implement collection strategies and procedures

- Correspond with debtors via phone, email, and mail

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Collection Specialist Resume with 10 Years of Experience

Dynamic collection specialist with a decade of experience in handling outbound and inbound collection activities. A highly successful career in driving superior customer service and ensuring customer satisfaction. Proven record in creating and implementing policies and procedures to ensure regulatory compliance. Skilled in negotiating with customers and managing customer accounts. Possess a proven track record in successfully recovering past due accounts balances.

Core Skills:

- Excellent communication and customer service skills

- Strong negotiation and problem- solving skills

- Proficient in account management

- Knowledgeable in collections regulations

- Experienced in conflict resolution

- Sound working knowledge of computer applications

Responsibilities:

- Performed outbound calls to customers to collect past due accounts

- Reviewed customer accounts and made payment arrangements

- Negotiated with customers to settle accounts

- Researched payment discrepancies and provided solutions

- Prepared detailed reports on collection activities and status

- Conducted skip tracing activities to locate customers

- Assisted with dispute resolution and customer inquiries

- Ensured compliance with all regulatory requirements

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Collection Specialist Resume with 15 Years of Experience

Dynamic, motivated and task- oriented Collection Specialist with over 15 years of experience in credit and collection operations, including dispute resolution and reconciliation. Proven track record of consistently meeting goals and objectives, while working effectively both independently and in a team environment. Highly reliable and organized professional with strong customer service, problem solving and communication skills.

Core Skills:

- Credit and Collection Operations

- Dispute Resolution

- Reconciliation

- Problem Solving

- Customer Service

- Excellent Communication

- Time Management

- Negotiation

- Organization

- Attention to Detail

Responsibilities:

- Managing customer accounts and accounts receivables

- Making collection calls and negotiation on overdue accounts

- Recording and reconciling customer payments

- Investigating and resolving customer complaints and disputes

- Maintaining and updating customer information in the system

- Analyzing credit risk and recommending appropriate action

- Generating reports and monitoring customer accounts

- Developing and implementing collection strategies and procedures

- Liaising with other departments and building relationships with customers

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Collection Specialist resume?

A Collection Specialist resume should include the following elements to showcase your ability to work in the field:

- Relevant Education: Showcase any degrees or certifications you have in the field, as well as any relevant courses you have taken that may be applicable to the job you are applying for.

- Professional Experience: List all of your professional experience as a Collection Specialist, including any awards or accomplishments you may have.

- Skills: Highlight any important skills that may be relevant to the job, such as interpersonal communication, problem solving, and negotiation.

- Software Knowledge: Detail any software programs you are proficient in that may be useful in a Collection Specialist role, such as Microsoft Excel and QuickBooks.

- Professional References: Include two to three professional references who can vouch for your work ethic and abilities.

By including these elements in your Collection Specialist resume, you can give employers a comprehensive overview of your skills and experience, and make your resume stand out from the competition.

What is a good summary for a Collection Specialist resume?

A Collection Specialist resume should include a summary that emphasizes the candidate’s knowledge and experience of credit and collection operations, accounts receivable, and customer service. The summary should also demonstrate the candidate’s problem-solving skills, attention to detail, and ability to calmly handle tense customer situations. The summary should also list the candidate’s qualifications and years of experience in the field. Additionally, the summary should highlight soft skills such as active listening, excellent communication, and strong negotiation and persuasion skills. Last, the summary should emphasize the candidate’s commitment to meeting deadlines and staying organized.

What is a good objective for a Collection Specialist resume?

A Collection Specialist resume should convey a strong sense of responsibility, accuracy, and an ability to multitask in a fast-paced environment. When creating an objective for a Collection Specialist resume, it should include the following points:

- Demonstrate a commitment to maintaining efficient operations and promoting customer satisfaction

- Utilize strong organizational and communication skills to effectively manage accounts

- Emphasize the ability to remain compliant with laws and regulations while pursuing debt collection

- Show a passion for problem-solving and data-driven strategy to maximize collection efforts

- Stress the importance of adhering to strict deadlines and maintaining a positive work ethic

How do you list Collection Specialist skills on a resume?

A Collection Specialist’s resume should include the following skills:

- Experience in customer service: Collection Specialists must be able to communicate effectively with customers, maintain rapport, and handle high-pressure situations.

- Knowledge of collection laws: Collection Specialists must be knowledgeable about the laws and regulations regarding debt collection in the United States.

- Negotiation skills: Collection Specialists must be able to negotiate payment arrangements with customers and find mutually beneficial solutions to debt repayment.

- Attention to detail: Collection Specialists must be detail-oriented and able to maintain accurate records of payments, collections, and customer contact.

- Analytical skills: Collection Specialists must be able to analyze data and make informed decisions based on the information they have.

- Computer skills: Collection Specialists must have the ability to use computers to record, access, and analyze data.

- Time management: Collection Specialists must be able to manage their time efficiently and prioritize tasks in order to meet deadlines.

What skills should I put on my resume for Collection Specialist?

When you’re looking for a job as a Collection Specialist, it’s important to highlight the right skills on your resume to make sure you stand out. Here are some of the skills you should include on your resume to show potential employers that you’re the right person for the job:

- Communication skills: As a Collection Specialist, you need to be able to communicate effectively, both verbally and in writing, to ensure you’re able to contact debtors and discuss their financial situation.

- Negotiation skills: You must be able to negotiate and reach agreements with debtors that are in their best interest and your employer’s best interest.

- Organizational skills: You will be dealing with large amounts of data, so the ability to stay organized and prioritize tasks is essential.

- Analytical skills: You must be able to analyze financial data in order to determine the best course of action for collecting outstanding debts.

- Conflict resolution skills: You should be able to calmly and professionally handle difficult situations that may arise when dealing with debtors.

- Financial knowledge: It’s important to understand the basics of finances and the laws governing debt collection in your area.

By showcasing these skills on your resume, you can demonstrate to potential employers that you have the right qualifications to be a successful Collection Specialist.

Key takeaways for an Collection Specialist resume

When applying for a Collection Specialist role, it’s important to create a resume that demonstrates your expertise in the field and highlights your top achievements. Your resume should include key takeaways that make you stand out from the competition and show employers the value you can bring to their team. Here are some key takeaways to include on your Collection Specialist resume:

• Demonstrated expertise in researching and resolving past due payments.

• Outstanding ability to communicate effectively with customers and maintain positive relationships.

• Proven ability to negotiate payment plans, collect payments, and maintain accurate records.

• Skilled at using collection software to track payments, monitor accounts, and send out notices.

• Experienced in working with clients experiencing financial hardship to develop payment plans.

• Knowledgeable of state and federal regulations related to debt collection.

• Ability to handle difficult conversations and de-escalate customer disputes.

• Achieved recognition for success in reducing delinquencies and increasing client satisfaction.

By including these key takeaways on your Collection Specialist resume, you will be able to highlight the value you can bring to the role and stand out from the competition. With this information, employers will be able to quickly assess your suitability for the role and recognize the unique skills and achievements you can bring to the job.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder