Writing an effective resume can be a challenge, especially when applying for a job as an Insurance Underwriting Manager. This type of position requires a highly specialized skill set, and it can be difficult to know where to start. This guide will provide tips and advice on how to write a resume as an Insurance Underwriting Manager that will catch the attention of potential employers. A professional and organized resume will allow you to showcase your qualifications and experience, so employers are more likely to consider you for the role. With examples of resumes specifically for this type of job, you will have a better idea of how to structure and present your own. Follow this guide, and you will be well on your way to writing a resume that will impress potential employers and help you land the job.

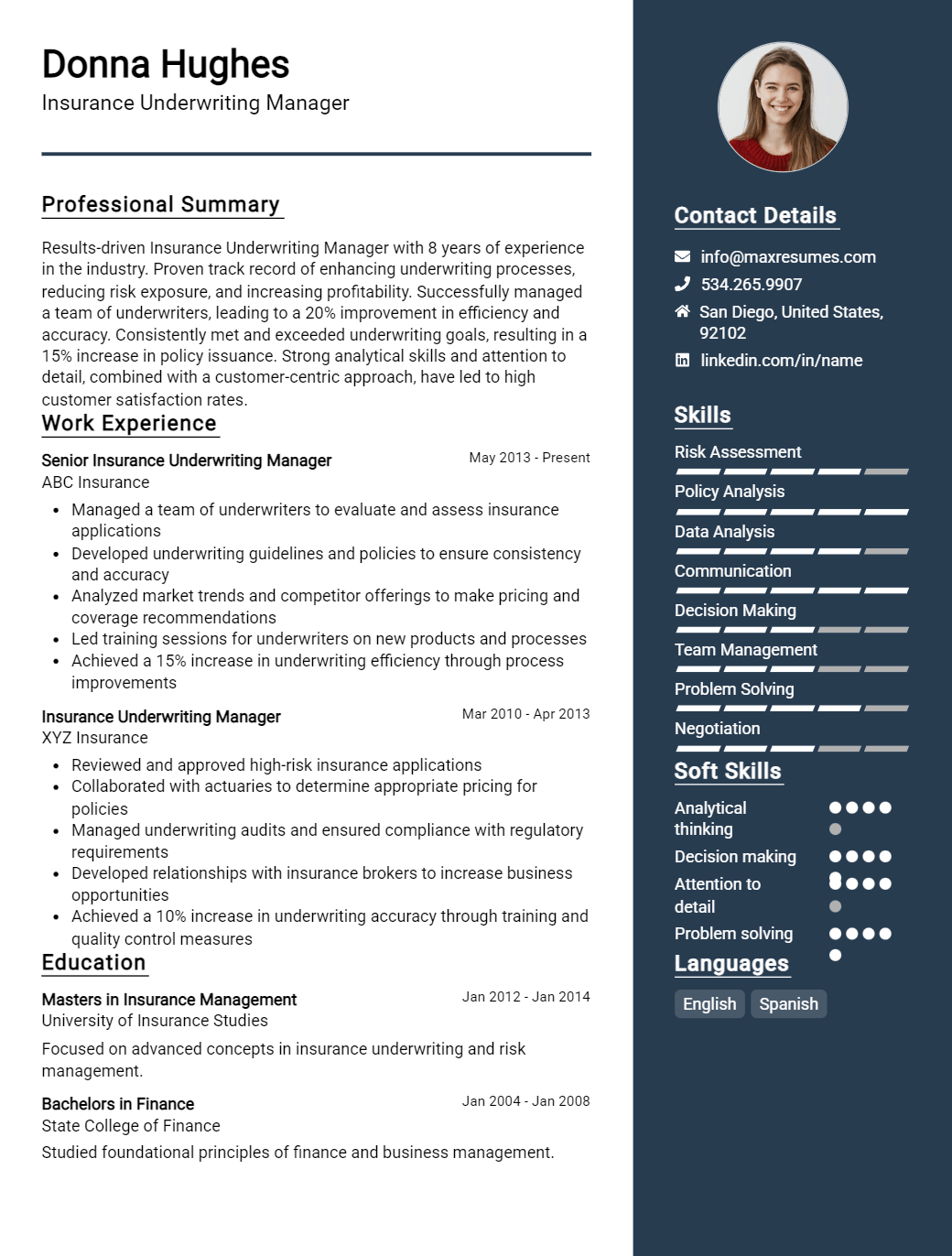

Underwriting Manager Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Insurance Underwriting Manager Resume Examples

John Doe

Insurance Underwriting Manager

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

Highly motivated and experienced Insurance Underwriting Manager with more than 8 years of experience in the insurance industry. Proven track record of driving increased profitability and customer satisfaction for insurance companies. Skilled in management, customer relations, marketing, underwriting and product development. Possess a strong background in risk management and a comprehensive understanding of the insurance industry.

Core Skills:

- Risk Management

- Underwriting

- Team Management

- Policy Development

- Customer Relations

- Product Development

- Regulatory Compliance

- Process Improvement

- Financial Analysis

Professional Experience:

Insurance Underwriting Manager

ABC Insurance, Los Angeles, CA

December 2017 – Present

- Manage a team of underwriters and customer service representatives ensuring efficient process operations

- Analyze and assess customer profiles and credit risk to make decisions on issuing policies

- Negotiate and review coverage terms and pricing plans

- Develop and implement process improvement initiatives to increase efficiency

- Ensure compliance with industry regulations and company policies

Insurance Underwriting Supervisor

ABC Insurance, Los Angeles, CA

August 2015 – December 2017

- Supervised and managed processes related to underwriting, customer service and policy administration

- Analyzed and evaluated customer profiles, claims and financial statements to determine risk and coverage

- Collaborated with other departments to develop new products, policies and processes

- Provided professional and timely customer service support

Education:

Bachelor of Science in Business Administration

University of California, Los Angeles, CA

May 2015

Insurance Underwriting Manager Resume with No Experience

- Recent college graduate with an ambition to enter the insurance industry as an insurance underwriting manager.

- Strong understanding of the insurance industry and the underwriting process.

- Highly organized and detail- oriented with excellent problem- solving skills.

Skills

- Knowledge in the insurance industry

- Analytical and problem solving skills

- Excellent communication and organizational skills

- Ability to work independently and as part of a team

Responsibilities

- Develop and implement underwriting strategies for new and existing policies and contracts

- Analyze and assess risk profiles for potential applicants

- Perform detailed review of policies and contracts

- Identify and address any potential issues or discrepancies

- Provide training and guidance to new and existing staff on underwriting processes and procedures

Experience

0 Years

Level

Junior

Education

Bachelor’s

Insurance Underwriting Manager Resume with 2 Years of Experience

A highly motivated and organized Insurance Underwriting Manager with two years of experience managing teams in a fast- paced, high- pressure environment. A strategic thinker with a proven track record of successfully leading underwriting teams in achieving organizational goals of cost- effectiveness, efficiency, and customer satisfaction, while maintaining a high level of technical expertise in risk assessment and compliance. A great communicator who excels at building relationships and instilling accountability with all levels of stakeholders.

Core Skills:

- Risk Assessment and Compliance

- Project Management

- Team Leadership

- Problem Solving

- Relationship Building

- Organizational Skills

- Strategic Thinking

- Multi- tasking

- Financial Acumen

Responsibilities:

- Developed and implemented underwriting policies and procedures for all lines of business

- Managed underwriting and actuarial teams to ensure efficient workflow and accuracy of underwriting processes

- Conducted quality assurance reviews of underwriting results to ensure compliance with established standards

- Developed and monitored risk assessment models and analysis

- Led team of underwriters in identifying, assessing and mitigating risks to ensure customer satisfaction

- Analyzed financial data to develop risk- based pricing strategies

- Assisted in development of client relationships and initiatives

- Reviewed and negotiated contracts and binding agreements in accordance with established guidelines

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Insurance Underwriting Manager Resume with 5 Years of Experience

An accomplished Insurance Underwriting Manager with 5 years of experience in the insurance industry. I have expertise in developing, underwriting and implementing insurance programs. I have strong technical, communication and organizational skills, and I am able to effectively collaborate with other departments to find solutions. My track record includes a proven ability to manage risk, develop strategies for expanding insurance offerings, and provide excellent customer service. I am confident that I can make a valuable contribution to an insurance organization.

Core Skills:

- Demonstrated knowledge of insurance products and underwriting standards

- Excellent communication and interpersonal skills

- Proven ability to manage risk and develop strategies

- Ability to collaborate and work effectively with other departments

- Strong technical and organizational skills

- Ability to handle multiple tasks and prioritize workload

Responsibilities:

- Develop, implement and manage insurance programs

- Analyze, underwrite and approve insurance applications

- Act as primary liaison between insurance agents and underwriters

- Monitor insurance programs and make adjustments as needed

- Manage and review financial data associated with insurance programs

- Identify and investigate potential areas of risk

- Ensure compliance with industry regulations and standards

- Develop strategies for expanding insurance offerings

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Insurance Underwriting Manager Resume with 7 Years of Experience

An experienced Insurance Underwriting Manager with 7 years of experience in the insurance industry and a comprehensive understanding of core insurance processes, such as underwriting, policy adjudication and risk management. Skilled at analyzing risk, identifying areas for improvement and evaluating opportunities for growth. Excels in meeting goals and achieving success in a fast- paced and rapidly changing environment.

Core Skills:

- Underwriting and Risk Management

- Policy Adjudication

- Claims Processing

- Customer Service and Relations

- Market Analysis

- Data Entry and Record- Keeping

- Problem- solving and Conflict Resolution

Responsibilities:

- Develop and implement underwriting processes and procedures

- Analyze risk and assess the potential for loss

- Evaluate potential areas for growth and opportunities for improvement

- Assist in the development and implementation of new products or services

- Provide guidance and support to claims processing staff

- Maintain and update records of claims and policies

- Provide customer service and build relationships with clients and other personnel

- Conduct market analysis to identify trends and potential areas of risk

- Evaluate and assess policies for accuracy and compliance

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Insurance Underwriting Manager Resume with 10 Years of Experience

Highly experienced Insurance Underwriting Manager with 10 years of experience in the insurance industry. Proven record of success in managing and leading multiple teams of underwriters and providing them with guidance and support. Highly proficient in identifying and mitigating risk, pricing and evaluating insurance policies, and providing strategic guidance to help clients understand their insurance needs. Possess strong decision- making, problem- solving, and communication skills.

Core Skills:

- Risk management

- Insurance pricing and evaluating

- Strategic guidance

- Decision- making

- Problem- solving

- Team management and leadership

- Communication

- Time management

Responsibilities:

- Manage, motivate, and lead teams of underwriters to ensure productivity and high- quality standards are met.

- Identify and assess various levels of risk associated with insurance policies and in order to create comprehensive risk profiles.

- Price and evaluate insurance policies to ensure they are within company standards and regulations.

- Provide strategic guidance to clients to help them understand their insurance needs.

- Analyze market trends and competitor products to identify areas of improvement or opportunities for new business.

- Prepare and present reports and documents to management and clients.

- Develop and implement policies and procedures to ensure compliance with industry regulations.

- Monitor and review performance of underwriters to provide feedback and guidance.

- Maintain up- to- date knowledge of all changes in industry regulations and laws.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Insurance Underwriting Manager Resume with 15 Years of Experience

I am a seasoned Insurance Underwriting Manager with more than 15 years of experience in the industry. I possess extensive knowledge of underwriting principles and practices, as well as proficiency in budgeting, financial analysis, and risk assessment. I have a proven track record of success in meeting and exceeding performance targets, as well as reducing operational costs and increasing profit margins. I am an effective communicator who is able to build strong working relationships with all stakeholders and ensure that deadlines are consistently met.

Core Skills:

- Underwriting Principles & Practices

- Financial Analysis & Risk Assessment

- Budgeting & Cost- Reduction

- Risk Management & Compliance

- Project Management & Leadership

- Data Analysis & Interpretation

- Stakeholder Management

- Strategic Planning & Implementation

Responsibilities:

- Analyzing and assessing risk in order to determine underwriting decisions

- Developing underwriting strategies to meet corporate goals and objectives

- Managing operational budgets and ensuring that financial targets are consistently achieved

- Conducting financial analysis to identify trends and opportunities

- Developing and maintaining relationships with insurance carriers, brokers and other stakeholders

- Preparing underwriting reports and presenting them to senior management

- Monitoring and ensuring compliance with industry regulations and policies

- Assisting with the implementation of process improvements that increase efficiency

- Providing guidance and training to team members to ensure that underwriting standards are met.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Insurance Underwriting Manager resume?

A Insurance Underwriting Manager is an important role in the insurance industry, and so having a strong resume is essential in order to land that role. A well-crafted resume should demonstrate your qualifications, experience, and technical skills in the insurance industry. Here are some important things that should be included on a Insurance Underwriting Manager’s resume:

- Experience: Include any experience you have in the insurance industry, such as managing underwriting operations, handling customer service queries, performing risk analysis, and creating and executing underwriting policies and procedures.

- Education: Include any relevant educational qualifications you have, such as a degree in finance, insurance, or economics.

- Technical Skills: This should include any specialized technical skills you have, such as working with rating software and databases, conducting financial analysis, and understanding insurance regulations.

- Leadership and Management Skills: Showcase any leadership and management skills you have that are relevant to overseeing underwriting operations, such as problem solving and decision making.

- Communication Skills: Demonstrate any strong communication skills you have that are necessary for working with customers and colleagues, such as being able to communicate effectively in a team environment.

- Attention to Detail: Stress any attention to detail that you have, such as being able to review and analyze policies to ensure accuracy.

By highlighting these key elements on your Insurance Underwriting Manager resume, you can show employers that you have the right qualifications, experience, and skills to be successful in the role.

What is a good summary for a Insurance Underwriting Manager resume?

A Insurance Underwriting Manager is responsible for managing the underwriting process for insurance policies. They must assess the risk of each policy, review applications and documents, and make decisions about whether or not to accept or decline a policy. A good summary for a Insurance Underwriting Manager resume should highlight the candidate’s ability to evaluate risk, their knowledge of the insurance industry, and their experience with risk management and underwriting. The summary should also emphasize the candidate’s ability to manage a team and make decisions that are in the best interest of the company. It is also important to showcase any industry certifications or special training that the candidate has, such as a Chartered Property and Casualty Underwriter (CPCU) designation.

What is a good objective for a Insurance Underwriting Manager resume?

The job of an Insurance Underwriting Manager is to manage the activities of the underwriting department in order to meet the company’s financial goals. The objective should emphasize the candidate’s ability to manage and lead a team, as well as their experience and expertise in the field of insurance underwriting.

A good objective for an Insurance Underwriting Manager resume should include the following:

- Demonstrate strong organizational and leadership skills

- Proven ability to manage and develop a team of insurance underwriters

- Experience in managing and executing underwriting strategies

- Expertise in analyzing and interpreting financial data

- Strong background in risk management

- Ability to develop and implement new underwriting policies and procedures

- Excellent communication and problem-solving skills

How do you list Insurance Underwriting Manager skills on a resume?

When writing a resume for an Insurance Underwriting Manager position, it’s important to emphasize the skills that make you a great candidate. The skills you list should both reflect the duties of an Insurance Underwriting Manager and showcase your abilities to prospective employers.

To make sure you are listing the right skills on your resume, consider the following:

- Analytical Skills: Insurance Underwriting Managers need to understand complex data and financial information and assess the associated risks. Demonstrate your analytical skills by providing examples of how you assess and evaluate data.

- Decision Making: As an Insurance Underwriting Manager, you will need to make decisions based on the data you assess. Include examples that demonstrate your ability to make sound decisions in a timely manner.

- Interpersonal Communication: Insurance Underwriting Managers need to be able to communicate effectively with customers, colleagues, and other stakeholders. Highlight your ability to communicate clearly and concisely, both verbally and written.

- Risk Management: Insurance Underwriting Managers are responsible for managing risk. Describe your experience with risk management and how you assess and mitigate risk.

- Time Management: Insurance Underwriting Managers need to be able to manage their time effectively and prioritize tasks. Detail how you remain organized and efficient in a fast-paced environment.

By highlighting your skills as an Insurance Underwriting Manager, you can make sure your resume stands out from the competition. Remember to include relevant examples to demonstrate your abilities and show prospective employers that you are the right person for the job.

What skills should I put on my resume for Insurance Underwriting Manager?

The insurance underwriting manager is a critical role that requires strong analytical, problem-solving, and communication skills. When creating your resume for this position, you should highlight these abilities, as well as any other relevant qualifications you possess.

Here are some of the skills that should be included on your resume for an insurance underwriting manager role:

- Strong analytical skills: As an insurance underwriting manager, you will need to be able to assess a variety of data and information to make informed decisions regarding risk management and insurance policies.

- Good problem-solving skills: Insurance underwriting managers must be able to identify potential problems and quickly find solutions.

- Excellent communication skills: As an insurance underwriting manager, you will need to be able to communicate effectively with colleagues, clients, and other stakeholders.

- Familiarity with relevant regulations: You should be aware of all relevant insurance regulations and be able to apply them to your work.

- Knowledge of the insurance industry: You should have a good understanding of the insurance landscape, including the different types of policies and products.

- Attention to detail: Insurance underwriting managers should have an eye for detail and be able to spot potential errors or inconsistencies.

- Leadership experience: Insurance underwriting managers may be tasked with leading a team, so any leadership experience should be highlighted on your resume.

By including these skills on your resume, you’ll be able to demonstrate to potential employers that you have the necessary qualifications for an insurance underwriting manager role.

Key takeaways for an Insurance Underwriting Manager resume

When crafting a resume for an Insurance Underwriting Manager role, it is important to include key information that is relevant and meaningful to the employer. Here are some key takeaways for an Insurance Underwriting Manager resume:

- Demonstrate your understanding of the insurance industry: Your resume should demonstrate your knowledge and understanding of the insurance industry, including insurance regulations, laws and policies. Highlight any course work, industry certifications and/or professional training you have completed.

- Showcase your leadership capabilities: Insurance Underwriting Managers must be strong leaders who can motivate their team and ensure that deadlines are met. Emphasize any leadership experience you have had in previous roles or in volunteer capacities.

- Include key performance indicators: Insurance Underwriting Managers are expected to hit specific performance targets. Include your key accomplishments in previous roles, such as claims processing speed, number of policies underwritten and other performance metrics.

- Highlight interpersonal skills: Insurance Underwriting Managers must be able to effectively communicate with their team and customers. Be sure to highlight any communication and interpersonal skills that you possess, such as problem-solving, conflict resolution, and customer service.

- Stress your expertise: Insurance Underwriting Managers are expected to be knowledgeable in their field. Highlight any relevant expertise that you possess such as risk management, data analysis, and financial forecasting.

By making sure to include these key takeaways on your resume, you will be well on your way to landing your dream job as an Insurance Underwriting Manager.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder