Enrolling as an Enrolled Agent can be a great way to become an expert in the field of taxation. It requires both specialized training and passing an exam. As such, crafting an effective Enrolled Agent resume is essential to stand out from the competition. This guide will provide an overview of how to create a successful resume, as well as Enrolled Agent resume examples to help you write an effective resume. With the tips and examples in this guide, you will be able to craft a resume that will make you stand out from the rest of the applicants.

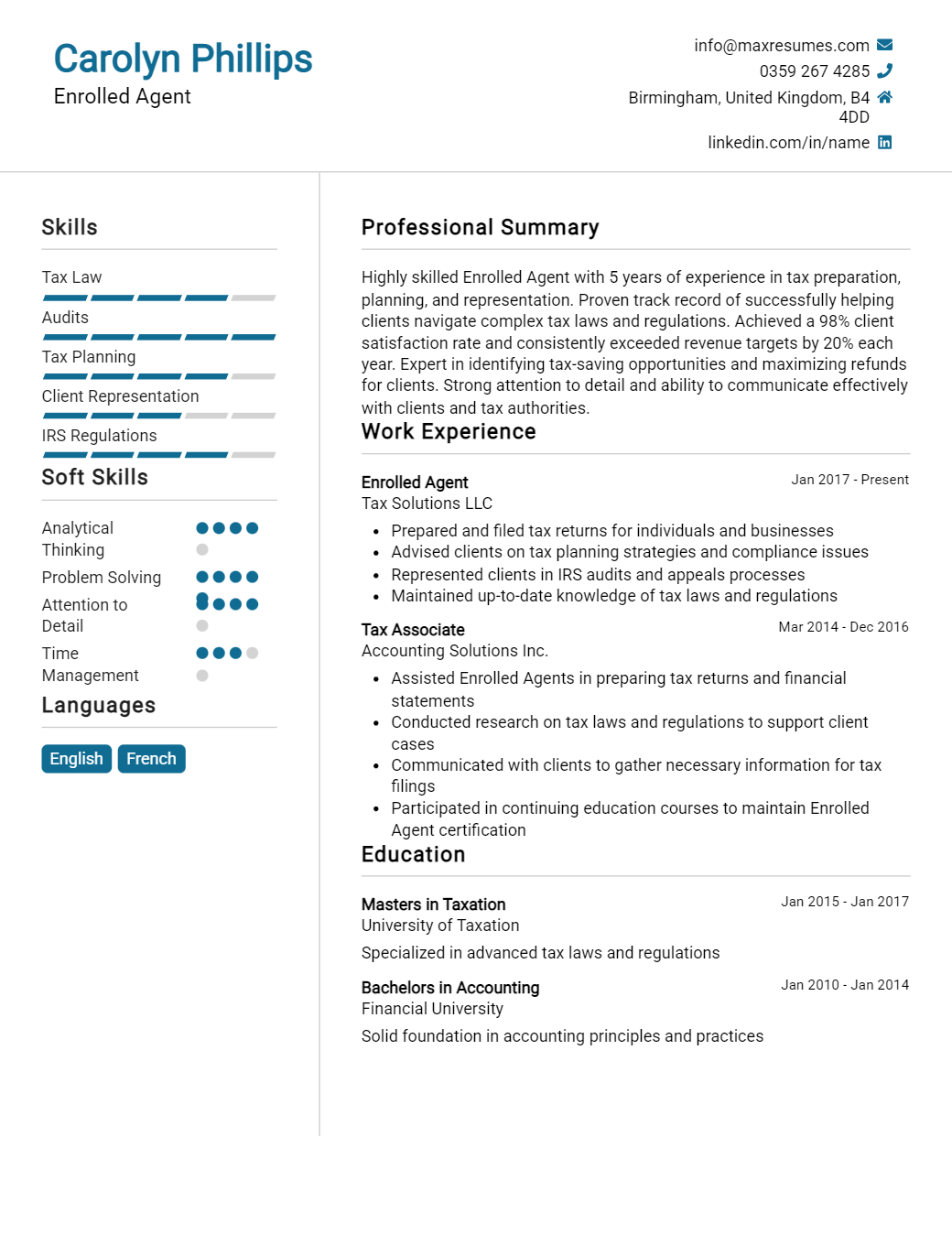

Enrolled Agent Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Enrolled Agent Resume Examples

John Doe

Enrolled Agent

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am an experienced Enrolled Agent with a proven track record of success in the tax industry. I have a strong background in taxation, including tax research, tax preparation, and consulting. I have a deep understanding of the laws and regulations governing taxation, as well as excellent communication and interpersonal skills. My extensive knowledge of the taxation system allows me to provide clients with comprehensive tax advice and strategies that ensure their financial success.

Core Skills:

- Comprehensive knowledge of tax laws, regulations and principles

- Thorough understanding of financial statements and tax documents

- A strong ability to analyze and interpret financial data

- Proficient in tax software programs, such as QuickBooks, TurboTax and ProSeries

- Excellent communication and interpersonal skills

- Ability to develop customized tax strategies for clients

Professional Experience:

- Enrolled Agent at ABC Tax Solutions, Inc. – May 2015 to present

- Responsible for preparing tax returns for clients, ensuring accuracy of documents and ensuring compliance with applicable tax laws

- Perform tax research and provide tax advice and recommendations to clients

- Provide comprehensive tax planning services, including federal and state tax planning

- Assist clients with tax audits and dispute resolution

Education:

- Certified Enrolled Agent, Internal Revenue Service – June 2015

- Bachelor of Business Administration, Accounting, University of Colorado – May 2012

Enrolled Agent Resume with No Experience

Dynamic and results- oriented Enrolled Agent with 7+ years experience in accounting and financial operations. Adept at preparing and examining financial documents, managing accounts receivable and payable, and resolving customer issues. Proven record of developing creative solutions to complex financial problems. Seeking to leverage strong analytical, communication and problem- solving skills to bring success to a progressive organization.

Skills

- Knowledge of financial statements and regulatory requirements

- Proficient in QuickBooks, Microsoft Office, and Turbo Tax

- Highly organized and detail- oriented

- Excellent critical thinking and problem- solving skills

- Strong communication and interpersonal skills

- Ability to work independently and as part of a team

Responsibilities

- Examine financial documents for accuracy and compliance

- Prepare and analyze monthly, quarterly and yearly account reconciliations

- Handle accounts receivable and accounts payable

- Manage customer relationships and resolve customer inquiries

- Analyze financial risks and provide solutions for improvement

- Ensure compliance with tax laws and regulations

Experience

0 Years

Level

Junior

Education

Bachelor’s

Enrolled Agent Resume with 2 Years of Experience

An experienced Enrolled Agent with 2 years of experience in corporate tax preparation, IRS representation, and other financial services. Possess a strong knowledge of tax laws and regulations and excellent problem- solving skills to ensure accurate and timely completion of returns. Skilled in providing tax advice to clients, preparing and filing tax returns, and handling IRS audits.

Core Skills:

- Tax Law Knowledge

- IRS Representation

- Tax Preparation

- Audit Representation

- Problem- Solving

- Financial Services

- Tax Advice

- Organizational Skills

- Time Management

Responsibilities:

- Gathering and preparing tax documents for clients

- Filing tax returns for individuals and organizations

- Calculating and filing estimated tax payments

- Providing advice on tax legislation and regulatory changes

- Representing clients in IRS audits

- Resolving tax disputes with the IRS

- Conducting research on tax laws and regulations

- Identifying and addressing tax planning opportunities

- Staying up to date on changes in tax laws and regulations

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Enrolled Agent Resume with 5 Years of Experience

A highly experienced Enrolled Agent with 5 years of expertise in providing tax services and advice to individuals and corporations. Proven ability to manage client accounts, compute and file taxes accurately, review financial statements, and provide excellent customer service. Solid understanding of tax codes and regulations and the ability to implement them in tax preparation.

Core Skills:

- Tax Accounting

- Tax Preparation

- Tax Advisory

- Tax Compliance

- Client Management

Responsibilities:

- Prepared and filed taxes for individuals and businesses

- Reviewed financial statements to identify any discrepancies

- Advised clients on various strategies to reduce tax liability

- Reviewed and audited financial documents for accuracy and compliance with IRS regulations

- Provided guidance on business and personal financial decisions

- Managed client accounts and provided customer service as needed

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Enrolled Agent Resume with 7 Years of Experience

A Certified Enrolled Agent with 7 years of experience in handling complex tax law and regulations, providing tax and financial advice, preparing individual and business tax returns, and representing clients before the IRS. Experienced in both domestic and international tax requirements, and able to navigate clients through the intricacies of the tax code. Adept at using a variety of software to review, analyze, and resolve tax issues. Skilled in gathering, organizing, and interpreting financial data.

Core Skills:

- Tax Planning

- Tax Preparation

- US Tax Code

- IRS Representation

- Financial Analysis

- Auditing

- Software Proficiency

- Data Entry

- Problem Resolution

Responsibilities:

- Prepared annual tax returns for individuals, businesses, and trusts in compliance with US tax laws.

- Provided tax planning and advice for clients to minimize taxes.

- Represented clients during IRS audits.

- Analyzed financial data to identify potential tax savings opportunities.

- Reviewed, updated, and maintained financial records.

- Researched complex tax laws and regulations to develop a set of solutions for clients.

- Maintained data entry and electronic filing systems for client records.

- Identified discrepancies and discrepancies in tax documents and proposed solutions.

- Advised clients on changes to US tax laws and regulations.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Enrolled Agent Resume with 10 Years of Experience

Highly experienced Enrolled Agent with 10+ years of experience providing comprehensive tax services to individuals and businesses. Proven track record of helping clients understand and comply with federal and state rules and regulations. Skilled at preparing, filing and amending tax returns, analyzing financial data and implementing tax strategies. Expertise in establishing and maintaining strong relationships with clients, government agencies and other tax professionals.

Core Skills:

- Certified Enrolled Agent (EA)

- Tax Planning and Compliance

- Analyzing Financial Data

- IRS Representation

- Tax Research and Resolution

- Tax Return Preparation

- Tax Planning Strategies

- Federal and State Tax Laws

- Financial Accounting

- Technical Writing

Responsibilities:

- Assisted individuals and businesses in preparing, filing, and amending tax returns in compliance with federal and state laws.

- Conducted research to resolve outstanding tax issues and resolve discrepancies.

- Negotiated settlements and payment plans with the IRS and state agencies.

- Analyzed financial information to identify discrepancies and errors.

- Provided advice on tax laws, regulations, and strategies to optimize deductions and credits.

- Performed detailed reviews of financial statements, account histories and other financial documents.

- Identified opportunities for tax savings and minimized exposure to tax penalties.

- Ensured compliance with federal, state and local laws and regulations.

- Developed and implemented tax strategies to minimize tax liabilities.

- Provided technical support and training to staff on tax laws, regulations, and filing requirements.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Enrolled Agent Resume with 15 Years of Experience

I am an Enrolled Agent with 15+ years of experience in accounting, tax preparation and compliance. I am adept in managing fiscal operations, supervising staff and responding to client inquiries. I have an excellent knowledge of tax law, a strong ability to analyze complex financial data and a dedication to providing quality service. I also have a proven record of success in developing accounting systems, preparing financial statements and ensuring timely filing of tax returns.

Core Skills:

- Tax Law: Knowledge and understanding of applicable state and federal tax laws and regulations.

- Accounting: Preparation of financial statements, bookkeeping, auditing, and other accounting functions.

- Analysis: Ability to analyze financial data in order to identify trends, risks, and opportunities.

- Customer Service: Responding to client inquiries and resolving any issues in a timely manner.

- Organization: Professionalism, attention to detail, and ability to prioritize tasks.

Responsibilities:

- Prepare complex tax returns for businesses and individuals in accordance with federal, state, and local regulations.

- Validate accuracy of financial data, analyze trends, and make recommendations for improvement.

- Research and resolve tax issues for clients and ensure compliance with tax laws.

- Assist clients with filing tax returns and explanations of tax liabilities or refunds.

- Provide guidance and advice to clients on tax- related matters.

- Train and supervise staff on accounting and tax compliance procedures.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Enrolled Agent resume?

A resume for an Enrolled Agent should include a comprehensive overview of their skills and experience. Here are some of the key points to include on an Enrolled Agent resume:

- Professional Summary: A short summary of your professional experience and goals as an Enrolled Agent.

- Education: List any relevant education and certifications that you possess.

- Professional Experience: A detailed list of your experience working as an Enrolled Agent. Include any special projects or accomplishments.

- Skills: List any relevant skills, such as tax preparation, financial analysis, problem-solving, and communication that you have developed in your career.

- Certifications: List any Enrolled Agent certifications you may have acquired such as the Enrolled Agent Credential or the Enrolled Agent Examination.

- Professional Affiliations: List any professional organizations or associations you are a part of, such as the National Association of Enrolled Agents.

-Additional Experience: List any additional experience that may be relevant to your work as an Enrolled Agent, such as accounting, bookkeeping, or financial consulting.

-References: Include the contact information of two to three professional references who can speak to your qualifications.

What is a good summary for a Enrolled Agent resume?

A good summary for an Enrolled Agent resume should highlight the individual’s ability to serve as a federally-licensed tax practitioner, their comprehensive knowledge of tax laws, and their experience working with clients on their taxes. It should focus on the professional’s track record of accuracy and integrity when handling complex tax issues and their ability to provide clients with personalized, tailored tax advice. An effective Enrolled Agent summary will also showcase the individual’s commitment to compliance and their dedication to staying up to date on changes in the tax code.

What is a good objective for a Enrolled Agent resume?

A resume for an Enrolled Agent should demonstrate experience, qualifications, and expertise to potential employers. To help employers understand your qualifications and skills, a good objective is essential.

A good objective for an Enrolled Agent resume should include the following:

- Highlighting your experience and expertise in preparing, filing, and representing taxpayers before the IRS

- Demonstrating your excellent communication and customer service skills

- Showcasing your knowledge of tax preparation software, accounting principles, and filing protocols

- Emphasizing your commitment to helping clients meet their tax filing goals

- Profiling your understanding of regulations and compliance requirements

By including this information in your objective, you can demonstrate to employers that you are the right person for the job. With the right objective, you can make sure that your resume stands out from the competition and puts your best foot forward.

How do you list Enrolled Agent skills on a resume?

When writing a resume as an Enrolled Agent, it is important to highlight your professional skills. When listing your skills, it is important to be succinct and include only the most relevant information. Here is a guide on how to list Enrolled Agent skills on a resume:

- Include any certifications or licenses you have earned as an Enrolled Agent: Include the full name of the certification or license and date of issuance.

- Include any specialized skills related to your job as an Enrolled Agent: These could include bookkeeping, tax preparation and planning, financial statements, and estate planning.

- Showcase your ability to stay current with all tax laws and regulations: This could include courses or seminars you have completed, as well as any other training related to tax law.

- Demonstrate your excellent communication, organizational, and problem-solving skills: These skills are essential in the role of an Enrolled Agent and should be highlighted on your resume.

- Showcase your ability to multitask and handle a large workload: As an Enrolled Agent, you may need to work on multiple client cases at once and must be able to handle a high workload.

By showcasing your skills on your resume, you can show potential employers why you are the best choice for the job. Highlighting your Enrolled Agent skills on your resume can help you stand out to potential employers and give you an edge in the job market.

What skills should I put on my resume for Enrolled Agent?

When preparing a resume as an Enrolled Agent, it is important to showcase the skills and qualifications that make you uniquely qualified for the role. Enrolled Agents are expected to have a strong knowledge of the tax code and a commitment to accurate tax filing. When building your resume for an Enrolled Agent role, include the following skills to demonstrate your suitability:

- Tax Preparation: As an Enrolled Agent, you must be well-versed in the preparation of individual and corporate tax returns. Showcase your experience in this area by including the specifics of your work – any software used, the types of clients you have served, or any special events or workshops you have attended related to tax preparation.

- Financial Analysis: Enrolled Agents must have excellent analytical skills in order to accurately assess and interpret complex tax regulations. Demonstrate your skill in this area by including any specific projects you have completed or any certifications or advanced training you have obtained.

- Problem Solving: Enrolled Agents are often called upon to resolve client issues related to taxes. Showcase your ability to address difficult problems by including any relevant experience in leadership roles or any specific situations in which you have exercised excellent problem solving skills.

- Client Service: Enrolled Agents must have excellent interpersonal skills in order to confidently interact with clients. Explain how you have leveraged your experience with customer service, communications, or sales in order to provide excellent service to clients.

By highlighting your skills and experience in the areas of tax preparation, financial analysis, problem solving, and client service, your resume will stand out and demonstrate your suitability for the role of Enrolled Agent.

Key takeaways for an Enrolled Agent resume

As an Enrolled Agent, your resume must show that you have the accounting, auditing, and tax preparation skills to meet the needs of any client. The following key takeaways are important to consider when writing your resume:

- Highlight your qualifications as an Enrolled Agent – Your resume should clearly outline your qualifications as an EA, including any licenses, certificates, or special designations you hold.

- Emphasize your experience – Employers will want to know you have the necessary experience to tackle their tax and accounting challenges. Make sure to include any relevant past work or internships you’ve held.

- Showcase your knowledge – You should include a section on your resume that showcases your knowledge of accounting, auditing, and tax preparation. As an Enrolled Agent, you should have a comprehensive knowledge of the U.S. tax system, so make sure to emphasize the courses you took in school and any additional training you’ve completed.

- Demonstrate your problem-solving skills – Employers will want to know you can think critically and solve complex problems. Include examples of challenges you’ve faced and how you solved them in a professional, efficient manner.

- Emphasize your computer skills – As an Enrolled Agent, you’ll be responsible for utilizing a variety of computer programs and applications to make your job easier. Make sure to list any software programs you’re familiar with and any computer skills you possess.

Following these key takeaways can help you create an effective Enrolled Agent resume. Make sure to tailor your resume to the position you’re applying for so employers can get a better understanding of the value you can bring to their organization. Good luck!

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder