Are you looking to land a job as a Risk Manager? Writing a strong resume is essential to success in this field. A well-written resume can set you apart from the competition and demonstrate to employers that you are an excellent candidate for the role. This guide provides tips and advice on how to craft a winning resume to help you get the Risk Manager job you desire. It also includes examples of resumes that have been successful in securing Risk Manager jobs. With these tips and examples, you will be able to create a unique and powerful resume that will help you stand out in your job search.

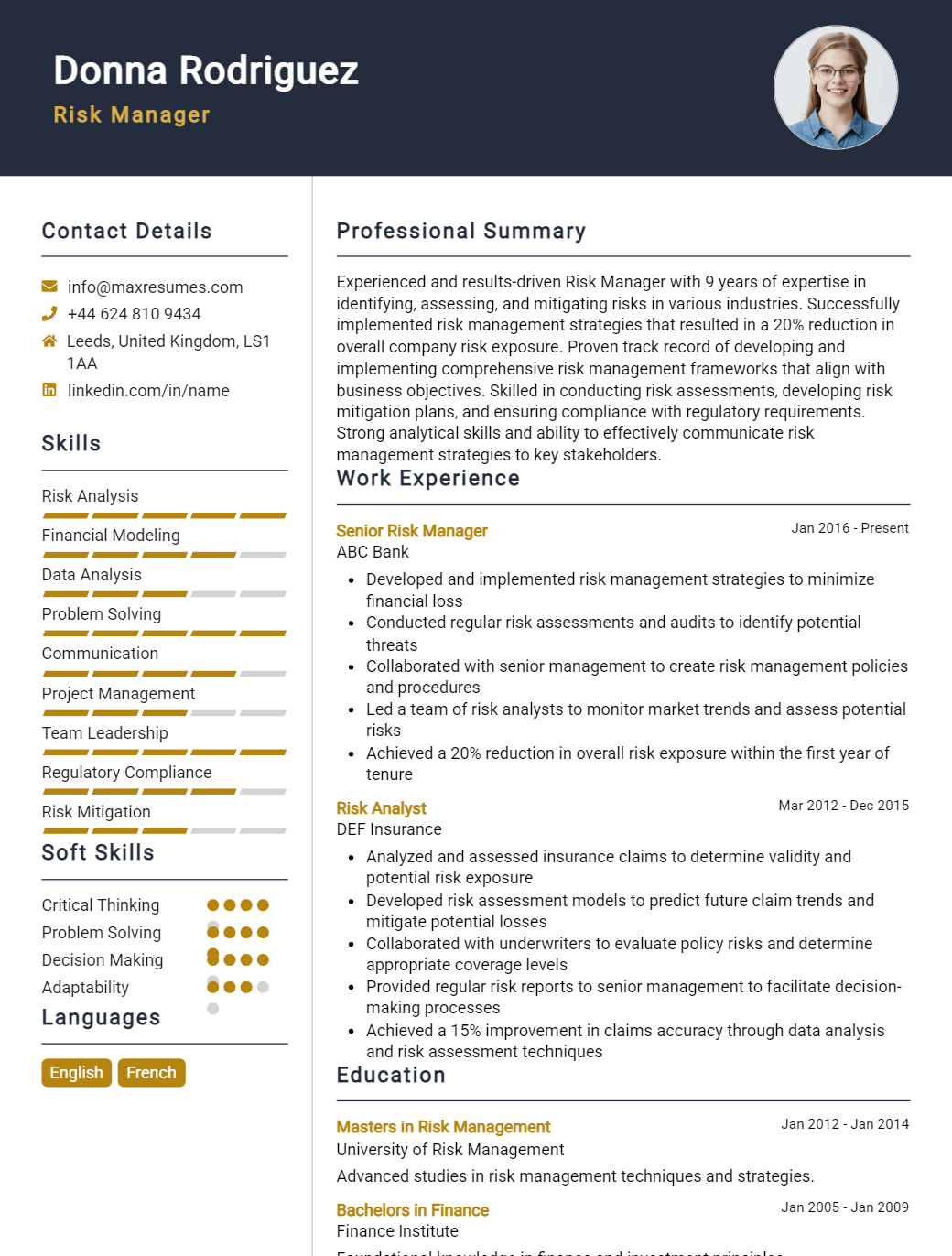

Risk Manager Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Risk Manager Resume Examples

John Doe

Risk Manager

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

An experienced Risk Manager with a background in financial analysis and banking, I have a strong understanding of financial risk and the ability to manage it. With a Bachelor of Science degree in Finance, I am proficient with complex financial models and have a deep knowledge of various risk management techniques. My experience includes developing and implementing risk management plans, conducting research into potential risk scenarios, and developing strategies to mitigate risk. I am well- versed in the latest trends in the financial industry, and I am confident that I can make a positive contribution to any organization.

Core Skills:

- Financial Analysis

- Risk Management

- Data Management

- Risk Mitigation Strategies

- Financial Modeling

- Analytical Thinking

- Research

Professional Experience:

- Risk Analyst, Bank of America, 2014- 2018

- Developed risk management plans and monitored their implementation

- Conducted trend analysis and data research to identify potential risks

- Developed strategies to mitigate risk and prevent losses

- Analyzed financial data and provided recommendations for managing risk

- Prepared detailed reports for senior management on risk management plans

- Monitored risk- related regulatory changes and provided updates to management

Education:

- B.S. in Finance, University of Pennsylvania, 2012

Risk Manager Resume with No Experience

Recent college graduate with a Bachelor of Science in Risk Management and Insurance looking to start a career as a Risk Manager. Seeking a position where my knowledge and expertise in the field of Risk Management can benefit the organization.

Skills

- Strong analytical skills to evaluate and assess risk

- Ability to utilize an array of strategies and policies to mitigate risk

- Outstanding organizational and communication skills

- Proficient in Microsoft Office Suite

- Ability to solve complex problems

- Good understanding of insurance industry regulations and compliance

Responsibilities

- Develop and implement risk management strategies and policies to protect the organization

- Monitor and track risk exposure

- Evaluate risks and recommend mitigating actions

- Analyze and assess potential risks

- Interpret and implement existing insurance regulations and policies

- Collaborate with senior management to identify, assess and manage risks

- Review and negotiate contracts to ensure compliance with company risk management policies

- Conduct training sessions on risk management processes and procedures

Experience

0 Years

Level

Junior

Education

Bachelor’s

Risk Manager Resume with 2 Years of Experience

Results- driven Risk Manager with 2 years of experience in identifying, evaluating, and controlling business risks. Proven track record in devising and implementing risk management policies, procedures, and strategies to protect assets, maximize profitability, and reduce losses. Skilled in finding, examining, and mitigating potential losses, ensuring compliance with federal and state regulations, and leveraging data and analytics to identify and address risks.

Core Skills:

- Risk Identification

- Risk Analysis

- Risk Mitigation

- Data Analysis

- Regulatory Compliance

- Risk Management Strategies

- Loss Prevention

- Conflict Resolution

- Project Management

- Negotiation

Responsibilities:

- Identified and evaluated risks associated with operations, projects, programs, and products.

- Developed and implemented risk management policies, processes, and procedures.

- Analyzed data and identified trends to inform decision making and develop effective risk management strategies.

- Edited, updated, and maintained corporate insurance policies and other documents.

- Ensured compliance with state, federal, and local regulations.

- Reviewed and approved contracts and agreements.

- Monitored the risk management system for potential violations or deficiencies.

- Conducted internal investigations into potential losses and fraud.

- Resolved conflicts between departments, teams, and individuals.

- Coordinated with external auditors and legal counsel to ensure regulatory compliance.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Risk Manager Resume with 5 Years of Experience

Diligent and results- driven Risk Manager with 5 years of experience in risk management and financial analysis roles. Proven track record of forecasting and mitigating risks, managing investments, and optimizing financial operations to maintain business continuity. Skilled in data analysis, financial modeling, financial reporting, and project management. Exceptional communication and problem- solving skills.

Core Skills:

- Financial Analysis

- Financial Modeling

- Financial Reporting

- Risk Management

- Investment Management

- Data Analysis

- Project Management

- Problem Solving

- Communication

Responsibilities:

- Developed risk management policies, procedures and controls to minimize financial liabilities and risks.

- Analyzed and evaluated the organization’s risk management processes and procedures to ensure compliance with internal and external standards.

- Monitored and analyzed financial trends, changes and investments to identify potential risk factors.

- Performed financial analysis and forecasting to anticipate potential financial losses due to fluctuating business conditions.

- Built and maintained relationships with external auditors to ensure compliance with regulatory standards.

- Developed financial models to identify opportunities for improving investment returns.

- Developed financial reports to assess business performance, trends and risks.

- Developed project plans and timelines to ensure successful implementation of projects.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Risk Manager Resume with 7 Years of Experience

A highly motivated and organized Risk Manager with seven years of experience in developing effective strategies to reduce organizational risk. Possessing expertise in identifying, analyzing, and mitigating risks, as well as developing comprehensive risk management plans and programs. Proven track record of reducing business risks, improving operational efficiency and eliminating financial losses.

Core Skills:

- Excellent problem- solving skills

- Comprehensive knowledge of risk management principles and best practices

- Highly organized with the ability to prioritize tasks

- Excellent analytical and critical thinking skills

- Ability to manage multiple projects and deadlines

- Excellent interpersonal, communication and negotiation skills

Responsibilities:

- Developing and implementing comprehensive risk management strategies

- Identifying potential risks and developing plans to mitigate them

- Conducting regular risk assessments and evaluating risk management systems

- Developing risk management processes and procedures

- Establishing risk management policies and procedures

- Monitoring the internal environment for risk changes and taking appropriate action

- Analyzing the financial impact of risk and providing solutions to reduce it

- Creating risk management reports and providing regular updates to senior management

- Developing risk management training programs and conducting training sessions

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Risk Manager Resume with 10 Years of Experience

Risk Manager with 10 years of experience in financial and risk management services. Proven track record of developing, implementing and monitoring risk management strategies and policies to mitigate risks, establish internal control systems and improve operational effectiveness. Skilled in identifying and assessing potential risks, developing acceptable solutions and managing them to minimize losses. Experienced in developing, analyzing and implementing risk- based and capital- based models for financial and operational decisions.

Core Skills:

- Risk Management

- Capital/Financial Modeling

- Risk Identification

- Risk Assessments

- Internal Control Systems

- Operational Effectiveness

- Document/Data Analysis

- Regulatory Compliance

- Strategic Planning

- Business Process Analysis

Responsibilities:

- Developed and monitored risk management strategies, policies and procedures to ensure compliance with applicable regulations and industry standards.

- Identified, assessed and managed potential risks to minimize losses.

- Developed, analyzed and implemented risk- based and capital- based models for financial and operational decisions.

- Evaluated and monitored existing risk tolerance level.

- Developed and maintained Risk Register and Risk Heat Maps.

- Monitored and analyzed various data sources to identify risks.

- Performed document and data analysis to ensure accuracy and reliability of risk management process.

- Developed and implemented internal control systems to improve operational effectiveness.

- Assisted in preparing and evaluating proposals for strategic and business objectives.

- Assessed the impact of new regulations and laws on the organization.

- Conducted review and analysis of business processes to identify potential risks and controls.

- Developed, maintained and monitored compliance with applicable laws and regulations.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Risk Manager Resume with 15 Years of Experience

A highly experienced Risk Manager with 15 years of experience in conducting and managing risk assessments, developing and implementing risk management strategies, and ensuring compliance with regulatory standards. Skilled in identifying potential operational risks and developing controls to mitigate those risks. Possesses excellent communication and organizational skills, as well as the ability to work independently and as part of a team.

Core Skills:

- Risk assessment and analysis

- Risk management

- Regulatory compliance

- Risk control implementation

- Strategic planning

- Project management

- Communication

- Team collaboration

Responsibilities:

- Conducting and managing risk assessments for new and existing operations

- Developing and implementing risk management strategies

- Identifying potential operational risks and developing controls to mitigate those risks

- Ensuring compliance with regulatory standards, policies and procedures

- Developing and implementing thoughtful and effective business strategies

- Managing projects within budget and timeline

- Collaborating with internal and external stakeholders to develop and implement risk management strategies

- Presenting risk management reports to upper management

- Educating and training staff on risk management policies and procedures

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Risk Manager resume?

Risk management is a growing field that requires a certain skill set and education to succeed. A Risk Manager resume should include all the necessary experience, qualifications, and education to showcase the candidate’s abilities to potential employers. Here are some essential elements to include on a Risk Manager resume:

- Details of the Risk Management qualifications and/or certifications held.

- Relevant work experience in the Risk Management field.

- Knowledge of relevant industry regulations and standards.

- Proficiency in risk assessment and mitigation strategies.

- Excellent communication and problem-solving skills.

- Strong analytical and decision-making skills.

- Ability to work under pressure and meet tight deadlines.

- Experience with risk management software and tools.

Including these items on your resume will help demonstrate to potential employers that you have the necessary experience and qualifications to handle the job. By highlighting your skills, experience, and qualifications, you can ensure that your resume stands out and shows employers why you’re the right person for the job.

What is a good summary for a Risk Manager resume?

A Risk Manager resume should provide a thorough and concise summary of the candidate’s qualifications and experience. It should demonstrate the candidate’s ability to identify, assess, and manage risk to protect organizational assets and interests. Additionally, the resume should detail the candidate’s expertise in developing and implementing risk management strategies and policies, as well as their experience with data analysis and risk assessment tools. The candidate’s experience in working with diverse stakeholders should also be highlighted, as well as their ability to prioritize and execute multiple projects in a timely manner. Additionally, the candidate’s knowledge of financial and operational risk management, regulatory compliance, and industry-specific standards should be noted. Finally, the candidate’s excellent communication, leadership, and problem-solving skills should be emphasized.

What is a good objective for a Risk Manager resume?

A well-written objective statement for a Risk Manager resume should highlight the candidate’s experience, abilities and qualifications, and demonstrate how their professional background makes them a perfect fit for the position.

The ideal objective statement for a Risk Manager position should include:

- Demonstrated experience in risk management, including identification and assessment of risks

- In-depth knowledge of relevant policies, regulations, and compliance procedures

- Ability to develop and implement effective risk management strategies

- Excellent communication and interpersonal skills

- Proven ability to work collaboratively with stakeholders and cross-functional teams

- Strong analytical and problem-solving skills

- Skilled at developing and monitoring budgets and business plans

- Ability to develop and present effective presentations to top-level management

- Experience working with diverse cultures and markets

How do you list Risk Manager skills on a resume?

The ability to identify and manage potential risks is key for any Risk Manager, and the skills listed on a resume should reflect this. When listing your Risk Manager skills on a resume, make sure to include both technical and soft skills.

- Technical Skills:

- Knowledge of risk management principles and practices

- Familiarity with insurance and liability laws

- Proficiency in risk management software

- Able to create and maintain risk profiles

- Strong analytical and problem-solving skills

- Excellent communication and negotiation abilities

- Soft Skills:

- Strong organizational and time management skills

- Ability to work independently and as part of a team

- Excellent customer service and interpersonal skills

- Superb critical thinking and decision-making abilities

- Highly detail-oriented and analytical mindset

- Able to spot potential risks and devise strategies to mitigate them

What skills should I put on my resume for Risk Manager?

A Risk Manager is responsible for assessing risk and creating strategies to prevent it, which requires a unique blend of problem-solving and analytical skills. When crafting your resume, it’s important to showcase the abilities and experience that make you the ideal candidate for the position. Here are some skills that you should include on your resume to make you stand out as a Risk Manager.

- Risk Assessment: Risk Managers must be able to analyze a situation and recognize potential threats to a company’s operations. Demonstrate your ability to identify potential risks and formulate solutions to mitigate them.

- Communication: Risk Managers must be able to communicate effectively with staff in other departments and with external parties. Highlight your ability to communicate in a clear, concise manner to ensure any messages you deliver are understood.

- Problem Solving: Risk Managers must be able to come up with creative solutions to unexpected problems. Showcase your ability to think on your feet and come up with effective solutions.

- Project Management: Risk Managers must be able to organize and manage multiple projects at once. Describe your experience in developing and executing plans to ensure projects are completed on time and within budget.

- Regulatory Compliance: Risk Managers must ensure that all activities are conducted in accordance with industry standards and regulations. Demonstrate your knowledge of relevant laws and regulations, and your ability to ensure compliance.

By highlighting these skills on your resume, you’ll be well on your way to landing the Risk Manager position you’re after.

Key takeaways for an Risk Manager resume

Writing a resume for a Risk Manager position can be a daunting task for any job seeker. With the job market continually evolving and new technology being introduced, it’s important to make sure your resume stands out from the competition. This article will provide some key takeaways for creating a resume for a Risk Manager position.

- Highlight Your Experience:

When creating your resume, it is important to highlight your experience in risk management. Make sure to list any projects or initiatives that you’ve worked on, as well as any certifications or qualifications you may have. Don’t forget to mention any specialized training courses that you have taken to hone your skills as a Risk Manager. - Demonstrate Your Knowledge:

Having a solid understanding of risk management is essential for any Risk Manager position. Make sure to include any statistics or analytics used to monitor and track risk, as well as any strategies or processes used to manage risk. - Showcase Your Skills:

Risk Managers must have an array of skills in order to effectively manage risk. Be sure to highlight any skills you have in areas such as strategic planning, decision-making, communication, problem-solving, and data analysis. - Include Your Achievements:

Any achievements should be featured on your resume. Make sure to include any awards you have received or any metrics you have achieved with regards to reducing risk or improving performance. - Tailor Your Resume:

Your resume should be tailored to the specific Risk Manager position you are applying for. Make sure to highlight any experience you have that is specific to that position, as well as any skills or qualifications that would be beneficial for the role.

With these key takeaways in mind, you will be well equipped to create an effective resume for a Risk Manager position. Be sure to highlight your experience, knowledge, skills, and achievements to ensure you stand out from the competition. Good

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder