Writing a resume for a Tax Analyst role can be a challenging task. As a Tax Analyst you are responsible for analyzing and preparing taxes, researching tax regulations and advising on compliance matters, and must possess a combination of accounting, finance, and legal skills. Your resume should showcase your tax knowledge, technical skills, and ability to provide sound advice. In this guide, we provide you with tips on what to include in your resume and examples of effective resume writing for Tax Analysts. With the right information and guidance, you can write an effective resume and get one step closer to landing the job.

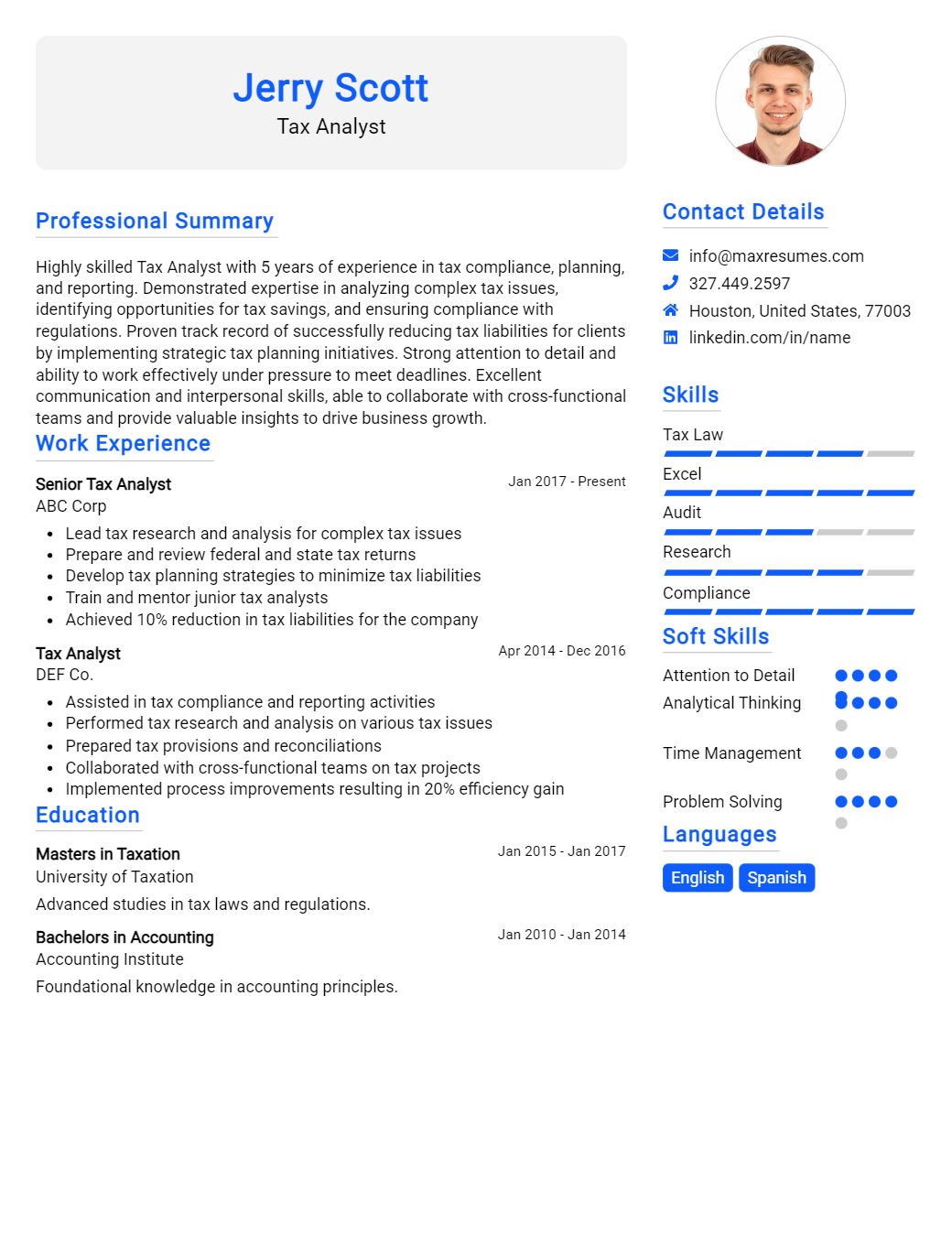

Tax Analyst Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Tax Analyst Resume Examples

John Doe

Tax Analyst

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

A highly organized and detail- focused Tax Analyst with five years of professional experience in the financial services industry. Highly experienced in analyzing tax regulations, preparing complex tax documents, and efficiently managing tax filings. Adept in reconciling financial accounts, preparing tax returns, and accurately assessing taxes. Proven track record of developing strategies to minimize company tax liabilities. Possesses excellent analytical, problem- solving, and communication skills.

Core Skills:

- Tax Analysis

- Financial Account Reconciliation

- Tax Return Preparation

- Tax Planning Strategies

- Advanced Excel Proficiency

- Financial Reports Creation

- Auditing and Compliance

- Complex Tax Document Creation

Professional Experience:

Tax Analyst, ABC Financial Services – Portland, OR

June 2015 – Present

- Perform a review of clients’ tax documents and identify areas of potential tax savings

- Reconcile financial accounts to ensure accurate and timely tax filings

- Prepare tax documents, including 1099 forms and other related documents

- Analyze company financials to determine appropriate tax liabilities

- Develop and execute tax planning strategies to minimize tax burden

- Generate quarterly and yearly financial reports for internal and external use

- Stay abreast of current and upcoming tax regulations to ensure compliance

Tax Analyst, XYZ Financial Services – Portland, OR

March 2013 – May 2015

- Assessed and calculated tax liabilities for clients on a monthly and quarterly basis

- Created detailed tax documents and reports for upper management review

- Reviewed financial statements and identified potential areas of improvement

- Developed and implemented strategies to minimize tax burden for clients

- Ensured accuracy of client tax filings by reviewing and auditing documents

- Developed and maintained a comprehensive database of tax records

Education:

Bachelor of Science in Accounting, Portland State University – Portland, OR – 2012

Tax Analyst Resume with No Experience

Recent college graduate with a degree in Business, specializing in Tax Analysis. Possesses an eagerness to learn and advance in the field with a combination of analytical and problem- solving skills.

Skills:

- Ability to interpret and analyze complicated data

- Proficient in Microsoft Excel and software programs

- Analytical and critical thinking

- Excellent organizational and communication skills

Responsibilities:

- Reviewing financial documents for accuracy

- Developing strategies to ensure compliance with applicable tax regulations

- Analyzing financial data and records to identify discrepancies

- Researching and resolving any issues that arise with state, federal, and local taxes

- Working with other teams to identify potential tax savings opportunities

- Preparing reports and making presentations on tax- related topics

- Assisting with the preparation of tax returns and ensuring accuracy of information

Experience

0 Years

Level

Junior

Education

Bachelor’s

Tax Analyst Resume with 2 Years of Experience

Tax Analyst with 2 years of experience providing accurate taxation services to clients. Possesses sound knowledge of taxation laws, regulations, and compliance requirements. Adept at analyzing financial statements, researching and resolving tax discrepancies, and preparing various tax reports. Skilled in dealing with clients and auditors with a professional and friendly approach.

Core Skills:

- Tax Analysis

- Tax Accounting

- Regulatory Compliance

- Financial Reporting

- Tax Returns

- Client Relations

- Data Analysis

- Problem- solving

- Attention to Detail

Responsibilities:

- Prepared various tax reports in accordance with local and federal tax regulations

- Analyzed financial statements, estimated taxes, and calculated tax liabilities

- Developed and implemented tax strategies to reduce tax liabilities

- Researched and resolved discrepancies in tax liabilities

- Assisted clients with filing tax returns, amendments, and extensions

- Negotiated with auditors to resolve tax discrepancies

- Maintained accurate records and updated taxation databases

- Processed payments, refunds, and credits with accuracy

- Answered client inquiries, provided assistance, and updated them on tax policies

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Tax Analyst Resume with 5 Years of Experience

A motivated and analytical Tax Analyst with 5 years of experience in tax compliance, reporting, and transaction processing. Adept in researching and analyzing sophisticated tax issues to find resolutions and apply relevant tax laws and regulations. Experience in consulting with external clients and internal stakeholders to understand their business needs. Skilled in quickly and accurately preparing tax returns, mitigating risk, and providing tax advice.

Core Skills:

- Tax Research

- Tax Auditing

- Tax Planning

- Tax Compliance

- Tax Law

- Tax Returns Preparation

- Risk Mitigation

- Tax Consulting

- Data Analysis

Responsibilities:

- Conducted research and analysis to ensure complex tax returns and data were in accordance with the applicable tax laws and regulations.

- Prepared and recommended the completion of tax returns, ensuring accuracy and compliance with federal, state, and local tax laws.

- Assisted in resolving complex and sophisticated tax issues, researching relevant tax laws and regulations to identify solutions.

- Provided tax advice and guidance to internal stakeholders and external customers in accordance with US and international tax regulations.

- Conducted tax audits to ensure compliance with federal, state, and local regulations, ensuring accuracy of tax returns.

- Monitored and prepared reports on tax compliance and identified potential risks and recommended appropriate solutions.

- Collaborated with internal stakeholders and external customers to understand their business needs and provided tax consulting services.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Tax Analyst Resume with 7 Years of Experience

Highly organized, motivated, and detail- oriented Tax Analyst with 7 years of experience leading individuals and groups to effectively prepare, and analyze tax returns. Excels in creating strategies to minimize tax liabilities and increase returns. Possesses the ability to work independently and collaborate in a team environment.

Core Skills:

- Proficient in tax research and analysis

- Knowledge of federal, state, and local tax regulations

- Able to complete complex tax returns accurately and efficiently

- Excellent communication and interpersonal skills

- Strong time management and organizational skills

- Computer literate with working knowledge of Microsoft Office

- High aptitude for problem- solving

- Strong understanding of accounting principles and practices

Responsibilities:

- Analyze financial statements to determine tax liabilities

- Prepare and review federal, state, and local tax returns

- Research and recommend tax strategies to minimize liabilities

- Provide technical tax support to clients and colleagues

- Document and track all tax- related records and filing deadlines

- Develop and present tax- related advice to clients

- Maintain current knowledge of tax laws and regulations to ensure compliance

- Monitor tax payments and refunds to ensure accuracy and completeness.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Tax Analyst Resume with 10 Years of Experience

Experienced Tax Analyst with 10 years of broad- based experience in tax preparation, research, and analysis. Leveraging in- depth knowledge of taxation principles and regulations to interpret, review, and analyze complex financial documents. Possessing excellent client management, organizational, and problem- solving skills.

Core Skills:

- Tax Research

- Tax Preparation

- Tax Audit

- Financial Analysis

- Tax Compliance

- Problem Solving

- Client Management

- Regulatory Compliance

Responsibilities:

- Assisted in the preparation of federal, state, and local tax returns

- Ensured accuracy of tax documents and compliance with applicable regulations

- Researched tax laws and regulations to determine tax liabilities

- Conducted complex tax analysis of financial documents and tax returns

- Analyzed financial records to identify potential deductions and credits

- Generated monthly financial reports to track company’s tax obligations

- Prepared and submitted tax audit documentation to tax authorities

- Monitored changes in tax laws and regulations to ensure compliance

- Assisted the tax manager in training new personnel on tax regulations and filing requirements

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Tax Analyst Resume with 15 Years of Experience

Highly skilled Tax Analyst with 15 years of experience in the field of taxation. Possesses strong analytical and problem- solving abilities to develop, analyze, and implement tax strategies for increased efficiency and cost management. Skilled in the preparation of financial and tax reporting, analyzing financial data, driving continuous process improvement and maintaining accurate financial records. Expert in evaluating and advising on the impact of business decisions with regards to the taxes.

Core Skills:

- Tax Planning

- Tax Returns Preparation

- Financial Management

- Financial Analysis

- Tax Law Compliance

- Accounting

- Auditing

- Data Analysis

- Risk Analysis

Responsibilities:

- Develop and execute effective tax strategies

- Analyze and review financial records

- Prepare and file tax returns to the IRS

- Provide assistance on complex tax issues

- Assess the potential tax liabilities and recommend areas of improvement

- Review contracts and other legal documents for tax implications

- Perform regular audits of tax accounts and records

- Assist in the tax planning process

- Prepare reports on taxes due and taxes paid

- Prepare tax forecasts and budgets

- Research and analyze new tax laws and regulations

- Ensure tax compliance with federal, state, and local laws and regulations

- Provide support to the accounting team on tax matters

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Tax Analyst resume?

Tax Analysts are in high demand in the finance industry, and if you’re looking for a job in this field, you’ll need an impressive resume. To make sure your resume stands out and highlights all of your qualifications, here are a few things you should include in your tax analyst resume:

- Comprehensive and detailed knowledge of tax laws and regulations: As a tax analyst, you’ll need to be up to date on all federal and state tax laws and regulations. Make sure to include any courses you’ve taken that are related to tax law and any certifications you’ve obtained.

- Expertise in tax preparation and filing: Tax analysts must be experts in tax preparation and filing. Include any relevant experience you have preparing and filing taxes, as well as any software programs you are familiar with.

- Analytical and problem-solving skills: Tax analysts must be able to analyze and interpret complex tax regulations and make informed decisions. Be sure to mention any analytical skills you have and any financial problems you have solved in the past.

- Attention to detail: Tax analysts must have excellent attention to detail in order to identify and correct errors in financial records. Highlight any relevant experience or training you have that demonstrates your attention to detail.

- Excellent communication skills: As a tax analyst, you’ll need to be able to clearly communicate with clients and colleagues, both verbally and in writing. Mention any courses you’ve taken in communication or public speaking, as well as any experience you have working in a team environment.

By highlighting your qualifications in these areas, you’ll be sure to craft an impressive tax analyst resume that will help you stand out from the competition.

What is a good summary for a Tax Analyst resume?

A Tax Analyst resume should capture the prospective employer’s attention with a compelling summary that shows the candidate’s knowledge of tax law and financial analysis, as well as their ability to identify tax savings opportunities, meet deadlines and provide accurate tax advice. The summary should emphasize the candidate’s experience in both individual and corporate taxation, as well as any relevant certifications or credentials. It should also mention their strong attention to detail and strong communication skills. Finally, the summary should mention the candidate’s ability to stay up to date with changes to the tax codes, ensuring compliance with all applicable laws and regulations.

What is a good objective for a Tax Analyst resume?

A Tax Analyst is an invaluable asset for any financial organization. It is a specialized skill set that requires a combination of tax knowledge and accounting expertise. When writing a resume for this position, having a well-crafted objective statement tailored to the job description can help set you apart from the competition. Here are some tips on how to write a good objective for a Tax Analyst resume:

- Be Specific: When creating your objective statement, make sure to include the specific title of the position you are applying for, such as “Tax Analyst”. This will let potential employers know you understand the role.

- Highlight Skills and Qualifications: Include any applicable skills and qualifications, such as tax expertise, accounting experience, and familiarity with relevant software. This will show potential employers that you have the necessary knowledge and abilities.

- Showcase Your Commitment: Let potential employers know that you are committed to the work by using language such as “seeking to utilize my tax knowledge and accounting expertise to contribute to the success of your organization”.

By following these tips, you will be able to craft an effective objective statement for your Tax Analyst resume that will help you stand out from the competition. Good luck with your job search!

How do you list Tax Analyst skills on a resume?

Tax Analysts are an integral part of many businesses, as they are responsible for ensuring accurate tax filings, compliance with tax regulations, and the preparation of financial reports. As such, it is essential for those interested in this position to possess a wide range of skills and knowledge. When creating a resume for a Tax Analyst position, it is important to highlight your skills and qualifications to stand out from the competition. Here are some key skills and qualifications to list on a Tax Analyst resume:

- In-depth knowledge of local, state and federal tax laws and regulations: Tax Analysts should have an extensive understanding of the various tax laws and regulations in order to properly advise clients on their tax matters.

- Analytical and problem-solving skills: Tax Analysts must be able to analyze complex data and financial documents to identify discrepancies and potential tax savings opportunities. They must also be able to identify potential risks and formulate solutions.

- Advanced communication skills: Tax Analysts must be able to effectively communicate complex tax information to their clients in a clear and concise manner. They must also be able to provide customers and colleagues with clear instructions on tax filing procedures and regulations.

- Detail-oriented: As Tax Analysts are responsible for managing and adhering to complex tax laws, they must be detail-oriented in order to ensure accuracy and compliance.

- Proficient in Microsoft Excel: Tax Analysts must be proficient in using Excel in order to complete tax calculations and financial projections.

- Adaptable: Tax Analysts must be able to quickly adjust to changes in tax laws and regulations. They must be able to quickly understand new information and apply it to their work.

By listing these skills and qualifications on your resume, you will be able to demonstrate that you possess the necessary skills and qualifications needed to succeed as a Tax Analyst.

What skills should I put on my resume for Tax Analyst?

A resume for a Tax Analyst should include technical and analytical skills that demonstrate your knowledge of tax preparation, accounting, and financial analysis. Additionally, employers may appreciate soft skills such as communication, organization, and problem-solving. When creating your resume, you should include the following key skills:

- Tax Preparation: Tax Analysts are responsible for preparing taxes for both individuals and businesses. This includes calculating refunds or payments due and filing on behalf of the client.

- Accounting: Tax Analysts must have an understanding of accounting principles, such as balance sheets and income statements. This knowledge is necessary to ensure that taxes are calculated correctly and that any potential tax savings are identified.

- Financial Analysis: A Tax Analyst must be able to analyze financial statements and determine the potential effect of taxes on the financial situation of the client.

- Communication: Tax Analysts must be able to communicate effectively with clients, colleagues, and other stakeholders. This includes being able to explain complex financial and tax information in a way that is easy to understand.

- Organization: Tax Analysts must be able to manage multiple projects and keep track of deadlines. This requires strong organizational skills and the ability to prioritize tasks.

- Problem-Solving: A Tax Analyst must be able to troubleshoot and find solutions to complex tax problems. This requires analytical thinking and the ability to identify the best course of action.

Key takeaways for an Tax Analyst resume

If you’re a Tax Analyst looking for a job, you’ll need to make sure your resume stands out from the competition. There are a few key takeaways that you should keep in mind when writing your resume.

First, make sure to highlight your educational background. A Tax Analyst should have a strong understanding of the various tax laws, regulations and processes. Make sure to list any relevant degrees or certifications that you have obtained.

Second, emphasize your experience in the tax field. This can include a list of any tax-related positions you have held in the past as well as any volunteer or internship experience that you may have. Employers want to know that you have the knowledge and experience to handle the position.

Third, showcase your problem-solving abilities. It’s important that Tax Analysts are able to quickly identify issues and find solutions. Explain any difficult situations you have faced in the past and how you successfully handled them.

Fourth, demonstrate your technical skills. Tax Analysts are required to be proficient in various software applications, so make sure to list any programs you are comfortable using.

Finally, make sure to include any awards or recognition you have received in the field of taxation. This will show employers that you are not only knowledgeable, but also successful in the field.

By following these key takeaways, you’ll be able to create an impressive resume that will make you stand out from the rest.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder