Writing a resume as a wealth manager can be a challenging task. Wealth managers must present themselves as experienced and knowledgeable professionals who can handle clients’ finances and investments with confidence. Crafting the perfect wealth manager resume may seem daunting, but it doesn’t have to be! In this blog post, we’ll provide an easy-to-follow guide for writing a compelling wealth manager resume, with examples to get you started.

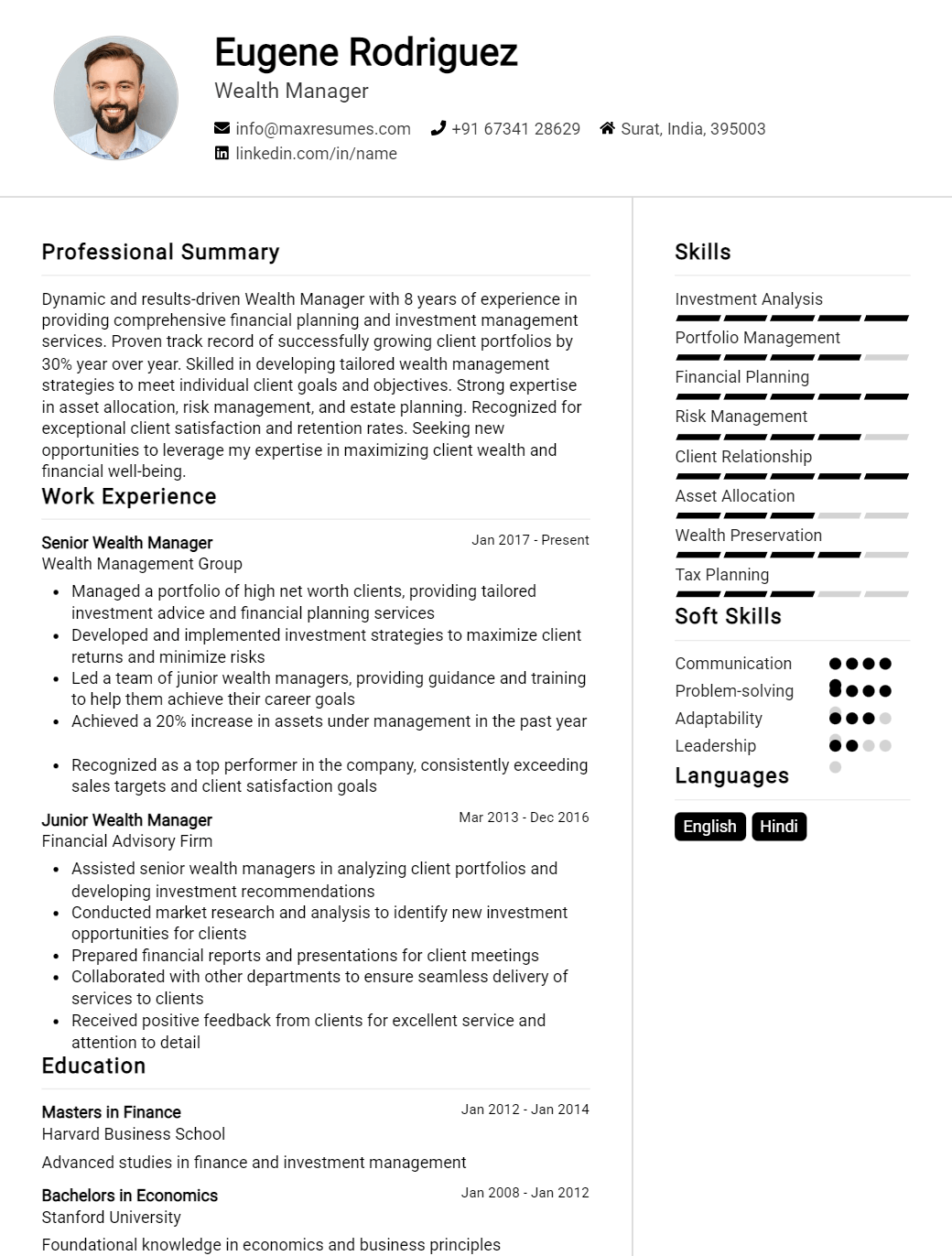

Wealth Manager Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Wealth Manager Resume Examples

John Doe

Wealth Manager

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

A highly motivated and enthusiastic wealth manager with over 10 years of experience in the financial industry. Demonstrates a unique combination of sound judgement and knowledge in financial planning, risk management, and portfolio management. Possesses exemplary customer service skills, excellent organizational and communication skills, and a commitment to the highest standards of ethical conduct.

Core Skills:

- Financial Planning

- Wealth Management

- Risk Management

- Portfolio Management

- Investment Strategies

- Retirement Planning

- Tax Planning

- Financial Analysis

- Regulatory Compliance

- Customer Service

Professional Experience:

Wealth Manager, XYZ Bank, 2010 – Present

- Manage a team of financial advisors to provide comprehensive financial planning services to clients

- Develop and implement wealth management strategies to achieve client’s financial goals

- Analyze portfolios to identify areas of risk and recommend appropriate investments to mitigate it

- Prepare financial statements and reports for clients

- Monitor regulatory compliance and ensure that commission and fees are in accordance with applicable regulations

- Provide guidance and advice in the areas of retirement planning, tax planning, and estate planning

Senior Financial Advisor, ABC Bank, 2005 – 2010

- Developed investment plans and portfolios for clients

- Advised clients on financial products and services

- Conducted financial analysis to identify areas of risk and suggest appropriate investments to mitigate it

- Assisted customers with retirement planning, estate planning, and tax planning

- Ensured regulatory compliance and monitored performance of investments

Education:

MBA in Finance, University of XYZ, 2004

Bachelor’s Degree in Business Administration, University of ABC, 2002

Wealth Manager Resume with No Experience

Objective

To obtain a position as a Wealth Manager and to help clients achieve their financial goals.

- Recent college graduate with a Bachelor’s degree in Finance

- A motivated and driven individual with the ability to handle multiple tasks and projects

- Proficient in Microsoft Office, financial analysis, and market research

- Strong communication, interpersonal, and organizational skills

Skills

- Financial Analysis

- Client Relationship Management

- Investment Planning

- Portfolio Management

- Financial Modeling

- Risk Management Strategies

- Business Development

- Data Analysis

- Accounting Principles

- Tax Planning

Responsibilities

- Providing exceptional customer service to clients

- Assessing client financial needs and developing comprehensive financial plans

- Analyzing financial data to determine client’s risk capacity and investment objectives

- Recommending and developing investment strategies

- Reviewing and monitoring client investments

- Developing and managing client relationships

- Ensuring that all financial regulations and compliance standards are met

- Conducting research on new products and services

- Developing and managing client portfolios

- Providing accurate, timely and actionable advice to clients

Experience

0 Years

Level

Junior

Education

Bachelor’s

Wealth Manager Resume with 2 Years of Experience

A motivated and organized individual with two years of experience as a Wealth Manager, I have served numerous clients and assisted with the investment and management of their financial assets. My expertise lies in providing accurate and efficient analysis and financial advice, as well as adeptly addressing clients’ needs and concerns. I’m also knowledgeable in portfolio management, compliance, and risk management. My interpersonal skills have enabled me to consistently build and maintain strong relationships with clients and professionals in the industry.

Core Skills:

- Portfolio Management

- Financial Planning

- Risk Analysis

- Strategic Investment

- Client Relationship Building

- Compliance

Responsibilities:

- Assess financial needs of clients and develop financial plans to meet short- and long- term objectives

- Develop, review, and manage investment portfolios

- Research and evaluate stock, bonds, and other investments based on historic performance and market trends

- Monitor and analyze markets to identify new investment opportunities

- Manage portfolios and reinvest funds as needed

- Maintain compliance with internal and external regulations

- Execute trades on behalf of clients

- Provide regular financial updates to clients and ensure their satisfaction with services

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Wealth Manager Resume with 5 Years of Experience

Dynamic and results- driven Wealth Manager with 5 years of experience in helping clients build and manage wealth in a variety of ways. Skilled in developing tailored financial plans that meet client needs, objectives and risk tolerance. Proven expertise in investments, estate planning, retirement planning, tax planning, insurance and banking. Committed to provide a comprehensive, professional and comprehensive wealth management experience.

Core Skills:

- Financial Analysis

- Investment Management

- Portfolio Design

- Risk Management

- Tax Planning

- Retirement Planning

- Estate Planning

- Insurance Planning

- Financial Modeling

- Banking

Responsibilities:

- Develop tailored financial plans for clients based on their needs, objectives and risk appetite

- Identify and analyze investment opportunities to grow and protect clients’ wealth

- Conduct financial and market research to stay abreast of changes in the industry

- Provide estate and retirement planning services to clients

- Advise clients on insurance policies to secure their wealth and future

- Assist clients in preparing and filing tax returns

- Build strong client relationships and provide ongoing customer service

- Review clients’ financial statements on a regular basis to ensure performance

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Wealth Manager Resume with 7 Years of Experience

A highly experienced Wealth Manager with seven years of experience in developing and executing comprehensive financial and investment plans for high- net- worth clients. I am able to provide clients with guidance on a wide range of financial topics such as estate planning, retirement planning, risk management, asset allocation, and more. I have an excellent track record of providing successful results to clients, and I am highly organized, reliable, and detail- oriented.

Core Skills:

- Advanced knowledge of financial products and services

- In- depth understanding of the financial planning process

- Excellent communication and interpersonal skills

- Proven ability to build strong relationships with clients

- Highly organized and detail- oriented

- Ability to analyze and interpret financial data

- Proficient in Microsoft Office applications

Responsibilities:

- Developing financial plans for high- net- worth clients

- Creating a comprehensive analysis of clients’ current financial situation

- Advising clients on investment strategies and asset allocation

- Analyzing financial data and making recommendations based on findings

- Developing strategies to help clients reach their long- term financial goals

- Monitoring investments and making adjustments as needed

- Providing clients with timely updates on their investments

- Keeping clients informed of current financial trends and market conditions

- Identifying areas of risk and providing appropriate solutions

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Wealth Manager Resume with 10 Years of Experience

An experienced Wealth Manager with 10 years of experience in providing quality financial advice and creating strategies to facilitate financial stability. Experienced in managing high- net worth individuals, assisting clients with financial planning, and developing strategies to increase client wealth. Possesses excellent communication, problem- solving, and interpersonal skills, as well as a deep knowledge of the financial services industry.

Core Skills:

- Investment Planning

- Risk Management

- Portfolio Management

- Financial Analysis

- Client Relationship Management

- Tax Planning

- Strategic Planning

- Wealth Forecasting

- Regulatory Compliance

- Asset Allocation

Responsibilities:

- Developing comprehensive financial plans for clients

- Analyzing clients’ risk tolerance, investment goals, and financial situations

- Conducting research and due diligence to identify and select suitable investments

- Recommending and implementing portfolio allocation strategies

- Monitoring and reviewing portfolio performance

- Keeping up to date with the latest industry regulations and financial trends

- Managing client relationships and providing ongoing advice and guidance

- Collaborating with other wealth management professionls and financial advisors

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Wealth Manager Resume with 15 Years of Experience

Highly experienced and knowledgeable Wealth Manager with over 15 years of experience in financial planning and wealth management. Possesses extensive expertise in the creation and management of financial strategies, which have enabled many clients to achieve their desired financial goals. Possesses excellent communication and interpersonal skills, as well as a strong ability to identify and analyze potential risks and opportunities. A dedicated and motivated team player who is also capable of working independently with minimal supervision.

Core Skills:

- Advanced knowledge of financial planning, portfolio management and investment strategies

- Extensive experience in creating and implementing financial plans

- Strong problem solving and analytical skills

- Excellent communication and interpersonal skills

- Ability to identify potential risks and opportunities

- Ability to work independently and with a team

- Proficiency in using various financial software and tools

Responsibilities:

- Develop and manage comprehensive financial plans for clients

- Analyze and review data to identify potential risks and opportunities

- Develop investment strategies and portfolio management plans

- Implement financial plans and strategies to exceed clients’ financial targets

- Provide financial counseling and advice to clients

- Monitor investments and financial markets to identify new opportunities

- Conduct research and analysis of financial markets

- Stay up- to- date with the latest financial regulations and trends

- Liaise with other financial professionals, such as tax advisors and estate planners

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Wealth Manager resume?

When it comes to creating a successful resume for a wealth manager, there are certain components that must be included in order to make it stand out to potential employers. A wealth manager resume should include the following information:

- Professional Summary: This is a brief overview of the candidate’s qualifications and experience. It should be succinct and focus on the key skills that make the wealth manager a great fit for the job.

- Education: This is a critical part of the resume, as many employers will prefer candidates who have a college degree in a related field. It is important to list the name of the institution, dates of attendance, and the degree earned.

- Previous Experience: This section should include a detailed description of previous wealth manager positions held, such as the company name, position title, and dates of employment.

- Areas of Expertise: This section should list the key areas of expertise that the wealth manager possesses, such as investment management, portfolio analysis, risk management, tax planning, and financial planning.

- Professional Certifications: Certifications are important to employers and can set a candidate apart from the competition. List any relevant certifications that the wealth manager has obtained.

- Special Achievements: List any awards or other achievements that the wealth manager has received in the past that demonstrate their expertise in the field, such as awards from professional organizations or recognition from employers.

- References: List at least two professional references who can vouch for the wealth manager’s qualifications and skills.

These are the essential elements that should be included in a wealth manager resume. With this information, employers can quickly and easily assess a potential candidate’s qualifications and decide if they are the right fit for the job.

What is a good summary for a Wealth Manager resume?

A wealth manager resume should provide a clear and concise summary of the applicant’s experience, qualifications, and skills related to the role. It should demonstrate the individual’s ability to provide advice and guidance on a variety of financial matters, and show the understanding of financial planning and asset management. The resume should also include an education section, providing details of any qualifications related to the field of finance. Additionally, the resume should emphasize the applicant’s ability to build relationships with clients and maintain a high level of professionalism and customer service. Finally, the resume should include any relevant work experience, such as in the financial services or banking industries, or any specific work that relates to the role of a wealth manager.

What is a good objective for a Wealth Manager resume?

A wealth manager resume should have an objective that succinctly summarizes a candidate’s qualifications and goals. It should be tailored to the position and company, highlighting skills and experience that make the candidate the best fit.

The right objective will draw attention to a resume and help a candidate stand out from the competition. Below are a few tips for crafting a good objective for a wealth manager resume.

- Demonstrate knowledge of the industry: Showing that a candidate is familiar with the industry and the current trends is essential in a successful wealth manager resume objective. Listing any professional certifications, expertise in specific investments, or experience in the field will show potential employers that the candidate is knowledgeable.

- Highlight interpersonal skills: Wealth managers need to be able to effectively communicate with their clients. A resume objective should showcase a candidate’s ability to be a good listener, build trust, and provide excellent customer service.

- Showcase leadership qualities: Wealth managers must be able to take control of situations and make sound financial decisions. An objective should demonstrate a candidate’s ability to lead by giving examples of their success in previous roles.

By following these tips, a candidate can craft an effective and compelling objective for a wealth manager resume. It should concisely communicate why the candidate is the best fit for the job, highlighting the knowledge and attributes that make them stand out from the competition.

How do you list Wealth Manager skills on a resume?

When creating a resume for a Wealth Manager position, it is important to include all the necessary information about your skills, experience and education. Your skills should be listed to demonstrate your capabilities in the areas of finance, client relationship management and investments.

To list your wealth manager skills on your resume, consider the following:

- Comprehensive knowledge of financial markets and investment strategies

- Proficient in creating financial plans and investment portfolios

- Expertise in analyzing individual financial situations

- Ability to develop and maintain relationships with clients

- Excellent communication skills and ability to explain difficult concepts

- Knowledge of tax law and regulations related to wealth management

- Excellent organizational, problem-solving and analytical skills

- Ability to work independently and as part of a team

- Experienced in using financial software and other tools

- Adept at making sound financial decisions

- Ability to multi-task and prioritize workloads

- Detail-oriented and able to meet deadlines

- Flexible and able to adapt to changing market conditions

By showcasing these skills on your resume, you can demonstrate to potential employers that you are a qualified candidate for the wealth manager position.

What skills should I put on my resume for Wealth Manager?

When you’re applying for a position as a wealth manager, you want to make sure your resume stands out from the competition. To give yourself the best chance of getting hired, you should include the key skills and experience related to the role on your resume.

- Here is a list of skills you should include when applying for a wealth manager position:

- Financial Analysis: The ability to analyze financial statements and other data to determine which investments and strategies will be most beneficial.

- Investment Management: Experience in managing stocks, bonds, and other investments.

- Risk Analysis: The ability to identify, analyze, and manage risks associated with financial investments.

- Portfolio Management: Experience in creating and managing portfolios of investments.

- Client Relations: The ability to build strong relationships with clients and understand their needs.

- Project Management: The ability to manage projects and ensure goals are met in a timely and efficient manner.

- Communication: Strong verbal and written communication skills to be able to clearly explain investment strategies and performance.

- Onalytical Thinking: The ability to think critically and solve problems.

By including these key skills on your resume, you can show potential employers that you have the necessary skills and experience to perform the job of a wealth manager.

Key takeaways for an Wealth Manager resume

Wealth managers play a vital role in helping clients achieve their financial goals and secure their future, so it’s important to have a well-crafted resume that reflects your skills and experience. Here are the key takeaways for an effective wealth manager resume:

- Highlight any experience you have in the financial and investment sectors. Whether it’s previous banking or investment management experience, make sure to include it on your resume.

- Showcase your qualifications. Include any certifications, such as a Chartered Financial Analyst (CFA) designation, and any relevant coursework you have taken.

- Demonstrate your understanding of financial markets. Include any knowledge of stock market trends, portfolio diversification, and asset allocation strategies.

- Showcase your problem-solving and analytical skills. Wealth managers need to be able to analyze and interpret complex financial data, so be sure to emphasize this on your resume.

- Include any relevant awards or recognition. If you have been recognized for your financial management or investment skills, make sure to include this on your resume.

- Demonstrate your communication and interpersonal skills. Wealth managers need to be able to build relationships and communicate effectively with clients, so make sure to emphasize this on your resume.

By following these key takeaways, you can create a strong wealth manager resume that will help you stand out from the competition and land the job of your dreams.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder