The tax associate role is becoming increasingly important in both public and private sectors. With the growing demand for experienced tax associates, it is important for those looking to become one to create an impactful resume. To create the best possible resume, it is important to understand the key elements that should be included and how to word and format them. This article provides an in-depth guide on how to write a tax associate resume and includes multiple examples of professionally-crafted resumes that can be used as a template.

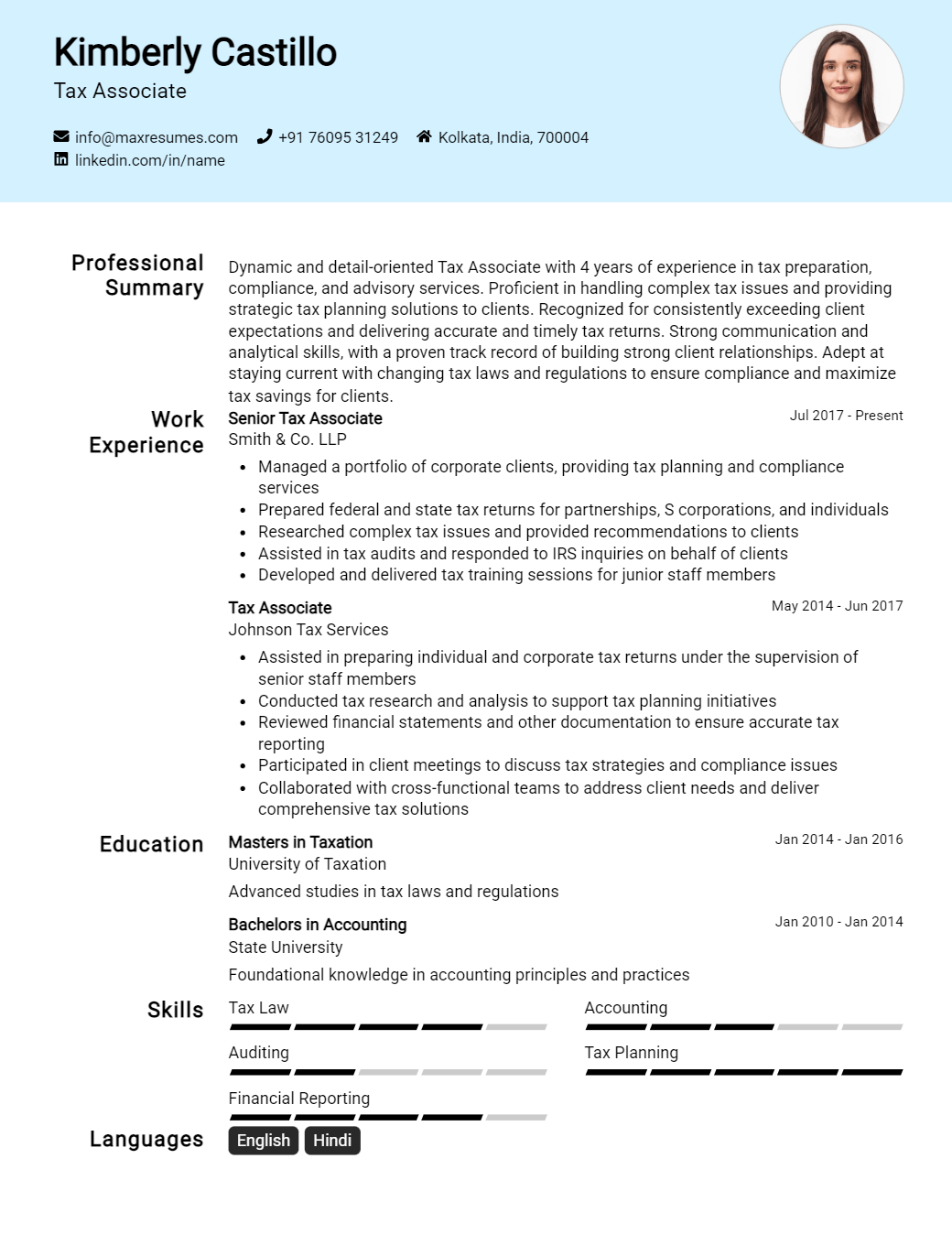

Tax Associate Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Tax Associate Resume Examples

John Doe

Tax Associate

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am a reliable, motivated, and detail- oriented Tax Associate with excellent problem- solving, organizational, and communication skills. I have extensive experience in managing complex financial operations and developing tax strategies for clients. I am adept at evaluating financial records and tax documents as well as preparing accurate, timely, and thorough tax reports. I am also well- versed in providing strategic tax advice and ensuring goals are met in an accurate and cost- effective manner. I am a team player and am committed to providing quality customer service.

Core Skills:

- Tax Preparation

- Financial Analysis

- Financial Planning

- Tax Planning

- Banking Regulations

- Tax Law

- Budgeting

- Auditing

- MS Office

- QuickBooks

Professional Experience:

Tax Associate, ABC Tax Solutions– June 2019 to Present

- Prepare and file income tax returns for individuals, businesses, and corporations

- Analyze financial documents and prepare reports

- Research and calculate tax liabilities

- Develop tax strategies for clients

- Communicate with clients to answer questions and provide advice

- Assist clients with filing and correcting tax forms

- Interpret and apply tax laws and regulations

Tax Analyst, XYZ Tax Group – December 2017 to June 2019

- Reviewed and analyzed tax returns for high net- worth clients

- Prepared and filed federal, state, and local tax returns

- Prepared financial statements for business clients

- Researched and analyzed complex tax issues

- Assisted clients with obtaining tax credits and deductions

- Assessed potential exposures and liabilities

- Monitored changes in tax laws and regulations

Education:

Bachelor of Business Administration, Taxation

University of California, Los Angeles, CA

Graduated 2017

Tax Associate Resume with No Experience

Recent graduate with an accounting degree eager to join an accounting firm as a tax associate. Possess excellent organizational and communication skills. A keen eye for detail and a passion for helping others with their taxes.

Skills

- Analytical Thinking

- Organizational Skills

- Problem Solving

- Time Management

- Multitasking

- Data Analysis

- Computer proficiency

- Tax Preparation

- Strong Communication

Responsibilities

- Assist clients with tax filing and preparation

- Collect and organize financial documents

- Perform research related to tax laws and regulations

- Assist in the preparation of tax returns

- Review tax returns for accuracy and completeness

- Provide advice to clients on tax- related matters

- Keep up to date with changes to tax laws and regulations

- Maintain client confidentiality

Experience

0 Years

Level

Junior

Education

Bachelor’s

Tax Associate Resume with 2 Years of Experience

Driven and detail- oriented Tax Associate with two years of experience in accounting and tax preparation. Possesses excellent communication and time management skills and an in- depth knowledge of accounting principles and the latest tax regulations. Able to effectively prepare tax returns for individuals and businesses of all sizes, ensuring accuracy and compliance.

Core Skills:

- Tax Preparation

- Accounting Principles

- Tax Regulations

- Communication

- Time Management

- Problem Solving

- Organization

Responsibilities:

- Prepared and filed income tax returns and business tax returns for individuals and businesses of all sizes.

- Ensured accuracy and compliance by staying up to date on the latest tax regulations and laws.

- Educated clients on their tax obligations and available deductions.

- Researched and resolved complex tax issues.

- Reviewed and reconciled financial records.

- Provided assistance with the preparation of financial statements.

- Developed tax strategies to help clients minimize their tax liability.

- Coordinated with other departments to ensure timely filing of all relevant documents.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Tax Associate Resume with 5 Years of Experience

Highly organized and detail- oriented Tax Associate with 5 years of experience in tax preparation, research, and review. Adept at utilizing a variety of software to assess the accuracy of tax returns, identify and apply tax credits, and analyze financial records. Excellent communication and interpersonal skills, with an ability to effectively collaborate with clients and colleagues.

Core Skills:

- Tax Preparation

- Financial Analysis

- Research and Review

- Financial Recordkeeping

- Problem- Solving

- Communication

- Interpersonal Skills

Responsibilities:

- Prepared complex individual and corporate tax returns for a variety of clients.

- Developed and maintained financial records, including income statements and balance sheets.

- Assisted clients in accurately filing taxes by researching and identifying tax credits and deductions.

- Recalculated financial information to ensure accuracy of returns.

- Researched and analyzed tax laws to ensure compliance with federal, state, and local regulations.

- Worked effectively with clients to develop strategies and plans to minimize tax liabilities.

- Collaborated with other tax professionals to recommend and implement process improvements.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Tax Associate Resume with 7 Years of Experience

I am an experienced Tax Associate with over seven years of expertise in preparing and filing taxes, providing tax planning advice, and researching complex tax issues. I have a strong knowledge of individual, corporate, and partnership taxation, as well as strong oral and written communication skills. I am highly organized, detail- oriented, and have the ability to multitask and prioritize efficiently. My experience has helped me develop a high level of professionalism, integrity, and dedication to the work I do. I am confident that I can provide exceptional service to all clients.

Core Skills:

- Tax Preparation

- Tax Planning

- Research and Analysis

- Auditing

- Tax Regulation Knowledge

- Oral and Written Communication

- Organizational and Time Management

- Problem Solving

Responsibilities:

- Prepare, complete, and file federal, state, and local income tax returns for clients.

- Research and analyze tax laws and regulations to ensure compliance.

- Advise clients on tax planning strategies to minimize tax liabilities.

- Perform audits of financial records for accuracy and compliance with regulations.

- Provide support and assistance during tax examinations and audits.

- Identify opportunities for clients to reduce tax liabilities.

- Develop and maintain strong relationships with clients.

- Monitor legislation and regulations to ensure compliance with all applicable laws.

- Ensure accurate and timely preparation of tax returns.

- Provide accurate and timely responses to inquiries from clients and tax authorities.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Tax Associate Resume with 10 Years of Experience

Highly organized and detail- oriented Tax Associate with 10 years of experience in tax preparation, financial analysis, and auditing. Skilled in the interpretation and application of US federal and state tax codes, as well as international tax regulations. Possesses strong research and problem- solving skills, with the ability to provide innovative solutions to complex tax situations. Utilizes exceptional communication and customer service abilities to ensure all clients’ needs are met.

Core Skills:

- Tax Preparation and Planning

- Financial Analysis

- Auditing and Compliance

- International Tax Regulations

- Research and Problem- Solving

- Communication and Customer Service

Responsibilities:

- Prepared individual, corporate, and estate tax returns.

- Conducted financial and account analysis to identify and minimize tax liabilities.

- Reviewed documents and records to ensure compliance with federal, state, and international tax regulations.

- Provided comprehensive advice and guidance for tax- related matters.

- Identified deductions and credits to maximize tax savings for clients.

- Researched new tax statutes and regulations to ensure compliance.

- Developed strategies to reduce clients’ tax burdens.

- Coordinated with outside auditors and tax consultants to resolve tax issues and provide accurate tax advice.

- Prepared monthly and quarterly financial reports.

- Assisted in the development and implementation of new policies and procedures.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Tax Associate Resume with 15 Years of Experience

I am a Tax Associate with 15 years of experience in the industry, providing tax compliance services to individuals and businesses. My expertise lies in tax planning, return preparation, reconciliations, and research. My ability to stay up- to- date on changing tax regulations, as well as my excellent problem- solving skills, have enabled me to reduce client tax burdens and provide the best advice.

Core Skills:

- Tax Planning

- Tax Return Preparation

- Reconciliations

- Research

- Problem- Solving

- Tax Regulations

Responsibilities:

- Preparing and filing accurate tax returns for individual and business clients

- Conducting research on complex taxation matters

- Reconciling accounts and ensuring accuracy of financial statements

- Identifying potential tax savings opportunities for clients

- Keeping up- to- date on changing regulations and laws

- Assisting clients with tax planning and compliance

- Responding to client inquiries and providing timely advice

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Tax Associate resume?

A Tax Associate resume should be carefully crafted to illustrate an individual’s aptitude for understanding tax law and computing taxes accurately. An effective resume should draw attention to the Associate’s education, experience, and technical knowledge. Candidates should include the following in their Tax Associate resumes:

- Professional Summary: A summary of the candidate’s qualifications, experience, and notable achievements.

- Education: A list of educational qualifications and accreditations the candidate holds.

- Work Experience: A list of professional positions the candidate has held in the past, including job titles, companies, and years of service.

- Skills: A list of relevant hard and soft skills for the position.

- Technical Knowledge: A list of the candidate’s technical knowledge, such as software programs, tax law, and accounting principles.

- Awards and Recognition: A list of awards and recognition earned by the candidate.

- Professional Memberships: A list of professional organizations and associations the candidate is a member of.

- Additional Information: Any additional information that may be useful to the hiring manager, such as language fluency, volunteer work, and certifications.

By including this information in a resume, a Tax Associate candidate can demonstrate their credentials and level of expertise in a concise and organized manner.

What is a good summary for a Tax Associate resume?

A Tax Associate resume should provide a comprehensive summary of the skills and qualifications a candidate has that make them an ideal candidate for the role. The summary should highlight experience in tax law, attention to detail, and analytic skills, as well as any experience in preparing and filing taxes. The summary should also outline the candidate’s ability to work with clients and other professionals in the field to ensure accuracy and compliance with regulations. Additionally, a Tax Associate resume should list any certifications and educational qualifications the candidate has that are relevant to the job. Finally, the summary should outline any personal traits, such as a positive attitude and ability to work independently or in a team, that make the candidate stand out. By including these details, a Tax Associate resume can make a candidate stand out to potential employers.

What is a good objective for a Tax Associate resume?

Writing a resume for a Tax Associate job is a daunting task as you need to highlight your specialized skills, knowledge, and experience. It is important to create an objective statement that will grab the attention of the hiring manager and get them to read your resume.

Here are some tips on writing a good objective for a Tax Associate resume:

- Showcase your knowledge and experience: Highlight your specialized knowledge in tax law and accounting principles. Showcase your experience in filing tax returns and assisting clients with their tax needs.

- Demonstrate your problem-solving skills: Point out your ability to identify, analyze, and resolve complex tax issues. Show that you are a creative problem solver who can think outside the box.

- Put your customer service skills to use: Demonstrate your excellent customer service and communication skills. Show that you are highly organized, detail-oriented, and adept at multitasking.

- Prove your dedication to accuracy: Stress your commitment to accuracy and integrity. Show that you understand the importance of accuracy and can be trusted to get the job done correctly.

By following these tips and creating a well-written objective statement, you will be sure to capture the attention of the hiring manager. Good luck with your resume!

How do you list Tax Associate skills on a resume?

Tax Associates are financial professionals who help individuals and businesses with their tax preparation and filing needs. They must have a strong understanding of taxation, accounting, and finances in order to be successful. To make sure potential employers know you have the skills to be a successful Tax Associate, you should list all relevant skills on your resume. Here’s how to list Tax Associate skills on your resume.

- Include all Tax Associate-specific technical skills: This includes any software or coding skills, as well as knowledge of relevant financial regulations.

- List any relevant experience you have: This includes tax preparation, filing, or accounting experience.

- Highlight your organization and communication skills: Tax Associates often work with multiple clients and need to be able to communicate in a clear and organized manner.

- Show your attention to detail: Tax Associates need to be able to review and analyze financial data, so employers need to know that you can pay close attention to details.

- Stress your problem-solving abilities: Tax Associates often have to deal with complex financial issues that require creative solutions.

- Demonstrate your time management skills: Tax Associates need to be able to manage their time and meet deadlines in order to be successful.

What skills should I put on my resume for Tax Associate?

Tax Associates are in demand in many corporate organizations, as they provide key services in managing tax liabilities for businesses. A Tax Associate must have a strong knowledge of the taxation system and laws, as well as the ability to use this knowledge in a variety of situations. When creating your resume, you should include the following skills and qualifications to make your resume stand out:

- Knowledge of taxation laws and regulations: Tax Associates must have a strong understanding of the federal and local laws, regulations, and procedures related to taxation. They should also be able to interpret new regulations and laws as they are introduced.

- Analytical skills: Tax Associates must be able to analyze data and financial information in order to draw accurate conclusions and make efficient decisions.

- Excellent communication skills: Tax Associates must be able to communicate effectively with clients, colleagues, and other professionals in order to explain complex concepts, procedures, and regulations.

- Computer skills: Tax Associates should be proficient in using computers, including using spreadsheet and word-processing software. They should also be able to use specialized tax software to complete their tasks.

- Organizational skills: Tax Associates must have the ability to organize data and documents for efficient processing. They should also be able to prioritize tasks and meet deadlines.

- Attention to detail: Tax Associates should be detail-oriented and have the ability to spot errors and inaccuracies in financial information. In addition, they should have strong problem-solving skills and be able to develop creative solutions to complex problems.

By including these skills and qualifications on your resume, you can demonstrate to employers that you have the skills necessary to be a successful Tax Associate.

Key takeaways for an Tax Associate resume

A tax associate is a professional responsible for managing taxes for individuals, businesses, and other entities. To be successful in this role, you must be highly organized and knowledgeable about the complexities of tax law. A well-crafted resume can help you stand out from the competition and catch the attention of prospective employers. Here are some key takeaways for an effective tax associate resume:

- Highlight Your Relevant Skills: Make sure to highlight any relevant skills that you have, such as accounting, finance, taxation, and mathematics. Also, emphasize any knowledge of tax law and regulations you have.

- Showcase Your Professional Experience: Include any professional experience you have in a related field. This could include experience as a tax accountant or tax preparer.

- Outline Your Education: Outline any relevant educational background you have. This could include a degree in accounting, finance, or taxation.

- Demonstrate Your Strengths: Share any strengths that you have that make you a great fit for a tax associate role. This could include tech proficiency, problem-solving abilities, or strong communication skills.

- Highlight Your Accomplishments: Showcase any accomplishments you have had in the tax field. This could include successfully filing taxes for a high-profile client or resolving a complex tax issue.

By following these key takeaways and including the right information on your tax associate resume, you can increase the chances of getting called in for an interview. Good luck!

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder