Are you applying for a Venture Capital Analyst position? If so, you need to make sure that your resume stands out. Crafting a strong resume is essential for any job application, and for a Venture Capital Analyst position you need to showcase your ability to analyze financial statements, project future performance, and identify emerging trends in the market. In this guide, you’ll learn how to write a Venture Capital Analyst resume that will get you noticed by potential employers. Through examples and tips, you’ll discover what to include on your resume and how to effectively showcase your skills and expertise.

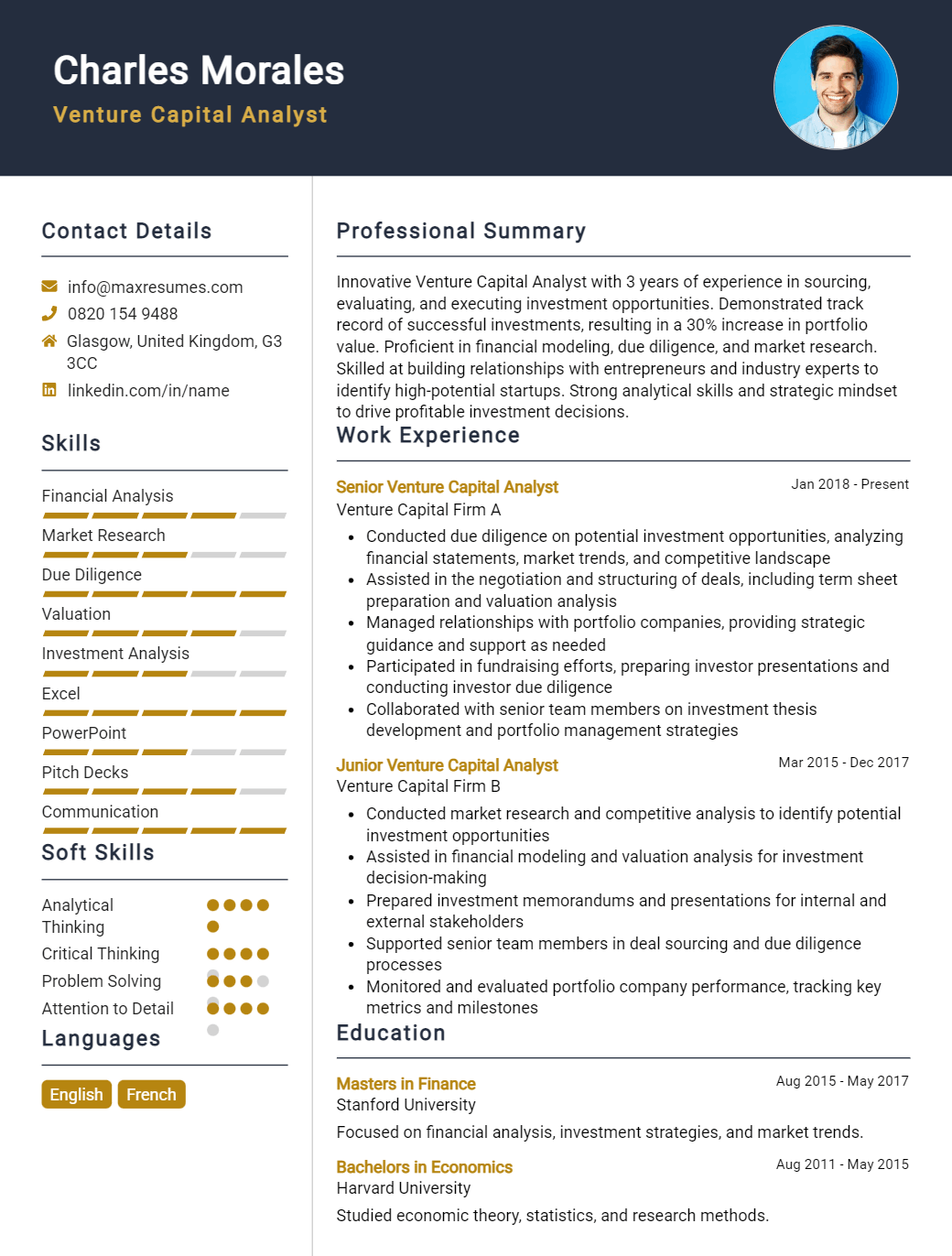

Venture Capital Analyst Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Venture Capital Analyst Resume Examples

John Doe

Venture Capital Analyst

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am a Venture Capital Analyst with 5+ years of experience in venture capital and private equity. My core skills include financial modelling, due diligence, portfolio management, and investor relations. My professional experience includes working with top venture capital firms, performing due diligence on target companies, and managing portfolio investments. I have a strong educational background, including a bachelor’s degree in finance and a master’s degree in economics. My advanced knowledge of venture capital and private equity make me an ideal candidate for any venture capital role.

Core Skills:

- Financial Modelling

- Due Diligence

- Portfolio Management

- Investor Relations

Professional Experience:

- ABC Venture Capital, Analyst, 2018- 2020

- Conducted market and competitor analysis on target companies

- Performed financial due diligence and evaluated investments

- Prepared presentations to present to VC and PE partners

- Developed financial models for prospective investments

- Managed portfolio investments and monitored portfolio performance

- XYZ Private Equity, Associate, 2015- 2018

- Conducted due diligence and valuations on target companies

- Developed financial forecasts, risk assessments, and other financial models

- Assessed competitive landscape, market trends, and strategic risks

- Negotiated financial terms of transactions on behalf of the firm

- Led investor relations and oversaw reporting and compliance

Education:

- Master’s Degree in Economics, ABC University, 2020

- Bachelor’s Degree in Finance, XYZ University, 2015

Venture Capital Analyst Resume with No Experience

Recent college graduate with a strong academic background in finance, excellent analytical and problem- solving skills, and a commitment to actively contributing to the success of the venture capital firm.

Skills:

- Exceptional financial modeling and analysis skills

- Strong understanding of financial statements and investment analysis

- Ability to identify potential investments while assessing risk

- Excellent written and verbal communication skills

- Ability to work productively in a team environment

- Proficient with Microsoft Office Suite (Word, Excel, PowerPoint)

Responsibilities:

- Develop financial models for prospective investments

- Analyze financial statements and evaluate potential investments

- Perform due diligence to assess risk for investments

- Collaborate with other professionals in venture capital firm to develop strategies

- Research trends in venture capital investments

- Monitor existing investments and track performance

Experience

0 Years

Level

Junior

Education

Bachelor’s

Venture Capital Analyst Resume with 2 Years of Experience

A highly experienced Venture Capital Analyst with two years of professional experience in the venture capital field. Diversified skill set in analyzing investment opportunities, market analysis, financial modeling and due diligence. Demonstrated ability in identifying and analyzing investments that drive profitable results. Proven track record of meeting deadlines and exceeding expectations. Exceptional ability to develop and maintain relationships with key stakeholders while providing insight and analysis to portfolio companies.

Core Skills:

- Investment Analysis

- Financial Modeling

- Market Analysis

- Due Diligence

- Stakeholder Relationships

- Portfolio Management

- Risk Management

- Data Analysis

- Negotiation

- Problem Solving

- Decision Making

Responsibilities:

- Assessed and evaluated potential investments through market research and financial analysis

- Developed detailed financial models and conducted due diligence of target investments

- Analyzed target companies to identify potential areas of risk and established plan to mitigate them

- Conducted legal and tax due diligence of potential investments

- Monitored and evaluated existing investments for potential exit opportunities

- Developed relationships with stakeholders to ensure alignment with goals of the venture capital firm

- Maintained portfolio of investments and provided recommendations for further investments or divestitures

- Presented findings, conclusions, and recommendations to key stakeholders

- Leveraged risk management techniques to ensure investments were successful

- Negotiated terms of potential investments

- Developed and maintained internal investment tracking systems

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Venture Capital Analyst Resume with 5 Years of Experience

Results- driven venture capital analyst with 5+ years of experience analyzing business opportunities, conducting due diligence, and making investment recommendations. Experienced in both venture capital and private equity investments, with a proven track record of financial modeling, market research, and data analysis. Highly skilled in collaborating with internal and external stakeholders to achieve optimal results.

Core Skills:

- Financial Modeling

- Market Research

- Data Analysis

- Due Diligence

- Investment Recommendations

- Collaboration

Responsibilities:

- Conducted detailed analysis of potential investments and developed financial models to assess potential returns.

- Researched the market, industry trends, and competitive landscape to make informed investment decisions.

- Performed due diligence steps on investments to ensure they met all requirements and standards.

- Collaborated with external stakeholders and investment advisors to identify new funding sources and opportunities.

- Created comprehensive presentations to present to management and external investors.

- Advised on the structuring of deals and provided ongoing analysis post- investment.

- Negotiated exit terms and managed portfolio investments to maximize returns.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Venture Capital Analyst Resume with 7 Years of Experience

I am an experienced Venture Capital analyst with 7 years of experience in the field. I have an extensive background in finance, financial analysis, and investments. I have developed strong analytical and problem- solving skills, and an excellent understanding of the venture capital market. I have great communication and presentation skills, and an ability to develop relationships with potential investors and partners. I am a highly motivated professional with a proven track record of success in venture capital, and am passionate about helping entrepreneurs realize their goals.

Core Skills:

- M&A and Venture Capital experience

- Financial Analysis and Modeling

- Expertise in Investment and Portfolio Management

- Business Development and Networking

- Research and Market Analysis

- Project Management and Growth Strategies

Responsibilities:

- Analyzing and evaluating financial data of potential investments

- Developing financial models for venture capital investment opportunities

- Creating business plans and presentations for potential investments

- Assessing market trends, opportunities, and risks related to investments

- Negotiating terms and conditions of investments

- Managing portfolios and tracking performance of investments

- Researching and monitoring industry news and trends

- Conducting due diligence and providing financial analysis of companies

- Developing and maintaining relationships with investors, partners, and clients

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Venture Capital Analyst Resume with 10 Years of Experience

A highly motivated and results- focused Venture Capital Analyst with 10 years of experience in the financial and investment markets. Skilled in portfolio management, financial analysis, and business strategy. Proven track record of identifying and capitalizing on profitable investment opportunities. Excellent communication and problem- solving skills and the ability to think outside the box to provide innovative solutions. Strong team player with a great attitude and the highest standards of excellence.

Core Skills:

- Financial Analysis

- Investment Research

- Portfolio Management

- Risk Assessment

- Business Strategy

- Problem- Solving

- Negotiation

- Interpersonal Communication

Responsibilities:

- Conduct market research, financial analysis, and financial modeling to evaluate potential investments

- Monitor the performance of existing investments and conduct portfolio management to maximize returns

- Develop and maintain relationships with potential investors and partners

- Analyze financial and non- financial data to identify potential investments

- Develop and implement investment strategies to meet financial goals

- Utilize financial tools to assess risk and identify opportunities

- Prepare investment proposals and present to senior management and investors

- Negotiate and close deals with limited partner investors and venture capital funds

- Keep track of emerging trends and technologies in venture capital industry

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Venture Capital Analyst Resume with 15 Years of Experience

A highly experienced and self- motivated Venture Capital Analyst with 15 years of progressive experience in the venture capital industry, with expertise in conducting due diligence and financial analysis, evaluating and structuring deals, and providing strategic guidance to venture- backed companies. Possesses a deep understanding of the venture capital industry, investment strategies, and capital markets. Proven ability to think strategically, build and maintain relationships with investors, stakeholders, and target companies.

Core Skills:

- Venture Capital Analysis

- Due Diligence

- Financial Analysis

- Deal Structuring

- Strategic Thinking

- Investment Strategies

- Capital Markets

- Relationship Building

Responsibilities:

- Analyzing companies and strategic opportunities to make venture capital investments.

- Conducting due diligence on companies to evaluate investment opportunities.

- Developing financial models and performing financial analysis to assess investment opportunities.

- Structuring deals, including term sheets, and negotiating with companies and investors.

- Providing strategic guidance to companies in the venture capital portfolio.

- Building and maintaining relationships with investors, stakeholders, and target companies.

- Staying abreast of developments in the venture capital industry and markets.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Venture Capital Analyst resume?

When creating a resume for a Venture Capital Analyst, the goal should be to show off your skills and experiences that demonstrate you have what it takes to manage and evaluate investments for a venture capital firm.

In order to make sure your information stands out, here are a few key items to consider including in your resume:

- Relevant Professional Experience: Include any venture capital experience you have, such as evaluating potential investments, negotiating deals, and monitoring existing portfolio companies. Be sure to emphasize any successes you’ve had in these roles.

- Technical Skills: Highlight any specialized skills you have such as financial modeling, market analysis, and portfolio analysis.

- Education: If you have an undergraduate or graduate degree in finance, economics, or a related field, be sure to include it on your resume.

- Industry Knowledge: Demonstrate your expertise in the venture capital industry by providing examples of your knowledge of relevant topics such as venture capital trends, emerging markets, and regulations.

- Soft Skills: Showcase your communication and collaboration abilities, as well as your problem-solving and analytical skills.

By including these key elements in your Venture Capital Analyst resume, you’ll be well on your way to securing your dream job!

What is a good summary for a Venture Capital Analyst resume?

A Venture Capital Analyst is a financial specialist responsible for researching and analyzing investment opportunities in early-stage companies. A good summary for a Venture Capital Analyst resume should highlight a candidate’s ability to assess business plans, financial statements, market trends, and other data to identify and assess potential investments. The summary should also stress the candidate’s understanding of the venture capital industry, their ability to think strategically, and their proficiency with financial modeling and analysis. The summary should also demonstrate the candidate’s ability to collaborate with senior partners, communicate findings and be an effective part of a team.

What is a good objective for a Venture Capital Analyst resume?

A Venture Capital Analyst is a financial professional who assists venture capitalists in sourcing, analyzing and managing investments. In order to stand out from the crowd and demonstrate your skills and capabilities to employers, it is important to have a well-crafted resume objective. A good objective for a Venture Capital Analyst resume should emphasize your expertise in financial analysis, portfolio management and venture capital investments.

Here are some sample objectives for a Venture Capital Analyst resume:

- To obtain a Venture Capital Analyst position that will allow me to use my financial analysis skills, portfolio management experience and venture capital investment expertise to help the firm reach its financial goals.

- Seeking a Venture Capital Analyst position that capitalizes on my extensive experience in financial analysis and portfolio management in order to develop and implement successful investment strategies.

- Seeking a Venture Capital Analyst position that utilizes my extensive knowledge of venture capital investments and financial analysis to provide creative solutions and maximize returns.

- Looking for a Venture Capital Analyst role that will take advantage of my analytical and problem-solving skills to identify new investment opportunities and develop successful strategies.

How do you list Venture Capital Analyst skills on a resume?

When applying for a position as a Venture Capital Analyst, it’s important to ensure that your resume reflects the skills and qualifications that employers are looking for. Here are some venture capital analyst skills you should include on your resume:

- Financial Analysis: Demonstrate your understanding of financial tools and techniques, such as discounted cash flow analysis and capital budgeting, to evaluate potential investments.

- Negotiation: Showcase your ability to effectively negotiate terms and conditions of potential deals.

- Market Research: Illustrate your knowledge of the venture capital industry, and the ability to identify opportunities through market research.

- Networking: Highlight your ability to build relationships and network within the venture capital industry.

- Communication: Demonstrate your written and verbal communication skills to effectively communicate with investors and other stakeholders.

- Problem-Solving: Showcase your ability to identify and address potential problems related to investments.

- Strategic Thinking: Emphasize your ability to develop strategies and plans for managing investments.

By ensuring that you list the above venture capital analyst skills on your resume, you’ll be well positioned to secure a competitive position in the venture capital industry.

What skills should I put on my resume for Venture Capital Analyst?

Venture capital analysts are growing in demand as the venture capital sector rapidly expands. To stand out amongst the competition, it’s important to have the right skills on your resume to demonstrate your knowledge in the area.

Here are some of the key skills and qualifications to include on your resume when applying for a venture capital analyst position:

- Financial Modeling: A venture capital analyst needs to have a strong understanding of financial modeling, including how to build and analyze financial models for various investments.

- Investment Analysis: Analysts must be able to evaluate potential investments, assessing the risks and rewards involved. Knowledge of different investment strategies and types of investments is essential.

- Market Research: Analysts must be able to conduct market research to help inform investment decisions. This includes conducting industry research and analyzing market trends.

- Data Analysis: Analysts must have a good eye for details, as well as the ability to analyze and interpret data. This includes using both qualitative and quantitative methods.

- Problem-Solving: As an analyst, you must be able to identify problems and propose solutions. This includes researching and analyzing data, as well as coming up with creative solutions to complex problems.

- Interpersonal Skills: Analysts must have strong interpersonal skills to effectively interact with clients, colleagues, and potential investments.

- Communication Skills: Analysts must be able to explain their investment decisions and strategies to others. Strong written and verbal communication skills are essential for success in this role.

These are just some of the key skills and qualifications that should be included on your resume when applying for a venture capital analyst position. Showing your proficiency in these areas demonstrates that you have the knowledge and experience necessary to succeed in this role.

Key takeaways for an Venture Capital Analyst resume

When crafting a resume as a Venture Capital Analyst, it is important to stand out from the competition and highlight your unique skills, experience, and qualifications. Here are some key takeaways to keep in mind when writing your resume:

- Summarize Your Experience: Include a brief summary of your experience that showcases your qualifications for the role. Highlight any organizations or companies you have previously worked with and emphasize any successful investments you were involved in.

- Emphasize Your Technical Skills: Make sure to include any specialized software and systems you are familiar with and proficient in using. This will give prospective employers an insight into your expertise in the field.

- Highlight Your Financial Knowledge: Make sure to include any qualifications, certifications, or coursework related to financial analysis and venture capital. This will highlight your knowledge of the field and demonstrate your commitment to your career.

- Demonstrate Your Network: While crafting your resume, it is important to emphasize any professional networks you are part of. This will show prospective employers that you are well-connected in the venture capital industry.

- Showcase Your Soft Skills: It is important to also include any soft skills you have that are applicable to the role. Examples may include strong communication skills, the ability to work under pressure, or a proven track record of working well in teams.

By following these key takeaways, your resume will be sure to stand out and make a great impression on potential employers. Good luck!

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder