Are you looking for help writing your resume as a Tax Manager? Your resume is a crucial part of your job search, and it can be difficult to know where to start. This guide will provide you with the steps and resources you need to create a resume that will stand out from the competition. We will discuss how to format your resume, highlight your accomplishments, and provide you with examples of resumes created for a Tax Manager role. By the end of this guide, you will have a resume that will help you land your dream job.

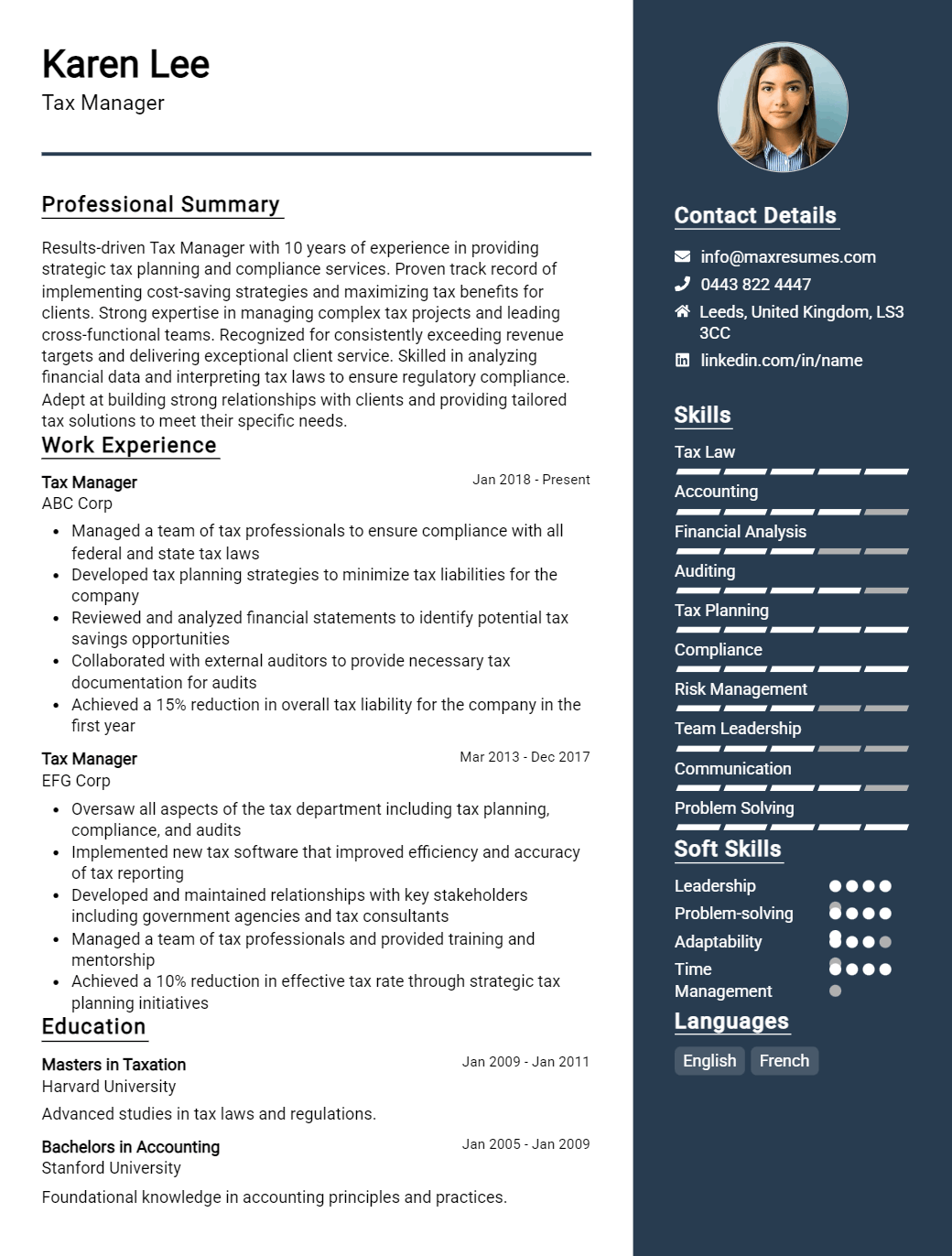

Tax Manager Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Tax Manager Resume Examples

John Doe

Tax Manager

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am an experienced Tax Manager with more than 10 years of experience in taxation and financial planning. I have worked for both companies and high net worth individuals. I possess excellent verbal and written communication skills, great attention to detail and a passion for understanding the intricacies of the tax system. I am committed to helping clients make the best decisions for their financial situation and achieving their financial goals.

Core Skills:

- Expertise in taxation and financial planning

- Excellent written and verbal communication skills

- Proven ability to manage multiple tasks and prioritize effectively

- Knowledge of tax law, accounting principles and tax planning strategies

- Proficiency with various software programs (QuickBooks, TurboTax)

Professional Experience:

Tax Manager – ABC Company, 2014 – Present

- Preparing and filing tax returns for individuals, trusts, and corporations

- Developing tax strategies to reduce overall tax liability

- Providing advice on tax implications of investments, estate planning and other financial transactions

- Managing a team of tax professionals to ensure timely and accurate completion of tax returns

- Identifying opportunities for tax savings and mitigating risks

- Representing clients in tax audits, disputes and negotiations

Tax Analyst – XYZ Company, 2010 – 2014

- Analyzed financial data and prepared tax returns for individuals, trusts, and corporations

- Developed tax strategies to reduce overall tax liability

- Researched and analyzed changes in tax law and new regulations

- Prepared and reviewed quarterly and annual tax projections

- Assisted in the preparation of financial statements for various clients

Education:

Master of Science, Taxation – University of XYZ, 2010

Bachelor of Science, Accounting – University of ABC, 2008

Tax Manager Resume with No Experience

- Results- oriented individual with a passion for managing taxes and business operations in a professional manner

- Strong organizational, research and problem solving skills

- Proficient in tax preparation and management procedures

Skills

- Strong interpersonal and customer service skills

- Excellent communication and negotiation skills

- Excellent problem- solving and analytical skills

- Proficiency in Microsoft Office Suite

- Knowledge of QuickBooks and other accounting software

Responsibilities

- Analyze and interpret tax laws and regulations

- Prepare and review various tax returns

- Identify areas of potential tax savings and create strategies to reduce tax liability

- Develop and implement tax strategies for clients

- Ensure that tax documents and filings are accurate and up- to- date

- Advise clients on their tax obligations and other financial matters

- Provide accurate and timely advice to clients

- Liaise with tax authorities to ensure compliance

- Monitor changes in tax legislation and regulations

- Manage and review tax documents and records

Experience

0 Years

Level

Junior

Education

Bachelor’s

Tax Manager Resume with 2 Years of Experience

A highly experienced and certified Tax Manager with a CPA designation and two years of progressive experience in the Accounting field. A self- starter who takes initiative and is able to work independently and as part of a team to ensure compliance with accounting regulations, guidelines and standards. Possesses a comprehensive knowledge of accounting and taxation principles, as well as a comprehensive understanding of the taxation process. Demonstrates an excellent ability to develop and maintain strong relationships with clients, and possesses excellent communication and organizational skills.

Core Skills:

- Tax Planning

- Research and Analysis

- Auditing

- Accounting Principles

- Tax Legislation

- Compliance

- Leadership

- Organizational Skills

- Risk Management

- Strategy

- Data Analysis

- Problem Solving

Responsibilities:

- Develop and prepare accurate business and individual tax returns

- Provide guidance and assistance to clients on tax- related issues

- Evaluate and recommend strategies to minimize tax liability

- Perform tax research, analysis and planning

- Audit and review financial statements to ensure compliance with laws and standards

- Lead and mentor staff in the taxation department

- Assist in the preparation of tax projections and forecasts

- Keep up to date on all changes in tax laws and regulations

- Analyze and evaluate the financial position of clients

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Tax Manager Resume with 5 Years of Experience

Highly organized and professional Tax Manager with 5 years of experience in tax management, compliance, and reporting. Possesses an in- depth knowledge of taxation regulations and adept at providing accurate and timely results. Adept at providing tax planning strategies that are tailored to the business’s individual needs, as well as managing multiple projects and teams. Highly motivated and driven to achieve success.

Core Skills:

- Proficient in taxation regulations

- Adept at tax planning

- Familiar with Excel, Word, and QuickBooks

- Strong project and team management skills

- Highly organized and detail- oriented

- Excellent communication and interpersonal skills

Responsibilities:

- Developing and implementing tax strategies to maximize the benefits of existing tax regulations

- Preparing and filing tax returns for businesses

- Managing and mentoring team members to ensure compliance with taxation regulations

- Analyzing tax data for accuracy and efficiency

- Conducting audits of financial statements and business transactions

- Maintaining up- to- date knowledge of the latest tax laws and regulations

- Providing tax advice to executives and other stakeholders

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Tax Manager Resume with 7 Years of Experience

A results- driven tax manager with 7 years of experience in the finance industry, offering expertise in tax planning, compliance, global taxation and financial statement preparation. Highly experienced in creating and managing filing procedures while interacting with both internal and external stakeholders. Demonstrated success in creating effective strategies and processes to accelerate the filing process, minimize audit risk and minimize the global tax burden.

Core Skills

- Tax Planning

- Tax Compliance

- Tax Return Preparation

- Global Taxation

- Financial Statement Preparation

- Audit Risk Mitigation

- Tax Burden Minimization

- Filing Process Management

- Internal and External Stakeholder Interaction

Responsibilities

- Developed and implemented effective strategies to ensure timely filing, accurate information and adherence to tax laws.

- Prepared and submitted tax returns and financial statements in a timely and accurate manner.

- Ensured that the organization was in compliance with applicable tax laws and regulations.

- Conducted research on tax regulations and consulted with internal and external stakeholders to ensure compliance.

- Developed and implemented processes and procedures to ensure efficient filing and audit risk minimization.

- Optimized the global tax burden by analyzing tax regulations and advising on the most cost- effective solutions.

- Provided guidance and training to team members on tax laws, regulations and filing procedures.

- Collaborated with finance team to ensure accuracy and timeliness of financial statements.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Tax Manager Resume with 10 Years of Experience

Accomplished Tax Manager with 10 years of extensive expertise in tax regulations and compliance, financial analysis, and accounting. Skilled in leading and directing teams to ensure accurate and timely execution of tax- related projects. Highly organized and efficient with a strong work ethic and excellent decision- making skills.

Core Skills:

- Tax analysis and compliance

- Financial reporting and analysis

- Accounting principles

- Team leadership and management

- Problem solving and decision making

- Project planning and implementation

- Organizational and communication skills

Responsibilities:

- Perform tax research and prepare tax returns in accordance with US and international regulations

- Analyze financial statements and create annual and quarterly tax projections

- Administer payroll taxes, sales and use taxes, property taxes, and excise taxes

- Lead and direct tax team to ensure timely and accurate execution of tax compliance projects

- Analyze tax planning options to identify and implement tax savings opportunities

- Identify, monitor, and manage compliance risks

- Monitor industry and tax law changes to ensure tax compliance

- Provide guidance and support to team members regarding complex tax issues

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Tax Manager Resume with 15 Years of Experience

I am an experienced Tax Manager with over 15 years of experience in providing financial advice and planning to large and medium- sized firms. I have extensive knowledge of federal and state taxation laws, extensive experience in tax preparation and filing, and have a comprehensive understanding of individual, corporate, and partnership taxes. I have a proven ability to reduce corporate and individual tax liabilities through my creative and strategic approach. I am highly motivated and organized with excellent communication and problem- solving skills.

Core Skills:

- Tax Planning & Preparation

- Tax Research & Analysis

- Tax Code Compliance

- Tax Auditing & Reporting

- Financial Planning & Risk Management

- Cost Control & Budgeting

- Corporate Restructuring

- Client Relations

- Communication & Presentation Skills

- Leadership & Interpersonal Skills

Responsibilities:

- Prepare and file tax returns for individuals, corporations, and partnerships

- Develop and implement tax strategies to reduce corporate and individual taxes

- Establish internal processes and controls to ensure compliance with federal and state tax laws

- Identify potential tax deductions and credits to minimize tax liability

- Analyze financial statements and other financial data to assess tax implications

- Conduct tax research and analysis on various tax topics

- Manage tax audits and related investigations from the IRS and other agencies

- Collaborate with the finance department to ensure accurate and efficient tax filing

- Supervise and train junior staff on tax concepts and procedures

- Develop and implement tax planning strategies to optimize company’s financial performance

- Prepare quarterly and year- end tax reports for senior management.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Tax Manager resume?

A Tax Manager’s resume is a critical document for any accounting or finance professional. It should contain all of the necessary qualifications, skills, and experiences that relate to the position. To ensure that your resume stands out from the competition, here are the elements that should be included:

- Summary: Provide a brief summary of your experience and qualifications, outlining your most relevant skills and accomplishments.

- Education: List your highest education level and any relevant degrees or certifications.

- Professional Experience: Include all relevant professional experience, highlighting your accomplishments and any relevant tax-related responsibilities and projects.

- Technical Skills: List any specialized software programs and systems that you’re proficient in.

- Relevant Courses: Highlight any courses or training that you’ve taken related to tax or accounting.

- Other Qualifications: Include any other qualifications that are specifically relevant to the Tax Manager role.

By including all of these elements, you can create a comprehensive and impressive resume for a Tax Manager position.

What is a good summary for a Tax Manager resume?

The primary goal of any tax manager is to ensure that their organization’s financial and tax obligations are in compliance with all applicable laws and regulations. A strong tax manager resume will include a summary of qualifications that showcase the applicant’s extensive knowledge and experience in the field of taxation. This summary should include a list of duties that the tax manager has performed in the past, including areas like preparing and analyzing financial statements, implementing tax strategies, dealing with tax authorities, and working with auditors. The summary should also highlight the tax manager’s ability to work under pressure and successfully manage multiple projects. Additionally, any special certifications or qualifications should be included in the summary. Ultimately, an effective summary should paint a picture of a knowledgeable and experienced individual who is capable of handling the many responsibilities of a tax manager.

What is a good objective for a Tax Manager resume?

A tax manager is responsible for the preparation and filing of tax returns, as well as overseeing the organization’s tax compliance. When writing a resume for a tax manager position, it is important to include an objective that clearly states your qualifications, experience, and long-term goals.

Good objectives for a tax manager resume include:

- Experienced tax manager with 10+ years of experience in tax preparation and filing, audit defense, and IRS compliance

- Seeking an opportunity to leverage expertise in complex tax regulations and financial management to promote organizational growth and success

- Proven ability to manage multiple projects simultaneously while meeting deadlines and delivering accurate results

- Highly organized, detail-oriented, and knowledgeable in tax regulations and legislation

- Dedicated to ensuring compliance with all applicable tax laws, regulations, and guidelines

- Committed to providing an exemplary level of customer service and delivering value to the organization through efficient tax management

How do you list Tax Manager skills on a resume?

Tax Manager is a professional responsible for creating, organizing, and maintaining tax records and data. They must have a deep understanding of tax laws and regulations, as well as a strong analytical skillset. To create a strong resume for a Tax Manager position, you should list all of the relevant skills you have that are applicable to the role. Here are some skills to include in your Tax Manager resume:

- Advanced knowledge of tax law and tax regulations: Tax Managers must have advanced understanding of tax laws and regulations in order to accurately assess and manage taxes.

- High-level analytical skills: Tax Managers must be able to analyze large amounts of information and data and draw accurate conclusions.

- Strong organizational skills: Tax Managers must be able to manage and organize tax records, making sure that all information is up-to-date and accurate.

- Excellent communication skills: Tax Managers must be able to effectively communicate with clients, co-workers, and other stakeholders.

- Attention to detail: Tax Managers must pay attention to detail in order to ensure accuracy in all tax records and documents.

By including these skills in your resume, you can demonstrate that you have the knowledge and skills necessary to be successful as a Tax Manager.

What skills should I put on my resume for Tax Manager?

Your resume should effectively showcase your abilities and experience to make a lasting impression on potential employers. As a tax manager, you need to demonstrate superior knowledge and understanding of the tax system, as well as your ability to manage and oversee tax preparedness. Here are some key skills to consider including on your resume for a tax manager role:

- Tax Planning and Compliance: Demonstrating your ability to strategize tax plans and ensure compliance with relevant regulations.

- Research and Analysis: Highlighting your ability to analyze and interpret financial information and research tax laws, regulations, and guidelines for accuracy.

- Accounting: Showing your expertise in accounting principles, practices, and procedures.

- Communication: Emphasizing your outstanding communication skills for interacting effectively with clients, colleagues, and other stakeholders.

- Management: Showcasing your leadership and management skills to ensure the timely and accurate completion of tax returns.

- Software Proficiency: Proving your proficiency with relevant tax software and tools, such as ProSeries, TaxWise, and TaxAct.

By emphasizing these skills on your resume, you can demonstrate to employers that you are an ideal candidate for the job.

Key takeaways for an Tax Manager resume

Tax Managers are responsible for ensuring their organisation meets its tax obligations, ensuring compliance with tax regulations, and optimising the company’s tax position. A successful Tax Manager resume should highlight a candidate’s tax knowledge, financial acumen, and analytical skills.

When writing your resume, there are a few key takeaways you should keep in mind:

- Highlight Your Tax Knowledge

Tax Managers must have an in-depth understanding of all relevant tax laws and regulations. Make sure to include any relevant qualifications and certifications on your resume, such as a Certified Public Accountant (CPA) or Certified Tax Accountant (CTA) designation.

- Demonstrate Your Financial Skills

Tax Managers must have a strong financial background to ensure their organisation is meeting its tax obligations. Make sure to include any relevant financial experience and skills, such as budgeting, forecasting, and financial reporting.

- Showcase Your Analytical Skills

Tax Managers must be able to analyse complex financial data and develop strategies to optimize the organisation’s tax position. Make sure to include any relevant analytical experience and skills, such as data analysis, financial modelling, and problem-solving.

- Emphasise Your Communication Skills

Tax Managers must also be able to effectively communicate with stakeholders and team members. Include any relevant communication experience and skills, such as presentation, negotiation, and relationship-building.

By keeping these key takeaways in mind, you can ensure your resume is tailored for the Tax Manager role and stands out from the competition.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder