Writing a resume as an insurance loss control specialist can be a daunting task, as the skills and experience required for this specialized field require a precise understanding of the job and how to convey your expertise in an effective way. This guide will provide you with tips and examples to help you write a successful resume for an insurance loss control specialist. You’ll also learn about the job requirements and important skills and qualifications that employers look for. With a strong resume and the right preparation, you can impress potential employers and land the insurance loss control specialist position you’re after.

Loss Control Specialist Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Insurance Loss Control Specialist Resume Example

John Doe

Loss Control Specialist

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

An experienced and highly motivated Loss Control Specialist with a strong customer service track record and extensive experience in the insurance industry. Highly adept at analyzing potential risks and hazards, conducting loss control and safety surveys, and providing technical advice and support to clients. Possesses thorough knowledge of applicable codes and regulations related to loss control and safety.

Core Skills:

- Risk and Hazard Analysis

- Loss Control and Safety Surveys

- Compliance with Codes & Regulations

- Technical Support

- Client Communication

- Research and Reporting

- Data Analysis

Professional Experience:

Loss Control Specialist, XYZ Insurance, June 2018- Present

- Conduct risk and hazard analysis to identify threats to client operations.

- Develop and implement loss control and safety surveys for clients to assess current safety and efficiency standards.

- Review and interpret applicable codes and regulations to ensure compliance with policies and procedures.

- Provide technical support to clients regarding loss control and safety issues.

- Communicate regularly with clients to maintain a positive working relationship.

- Research and report on safety- related topics for clients.

- Analyze data to identify potential areas of improvement for clients.

Education:

Bachelor of Science in Safety and Loss Control, ABC University, 2017

Insurance Loss Control Specialist Resume with No Experience

Recent college graduate with a passion for insurance and a desire to learn and excel as a Loss Control Specialist. Adaptable and organized with a commitment to providing quality services to customers.

Skills

- Strong organizational skills

- Excellent customer service

- Knowledge of insurance policies

- Problem- solving ability

- Proficiency in Microsoft Office

Responsibilities

- Inspect physical locations for safety and security

- Assess potential hazards and risks

- Analyze data to identify areas for improvement

- Provide detailed reports for business owners

- Develop comprehensive safety plans

- Advise business owners on proper safety measures

- Conduct employee training regarding safety protocols

Experience

0 Years

Level

Junior

Education

Bachelor’s

Insurance Loss Control Specialist Resume with 2 Years of Experience

Diligent and detail- oriented Insurance Loss Control Specialist with two years of experience in providing assistance and support to insurance companies, brokers and underwriters. Experienced in performing inspections, collecting data, identifying risk preventative measures and auto- rating for insurance companies. Skilled in customer relations, problem solving and time management. Seeking to leverage expertise to take on a new professional challenge.

Core Skills:

- Inspection and Risk Mitigation

- Data Analysis and Collection

- Auto- rating

- Customer Relations

- Time Management

- Problem Solving

Responsibilities:

- Conducted regular inspections of property and equipment to identify potential risk and liabilities.

- Gathered data and information to determine appropriate auto- rating for insurance companies.

- Provided guidance and recommendations on risk prevention and determination.

- Assisted with customer inquiries, disputes, and renewals.

- Created and maintained accurate records of inspections and customer relations.

- Developed and implemented strategies to improve customer relations.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Insurance Loss Control Specialist Resume with 5 Years of Experience

A seasoned and dedicated Insurance Loss Control Specialist with 5 years of experience in the insurance industry. Proven track- record in successfully overseeing the development and implementation of loss control processes, driving continuous improvement initiatives, and managing multiple simultaneous projects. Experienced in analyzing risk and utilizing various methods to reduce potential exposure, as well as developing detailed reports to senior management outlining findings. Possesses a proven ability to coordinate and prioritize multiple tasks with accuracy and efficiency.

Core Skills:

- Insurance Loss Control

- Risk Analysis

- Process Improvement

- Report Writing

- Project Management

- Regulatory Compliance

Responsibilities:

- Developed and implemented loss control processes tailored to meet the specific needs of each client

- Performed detailed risk analysis of the policies and procedures to ensure compliance with applicable regulations

- Implemented process improvement initiatives to reduce exposure and increase efficiency

- Prepared detailed reports for senior management outlining findings and recommended actions

- Managed multiple projects simultaneously to ensure deadlines were met

- Ensured compliance with applicable insurance regulations and laws

Experience

5+ Years

Level

Senior

Education

Bachelor’s

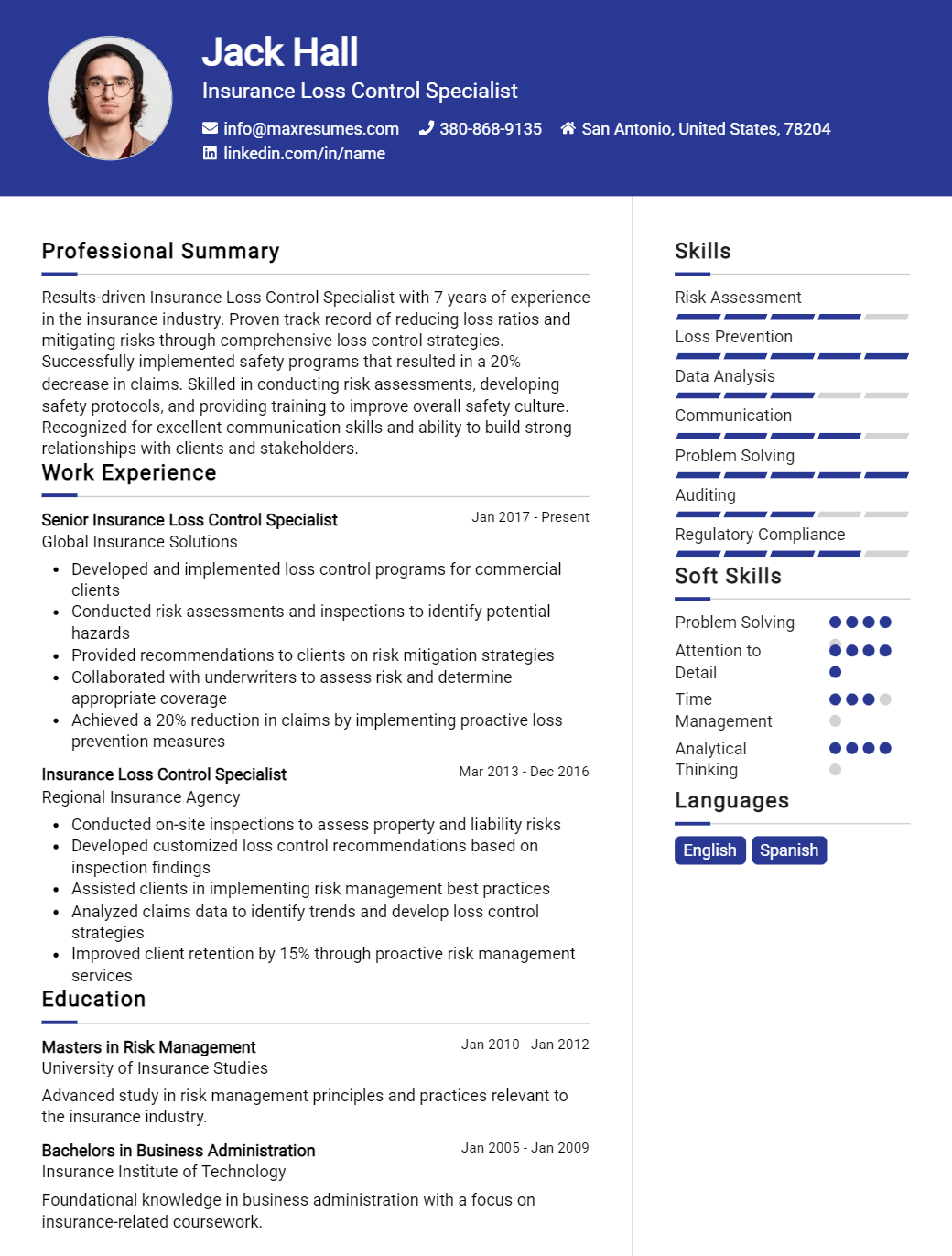

Insurance Loss Control Specialist Resume with 7 Years of Experience

With 7 years of experience as an Insurance Loss Control Specialist, I have developed a comprehensive knowledge in all aspects of insurance, including underwriting, loss control and analysis, and risk management. My analytic, problem- solving and communication skills have enabled me to effectively identify risks, assess insurance needs and provide comprehensive solutions to clients. I am comfortable with working independently or as part of a collaborative team, and I have a talent for working with a wide range of stakeholders, including clients, insurance companies and regulators.

Core Skills:

- Analytical Thinking

- Risk Assessment

- Underwriting

- Loss Control

- Regulatory Compliance

- Problem Solving

- Client Management

- Report Writing

- Communication

Responsibilities:

- Conducted detailed risk assessments to identify areas of risk exposure and develop alternative solutions

- Analyzed environmental and financial conditions of potential insureds

- Evaluated insurance needs and provided underwriting guidance and risk management advice

- Developed and implemented loss control strategies to reduce risks and improve the safety and security of clients

- Prepared detailed reports for clients, insurance companies and regulators

- Performed detailed reviews of policy documents, contracts and other relevant documents

- Maintained a thorough understanding of regulatory and industry standards

- Monitored and reviewed loss control programs to ensure compliance with applicable laws and regulations

- Assisted in training and development of insurance personnel on loss control best practices.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Insurance Loss Control Specialist Resume with 10 Years of Experience

Experienced Insurance Loss Control Specialist with 10+ year’s experience developing and implementing plans to reduce losses, identify and mitigate risks, and ensure compliance with federal and state regulations. Adept in creating informative reports and providing professional recommendations after evaluating risk and identifying potential areas of vulnerability. Proven ability to employ effective communication and organizational skills to develop innovative preventative plans and conflict resolution strategies.

Core skills:

- Risk Analysis

- Regulatory Compliance

- Loss Reduction Strategies

- Conflict Resolution

- Risk Management

- Report Writing

- Data Analysis

- Business Continuity Planning

- Documentation and Record Keeping

Responsibilities:

- Conducting detailed risk assessment of an organization’s operations and designing preventative strategies to reduce exposure to losses

- Developing and implementing risk management plans to ensure compliance with federal and state regulations

- Analyzing data and providing professional recommendations to manage risks more effectively

- Conducting audits and inspections of organization’s operations to identify areas of vulnerability

- Providing in- depth reports on risk management and loss control programs

- Developing and delivering training programs for employees on risk management and safety procedures

- Developing and maintaining documentations and records of risk management activities and changes

- Managing business continuity planning programs and ensuring that plans are up- to- date

- Collaborating with senior management to identify and mitigate potential risks to the organization

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Insurance Loss Control Specialist Resume with 15 Years of Experience

I am an experienced Insurance Loss Control Specialist with 15 years of experience helping businesses reduce and mitigate potential risks and losses. I have an extensive experience in insurance risk assessment, hazard analysis, safety program development, and regulation compliance. My expertise also includes providing loss control report and instruction to clients, conducting safety inspections, and analyzing safety reports. I am well- versed in the regulations, industry best practices, and safety protocols of the industry.

Core Skills:

- Insurance Risk Assessment

- Hazard Analysis

- Safety Program Development

- Regulation Compliance

- Loss Control Reporting

- Safety Inspections

- Safety Report Analysis

- Knowledge of Industry Regulations

- Industry Best Practices

- Safety Protocols

Responsibilities:

- Develop and implement safety plans to reduce and mitigate potential risks and losses

- Conduct safety inspections to identify potential hazards and address areas of concern

- Create detailed loss control reports and instructions to clients

- Analyze safety reports and identify risks and potential losses

- Provide guidance and advice to clients on safety regulations and industry best practices

- Maintain records and documentation of safety inspections and reports

- Monitor and review safety programs to ensure compliance with industry regulations and standards

- Participate in training and seminars related to insurance loss control

- Conduct research to stay up to date on new industry regulations, best practices, and safety protocols

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Insurance Loss Control Specialist resume?

A career as an insurance loss control specialist requires strong analytical, communication and research skills. When creating a resume for this type of job, it is important to highlight your skills and experience in a way that catches the eye of potential employers. Here is a list of what should be included in an insurance loss control specialist resume:

- Professional Summary: Provide a brief but descriptive overview of your experience and qualifications.

- Education: Include any degrees, certifications, and training programs applicable to the position.

- Technical Skills: List any software, tools or other technical skills that you have acquired and can use to benefit the company you are applying to.

- Work Experience: Include any positions that are related to the insurance industry and highlight any relevant accomplishments.

- Leadership: Share any notable achievements that demonstrate your leadership abilities.

- Problem Solving: Detail any past experiences in which you were able to identify and solve a problem quickly and efficiently.

- Communication: Describe your communication skills and any successes in working with diverse groups of people or in difficult situations.

- Analytical Skills: Showcase your ability to analyze data, identify trends and develop action plans.

- Interpersonal Skills: Provide examples of your ability to build strong relationships and collaborate effectively.

What is a good summary for a Insurance Loss Control Specialist resume?

A summary for an Insurance Loss Control Specialist resume should highlight your experience in the industry, as well as any specialized skills and knowledge you have acquired. It should also include your ability to evaluate a business’s risk and compliance with state and federal regulations. Your summary should mention any relevant experience in the insurance industry, such as managing claims, conducting risk assessments, evaluating insurance policies, and providing risk analysis. Finally, it should emphasize your attention to detail and customer service skills, as well as your ability to analyze and interpret data. With your summary, you should demonstrate your commitment to helping businesses reduce their risk of loss and liability.

What is a good objective for a Insurance Loss Control Specialist resume?

A good objective for a Insurance Loss Control Specialist resume should demonstrate the applicant’s ability to identify and mitigate risks, provide sound advice and recommendations, and analyze data to identify trends. A successful objective should also showcase the applicant’s dedication to the industry, their willingness to learn and grow, and their ability to work collaboratively in a team environment.

An ideal objective should include the following:

- Utilize expert knowledge of the insurance industry and risk management techniques to develop and implement effective loss control strategies

- Evaluate data and create strategies to reduce the impact of losses and improve the overall safety and effectiveness of the organization.

- Analyze processes and procedures to identify areas of improvement and ensure compliance with state and regulatory standards.

- Provide consultation and sound advice to internal and external stakeholders in order to mitigate risk and increase safety

- Develop and maintain relationships with insurance companies, regulators and other stakeholders within the industry.

- Remain up-to-date on existing and emerging risk management technologies and practices.

How do you list Insurance Loss Control Specialist skills on a resume?

When creating a resume for a position as an Insurance Loss Control Specialist, it’s important that you showcase your specific skills and qualifications in order to stand out from the crowd. Your skillset should objectively demonstrate how you can be a valuable asset to an insurance company and how you can help them better manage loss control. Here are some key skills to include on your resume:

- Knowledge of the insurance industry: It is essential to have a fundamental understanding of the insurance industry and its various regulations. Showcasing this knowledge will allow recruiters to understand how you can be an effective Insurance Loss Control Specialist.

- Analytical skills: A successful Insurance Loss Control Specialist must have strong analytical skills to be able to identify risks and develop strategies for mitigating them.

- Risk assessment: Risk assessment is an essential part of a Loss Control Specialist’s job. Your resume should detail your ability to assess risk, identify potential losses, and develop strategies to mitigate potential harm.

- Problem solving: Solving problems is a major part of managing risk. A good Loss Control Specialist must be able to troubleshoot potential risks and find viable solutions.

- Communication: Communication is essential in an Insurance Loss Control Specialist role. Ensuring that you can effectively communicate with colleagues and clients is a must-have skill to include on your resume.

- Interpersonal skills: Strong interpersonal skills are important when dealing with clients. Demonstrating how you can build relationships and effectively negotiate with clients is a great skill to highlight on your resume.

What skills should I put on my resume for Insurance Loss Control Specialist?

When crafting a resume for a job as an Insurance Loss Control Specialist, it is important to highlight the key skills that demonstrate your knowledge and abilities. Depending on the job you are applying for, you may want to include some of the following skills:

- Knowledge of safety principles and risk management: You should be able to demonstrate a thorough understanding of risk management principles, safety codes, and industry regulations.

- Interpersonal skills: Insurance Loss Control Specialists need to be able to communicate effectively with colleagues, clients, and other stakeholders.

- Organizational capabilities: Specialists must be able to prioritize tasks and meet deadlines in order to ensure that all Loss Control processes are completed in a timely manner.

- Problem-solving skills: Specialists must have the ability to analyze situations and develop solutions that reduce potential losses.

- Documentation/Reporting: Insurance Loss Control Specialists must be able to create accurate reports and maintain detailed records of their activities.

- Research and Analysis: Specialists should be able to conduct research to identify and analyze trends and hazards that could lead to losses.

- Technical Expertise: Depending on the job, Specialists may need to demonstrate expertise with technology such as data analysis software, spreadsheets, and other tools.

- Project Management: Specialists should be able to plan and manage Loss Control projects in order to ensure that they are completed efficiently and effectively.

Key takeaways for an Insurance Loss Control Specialist resume

When it comes to creating a resume for a job in the insurance industry, there are certain key takeaways that should be kept in mind. As an insurance loss control specialist, you should make sure to emphasize your knowledge of the insurance industry, your ability to manage risk, and your experience in assessing and controlling losses.

To start, you should make sure to include your experience in the insurance industry, such as your experience in underwriting, risk assessment, and loss control. It is also important to showcase your knowledge of the insurance industry regulations and laws, as well as your understanding of the industry trends and developments.

In addition, you should accentuate your ability to assess risk and take steps to minimize losses. This could include providing examples of how you have identified and managed potential risks, as well as how you have implemented strategies to reduce the potential for losses.

It is also important to emphasize your ability to communicate effectively in the insurance industry. You should provide examples of how you have effectively negotiated with clients, as well as how you have been able to work with other professionals in the industry to come up with the best solutions and strategies.

Finally, you should make sure to showcase your team-oriented skills. You should provide examples of how you have effectively collaborated with other professionals in the industry to come up with innovative solutions and strategies.

By keeping these key takeaways in mind, you can ensure that your resume for an insurance loss control specialist will stand out from the competition. By emphasizing your knowledge of the insurance industry, your ability to manage risk, your communication skills, and your team-oriented approach, you can showcase your talents and experiences to potential employers.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder