Retirement is an exciting and important milestone for every individual. As such, it is essential to create a retirement specialist resume that stands out and showcases your skills and qualifications. A retirement specialist resume can make you a more attractive job candidate, and it is important to make sure that your resume is tailored to the job description and your career objectives. This guide will walk you through how to write a retirement specialist resume, including examples and tips to ensure you stand out from the competition.

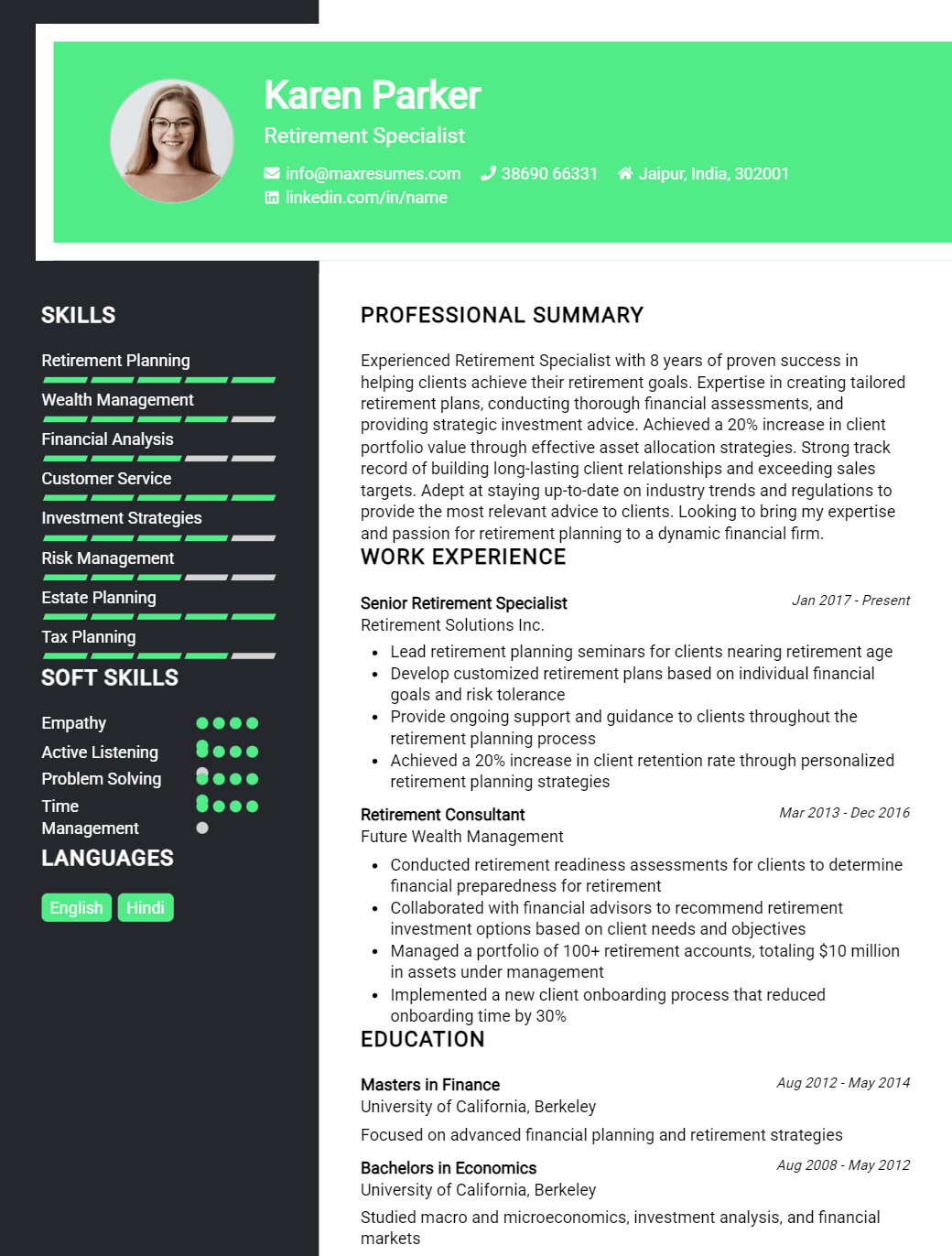

Retirement Specialist Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Retirement Specialist Resume Examples

John Doe

Retirement Specialist

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

Highly motivated and experienced Retirement Specialist with excellent customer service skills and a proven ability to develop and maintain relationships with clients. Possess extensive knowledge of retirement plans and benefits and the ability to effectively communicate with clients to ensure the best planning and coverage for their retirement needs. Experience working in fast- paced environments and an ability to work autonomously or as part of a team.

Core Skills:

- Client Relationship Management

- Retirement Plan Creation and Administration

- Regulatory Compliance

- Financial Planning and Budgeting

- Retirement Benefit Strategies

- Retirement Account Management

- Retirement Investment Strategies

- Retirement Plan Consultation

- Retirement Education

Professional Experience:

Retirement Plan Specialist, ABC Company, 2017- Present

- Managed and administered employer- sponsored retirement plans, ensuring compliance with ERISA and IRS regulations.

- Developed and implemented a comprehensive retirement plan that was tailored to the needs of the clients.

- Provided individual retirement planning and counseling, including benefit and investment strategies.

- Researched and identified new retirement solutions and products.

- Managed client accounts, evaluated performance and made investment recommendations.

Retirement Plan Coordinator, XYZ Company, 2015- 2017

- Provided support to retirement planning advisors and ensured compliant operations.

- Developed strong relationships with clients, providing retirement planning advice and guidance.

- Drafted and implemented retirement plan documents and maintained accurate records.

- Coordinated plan audits and prepared necessary documents.

Education:

Bachelor of Science in Business Administration, ABC University, 2015

Retirement Specialist Resume with No Experience

Recent college graduate eager to gain experience in the retirement specialist field. Possesses strong organizational and interpersonal skills, as well as a keen attention to detail. Demonstrated ability to work independently and collaboratively in a fast- paced environment.

Skills

- Analytical thinker

- Exceptional problem- solving skills

- Strong organizational skills

- Ability to work independently and collaboratively

- Excellent communication skills

- Proficient in Microsoft Office

- Attention to detail

Responsibilities

- Conduct research and analysis to support retirement plan objectives

- Provide retirement plan compliance and administration services

- Assist with preparing retirement plan regulatory filings and documents

- Manage and process retirement plan related data

- Assist with the retirement plan’s recordkeeping and trust operations

- Ensure the accuracy of data and documents related to the retirement plan

- Provide customer service and support for advisors, participants and employers on retirement plan matters

Experience

0 Years

Level

Junior

Education

Bachelor’s

Retirement Specialist Resume with 2 Years of Experience

Dedicated and knowledgeable Retirement Specialist with two years of experience in the financial services industry. Skilled in preparing retirement plans and performing calculations for participants. Experienced in conducting education seminars, handling paperwork and preparing reports. Possess strong organizational and analytical skills.

Core Skills:

- Retirement Plan Administration

- Pension and 401k Basics

- Financial Analysis

- Presentation & Training

- Employee Education

- Fund & Investment Management

- Client Relations

- Regulatory Compliance

- Record Keeping

Responsibilities:

- Prepared retirement plans and calculations for participants

- Conducted educational seminars and employee meetings

- Handled paperwork related to retirement plans and processed applications

- Prepared investment reports and monitored fund performance

- Assisted clients with inquiries and concerns

- Ensured compliance with laws and regulations governing retirement plans

- Maintained records of employee contribution, retirement benefits, and other related transactions

- Collaborated with other departments to provide accurate and timely financial advice

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Retirement Specialist Resume with 5 Years of Experience

With 5 years of experience in retirement planning, I bring a unique combination of financial expertise, strategic planning, and customer service. My background includes providing customized retirement plans and financial advice to a wide range of clients. I have a proven track record of developing successful retirement plans that meet the needs of my clients. In addition, I have an in- depth knowledge of retirement- related laws and regulations, and the ability to assess and manage retirement- related risks. I am organized, detail- oriented, and passionate about helping my clients reach their retirement goals.

Core Skills:

- Retirement Planning

- Financial Analysis

- Regulatory Compliance

- Risk Management

- Customer Service

- Communication

- Problem- Solving

- Time Management

Responsibilities:

- Provided customized retirement plans and financial advice to a large range of clients.

- Analyzed client’s financial data to develop retirement plans that suited their individual needs.

- Assessed and managed retirement- related risks.

- Monitored retirement- related regulations and legislation.

- Assisted clients with understanding and utilizing retirement plans.

- Developed a full range of retirement- related documents, such as wills, trusts, and other legal documents.

- Communicated with clients regarding their retirement options.

- Resolved client issues and questions in a timely manner.

- Maintained accurate and up- to- date records of client’s retirement accounts and investments.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Retirement Specialist Resume with 7 Years of Experience

Retirement Specialist with 7 years of experience in the finance industry. Possess an in- depth understanding of retirement benefits and plans, annuities and estate planning. Skilled in providing detailed advice and guidance to clients on retirement plans, products, and strategies. Experienced in developing, evaluating and assessing retirement plan options to ensure the best solution for clients.

Core Skills:

- Retirement planning

- Estate planning

- Annuity products

- Financial needs analysis

- Compliance regulations

- Client relationship management

- Retirement product sales

- Retirement income planning

Responsibilities:

- Provided comprehensive retirement planning advice and guidance to clients based on their individual needs.

- Developed and evaluated retirement plans to ensure the best solution for clients.

- Created and presented detailed financial needs analysis to clients.

- Recommended product and services to clients.

- Ensured compliance with regulations, policies and procedures.

- Monitored market trends and changes in retirement products to ensure clients receive the best options available.

- Developed and maintained positive relationships with clients and other professionals.

- Assisted clients with retirement income planning.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Retirement Specialist Resume with 10 Years of Experience

Dedicated retirement specialist with over 10 years of experience in the financial services industry. Expert in retirement planning, investments, insurance and retirement- related products. Skilled in developing retirement plans and providing retirement- related advice to clients. Adept in executing financial strategies for clients for the sole purpose of achieving their retirement goals. Experienced in dealing with clients, government agencies, and financial institutions.

Core Skills:

- Retirement Planning

- Investments and Insurance

- Financial Strategies

- Client Service

- Data Analysis

- Budgeting

- Risk Management

- Business Development

Responsibilities:

- Advised clients on retirement planning, investments and insurance.

- Developed retirement plans and financial strategies for clients.

- Advised clients on estate planning and trust management.

- Monitored client’s investments to ensure maximum returns.

- Liaised with government agencies and financial institutions to execute the client’s retirement goals.

- Analyzed data to forecast retirement- related needs and costs.

- Developed budget plans for clients to ensure their retirement goals were met.

- Assessed risk management policies to maximize returns and minimize risks.

- Developed and implemented business plans to ensure clients’ retirement goals were met.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Retirement Specialist Resume with 15 Years of Experience

A highly experienced Retirement Specialist with 15 years of experience in administering and managing retirement plans. Skilled in developing complex pension plans and creating retirement investment strategies for clients. Familiar with the rules and regulations governing the retirement industry, and adept at evaluating plans for compliance with ERISA. Possess excellent interpersonal skills to build and maintain positive relationships with clients.

Core Skills:

- Financial Planning

- Retirement Planning

- Pension Plan Administration

- Risk Assessment

- Investment Analysis

- Communication

- Interpersonal Skills

- Organizational Skills

Responsibilities:

- Advised clients on retirement planning strategies, helping them to make informed decisions.

- Developed and monitored pension and 401(k) plans.

- Conducted detailed analysis of retirement plans to ensure compliance with ERISA regulations.

- Implemented risk management techniques to maximize returns and minimize losses.

- Developed complex investment strategies for clients using a variety of asset classes.

- Educated clients on retirement plan benefits, options and investments.

- Collaborated with financial professionals to provide sound advice and accurate information.

- Created and maintained detailed records of all retirement plans and transactions.

- Assisted clients with filing retirement plan paperwork and making contributions.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Retirement Specialist resume?

A Retirement Specialist resume is a crucial part of building a successful retirement career. To help you create an effective resume, here are some important elements to consider:

- Summary: A well-crafted summary of your experience and qualifications as a Retirement Specialist. This should be a brief overview of your professional accomplishments, including relevant skills and areas of expertise.

- Work Experience: Include any experience related to retirement planning, such as an administrative role in a retirement services firm or prior roles in financial planning or consulting. Highlight your achievements in each role and make sure to include the years you held each position.

- Education: List all relevant educational qualifications, such as a degree in financial planning, a certificate in retirement planning, or any other related credentials.

- Professional Certifications: Include any professional certifications you have in retirement planning, such as Certified Retirement Counselor (CRC) or Retirement Planner (RP).

- Special Skills: A Retirement Specialist resume should include any special skills related to the field, such as knowledge of retirement regulations and laws, financial analysis, or retirement portfolio management.

- Personal Skills: Many Retirement Specialists must be able to communicate with clients and build relationships of trust. As such, emphasize any soft skills related to customer relations, such as strong communication and problem solving skills.

By carefully crafting a Retirement Specialist resume that includes all of these elements, you can make sure that your resume stands out from the competition.

What is a good summary for a Retirement Specialist resume?

A retirement specialist resume should include a summary highlighting the professional’s expertise in helping clients plan for their retirement. It should cover their experience working with financial products, retirement savings plans, and investment strategies. The summary should also mention any certifications or qualifications the professional may have in the retirement planning field. In addition, the summary should highlight any notable successes the professional has achieved while working as a retirement specialist. Finally, the resume should also express the retirement specialist’s passion and commitment to helping clients achieve their retirement goals.

What is a good objective for a Retirement Specialist resume?

Writing an effective resume is a critical step in applying for a job as a Retirement Specialist. An effective resume should include an objective statement that clearly states the desired position, as well as information about your relevant qualifications and experience.

A good objective for a Retirement Specialist resume should include:

- A clear indication of the desired position and the company the applicant is applying to.

- A demonstration of the applicant’s experience and qualifications related to retirement planning.

- A statement of the applicant’s commitment to providing quality retirement services.

- A description of the applicant’s ability to build relationships with customers and understand their financial needs.

- A mention of the applicant’s ability to work in a team and ensure compliance with relevant regulations.

By including this information in the objective statement, a Retirement Specialist resume will be more likely to stand out to potential employers.

How do you list Retirement Specialist skills on a resume?

When you’re looking to transition into a career as a Retirement Specialist, it’s important to make sure your resume accurately reflects your skills. With the right resume, you can show potential employers that you have the necessary expertise and experience to be a successful Retirement Specialist.

Here are some skills to list on your resume when applying for a Retirement Specialist position:

- Knowledge of retirement and financial planning: As a Retirement Specialist, you will be responsible for helping clients plan for their retirement. This includes understanding different types of retirement savings plans, investing strategies, and tax laws.

- Investment management: Retirement Specialists are responsible for managing clients’ investments. This includes being knowledgeable about different investment options, being able to identify profitable investments, and monitoring clients’ investments over time.

- Analytical skills: You will be responsible for analyzing clients’ financial data and making recommendations on how to improve their financial situation. This requires strong analytical skills, including the ability to interpret and explain complex financial data.

- Communication: You will need to be able to explain complex financial concepts to clients in a way that is easy for them to understand. You must also be able to effectively communicate with clients to ensure they are making the right decisions for their retirement.

- Problem-solving: Retirement Specialists must be able to identify and solve a variety of financial problems. This requires strong problem-solving and critical thinking skills.

- Organizational skills: As a Retirement Specialist, you need to be able to stay organized and on top of multiple clients and their information. This requires strong organizational skills and the ability to prioritize tasks.

By including these skills on your resume, you can demonstrate to potential employers that you are a qualified candidate for the position.

What skills should I put on my resume for Retirement Specialist?

When you’re looking for a job as a Retirement Specialist, you need to make sure your resume is tailored to highlight the skills the employer is looking for. Here are some key skills employers are seeking in a Retirement Specialist:

- Knowledge of Retirement Planning: A Retirement Specialist should possess a deep understanding of retirement plans and products, including private pensions, 401(k)s, and IRAs.

- Analytical Skills: A Retirement Specialist should be able to analyze complex financial data and advise clients on the best retirement solutions for them.

- Communication and Interpersonal Skills: A Retirement Specialist should be an excellent communicator and listener, with strong interpersonal skills to be able to explain retirement options in a way that is easy to understand.

- Research Capabilities: A Retirement Specialist should have strong research capabilities and be able to stay up to date on the latest financial trends and regulations.

- Problem-Solving Skills: A Retirement Specialist should be able to think critically and come up with creative solutions to complex retirement planning problems.

- Organizational Skills: A Retirement Specialist should be organized and have the ability to manage multiple tasks and clients.

Having these skills on your resume will show employers that you have the capabilities to provide high-quality services to clients. Make sure to highlight these skills in your resume, cover letter, and job interviews. Good luck!

Key takeaways for an Retirement Specialist resume

Writing a retirement specialist resume can be a daunting task, especially if you don’t know the exact skills and experience employers are looking for. To help, here are some key takeaways to consider when writing your resume:

- Highlight Relevant Experience: Make sure to include any previous experience with retirement planning, investments, tax planning, and financial planning. Make sure to list any relevant certifications or licenses you may have, as well as coursework or training related to retirement planning.

- Make Your Education Clear: Be sure to include any relevant degrees or certifications related to retirement planning. This will help demonstrate your knowledge in the field and show employers that you are qualified for the job.

- Showcase Your Skills: Outline any relevant skills you have that will help you in the role of a retirement specialist. These may include financial analysis, budgeting, and problem-solving skills.

- Describe Your Interpersonal Skills: You need to be able to work with clients, other staff, and other stakeholders. Explain how you have used your interpersonal skills to help clients, manage staff, and build relationships.

- Showcase Your Accomplishments: Provide examples of accomplishments you have achieved in the past, such as successful retirement plans, financial advice, or investments made. This will help show employers that you can be successful in the role.

By following these takeaways, you can create a resume that highlights your experience and skills and helps you stand out among other applicants. With a great resume, you will be well on your way to becoming a successful retirement specialist.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder