Are you a senior tax accountant looking to apply for a new job? Writing a compelling resume is the key to getting noticed by a potential employer. A great resume will grab the attention of a recruiter and make them more likely to contact you for an interview. This article provides a comprehensive guide on how to write a great senior tax accountant resume, including examples and tips for crafting an effective resume. Follow this guide to ensure your resume stands out among other job applicants and lands you the job you want.

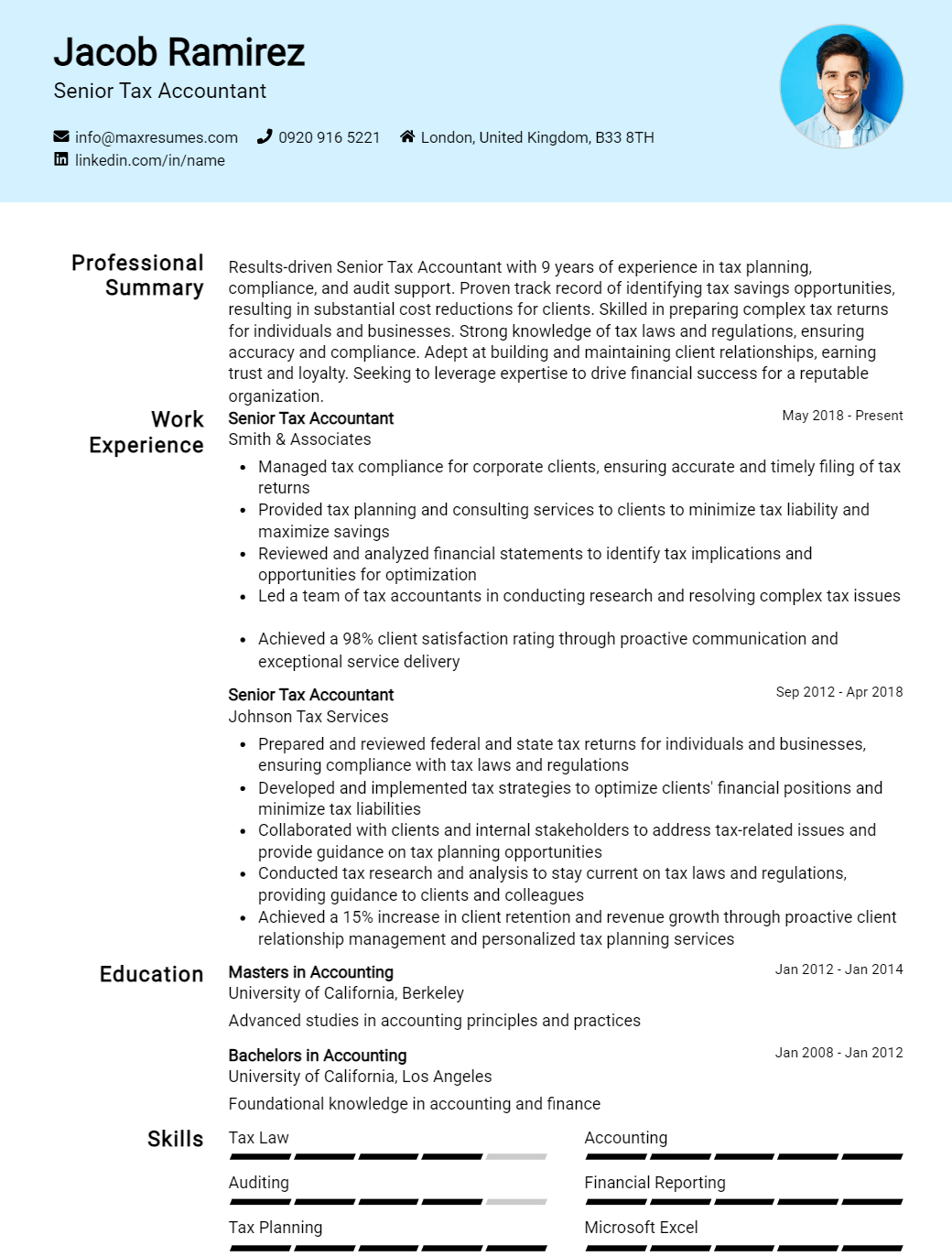

Senior Tax Accountant Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Senior Tax Accountant Resume Examples

John Doe

Senior Tax Accountant

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

A highly experienced and motivated Senior Tax Accountant with over 9 years of experience providing comprehensive financial support to clients and their businesses. Possesses excellent problem- solving skills, strong attention to detail, and a well- developed ability to interpret and explain complex tax concepts. Utilizes specialized software and tax knowledge to accurately prepare and file tax returns for clients and businesses. A reliable and hardworking professional with excellent communication and interpersonal skills.

Core Skills:

- Proficient in tax accounting concepts and principles

- Extensive experience in preparing and filing tax returns

- Knowledge of IRS regulations and filing requirements

- Computer and software proficiency

- Exceptional problem- solving and analytical skills

- Excellent communication and interpersonal skills

- Ability to work independently and in teams

Professional Experience:

Senior Tax Accountant, ABC Tax Services – New York, NY (2015- Present)

- Prepare tax returns for individuals and businesses to ensure accuracy and compliance with IRS regulations

- Review client documents and financial statements to assess potential tax liabilities and minimize tax- related risks

- Analyze financial data and identify tax- saving opportunities to maximize tax benefit

- Monitor and assess changes in regulations to ensure compliance with all relevant tax regulations

- Provide advice and assistance to clients with any tax- related inquiries

- Liaise with the IRS and other government agencies to resolve tax issues

Tax Accountant, XYZ Tax Services – New York, NY (2013- 2015)

- Compiled tax returns and financial statements to ensure accuracy and compliance with IRS regulations

- Analyzed financial data to identify potential tax liabilities and develop tax- saving strategies

- Reviewed and updated tax information regularly to keep up- to- date with changes in regulations

- Collaborated with other departments to provide advice and assistance with tax- related matters

- Assisted with resolving any IRS or other

Senior Tax Accountant Resume with No Experience

Recent business school graduate looking to pursue a career as a Senior Tax Accountant. Possess a deep understanding of business finance, accounting principles, and tax laws and regulations. Highly organized, detail- oriented, and motivated to succeed in a challenging environment.

Skills

- Knowledge of accounting principles

- Advanced understanding of tax laws and regulations

- Highly organized

- Detail- oriented

- Strong communication and interpersonal skills

- Proficient in Microsoft Office Suite

- Ability to multitask and meet deadlines

Responsibilities

- Research new tax laws and regulations

- Prepare and review tax returns

- Analyze financial statements

- Manage client relationships

- Update and maintain accounting records

- Assist with auditing processes

- Provide tax planning and advice to clients

Experience

0 Years

Level

Junior

Education

Bachelor’s

Senior Tax Accountant Resume with 2 Years of Experience

Highly organized and detail- oriented Senior Tax Accountant with two years of experience in tax preparation and filing. Adept in preparing financial documents and reports, making calculations, and producing complex tax returns. Exceptional knowledge of financial regulations and IRS compliance processes. Proven ability to develop and maintain working relationships with clients, managers, and other team members.

Core Skills

- Tax Return Preparation

- Financial Statement Analysis

- Account Reporting

- Auditing

- IRS Compliance

- Financial Regulations

- Problem Solving

- Data Entry

- Budget Forecasting

Responsibilities

- Prepared and filed complex tax returns for individuals and businesses

- Reviewed accounts and financial statements for accuracy

- Advised clients on tax savings opportunities

- Assessed potential tax liability and provided tax planning strategies

- Created and maintained client tax records and databases

- Researched and analyzed IRS regulations and updated filing procedures accordingly

- Ensured compliance with federal, state, and local tax laws and regulations

- Prepared reports to senior management on tax returns and financial data

- Collaborated with management, staff, and clients to resolve complex tax issues

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Senior Tax Accountant Resume with 5 Years of Experience

Highly experienced Senior Tax Accountant with 5 years of experience in taxation and finance. Skilled in preparing and filing tax returns for both individuals and businesses, analyzing financial data and developing strategies for minimizing tax liabilities. Adept at handling complex tax issues, managing audits and providing solutions for tax- related concerns. Possesses an in- depth understanding of federal, state and local tax regulations.

Core Skills:

- Tax Compliance

- Financial Reporting

- Auditing

- Risk Management

- Tax Planning

- Tax Research

- Data Analysis

- Problem- Solving

- Regulatory Compliance

Responsibilities:

- Prepared, reviewed and filed tax returns for individuals and businesses.

- Analyzed financial data and identified areas for cost reduction, tax savings, and improved efficiency.

- Developed and implemented strategies to reduce tax liability and maximize profits.

- Managed audits by federal, state and local tax authorities.

- Assisted in the preparation of financial statements and budgets.

- Researched and complied with applicable federal, state and local tax regulations.

- Developed problem- solving strategies to address complex tax issues.

- Provided solutions and recommendations to resolve tax- related matters.

- Reviewed and evaluated corporate, partnership and trust information.

- Advised clients on tax regulations and planning strategies.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Senior Tax Accountant Resume with 7 Years of Experience

I am a highly experienced Senior Tax Accountant with 7 years of experience in the field. My core competences include understanding complex financial statements, performing tax computations and returns, and helping to identify areas of tax savings and tax compliance. I have a deep knowledge of the latest tax laws and regulations, and I am confident in my ability to help clients confidently achieve their goals and objectives.

Core Skills:

- Tax returns preparation

- Financial statement analysis

- Tax compliance

- Tax planning and consulting

- Tax research

- Financial analysis

- Advanced Excel skills

- Tax software proficiency

Responsibilities:

- Calculate and prepare tax returns including individual, corporate, partnership, and non- profit entities

- Review financial statements to ensure accuracy and compliance

- Identify areas of tax savings and tax compliance

- Identify and analyze complex tax issues

- Research various tax laws and regulations to ensure compliance

- Prepare and present tax analysis for clients

- Advise customers on different tax strategies and approaches

- Provide insight and advice on tax planning and consultancy

- Manage client inquiries and complaints in a timely manner

- Manage and resolve tax disputes with the authorities.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Senior Tax Accountant Resume with 10 Years of Experience

A highly motivated, trustworthy and accomplished Senior Tax Accountant with 10+ years of experience in accounting and tax preparation. Adept at managing and analyzing financial data, creating reports, and developing strategies for minimizing tax liabilities. Possesses a keen understanding of GAAP principles and tax regulations. Possesses expertise in staying up to date with changes in tax law and handling complex tax issues.

Core Skills:

- Tax Planning & Research

- Accounting & Auditing

- Financial Reporting

- Tax Law Compliance

- Advanced Tax Strategies

- Budget & Cost Control

- Data Analysis

- GAAP Compliance

- Account Reconciliation

- Risk Management

Responsibilities:

- Prepare, review, and file federal, state, and local tax returns in a timely and accurate manner

- Provide assistance in the preparation of financial statements and other financial information

- Research tax issues and develop strategies to minimize tax liabilities

- Review and suggest changes to existing financial policies and procedures

- Analyze and reconcile accounts, prepare journal entries and maintain financial ledgers

- Assist in the preparation of quarterly and annual reports

- Assist with audits and other tax related projects

- Stay up to date on changes in tax law and regulations

- Maintain records and prepare reports for management review

- Provide tax consulting services to clients

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Senior Tax Accountant Resume with 15 Years of Experience

Highly skilled Senior Tax Accountant with 15 years of experience in tax preparation and analysis. Expert in using tax software and financial tools to analyze data and prepare summaries. Possesses a strong understanding of tax laws, principles and regulations. Experienced in preparing individual and business returns, developing financial strategies, and preparing complicated tax reports. Able to collaborate with clients and other tax professionals to ensure accuracy and compliance with set regulations.

Core Skills:

- Tax Preparation

- Tax Analysis

- Financial Strategies

- Tax Compliance

- Tax Software

- Accounting Principles

- Financial Reports

- Communication

- Data Analysis

- Negotiation

Responsibilities:

- Preparing individual and business tax documents and tax returns

- Analyzing financial data and preparing summaries and reports

- Developing financial strategies to optimize tax benefits

- Ensuring accuracy and compliance with set regulations

- Collaborating with clients and other tax professionals

- Negotiating with government agencies to settle tax disputes

- Assisting with audits for businesses and individuals

- Answering tax- related inquiries from clients

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Senior Tax Accountant resume?

A Senior Tax Accountant resume should contain all the necessary information that pertains to the job. It should be professional and concise, highlighting the qualifications, experience, and skills that make the individual a strong candidate. In order to ensure that the resume best demonstrates the applicant’s qualifications, the following should be included:

- Leadership experience: List any positions of leadership held previously. Include the size and type of organization, the duration of the role, and any accomplishments achieved.

- Tax preparation skills: List any and all tax preparation software that the applicant is proficient in, as well as any seminars or classes attended.

- Tax research skills: Demonstrate any tax research methods and techniques the applicant is familiar with.

- Regulatory experience: Show any experience the applicant may have in regards to staying up-to-date with the latest tax laws and regulations.

- Audit experience: Demonstrate any experience the applicant may have in regards to audits, including the types of audits they may have performed.

- Communication skills: Describe any experience with verbal and written communication, as well as any public speaking engagements.

- Problem-solving abilities: Describe any experience with problem-solving, and success in resolving tax-related issues.

- Professional associations: List any professional associations the applicant is a member of, as well as any related certifications.

- Ability to work under pressure: Describe any experience with meeting deadlines and any other tasks that may require attention, quickly and efficiently.

By including these details, a Senior Tax Accountant resume will demonstrate the prospective employee’s qualifications, experience, and skills. This will help the applicant stand out from the competition and increase the chances of securing the desired position.

What is a good summary for a Senior Tax Accountant resume?

A Senior Tax Accountant is an accountant who specializes in taxation and compliance. They are responsible for preparing and filing federal, state, and local tax returns, as well as researching tax laws and regulations to provide advice to clients. A strong summary for a Senior Tax Accountant resume should showcase the applicant’s experience in preparing and submitting tax returns and their knowledge of tax laws, as well as their ability to work collaboratively with clients and colleagues. It should also highlight any other relevant certifications or qualifications that the applicant may have. A good summary for a Senior Tax Accountant resume should demonstrate the applicant’s expertise and commitment to accuracy, as well as their enthusiasm for working with clients and providing them with sound advice and guidance.

What is a good objective for a Senior Tax Accountant resume?

When creating a resume for a Senior Tax Accountant position, one of the most important aspects is the objective. A concise and impactful objective outlines the goals of the resume and can help you stand out to potential employers.

Here are some good objectives for a Senior Tax Accountant resume:

- To obtain a full-time Senior Tax Accountant position in a reputable firm where I can apply my accounting expertise and experience to effectively provide comprehensive tax services.

- To utilize my comprehensive knowledge of tax regulations to ensure compliance with government requirements.

- To collaborate with team members to successfully manage multiple tax projects and deadlines.

- To leverage my problem-solving skills when researching and resolving complex tax issues.

- To use my excellent customer service skills to provide support and advice to clients.

How do you list Senior Tax Accountant skills on a resume?

The role of a Senior Tax Accountant requires a high level of knowledge and skill in the area of taxation. When listing your skills on a resume for this position, you should focus on the key competencies and abilities needed for success in the role. Here are some of the skills that should be included in your Senior Tax Accountant resume:

- In-depth knowledge of tax regulations and laws: Senior Tax Accountants need to be familiar with tax codes and regulations in their jurisdiction.

- Excellent interpersonal and communication skills: Senior Tax Accountants need to be able to effectively communicate and negotiate with their clients and other stakeholders.

- Accuracy and attention to detail: Senior Tax Accountants need to be able to pay attention to details and provide accurate tax calculations.

- Computer literacy: Senior Tax Accountants must be proficient in using tax software and other computer programs to efficiently manage client accounts.

- Project management experience: Senior Tax Accountants must be able to manage multiple projects at once and meet deadlines.

- Analytical skills: Senior Tax Accountants need to be able to analyze complex financial data and make informed decisions.

By including these skills in your resume, you can demonstrate to potential employers that you have the required skills to excel in the role of a Senior Tax Accountant.

What skills should I put on my resume for Senior Tax Accountant?

When crafting a resume for a senior tax accountant position, it’s important to demonstrate the skills you have that are relevant to the job. Not only do you need to display your technical understanding of taxes and your working knowledge of tax preparation software, but you also need to prove that you have the managerial skills and experience to supervise and train other staff members. Here are some skills to consider adding to your resume:

- Tax preparation: Demonstrate your proficiency in preparing taxes for individuals and businesses, including knowledge of local, state, and federal tax laws.

- Software proficiency: Detail your expertise in tax software programs such as TurboTax, ProSeries, and TaxAct.

- Research: Show that you can research and interpret tax regulations and rulings to provide accurate advice to clients.

- Team management: Highlight any experience you have in managing and training teams of tax professionals.

- Communication: Emphasize your ability to effectively communicate complex tax concepts to clients and colleagues.

- Problem solving: Demonstrate your adeptness in identifying and resolving issues related to tax accounting.

- Attention to detail: Make sure to include your ability to review financial documents and identify errors or discrepancies.

- Organizational skills: Showcase your ability to manage a large workload and meet tight deadlines.

Key takeaways for an Senior Tax Accountant resume

If you are a senior tax accountant, your resume should be a clear representation of your experience and qualifications. By emphasizing your key skills and accomplishments, you can stand out from the competition and secure the job you desire. Here are some key takeaways to keep in mind when crafting your resume:

- Highlight Your Tax Qualifications: Your resume should include all relevant certifications, such as certification as a public accountant or as an Enrolled Agent with the IRS. Also, include any information on continuing education courses and other qualifications related to tax.

- Highlight Experience: Include any relevant work experience and accomplishments, such as tax planning and advice, filing federal and state taxes, and conducting audit and review of returns.

- Focus on Specifics: Quantify your accomplishments. If you’ve saved clients money by reducing the amount of taxes owed, include the amount. If your work has led to a successful audit or appeal, include that as well.

- Use Industry-Specific Language: Use language that is specific to the field of tax accounting. This will help the hiring manager understand your level of expertise.

- Include Technology Skills: Include any proficient or expert skills in tax software, such as QuickBooks, Taxwise, and ProSeries.

By highlighting your qualifications and experience in a clear and concise manner, you can create a resume that will stand out to prospective employers. Good luck on your job search!

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder