A successful resume is the most important tool in your job search arsenal. As a Compliance Analyst, you must construct a resume that showcases your compliance expertise and experience. To ensure your resume meets the standards of your field, it is important to understand how to write an effective resume that will show potential employers you are the ideal candidate for the job. In this blog post, I will provide an insurance compliance analyst resume writing guide with examples to help you write a powerful resume that will get you noticed.

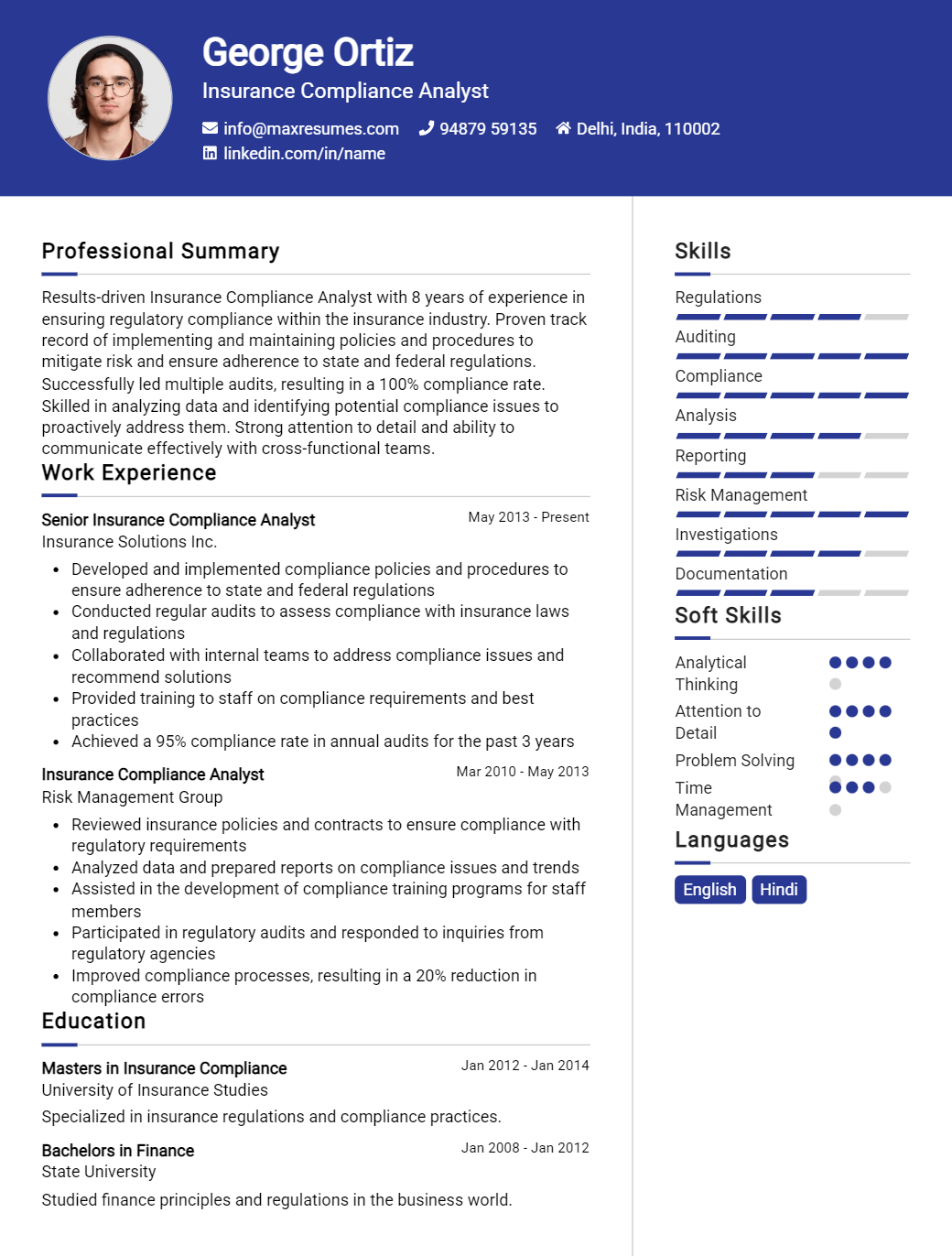

Compliance Analyst Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Insurance Compliance Analyst Resume Examples

John Doe

Insurance Compliance Analyst

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am a proactive and service- oriented Insurance Compliance Analyst with over 10 years of experience in the industry. My core competencies include developing and implementing compliance plans, conducting audits, and ensuring that organizations are compliant with industry regulations. I am adept in utilizing a variety of software such as Excel and Access, and I have an in- depth knowledge of the relevant laws and regulations, as well as the ability to interpret and apply them. I am an effective communicator, enjoying working in teams and collaborating with different stakeholders.

Core Skills:

- Excellent knowledge of the applicable laws and regulations

- Analytical and problem solving skills

- Proficiency in Excel and Access

- In- depth understanding of the insurance industry

- Strong communication and interpersonal skills

- Highly organized and detail- oriented

- Ability to interpret and apply industry regulations

- Developing and implementing compliance plans

Professional Experience:

Insurance Compliance Analyst, Axiom Insurance, June 2012 – Present

- Ensure compliance with industry regulations and applicable laws

- Develop, implement and maintain the compliance plans

- Conduct ongoing reviews and audits of the organization’s practices

- Identify and address any areas of non- compliance

- Conduct risk assessment to identify potential violations or areas of risk

- Train staff on compliance requirements and best practices

- Create and maintain relevant records and documentations

Insurance Compliance Analyst, Stellar Insurance, January 2009 – June 2012

- Developed and implemented compliance plans

- Conducted regular audits and reviews of the organization’s practices

- Identified and addressed any potential violations or areas of non- compliance

- Provided training to the staff on the relevant regulations and best practices

- Created and maintained relevant records and documentations

Education:

Bachelor of Science, Economics

Insurance Compliance Analyst Resume with No Experience

Recent college graduate seeking an entry- level position as an Insurance Compliance Analyst. Possess strong research and analytical skills, a keen eye for detail, and the ability to interpret complex regulations. Proven ability to learn quickly and handle multiple tasks simultaneously.

Skills

- Knowledge of insurance regulations

- Excellent research and analytical skills

- Strong organizational and administrative skills

- Excellent communication and problem solving skills

- Ability to interpret complex regulations

- Proficient in Microsoft Office

- Ability to work independently

Responsibilities

- Monitor insurance regulations and developments to ensure compliance

- Analyze data to identify potential compliance issues

- Develop and implement compliance policies and procedures

- Maintain and update insurance compliance records

- Provide guidance and assistance to team members

- Communicate with insurers to ensure accurate data is provided

- Assist with audits, investigations, and other compliance related tasks.

Experience

0 Years

Level

Junior

Education

Bachelor’s

Insurance Compliance Analyst Resume with 2 Years of Experience

A highly motivated and dedicated Insurance Compliance Analyst with two years of experience in conducting audits and reviews of insurance companies and policies to ensure compliance with industry regulations. Possess a solid understanding of the insurance industry, current compliance regulations, and the ability to assess risk, analyze documents, and provide detailed reports. Excellent problem- solving capabilities and an ability to build positive relationships with clients and colleagues.

Core Skills:

- Insurance Industry Knowledge

- Compliance Regulations

- Risk Assessment

- Document Analysis

- Report Preparation

- Problem Solving

- Communication

Responsibilities:

- Conducting audits and reviews of insurance companies and policies to ensure compliance with industry regulations.

- Assessing risk, analyzing documents and providing detailed reports.

- Developing and maintaining positive relationships with clients and colleagues.

- Updating and maintaining policies, procedures, and other relevant documents.

- Investigating customer complaints and providing appropriate resolution.

- Assisting in the development of new policies, procedures, and products.

- Analyzing data and preparing reports for senior management.

- Monitoring and reporting on regulatory changes and developments.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Insurance Compliance Analyst Resume with 5 Years of Experience

Highly organized, detail- oriented Insurance Compliance Analyst with 5+ years of experience in research, project management and financial analysis. Adept at developing, implementing and monitoring programs to ensure compliance with applicable laws and regulations across a wide range of insurance products. Demonstrated ability to analyze complex data and develop reports for management, as well as in- depth knowledge of industry trends and standards. Passionate about leveraging expertise to ensure the highest levels of compliance and customer satisfaction.

Core Skills:

- Compliance Research and Analysis

- Regulatory Standards

- Risk and Compliance Management

- Project Management

- Financial Analysis

- Problem Solving and Decision Making

- Report Writing

- Team Leadership

- Time Management

- Communication and Interpersonal Skills

Responsibilities:

- Conducting research on applicable laws and regulations related to insurance products

- Developing and implementing new compliance procedures and controls

- Developing monitoring programs to ensure compliance with all applicable laws and regulations

- Analyzing and identifying potential risk areas by reviewing customer transactions

- Preparing detailed reports for management on compliance issues and risk assessments

- Collaborating with other departments to ensure effective implementation and maintenance of compliance standards

- Developing risk mitigation strategies to minimize the potential for non- compliance

- Identifying areas for improvement in existing compliance programs

- Monitoring changes in industry standards and regulations and adapting compliance processes accordingly

- Providing guidance and training to team members on compliance processes and procedures

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Insurance Compliance Analyst Resume with 7 Years of Experience

A professional Insurance Compliance Analyst with 7 years of experience in conducting compliance reviews, monitoring regulatory changes and providing regulatory training. Possess a deep understanding of the current regulations and can interpret rules, regulations and guidelines set by federal and state agencies. Experienced in developing and maintaining compliance programs, ensuring adherence to government regulations and industry standards.

Core Skills:

- Insurance compliance and regulatory experience

- Risk management and compliance program development

- Regulatory change monitoring

- Federal and state agency regulations

- Regulatory and compliance training

- Data analysis and reporting

- Computer proficiency

Responsibilities:

- Performed audits and identified areas of non- compliance

- Developed and maintained compliance programs and policies

- Monitored and reported on regulatory changes

- Prepared and provided regulatory and compliance training

- Evaluated and interpreted federal and state regulations

- Conducted research on insurance topics and trends

- Developed and implemented data analysis and reporting procedures

- Coordinated with clients to ensure compliance with regulations

- Assisted in the investigation of potential violations of compliance standards

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Insurance Compliance Analyst Resume with 10 Years of Experience

A highly experienced and motivated Insurance Compliance Analyst with 10 years of experience. Possesses ability to develop and maintain effective management policies and procedures, engage in risk- assessment activities, and analyze and document data. Proven track record of creating and implementing compliance plans and procedures, as well as identifying and recommending corrective actions for compliance issues. Adept in developing, implementing and monitoring compliance programs.

Core Skills:

- Risk- Assessment

- Regulatory Compliance

- Data Analysis

- Documentation

- Report Preparation

- Compliance Program Development

- Policy & Procedure Development

- Corrective Action Recommendations

- Quality Assurance

Responsibilities:

- Ensure compliance with federal and state regulations regarding insurance products.

- Identify and document compliance issues, and provide recommendations to rectify them.

- Analyze and document insurance policies, procedures, and processes.

- Develop and maintain compliance programs, policies, and procedures.

- Monitor and audit compliance with applicable laws and regulations.

- Prepare reports and presentations regarding compliance issues.

- Participate in risk- assessment activities, and provide recommendations to mitigate risks.

- Prepare corrective action plans and provide recommendations for improvements.

- Ensure that all insurance policies and procedures are up to date and compliant.

- Monitor and review insurance contracts, and ensure that all contracts are in compliance with applicable laws and regulations.

- Respond to inquires and complaints from clients, and provide advice and assistance.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Insurance Compliance Analyst Resume with 15 Years of Experience

Highly accomplished Insurance Compliance Analyst with over 15 years of experience in the financial services industry. Skilled in identifying, assessing, and mitigating compliance risk in the areas of products, processes, and systems. Proven track record of improving operational controls to meet regulatory requirements. Excellent written, verbal, and communication skills with a strong ability to build long- term relationships.

Core Skills:

- Risk Management

- Regulatory Compliance

- Audit Preparation

- Contract Negotiation

- Policy & Procedure Development

- Project Management

- Business Analysis

- Process Improvement

Responsibilities:

- Developed risk assessment frameworks for products, services, and systems in order to identify and address potential compliance issues.

- Monitored compliance activities to ensure all regulations and laws were adhered to.

- Conducted reviews and audits of business processes and procedures to ensure compliance with regulatory requirements.

- Developed and implemented strategies to minimize the risk of non- compliance.

- Analyzed contracts and agreements to assess legal consequences of proposed business activities.

- Collaborated with stakeholders to establish policies and procedures to ensure compliance with relevant laws and regulations.

- Developed and maintained relationships with internal customers, regulatory authorities, and external vendors.

- Assisted in the preparation of and responses to regulatory reports and inquiries.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Insurance Compliance Analyst resume?

A resume for an Insurance Compliance Analyst should include a few key elements that demonstrate an individual’s qualifications and abilities. Here are some of the items that should be highlighted:

- Knowledge of applicable state and federal laws, regulations, and standards related to the insurance industry

- Ability to interpret and explain insurance guidelines and policy language

- Experience in auditing and evaluating insurance policies and procedures

- Proficiency with various software and systems used in risk analysis and compliance

- Strong problem-solving and analytical skills

- Excellent communication skills, both written and verbal

- Ability to multitask and prioritize tasks

- Good organizational skills and attention to detail

- Demonstrated leadership skills

- Flexibility in dealing with changes and new challenges

- Bachelor’s Degree in Insurance or a related field

Including the above information in a resume for an Insurance Compliance Analyst will help potential employers recognize the qualifications and skills of the individual. Additionally, it will showcase the individual’s ability to be a successful member of the team and help the organization meet its compliance goals.

What is a good summary for a Insurance Compliance Analyst resume?

A successful Insurance Compliance Analyst resume should highlight a professional’s experience in ensuring that all relevant insurance regulations and laws are being followed. This involves staying up-to-date on changes and amendments in the insurance industry, performing detailed research of relevant policies, and evaluating insurance contracts and documents. Additionally, a good Insurance Compliance Analyst will be able to effectively communicate with insurance companies and policyholders, as well as build strong relationships with internal and external stakeholders. The ideal candidate should demonstrate excellent analytical and problem-solving skills, as well as strong organizational abilities.

What is a good objective for a Insurance Compliance Analyst resume?

A Insurance Compliance Analyst position is an important role in the finance industry, and having a strong objective on your resume can help you stand out from the competition. Your objective should emphasize the ways in which you can benefit the company, such as your knowledge of risk management, insurance regulations, and industry trends.

A good objective for an Insurance Compliance Analyst resume should include:

- Demonstrating a comprehensive understanding of insurance regulations, risk assessment, and compliance standards

- Proven ability to manage multiple projects and prioritize tasks effectively

- Experience in creating and maintaining effective compliance processes

- Knowledgeable in industry trends and best practices

- Commitment to delivering superior customer service and supporting the organization’s goals

- Ability to analyze complex data and develop meaningful insights

- Proven track record of achieving regulatory compliance in a timely manner

How do you list Insurance Compliance Analyst skills on a resume?

The role of an Insurance Compliance Analyst involves researching, interpreting, and interpreting complex regulations and laws related to the insurance industry. As such, it’s essential to list the right skills on a resume to demonstrate your expertise in this field. Here are some essential skills to include when crafting your resume:

- Research: Insurance Compliance Analysts must have strong research skills to identify, interpret and apply relevant regulations in the insurance industry.

- Analytical Thinking: Insurance Compliance Analysts must be able to analyze complex regulations and laws to ensure compliance with applicable standards.

- Attention to Detail: Insurance Compliance Analysts must have keen attention to detail to ensure that all regulations are correctly followed and that any potential issues are identified and addressed.

- Problem-Solving: Insurance Compliance Analysts must be able to quickly identify and resolve any issues that arise in order to maintain compliance with applicable laws and regulations.

- Communication: Insurance Compliance Analysts must have excellent communication skills to be able to effectively collaborate with colleagues and explain complex regulations in a clear and concise manner.

- Organization: Insurance Compliance Analysts must possess strong organizational skills to manage multiple tasks, prioritize tasks, and track deadlines.

By including the above skills in your resume, you will demonstrate to potential employers that you have the knowledge and expertise to be an effective Insurance Compliance Analyst.

What skills should I put on my resume for Insurance Compliance Analyst?

Insurance Compliance Analysts use their knowledge of insurance policies and regulations to ensure their employer’s adherence to compliance standards. This job requires strong analytical and problem-solving skills, as well as an in-depth knowledge of the insurance industry. If you want to be an Insurance Compliance Analyst, there are certain skills and qualifications you should include on your resume to demonstrate your capabilities.

- Thorough understanding of insurance products and services, as well as applicable state and federal laws and regulations

- Strong organizational and problem-solving skills

- Excellent communication, interpersonal, and analytical skills

- Ability to work independently and in a team environment

- Proficient in Microsoft Office applications and other software used to track and report compliance data

- Ability to interpret data and develop strategies for improving compliance

- Ability to research and analyze industry trends

- Ability to identify potential compliance violations and take corrective action

- Knowledge of healthcare or financial laws and regulations, as applicable

Key takeaways for an Insurance Compliance Analyst resume

If you are writing a resume as an Insurance Compliance Analyst, there are some key takeaways you should remember to help make it stand out.

First, showcase your technical knowledge. As an Insurance Compliance Analyst, you need to demonstrate that you have a strong understanding of insurance regulations, laws, and best practices. Include any certifications or degrees you may have that demonstrate your knowledge in this field.

Second, demonstrate your problem-solving skills. Insurance Compliance Analysts are called upon to review data, identify issues, and devise solutions. Include examples of the problems you have solved or the processes you have implemented in the past.

Third, highlight your attention to detail. Insurance Compliance Analysts are required to have a keen eye for detail. This means taking a close look at the data and ensuring that all information is correct. Demonstrate your attention to detail by providing examples of times you have identified errors and implemented changes to improve accuracy.

Fourth, showcase your communication skills. Insurance Compliance Analysts often work with multiple departments and stakeholders. Showcase your ability to communicate effectively with both technical and non-technical personnel.

Finally, make sure to provide examples of your ability to work independently and collaboratively. This can include both working autonomously and as part of a team.

By following these key takeaways, you can show potential employers that you are an ideal candidate for the Insurance Compliance Analyst position.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder