If you’re an actuary, you know that your resume needs to present the right information in an organized way to show potential employers that you’re the right fit for the job. A good actuary resume should include your qualifications, experience and skills, as well as showcasing your potential to potential employers. Writing an actuary resume can seem like a daunting task, but our guide is here to provide you with tips, tricks and examples to help you create an effective resume that will get you noticed. Read on to learn how to write a great actuary resume.

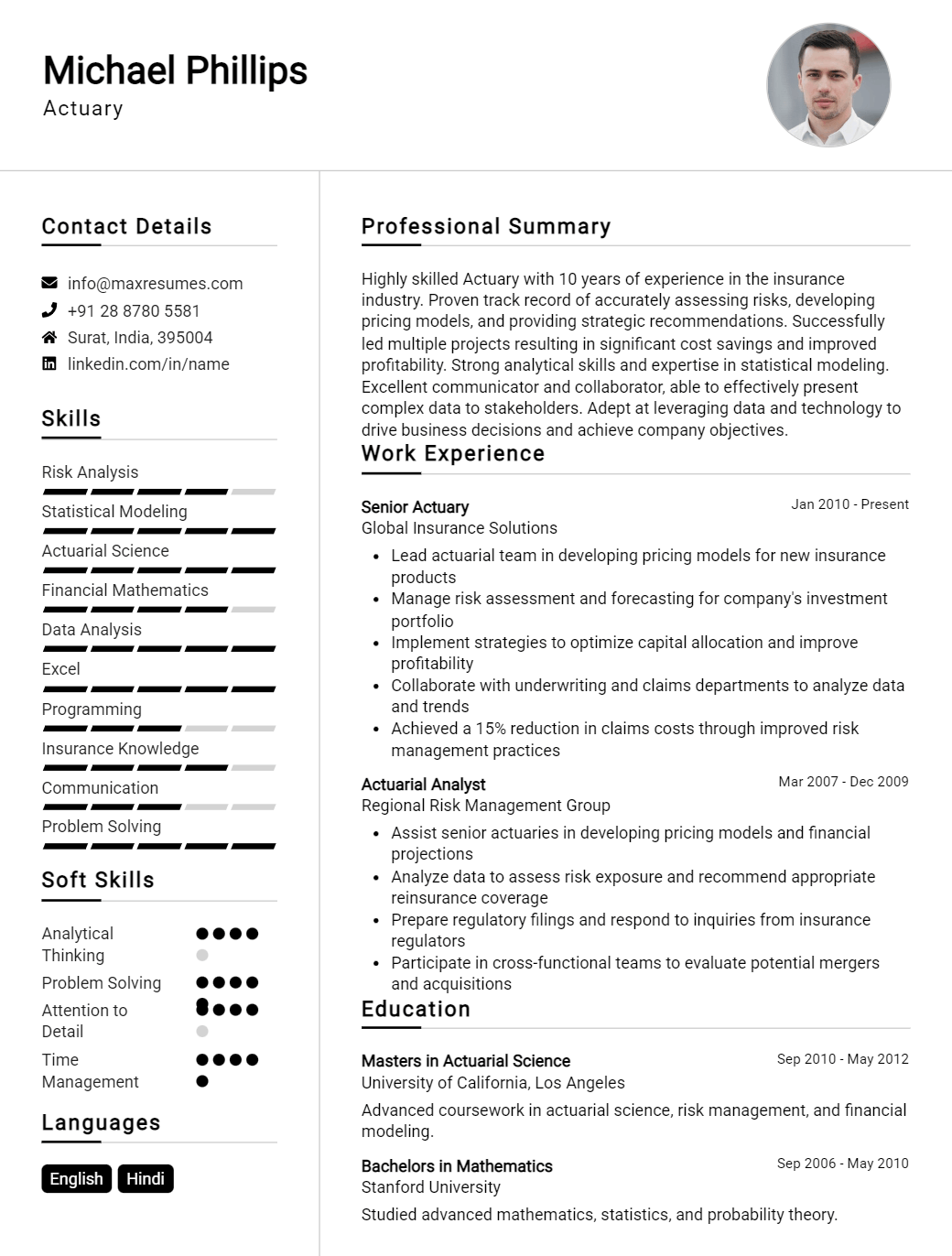

Actuary Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Actuary Resume Examples

John Doe

Actuary

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

Dynamic and highly motivated Actuary with a passion for helping clients make sound investment decisions. Over 4 years of experience analyzing and interpreting complex data sets to identify trends and provide statistical modeling for predictive analytics. Proven success in providing accurate and timely analyses to support decision- making. Solid ability to communicate effectively and build strong relationships with clients.

Core Skills:

- Statistical Modeling

- Data Analysis

- Risk Management

- Project Management

- Financial Analysis

- Presentation & Reporting

- Relationship Building

Professional Experience:

Actuary Consultant

ABC Corporation, San Francisco, CA

September 2015 – Present

- Develop statistical models using actuarial methods to determine financial outcomes for clients

- Analyze and interpret data to identify trends and recommend strategies for reducing risk and increasing yield

- Provide timely and accurate reports to management to analyze and evaluate financial performance

- Collaborate with team members to develop innovative solutions to complex problems

- Develop and maintain relationships with clients to ensure satisfaction in service offerings

Actuarial Analyst

XYZ Corporation, Los Angeles, CA

January 2013 – August 2015

- Analyzed financial data to develop models to calculate risks and returns to support decision- making

- Evaluated and monitored financial performance to ensure accuracy of data and compliance with regulations

- Developed presentations to communicate results and recommendations to management

- Assisted with the development of new products and services to increase customer satisfaction

Education:

Bachelor of Science in Actuarial Science

University of California, Los Angeles

2009 – 2013

Actuary Resume with No Experience

Recent college graduate with strong quantitative and analytical skills seeking to use my knowledge in the actuary field. Proven ability to develop solutions to complex problems and a strong desire to learn and grow in the field.

Skills:

- Familiarity with mathematics and statistics

- Solid understanding of numerical concepts

- Strong analytical and critical thinking skills

- Good communication and interpersonal skills

- Excellent problem solving and research skills

- Proficient in Microsoft Office Suite

Responsibilities:

- Analyzing data to identify trends and patterns

- Performing calculations to determine risks

- Developing models to aid in decision making

- Conducting research to gather additional information

- Creating reports to present data to management

- Monitoring and analyzing changes in the environment

- Providing counsel and advice to clients based on analysis

Experience

0 Years

Level

Junior

Education

Bachelor’s

Actuary Resume with 2 Years of Experience

Accomplished and results driven Actuary with two years of experience in the field, possessing a proven track record of success in the insurance industry. Experienced in risk management, probability analytics and financial modeling, I have helped develop and implement risk mitigation strategies to maximize performance of insurance companies. Proven ability to identify and analyze cost and benefit trade- offs associated with various business decisions and develop plans to achieve corporate goals.

Core Skills:

- Risk Management

- Probability Analytics

- Financial Modeling

- Cost/Benefit Analysis

- Insurance Product Development

- Strategic Planning

Responsibilities:

- Assessed and managed corporate risks using probabilistic modeling, actuarial techniques and financial analysis

- Developed and implemented insurance products for different markets

- Calculated reserves for all products to ensure compliance with all standards

- Conducted financial analysis and statutory reporting to ensure accuracy of financial statements

- Analyzed data to identify trends and develop projections

- Developed strategies to mitigate corporate risks while maximizing performance and profitability

- Collaborated with other departments to ensure smooth operation of insurance firm

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Actuary Resume with 5 Years of Experience

Dynamic, highly- skilled actuary with 5 years of experience in insurance and financial services settings. Proven ability to deliver accurate and timely actuarial results. Experienced in high- volume data management and analysis, predictive modeling and forecasting. Adept in identifying trends and providing insights to inform decision- making. Expert in identifying and implementing process improvement strategies to maximize efficiencies. Strong collaborator with excellent communication skills.

Core Skills:

- Actuarial analysis

- Modeling and forecasting

- Data analysis

- Risk assessment

- Insurance/financial services

- Process improvement

- Report generation

- Data sourcing

- Excel proficiency

Responsibilities:

- Developed actuarial data models to analyze and interpret insurance and financial data.

- Performed financial and statistical analysis to identify and implement process improvements to increase operational efficiency.

- Generated and delivered accurate actuarial data reports to stakeholders in a timely manner.

- Managed high- volume data entry and data manipulation in Excel.

- Utilized predictive models to forecast future trends in the insurance and financial services industries.

- Evaluated risks to ensure compliance with applicable regulations and standards.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Actuary Resume with 7 Years of Experience

A dedicated and organized actuary professional with seven years of experience in risk management and financial analysis. Highly skilled in accurately predicting and calculating risk probabilities, developing financial strategies and presenting detailed reports. Experienced in using sophisticated software to interpret trends and analyze data. An excellent problem solver with the ability to identify potential financial risks and develop effective solutions to minimize their impact.

Core Skills:

- Risk management

- Financial analysis

- Advanced software & modeling

- Statistical analysis

- Data interpretation

- Report writing

- Problem solving

- Financial strategy development

Responsibilities:

- Calculating and accurately predicting risk probabilities

- Developing long- term financial strategies for clients

- Analyzing and interpreting data to identify potential risks

- Generating detailed reports for clients and management

- Developing models for forecasting and evaluating financial performance

- Evaluating financial statements to identify short and long term trends

- Creating and implementing strategies to minimize risk and maximize returns

- Assisting in the preparation of company budgets and financial plans.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Actuary Resume with 10 Years of Experience

I am a highly motivated and skilled Actuary with 10 years of experience. I have a strong background in mathematics, insurance, and risk management. My core skills include analysis and modeling of complex financial and insurance data, creating actuarial models and financial reports, and the development of strategies to manage risk. I am adept in data analysis and the development of quantitative models to analyze financial and insurance data.

Core Skills:

- Risk Management

- Actuarial Modeling

- Financial Analysis

- Data Analysis

- Quantitative Analysis

- Mathematics

Responsibilities:

- Analyzing financial and insurance data to develop actuarial models

- Designing and constructing financial reports

- Creating strategies to manage risks

- Providing recommendations based on quantitative analysis

- Developing models to analyze the financial and insurance data

- Assessing the impact of changes in the financial and insurance industries

- Evaluating and interpreting actuarial data to assess risk levels

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Actuary Resume with 15 Years of Experience

I am an experienced actuary with over 15 years of experience in the field of risk management, life and health insurance, and financial services. I specialize in data analysis, predictive modeling, and financial risk assessment to provide sound financial advice to clients. I have an excellent understanding of the principles of actuarial science and the ability to analyze complex data in order to develop creative solutions to challenging situations. I am also well- versed in financial and economic principles, as well as in the latest trends and developments in the insurance industry.

Core Skills:

- Advanced knowledge of actuarial science principles

- Experience in data analysis and predictive modeling

- Proficient in financial and economic principles

- Ability to develop creative solutions to complex situations

- Excellent understanding of the insurance industry

- Strong communication and interpersonal skills

- Ability to work independently and in a team

Responsibilities:

- Analyze complex data and formulate models to assess financial risk

- Identify potential areas of financial loss or gain

- Develop strategies to minimize financial loss and increase profitability

- Analyze trends in the insurance industry and provide recommendations

- Develop and maintain rating systems for life and health insurance products

- Prepare actuarial reports and present findings to management

- Advise clients on insurance and other financial services

- Manage and oversee the daily operations of the actuarial department

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Actuary resume?

A career as an actuary requires specialized knowledge and experience in a wide variety of topics including mathematics, finance, economics, and insurance. Because of this, there are certain qualifications and skills that a potential employer will be looking for in a successful actuary resume.

When writing a resume for an actuarial position, make sure to include the following:

- Educational Qualifications: List any degrees, certifications or licenses you have earned. If you have completed any specialty courses or have any relevant work experience, make sure to include that as well.

- Professional Experience: Include any professional positions you have held in the past. Include details about your job duties and any accomplishments.

- Skills and Knowledge: Make sure to list any specific skills or knowledge related to the actuarial field that you have acquired.

- Computer Skills: Actuaries rely heavily on computers to do their work so it is important to demonstrate that you have the necessary computer skills. Include any software or programming languages that you are familiar with.

- Analytical and Problem Solving Skills: Demonstrate your ability to analyze and interpret data, identify patterns, and think logically. Make sure to include any examples of successful solutions you have been involved in.

- Communication Skills: Good communication is essential in any job but especially so for an actuary. Make sure to highlight any communication skills such as writing, public speaking or interpersonal skills that you possess.

By including these important points in your resume you can be sure that potential employers will have a clear understanding of your qualifications and experience as an actuary.

What is a good summary for a Actuary resume?

A good summary for an Actuary resume should focus on the candidate’s skills and experience that are relevant to the actuary role. It should also mention any professional certifications or qualifications the candidate may have in the field. The summary should be concise and to the point, highlighting only the most relevant information. It should be written in a professional manner and should also showcase the candidate’s enthusiasm and passion for the role. The summary should also demonstrate the candidate’s commitment to accuracy and detail as well as their ability to analyze and interpret data. Lastly, it should provide a brief overview of the candidate’s work history and any other accomplishments that may be relevant.

What is a good objective for a Actuary resume?

A resume objective is your chance to let potential employers know why you are the ideal candidate for the job. As an actuary, you want to make sure your resume objective succinctly states your qualifications, experience and skills. A good objective should also highlight the value you bring to the role and organization. Here are some tips for writing a strong objective for an actuary resume:

- Focus on your key qualifications: Highlight your experience in actuarial science, risk analysis, and data analysis. Showcase your knowledge of the actuarial field and your understanding of trends and regulations.

- Demonstrate your professional skills: Actuaries are expected to have a range of professional skills such as problem solving, critical thinking, and communication. Showcase these skills in your objective.

- Showcase your values: Actuaries are expected to be professional, ethical, and responsible. Make sure to highlight these values in your objective.

- Make it tailored: Make sure your objective is tailored to the specific role you are applying for. Show how your qualifications and experience make you the best candidate for the job.

By following these tips, you can craft a strong objective for your actuary resume that will set you apart from other applicants.

How do you list Actuary skills on a resume?

When putting together your resume, you’ll want to highlight the Actuary skills you possess in order to show recruiters and hiring managers that you’re the right fit for their job. Here are a few tips on how to best list your Actuary skills on your resume.

- Identify key Actuary skills: Before you start adding Actuary skills to your resume, it’s important to identify what specific skills the position you’re applying for requires. Read over the job description and highlight any skills that are requested. Make sure your resume reflects these skills and qualifications.

- Leverage keywords: Chances are recruiters and hiring managers are using an automated system to scan through resumes. To make sure your resume stands out, utilize keywords from the job description when describing your skills and qualifications.

- Quantify your results: As an Actuary, you have likely dealt with data and made decisions based on those numbers. To demonstrate your ability to make decisions and influence outcomes, quantify your accomplishments whenever possible.

- Showcase technical abilities: Actuaries must be comfortable with technology, including software programs, databases, and programming languages. Don’t forget to list any of the technical abilities you have.

- Highlight soft skills: Actuaries must also have strong communication, problem solving, and organizational skills. Showcase these soft skills on your resume and provide examples of how you have utilized them.

By adding the right Actuary skills to your resume, you will be able to show recruiters and hiring managers that you have the qualifications and expertise to excel in the role.

What skills should I put on my resume for Actuary?

An actuary is an individual who uses mathematical and statistical techniques to measure risk and uncertainty and to help make decisions in the insurance and finance industries. When creating your resume as an actuary, it is important to highlight the skills that employers in the field are looking for. Here are some of the skills that should be included:

- Knowledge of mathematics and statistics: An actuary must possess a thorough understanding of mathematics and statistics. They must be able to analyze data and draw conclusions from it. This includes knowledge of probability theory, calculus, linear algebra, and other related topics.

- Analytical and problem-solving skills: Being able to think critically and solve problems using data is a key skill for an actuary. They must be able to interpret and analyze data quickly and accurately and come up with solutions to complex problems.

- Computer skills: Actuaries must be highly proficient with computers, as they use them to analyze and manage large amounts of data. Knowledge of programming languages, software, and databases is a must.

- Communication skills: Actuaries must be able to effectively communicate their findings, both in writing and verbally. They must also be able to explain complex concepts to non-experts.

- Interpersonal skills: An actuary must be able to work well with people from different backgrounds, including investors, clients, and insurance agents. They must be able to collaborate and build relationships with these people in order to get their message across.

By including these skills on your resume, you will be able to demonstrate to potential employers that you have the skills necessary to succeed in the actuarial field.

Key takeaways for an Actuary resume

For an actuary resume, there are several key points on which to focus. An actuary is a professional whose job is to analyze risk, advise on insurance and financial matters, and ensure that companies are meeting their financial objectives. A good actuary resume should reflect an individual’s professional qualifications, skills, experience, and achievements.

One of the most important elements of an actuary resume is to highlight your qualifications. This could include certifications and degrees in risk analysis, economics, finance, and other relevant areas. It is also important to list any relevant professional experience, as well as any internships or specialized training programs. It is also important to list any software programs you are familiar with, such as Microsoft Office or SAS.

Another key point to include on an actuary resume is your technical ability. This means listing any technical skills you may have, such as expertise in probability, statistics, and programming languages. It is also important to list any specializations you may have, such as health insurance, life insurance, or annuities.

Finally, it is important to list any professional achievements you may have, such as awards and publications. This will help to demonstrate your experience in the field and may help to set you apart from other applicants.

By following these key takeaways for an actuary resume, you will be able to create a resume that effectively conveys your qualifications and experience. This is an essential part of getting hired for an actuary job, and it is important to make sure that your resume is as impressive and compelling as possible.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder