Writing a resume is one of the most important steps in your job search journey. As a treasury manager, you need to showcase your skills and qualifications in order to standout from other applicants. In this guide, you will learn the key components to include in your treasury manager resume, and get tips on how to write an effective resume that will help you get noticed by employers. You will also find examples of treasury manager resumes to use as inspiration for your own document. With the right understanding and knowledge, you can create a job-winning resume that will help you land your dream job.

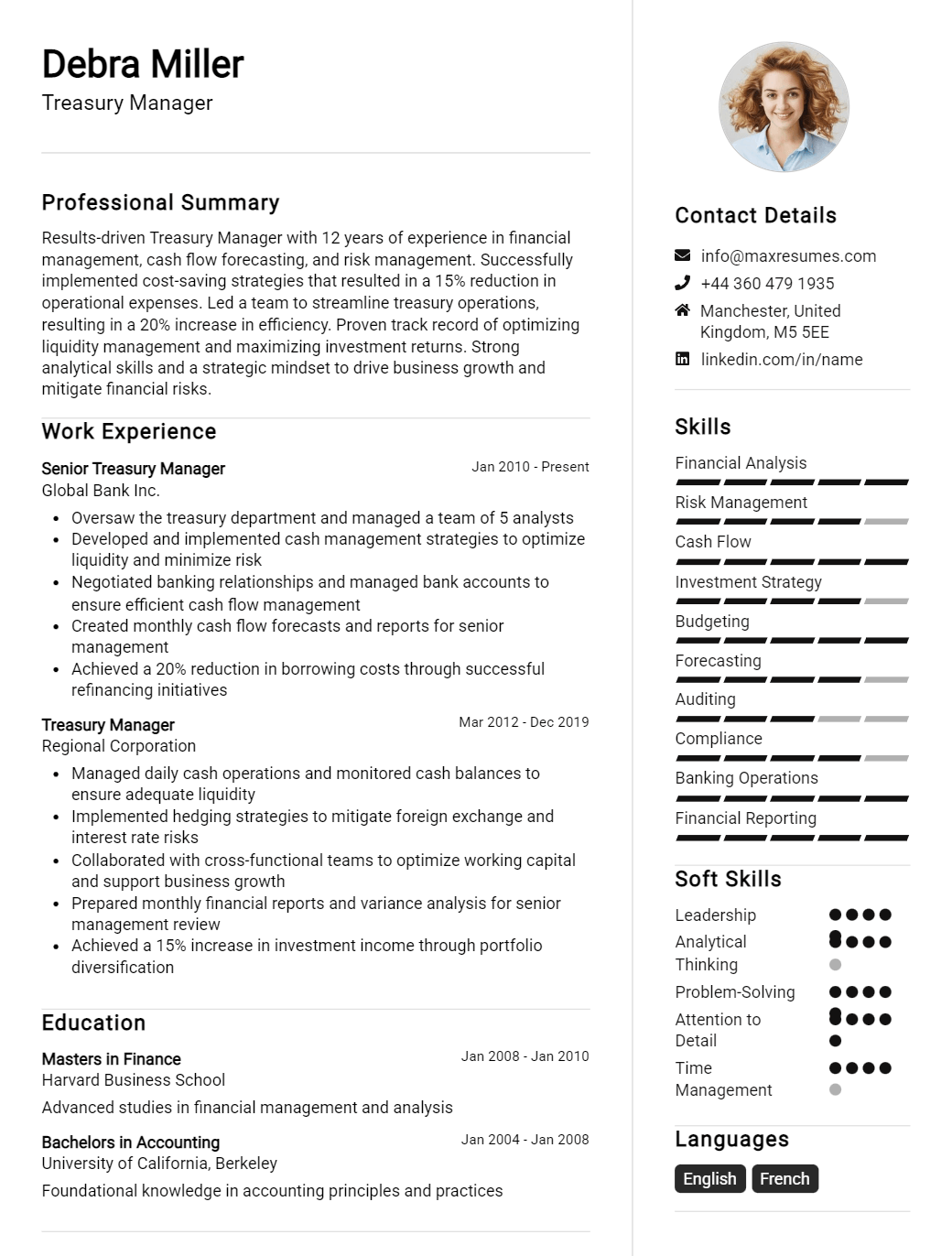

Treasury Manager Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Treasury Manager Resume Examples

John Doe

Treasury Manager

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

Driven and detail- oriented Treasury Manager with over 10 years of experience in the treasury industry. Proven track record of driving productivity while maintaining a high degree of accuracy and compliance. Exceptional ability to research and analyze complex financial data and develop innovative strategies to optimize liquidity and cash flow. Demonstrated ability to lead projects and processes that improve liquidity and reduce risk.

Core Skills:

- Cash Management

- Treasury Operations

- Risk Management

- Liquidity Optimization

- Financial Analysis

- Account Reconciliation

- Budget Forecasting

- Regulatory Compliance

- Project Management

Professional Experience:

Treasury Manager, ABC Corporation, 2011- 2021

- Led the cash management and liquidity optimization for the entire organization.

- Ensured regulatory compliance with all Federal, State, and local laws related to cash management and finance.

- Managed all treasury operations, including account reconciliations, cash flow forecasting, and incentive payments.

- Developed and implemented innovative cash management strategies to optimize liquidity and reduce risk.

- Responsible for budget forecasting and financial analysis.

- Collaborated with internal and external stakeholders on projects to improve financial performance.

Education:

B.S. in Finance, University of New York, 2007- 2011

Treasury Manager Resume with No Experience

A highly motivated and organized individual seeking a position as a Treasury Manager at a leading organization. Experienced in financial planning, budgeting, and analysis. Possess strong problem- solving skills and an ability to effectively manage multiple priorities.

Skills

- Proficient in Microsoft Office Suite

- Strong communication and interpersonal skills

- Excellent analytical, organizational, and time- management abilities

- Highly detail- oriented

- Ability to work independently and in a team environment

Responsibilities

- Develop and manage treasury systems and procedures

- Analyze financial data and prepare accurate financial reports

- Oversee all cash payments and collections activities

- Manage and monitor foreign exchange transactions

- Develop forecasting models and maintain a cash flow projection

- Ensure compliance with company policies, procedures, and applicable regulations

- Maintain relationships with banks and financial institutions

- Monitor global financial markets and suggest appropriate actions

Experience

0 Years

Level

Junior

Education

Bachelor’s

Treasury Manager Resume with 2 Years of Experience

Dynamic and result- oriented Treasury Manager with 2 years of experience in managing treasury operations and helping organizations meet their financial goals. Acknowledged for ability to develop and implement strategies to ensure liquidity and improve profitability. Excellent analytical, problem- solving, decision- making and communication skills; able to effectively manage cash flow, develop and implement treasury policies and identify emerging risks.

Core Skills:

- Treasury Operations

- Cash Flow Management

- Risk Management

- Financial Forecasting

- Forex Exposure

- Softwares – MS Excel, Tally, Quickbooks

- Mis Reporting

- Strategic Planning

Responsibilities:

- Developed and supervised treasury operations, including cash flow management, cash flow forecasting and liquidity planning.

- Identified and managed foreign exchange exposure and ensured that foreign exchange rates are in line with corporate policies.

- Monitored and managed cash transactions, including bank reconciliation, cash flow and treasury performance reports.

- Developed and maintained financial models and cash flow forecasts to ensure strategic decision- making and long- term financial health.

- Implemented and maintained Treasury policies and procedures in line with corporate and legal standards.

- Conducted periodic risk assessments to identify and manage emerging risks.

- Produced MIS reports, financial statements and financial reports to senior management.

- Utilized accounting software to facilitate efficient treasury operations and accurate financial reporting.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Treasury Manager Resume with 5 Years of Experience

Highly organized and efficient Treasury Manager with five years of experience in the financial industry. Possesses strong technical knowledge in areas of financial analysis, cash flow management, and risk management. An excellent problem solver with good communication skills able to effectively collaborate with all stakeholders.

Core Skills:

- Financial Analysis

- Cash Flow Management

- Risk Management

- Problem Solving

- Stakeholder Management

- Data Analysis

- Financial Planning

Responsibilities:

- Developed and oversaw cash flow projections and liquidity strategies to maximize returns and minimize risk.

- Prepared and tracked financial information to support business decisions.

- Analyzed financial market trends to identify opportunities and risks.

- Created and maintained financial models to monitor portfolio performance and to make recommendations for long- term investments.

- Developed and maintained relationships with financial institutions and other stakeholders to ensure optimal performance.

- Monitored and reported on any changes in current market conditions that might affect the organization’s financial performance.

- Managed and reported on compliance with financial regulations.

- Provided data analysis and forecasting for senior management.

- Participated in the development of long- term financial plans.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Treasury Manager Resume with 7 Years of Experience

I am a highly experienced Treasury Manager with seven years of experience in the financial sector. I have a proven track record of overseeing and managing the treasury departments of small and large- scale organizations. I am adept at streamlining processes, creating strategies, and managing staff to ensure that the organization meets financial goals. My core skills include cash management, budgeting, financial analysis, treasury policies, and procedures, credit analysis and risk management. I am comfortable working with a wide range of financial instruments and have a comprehensive understanding of the treasury operations.

Core Skills:

- Cash management

- Budgeting

- Financial analysis

- Treasury policies and procedures

- Credit analysis

- Risk management

- Financial instruments

- Treasury operations

Responsibilities:

- Designing and overseeing the implementation of the strategic treasury plans.

- Monitoring macro- economic conditions and assessing their impact on the cash flow and liquidity.

- Developing and managing cash flow forecasts and reporting on results.

- Analyzing and managing the company’s risk exposure.

- Performing cash and bank reconciliations.

- Negotiating financial arrangements and implementing measures to optimize the liquidity of funds.

- Ensuring compliance with established treasury policies and procedures.

- Establishing and maintaining relationships with banking and financial services partners.

- Supervising and training junior staff members.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Treasury Manager Resume with 10 Years of Experience

Treasury Manager with 10+ years of experience in the banking and financial services industry. Possesses a comprehensive track record of success in the management of treasury- related activities and financial operations. Adept in developing and implementing strategies to maximize returns on investments, reduce costs, and manage risk.

Core Skills:

- Strong leadership and communication skills

- Analytical and problem- solving capabilities

- Ability to identify, analyze and interpret financial trends

- Proficient in the use of financial software and applications

- Knowledge of risk management principles and practices

- Expertise in financial accounting and reporting

Responsibilities:

- Develop and implement financial strategies to maximize returns and minimize risks

- Monitor the performance of financial investments and suggest alternatives

- Oversee the daily operations of the treasury department

- Ensure compliance with all applicable laws and regulations

- Prepare financial statements, reports and analysis for senior management

- Analyze financial data and keep track of market trends to inform decision making

- Manage cash flow, liquidity, and foreign exchange activities

- Negotiate with financial institutions and ensure adherence to contracts and agreements

- Assess the creditworthiness of borrowers and calculate the risk exposure

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Treasury Manager Resume with 15 Years of Experience

Highly- motivated Treasury Manager with 15 years of experience in the field of Financial Management, Accounts & Treasury. Successfully handled the end- to- end operations of the Treasury Department, from cash and liquidity management to forecasting and regulatory compliance. Possesses excellent communication and interpersonal skills, as well as in- depth knowledge of risk and financial management, along with a strong background in accounting principles and practices.

Core Skills:

- Financial Management

- Accounts & Treasury

- Cash & Liquidity Management

- Forecasting & Regulatory Compliance

- Risk Management

- Accounting Principles & Practices

- Interpersonal & Communication Skills

Responsibilities:

- Managed the day- to- day activities of the Treasury Department, including cash and liquidity management, forecasting and budgeting.

- Developed plans and strategies for optimizing cash flows and reducing financial risks.

- Prepared and analyzed daily and monthly reports on the financial performance of the Treasury Department.

- Monitored the market for potential investment opportunities and executed trades accordingly.

- Coordinated with external auditors for the purpose of periodic audits, and ensured compliance with regulations.

- Developed and maintained relationships with banks and other financial institutions.

- Ensured compliance with local, state and federal regulations related to the Treasury Department.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Treasury Manager resume?

A Treasury Manager is a critical role for any organization, and their resume should reflect the qualifications and experience necessary for the position. In order to be successful in this role, a Treasury Manager resume should include the following:

- Demonstrated experience in treasury management and operations, including cash management and financial planning.

- Proficiency in capital markets, banking services and credit tools.

- Understanding of financial market risk and its management.

- Proven ability to develop and execute short and long-term financial strategies.

- Knowledge of accounting principles, practices and procedures.

- Ability to create and interpret financial reports.

- Excellent problem-solving and analytical skills.

- Ability to work independently and as part of a team.

- Knowledge of financial regulations, laws and standards.

- Proven ability to prioritize tasks and manage multiple projects.

- Strong organizational and communication skills.

What is a good summary for a Treasury Manager resume?

A Treasury Manager is a highly skilled professional in charge of financial activities related to cash management, banking, investments, and financial risk management. An effective Treasury Manager resume should focus on the candidate’s ability to manage cash flow, develop strategies for minimizing financial risk, and maximize return on investment.

Candidates should highlight their professional experience, technical skills, and any industry certifications in their summary. It should also include any successes, such as increased portfolio returns or cost savings, that demonstrate their capabilities as a Treasury Manager. In addition, a strong summary should emphasize the candidate’s ability to analyze financial data and develop strategies that can improve the company’s overall financial performance.

Overall, a Treasury Manager resume should demonstrate the candidate’s financial expertise, analytical skills, and ability to drive successful financial strategies. In addition, the summary should include any certifications or awards that demonstrate their professional achievements.

What is a good objective for a Treasury Manager resume?

A good objective for a Treasury Manager’s resume should emphasize the candidate’s abilities to effectively manage the cash flow of a company, which can include managing investments, funds, and assets. It should also demonstrate the candidate’s experience and knowledge in financial analysis, accounting, and corporate finance. Here are some examples:

- Proven track record of efficiently managing cash flow and developing strategies to optimize the financial position of a company

- Experienced in banking and financial operations, including investments, liquidity management, and risk management

- Skilled in financial analysis and forecasting, budgeting and reporting, and accounting and finance principles

- Demonstrated success in implementing corporate finance strategies to increase the value of the organization

- Ability to lead cross-functional teams to achieve financial objectives in a timely and efficient manner

- Proficient in using financial software and systems to analyze and report financial results

- Committed to maintaining high standards of integrity and accuracy in financial reporting

How do you list Treasury Manager skills on a resume?

A Treasury Manager is responsible for overseeing financial investments and managing the financial risk of an organization. When writing your resume for a Treasury Manager role, you should include the skills and qualifications that make you the best candidate for the job. Here are some of the skills and qualifications that you might list on your resume for a Treasury Manager position:

- Expertise in financial planning, investment strategies, and risk management

- Proven ability to work with financial models, financial forecasting and budgeting

- Experience with financial software, such as Metastock and Bloomberg

- In-depth knowledge of financial regulations, accounting principles, and capital markets

- Strong interpersonal, communication and negotiation skills

- Analytical and critical thinking skills

- Exceptional leadership capabilities and the ability to motivate and manage teams

- Detail-oriented and organized, with the ability to multitask and meet deadlines

- Bachelor’s degree in Finance, Economics, Accounting or related field

- Professional certification in Treasury Management (e.g. Certified Treasury Professional)

What skills should I put on my resume for Treasury Manager?

When crafting your resume for a Treasury Manager position, it is important to highlight your applicable skills so that employers can quickly recognize that you are the best candidate for the job. Here are some essential skills to include on your resume:

- Budget Management: As a Treasury Manager, you need to have a thorough understanding of budget planning and management. You will be responsible for planning and monitoring the Treasury Department’s budget to ensure the company’s financial goals are met.

- Financial Analysis: You must possess excellent analytical skills to be able to analyze financial data and draw relevant conclusions. This includes utilizing various methods of financial analysis such as ratio analysis, trend analysis, and variance analysis.

- Banking: You will be responsible for managing the company’s banking relationships, including negotiating with banks on behalf of the company. You must have extensive knowledge of various banking processes and services.

- Risk Management: Treasury Managers must be adept at risk management, as you will be responsible for monitoring and managing the company’s financial exposures and ensuring compliance with applicable regulations.

- Communication: You must possess strong written and verbal communication skills to be able to effectively convey Treasury-related information to internal and external stakeholders.

These are just some of the skills to include on your resume for a Treasury Manager position. Be sure to review the job description carefully so you can tailor your resume to best emphasize your qualifications and experience that are relevant to the position.

Key takeaways for an Treasury Manager resume

For any Treasury Manager, updating their resume is an important part of staying competitive in the job market. A great place to start is by including key takeaways that showcase your strengths and experience. Here are some key takeaways for a Treasury Manager resume:

- Demonstrated experience managing and reconciling complex financial transactions

- Proven ability to improve a company’s financial health through strategic treasury initiatives

- Skilled in managing cash flows, mitigating financial risks, and monitoring credit ratings

- Expertise in cash forecasting and budgeting

- Well-versed in banking and financial regulations and compliance

- Ability to develop and maintain relationships with vendors and financial partners

- Experienced in developing new financial strategies, policies, and procedures

- Knowledgeable in the use of advanced financial software and applications

By emphasizing your key takeaways and experience on your resume, you can make a great first impression with any potential employer. With the right tools and information, you can be a top candidate for any Treasury Manager position.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder