Writing a strong resume when applying for the position of an Insurance Credit Analyst is a challenging task. As an aspiring candidate, you must be able to showcase your professional experience, skills, and qualifications. This guide will provide you with basic resume writing advice as well as examples of how to properly format your resume for an Insurance Credit Analyst position. Additionally, you will find useful tips on how to stand out from other applicants and increase your chances of getting the job.

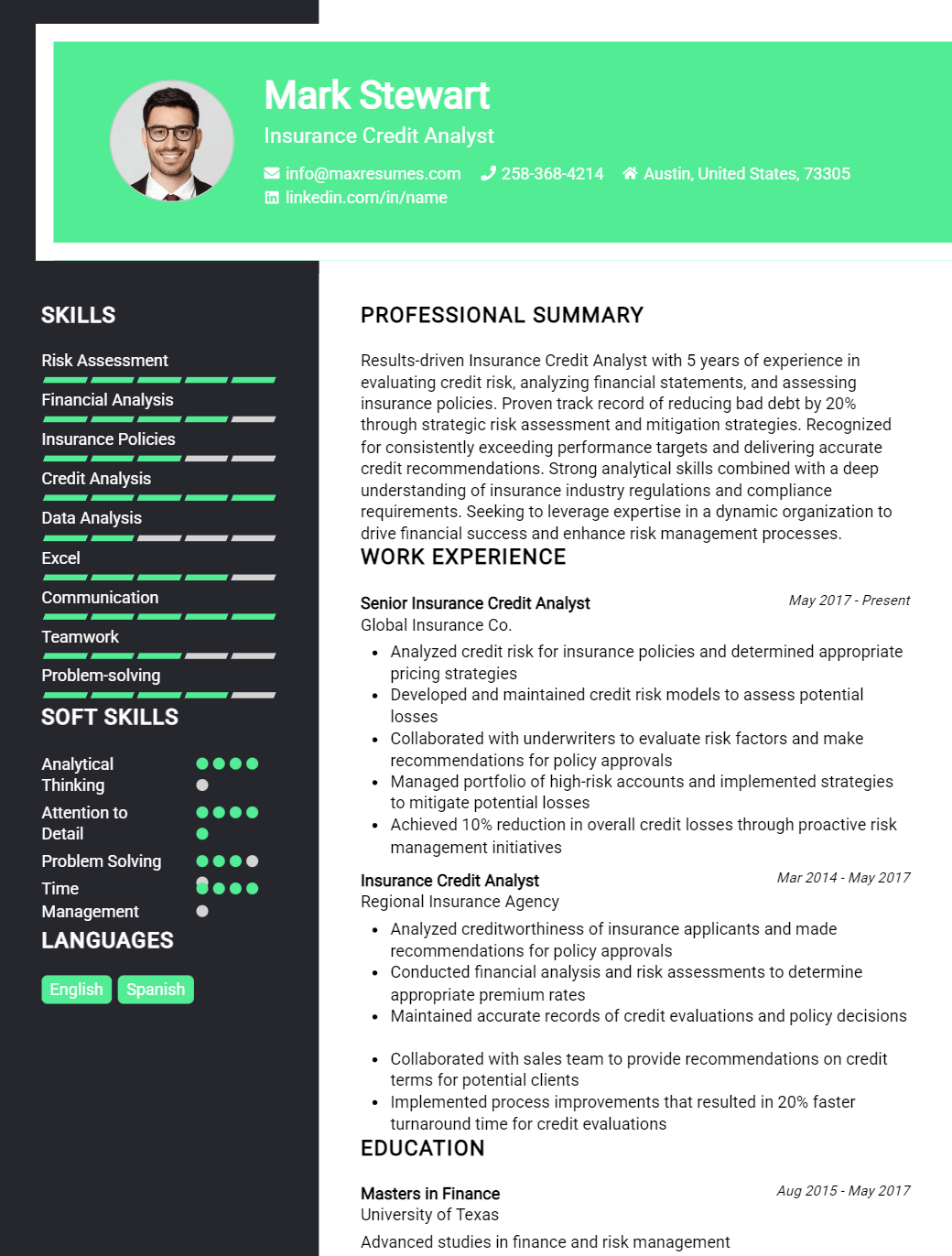

Credit Analyst Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Insurance Credit Analyst Resume Examples

John Doe

Insurance Credit Analyst

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am a highly organized and analytical professional with over 8 years of experience in the insurance credit and financial analysis industry. My expertise lies in researching and analyzing credit and financial data to accurately assess the risk of a potential client. I am experienced in working with a wide range of financial statements and other financial documents, and I am well- versed in the nuances of the insurance industry. I possess strong problem- solving and communication skills, allowing me to quickly identify potential issues and recommend solutions to address them. I am eager to use my financial analysis skills to contribute to the success of an insurance organization.

Core Skills:

- Financial Analysis

- Credit Risk Assessment

- Insurance Industry Expertise

- Data Analysis

- Problem Solving

- Communication

Professional Experience:

Senior Credit Analyst, ABC Insurance Company, 2016 – Present

- Analyze and evaluate the credit risk of potential clients by researching and reviewing financial statements, credit reports, and other financial documents

- Consult with insurance underwriters to discuss credit risk and make recommendations for the approval of policies

- Develop and implement procedures to ensure that credit processes are followed to reduce risk

- Monitor existing accounts to ensure that credit risk is minimized

- Ensure compliance with all insurance regulations and policies

Credit Analyst, XYZ Insurance Company, 2012 – 2016

- Performed detailed financial analysis of potential clients’ financial statements to assess creditworthiness

- Collaborated with underwriting team to develop comprehensive credit risk profiles and risk mitigation strategies

- Developed and maintained relationships with clients to ensure accuracy of credit information

- Maintained accurate records of credit risk analysis and credit decisions

- Identified any potential issues with credit risk and reported them to management

Education:

Bachelor of Science in Business Administration, ABC University, 2010 – 2012

Associate of Science in Financial Analysis, XYZ College, 2008 – 2010

Insurance Credit Analyst Resume with No Experience

A highly motivated and resourceful individual eager to launch a career as an Insurance Credit Analyst. My background in business and finance has enabled me to develop strong problem- solving and analytical skills, which I can apply to the field of insurance credit.

Skills

- Strong problem- solving and analytical skills

- Excellent verbal and written communication skills

- Highly organized and detail- oriented

- Excellent time management and multitasking abilities

- Proficient with Microsoft Office Suite

- Knowledge of relevant insurance regulations and requirements

Responsibilities

- Review and analyze credit applications and financial statements

- Assess risk associated with lending decisions

- Provide recommendations on credit limits and terms

- Monitor and analyze changes in credit environment

- Evaluate creditworthiness of existing customers

- Assist in developing and implementing policies and procedures for loan processing

Experience

0 Years

Level

Junior

Education

Bachelor’s

Insurance Credit Analyst Resume with 2 Years of Experience

Highly organized and detail- oriented Insurance Credit Analyst with two years of experience in performing credit checks and risk assessments for clients. Possess a Bachelor’s Degree in Business Administration and a Certified Credit Analyst designation. Demonstrated ability to analyze financial statements and assess creditworthiness of clients, while ensuring adherence to banking regulations. Proven skills in engaging with clients, providing solutions to credit problems, and contributing to the sales process.

Core Skills:

- Credit Analysis

- Risk Assessment

- Financial Statement Analysis

- Banking/Regulatory Compliance

- Client Relations

- Problem Solving

- Sales Process

Responsibilities:

- Conducted credit checks and risk assessment of clients before approving credit

- Analyzed financial statements of clients to assess creditworthiness

- Verified if clients adhered to the applicable banking regulations

- Provided solutions to clients facing credit problems

- Assisted with sales process by understanding client needs and providing appropriate financial solutions

- Developed and maintained strong relationships with clients

- Prepared credit reports and documents for internal and external review

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Insurance Credit Analyst Resume with 5 Years of Experience

Highly analytical and detail- oriented Insurance Credit Analyst with 5 years of experience in assessing the creditworthiness of clients and partnering with risk management teams to develop sound strategies for expanding the company’s portfolio. Skilled in financial analysis, credit rating models, and risk management operations. Possess an in- depth knowledge of the regional financial markets and their regulations. Seeking a position to leverage my skills and expertise to support the growth of an established financial services organization.

Core Skills:

- Financial Analysis

- Credit Rating Models

- Risk Management Strategies

- Creditworthiness Evaluation

- Regulatory Compliance

- Portfolio Management

- Data Interpretation

- Relationship Building

Responsibilities:

- Evaluated creditworthiness of clients through due diligence and market analysis of financial statements

- Developed risk management strategies for the company’s portfolio to ensure regulatory compliance

- Analyzed financial data and provided reports to support the company’s decision- making process

- Developed credit rating models and risk management procedures to minimize losses

- Collaborated with stakeholders to identify potential areas of improvement and suggest solutions

- Identified potential problems and provided solutions to mitigate the risks associated with them

- Monitored changes in the financial markets and regulatory updates and ensured compliance with applicable laws

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Insurance Credit Analyst Resume with 7 Years of Experience

Highly experienced Insurance Credit Analyst offering 7 years of expertise in the financial services industry. Demonstrated ability to accurately assess risk on loan applications, ensuring compliance with company policies and regulatory standards. Proven track record of effectively managing a high volume of loan applications, with a focus on achieving customer satisfaction.

Core Skills:

- Risk Analysis

- Credit Analysis

- Regulatory Compliance

- Documentation Analysis

- Problem Solving

- Decision Making

- Organizational Skills

Responsibilities:

- Analyze loan documents to assess risk

- Utilize credit scoring models to identify potential credit risks

- Prepare loan applications for approval

- Review loan documents to ensure accuracy and compliance

- Monitor and report on loan portfolio performance

- Determine credit scoring and loan approval ratings

- Analyze customer credit reports to identify risk factors

- Monitor credit limits and loan terms

- Research emerging trends in the credit industry to ensure compliance with laws and regulations.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Insurance Credit Analyst Resume with 10 Years of Experience

Experienced Insurance Credit Analyst specializing in risk assessment and credit analysis. Skilled in evaluating creditworthiness and analyzing financial statements, with a comprehensive understanding of principles and practices in consumer, commercial, and mortgage lending. Equipped to provide guidance and expertise on loan structuring, loan processing, and portfolio management.

Core Skills:

- Risk Assessment

- Credit Analysis

- Financial Statement Analysis

- Consumer/Commercial/Mortgage Lending

- Loan Structuring

- Loan Processing

- Portfolio Management

- Communication

- Computer Proficiency (MS Office, CRMs)

Responsibilities:

- Performed thorough credit analysis of consumer, commercial and mortgage loan applications

- Evaluated creditworthiness of loan applicants and determined overall risk assessment

- Analyzed financial statements and provided recommendations on appropriate loan structuring

- Assisted in loan processing activities and ensured timely completion of loan applications

- Managed loan portfolio and identified any potential credit risks or delinquency issues

- Communicated with loan applicants and provided guidance and assistance

- Utilized computer software for data entry and reporting (MS Office, CRMs)

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Insurance Credit Analyst Resume with 15 Years of Experience

A financial services professional with over 15 years of experience in the insurance industry. Utilizing a comprehensive understanding of insurance policies, credit analysis and financial analysis, I have worked for a variety of companies in a variety of roles, from credit analyst to auditor. My expertise lies in interpreting financial statements and understanding the implications of creditworthiness and risk. My exceptional communication and problem solving skills, combined with a commitment to improving client outcomes, have enabled me to become a valuable asset to my employers.

Core Skills:

- Credit Analysis

- Financial Analysis

- Risk Analysis

- Insurance Policies

- Communication

- Problem Solving

- Data Analysis

- Client Relations

Responsibilities:

- Evaluated customer creditworthiness and risk profile for loan determinations, using financial statements and credit reports.

- Performed financial and credit analysis of clients, to determine the risk of extending credit and to calculate the appropriate credit limit.

- Developed, implemented and maintained credit policies, procedures and practices.

- Monitored and reported on customer and industry trends and challenges.

- Researched and identified new markets and potential clients.

- Developed and maintained relationships with clients and stakeholders.

- Negotiated terms of credit for customers and ensured compliance with relevant laws and regulations.

- Provided financial and strategic advice to clients to help them manage their finances.

- Analyzed and reviewed customer payments to ensure timely receipt of payments.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Insurance Credit Analyst resume?

A resume for an Insurance Credit Analyst should include the following:

- Education: Include your highest level of education, including any relevant degrees or certifications.

- Work Experience: List all relevant work experience, including job title, company name, and dates of employment.

- Skills: Include any relevant technical skills, such as experience with financial software, databases, and research tools.

- Professional Achievements: Highlight any achievements in your professional career, such as awards or successful projects.

- Knowledge of Insurance Credit: Demonstrate your knowledge of insurance credit, including understanding of credit scoring, loan underwriting, and risk-management principles.

- Ability to Analyze Risk: Showcase your ability to assess credit risk and make sound financial recommendations.

- Analytical Thinking: Demonstrate your ability to think analytically and interpret complex data.

- Communication Skills: Showcase your communication skills, including experience with oral and written communication.

- Ability to Work Under Pressure: Demonstrate your ability to remain composed, composed and organized in high-pressure situations.

- Leadership: Highlight any leadership experience, such as supervising teams or managing large projects.

By including all these components, you can create an effective resume that will help you stand out from the competition and secure a job as an Insurance Credit Analyst.

What is a good summary for a Insurance Credit Analyst resume?

A good summary for an Insurance Credit Analyst resume should focus on the applicant’s unique qualifications and experience in the industry. It should highlight any experience in assessing credit risks, structuring and designing financial products, and conducting analytics to support complex financial decisions. The summary should also emphasize the applicant’s ability to work effectively in a team environment and their excellent problem solving skills. Ultimately, the summary should showcase the applicant’s expertise in the field of insurance credit analysis and convey that they are an ideal candidate for the role.

What is a good objective for a Insurance Credit Analyst resume?

A good objective for a Insurance Credit Analyst resume should focus on the applicant’s qualifications and experience in the field, as well as the specific skills they will bring to the role.

Some key points to consider when crafting an Insurance Credit Analyst resume objective include:

- Demonstrating knowledge of credit risk analysis principles

- Highlighting relevant qualifications such as a bachelor’s degree in finance or accounting

- Showing expertise in financial analysis, portfolio management, and credit underwriting

- Mentioning any experience in the insurance industry

- Highlighting interpersonal skills such as communication, collaboration, and customer service

- Demonstrating strong organizational and problem-solving skills

By emphasizing their qualifications, skills, and experience, applicants can set themselves apart from other candidates and stand out to potential employers.

How do you list Insurance Credit Analyst skills on a resume?

When writing a resume, it is important to showcase the right skills to make a good impression on potential employers. Insurance Credit Analyst is a demanding and rewarding job, and the skills required to succeed in the role must be accurately laid out in the resume. Here are some of the key skills to include when listing Insurance Credit Analyst skills on a resume:

- In-depth Knowledge of Insurance Credit Analysis: Insurance Credit Analysts must have comprehensive knowledge of the insurance credit analysis process and related regulations.

- Analytical Skills: Insurance Credit Analysts must have strong analytical skills to be able to evaluate risk and develop effective strategies for mitigating it.

- Risk Assessment: Insurance Credit Analysts must be able to identify and assess risk on a wide scale in order to develop effective strategies for minimizing it.

- Financial Management: Insurance Credit Analysts must have strong financial management abilities, including budgeting, forecasting, and analyzing financial information.

- Data Analysis: Insurance Credit Analysts must have the ability to analyze and interpret large amounts of data in order to reach meaningful conclusions.

- Communication Skills: Insurance Credit Analysts must be able to effectively communicate their findings and recommendations to management in order to influence decision-making.

By including these key skills in your resume, you will be able to demonstrate to potential employers that you have the skills and knowledge necessary to excel as an Insurance Credit Analyst.

What skills should I put on my resume for Insurance Credit Analyst?

As an Insurance Credit Analyst, you need a resume that shows you possess the necessary skills, qualifications, and experience for the job. Here is a list of the key skills and qualifications you should consider including on your resume:

- Data Analysis: Insurance Credit Analysts must have excellent analytical skills, allowing them to identify trends and potential risks in financial data and make informed decisions.

- Risk Management: Insurance Credit Analysts must understand risk management, ensuring that the organization is protected from potential losses.

- Business Acumen: Insurance Credit Analysts must have a strong understanding of business operations, industry trends, and regulations.

- Financial Knowledge: Insurance Credit Analysts must have a strong knowledge of the financial markets, including stocks, bonds, and derivatives.

- Computer Skills: Insurance Credit Analysts must be proficient with computer software, including spreadsheets, databases, and statistical programs.

- Communication Skills: Insurance Credit Analysts must be able to communicate effectively with colleagues, superiors, and clients.

- Negotiation Skills: Insurance Credit Analysts must be able to negotiate favorable terms and agreements on behalf of the organization.

By including these skills on your resume, you will demonstrate to potential employers that you possess the necessary qualifications to be a successful Insurance Credit Analyst.

Key takeaways for an Insurance Credit Analyst resume

An insurance credit analyst plays an essential role in the insurance industry. They assess the creditworthiness of potential and existing customers to determine the level of risk associated with granting a loan or policy. As such, a resume for an insurance credit analyst should highlight their experience, education, and skills. Below are some key takeaways for creating a strong resume for an insurance credit analyst.

- Highlight your education: An insurance credit analyst should have a good understanding of finance, accounting, and risk management. Make sure to include the educational institutions you attended and the degrees you earned.

- Showcase your experience: Be sure to demonstrate your experience with credit analysis and relevant skills such as financial modeling and analysis, data mining, and risk assessment.

- Discuss certifications: Insurance credit analysts may hold industry certifications such as the Associate of the Chartered Insurance Institute or the Chartered Insurance Institute of Canada. List any certifications you hold on your resume.

- Demonstrate your skills: Insurance credit analysts should have excellent communication, interpersonal, and organizational skills. Be sure to highlight your proficiency in these areas.

- Emphasize your knowledge: Make sure to showcase your knowledge of regulations related to insurance and credit.

By following these key takeaways, your resume for an insurance credit analyst position should be well-rounded and stand out from the competition. Good luck!

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder