Having a resume that stands out is essential for a Revenue Officer who is looking for a position in the financial industry. A well-crafted resume is an important tool for showing potential employers that you have the skills and qualifications for the job. This guide will provide an overview of the key elements of a successful Revenue Officer resume, as well as offer examples to help you get started. With this guide, you can ensure that your resume stands out from the crowd and effectively showcases your strengths to potential employers.

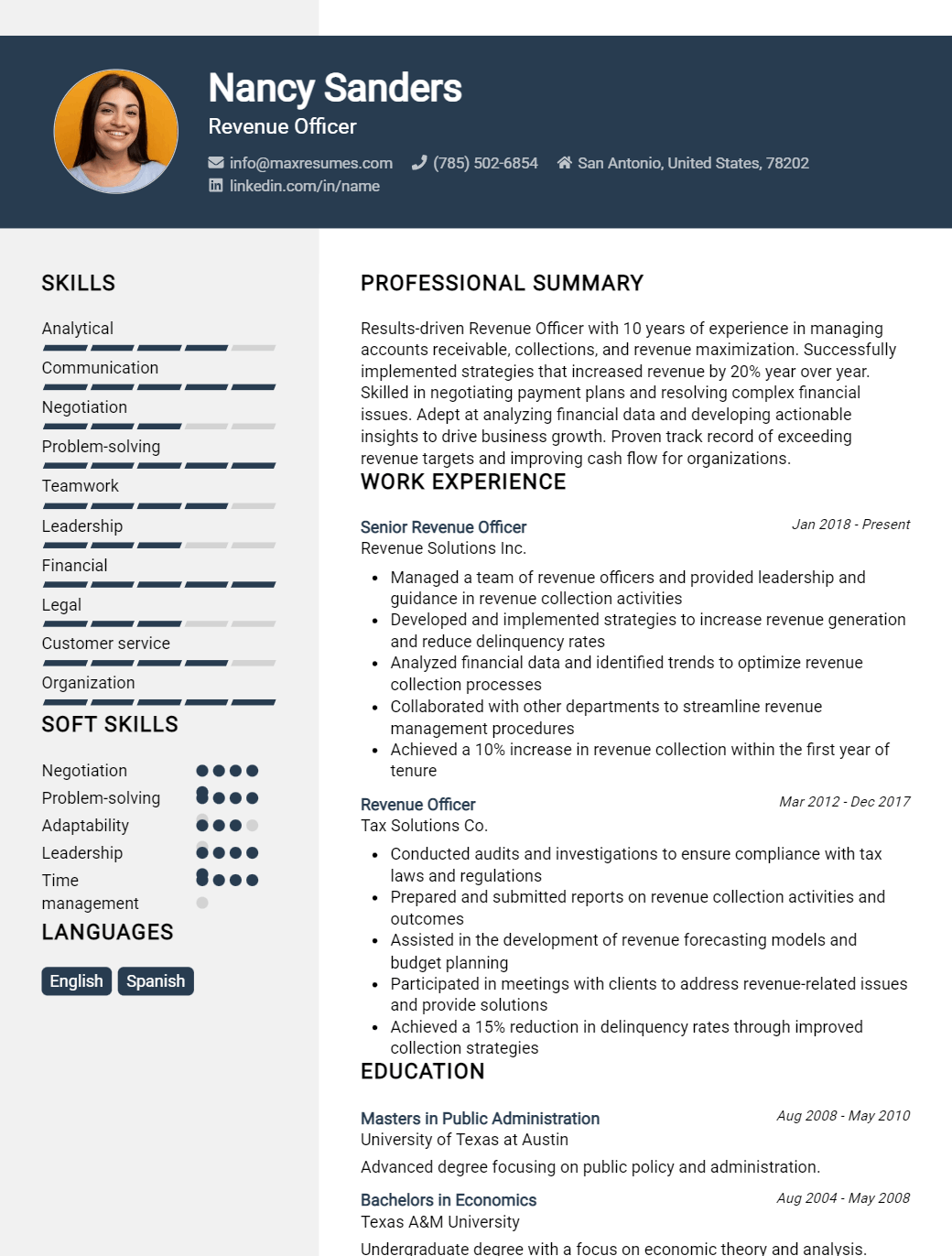

Revenue Officer Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Revenue Officer Resume Examples

John Doe

Revenue Officer

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am an experienced Revenue Officer with more than 10 years of professional experience in various fields. My expertise lies in tax regulations, compliance, and collection for private, state, and federal institutions. I have strong organizational, communication, and problem- solving skills, and I am highly efficient in dealing with financial documents. I am committed to collecting the right amount of taxes effectively and professionally.

Core Skills:

- Interpretation of Tax Regulations

- Financial Analysis

- Accounts Reconciliation

- Auditing Processes

- Financial Reporting

- Asset Protection

- Tax Compliance

- Problem- Solving

- Organizational Skills

- Multi- tasking

Professional Experience:

Revenue Officer, ABC Corporation, New York, NY

- Developed and updated tax compliance programs for the company’s clients

- Interpreted and enforced federal, state, and local regulations governing income taxes

- Prepared financial statements and reports to verify compliance with regulations

- Assessed, analyzed, and verified financial data to ensure accuracy

- Provided guidance and advice to management on taxation issues

- Conducted audits of personal, corporate, and estate tax returns

- Researched and addressed potential areas of non- compliance

Revenue Officer, XYZ Corporation, New York, NY

- Drafted and maintained tax regulations documents

- Reviewed financial accounts to ensure accurate payments

- Conducted audits and inspections of properties for taxation purposes

- Identified areas of non- compliance and suggested corrective action

- Prepared financial statements and reports for management review

- Provided technical advice on taxation issues

- Researched and resolved taxation disputes between company and clients

Education:

BS in Accounting, New York University, New York, NY- 2009

Revenue Officer Resume with No Experience

A self- motivated and professional individual looking to apply my financial and customer service experience to the role of Revenue Officer. Possesses a strong background in accounting, customer service and bookkeeping with the ability to think analytically, anticipate problems and take appropriate action.

Skills:

- Strong understanding of accounting principles and practices

- Ability to analyze financial data and prepare reports

- Excellent communication and customer service skills

- Proficient in Microsoft Office Suite

- Ability to prioritize tasks and manage multiple projects

- Good organizational skills

- Highly detail oriented

Responsibilities:

- Receive and process payments

- Provide customer service and resolve customer inquiries

- Monitor and track payment activity

- Conduct financial audits of customer accounts

- Ensure accuracy of customer records

- Identify trends and irregularities in customer accounts

- Perform credit checks and risk assessment

- Collect overdue payments and negotiate payment plans

- Coordinate with other departments to ensure accurate processing of customer accounts

Experience

0 Years

Level

Junior

Education

Bachelor’s

Revenue Officer Resume with 2 Years of Experience

Diligent and organized Revenue Officer with two years of expertise in accounting and tax collection. Possesses strong analytical and problem- solving skills to ensure accurate assessment and collection of taxes. Able to build and maintain relationships with clients in a professional manner. Experienced in utilizing computerized account management systems.

Core Skills:

- Accounting

- Tax Collection

- Analytical and Problem- Solving

- Relationship Building

- Computerized Account Management

Responsibilities:

- Assessed and collected taxes from citizens in accordance with local laws and regulations.

- Verified filing documents for accuracy and completeness.

- Provided technical advice and assistance to clients on tax- related matters.

- Developed and maintained strong relationships with citizens and other stakeholders.

- Discussed and negotiated payment plans with delinquent taxpayers.

- Organized and maintained databases of taxpayer information.

- Analyzed tax returns and identified discrepancies.

- Maintained a detailed record of all tax collection proceedings.

- Resolved any issues arising from collection efforts.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Revenue Officer Resume with 5 Years of Experience

Results- oriented revenue officer with 5 years of experience in managing and implementing financial strategies to support organizational objectives. Experienced in developing and implementing revenue management strategies, creating financial forecasts, and administering and analyzing budgets. Highly skilled in overseeing accounts receivable, accounts payable, and cash handling operations, as well as monitoring and controlling financial transactions. A dedicated professional who is able to work independently, as well as collaboratively with all levels of management, staff, vendors, and other stakeholders.

Core Skills:

- Revenue Management

- Financial Forecasting

- Financial Analysis

- Accounts Receivable/Payable

- Budget Administration

- Cash Handling

- Compliance

- Problem- Solving

- Teamwork

- Communication

Responsibilities:

- Developed and implemented revenue management strategies to optimize financial performance.

- Monitored and controlled financial transactions to ensure accuracy and compliance with applicable laws and regulations.

- Created and managed financial forecasts to identify potential risks and opportunities.

- Administered and analyzed budgets to ensure accuracy and efficiency of financial operations.

- Oversaw accounts receivable and accounts payable in order to maintain timely payments.

- Managed cash handling operations and reconciled accounts to ensure accuracy.

- Collaborated with all levels of management, staff, vendors, and other stakeholders.

- Resolved complex financial issues and identified opportunities for improvement.

- Assisted with audits and other compliance measures to ensure accuracy and compliance.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Revenue Officer Resume with 7 Years of Experience

Highly organized and detail- oriented Revenue Officer with 7+ years of experience in collecting due taxes, managing large accounts, and data entry. Possess excellent financial analysis, problem- solving, and communication skills and a strong commitment to creating a cohesive and efficient team. Greatly skilled in creating detailed reports and identifying non- compliant taxpayers and discrepancies. Adept at using various software, including Windows, Microsoft Office Suite, and other relevant computer programs.

Core Skills:

- Account Management

- Tax Collection

- Data Entry

- Financial Analysis

- Report Writing

- Problem- Solving

- Software Proficiency

- Interpersonal Communication

- Organizational Skills

Responsibilities:

- Developed, managed, and monitored large accounts and tax collection processes.

- Gathered, compiled, and analyzed financial information and generated detailed reports.

- Identified non- compliant taxpayers and discrepancies in records.

- Prepared and distributed notices, bills, and other documents to taxpayers.

- Collaborated with other departments and personnel to uphold accurate records.

- Performed data entry accurately and in a timely manner.

- Provided advice and assistance to taxpayers regarding their accounts.

- Resolved taxpayer disputes and answered inquiries.

- Ensured compliance with relevant laws, regulations, and procedures.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Revenue Officer Resume with 10 Years of Experience

Knowledgeable and experienced Revenue Officer with over 10 years of experience in ensuring compliance with government regulations and collecting taxes. Skilled in developing and implementing effective policies, procedures, and financial systems. Extensive experience in financial analysis, reporting, and developing strategies for maximizing revenues. Excellent problem- solving and communication skills, with the ability to work independently and as part of a team.

Core Skills:

- Tax Collection

- Financial Analysis

- Regulatory Compliance

- Financial Reporting

- Policy Development

- Strategic Planning

- Problem- Solving

- Communication

- Interpersonal Skills

Responsibilities:

- Ensured compliance with government regulations, laws, and organizational procedures related to taxes

- Performed financial analysis to identify potential revenue opportunities

- Prepared financial reports to inform upper management of financial performance

- Developed and implemented effective policies and procedures to maximize tax revenues

- Analyzed data to develop strategies for improving revenue streams

- Monitored changes in tax regulations and financial markets

- Investigated and resolved customer disputes related to tax collection

- Advised customers on payment options

- Negotiated payment plans with delinquent customers

- Maintained accurate and up- to- date records of customer tax accounts

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Revenue Officer Resume with 15 Years of Experience

Revenue Officer with 15 years of experience in collecting taxes, processing payments, and auditing records. A proven track record of success in meeting and exceeding collection goals while providing excellent customer service. Proficient in a variety of bookkeeping, accounting, and auditing software programs.

Core Skills:

- Tax Collection

- Data Analysis

- Auditing

- Accounting

- Bookkeeping

- Customer Service

- Problem- Solving

- Microsoft Office Suite

Responsibilities:

- Collected taxes from individuals and businesses

- Analyzed financial records to determine tax liabilities

- Audited accounts for accuracy of financial information and discrepancies

- Processed payment for taxes and other government related fees

- Investigated tax fraud and evasion cases

- Assisted taxpayers in completing returns

- Answered questions and provided customer service related to taxes

- Provided outreach to delinquent taxpayers

- Resolved complex issues and discrepancies

- Conducted research and prepared reports

- Worked with other agencies and law enforcement in collections

- Utilized computerized bookkeeping, accounting, and auditing software programs

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Revenue Officer resume?

A resume for a Revenue Officer position should include the professional experience and technical skills that demonstrate your ability to effectively perform the role. When crafting your resume, make sure to include the following elements:

- Professional Summary: A concise summary of your professional background that highlights your most relevant experience and accomplishments.

- Education: Any formal degrees or certificates you have earned in relation to finance, accounting, or revenue collection.

- Work Experience: A detailed list of your previous jobs and responsibilities related to the role.

- Skills: A list of the technical and soft skills that you possess that make you a great candidate for the job.

- Awards and Achievements: Any awards or recognitions you have earned in the past that demonstrate your performance in the field.

- Professional Memberships: Any memberships that demonstrate your commitment to staying current in the field.

By including these elements in your resume, you will be able to showcase why you are the ideal candidate for the Revenue Officer position.

What is a good summary for a Revenue Officer resume?

A good summary for a Revenue Officer resume should include any relevant qualifications and experience, especially in the areas of finance, accounting, and taxation. It should highlight an individual’s customer service skills and attention to detail, as well as their ability to analyze and interpret data. The summary should also demonstrate an individual’s knowledge of federal, state, and local regulations, as well as their ability to consistently achieve or exceed budgetary goals. Additionally, the summary should reflect any other skills or qualities that would make the individual an ideal fit for the position, such as excellent communication, problem-solving and organizational skills.

What is a good objective for a Revenue Officer resume?

A resume objective for a Revenue Officer position should clearly define the candidate’s career goals and emphasize the skills and experiences that make them the ideal choice. It should also show the hiring manager that the individual understands the role of a Revenue Officer and the duties it entails.

Examples of a good objective for a Revenue Officer resume include:

- Experienced Revenue Officer seeking to leverage 10+ years of experience in taxation and financial compliance to contribute to the success of a leading financial institution

- Proven financial professional with expertise in tax law, compliance, and financial forecasting looking to join a forward-thinking organization

- Detail-oriented Revenue Officer with experience in financial statements and audit procedures, seeking to maximize the efficiency of a respected firm

- Self-motivated Revenue Officer possessing strong communication and problem solving skills, aiming to support the financial objectives of a leading company

- Results-driven Revenue Officer with an in-depth knowledge of taxation and financial regulations, aiming to help secure a stable financial future for a respected organization

These objectives highlight the candidate’s experience and skill set that are necessary for the role of a Revenue Officer. They show the hiring manager that the applicant understands the responsibilities of the position and is committed to meeting the financial objectives of the organization.

How do you list Revenue Officer skills on a resume?

When creating a resume for a Revenue Officer position, it is important to emphasize the skills and qualifications that are the perfect fit for the job. A well-crafted resume should highlight the core competencies and professional experiences that demonstrate your ability to manage and oversee the finances of a company or organization.

Below is a list of skills you should consider including on your resume when applying to Revenue Officer positions:

- Financial knowledge: Revenue Officers must be well-versed in accounting principles and financial software applications. They should also be familiar with budget analysis, auditing procedures and taxation regulations.

- Organizational: Revenue Officers must be able to manage large amounts of information, juggle multiple tasks and prioritize work.

- Research and problem-solving: Revenue Officers must have excellent research skills to help them uncover and identify discrepancies in financial records.

- Attention to detail: Revenue Officers should be detail-oriented and able to accurately review financial documents.

- Communication: Revenue Officers must be able to effectively communicate with colleagues and stakeholders. They must also be able to explain complicated financial concepts in a clear, concise manner.

- Interpersonal skills: Revenue Officers must be able to work well with a variety of individuals to ensure smooth operations.

By including these skills on your resume, you can show prospective employers that you have the abilities and qualifications to succeed in a Revenue Officer role.

What skills should I put on my resume for Revenue Officer?

A Revenue Officer’s resume should showcase the skills necessary to be successful in this position. To ensure your resume is complete and accurate, here are the skills that you should include:

- Knowledge of Relevant Laws and Regulations: A Revenue Officer should have a thorough understanding of the laws and regulations that govern the taxation system. This includes federal, state, and local regulations.

- Analytical Skills: Revenue Officers must be able to analyze financial documents, such as tax returns and accounts, to identify potential issues and discrepancies.

- Interpersonal Skills: Revenue Officers must be able to communicate effectively with taxpayers to resolve issues and explain their rights and obligations.

- Negotiation Skills: Revenue Officers must be able to negotiate payment plans with taxpayers, such as installment payment plans and offers in compromise.

- Computer Skills: Revenue Officers must be proficient in the use of computers and technology for tasks such as managing databases and preparing reports.

- Organization Skills: Revenue Officers must be able to organize their work efficiently and manage multiple tasks simultaneously.

- Problem-Solving Skills: Revenue Officers must be able to identify problems and develop solutions to resolve them.

Having these skills listed on your resume will make you a more attractive candidate for a Revenue Officer position. Make sure to highlight these skills in your resume and provide examples of how you have used them in the past.

Key takeaways for an Revenue Officer resume

A Revenue Officer resume should focus on the candidate’s aptitude and experience in the field of tax law, financial analysis, and auditing. Revenue Officers should have excellent interpersonal and technical skills, as well as a solid background in accounting and finance. In addition, it’s important to highlight the candidate’s ability to interpret and implement applicable regulations and laws, as well as their attention to detail. Here are a few key takeaways for an effective Revenue Officer resume:

- Demonstrate experience in tax law, finance, and accounting.

- Highlight interpersonal skills, such as the ability to negotiate effectively with clients.

- Showcase technical skills, such as the ability to use financial software and databases.

- Show knowledge of applicable regulations and laws.

- Demonstrate attention to detail in financial analysis and auditing.

- Provide examples of successful projects and audits conducted.

- Detail any awards or recognition received for excellent performance.

These takeaways should help Revenue Officers create a strong and effective resume that showcases their qualifications and experience. With a resume that demonstrates these key points, Revenue Officers can be confident that they are putting their best foot forward in their career search.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder