Writing a resume for an insurance compliance officer position can be a daunting task. This guide provides best practices for resume creation, as well as examples of resumes from successful applicants. It will also provide insight into crafting a targeted resume that showcases an applicant’s relevant experience and accomplishments. The tips and resources provided in this guide will help applicants craft a resume that effectively conveys their qualifications to potential employers.

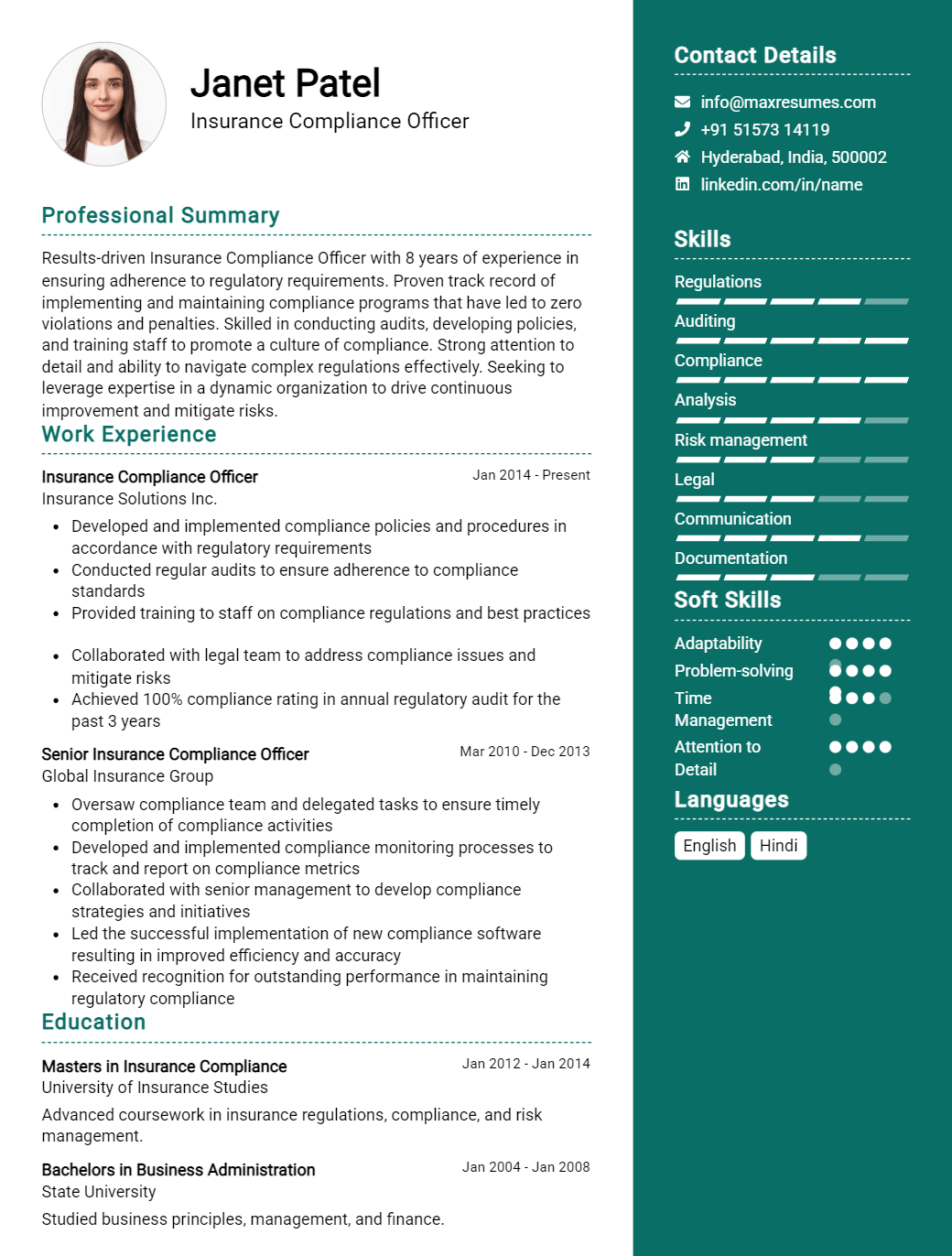

Compliance Officer Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Insurance Compliance Officer Resume Examples

John Doe

Insurance Compliance Officer

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

A professional and experienced Insurance Compliance Officer with extensive expertise in regulatory compliance and risk management processes. Proven ability to develop and implement policies and procedures to ensure the accuracy and integrity of the organization’s compliance program. Highly skilled in the interpretation and application of relevant laws, regulations and industry codes of practice. Possesses excellent communication and problem- solving skills, which can be applied to ensuring compliance with all applicable laws and regulations.

Core Skills:

- Laws, regulations and industry codes of practice

- Compliance and risk management

- Development and implementation of policies and procedures

- Interpretation and application of relevant laws

- Excellent communication

- Problem- solving

Professional Experience:

Insurance Compliance Officer, ABC Company – June 2019 to Present

- Develop, implement and maintain a comprehensive compliance program

- Conduct regular reviews of the organization’s compliance activities

- Monitor regulatory changes and updates to ensure compliance

- Identify and investigate compliance issues and recommend corrective action

- Provide advice and guidance on compliance matters to various areas of the organization

- Conduct research and prepare reports on relevant laws and regulations

Education:

Bachelor of Science in Business Administration, University of XYZ, 2019

Insurance Compliance Officer Resume with No Experience

A motivated and detail- oriented individual seeking to leverage my strong communication and organizational skills to fulfill the role of Insurance Compliance Officer. I am eager to learn and apply best practices in the field of insurance compliance and risk management.

Skills

- Strong attention to detail

- Proven analytical/problem solving skills

- Excellent written and verbal communication

- Proficient with relevant computer software and systems

- Proven organizational skills

- Ability to prioritize tasks and work independently

Responsibilities

- Monitoring insurance regulations and laws pertinent to the company

- Ensuring that the company adheres to insurance regulations and laws

- Developing and implementing policies and procedures related to insurance compliance

- Providing support and guidance to the company’s staff on insurance related matters

- Creating reports and reviewing existing policies and procedures

- Identifying areas of risk and working to eliminate them

- Conducting research on current trends and best practices in the insurance industry

- Collaborating with other departments to ensure compliance with laws and regulations

Experience

0 Years

Level

Junior

Education

Bachelor’s

Insurance Compliance Officer Resume with 2 Years of Experience

I am an experienced Insurance Compliance Officer with over 2 years of experience in the financial industry. I have a deep knowledge of applicable regulations and understand the importance of adherence to those regulations. I possess excellent organizational and communication skills, enabling me to effectively manage complex projects and ensure the highest standards of compliance. I am a motivated self- starter and take great pride in meeting and exceeding expectations.

Core Skills:

- Regulatory Compliance

- Risk Management

- Data Analysis

- Project Management

- Communication

- Organizational Skills

- Problem Solving

- Document Preparation

Responsibilities:

- Monitor and analyze changes in laws, regulations, and industry best practices, and ensure compliance throughout the organization.

- Develop and implement comprehensive policies, procedures, and systems to ensure compliance with all applicable rules and regulations.

- Communicate and coordinate with internal and external stakeholders to ensure compliance with all requirements.

- Identify and assess risks associated with new and existing operations, and develop and implement strategies to mitigate those risks.

- Maintain and update records and documentation related to compliance activities.

- Monitor and review internal processes and procedures to ensure compliance with regulations and internal policies.

- Develop and conduct training programs to ensure employees remain up- to- date on relevant compliance regulations and requirements.

- Respond to inquiries from regulatory authorities and provide requested information in a timely manner.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Insurance Compliance Officer Resume with 5 Years of Experience

A highly motivated, detail- oriented Insurance Compliance Officer with 5 years of experience in the insurance industry. Possess an in- depth knowledge of insurance laws and regulations and is an expert in risk management and assessment. Possesses a strong ability to identify, address and resolve any areas of non- compliance as well as provide comprehensive oversight to ensure all procedures and policies are met.

Core Skills

- Comprehensive knowledge of insurance laws and regulations

- Risk management and assessment

- Effective communication and interpersonal skills

- Attention to detail and problem solving

- Ability to develop and maintain compliance policies and procedures

- Computer literacy

Responsibilities

- Develop and implement compliance policies and procedures to ensure adherence to applicable laws and regulations

- Monitor developments in insurance laws, regulations and industry best practices

- Conduct periodic risk assessments to identify potential areas of non- compliance

- Investigate and resolve any non- compliance issues

- Ensure that all insurance policies, procedures, and systems are up- to- date and in compliance with applicable regulations

- Review and process documentation to ensure accuracy

- Provide guidance to staff on any compliance related issues

- Provide training to staff on insurance- related matters

- Liaise with relevant government authorities on compliance issues

- Prepare and submit reports on compliance activities as required

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Insurance Compliance Officer Resume with 7 Years of Experience

Results- driven Insurance Compliance Officer with seven years of experience in the insurance industry. Adept in performing a wide range of duties such as developing, implementing, and monitoring compliance programs, maintaining up- to- date knowledge of applicable laws and regulations, and conducting compliance trainings. Proven success in providing professional guidance to ensure compliance with local and international regulations. Possesses strong analytical and problem- solving skills, with a willingness to take initiative and prioritize conflicting projects.

Core Skills:

- Regulatory Compliance

- Risk Assessment

- Policy & Procedure Development

- Problem Solving

- Auditing & Monitoring

- Investigation & Reporting

- Records Management

- Presentation & Training

Responsibilities:

- Developed and implemented effective compliance programs that ensure the company’s adherence with local and international regulations.

- Conducted regular audits and assessments to ensure compliance with policies and procedures.

- Monitored changes in local and international laws and regulations, and updated compliance programs accordingly.

- Investigated reported compliance violations and incidents, and prepared detailed reports outlining findings and recommendations.

- Devised and conducted trainings and presentations to raise awareness of compliance- related topics.

- Maintained accurate records of compliance- related documents and activities.

- Collaborated with other departments to resolve compliance- related issues and ensure smooth operations.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Insurance Compliance Officer Resume with 10 Years of Experience

Experienced Insurance Compliance Officer with 10 years of experience in health, life, and property insurance compliance. A detail- oriented and effective communicator with a proven track record of driving successful compliance initiatives. Skilled in developing and managing compliance programs, ensuring accuracy of client data, and analyzing regulatory changes. Highly knowledgeable in the implementation and reporting of corporate compliance strategies.

Core Skills:

- Regulatory Compliance

- Client Data Analysis

- Compliance Program Development

- Insurance Compliance Monitoring

- Reporting & Documentation

- Risk Management

- System Auditing

- Company & Regulatory Policies

Responsibilities:

- Created and implemented companywide compliance programs for health, life, and property insurance policies.

- Developed systems and processes for monitoring daily operations to ensure compliance with insurance regulations.

- Analyzed client data and generated reports to identify non- compliance and non- compliant activities.

- Collaborated with internal departments to ensure accurate and timely reporting and documentation of compliance activities.

- Performed system audits to identify risks and ensure compliance with insurance regulations.

- Monitored corporate and regulatory policies to ensure compliance with the latest industry standards.

- Assisted with the development of risk management strategies to ensure the safety of clients and compliance with regulations.

- Developed training materials and led training sessions for employees on insurance compliance.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Insurance Compliance Officer Resume with 15 Years of Experience

A proven Insurance Compliance Officer with 15 years of experience in the insurance compliance field. Analytical, detail- oriented, and highly organized with excellent research and communication skills, able to effectively interpret guidelines, policies and regulations and ensure compliance with applicable laws and regulations. Skilled at developing and implementing policies, procedures and systems designed to monitor, detect and prevent compliance issues.

Core Skills:

- Extensive knowledge of Governmental regulations and industry standards

- Excellent organizational, problem- solving and decision- making capabilities

- Strong written and verbal communication skills

- Research and analysis capabilities

- Ability to identify and resolve issues quickly and efficiently

Responsibilities:

- Monitor and review compliance activities to ensure adherence to applicable laws and regulations

- Develop and implement compliance policies and procedures

- Identify and assess potential risks and issues related to compliance

- Conduct internal audits and investigations to ensure compliance with established regulations

- Provide guidance and advice on compliance issues

- Coordinate with other departments to ensure compliance with applicable laws

- Prepare and submit reports to senior management

- Identify trends and recommend corrective actions

- Provide training to staff on compliance procedures and standards

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Insurance Compliance Officer resume?

A well-crafted resume is a critical element of a successful job search. A resume for an Insurance Compliance Officer must accurately reflect your professional experience, demonstrate your qualifications and highlight your skills.

When creating your resume, it is important to include the following information:

- Professional Summary: Begin with a summary of your key qualifications and professional experience. Be sure to include the types of organizations you have worked for, the insurance regulations you are familiar with, and any relevant certifications.

- Work Experience: Highlight any positions related to insurance compliance that you have held in the past. Include the company name, position, and dates of employment.

- Education: List the names and dates of any degrees, certifications, or other relevant education that is applicable to the position.

- Skills: Include any technical, interpersonal, or other skills that are applicable to the position.

- Achievements: Detail any awards, honors, or accomplishments that you have received in your professional career related to insurance compliance.

- Community Involvement: Include any volunteer work, professional associations, or other activities that demonstrate your commitment to the field of insurance compliance.

By including all of this information in your resume, you will ensure that you have a complete and accurate representation of your professional career.

What is a good summary for a Insurance Compliance Officer resume?

A good summary for an Insurance Compliance Officer resume should include a statement of the candidate’s educational and professional experience, an overview of their most notable accomplishments, and a summary of the qualifications and skills that make them an ideal candidate for the job.

Specifically, the summary should demonstrate the candidate’s knowledge of insurance compliance regulations, their strong problem-solving and analytical skills, their strategic thinking approach, and their ability to work in fast-paced environments.

The candidate should also discuss the regulatory environments they have worked in, the records and compliance issues they have managed, and the technical systems they are familiar with. Additionally, they should explain their ability to stay informed on changing regulations and compliance laws, and their commitment to upholding the standards necessary to protect the interests of the company and its clients.

In short, a good summary for an Insurance Compliance Officer resume should show that the candidate has the necessary qualifications, experience, and skills to excel in the role and contribute to the success of the organization.

What is a good objective for a Insurance Compliance Officer resume?

A career as an Insurance Compliance Officer requires an individual to have excellent managerial and organizational skills. The role involves ensuring that a company is adhering to the laws and regulations related to insurance and financial services. A successful Insurance Compliance Officer should have a comprehensive understanding of the insurance industry, as well as the ability to develop and implement effective compliance strategies.

Having a strong objective statement on a resume is essential in order to stand out to potential employers and demonstrate your commitment to the position. Here are some good objectives for an Insurance Compliance Officer resume:

- Develop and implement comprehensive compliance strategies that are compliant with state and federal laws and regulations

- Utilize knowledge of the insurance industry and legal principles to ensure compliance with all applicable laws and regulations

- Monitor internal and external activities to ensure compliance with regulations and laws

- Establish policies and procedures that are in compliance with applicable laws and regulations

- Serve as a liaison between the organization and regulatory bodies to ensure compliance

- Provide guidance and advice to management on compliance-related issues

- Identify and address areas of non-compliance and advise on corrective action

- Develop and manage compliance processes and procedures to identify and mitigate risks

- Maintain knowledge of the most recent updates and changes in regulations and laws

- Foster a culture of compliance within the organization.

How do you list Insurance Compliance Officer skills on a resume?

It is important to list the right skills when applying for a job as an Insurance Compliance Officer to help you stand out from other applicants. A well-crafted resume can give potential employers a good indication of what you can bring to the table. To make sure your resume is as strong as possible, list your relevant skills in a skills section. Here are some of the key Insurance Compliance Officer skills you should consider including on your resume.

- Knowledge of Insurance Laws and Regulations: An Insurance Compliance Officer must have a comprehensive understanding of relevant insurance laws, regulations, and best practices.

- Risk Assessment: Insurance Compliance Officers must be able to assess risk and identify areas of risk management that need to be addressed.

- Strong Analytical Skills: Insurance Compliance Officers must be able to analyze data, draw accurate conclusions, and provide effective solutions.

- Attention to Detail: Insurance Compliance Officers must be able to identify potential issues and red flags and take action to correct them.

- Strong Communication Skills: Insurance Compliance Officers must be able to communicate effectively with management, staff, and external parties.

- Organizational Skills: Insurance Compliance Officers must be able to prioritize tasks, manage time effectively, and ensure that all deadlines are met.

By listing these skills on your resume, you can demonstrate to potential employers that you have the qualifications and skills needed to be a successful Insurance Compliance Officer.

What skills should I put on my resume for Insurance Compliance Officer?

As an insurance compliance officer, you need to demonstrate a range of knowledge, experience and skills to perform the job well. When creating your resume, make sure to highlight the key skills that demonstrate your expertise in the insurance industry and your ability to comply with regulations. Here are some of the top skills to consider adding to your resume for an insurance compliance officer position:

- Regulatory Compliance: You need to understand the rules and regulations that apply to the insurance industry, and be able to interpret and implement them in your work.

- Risk Management: You need to be able to identify and assess potential risks, and develop strategies to mitigate those risks.

- Analytical Thinking: You need to be able to analyze data, identify patterns and draw meaningful conclusions from it.

- Communication: You need to be able to communicate effectively with all levels of staff, clients and regulators.

- Interpersonal Skills: You need to be able to work with different personality types and maintain open communication.

- Research Skills: You need to be able to conduct research and identify resources to obtain the information needed to comply with regulations.

- Problem Solving: You need to be able to think critically and develop solutions to complex problems.

By adding these skills to your resume, you can show employers that you have the qualifications needed to be an effective insurance compliance officer.

Key takeaways for an Insurance Compliance Officer resume

When it comes to creating an effective resume for an insurance compliance officer, there are several key points to keep in mind. Here are some of the key takeaways for an insurance compliance officer resume:

- Make sure to highlight any relevant certifications or qualifications that you have. If you are a certified insurance compliance officer (CICO), make sure to include this in your resume. It will give employers an idea of your expertise and help them better assess your suitability for the job.

- Include any relevant experience or achievements that demonstrate your understanding of insurance compliance. This could be anything from developing and implementing effective compliance programs to successfully managing customer complaints.

- Describe your skills in detail. Insurance compliance is a complex field and requires a specific set of skills to be successful. Make sure to list out any skills related to insurance compliance that you possess such as interpreting legal documents, understanding customer needs, and maintaining accurate records.

- Make sure to include any relevant industry knowledge. If you have extensive knowledge of the insurance industry, make sure to include this in your resume. This will show employers that you are familiar with the industry and its regulations.

- Emphasize your ability to work with teams. Insurance compliance requires collaboration and teamwork, so make sure to emphasize your ability to work well with others.

These are just some of the key takeaways for an insurance compliance officer resume. By taking the time to include the right information, you can give yourself the best chance of landing the job.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder