Writing a resume for a Tax Auditor position is no easy task. The resume needs to showcase a candidate’s qualifications, experiences, and skills that are relevant and necessary for the position. Additionally, it needs to be tailored to the job description and present the candidate in the best light possible. This guide provides a comprehensive look at resume writing for Tax Auditors, including tips on writing, formatting, and examples of resumes for Tax Auditors. With this guide, anyone applying for a Tax Auditor position can create an outstanding resume that will impress any recruiter.

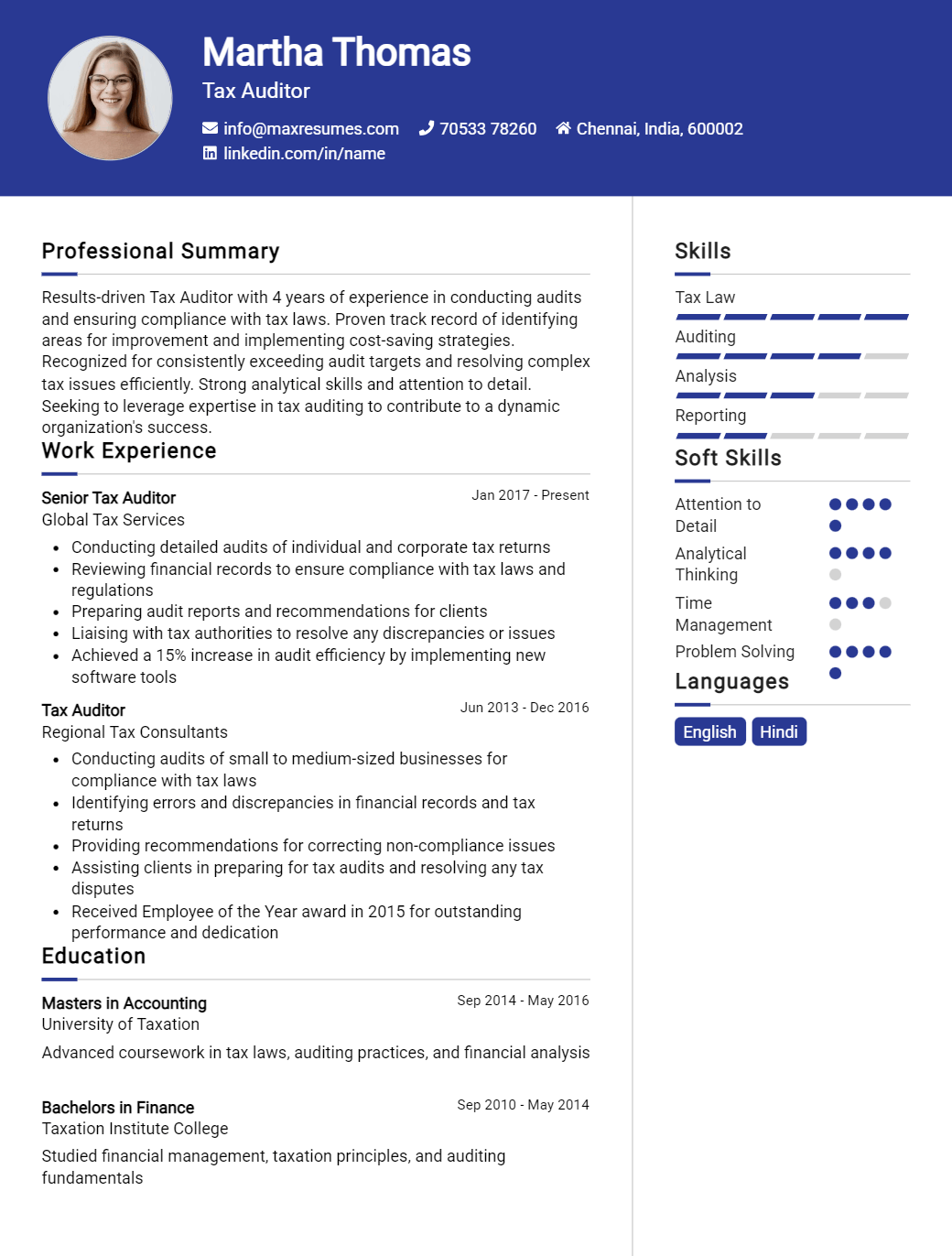

Tax Auditor Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Tax Auditor Resume Examples

John Doe

Tax Auditor

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am an experienced tax auditor with 10 years of experience in the accounting and financial services industry. I have an eye for detail and am skilled in a variety of accounting principles, including GAAP and IFRS. I am a team player who can work collaboratively with colleagues to achieve success while adhering to regulations and guidelines. My comprehensive knowledge of tax laws, regulations, and processes ensures that I can efficiently and accurately audit financial documents.

Core Skills:

- Proficient in accounting principles, including GAAP and IFRS

- Strong knowledge of tax laws, regulations, and processes

- Advanced proficiency in financial record and analysis

- Excellent attention to detail and organizational skills

- Strong problem- solving and analytical skills

- Ability to collaborate effectively with colleagues

Professional Experience:

Tax Auditor, ABC Corporation, 2018- Present

- Analyze financial documents to ensure compliance with applicable regulations and guidelines

- Plan and coordinate audits of corporate income tax returns, payroll taxes, and other taxes

- Conduct research and document findings in order to make appropriate adjustments

- Evaluate and review financial records to ensure accuracy and completeness

- Identify discrepancies in financial documents, assess accuracy of calculations, and recommend corrective action

- Train and provide guidance to staff on tax regulations and processes

Tax Auditor, XYZ Corporation, 2014- 2018

- Reviewed and analyzed financial documents to ensure compliance with applicable laws and regulations

- Conducted detailed audits of corporate income tax returns, payroll taxes, and other taxes

- Investigated discrepancies in financial documents and provided recommendations for corrective action

- Identified and documented errors and inaccuracies in calculations, financial statements, and other documents

- Provided advice and guidance to staff on tax regulations and processes

Education:

Bachelor of Science in

Tax Auditor Resume with No Experience

Recent college graduate with a degree in Accounting looking to start a career as a Tax Auditor. Possesses a strong understanding of accounting principles and the ability to quickly learn new processes and procedures. Highly organized and detail- oriented with exceptional analytical and problem- solving skills.

Skills

- Ability to interpret and analyze financial data

- Proficient in accounting software and MS Office programs

- Excellent written and verbal communication skills

- Strong research and investigative skills

- Highly organized, detail- oriented, and capable of multitasking

- Ability to work independently and as part of a team

Responsibilities

- Review tax records for accuracy and completeness

- Collaborate with the accounting team to ensure the accuracy of financial statements

- Investigate discrepancies in reported tax amounts

- Conduct research to ensure taxation is correctly applied

- Analyze financial records to assess compliance with tax laws and regulations

- Assist clients with tax- related questions and issues

- Prepare reports, summaries, and presentations to be used by management

Experience

0 Years

Level

Junior

Education

Bachelor’s

Tax Auditor Resume with 2 Years of Experience

A highly experienced and organized Tax Auditor with two years of experience in auditing companies, businesses, and individuals to ensure all taxes are correct and paid on time. Possess excellent communication skills, an ability to stay organized, and an eye for detail. Committed to upholding all laws and regulations regarding taxes, and offering insight and guidance to businesses to help increase their success.

Core Skills:

- Accurate financial recordkeeping

- Analytical problem solving

- Tax law knowledge

- Report preparation

- Excellent communication

- Research and data entry

- Time management

Responsibilities:

- Examining financial records and accounts

- Examining taxes and related documents

- Offering advice on tax compliance

- Investigating discrepancies

- Identifying potential tax issues

- Preparing reports on findings

- Collaborating with teams to identify solutions

- Keeping abreast of changes in tax laws

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Tax Auditor Resume with 5 Years of Experience

A highly experienced, detail- oriented Tax Auditor with 5 years of experience in conducting audits of financial records to ensure accuracy, compliance with reporting requirements, and adherence to statutes. Skilled in data analysis, bookkeeping, and financial statement preparation with a comprehensive knowledge of the theories, principles, and practices of accounting and taxation. Possesses excellent organizational, administrative and communication skills.

Core Skills:

- Auditing

- Data Analysis

- Bookkeeping

- Financial Reporting

- Taxation

- Organizational Skills

- Administrative Skills

- Communication Skills

Responsibilities:

- Conduct audits of financial records to ensure accuracy, compliance with reporting requirements, and adherence to statutes.

- Perform critical analysis of financial documents such as tax returns, balance sheets, income statements, etc.

- Review and assess client’s compliance with the applicable laws and regulations.

- Identify areas for potential improvement in the organization’s accounting system and procedures.

- Provide feedback and advice to clients.

- Develop and provide training materials to staff related to taxation and compliance matters.

- Maintain updated knowledge of tax laws and regulations.

- Develop recommendations to improve the organization’s tax practices.

- Prepare reports and present findings to upper management.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Tax Auditor Resume with 7 Years of Experience

Highly motivated and reliable Tax Auditor with seven years of experience auditing businesses and individuals to ensure accuracy in filing and payment of taxes. Experienced in reviewing financial documents and records, analyzing accounting systems and processes, and detecting discrepancies. Possesses excellent communication and problem- solving skills, with experience in both local and federal tax laws.

Core Skills:

- Tax Audit

- Accounting Systems & Processes

- Financial Records Review

- Tax Planning & Preparation

- Problem- Solving

- Written & Verbal Communication

- Local & Federal Tax Laws

Responsibilities:

- Conducted audits of businesses and individuals to ensure accurate filing and payment of taxes.

- Reviewed books, records, and financial statements to detect discrepancies and errors.

- Performed analysis of accounting systems, processes, and financial statements.

- Recommended changes to accounting systems and processes to ensure accurate tax filing and payment.

- Advised businesses and individuals on tax planning, preparation, and payment.

- Assisted with the preparation of reports and documents related to tax audits.

- Investigated, identified, and reported on potential violations of local and federal tax laws.

- Provided guidance and expertise to businesses and individuals on local and federal tax laws.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Tax Auditor Resume with 10 Years of Experience

Results- oriented professional with 10+ years of experience in auditing financial statements, analyzing tax returns and identifying areas of tax compliance risk. Skilled in data analysis, financial modeling, reporting and research. Exceptional communication, problem solving and time management skills. Proven track record of delivering accurate and timely results in a fast- paced environment.

Core Skills:

- Critical Thinking

- Tax Compliance

- Tax Auditing

- Financial Modeling

- Data Analysis

- Financial Reporting

- Research & Analysis

- Problem Solving

- Time Management

- Communication

Responsibilities:

- Conducted financial statement audits for large and small business entities to assess the accuracy and reliability of financial data

- Analyzed financial and tax returns to identify areas of risk or non- compliance

- Developed comprehensive financial models to identify potential issues and suggest improvements

- Prepared detailed reports on the results of audits to ensure that clients were compliant with laws and regulations

- Conducted research to ensure understanding of complex tax law and regulations

- Provided guidance and assistance to clients in understanding their tax obligations

- Consulted with clients to determine the most beneficial strategies for filing tax returns

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Tax Auditor Resume with 15 Years of Experience

Dedicated Tax Auditor with 15 years of experience in auditing and financial analysis, committed to providing excellent services to clients and stakeholders. Proven expertise in performing detailed financial analysis, managing complex tax audits, and providing advice for financial decisions. Known for ability to work accurately and effectively in high- pressure settings.

Core Skills:

- Financial Analysis

- Tax Auditing

- Tax Accounting

- Account Reconciliation

- Risk Management

- Financial Reporting

- Data Analysis

- Regulatory Compliance

- Customer Service

Responsibilities:

- Conduct detailed financial analysis and audits of tax returns, accounts, and financial statements

- Perform complex tax audits and compliance reviews in accordance with federal, state, and local regulations

- Interpret and analyze financial data to identify discrepancies, errors and potential risks

- Provide advice and recommendations for financial decisions based on tax regulations

- Maintain and reconcile accounts to ensure accuracy of financial reporting

- Develop and analyze financial reports to identify trends and potential problems

- Respond to inquiries from clients, stakeholders and other external parties

- Ensure compliance with applicable laws and regulations related to taxation

- Provide excellent customer service to ensure client satisfaction

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Tax Auditor resume?

A Tax Auditor’s job is to ensure that the company and its employees are compliant with the applicable tax laws. This includes reviewing financial information, generating reports and conducting audits. When writing a resume for this position, it is important to showcase your knowledge and experience in this field. Here are some key items to include in your resume:

- Professional Summary: Summarize your qualifications and background in a few sentences. This should include any relevant experience you have in the field of tax auditing.

- Education: Include any degrees or certifications you have related to tax auditing, such as an accounting degree or a Certified Public Accountant (CPA) certification.

- Work Experience: List any previous positions you have had as a tax auditor, including the name of the company or organization, your job duties and the dates of employment.

- Technical Skills: Mention any software or other tools you are proficient with, such as accounting software or spreadsheets.

- Professional Associations: Include any memberships you have in professional organizations related to tax auditing, such as the American Institute of Certified Public Accountants or the Association of Certified Fraud Examiners.

- Awards and Certifications: Include any awards or certifications you have received related to tax auditing or accounting.

By including these key points, you can create an effective resume that showcases your skills and experience in the field of tax auditing.

What is a good summary for a Tax Auditor resume?

A tax auditor resume should provide a concise summary of qualifications, including experience in the field of tax auditing, financial analysis, and accounting. The resume should emphasize the applicant’s background in conducting tax-related investigations and their ability to assess financial data for accuracy and completeness. Additionally, the resume should showcase any relevant certifications or qualifications that demonstrate the applicant’s expertise in the field.

It is important to highlight any software expertise, such as knowledge of tax preparation software and accounting programs, as well as any specialized training in the field of taxation. The resume should also provide a summary of the applicant’s ability to work with a variety of stakeholders, including clients, colleagues, and government officials. Finally, the resume should demonstrate the applicant’s commitment to professionalism, ethical conduct, and dedication to compliance with tax laws and regulations.

What is a good objective for a Tax Auditor resume?

A Tax Auditor resume should include a well-constructed objective that both accurately describes your skills and experience as well as informing potential employers of your career aspirations. A good objective should concisely highlight your accomplishments and qualifications that demonstrate your ability to be a successful Tax Auditor.

Below are some objectives that could work for a Tax Auditor resume:

- To utilize experience in taxation, auditing, and financial analysis to accurately analyze and review financial statements and records for a successful Tax Auditor role.

- To secure a position as a Tax Auditor where strong analytical and problem solving skills can be utilized to identify discrepancies and discrepancies in financial records.

- To use an extensive background in accounting and taxation to review, analyze, and audit financial documents for a Tax Auditor role.

- To bring five years of experience in taxation and auditing to a Tax auditor role in order to provide the highest quality of service and accuracy.

- To contribute a highly organized and detail-oriented approach to auditing and review financial documents as a Tax Auditor.

How do you list Tax Auditor skills on a resume?

When writing your resume, it’s important to include skills that are relevant to the job you are applying for. If you are applying for a Tax Auditor position, you should include a section on your resume that lists your Tax Auditor skills. Here are some of the most important skills to consider including:

- Tax Law Knowledge: A Tax Auditor must have knowledge of federal, state and local tax laws, as well as the ability to interpret and apply them in a variety of situations.

- Analytical Skills: A Tax Auditor must be able to analyze large amounts of financial data to identify trends and discrepancies.

- Problem Solving: A Tax Auditor should be able to identify problems and come up with effective solutions.

- Communication: A Tax Auditor should have strong communication skills, both verbal and written, as they must be able to communicate effectively with taxpayers and other stakeholders.

- Attention to Detail: A Tax Auditor must be able to review documents accurately and identify errors or omissions.

- Organizational Skills: A Tax Auditor must be able to manage their time, prioritize tasks and keep records organized.

By including these skills in your resume, you’ll be able to demonstrate to potential employers that you have the skills necessary to be a successful Tax Auditor.

What skills should I put on my resume for Tax Auditor?

When you’re applying for a job as a Tax Auditor, it’s important to showcase the skills that employers are looking for on your resume. Here are some skills you should consider including on your resume if you’re applying to be a Tax Auditor:

- Comprehensive knowledge of tax laws: Tax Auditors should have a deep understanding of how the tax system works and the relevant regulations and laws governing it.

- Analytical skills: Tax Auditors must have the ability to analyze tax data to identify potential issues, draw logical conclusions, and make well-informed decisions.

- Technical proficiency: Tax Auditors must be comfortable working with computers and financial technology. They should have experience with tax software and other digital tools used to manage and analyze tax data.

- Attention to detail: Tax Auditors need to have an eye for detail, as they are responsible for ensuring accuracy in all financial reporting.

- Communication skills: Tax Auditors must be able to effectively communicate their findings both orally and in writing.

- Organizational skills: Tax Auditors need to be organized and efficient in their work in order to keep up with the demands of their job.

- Time management: Tax Auditors must be able to manage their workload efficiently, as they often have to juggle multiple projects simultaneously.

By showcasing these skills on your resume, you’ll be in a better position to land a job as a Tax Auditor.

Key takeaways for an Tax Auditor resume

If you are seeking a job as a tax auditor, you need to make sure that your resume stands out from all the other applicants. As a tax auditor, you will be responsible for ensuring that tax laws and regulations are followed and that taxes are paid correctly. Your resume should show potential employers that you have the skills, experience, and knowledge to perform the job duties effectively.

Here are some key takeaways to highlight in your tax auditor resume:

- Detail-orientation: As a tax auditor, you need to have an eye for detail. You should emphasize any relevant skills and experiences on your resume that demonstrate your attention to detail, such as working with financial data, understanding complex tax regulations, and managing multiple tasks at once.

- Analytical and problem-solving skills: Tax auditors must be able to identify and resolve any discrepancies in the financial documents they review. Showcase any experiences on your resume that demonstrate your ability to think analytically and solve complex problems.

- Organization: Tax auditors need to be organized in order to effectively manage their workload. Highlight any experiences that demonstrate your organizational skills, such as managing multiple projects at once or effectively using time management techniques.

- Communication: As a tax auditor, you will need to be able to effectively communicate with clients and colleagues. Make sure to highlight any experiences that demonstrate your ability to communicate clearly, such as communicating with clients or preparing documents for internal and external stakeholders.

By emphasizing these key takeaways in your resume, you can demonstrate to employers that you have the skills and experience necessary to be a successful tax auditor.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder