Are you interested in applying for a Tax Director role? Writing an effective resume is an important step in your job search journey. Whether you are a first-time job seeker or an experienced professional, having a well-crafted resume is a must if you want to be considered for the job. This guide will provide you with helpful tips on how to write a standout Tax Director resume, featuring real-world examples of successful resumes. With the right resume in hand, you can confidently apply for the role and be one step closer to landing your dream job.

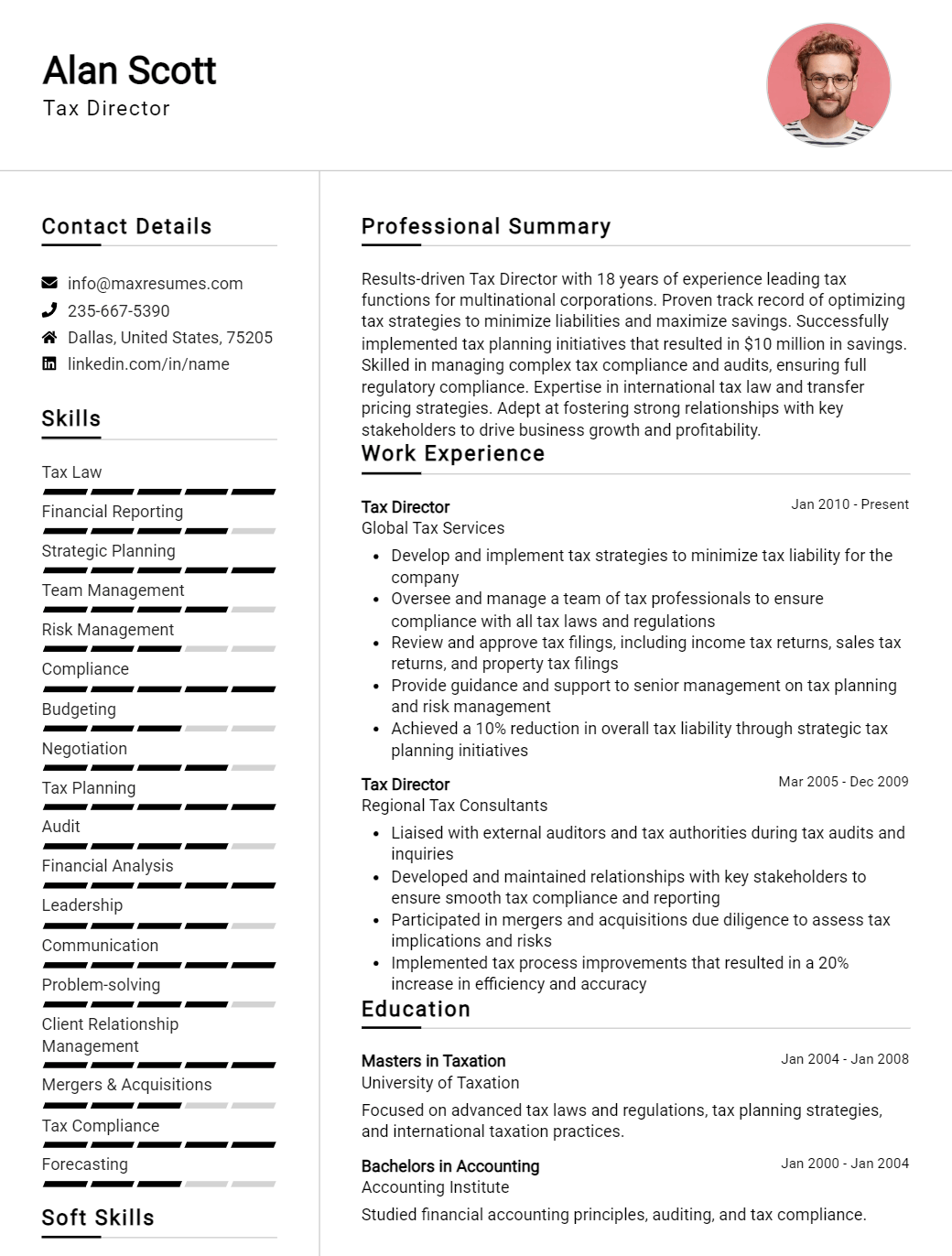

Tax Director Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Tax Director Resume Examples

John Doe

Tax Director

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

Results- oriented Tax Director with 15+ years of experience in financial services with a specialty in tax management and preparation. Possessing a CPA certification and a background in international financial reporting, I have a demonstrated ability to manage and strategize multi- million dollar tax operations. Skilled in providing excellently managed and organized tax services, as well as formulating policies, procedures, and internal controls to ensure that all tax operations are compliant with Federal and State regulations.

Core Skills:

- CPA Certifications

- Tax Preparation

- Tax Planning/Management

- International Financial Reporting

- Strategic Planning

- Tax Compliance

- Regulatory Compliance

- Financial Analysis

- Client Relations

- Leadership

- Budgeting

Professional Experience:

Tax Director, ABC Financial Solutions, Palo Alto, CA, 2018 – Present

- Analyze and assess financial statements, operations, and investments for tax implications.

- Review and analyze existing tax processes to ensure compliance with Federal, State, and local regulatory requirements.

- Implement and manage tax strategies and procedures to maximize tax savings.

- Develop and manage budgets, as well as forecast and analyze long- term financial trends.

- Develop and maintain relationships with clients and external stakeholders.

- Lead a team of tax professionals in the preparation of tax returns.

Tax Manager, XYZ Accounting Firm, San Francisco, CA, 2012 – 2018

- Managed and supervised the preparation of corporate and individual tax returns.

- Ensured compliance with Federal, State, and local regulations.

- Developed and implemented tax strategies to maximize tax savings.

- Reviewed and analyzed financial statements, investments, and operations for tax implications.

- Prepared financial and tax reports for senior management.

- Provided training and guidance to junior staff members.

Education:

Bachelor of Science in Accounting, Stanford

Tax Director Resume with No Experience

Results- driven Tax Director with a six- year background in developing efficient strategies to increase revenue and reduce costs. Adept in handling complex financial tasks and providing intricate analysis. Experienced in providing accurate, timely solutions to financial data issues.

Skills

- Financial analysis

- Tax preparation

- Accounting software

- Tax research

- Tax law knowledge

- Project management

- Problem- solving

- Data analysis

- Risk management

- Communication

Responsibilities

- Evaluate and identify tax liabilities and opportunities.

- Review and analyze financial statements and cash flow data.

- Develop, analyze, and interpret complex financial data.

- Plan, coordinate, and prepare tax returns for individuals, businesses, and estates.

- Negotiate with the IRS and other tax agencies.

- Develop, coordinate, and implement tax strategies and solutions.

- Monitor and verify compliance with tax regulations.

- Provide tax advice to clients and senior management.

- Analyze, evaluate, and interpret tax regulations and tax law.

- Research, analyze, and prepare written reports for tax planning.

- Monitor changes in tax legislation and regulations.

Experience

0 Years

Level

Junior

Education

Bachelor’s

Tax Director Resume with 2 Years of Experience

A highly experienced Tax Director with two years of experience in providing leadership and management to tax operations, compliance and planning. Possesses excellent knowledge of tax laws and regulations, as well as a track record of success in maximizing tax savings through proactive and strategic tax management. Skilled in developing, implementing and overseeing efficient and effective tax strategies, policies and management systems. Proven ability to build strong relationships with clients and colleagues.

Core Skills:

- Tax Planning

- Tax Compliance

- Tax Law Knowledge

- Tax Risk Management

- Financial Analysis

- Strategic Planning

- Problem Solving

- Leadership and Management

Responsibilities:

- Develop and implement effective tax strategies, policies and management systems that comply with local and federal tax laws.

- Manage and review all activities related to the filing of accurate tax returns including corporate taxes, estimated taxes, sales and use taxes, and payroll taxes.

- Analyze financial statements and other relevant documents to ensure tax compliance and identify potential tax savings opportunities.

- Lead and manage the tax department, ensuring compliance with all applicable laws and regulations.

- Research complex tax issues and provide advice to senior management on all tax matters.

- Monitor changes in tax laws and regulations and advise senior management on the best strategies to minimize tax liability.

- Liaise with external auditors, attorneys, and other professional advisors on tax- related matters.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Tax Director Resume with 5 Years of Experience

Highly organized and detail- oriented Tax Director with 5 years of experience in the tax industry. Proven ability to develop and implement successful tax strategies that promote compliance, reduce costs and mitigate risks. Adept at utilizing accounting and financial analysis software such as Microsoft Excel, QuickBooks and TaxWise to analyze and present tax information. Experienced in researching and interpreting complex tax laws and regulations.

Core Skills:

- Tax Preparation

- Tax Planning

- Audit & Compliance

- Financial Analysis

- Accounting Software

- Tax Research & Interpretation

- Tax Strategies & Solutions

- Budgeting & Forecasting

- Client Relationship Management

Responsibilities:

- Prepared and filed monthly, quarterly and yearly tax returns for individuals and businesses.

- Developed, implemented and monitored effective tax strategies to minimize financial liabilities and maximize returns.

- Ensured compliance with all applicable federal, state and local laws, regulations and standards.

- Researched and interpreted complex tax laws, regulations and standards to identify tax planning opportunities.

- Prepared and presented financial analysis, budgeting and forecasting reports to executive management.

- Created and maintained all accounting records, including financial statements and books of account.

- Managed client relationships and provided guidance and advice on tax planning opportunities.

- Analyzed and presented financial data, including tax returns, tax analyses and audit schedules.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Tax Director Resume with 7 Years of Experience

Dynamic Tax Director with 7 years of experience and expertise in accounting, finance and taxation procedures, combined with a proven track record of providing efficient and effective financial services to clients. Proven ability to handle complex tax matters and ensure timely and accurate reporting of accounts. Adept at working with cross- functional teams to create best practices and to ensure adherence to organizational policies and procedures.

Core Skills:

- Tax Planning and Advisory

- Accounting Standards

- Financial Statement Analysis

- Tax Laws and Regulations

- Revenue Accounting

- Tax Research

- Internal Auditing

- Financial Reporting

Responsibilities:

- Develop and implement efficient planning strategies and tax management services, such as tax planning and forecasting, to ensure organization’s compliance with the applicable tax laws.

- Ensure accurate and timely reporting of all financial accounts and provide comprehensive analysis and explanation of financial data.

- Assist in the preparation and review of financial statements, including income statement, balance sheet and cash flow statement.

- Analyze and review tax returns and documents and reconcile discrepancies with related accounts.

- Monitor financial markets and advise on potential investment opportunities and risk management strategies.

- Develop and implement strategies to optimize and reduce costs associated with taxes and other financial activities.

- Research and analyze tax changes, new state and federal laws and regulations, and assess the impact on the organization.

- Prepare tax returns, review and audit tax returns and provide guidance to ensure compliance with applicable tax laws.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Tax Director Resume with 10 Years of Experience

Highly qualified and experienced Tax Director with over 10 years of vast experience in tax planning, tax research, compliance and team management. Proven track record of success in providing excellent tax services to clients, with a strong focus on meeting government regulations. Possess a thorough understanding of tax laws and regulations, as well as an ability to ensure proper compliance with corporate tax rules. Possess excellent communication, management, organizational and leadership skills.

Core Skills:

- Tax Planning

- Tax Research

- Compliance

- Team Management

- Government Regulations

- Analysis and Reporting

- Financial Management

- Problem- Solving

- Risk Assessment

Responsibilities:

- Provided advice and support to clients on all aspects of taxation, including income tax, GST, payroll, and other related tax issues.

- Developed, implemented and monitored tax strategies to ensure compliance with government regulations.

- Drafted and reviewed regulations, tax returns and other legal documents.

- Analyzed financial statements and reported the results to clients and senior management.

- Managed and mentored a team of tax professionals.

- Organized and developed training programs for juniors and interns.

- Researched complex tax issues and provided solutions to clients.

- Identified and minimized tax risks associated with transactions.

- Prepared and reviewed regular tax reports to ensure accuracy and completeness.

- Negotiated with tax authorities to resolve issues and disputes.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Tax Director Resume with 15 Years of Experience

Tax Director with 15 years of experience in corporate tax compliance and tax reporting. Skilled in developing and implementing tax strategies to maximize tax savings, reducing risks and increasing shareholder value. Experienced in managing business tax affairs and providing advice on complex tax issues. Demonstrated success in developing tax strategies, interpreting and implementing tax laws, and advising clients on tax planning.

Core Skills:

- Tax Planning

- Tax Compliance & Reporting

- Tax Strategies

- Tax Law Interpretation

- Tax Return Preparation

- Research & Analysis

- Auditing

- Accounting & Financial Analysis

- Financial Planning

- Business Tax Management

Responsibilities:

- Provide comprehensive tax advice and services to clients

- Develop and implement tax strategies to reduce risks and increase shareholder value

- Analyze complex business tax affairs and develop strategies to optimize tax savings

- Research tax laws, regulations and precedents to ensure accurate and compliant tax returns

- Prepare and review annual tax returns and other required tax documents

- Identify and analyze potential tax issues and develop recommendations

- Conduct financial analysis and auditing to ensure accuracy

- Evaluate and advise on the potential impact of tax law changes

- Advise clients on strategies to minimize liability, avoid tax penalties and maximize savings

- Provide guidance and assistance to team members on complex tax matters

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Tax Director resume?

As a tax director, you have a great deal of responsibility and need to demonstrate your knowledge and experience. Writing an effective resume is essential to getting the job you want. Here are some tips for what to include on your tax director resume to make it stand out:

- Profile Summary: Start your resume with a profile summary that highlights your areas of expertise and the type of work you specialize in. Make sure to list any qualifications or certifications that are relevant to the job you are applying for.

- Experience: Include a detailed list of your previous professional positions and responsibilities. Use bullet points to describe the projects you have worked on and the results you achieved.

- Education: List your degree or any other relevant educational qualifications.

- Technical Skills: Include any knowledge of software and tools used in the tax profession.

- Professional Accomplishments: List any awards or certifications you have received in the tax profession.

- Soft Skills: Showcase your ability to communicate, collaborate, and problem solve.

- Additional Information: Mention any additional skills or qualifications that are relevant to the job.

By including all of the above information on your resume, you are sure to get noticed by potential employers. Make sure to tailor your resume to the role you are applying for and highlight specific achievements and experience that makes you stand out.

What is a good summary for a Tax Director resume?

A Tax Director resume should include summary of qualifications that demonstrate extensive knowledge of tax law, compliance, and reporting. The summary should emphasize the individual’s ability to lead and manage teams, develop and implement tax strategies, and identify and capitalize on tax savings opportunities. It should also highlight the individual’s ability to work with internal and external stakeholders to ensure timely and accurate tax reporting and compliance. Additionally, the summary should include specific experience in developing and implementing tax-saving strategies, researching tax issues, and preparing tax returns. Finally, the summary should emphasize the Tax Director’s ability to stay up-to-date on changes in the tax environment and provide solutions to complex tax issues.

What is a good objective for a Tax Director resume?

When writing a resume for a Tax Director position, the objective should focus on the skills, qualifications, and experience that the applicant brings to the job.

Below are a few objectives that will help guide you in crafting a successful resume:

- Demonstrate strong tax compliance and financial management skills to lead the organization in achieving their financial and taxation goals

- Utilize technical knowledge of tax laws and regulations to provide accurate and timely tax advice

- Manage and direct the activities of a team of tax professionals to ensure compliance with all applicable laws and regulations

- Develop and maintain effective relationships with external agencies to ensure effective and efficient tax management

- Implement effective strategies to reduce the organization’s tax burden and maximize profitability

- Analyze financial statements and provide insights that can be used to improve performance

- Demonstrate strong leadership skills to ensure the achievement of the organization’s financial and legal objectives

- Provide creative and innovative solutions to maximize the organization’s tax savings and mitigate risk

How do you list Tax Director skills on a resume?

Tax Directors are financial experts with a deep understanding of taxation procedures, regulations, and laws. They are responsible for managing and overseeing the tax department of an organization, as well as providing guidance and advice to senior management. When creating a resume for a Tax Director position, it is important to list the skills and qualifications that make you a strong candidate. Here are some of the skills and qualifications that should be included on a Tax Director’s resume:

- In-depth knowledge of tax regulations, principles and practices

- Proficient in analyzing, interpreting, and applying complex tax regulations

- Strong analytical, problem-solving and decision-making skills

- Ability to identify and resolve tax issues

- Excellent team leadership and management skills

- Understanding of financial principles and accounting practices

- Ability to develop and implement tax strategies

- Ability to build and maintain relationships with internal and external stakeholders

- Highly organized with the ability to multitask and manage multiple projects

- Excellent verbal and written communication skills

- Proficient in tax software applications and Microsoft Office Suite

- Ability to work independently and within a team

- Certified Public Accountant (CPA) or other relevant certification

What skills should I put on my resume for Tax Director?

When creating a resume for a Tax Director position, it is important to include a comprehensive list of skills and qualifications that demonstrate your ability to succeed in the role. To help you craft a successful resume, here are some of the most important skills to include:

- Tax Planning: Tax Directors need to have an extensive knowledge of the current tax laws and regulations, as well as the ability to develop and implement tax plans.

- Budgeting: Tax Directors must be adept at budgeting and managing finances, as well as managing and monitoring budget performance.

- Financial Analysis: Tax Directors must be able to analyze financial data, understand complex financial concepts, and make informed decisions.

- Leadership: Tax Directors need to be able to lead and motivate teams, delegate tasks, and ensure that goals and objectives are met.

- Communication: Tax Directors must be able to communicate effectively with senior management, colleagues, and external stakeholders.

- Technology: Tax Directors should be familiar with tax software, spreadsheets, and other relevant technology.

- Problem Solving: Tax Directors need to be able to identify problems, analyze data, and make decisions based on the facts.

Key takeaways for an Tax Director resume

Writing a resume as a Tax Director can be a daunting task. You need to be sure that your resume is going to stand out to potential employers when they are hiring in this field. Here are some key takeaways to keep in mind when writing a Tax Director resume:

- Focus on your experience: As a Tax Director, employers are going to want to see that you have experience in the field. Make sure to list your relevant work experience, especially any big projects or accomplishments.

- Highlight your expertise: Employers will also be looking for specific skills and knowledge related to tax. Make sure to highlight any relevant certifications, training, or specializations you have in the field.

- Showcase your leadership: As a Tax Director, you will likely be in charge of a team. Include any management experience you have in your resume and be sure to showcase your ability to lead and motivate a team.

- Demonstrate results: Don’t just list your experience, but also demonstrate the results you achieved. This can include any savings or efficiencies you were able to implement.

By following these key takeaways, you can ensure your Tax Director resume stands out to employers and gets you the job you want.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder