Writing a resume for a senior credit analyst position can be a daunting task. For the most part, it involves taking the time to create a winning document that incorporates all the essential information required by potential employers. A senior credit analyst should possess experience in the field and demonstrate leadership ability. To make the job search easier, we have compiled a resume writing guide and included several examples to help you create an impactful resume. With the right approach and our resume writing tips, you will have a winning resume in no time.

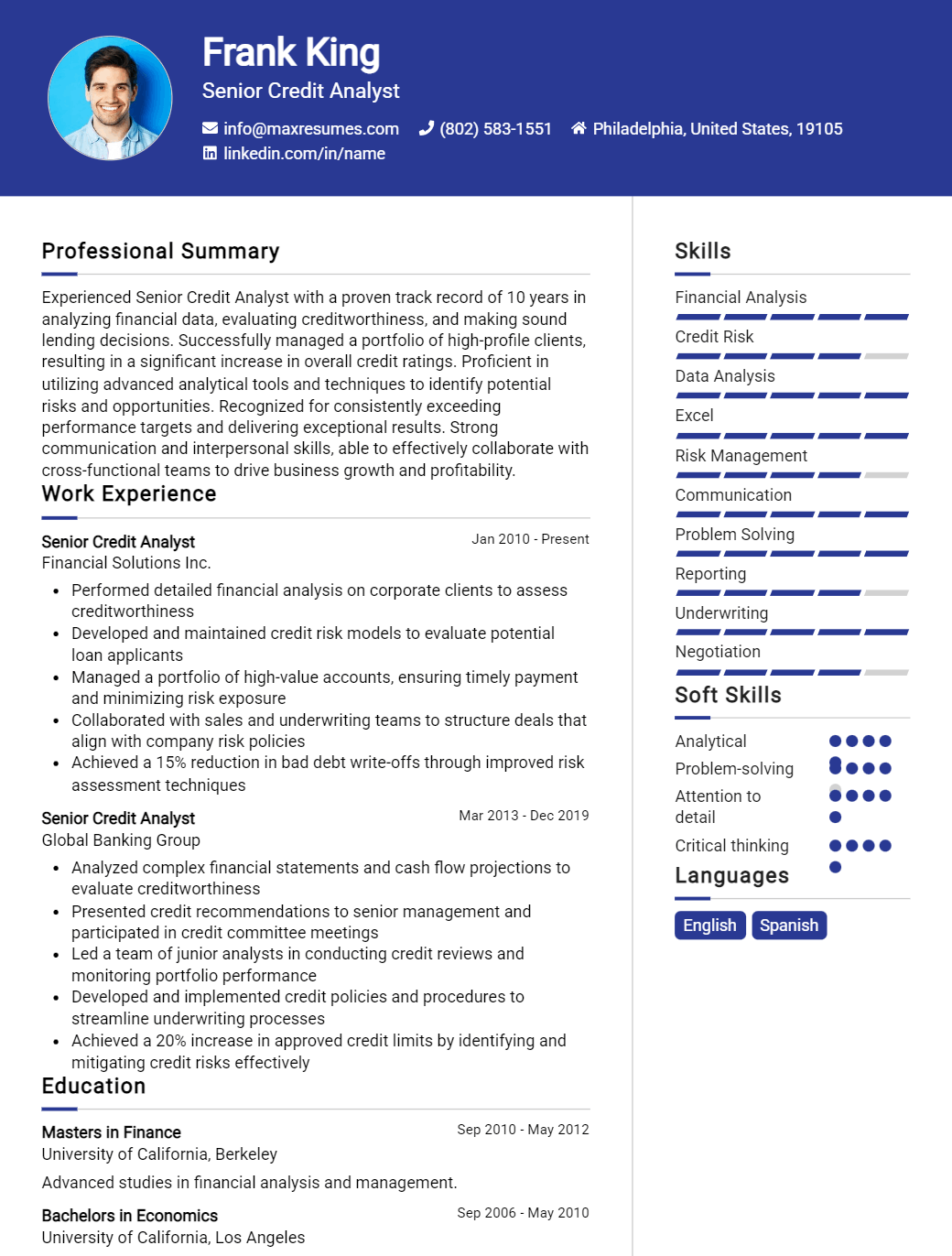

Senior Credit Analyst Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Senior Credit Analyst Resume Examples

John Doe

Senior Credit Analyst

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

An experienced Senior Credit Analyst with over 10 years of experience in the financial services industry. Possesses expertise in the areas of credit risk assessment, loan structuring, portfolio management, credit analytics and financial analysis. Adaptable and highly skilled at executing credit reviews and analysis with an emphasis on identifying and mitigating risk. Thrives in a fast- paced environment and is passionate about maintaining high professional standards in all areas of work.

Core Skills:

- Credit Analysis

- Risk Assessment

- Loan Structuring

- Portfolio Management

- Financial Analysis

- Data Analysis

- Problem Solving

- Credit Scoring

- Credit Monitoring

- Regulatory Compliance

Professional Experience:

Credit Analyst, ABC Bank – Houston, TX

June 2015 – Present

- Perform in- depth credit analysis and underwriting of complex loan requests including the evaluation of financial statements, collateral analysis, and debt service coverage.

- Conduct loan and portfolio reviews to identify potential risk and compliance issues.

- Perform credit analysis and review of documentation for real estate transactions.

- Develop and maintain a portfolio of credit and loan documents.

- Monitor and review loan performance and prepare reports and analyses on the portfolio.

- Review credit reports and ensure compliance with established internal guidelines.

Credit Analyst, XYZ Bank – San Francisco, CA

February 2009 – May 2015

- Developed and maintained portfolio of credit and loan documents.

- Conducted in- depth analysis and underwriting of complex loan requests.

- Assessed financial statements, collateral analysis, and debt service coverage.

- Conducted loan and portfolio reviews to identify potential risk and compliance issues.

- Monitored loan performance and prepared reports and analyses on the portfolio.

- Reviewed credit reports and ensured compliance with established internal guidelines.

Education:

MBA, Finance – University

Senior Credit Analyst Resume with No Experience

Highly dedicated and motivated Senior Credit Analyst with over 7 years of experience in financial analysis, credit risk assessment, and data management. Proven track record of making sound decisions and recommendations based on creditworthiness of customers and financial standing of companies. Possesses deep analytical and problem- solving skills, able to make sense of complex data. A team player with excellent communication skills and a passion for creating reliable credit policies and procedures.

Skills:

- Financial Analysis

- Credit Risk Assessment

- Data Management

- Analytical Thinking

- Problem- solving

- Communication

- Credit Policies and Procedures

Responsibilities:

- Analyze financial statements, credit reports, and other documents to determine the creditworthiness of customers.

- Monitor customer accounts to ensure timely payments.

- Develop and implement credit policies and procedures to assess and manage risk.

- Collaborate with internal and external stakeholders to establish credit limits, payment terms, and funding sources.

- Monitor credit trends to identify potential risks and develop strategies to mitigate them.

- Provide guidance and advice to business units on credit and financial matters.

- Keep up to date with industry best practices and regulatory changes to ensure compliance.

Experience

0 Years

Level

Junior

Education

Bachelor’s

Senior Credit Analyst Resume with 2 Years of Experience

Highly experienced and dedicated Senior Credit Analyst with more than 2 years of experience in risk assessment and credit analysis. Proven track record in supporting successful risk and financial management in the banking and financial services sector. Possess a deep understanding of credit and loan procedures, including financial analysis and financial reporting. Committed to maintaining a safe, secure and profitable lending environment through detailed risk assessment.

Core Skills:

- Credit Analysis

- Financial Reporting

- Risk Assessment

- Financial Analysis

- Loan Procedures

- Regulatory Compliance

- Banking Policies

- Data Modeling

- Problem Solving

- Team Leadership

Responsibilities:

- Analyzed and assessed credit risk for loan products and services.

- Assessed customer creditworthiness, utilizing various financial analysis techniques.

- Developed and implemented credit risk models and processes to identify and manage potential losses.

- Conducted in- depth financial analysis on companies and industries to evaluate loan applications.

- Developed financial models to analyze and assess credit risk.

- Developed and implemented policies, procedures and processes to ensure regulatory compliance.

- Reviewed credit applications and documentation to ensure accuracy and compliance.

- Performed detailed reviews and analysis of loan portfolios to identify emerging risks.

- Evaluated loan products and services to ensure profitability and return on investment.

- Developed and maintained relationships with internal customers to ensure customer satisfaction.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Senior Credit Analyst Resume with 5 Years of Experience

Highly skilled Senior Credit Analyst with 5 years of experience in financial analysis, loan assessment, and credit risk management. Proven ability to assess the creditworthiness of clients, make sound credit decisions, and identify potential credit risks. Skilled in analyzing financial statements and credit reports, as well as using data management and financial software. Experienced in developing credit policies and procedures and developing credit ratings. Passionate about helping clients secure the right credit opportunities while upholding the highest standards of financial accountability.

Core Skills:

- Financial Analysis

- Loan Assessment

- Credit Risk Management

- Creditworthiness Assessment

- Financial Statement Analysis

- Credit Report Analysis

- Data Management

- Financial Software

- Credit Policies & Procedures

- Credit Ratings

Responsibilities:

- Analyzed corporate financial statements and credit reports to assess creditworthiness and identify potential credit risks.

- Developed and maintained credit policies and procedures to ensure adherence to credit regulations.

- Conducted in- depth reviews of customers’ financial information, cash flow, and projections of future performance.

- Evaluated and recommended changes to existing credit policies and procedures.

- Developed and maintained credit ratings based on financial data.

- Monitored customer accounts to ensure compliance with credit policies and regulations.

- Prepared detailed reports on credit review findings and credit ratings.

- Collaborated with internal teams to ensure effective credit risk management.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Senior Credit Analyst Resume with 7 Years of Experience

Highly experienced Senior Credit Analyst with 7+ years of experience in assessing creditworthiness. Adept in analyzing financial statements and banking records to evaluate the credit worthiness of entrepreneurs and individual borrowers. Possess excellent financial acumen and knowledge of credit regulations, providing sound advice to financial officers and in- depth credit analysis.

Core Skills:

- Comprehensive knowledge of Credit Analysis

- In- depth expertise in financial statement analysis

- Proficient in loan underwriting, credit monitoring and financial analysis

- Excellent understanding of banking regulations

- Sound analytic and problem- solving skills

- Proficient in using credit analysis software

Responsibilities:

- Analyzing financial statements, credit reports, and other information for assessing creditworthiness of customers.

- Developing and maintaining relationships with loan officers and other stakeholders.

- Assessing customer financial statements and its impact on creditworthiness.

- Assisting in developing and evaluating loan packages.

- Performing various risk assessments and credit ratings.

- Generating reports on risk and financial analysis of loan applicants.

- Monitoring loan payments and other financial transactions.

- Evaluating customer creditworthiness and recommending credit limits.

- Analyzing financial trends, industry developments, and other related trends.

- Providing sound advice and support to financial officers.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Senior Credit Analyst Resume with 10 Years of Experience

Highly organized and analytical Senior Credit Analyst with 10 years of experience in the banking and finance industry. Skilled in risk assessment, loan evaluation, and financial analysis. Excels at managing the full credit cycle of multiple portfolios and establishing credit policies. Possesses an in- depth knowledge of loan origination, underwriting, and collections. Proven ability to develop and implement cost- effective procedures to reduce losses and manage delinquency.

Core Skills:

- Risk Assessment

- Loan Evaluation

- Financial Analysis

- Loan Origination

- Underwriting

- Collections

- Credit Policy

- Credit Cycle Management

- Loss Mitigation

- Delinquency Management

- Cost Analysis

Responsibilities:

- Assessed risk and evaluated loans on behalf of multiple financial institutions

- Analyzed financial statements, cash flow, and credit histories to assess creditworthiness

- Developed and implemented credit policies and procedures

- Monitored the full credit cycle of multiple portfolios

- Ensured compliance with all applicable laws and regulations

- Educated clients on the loan process and answered inquiries

- Established loan terms and conditions

- Negotiated with borrowers to modify terms

- Identified potential risks and losses

- Developed and implemented cost- effective procedures to reduce losses and manage delinquency

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Senior Credit Analyst Resume with 15 Years of Experience

Highly experienced Senior Credit Analyst offering more than 15 years of banking experience, providing a proven track record of meeting and exceeding goals. Adept at monitoring and managing loan portfolios, analyzing financial statements and credit histories, and identifying areas of risk and concern within credit applications. Expertly adept at developing and recommending credit policy modifications in order to maintain favorable loan portfolio performance. Dynamic and personable communicator with a strong customer service focus and commitment to accuracy.

Core Skills:

- Risk Management

- Financial Analysis

- Loan Portfolio Management

- Client Relationship Management

- Credit Policy Development

- Credit Underwriting

- Compliance & Regulatory Standards

- Financial Statement Analysis

Responsibilities:

- Developed and implemented credit policy guidelines for loan portfolio management

- Evaluated credit histories, financial statements, and other loan application documents to identify areas of risk and approve/deny loan applications

- Monitored loan portfolios to ensure that risk levels were within acceptable parameters

- Developed and recommended credit policy modifications to ensure favorable loan portfolio performance

- Conducted periodic credit reviews to ensure compliance with all credit policies and regulations

- Established and maintained relationships with clients to ensure satisfactory credit performance

- Developed and implemented procedures for ensuring accuracy in loan files and documents

- Managed and evaluated credit processes to ensure that all loans were documented correctly and in compliance with all regulations and standards.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Senior Credit Analyst resume?

A Senior Credit Analyst is responsible for analyzing the credit worthiness of potential customers and clients. Their resume should include a summary of their experience, skills, and qualifications that illustrate their ability to accurately assess credit risk.

- Comprehensive knowledge of credit risk management policies and procedures

- In-depth understanding of financial statements and credit reports

- Proven ability to analyze financial data and make sound credit decisions

- Proficient in credit scoring and debt collection models

- Skilled in risk monitoring and financial modeling techniques

- Expertise in preparing credit proposals and making recommendations

- Knowledge of debt and capital structure

- Experienced in preparing reports and presentations

- Excellent written and verbal communication skills

- Ability to interpret complex financial documents

- Strong analytical and problem-solving skills

- Ability to work independently and as part of a team

What is a good summary for a Senior Credit Analyst resume?

A Senior Credit Analyst resume should provide a concise yet comprehensive summary of the candidate’s background and qualifications. The resume should detail the individual’s experience in financial analysis, credit analysis, and loan underwriting. It should showcase their ability to analyze financial statements and credit reports, assess risk, and make sound business decisions. The resume should highlight the candidate’s accomplishments, such as successful loan applications, credit approvals, and financial restructuring. Additionally, the resume should demonstrate the candidate’s knowledge of laws and regulations related to banking, credit, and finance. Overall, a Senior Credit Analyst resume should demonstrate the individual’s extensive experience and expertise, as well as their commitment to helping clients reach their financial goals.

What is a good objective for a Senior Credit Analyst resume?

A Senior Credit Analyst is responsible for providing credit analysis and risk assessment services to banks and other financial institutions. They are typically required to have strong analytical, quantitative, and communication skills. As such, a strong objective for a Senior Credit Analyst resume should highlight these abilities.

- Demonstrate knowledge of credit analysis techniques, including financial statement analysis, capital structure analysis, and risk assessment.

- Showcase ability to interpret and analyze credit reports, market trends, and macroeconomic data.

- Prove excellent communication and interpersonal skills for working with clients, lenders, and other financial stakeholders.

- Exhibit strong quantitative and analytical skills for assessing credit risks.

- Demonstrate the ability to work independently and collaboratively in a team environment.

- Utilize experience in managing complex financial portfolios and contracts.

- Show proficiency in using financial software including Microsoft Excel, Access, and other relevant technology.

How do you list Senior Credit Analyst skills on a resume?

Being a Senior Credit Analyst is a challenging and rewarding job that requires both soft skills and hard skills. It is important to list them accurately and concisely on your resume so that employers understand the extent of your experience. Here are some of the skills to consider including on your resume:

- Problem Solving: As a Senior Credit Analyst, you will be expected to have the ability to analyze financial data and make decisions based on your findings. You should be able to quickly identify and solve problems in order to maximize success.

- Financial Analysis: You must have a deep understanding of financial analysis and be able to interpret financial data to determine the creditworthiness of an individual or organization. You should be able to identify trends, draw conclusions, and make decisions based on your analysis.

- Communication: You must be able to effectively communicate your findings and recommendations in a professional manner. You should be comfortable discussing complex topics with colleagues and clients alike.

- Organization: You must be able to stay organized and manage multiple projects at once. You should be able to prioritize tasks and manage your time effectively.

- Risk Assessment: You must be able to assess risks and develop strategies to minimize them. You should understand how to evaluate creditworthiness and determine the best course of action.

- Attention to Detail: You should be detail-oriented and be able to recognize discrepancies or anomalies that may lead to problems. You should also be able to spot potential errors and take corrective measures.

By listing these skills on your resume, employers will understand the extent to which you are qualified for the position. Make sure to include relevant examples and quantifiable results to demonstrate your ability to succeed in the role of a Senior Credit Analyst.

What skills should I put on my resume for Senior Credit Analyst?

As a Senior Credit Analyst, there are certain skills that employers look for in an applicant. To ensure that your resume stands out from the competition, it is important to highlight the skills that make you uniquely qualified for the position. Here are a few skills to consider adding to your resume for a Senior Credit Analyst position:

- Financial Analysis: A Senior Credit Analyst must be able to analyze financial documents, assess risks, and make sound recommendations. Demonstrate your knowledge of financial principles and your ability to interpret financial data.

- Risk Management: A Senior Credit Analyst must be able to evaluate and manage credit risk. Showcase your skills in evaluating the creditworthiness of borrowers and developing strategies to mitigate risk.

- Communication: Senior Credit Analysts must be able to communicate complex financial concepts to various stakeholders. Highlight your ability to communicate effectively, both verbally and in writing.

- Problem-Solving: Senior Credit Analysts often come across challenging situations that require creative solutions. Stress your proficiency in finding creative solutions to complex problems.

- Data Analysis: Analyzing data to identify trends and make data-driven decisions is an important part of a Senior Credit Analyst’s job. Showcase your proficiency in using data to make informed decisions.

- Attention to Detail: As a Senior Credit Analyst, you must be able to spot potential risks and make accurate judgments. Emphasize your ability to pay attention to detail and to identify potential problems.

Key takeaways for an Senior Credit Analyst resume

When you’re a senior credit analyst, you need to be sure that your resume is up to date and accurately reflects your skills and qualifications. It’s important to emphasize your analytical skills, as well as your experience evaluating financial documents. Here are some key takeaways to remember when crafting your senior credit analyst resume:

- Highlight your financial skills: It’s important to showcase your ability to analyze financial documents, assess risk, and make sound decisions. Be sure to emphasize your knowledge of financial statements, credit analysis techniques, and risk management.

- Emphasize your experience: Don’t forget to include your experience working with corporate clients, as well as any specialized training or certifications you have received.

- Showcase your problem-solving skills: Demonstrate your ability to think critically and come up with creative solutions. Showcase your ability to overcome challenges and come up with successful strategies.

- Detail your communication skills: Credit analysts need strong communication skills in order to effectively communicate with stakeholders, clients, and executives.

- Provide relevant examples: Not only should you include concrete examples of your successes, but you should also provide evidence of your analysis skills.

- Use the right keywords: Utilize keywords related to financial analysis and credit risk management in order to ensure your resume stands out.

By following these key takeaways, you’ll be sure to create a standout resume for your senior credit analyst position. Good luck!

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder