Are you looking for a job as an insurance claims manager? Writing the perfect resume may seem intimidating, but it doesn’t have to be. With the right guidance and resources, you can craft a resume that will set you apart from the competition and give you the best chance of landing the job. In this guide, we’ll provide tips on how to write an effective insurance claims manager resume, plus samples to give you a starting point. With this guide, you will be able to create a resume that will help you stand out and get the job you want!

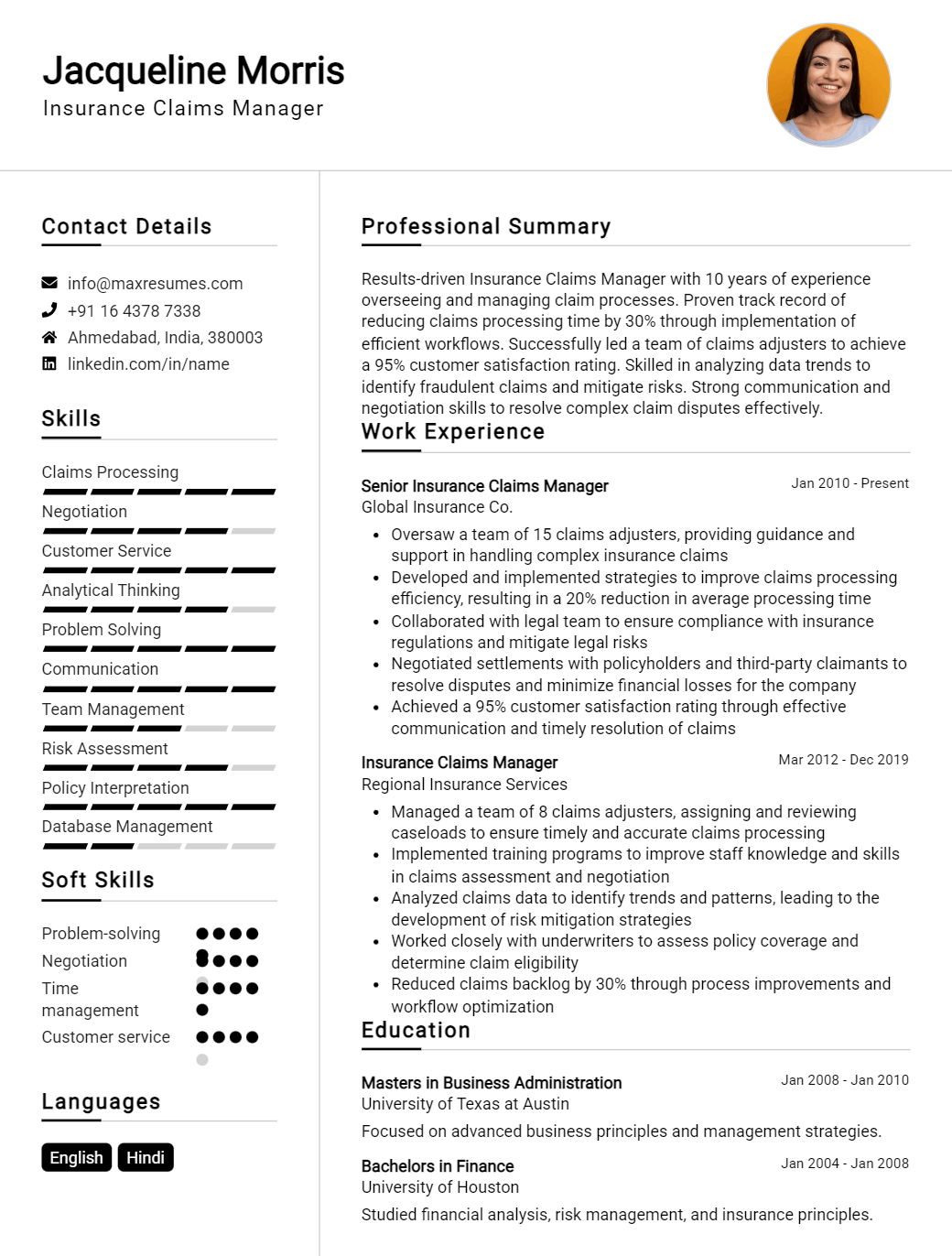

Claims Manager Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Insurance Claims Manager Resume Examples

John Doe

Insurance Claims Manager

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am an experienced Insurance Claims Manager with over 10 years of experience in the field. My expertise lies in assessing complex claims, developing solutions to resolve disputes, and managing a team of highly- skilled claims adjusters. I’m adept at utilizing both specialized software and data analytics to identify trends and develop innovative solutions. My strong interpersonal skills and ability to build relationships with clients and colleagues allows me to effectively communicate to ensure alignment across all stakeholders.

Core Skills:

- Claims Assessment & Dispute Resolution

- Client & Team Management

- Data Analysis & Software Utilization

- Regulatory Compliance

- Report Writing & Documentation

- Relationship Building & Communication

Professional Experience:

Insurance Claims Manager, ABC Insurance Co., San Francisco, CA

- Managed a team of 10 claims adjusters, overseeing their day- to- day operations and providing guidance, support, and mentorship

- Developed and implemented innovative solutions to resolve complex claims disputes

- Utilized specialized software and data analytics to assess claims and identify trends

- Ensured all claims were handled in accordance with regulatory compliance standards

- Prepared and documented detailed reports on claims and claims process

- Conducted regular meetings with clients to ensure satisfaction and alignment

Education:

Bachelor of Business Administration, Insurance & Risk Management, San Francisco State University, San Francisco, CA, 2008

Insurance Claims Manager Resume with No Experience

- A recent business graduate looking to leverage education and skills to excel in the insurance claims management role.

- Motivated problem solver with a passion for customer service and driven to deliver quality results.

Skills

- Strong problem solving, interpersonal, and communication skills

- Excellent organizational and time management abilities

- Proficiency in Microsoft Office Suite

- Excellent knowledge of insurance policies and claims processing

- Ability to analyze and interpret data accurately

- Ability to adapt to changing priorities and adjust to new processes

Responsibilities

- Assisting clients in filing and submitting claims

- Reviewing and verifying accuracy of claim information

- Researching, analyzing and resolving claim payment issues

- Processing and maintaining claim forms and documents

- Generating reports and statistics for management review

- Negotiating with insurers to ensure client satisfaction

- Identifying areas for improvement in claim processes

- Providing customer service support for clients

Experience

0 Years

Level

Junior

Education

Bachelor’s

Insurance Claims Manager Resume with 2 Years of Experience

A highly experienced insurance claims manager with 2 years of experience in managing and processing insurance claims. Proven track record in developing strategies to streamline the claims process, maintaining customer satisfaction, and ensuring regulatory compliance. Experienced in performing detailed investigations and efficiently preparing accurate and timely reports.

Core Skills:

- Claim investigation and management

- Regulatory compliance

- Risk assessment

- Policy review and interpretation

- Claims administration

- Negotiation of settlements

- Technical problem solving

- Report preparation

Responsibilities:

- Investigating and processing new insurance claims within specified deadlines

- Assessing risk of existing and potential claims and taking appropriate action

- Reviewing existing policies and negotiating favorable settlements

- Ensuring regulatory compliance for all claims and processes

- Communicating with clients and maintaining customer satisfaction

- Preparing detailed reports and analyses for insurance companies

- Resolving complex technical problems related to insurance claims

- Assisting in the development of strategies and processes to streamline the claims process

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Insurance Claims Manager Resume with 5 Years of Experience

A highly experienced Insurance Claims Manager with 5 years of experience in managing claims while ensuring excellent customer service. Proven ability to effectively manage large and complex claims, evaluate and review policies, and manage the team to ensure accurate data and timely resolution of claims. Possesses strong organizational and analytical skills to manage the entire claims process.

Core Skills:

- Excellent customer service skills

- Proficiency in Microsoft Office and Claims Management systems

- Ability to analyze and evaluate policies

- Strong organizational and problem- solving skills

- Excellent communication and interpersonal skills

Responsibilities:

- Manage and oversee the entire claims process for large and complex claims

- Review, analyze, and evaluate policy documents

- Direct and manage the claims team to ensure accurate data and timely resolution of claims

- Provide assistance with customer inquiries, filing new claims and claims processing

- Ensure timely and accurate processing of bills, invoices and payments

- Assist in resolving disputes and negotiating settlements

- Develop and implement procedures and systems to ensure efficient claims management

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Insurance Claims Manager Resume with 7 Years of Experience

An experienced Insurance Claims Manager with 7 years of experience in the insurance industry. Demonstrated success in developing and implementing insurance policies, evaluating claims, and managing risk. Excellent interpersonal and communication skills, with a strong focus on customer satisfaction and resolving claims efficiently. Possess strong background in analyzing data, managing and training team members, and developing claims strategies.

Core Skills:

- Data Analysis

- Insurance Policy Development and Implementation

- Team Management and Training

- Claims Evaluation

- Risk Management

- Customer Satisfaction

- Claims Resolution

Responsibilities:

- Developed, implemented and monitored insurance policies to ensure compliance and accuracy within the industry.

- Evaluated and managed all incoming claims, ensuring that all claims are processed accurately and efficiently.

- Analyzed data and trends to identify potential issues and risks with current policies and procedures.

- Managed and trained team members on new policies and procedures.

- Developed and managed claims strategies to ensure customer satisfaction and efficient resolution of claims.

- Provided customer service by responding to customer questions, concerns and complaints.

- Identified potential fraud and managed investigations accordingly.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Insurance Claims Manager Resume with 10 Years of Experience

A highly organized and analytical Insurance Claims Manager with 10 years of experience in overseeing claims processing, dispute resolution and policy contract management. Skilled in streamlining claims process and data collection in order to increase efficiency and reduce processing time. Proven ability to build and maintain professional relationships with clients, insurers and other stakeholders in order to facilitate understanding and resolution of claims.

Core Skills:

- Insurance Claims Management

- Policy Contract Negotiation

- Dispute Resolution

- Claims Processing

- Data Collection

- Claims Investigation

- Quality Assurance

- Regulatory Compliance

Responsibilities:

- Developed and implemented claims processing systems to streamline and improve productivity.

- Negotiated and administered policy contracts to ensure customer satisfaction.

- Investigated and evaluated complex claims to ensure accurate and fair resolution.

- Ensured compliance with insurance regulations and legal requirements.

- Monitored and evaluated customer satisfaction levels to ensure claims were appropriately addressed.

- Developed and maintained relationships with clients, insurers and other stakeholders to ensure successful claims processing.

- Managed customer interactions in order to facilitate understanding and resolution of claims.

- Analyzed and interpreted data to identify trends and suggest process improvements.

- Performed quality assurance reviews to ensure accuracy of data and compliance with regulations.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Insurance Claims Manager Resume with 15 Years of Experience

Insurance Claims Manager with 15+ years of experience in the insurance industry. Proven track record of successful claims management and exceptional customer service. Adept at developing and implementing strategic initiatives to reduce costs and improve efficiency. Demonstrated ability to coordinate successful resolution of complex claims from initiation through closure.

Core Skills:

- Experienced in all facets of claims management

- Excellent analytical, organizational and communication skills

- Strong problem solving and conflict resolution capabilities

- Proficient in utilizing various software and technology

- Knowledge of applicable laws and regulations

- Excellent customer service skills

Responsibilities:

- Managed the process of opening and closing claims to ensure accurate completion and resolution

- Developed and implemented claims management strategies to reduce costs and improve efficiency

- Analyzed claims to ensure compliance with applicable laws and regulations

- Reviewed documents and reports to ensure accuracy and proper payment of claims

- Negotiated settlements and payments of claims to achieve fair outcomes

- Maintained detailed records of all claims for audit and litigation

- Provided excellent customer service to claimants, claimants attorneys and other parties to the claim

- Assessed the financial impact of claims on the organization

- Researched, analyzed and interpreted insurance policies and contracts

- Developed and maintained working relationships with insurance providers and vendors

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Insurance Claims Manager resume?

A Insurance Claims Manager is responsible for overseeing the entire insurance claims process, from initial claims assessment, to final resolution. It is important for a Claims Manager to have a resume that clearly outlines their qualifications, experience, and skills. Here are some of the key points to include in a Insurance Claims Manager resume:

- Qualifications: A detailed list of qualifications, including licensing or certifications, should be included in the resume.

- Experience: Claims Manager jobs require a great deal of experience. Make sure to list any relevant experience, such as overseeing team of claims adjusters, working with legal representatives, or managing a claims department.

- Technical Skills: Claims Managers must have a thorough knowledge of insurance regulations and laws, as well as familiarity with computers and other software.

- Leadership Skills: Claims Managers must be able to effectively manage and motivate a team. Include any leadership awards or accomplishments that demonstrate your ability to lead.

- Analytical Skills: Claims Managers must have the ability to analyze data and make decisions quickly. List any awards, certifications, or accomplishments that demonstrate your analytical abilities.

- Communication Skills: Claims Managers must be able to communicate effectively with both clients and coworkers. Include any awards or accomplishments that demonstrate your communication skills.

With these key points included, a Claims Manager resume should be complete and demonstrate the skills, qualifications, and experience necessary for the job.

What is a good summary for a Insurance Claims Manager resume?

A Insurance Claims Manager resume should include a summary that highlights the candidate’s experience and skills. The summary should demonstrate the candidate’s ability to handle complex insurance claims, resolve disputes, and supervise staff members. It should also show the candidate’s knowledge of insurance policies and procedures and their commitment to delivering quality customer service.

The candidate should also list any special skills they have that are relevant to the position, such as working with databases, analyzing claims data, and developing computer systems. Additionally, they should list any awards they have received or any other accomplishments that demonstrate their ability to handle a variety of tasks.

Finally, the summary should provide a brief overview of their employment history and list their educational achievements. This will give potential employers an idea of the candidate’s qualifications and experience. A good Insurance Claims Manager resume should be concise, informative, and professional.

What is a good objective for a Insurance Claims Manager resume?

A good objective for a Insurance Claims Manager resume should be focused on the role that the applicant wishes to fulfil and the goals and philosophies of the organization. The objective should also demonstrate the applicant’s experience and qualifications for the role.

Here are some sample objectives for an Insurance Claims Manager resume:

- To leverage my 10+ years of experience working in the insurance industry to successfully manage and improve the claims process for XYZ Insurance.

- To apply my expertise in claims management to XYZ Insurance, creating a customer-focused and efficient claims process.

- To use my in-depth knowledge of the insurance industry and excellent organizational skills to optimize the claims process for XYZ Insurance.

- To apply my proven ability to manage complex insurance claims and document processes to ensure successful outcomes for XYZ Insurance.

- To utilize my exceptional ability to build strong relationships with customers, colleagues, and vendors to efficiently manage claims for XYZ Insurance.

- To leverage my experience in providing superior customer service to enhance the claims process for XYZ Insurance.

- To apply my knowledge of insurance claim protocols to ensure successful outcomes for XYZ Insurance.

- To use my leadership and problem-solving skills to effectively manage the claims process for XYZ Insurance.

How do you list Insurance Claims Manager skills on a resume?

In order to become a successful Insurance Claims Manager, it is essential to have certain skills, qualifications, and experience. When listing these skills on a resume, it is important to showcase your qualifications in a way that demonstrates your ability to manage and handle insurance claims. Here are some key skills to include in your resume:

- Knowledge of insurance claims processes: A strong understanding of the insurance claims process, from the initial filing to the final resolution, is essential for managing claims efficiently and accurately.

- Analytical and problem-solving skills: Insurance Claims Managers must be able to analyze claims data, identify potential problem areas, and develop solutions to resolve claims quickly and fairly.

- Communication and interpersonal skills: Insurance Claims Managers must be able to communicate effectively and professionally with clients, representatives, and other third-parties. They must also be able to provide sound advice, guidance, and customer service.

- Attention to detail: Insurance Claims Managers must be detail-oriented and able to review information thoroughly. They must also be able to recognize discrepancies on documents and claims.

- Computer proficiency: Insurance Claims Managers must be proficient in computer applications such as Microsoft Office and specialized claims management software.

By highlighting the necessary skills and qualifications required for an Insurance Claims Manager, employers can easily determine if you are the right candidate for the job. These skills should be listed in an organized and concise way on your resume, making it easy for employers to quickly spot them and consider your application.

What skills should I put on my resume for Insurance Claims Manager?

If you’re looking to get hired as an Insurance Claims Manager, there are certain skills and qualifications you should include on your resume to increase your chances of getting the job. Here are some of the skills employers expect from a successful Insurance Claims Manager:

- Knowledge of Insurance Policies: Insurance Claims Managers must have a comprehensive understanding of the different types of policies offered by insurance companies, including their limitations and exclusions.

- Interpersonal Skills: Insurance Claims Managers must be able to interact effectively with policyholders, brokers, and other stakeholders. This includes the ability to understand their needs, build rapport, and negotiate solutions.

- Analytical Skills: Claims Managers must be able to analyze large amounts of data quickly and accurately to detect potential fraud or errors. They must also be able to assess the degree of risk and make decisions accordingly.

- Problem-Solving Skills: Claims Managers are responsible for resolving disputes between policyholders and insurers. They must be able to think critically, identify potential solutions, and negotiate an agreement.

- Communication Skills: Insurance Claims Managers must be able to communicate effectively, both verbally and in writing. They must also have excellent listening skills.

- Leadership Skills: Claims Managers must be able to manage a team of staff and delegate tasks effectively. They must also be able to motivate and inspire their team.

By highlighting these skills and qualifications on your resume, you’ll be able to demonstrate to potential employers that you have the experience and abilities required to be a successful Insurance Claims Manager.

Key takeaways for an Insurance Claims Manager resume

When writing your resume as an Insurance Claims Manager, make sure to highlight the knowledge and experience you have in the insurance industry. A resume should include the following:

- Professional summary: Provide a brief overview of your experience and qualifications as an Insurance Claims Manager. Make sure to include key achievements, such as successful claims settlements or cost-savings initiatives.

- Experience: Include a list of your past roles and responsibilities as an Insurance Claims Manager, focusing on your accomplishments in each position. Be sure to focus on customer service, problem-solving, and effective negotiation skills.

- Technical expertise: As an Insurance Claims Manager, you have a deep understanding of the insurance industry and its regulations. List your understanding of insurance policies, claims handling processes, and risk assessments.

- Leadership skills: Highlight any leadership roles you had in your past positions, such as managing a team of claims processors. Stress your ability to motivate employees, delegate tasks, and foster collaboration.

- Education: Include any formal education you have, such as a bachelor’s degree in insurance or a related field. Also, don’t forget to list any certifications or industry awards you have earned.

By clearly highlighting your experience and qualifications in the Insurance Claims Manager role, you can ensure that you stand out to potential employers. With a well-written resume, you can show employers that you have the necessary skills and knowledge to be a successful Insurance Claims Manager.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder