Are you looking to land your dream job as an insurance risk surveyor? Writing a resume may be the most challenging part of the job search process, but it doesn’t have to be. With the right tools and information, you can expertly craft a resume that will capture the attention of employers and put you one step closer to getting the job. This guide will provide you with tips and advice for writing an effective insurance risk surveyor resume, as well as examples to help you get started.

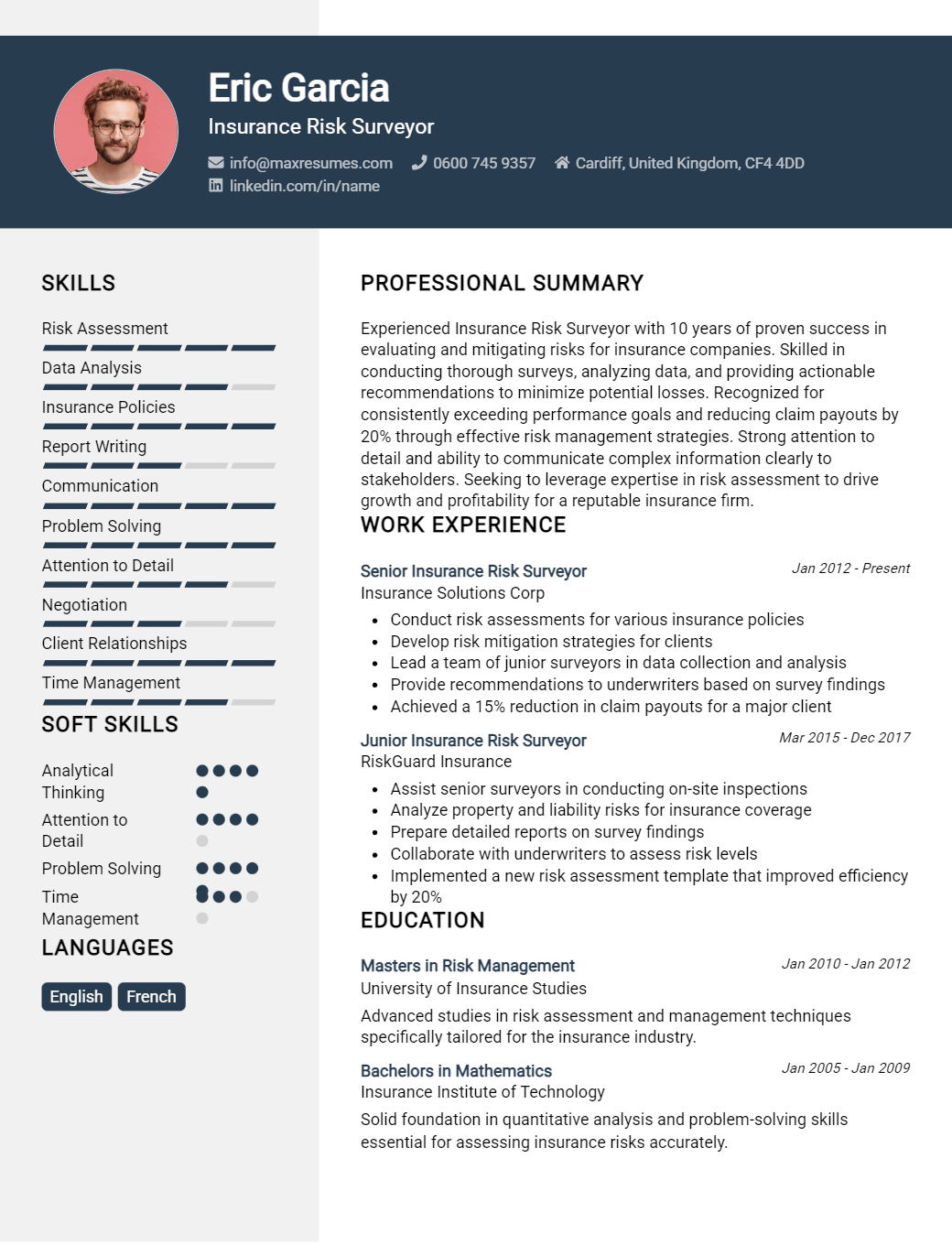

Risk Surveyor Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Insurance Risk Surveyor Resume Examples

John Doe

Insurance Risk Surveyor

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am a highly experienced Insurance Risk Surveyor with over five years of professional experience in the insurance industry. I have an in- depth knowledge of risk management, including assessment of risk, hazard mitigation, and insurance compliance. I am also a strong communicator, capable of delivering clear and concise reports to clients and senior leadership. My dedication to safety and risk management is second to none, allowing me to provide effective solutions to clients in the insurance sector.

Core Skills:

- Risk Management

- Hazard Mitigation

- Insurance Compliance

- Strong Communication

- Report Writing

- Safety

Professional Experience:

- Insurance Risk Surveyor, ABC Insurance, 2017- Present

- Assess risk, hazard mitigation, and insurance compliance for a variety of clients

- Develop and deliver reports to clients and senior leadership

- Participate in regular safety training for the organization

- Risk Analyst, XYZ Insurance, 2015- 2017

- Conducted risk assessments and evaluated insurance policies for potential risks

- Developed and presented risk mitigation plans to senior leadership

- Participated in safety programs to ensure proper safety protocols were followed

Education:

- Bachelor of Science in Risk Management, University of XYZ, 2013- 2015

Insurance Risk Surveyor Resume with No Experience

- Motivated insurance risk surveyor with no experience in the field looking to apply knowledge from education and internships in the insurance field to gain professional experience while helping clients manage risks.

SKILLS

- Strong analytical and problem- solving skills

- Excellent interpersonal and communication skills

- Proficiency in Microsoft Office, particularly Excel

- Ability to interpret and apply technical information

- Good organizational and time management skills

- Able to work independently and as part of a team

Responsibilities

- Conduct risk surveys and assessments of clients’ properties

- Analyze data and develop risk assessments

- Collaborate with clients to assess risk and develop solutions

- Provide detailed reports of findings to clients

- Identify potential liabilities and develop mitigation strategies

- Develop and implement plans to reduce risk

- Assist clients with risk management and insurance programs

- Ensure compliance with industry regulations and standards

Experience

0 Years

Level

Junior

Education

Bachelor’s

Insurance Risk Surveyor Resume with 2 Years of Experience

A highly motivated and organized professional Insurance Risk Surveyor with 2 years of experience conducting detailed surveys of residential and commercial properties for insurance companies. Possessing an excellent eye for detail and an ability to communicate effectively with clients and colleagues. Experienced in evaluating properties and assessing risk factors in order to provide comprehensive reports and recommendations.

Core Skills

- Knowledge of insurance policies and regulations

- Excellent attention to detail

- Ability to work without direct supervision

- Proficient in Microsoft Office

- Strong verbal and written communication skills

- Creative problem- solving capability

- Excellent time management skills

Responsibilities

- Conducting site visits to assess risks and inspect residential and commercial properties

- Verifying accuracy of insurance information provided by clients

- Compiling detailed reports and recommendations based on survey findings

- Discussing survey results with client to create risk mitigation strategies

- Collaborating with insurance brokers and underwriters to ensure accuracy of policy information

- Assisting in developing new insurance policies and procedures

- Making recommendations for changes in policy or procedures to improve efficiency and accuracy

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Insurance Risk Surveyor Resume with 5 Years of Experience

A highly skilled and experienced Insurance Risk Surveyor with 5 years of experience in helping clients identify, analyze and manage risks. Expertise in providing comprehensive risk survey reports, identifying potential risks and enforcing safety regulations. Experienced in assessing the value of property and its contents, forecasting risk and developing strategies to reduce risk. Committed to providing excellent customer service and ensuring compliance with legal requirements.

Core Skills:

- In- depth knowledge of risk survey procedures and techniques

- Excellent communication, interpersonal and problem- solving skills

- Ability to interpret and analyze complex data

- Proficiency in risk management and assessment software

- Proficient in Microsoft Office Suite (Word, Excel, Outlook, Powerpoint)

- Highly organized, detail- orientated and able to multi- task

- Confident with budgets, cost control and financial management

Responsibilities:

- Conduct thorough risk surveys for clients to identify and analyze potential risks

- Provide detailed reports outlining potential risks and proposed solutions

- Enforce safety regulations and recommend changes where necessary

- Assess property and contents for insurance purposes

- Forecast risk and develop strategies to reduce risk

- Review existing policies and recommend changes

- Liaise with clients, insurers and other professionals

- Ensure compliance with legal requirements and regulations

- Provide excellent customer service and advice

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Insurance Risk Surveyor Resume with 7 Years of Experience

A highly motivated and experienced Insurance Risk Surveyor with seven years of experience in the industry. Possesses excellent communication and negotiation skills and an in- depth knowledge of insurance policies and risk management. Able to work in a fast- paced environment while providing accurate assessments and conclusions. Skilled in assessing and evaluating potential risks, and identifying and mitigating them. Also experienced in providing technical support and analysis to clients, liaising with clients and colleagues, and creating effective solutions that meet industry standards.

Core Skills:

- Thorough understanding of insurance policies and risk management

- Excellent negotiation and communication skills

- Ability to work in a fast- paced environment

- Highly organized and detail- oriented

- Strong analytical and problem- solving abilities

- Proficient in Microsoft Office and other related software

Responsibilities:

- Conducting risk surveys and assessments to determine insurance coverage needs

- Providing technical support and analysis to clients

- Creating solutions that meet industry standards

- Developing and executing risk management plans

- Identifying and mitigating potential risks

- Liaising with clients and colleagues

- Maintaining up to date records and reports

- Ensuring compliance with regulations and laws

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Insurance Risk Surveyor Resume with 10 Years of Experience

A highly experienced Insurance Risk Surveyor with 10 years of experience in conducting insurance risk assessments for a wide range of businesses, from small to large. Proficient in evaluating risks, analyzing and interpreting data, and providing detailed risk assessment reports. Possess a strong knowledge of insurance terminology and an ability to identify areas of risk with accuracy. Excellent communication skills and a strong work ethic allow me to provide exceptional service to customers and clients alike.

Core Skills:

- Analyzing and interpreting data

- Identifying areas of risk

- Providing risk assessment reports

- Excellent communication skills

- Strong work ethic

Responsibilities:

- Conducting risk assessments for businesses of all sizes

- Gathering and analyzing data to identify potential risks

- Developing and presenting detailed reports on risk assessments

- Negotiating with insurance companies on behalf of clients

- Monitoring changes in the insurance industry and staying up to date on legislation and regulations

- Building strong relationships with customers, clients, and insurance companies

- Providing advice and guidance to clients on risk management and insurance coverage

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Insurance Risk Surveyor Resume with 15 Years of Experience

I am a seasoned and certified Insurance Risk Surveyor with 15 years of experience in the industry. My strong ability to provide accurate assessments, identify risk areas and mitigating solutions, and implement risk management plans has enabled me to excel in this field. I possess comprehensive knowledge of the insurance industry and am well versed in the principles of insurance underwriting and risk analysis. I possess excellent communication and problem- solving skills, enabling me to effectively collaborate with internal and external stakeholders. I also have a proven track record of producing detailed risk assessment reports and presenting them to the relevant parties.

Core Skills:

- Detailed Risk Assessment

- Insurance underwriting

- Risk Analysis

- Problem- Solving

- Communication

- Report Generation

- Risk Mitigation

- Risk Management

Responsibilities:

- Conducting on- site surveys of properties to determine risk and exposure

- Analyzing and assessing data from insurance companies to identify key risk areas

- Developing and implementing risk management plans to mitigate risks

- Developing detailed risk assessment reports and presenting them to the relevant parties

- Identifying potential areas for improvement and recommending solutions

- Advising clients on insurance coverage, exposure and risk

- Collaborating with internal and external stakeholders to identify and address risk areas

- Maintaining up- to- date knowledge of risk assessment regulations and standards

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Insurance Risk Surveyor resume?

- Risk Surveyor resumes should include a summary of qualifications that outlines the applicants’ experience in the insurance and risk survey field. The summary should include information such as years of experience and the types of risk surveys the applicant has worked on.

- The resume should also include a list of the insurance and risk surveying skills and abilities the applicant has, as well as any certifications they have earned.

- It should also list out the types of insurance and risk surveys the applicant has handled in the past, including the size of projects, scope of work, and results.

- The resume should list the companies the applicant has worked with in the past, including any successes or accomplishments at those companies.

- It should also include the applicant’s education, including any degrees or certifications in risk surveyor related fields.

- The resume should include the applicant’s contact information, such as telephone number, email address, and mailing address.

- Finally, the resume should include any additional skills and qualifications the applicant has that would be beneficial in the risk surveyor field. This could include knowledge of insurance regulations, risk management principles, software programs, or project management.

What is a good summary for a Insurance Risk Surveyor resume?

A good summary for an Insurance Risk Surveyor resume should emphasize the applicant’s knowledge and experience in assessing and managing risks for various types of insurance policies. The summary should also highlight the applicant’s communication and analytical skills, as well as their ability to develop strategies to reduce liabilities and maximize returns on investments. Additionally, the summary should provide an overview of the applicant’s certifications and any relevant work experience they may have in the insurance industry. A strong summary for an Insurance Risk Surveyor resume should demonstrate to potential employers that the applicant is a qualified and experienced professional who can help them minimize their risk exposure.

What is a good objective for a Insurance Risk Surveyor resume?

A risk surveyor’s resume should include a strong professional objective that speaks to their experience, qualifications, and career goals. It should emphasize their ability to assess the risk of particular situations and how they can use their knowledge and expertise to protect an insurance company’s investments. Here are some examples of good objectives for an insurance risk surveyor resume.

- To utilize my strong knowledge of risk assessment and management in order to identify and mitigate risk for an insurance company.

- To leverage my years of experience in risk management and analysis to effectively and efficiently assess and manage risk for an insurance company.

- To use my extensive background in insurance and risk surveyor to provide accurate assessment of risk and potential losses for a company.

- To effectively analyze high-risk situations and develop strategies to mitigate the risk for an insurance company.

- To utilize my strong communication and problem-solving skills to accurately assess and manage risk for an insurance company.

- To apply my knowledge of risk management and analysis to identify potential risks and create effective strategies to manage them.

How do you list Insurance Risk Surveyor skills on a resume?

When crafting a resume, it’s important to highlight your relevant experience and skills, especially for those seeking a position in insurance risk surveying. The following tips will help you make sure your resume stands out from the competition:

- Include an ‘Insurance Risk Surveyor Skills’ section: To ensure that your skills are clearly outlined, create an ‘Insurance Risk Surveyor Skills’ section explicitly to demonstrate your abilities.

- Focus on the skills most employers look for: Insurance risk surveyors must demonstrate strong technical skills, so make sure to include items such as the ability to read and interpret complex policy requirements, the ability to analyze data and present reports, and knowledge of risk management and coverage assessment.

- Highlight your ability to communicate effectively: Insurance risk surveyors must be able to communicate effectively with clients, colleagues, and other stakeholders. Showcase your ability to communicate clearly, both orally and in writing, in this section.

- Highlight any experience using relevant software: Employers often look for candidates who are familiar with the software used in the insurance industry. Be sure to list any relevant software you have experience with, such as computerized risk management systems or actuarial software.

- Include any certifications you hold: If you have any certifications related to insurance risk surveying, such as a Certified Insurance Risk Surveyor (CIRS) certification, make sure to include it in the Insurance Risk Surveyor Skills section.

By following these tips, you can make sure your resume stands out and showcases your Insurance Risk Surveyor skills.

What skills should I put on my resume for Insurance Risk Surveyor?

Risk Surveyors are tasked with assessing the potential financial risks of a client’s insurance policy. As such, it is important to highlight the skills and qualifications that show employers that you are an experienced and well-rounded professional. When crafting your resume for a Risk Surveyor position, consider including the following skills:

- Analytical: Risk Surveyors must possess strong analytical skills in order to evaluate and assess the risks associated with a client’s insurance policy. Employers will be looking for evidence that you can think critically and understand the complexities of risk management.

- Communication: Risk Surveyors must be able to communicate clearly and effectively with their clients. This involves explaining the risks associated with a policy, as well as discussing potential solutions.

- Technical Knowledge: Risk Surveyors must be well-versed in insurance policies, legal terminology, and financial regulations. Additionally, they must have a firm grasp of risk management principles.

- Interpersonal: Risk Surveyors must be able to build relationships with their clients and colleagues. As such, it is important to demonstrate that you are a highly personable professional with excellent interpersonal skills.

- Problem-Solving: Risk Surveyors must be able to identify potential risks and develop strategies to mitigate them. Employers will be looking for evidence that you have the ability to solve complex problems.

By including these skills and qualifications on your resume, you can highlight your qualifications and experience as a Risk Surveyor. Doing so will make you stand out to potential employers and help you secure a role as a Risk Surveyor.

Key takeaways for an Insurance Risk Surveyor resume

As an insurance risk surveyor, a resume is key to stand out from the competition. Here are a few key takeaways to help you craft the perfect resume:

- Highlight Your Skills and Education: Include any relevant certifications or certifications you have earned, any related experience, and any specialized knowledge in the insurance risk surveyor field.

- Showcase Your Professional Experience: Emphasize your past experience in the insurance risk surveyor field, and provide examples of how you’ve applied your knowledge and skills.

- Demonstrate Your Technical Knowledge: Include any software programs or hardware you’re familiar with, like assessing risk analyses and data platforms.

- Provide Evidence of Your Ability to Work with Clients: Showcase how you’ve worked with clients in the past to help them manage their risk and effectively mitigate claims.

- Demonstrate Your Leadership Qualities: Include any experience in management or leadership positions you’ve had in the past.

By following these key takeaways, your resume should help you stand out from the competition and put you in the best position to land the job you desire.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder