Having a complete and well-constructed resume is essential for any proprietary trader as it allows you to showcase your experience and qualifications to potential employers. It is important to craft a resume that accurately reflects your knowledge, strengths, and relevant skills in order to stand out from other applicants. A resume should be tailored specifically to the position you are applying for, and this guide will provide tips and techniques for writing a successful proprietary trader resume. Additionally, some examples of resumes for proprietary traders are provided to help you get started.

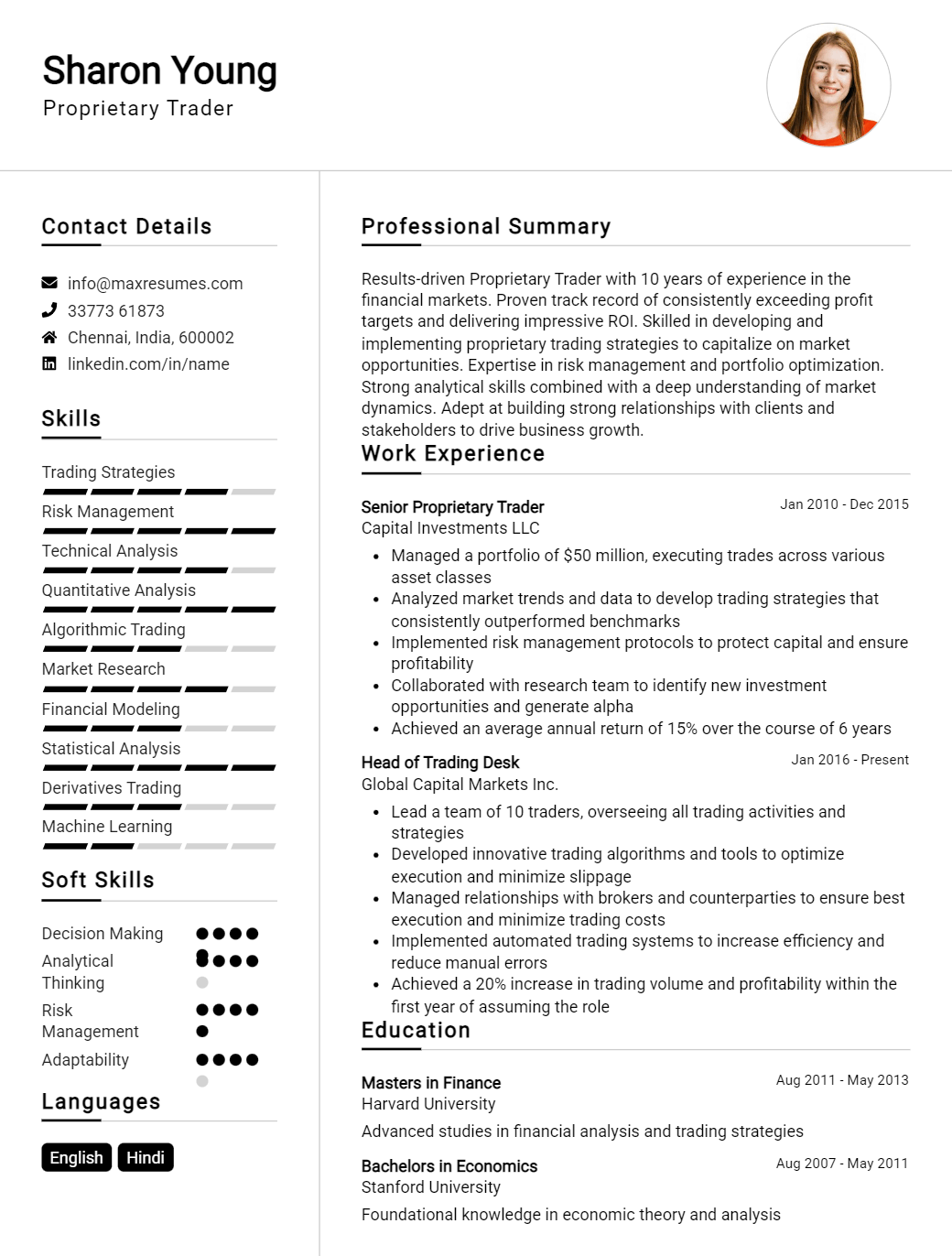

Proprietary Trader Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Proprietary Trader Resume Examples

John Doe

Proprietary Trader

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am an experienced Proprietary Trader with over five years of experience in the financial industry. I have a strong background in analyzing and understanding market trends, and utilizing risk management strategies to maximize profits. I have a proven track record of success with trading, and am looking to further my career in this field.

Core Skills:

- Advanced knowledge of financial markets

- Strong understanding of risk management strategies

- Excellent analytical skills

- Ability to analyse and identify market trends

- Proficiency with trading platforms

- Highly organized and detail- oriented

Professional Experience:

- Proprietary Trader – ABC Financial Group, London, UK (2015- present)

- Analyse market trends and make informed decisions for trades

- Monitor and manage risk exposure to generate maximum profits

- Develop effective risk management strategies to reduce losses

- Perform detailed analysis of financial markets and make informed decisions

- Utilize trading platforms to make trades in an efficient manner

Education:

- BSc Accounting & Finance – Kingston University, London, UK (2012- 2015)

Proprietary Trader Resume with No Experience

Recent college graduate with strong academic background and interest in the field of proprietary trading. Possess analytical and problem solving skills, and the drive to learn and excel in the industry.

Skills

- Extensive knowledge in financial markets

- Excellent communication and interpersonal skills

- Strong analytical and problem solving skills

- Excellent computer skills

- Ability to work independently and as part of a team

Responsibilities

- Analyze financial markets and identify profitable trading opportunities

- Develop and execute trading strategies

- Monitor and assess market conditions

- Maintain accurate records of trading activities

- Provide timely and accurate reports to management

- Keep up to date with industry developments and trends

Experience

0 Years

Level

Junior

Education

Bachelor’s

Proprietary Trader Resume with 2 Years of Experience

I am a highly motivated and driven Proprietary Trader with two years of experience in the financial industry. I have expertise in managing portfolios, identifying market trends and opportunities, conducting research and analysis, developing strategies, and executing profitable trades. I have a deep knowledge of financial instruments, the ability to assess a range of risk factors, and a proven track record of successful investments and trading decisions. I am passionate about the stock market and have a strong passion for the financial markets.

Core Skills:

- Portfolio Management

- Market Analysis

- Research and Analysis

- Trading Strategies

- Risk Management

- Financial Instruments

- Stock Market Knowledge

- Profitable Trading Decisions

Responsibilities:

- Monitor and analyze market trends and opportunities

- Develop and maintain trading strategies

- Execute trades following the strategy

- Analyze financial instruments and assess risk factors

- Manage portfolios to achieve the desired results

- Monitor and adjust investments to maximize returns

- Collaborate with team members to make the best trading decisions

- Implement risk management strategies to minimize losses

- Generate reports for performance evaluation

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Proprietary Trader Resume with 5 Years of Experience

A highly motivated and experienced Proprietary Trader with 5 years of experience in the financial services industry. Possesses a strong knowledge of stock market analysis, trade strategies, and investment methods. Possesses a strong work ethic, attention to detail, and a drive to succeed. Skilled in developing market strategies, monitoring and executing trades, and determining optimal positions. Has experience in working with multiple asset classes.

Core Skills:

- Stock Market Analysis

- Trade Strategies

- Investment Methods

- Market Strategies

- Trade Execution

- Risk Management

- Regulatory Requirements

- Portfolio Management

Responsibilities:

- Developing and executing strategies for generating optimal returns

- Monitoring and executing trades in stocks, options, futures, currencies, and other asset classes

- Analyzing financial markets, researching different stocks and sector trends

- Analyzing and evaluating current trading strategies to identify areas of improvement

- Executing orders in compliance with regulatory requirements

- Managing risk associated with trading activities

- Reviewing and adjusting portfolio holdings according to risk and return expectations

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Proprietary Trader Resume with 7 Years of Experience

I am a Proprietary Trader with over seven years of experience, specializing in investments and trading. I have extensive experience with complex financial instruments, including derivatives, bonds, and stocks. I have developed a deep understanding of financial markets, risk management, and portfolio analysis, and am adept at developing and executing strategies for consistent profitability. I am highly organized and detail- oriented, with excellent problem- solving and communication skills.

Core Skills:

- Advanced knowledge of financial markets

- Expertise in derivatives, bonds, stocks and options

- Deep understanding of portfolio analysis, risk management and pricing

- Proven ability to develop and execute strategies for consistent profitability

- Exceptional problem- solving and communication skills

- Highly organized and detail- oriented

Responsibilities:

- Develop sophisticated trading strategies to generate consistent profits.

- Analyze market trends, assess financial risks and adjust strategies accordingly.

- Execute trades and monitor positions to ensure profitability.

- Research new trading opportunities, identify potential investments and analyze potential returns.

- Maintain up- to- date knowledge of market changes, financial products and regulations.

- Monitor portfolio performance and adjust holdings and strategies to ensure compliance with risk management policies.

- Provide daily, weekly, and monthly performance reports to management.

- Maintain detailed records of all trading activities.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Proprietary Trader Resume with 10 Years of Experience

Proprietary trader with 10+ years of dynamic experience in the stock market and financial markets. Possesses an excellent understanding of capital markets and strategies related to trading. Adept at leveraging technical analysis and financial software to identify and capture advantageous trading opportunities. Committed to increasing returns and minimizing risk with a focus on high- growth stocks.

Core Skills:

- Multi- Asset Trading

- Financial Analysis

- Portfolio Management

- Risk Management

- Technical Analysis

- Trading Strategies

- Market Research

- Financial Software

Responsibilities:

- Monitoring markets and analyzing financial data to identify trading opportunities

- Developing and executing trading strategies that capitalize on favorable market conditions

- Managing a portfolio of financial instruments to maximize returns while minimizing risk

- Conducting market research to identify high- growth stocks and potential investments

- Using technical analysis and proprietary software to evaluate stocks and other assets

- Monitoring and complying with regulations to ensure trades are executed according to regulations

- Maintaining current knowledge of market trends and industry developments

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Proprietary Trader Resume with 15 Years of Experience

With 15 years of experience in the financial services sector, I have honed my skills in proprietary trading and am committed to driving successful investment decisions through dynamic analysis. I have expertise in market analysis, risk management, and portfolio management, and have a proven track record of success in developing and executing high- return strategies. My extensive knowledge of technical indicators, chart analysis, and financial instruments allow me to accurately forecast market trends and identify profitable opportunities. I am confident that I would make an excellent addition to any proprietary trading team.

Core Skills:

- Proprietary Trading

- Market Analysis

- Risk Management

- Portfolio Management

- Technical Indicators

- Chart Analysis

- Financial Instruments

- Strategy Development

- Strategy Execution

- Investment Decisions

Responsibilities:

- Conduct research on potential investments and identify profitable opportunities

- Monitor and analyze financial markets and develop strategies to maximize returns

- Create detailed financial models and forecasts

- Manage risk and evaluate risk/return trade- offs

- Execute trades and maintain open positions in order to maximize returns

- Analyze and interpret financial data and make sound investment decisions

- Monitor external factors such as economic trends and international news

- Develop and implement risk management strategies

- Collaborate with other traders and team members to develop and execute strategies

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Proprietary Trader resume?

When it comes to writing a resume for a proprietary trader, there are some specific items that should be included in order to make a great impression on potential employers.

A proprietary trader resume should include:

- Your contact information: Name, address, phone number, and email address

- A concise summary of your experience and skills relevant to the role

- Employment history, including previous roles as a trader, dates of employment, and the companies you worked for

- A list of any licenses or certifications you hold related to trading

- Education and any professional development activities relevant to trading

- Your knowledge of trading platforms, analytics, and other trading software

- Any awards or recognition you have received for your trading performance

- Your risk management skills, such as evaluating and managing risk exposure

- Your proficiency in technical and fundamental analysis

- Your experience with trading strategies, such as day trading, swing trading, and algorithmic trading

- Your ability to work in a fast-paced and highly competitive environment

- Your ability to work independently and collaboratively

- Your ability to make quick decisions and execute trades

- Any other relevant skills or experience that are useful for the job

Incorporating these items into your resume will demonstrate to employers that you possess the relevant skills and experience to be a successful proprietary trader.

What is a good summary for a Proprietary Trader resume?

A proprietary trader’s resume should focus on their experience, relevant qualifications, and skills in finance, trading, and risk management. It should include a summary of the trader’s successful career, such as highlights of any profitable trades and their ability to assess risk and provide accurate analysis. The summary should also include the trader’s experience in working with high-frequency trading systems, as well as their knowledge of trading strategies, market conditions, and trading regulations. Finally, the summary should list any additional qualifications or certifications that the trader may possess, such as a Series 65 or Series 7 license.

What is a good objective for a Proprietary Trader resume?

A good objective for a Proprietary Trader resume is to demonstrate the ability to generate a trading strategy that yields consistent profits, while also demonstrating an understanding of risk management practices.

- Showcase your ability to create and execute profitable trading strategies and utilize market data to make informed decisions.

- Demonstrate knowledge of risk management practices and the ability to adhere to them when making financial decisions.

- Prove your versatility in trading various markets and instruments, including both stocks and derivatives.

- Demonstrate a track record of success in trading and the ability to identify and capitalize on market trends.

- Display strong analytical, problem-solving, and financial modeling skills.

- Highlight your knowledge of the regulatory environment and the ability to adjust to changing regulations.

How do you list Proprietary Trader skills on a resume?

A Proprietary Trader is an individual who trades on behalf of a firm using the firm’s capital rather than their own. To be successful in this role, there are certain skills and qualities that are required. When putting together a resume for a position in Proprietary Trading, it is important to emphasize the skills that make you an ideal candidate. Here are some Proprietary Trader skills to consider including on your resume:

- Strong analytical skills: Proprietary Traders must be able to analyze large amounts of data quickly and accurately in order to make timely and profitable decisions.

- Financial knowledge: Proprietary Traders must have a thorough understanding of the financial markets and how different markets interact with each other.

- Risk management ability: Proprietary Traders must be able to identify and manage risks in order to maximize returns and minimize losses.

- Attention to detail: Proprietary Traders must be able to pay close attention to detail in order to identify the best opportunities and make the most of them.

- Problem solving skills: Proprietary Traders must be able to identify problems and come up with solutions in order to make the best decisions.

- Decision making: Proprietary Traders must be able to make decisions quickly and accurately in order to capitalize on opportunities as they arise.

- Strong communication skills: Proprietary Traders must be able to communicate their decisions and strategies effectively to both internal and external stakeholders.

By highlighting these Proprietary Trader skills on your resume, you can demonstrate to potential employers that you have the necessary skills to be successful in this role.

What skills should I put on my resume for Proprietary Trader?

When you’re applying for a Proprietary Trader position, you need to make sure your resume stands out from the competition. Having the right skills listed on your resume is essential in getting the job. Here are some key skills that should be included in your resume when applying for a Proprietary Trader position:

- Strong Analytical Skills: As a Proprietary Trader, you need to be able to make quick decisions based on your analysis of the markets. You need to be able to analyze financial data and spot trends or discrepancies that signal potential trades.

- Risk Management Skills: Proprietary traders are constantly assessing risk and making decisions about how much risk to take on. You need to be able to manage risk effectively and have the ability to evaluate the potential rewards vs. the potential losses.

- Organizational Skills: You need to be organized in order to effectively track and manage your open trades. You must also be able to prioritize tasks and manage your time wisely.

- Strong Technical Skills: Proprietary traders need to be tech-savvy in order to use trading software and online platforms in order to execute trades. You should have a strong understanding of the different platforms and be able to use them quickly and efficiently.

- Communication Skills: As a Proprietary Trader, you need to be able to effectively communicate with colleagues and clients. You should be able to explain your strategies and have the ability to handle any questions or concerns they may have.

Key takeaways for an Proprietary Trader resume

When writing your resume for a proprietary trading role, there are several key factors you should consider. Below are the key takeaways for an effective proprietary trader resume:

- Highlight Your Trading Experience: Your resume should include detailed information about your trading experience, including the strategies and techniques you have used successfully. Be sure to highlight any trading successes and any awards or recognitions you have achieved.

- Demonstrate Your Results: Proprietary traders need to demonstrate their ability to make money and minimize risk. Therefore, it is important to include performance metrics such as profits, losses, and return on investment.

- Showcase Your Market Knowledge: Proprietary traders must possess a deep understanding of the markets they trade in. Demonstrate your market knowledge by describing the markets you trade in, the strategies you employ, and the techniques you use.

- Emphasize Your Technical Skills: Proprietary traders must be proficient in many types of technology. Be sure to highlight the programming languages, software, and platforms you are familiar with.

- Provide Evidence of Your Professionalism: Proprietary traders need to demonstrate trustworthiness and professionalism. Include any certifications, licenses, or other credentials that demonstrate your commitment to the profession.

Following these key takeaways for an effective proprietary trader resume will help ensure that you make a strong impression with hiring managers. With the right resume, you can demonstrate your ability to succeed in a highly competitive and fast-paced trading environment.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder