Writing a resume for an insurance accountant position can be a daunting task, but it doesn’t have to be. With the proper guidance and resume writing tips, you can craft a resume that will help you stand out among other job applicants. This guide will provide all the tips and resources you need to write a successful, professional insurance accountant resume. From examples of resumes to advice on formatting, this guide will show you how to write a resume that will get you the job you want.

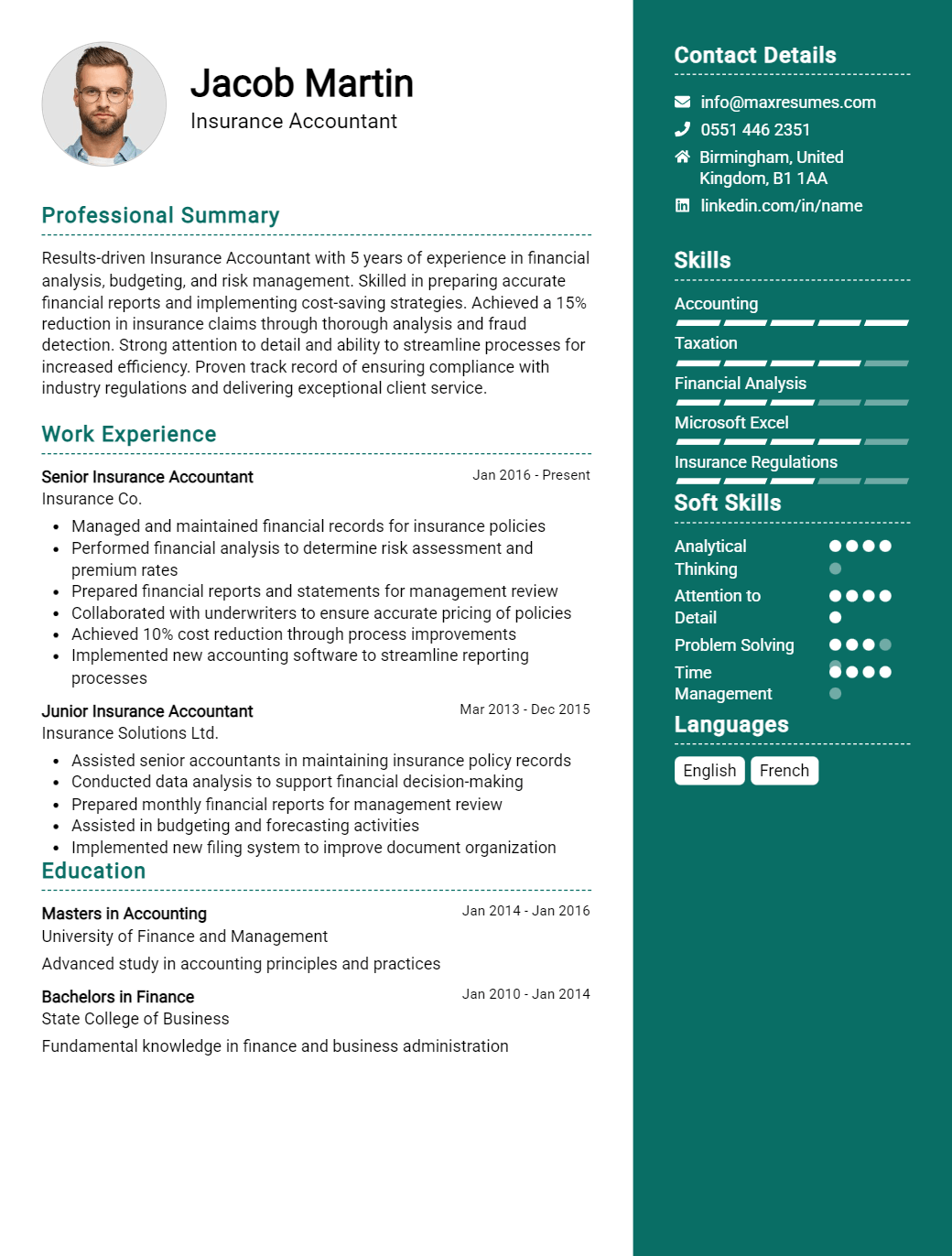

Accountant Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Insurance Accountant Resume Examples

John Doe

Insurance Accountant

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

Highly organized and detail- oriented Insurance Accountant with 8 years of professional experience. A results- driven professional with the ability to analyze financial data and produce actionable insights. Adept at budget planning, ledger management, and cost control. Proven ability to develop cost- effective strategies and handle complex accounting processes. Experienced in reviewing and verifying financial documents and providing clear insights to management while ensuring compliance with corporate and industry regulations.

Core Skills:

- Financial Analysis

- Cost Controlling

- Budgeting & Planning

- Ledger Maintenance

- Compliance & Reporting

- Document Verification

- Auditing & Reconciliation

- Risk Management

- Data Management & Entry

Professional Experience:

Accountant, ABC Insurance Agency, 2016 – Present

- Provide financial analysis for various insurance products, such as life, health and property insurance.

- Conduct cost analysis and develop strategies to reduce operational costs.

- Prepare and review annual financial statements and financial reports.

- Audit and reconcile accounts to ensure accuracy and compliance with regulations.

- Analyze financial data and provide insights to managers for decision making.

Insurance Accountant, XYZ Insurance Agency, 2013 – 2016

- Maintained ledger accounts and created financial statements for various insurance products.

- Developed cost- effective strategies and implemented them to maximize profitability.

- Analyzed financial documents and ensured compliance with corporate and industry regulations.

- Managed data entry and ensured accuracy of financial records.

Education:

MBA in Accounting, XYZ University, 2013

Insurance Accountant Resume with No Experience

Accomplished Insurance Accountant with a commitment to professionalism and a dedication to meeting the accounting needs of companies. Possess excellent skills in problem solving, analytical thinking, and research. Looking to gain experience in the insurance accounting industry.

Skills

- Strong understanding of accounting principles

- Proficient in Microsoft Office applications and accounting software

- Excellent organizational and time management abilities

- Ability to work independently and in a team environment

- Excellent communication and interpersonal skills

- Detail- oriented

Responsibilities

- Prepare and maintain accounting records and reports

- Monitor and reconcile accounts and transactions

- Analyze financial data and prepare financial reports

- Research and resolve discrepancies in financial records

- Monitor and ensure compliance with insurance accounting regulations

- Prepare and submit financial statements and reports to management

- Assist with budget preparation and monitoring of spending

Experience

0 Years

Level

Junior

Education

Bachelor’s

Insurance Accountant Resume with 2 Years of Experience

Dedicated Insurance Accountant with two years of experience in the insurance industry. A meticulous and detail- oriented individual with a strong background in financial management and customer service. Possesses the ability to perform comprehensive research and analysis, provide timely customer service and effectively manage complex financial transactions. Committed to creating efficiencies in processes and providing accurate financial information to stakeholders.

Core Skills:

- Financial Analysis and Reporting

- Accounts Receivable/Accounts Payable Management

- Insurance Industry Knowledge

- Microsoft Excel and Word

- Customer Service

- Team Collaboration

Responsibilities:

- Conducted detailed analysis of customer accounts and prepared financial statements for stakeholders.

- Managed accounts receivable and accounts payable, including customer collections, payments, and invoicing.

- Reviewed and processed insurance policy documents and payments.

- Provided customer service by responding to inquiries and resolving customer disputes.

- Collaborated with other departments to resolve customer issues.

- Maintained accurate financial records and ensured compliance with accounting regulations.

- Analyzed and reported financial data to senior management.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Insurance Accountant Resume with 5 Years of Experience

Highly organized and detail- oriented Insurance Accountant with 5+ years of experience providing accounting services to insurance companies. Possess a comprehensive understanding of the industry regulations and financial reporting procedures. Proven ability to manage expenses and make strategic decisions to improve financial performance. Outstanding interpersonal and problem- solving skills, with a passion for delivering numerically accurate results.

Core Skills:

- Strong knowledge of accounting principles and GAAP

- Proficiency in Microsoft Office Suite, QuickBooks and Sage Accounting

- Excellent critical thinking, analytical and problem- solving skills

- Excellent communication and customer service skills

- Strong organizational and time management skills

- Excellent attention to detail and data accuracy

Responsibilities:

- Perform general accounting functions such as accounts payable and accounts receivable

- Prepare financial statements and reports for management

- Analyze data and present findings to management

- Prepare and review ledger entries for accuracy

- Prepare and submit insurance claims

- Manage accounts receivable and accounts payable

- Handle payroll and employee benefits

- Reconcile discrepancies between accounts

- Manage and record journal entries

- Assist with budgeting and forecasting

- Maintain documentation and audit trails

- Ensure compliance with industry regulations and laws.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Insurance Accountant Resume with 7 Years of Experience

A dedicated and experienced Insurance Accountant with 7 years of experience in the banking and insurance industry offering expertise in financial operations, data analysis, and problem solving. Highly organized and capable of overseeing large projects, I have advanced knowledge of accounting principles and procedures, as well as experience in budgeting, forecasting, and auditing. I possess excellent communication and interpersonal skills, experience with regulatory compliance, and a commitment to ensuring accuracy and efficiency.

Core Skills:

- Advanced knowledge of accounting principles and procedures

- Proficient in corporate budgeting and forecasting

- Proven ability to complete audits and financial analyses

- Experience in regulatory compliance

- Excellent problem solving, communication, and interpersonal skills

- Proficient in Microsoft Office Suite

- Working knowledge of QuickBooks

- Highly organized and able to manage multiple tasks

Responsibilities:

- Preparation of financial statements and reports

- Supervised the daily operations of the accounting department

- Involved in the development and implementation of accounting policies

- Maintained accurate records and managed the accounts receivable and accounts payable

- Processed payroll and reviewed employee time sheets

- Analyzed financial data and generated financial reports

- Coordinated with insurance companies for underwriting and policy maintenance

- Monitored and reconciled bank accounts

- Ensured compliance with federal, state, and local regulations

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Insurance Accountant Resume with 10 Years of Experience

A highly experienced and motivated Insurance Accountant with 10 years of expertise in conducting financial analysis, providing financial advice and strategies, and developing and monitoring financial systems. Experienced in preparing and analyzing financial reports, developing budgets and forecasting, and using accounting software to manage financial activities. Possesses a keen eye for accuracy, excellent problem- solving skills and strong knowledge of regulatory requirements. A team player who communicates effectively and adapts quickly to new challenges.

Core Skills:

- Financial Analysis

- Financial Advice

- Financial System Development

- Financial Report Preparation

- Budgeting and Forecasting

- Accounting Software Management

- Regulatory Compliance

- Problem Solving

- Teamwork

- Communication

- Adaptability

Responsibilities:

- Conduct financial analysis to evaluate the financial performance of a company

- Provide financial advice and strategies to maximize company’s financial performance

- Develop and monitor financial systems to ensure accuracy and compliance

- Prepare and analyze financial reports to provide insights and identify areas of improvement

- Develop accurate budgets and forecasts to manage financial activities

- Use accounting software to manage financial activities and ensure accuracy

- Ensure compliance with regulatory requirements and industry standards

- Provide creative solutions for complex financial issues

- Work with teams to ensure successful completion of financial projects

- Communicate effectively with stakeholders and team members

- Adapt quickly to new challenges and environments

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Insurance Accountant Resume with 15 Years of Experience

Dynamic Insurance Accountant with 15 years of experience in providing financial guidance and support to key stakeholders. Proven success in streamlining processes, increasing accuracy, and helping to reduce costs and increase profits. Expertise in financial analysis and reporting, budgeting, forecasting, accounts receivable, accounts payable, and auditing. Skilled in problem- solving, communication, and liaising between departments.

Core Skills:

- Financial Analysis

- Forecasting

- Financial Reporting

- Accounts Receivable

- Accounts Payable

- Budgeting

- Auditing

- Problem Solving

- Communication

Responsibilities:

- Prepared and maintained accurate financial statements and reports.

- Assisted in the development of the annual budget and forecast.

- Analyzed variances from budget and forecast.

- Managed accounts receivable, including invoicing, collections and dispute resolution.

- Managed accounts payable, including invoice processing, payments, and vendor relations.

- Assisted in cashflow forecasting and ensured timely and accurate payments.

- Conducted regular audits of accounts to ensure accuracy and compliance with regulations.

- Developed and implemented process improvement initiatives to streamline operations and reduce costs.

- Ensured compliance with all applicable laws, regulations and company policies.

- Provided financial guidance, advice and support to key stakeholders.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Insurance Accountant resume?

When applying for a job as an Insurance Accountant, your resume needs to stand out from the competition and highlight your best professional attributes. To ensure your resume captures the attention of potential employers, here are some key components that you should be sure to include:

- Professional Summary: Start your resume off with a succinct summary that outlines your qualifications and experience as an Insurance Accountant.

- Education: List out all relevant educational experience, such as degrees, certificates, and other programs that you have completed related to insurance accounting.

- Relevant Skills & Knowledge: Highlight the skills and knowledge you have that are relevant to the insurance accounting field such as customer service, bookkeeping, record management, and financial analysis.

- Work Experience: Outline previous positions where you have gained experience in insurance accounting and any relevant responsibilities or accomplishments.

- Professional References: Provide two or three professional references that can speak to your work experience and knowledge as an Insurance Accountant.

- Certifications: If you possess any certifications related to insurance accounting, such as a CPA license or a Chartered Insurance Professional designation, be sure to include them on your resume.

By including these components in your resume, you will help ensure that you create an effective document that captures the attention of employers and helps you stand out in the competitive insurance accounting field.

What is a good summary for a Insurance Accountant resume?

A good summary for an Insurance Accountant resume should include a brief overview of the candidate’s experience and qualifications relevant to the position. The summary should also highlight any special skills or achievements that make the candidate stand out from other applicants. The summary should be concise and should not exceed two to three sentences. The summary should also include relevant information about the candidate’s experience in the insurance industry, such as the types of accounts they managed and how long they have been in the field. Additionally, the summary should mention the candidate’s ability to work both independently and in a team setting, as well as their commitment to meeting deadlines. Finally, the summary should mention any certifications or designations the candidate has achieved. With a well-crafted summary, a candidate can effectively showcase their qualifications and stand out from the competition.

What is a good objective for a Insurance Accountant resume?

The insurance industry is a dynamic, competitive and ever-changing field, so it’s important to craft an effective resume objective that sets you apart as a job candidate. A well-written objective can help an insurance accountant demonstrate their skills and knowledge to employers and show that they are the right fit for the position.

- Highlight your accounting and finance skills: Showcase your knowledge of financial analysis, accounts payable and receivable, and other relevant skills that will be beneficial to the role.

- Emphasize your customer service skills: Demonstrate your experience in providing excellent customer service and engaging with clients.

- Demonstrate your experience with insurance policies: Showcase your understanding of insurance policies and your ability to work with them.

- Showcase your organizational skills: Show that you have the ability to prioritize tasks and stay organized when dealing with multiple clients and tasks at once.

- Display your problem-solving skills: Show that you have the skills to troubleshoot, analyze, and resolve complex issues.

- Highlight your communication abilities: Showcase your communication skills, both verbal and written, to demonstrate that you’re capable of providing clear and concise information to clients and other stakeholders.

How do you list Insurance Accountant skills on a resume?

When it comes to creating a resume for an insurance accountant position, it is important to list all of the necessary skills that make you a great candidate. Insurance accountants must have strong analytical, problem solving, and organizational skills. They must also be able to manage multiple tasks and deadlines, as well as maintain accuracy and control in all accounting functions. Here are some key skills to include when listing your experience as an insurance accountant on a resume:

- Knowledge of Generally Accepted Accounting Principles (GAAP)

- Excellent research and analytical skills

- Proficiency in MS Office (Excel, Word, Outlook)

- Ability to identify discrepancies in financial data

- Proven experience in preparing financial reports

- Ability to develop and implement accounting procedures

- Strong organizational, communication, and interpersonal skills

- Ability to work independently and as part of a team

- Ability to stay up-to-date with changing insurance laws

What skills should I put on my resume for Insurance Accountant?

Insurance accountants are responsible for providing financial advice to clients in relation to their insurance policies. It is important to have a strong knowledge of the insurance industry in order to be successful in this role. Therefore, it is important to highlight your skills on your resume that demonstrate your ability to understand and analyze insurance policies. Here are some essential skills to consider when creating your insurance accountant resume:

- Knowledge of Insurance Policies and Regulations: Insurance accountants must have a thorough understanding of the insurance policies and regulations that apply to the products they are dealing with. This includes understanding the various clauses, coverage, and other details of the policy.

- Financial Analysis: Insurance accountants must be able to accurately analyze financial data and understand how to interpret the results. This includes being able to evaluate the risks associated with a policy and making informed decisions about where to invest money.

- Attention to Detail: Insurance accountants must pay close attention to detail and be able to accurately analyze and review documents. This includes understanding the details of insurance policies and being able to quickly identify any errors or discrepancies.

- Communication: Insurance accountants must be able to effectively communicate with their clients and other stakeholders. This includes being able to explain complex financial terms and policies in a way that is easy to understand.

- Problem-Solving: Insurance accountants must be able to quickly identify potential problems and come up with solutions to address them. This includes being able to think on your feet and come up with creative solutions to complex problems.

Key takeaways for an Insurance Accountant resume

When it comes to creating a resume as an insurance accountant, there are a few key takeaways you need to be aware of. Below are some tips to help you craft an effective and informative resume.

- Highlight Your Expertise and Knowledge: Being an insurance accountant requires a high level of expertise and knowledge, so make sure you showcase this on your resume. List the specific areas you specialize in and any training or certifications you have.

- Focus on Your Skills: While your expertise and knowledge should be highlighted, it’s also important to emphasize the skills you have that make you a great insurance accountant. These skills could include problem-solving, analytical thinking, and attention to detail.

- Showcase Your Achievements: It’s important to include any successes or achievements you have had in the past. This will show potential employers that you are capable of meeting expectations and achieving great results.

- Use Keywords: When applying for a job, it’s important to use the right keywords to ensure that your resume is seen by the right people. Make sure you research the job description and use the right keywords to show that you are a qualified candidate.

- Keep It Clean: Finally, make sure that your resume is clean and easy to read. Use a professional format and avoid using too much jargon or unnecessary information.

By following these tips, you can craft an effective and informative resume that will help you stand out from other applicants. Make sure you emphasize your expertise and knowledge, showcase your achievements, use keywords, and keep your resume clean and easy to read. This will increase your chances of getting hired and help you land the job you want.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder