Writing a resume as a tax professional is no easy feat. It takes precision, accuracy and an understanding of the tax process in order to create a successful resume. A great resume can open doors to job opportunities, interviews and new career opportunities. Writing a resume as a tax professional is different from any other profession and requires many specific sections and details to effectively showcase your skills and knowledge. This guide will provide you with tips, advice and examples on how to write a tax professional resume that stands out from the competition.

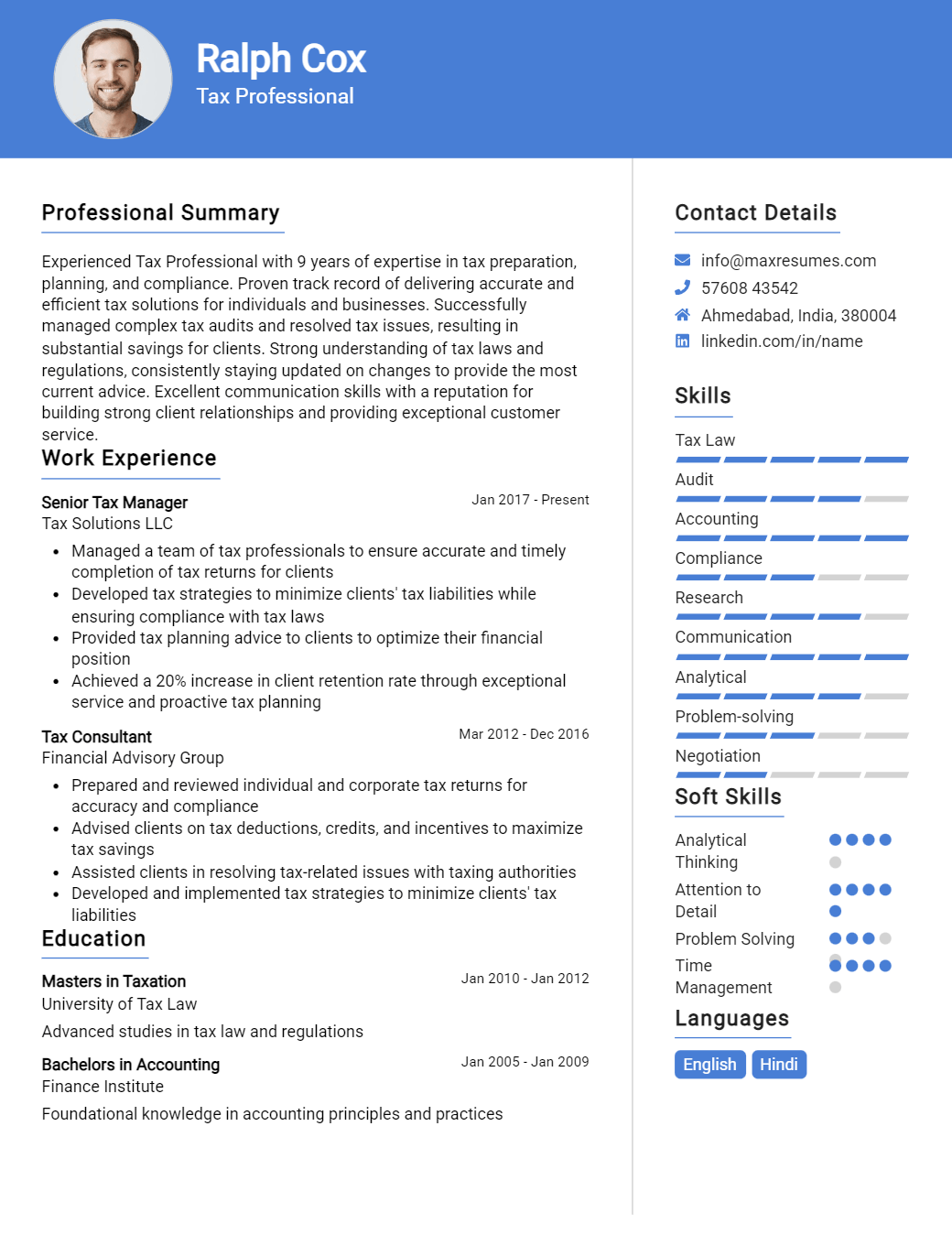

Tax Professional Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Tax Professional Resume Examples

John Doe

Tax Professional

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

A highly detail- oriented and experienced Tax Professional with 6 years of expertise in the field. Experienced in tax research and analysis, preparation of financial statements and tax returns. Possesses a deep knowledge of taxation principles, tax preparation software and forms. Adept at working independently as well as collaboratively in a team setting.

Core Skills:

- Tax preparation

- Tax research

- Financial statement preparation

- Tax return filing

- Tax software expertise

- Tax law knowledge

- Budgeting

- Cost accounting

Professional Experience:

Tax Associate, ABC Financial Group, Dallas, TX, 2016 – present

- Provide tax support to clients, including preparation of tax returns

- Analyze tax scenarios and advise clients on the most efficient tax strategies

- Handle all aspects of tax preparation, including gathering documents and filing returns

- Research tax issues and perform detailed analysis

- Prepare financial statements for businesses and individuals

- Monitor changes in tax laws and regulations and update clients accordingly

Senior Tax Accountant, XYZ Group, Dallas, TX, 2013 – 2016

- Prepared tax returns for individuals, trusts, and businesses

- Responsible for ensuring accuracy and compliance on all tax returns

- Performed detailed analysis of tax scenarios and advised clients of potential savings

- Researched and interpreted tax laws and regulations

- Developed and maintained strong relationships with clients and colleagues

Education:

Master of Science in Taxation, University of Texas at Dallas, Dallas, TX, 2013

Bachelor of Science in Accounting, University of Texas at Dallas, Dallas, TX, 2011

Tax Professional Resume with No Experience

Dedicated and motivated recent graduate searching for a job as a Tax Professional. Possess a Bachelor’s Degree in Accounting and have a good understanding of tax laws and regulations. Eager to learn and utilize new skills in a professional environment.

Skills:

- Strong understanding of current tax regulations

- Excellent analytical and problem- solving skills

- Good communication and interpersonal skills

- Proficient with Microsoft Office and other accounting software

- Excellent time management and organizational skills

Responsibilities:

- Gather and analyze data from financial reports, documents, and other sources

- Prepare and review individual and business tax returns

- Keep up to date with current tax laws and regulations in order to provide accurate advice

- Provide advice to clients on tax- related issues

- Research complicated tax issues and formulate solutions

- Ensure compliance with tax regulations and filing deadlines

Experience

0 Years

Level

Junior

Education

Bachelor’s

Tax Professional Resume with 2 Years of Experience

Results- driven tax professional with 2+ years of experience in preparing and filing corporate and individual income tax returns. Proven expertise in analyzing complex tax codes, accurately preparing and submitting federal, state, and local tax forms, and performing tax calculation and forecasting. Highly organized, detail- oriented, and adept in multitasking in a fast- paced environment.

Core Skills:

- Proficient in accounting software (Sage, QuickBooks, Microsoft Office)

- Excellent data analysis, problem- solving, and communication skills

- Highly organized and capable of meeting tight deadlines

- Comprehensive understanding of tax regulations and compliance standards

- Strong negotiation and interpersonal skills

Responsibilities:

- Accurately prepared and submitted federal, state, and local income tax returns

- Assessed and reported on the impact of changes in tax legislation and regulations

- Calculated taxes owed and prepared tax returns, ensuring accuracy and compliance with applicable laws

- Monitored tax payments and filings, and updated internal databases

- Researched and identified tax credits, deductions, and incentives to minimize tax liabilities

- Interpreted and applied tax regulation to client’s financial data

- Provided guidance and recommendations to clients on tax planning and filing strategies

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Tax Professional Resume with 5 Years of Experience

Dynamic and experienced Tax Professional with five years of experience in preparing, filing and analyzing taxes for a variety of clients. Possess an in- depth knowledge of tax laws and regulations and the ability to use this knowledge to create sound tax strategies. Demonstrated expertise in preparing complex tax returns and financial statements. Proven ability to work well with clients, explain complicated tax issues, and lead projects.

Core Skills:

- Tax preparation and filing

- Tax planning and analysis

- Financial statement preparation

- Tax laws and regulations

- Client relations

- Tax strategies

Responsibilities:

- Prepared and filed taxes for clients

- Conducted research and analysis to identify potential tax deductions

- Advised clients on optimal tax strategies

- Developed tax strategies to minimize tax liabilities and maximize refunds

- Reviewed and analyzed financial statements and tax returns

- Produced accurate and timely tax returns

- Provided expert advice and counsel on tax issues

- Resolved client inquiries and issues

- Built and maintained relationships with clients

- Ensured compliance with federal, state, and local tax regulations

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Tax Professional Resume with 7 Years of Experience

A highly motivated and dedicated Tax Professional with 7 years of experience in preparing and filing taxes for individuals, businesses and trust entities. Possesses the ability to review and analyze financial statements, tax returns and other documents to identify and resolve discrepancies. With a comprehensive understanding of federal, state and local tax codes, laws and regulations, able to develop comprehensive, compliant and accurate tax strategies. Possesses strong communication and interpersonal skills allowing them to effectively collaborate with a range of clients from individuals to multi- million dollar companies.

Core Skills:

- Analyzing financial statements and tax returns

- Advising clients on strategies for minimizing taxes

- Preparing and filing tax returns for individuals, businesses and trust entities

- Performing research to identify and resolve discrepancies

- Implementing tax strategies to minimize taxes

- Complying with federal, state and local tax codes, laws and regulations

- Understanding of accounting principles and practices

- Strong communication and interpersonal skills

Responsibilities:

- Prepare and file federal, state, and local income tax returns for individuals, businesses and trust entities

- Provide tax advice and develop strategies to minimize taxes

- Analyze financial statements and tax returns to identify and resolve discrepancies

- Research and communicate changes in tax laws and regulations

- Review and update all records to ensure accuracy and compliance

- Provide technical guidance and support to staff on complex tax issues

- Develop and implement tax strategies for individuals and businesses

- Identify and recommend areas for improvement in accounting and tax processes

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Tax Professional Resume with 10 Years of Experience

Highly skilled and knowledgeable Tax Professional with 10 years of experience in the field. Expertise in tax regulations and preparatory and audit practices. Possess a deep understanding of financial statements and tax implications on decisions and investments. Skilled in analyzing and interpreting complex financial statements quickly and accurately. Able to manage clients in a professional and empathetic manner, providing the best solutions and advice.

Core Skills:

- Tax Preparation

- Tax Planning

- Financial Statement Analysis

- Auditing

- Tax Problem Resolution

- Tax Regulations

- Cash Flow Management

- Investment Analysis

- Client Relations

- Negotiation and Persuasion

Responsibilities:

- Preparing and filing tax returns for clients

- Analyzing financial and tax statements to identify potential savings

- Researching tax regulations and filing requirements

- Identifying areas of potential risk and proposing solutions to mitigate liabilities

- Conducting audits of clients’ financial records

- Negotiating and appealing audit findings

- Developing tax strategies and offering advice on minimizing liability

- Resolving complex tax disputes

- Developing and maintaining effective client relationships

- Evaluating investment opportunities and advising clients on the most profitable decisions

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Tax Professional Resume with 15 Years of Experience

A highly experienced Tax Professional with 15 years of experience in the field. Skilled in working with various tax filing systems and experienced in tax return preparation, problem solving and working with clients. Excellent problem solving skills and an eye for detail that helps uncover potential problems. Highly organized and able to multi- task in order to meet deadlines. Familiar with the latest tax laws and regulations.

Core Skills:

- Tax Filing Systems

- Tax Return Preparation

- Problem Solving

- Client Service

- Tax Laws and Regulations

- Organizational Skills

- Deadline Management

Responsibilities:

- Perform tax return preparation and filing for clients.

- Evaluate and analyze client information to ensure accuracy and compliance with the latest tax laws and regulations.

- Assist in resolving complex tax issues.

- Review financial information and documents for accuracy.

- Research and develop strategies for tax planning.

- Negotiate with the IRS and other government agencies to secure favorable settlements.

- Advise clients on various tax strategies to minimize their tax liabilities.

- Provide clients with assistance in understanding and interpreting tax regulations.

- Maintain current knowledge of all changes in tax laws, regulations and procedures.

- Prepare and present information to clients in a clear and concise manner.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Tax Professional resume?

A tax professional resume should include the following information, which can help to demonstrate the individual’s suitability for the role:

- Professional summary: A brief overview of the individual’s experience, qualifications and areas of expertise.

- Education and qualifications: Details of any relevant qualifications, courses and certifications that the individual has completed.

- Work experience: A list of previous roles held and the responsibilities undertaken in each role, as well as any relevant achievements.

- Skills and knowledge: Technical and practical skills pertinent to the role, such as an understanding of taxation law, knowledge of taxation software, and the ability to keep records and accounts.

- Professional memberships: Any professional associations the individual is affiliated with, such as the American Institute of Certified Public Accountants (AICPA).

- Additional skills: Soft skills such as communication, problem-solving and team-working, as well as any other skills or knowledge that could be beneficial in the role.

By including the above information in a tax professional resume, potential employers can quickly assess an individual’s suitability for the position.

What is a good summary for a Tax Professional resume?

A Tax Professional resume should be concise, yet comprehensive enough to accurately communicate a candidate’s accomplishments, experience, and qualifications to potential employers. A good summary should highlight the candidate’s expertise in preparing and filing complex tax returns, as well as their understanding of federal and state tax codes. Additionally, the summary should include any specialty certifications or credentials the candidate holds, as well as relevant references or experience that might be applicable to the job. Finally, the summary should emphasize the Tax Professional’s attention to detail, accuracy, and ability to meet deadlines. When writing a summary for a Tax Professional resume, it is important to include this information in an easy-to-read, succinct format that entices potential employers to read further.

What is a good objective for a Tax Professional resume?

A tax professional is a skilled person who is responsible for preparing and filing taxes for clients, as well as providing advice on tax law and strategies to optimize clients’ tax liabilities. A good objective for a tax professional’s resume should demonstrate the candidate’s ability to offer effective tax advice and strategies, as well as the ability to efficiently and accurately prepare and file taxes.

- Demonstrate knowledge of tax law and accounting standards

- Have the ability to analyze financial information and make recommendations

- Possess strong organizational and communication skills

- Provide sound tax advice to clients

- Accurately prepare and file taxes

- Utilize tax preparation software programs, such as TurboTax and ProSeries

- Remain up-to-date on the latest tax law changes and regulations

How do you list Tax Professional skills on a resume?

Tax professionals are a highly valued asset in the corporate world, and their services are in high demand. Whether you’re a tax accountant, tax advisor, or tax specialist, you need to make sure your resume accurately reflects your tax professional skills.

Here’s how to list Tax Professional skills on a resume:

- Knowledge of relevant laws, regulations and standards: Tax professionals must be well-versed in all relevant laws and regulations that affect their work.

- Analytical and problem-solving skills: Being able to identify potential tax issues and resolve them quickly is an essential skill for tax professionals.

- Attention to detail: Mistakes in tax forms or calculations can cost companies a lot of money. Tax professionals must have an eye for detail to ensure accuracy.

- Communication skills: Tax professionals must be able to explain complex financial or legal concepts in simple terms to both colleagues and clients.

- Organization and time management skills: Keeping track of deadlines, organizing documents and managing client accounts are all important skills for tax professionals.

By listing these Tax Professional skills on a resume, you’ll be sure to capture the attention of potential employers and show that you’re a qualified and competent professional.

What skills should I put on my resume for Tax Professional?

Having an impressive tax professional resume is key to standing out from other candidates and getting the job you want. To make sure your resume stands out, there are certain skills that employers are looking for. Here are some of the skills you should include in your resume when applying for tax professional positions:

- Tax Preparation: Tax preparation is the process of filing income taxes for individuals and businesses. As a tax professional, you must have the knowledge and experience to accurately fill out tax returns and navigate complex tax codes.

- Tax Law Knowledge: Working as a tax professional requires a solid understanding of tax laws, as you must be able to answer clients’ questions and guide them through their own taxes.

- Research Skills: In addition to being up to date on the latest tax laws, you must also possess the skills to research and resolve tax-related issues. This includes being able to identify the most beneficial tax strategies for clients and understanding the implications of certain tax laws.

- Communication Skills: As a tax professional, you must be comfortable working with clients and communicating with them to ensure their taxes are done accurately and efficiently. This includes being able to explain complex tax concepts in layman’s terms.

- Time Management: Being a tax professional involves juggling multiple tasks and deadlines. You must have the ability to manage your time effectively to ensure that all tasks are completed on time and that client taxes are accurate and filed properly.

By including these skills in your resume, you’ll be able to demonstrate to employers that you have the knowledge and experience they’re looking for in a tax professional.

Key takeaways for an Tax Professional resume

A tax professional resume is a summary of your skills and experience that can be used when applying for jobs in the field of tax management or preparation. While some employers might focus on the technical aspects of your resume, the focus must be on the overall content and presentation of your resume. Here are some key takeaways for creating a tax professional resume that highlights your experience and qualifications:

- Emphasize Your Skills: Showcase the skills you have that are essential for a tax professional; such as tax preparation, financial analysis, and research. Highlight any experience or training you have had that is relevant to the job you are applying for.

- Demonstrate Your Experience: Include past job experiences that are related to tax-related activities. Make sure to include any certifications, awards, or honors you have received.

- Detail Your Education: Provide a thorough overview of your educational background, including the name of the institutions you attended, your degree program, and any courses you took that are relevant to the job.

- Include Professional References: Include references from your past employers, mentors, or advisors. Make sure to include contact information for each reference.

- Proofread and Edit: Pay attention to detail and make sure there are no errors in your resume. Check for spelling and grammar mistakes, as well as any typos.

By following these key takeaways, you can create a tax professional resume that stands out from the competition and helps you land the job of your dreams. Good luck!

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder