Writing a resume as an actuarial analyst can be overwhelming. Though the goal is to present yourself as the ideal candidate for the position, it can be hard to convey your skills and experience with the appropriate level of detail and professionalism. This guide provides helpful tips and examples for creating an actuarial analyst resume that will stand out. With the right structure and content, you can construct a document that effectively demonstrates your qualifications, skills, and experience as a prospective actuarial analyst.

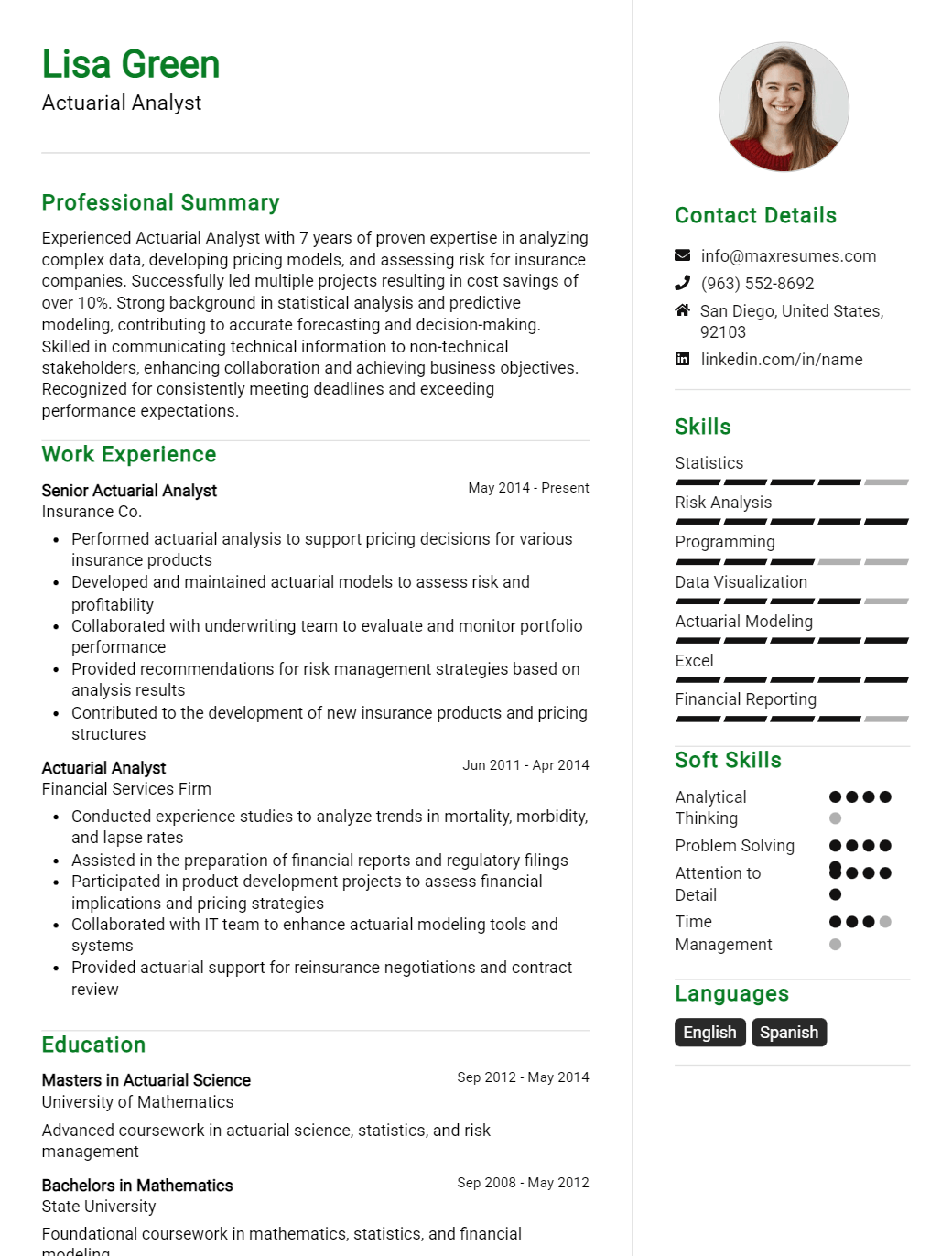

Actuarial Analyst Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Actuarial Analyst Resume Examples

John Doe

Actuarial Analyst

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

- Highly motivated and organized actuarial analyst offering a wide range of skills in data analysis, statistical modeling, and problem- solving.

- Extensive knowledge in life and health insurance, pension plans, and financial risk management.

- Strong background in mathematics and economics, demonstrated success in developing and improving actuarial models and creating reports for review.

Core Skills

- Statistics and Mathematical Modeling

- Insurance Pricing and Risk Assessment

- Data Analysis and Interpretation

- Problem Solving and Critical Thinking

- Financial Risk Management

- Life and Health Insurance

- Pension Plan Design

- Regulatory Compliance

Professional Experience

Actuarial Analyst, ABC Insurance Company, San Francisco, CA – August 2019 – Present

- Developed and implemented actuarial models to evaluate and price insurance policies

- Conducted analysis and interpretation of data to improve actuarial models and understand market trends

- Created financial reports and presented to senior management to support pricing and risk decisions

- Conducted risk analysis to ensure compliance with regulatory requirements

Actuarial Analyst Intern, XYZ Insurance Company, Houston, TX – June 2018 – June 2019

- Assisted in the development and evaluation of actuarial models to assess and price insurance policies

- Generated financial reports to understand the financial impact of actuarial models

- Conducted analysis of data to evaluate long- term trends in the insurance market

- Prepared presentations for senior management on pricing and risk management strategies

Education

Bachelor of Science in Mathematics, University of Texas, Austin, TX – May 2018

Actuarial Analyst Resume with No Experience

Actuarial Analyst with an eagerness to learn and become a professional in the actuarial field. Offers exceptional analysis and problem- solving skills with an understanding of data analysis and interpretation. Has a strong interest in mathematics, statistics, and financial modeling.

Skills

- Mathematics

- Statistical Analysis and Interpretation

- Financial Modeling

- Data Analysis

- Problem- Solving

- Excellent Communication Skills

- Proactive and Self- Motivated

Responsibilities

- Gather and analyze data to identify trends and relationships

- Utilize mathematics, statistics, and financial modeling to develop solutions

- Develop actuarial models and tests to assess the performance of various insurance policies

- Monitor the accuracy and validity of the data and make appropriate changes as needed

- Work with senior actuarial analysts and other professionals to understand their requirements and deliver solutions accordingly

- Create reports outlining the findings of the research and analysis for review

- Stay up- to- date with the changing regulations and trends in the actuarial field

Experience

0 Years

Level

Junior

Education

Bachelor’s

Actuarial Analyst Resume with 2 Years of Experience

A highly analytical, motivated and detail- oriented Actuarial Analyst with 2 years of experience in the actuarial field. Excellent at problem solving, data analytics and developing quantitative models. Experienced in pricing, risk management, and investment analysis. Proven ability to work independently and collaboratively in a fast- paced environment.

Core Skills:

- Quantitative Analysis

- Risk Management

- Statistical Modeling

- Data Analysis

- Financial Modeling

- Pricing

- Investment Analysis

Responsibilities:

- Developed quantitative models to evaluate the risk associated with different investment strategies.

- Developed financial models to accurately assess the viability of potential investments.

- Utilized data analytics and statistical modeling to develop pricing models for new products and services.

- Analyzed investment performance and trends to provide insight into potential performance of new products.

- Developed risk models to assess the probability of different financial scenarios.

- Constructed and monitored financial portfolios to maximize investment return.

- Conducted market research and competitive analysis to inform pricing decisions and product strategies.

- Assisted in implementing new policies, procedures and controls to ensure compliance with regulations.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Actuarial Analyst Resume with 5 Years of Experience

Highly motivated Actuarial Analyst with 5 years of experience in the insurance industry, offering a comprehensive and well- rounded knowledge of insurance, quantitative analysis, and financial modeling. Proven success in managing large projects, developing strategies and tools, and collaborating with multiple stakeholders. Thorough understanding of the actuarial and insurance principles, complex analysis and data- driven decisions. Highly organized, detail oriented, and adept in multi- tasking.

Core Skills:

- Actuarial Science

- Financial Modeling

- Insurance Principles

- Risk Management

- Data Analysis

- Complex Analysis

- Project Management

- Strategic Planning

Responsibilities:

- Developed and implemented financial models for insurance companies, helping them to assess the risk and make informed data- driven decisions

- Analyzed policy premiums, reserves, and other financial data to ensure compliance with company standards and regulations

- Evaluated and monitored the performance of insurance portfolios, identifying areas of improvement and developing strategies to mitigate the risks

- Prepared reports and presentations to review the results of the financial analysis to senior management

- Collaborated with colleagues and stakeholders to review actuarial models and documents, ensuring accuracy and consistency

- Developed tools and processes to improve the efficiency and accuracy of the actuarial analysis

- Analyzed the changing insurance trends and regulations, providing insights and recommendations to the management team.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Actuarial Analyst Resume with 7 Years of Experience

Actuarial Analyst with 7 years of experience in designing, developing and implementing complex actuarial models to assist with risk management and portfolio analysis. Adept at data analysis and interpretation, working with multiple stakeholders, and effectively communicating complex actuarial concepts. Proven ability to efficiently manage time and prioritize tasks to meet tight deadlines.

Core Skills:

- Actuarial Model Design and Development

- Data Analysis and Interpretation

- Risk Management

- Portfolio Analysis

- Financial Modeling

- Microsoft Excel

- Programming Languages (Python, R, VBA)

- Presentation and Reporting

- Stakeholder Management

- Time Management

Responsibilities:

- Developed actuarial models to facilitate risk analysis and portfolio analysis

- Analyzed available data and interpreted them to draw meaningful conclusions

- Created financial models to help determine the capital requirements of clients

- Utilized programming languages (Python, R, VBA) to develop specific actuarial models

- Prepared draft reports on various actuarial projects and communicated the findings to the stakeholders

- Participated in various meetings with senior management to discuss actuarial projects and their progress

- Developed presentations to summarize findings of actuarial projects

- Ensured that all actuarial projects were completed on time and within budget

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Actuarial Analyst Resume with 10 Years of Experience

A highly experienced Actuarial Analyst with 10+ years of experience in the insurance and banking sector. Expertise in analyzing data and developing actuarial models to identify risk trends and provide recommendations for improving business performance. Proven ability to manage multiple projects and deliver within tight deadlines. Excellent communication, organizational, and problem- solving skills.

Core Skills:

- Actuarial Data Analysis

- Risk Identification

- Business Performance Improvement

- Model Development

- Project Management

- Stakeholder Management

- Effective Communication

Responsibilities:

- Analyze actuarial data and develop models to identify risk trends and make recommendations for improvement

- Work collaboratively with internal stakeholders to ensure the accuracy of data and models used

- Monitor and evaluate the effectiveness of existing business performance models

- Develop and maintain reports on risk trends and business performance

- Manage multiple projects and ensure timely completion of tasks

- Research and develop new actuarial models as needed

- Provide technical support to internal stakeholders and customers

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Actuarial Analyst Resume with 15 Years of Experience

Highly experienced and organized Actuarial Analyst with 15 years in the actuarial field. Proven success in developing innovative and cost- effective resolutions to actuarial issues and developing accurate pricing models. Experienced in utilizing statistical methods to assess, analyze and model financial risks. Skilled in creating, manipulating and analyzing actuarial databases to produce financial projections and reports. Experienced in coordinating with stakeholders to develop and implement practical solutions for company and client needs.

Core Skills:

- Actuarial Analysis

- Risk Assessment

- Financial Modeling

- Database Management

- Statistical Methods

- Project Coordination

- Report Writing

Responsibilities:

- Collect, maintain and analyze data to assess the accuracy, validity and completeness of financial projections and reports

- Utilize statistical methods to identify, quantify and analyze financial risks

- Develop accurate pricing models and identify potential issues with pricing

- Create, manage and manipulate actuarial databases

- Develop practical solutions to company and client needs

- Coordinate with stakeholders to implement actuarial initiatives

- Write detailed reports on actuarial findings and analysis

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Actuarial Analyst resume?

When you are creating an Actuarial Analyst resume, it is important to demonstrate both your technical, analytical and communication skills. The resume should include the following details:

- Professional summary: This should be a brief summary of your professional background, experience and qualifications as an Actuarial Analyst.

- Education: This should include the name of the institutions where you completed your degree or professional certification and any additional qualifications you have.

- Experience: This should include details of all your past roles as an Actuarial Analyst. Include the name of the employer, the job title, a brief description of the role, and the dates of your employment.

- Skills: List the technical and analytical skills you have acquired while working as an Actuarial Analyst. This should include your expertise with statistical software, mathematical modelling techniques, financial analysis, and data analysis.

- Professional affiliations: If you are a member of any professional organizations, list them here.

- Awards: Include any awards or recognition you have received for your work as an Actuarial Analyst.

By providing a comprehensive overview of your background and experience, a well-written Actuarial Analyst resume can help you stand out from the competition.

What is a good summary for a Actuarial Analyst resume?

A good summary for an Actuarial Analyst resume should highlight the candidate’s education, experience, and certifications. The summary should also provide a brief overview of the candidate’s skills and accomplishments, and any special abilities or knowledge that could be useful for the position. The summary should be written in a professional manner that is easily digestible and relevant to the job for which the candidate is applying. The summary should be concise, yet provide enough insight into the candidate’s background to generate interest from the hiring manager.

What is a good objective for a Actuarial Analyst resume?

A good objective for an Actuarial Analyst resume should focus on the applicant’s qualifications and skills that set them apart from other candidates. It should also emphasize their desire to contribute to the success of the organization. Here are some examples of objectives that could be used on an Actuarial Analyst resume:

- To leverage my quantitative analysis and actuarial knowledge to identify and analyze risk and opportunities for the company.

- To utilize my experience in investment portfolio management and financial modeling to successfully develop actuarial models and recommendations.

- To utilize my knowledge of statistical analysis and actuarial principles to provide useful and accurate insights to company executives.

- To use my strong analytical skills to help the company identify and manage risk while optimizing returns.

- To use my knowledge of insurance products, regulations and pricing strategies to effectively manage risk and improve profitability.

- To use my knowledge of financial products and services to develop and implement actuarial strategies that will benefit the company.

How do you list Actuarial Analyst skills on a resume?

A successful Actuarial Analyst resume should showcase a candidate’s ability to apply knowledge of mathematics and statistics to solve complex problems as well as their ability to analyze data and formulate recommendations. When listing Actuarial Analyst skills on your resume, include both hard and soft skills.

Hard Skills:

- Advanced mathematical and statistical analysis

- Programming and software proficiency

- Database management

- Analytical and problem-solving skills

- Data analysis, interpretation and reporting

- Knowledge of insurance and risk management

- Knowledge of actuarial principles and practices

Soft Skills:

- Interpersonal communication

- Presentation and project management

- Adaptability and flexibility

- Organizational and time management

- Attention to detail and accuracy

- Initiative and motivation

- Negotiation and problem-solving

- Research and analytical thinking

- Teamwork and collaboration

- Customer service and public relations

What skills should I put on my resume for Actuarial Analyst?

A career in actuarial analysis requires a mix of both technical and interpersonal skills. When creating a resume for an actuarial analyst position, it is critical to highlight the skills that demonstrate your expertise and aptitude for the job. Here are some key skills to consider including on your resume:

- Mathematics: Actuarial analysts must possess a strong foundation in mathematical topics, such as calculus, statistics, and probability.

- Technical Writing: Communicating complex mathematical principles in a clear and concise way is a key ability for actuarial analysts. Demonstrating proficiency in technical writing is an important skill to include on a resume.

- Data Analysis: Actuarial analysts must be able to analyze large sets of data, identify trends and patterns, and draw meaningful conclusions.

- Financial Modeling: Actuarial analysts should have experience in financial modeling, which involves creating models to simulate various financial scenarios.

- Communication: Excellent communication skills are essential for actuarial analysts, who must communicate technical information to a range of stakeholders.

- Problem-Solving: Actuarial analysts must have the ability to creatively solve problems and devise innovative solutions.

By including these skills on your resume, you will be able to demonstrate your readiness for an actuarial analyst role.

Key takeaways for an Actuarial Analyst resume

An Actuarial Analyst resume is a key document for any professional in the field of actuarial science. This resume should be comprehensive and comprehensive, and should be tailored to the desired position. In order to ensure the best possible resume, the following key takeaways should be kept in mind.

First, the resume should include a clear summary of the skills and qualifications of the applicant. This should reflect the individual’s experience in actuarial science and demonstrate their ability to analyze data and interpret findings.

Second, the resume should include a list of relevant certifications and professional memberships. As the actuarial field is highly regulated, it is important to demonstrate that the applicant is up to date on the latest developments in the field. It is also important to demonstrate expertise in the software and systems used by the employer.

Third, the resume should include a section outlining the applicant’s academic qualifications. This should include relevant coursework and the results of any examinations or tests taken. The resume should also include any relevant internships, fellowships, and awards that the applicant has received.

Finally, the resume should include a section outlining any volunteer work or other activities that the applicant has participated in. This should show a commitment to service and to the actuarial profession. It should also demonstrate an interest in the field and demonstrate a dedication to lifelong learning.

By following these key takeaways, an Actuarial Analyst resume can be a powerful tool in securing a position in the actuarial field. By effectively demonstrating the applicant’s skills and qualifications, a resume can make the difference between success and failure in the job search process.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder