A Private Equity Analyst is an important position in the industry as they are tasked with analyzing financial data, conducting market research, and making investment decisions. If you want to get hired as a Private Equity Analyst, it is essential that you craft a resume that stands out from the competition. In this guide, you’ll find the tips and examples you need to write an exceptional resume for a Private Equity Analyst position. You will also learn how to include your skills and experiences to highlight your qualifications and make you an attractive candidate for the job.

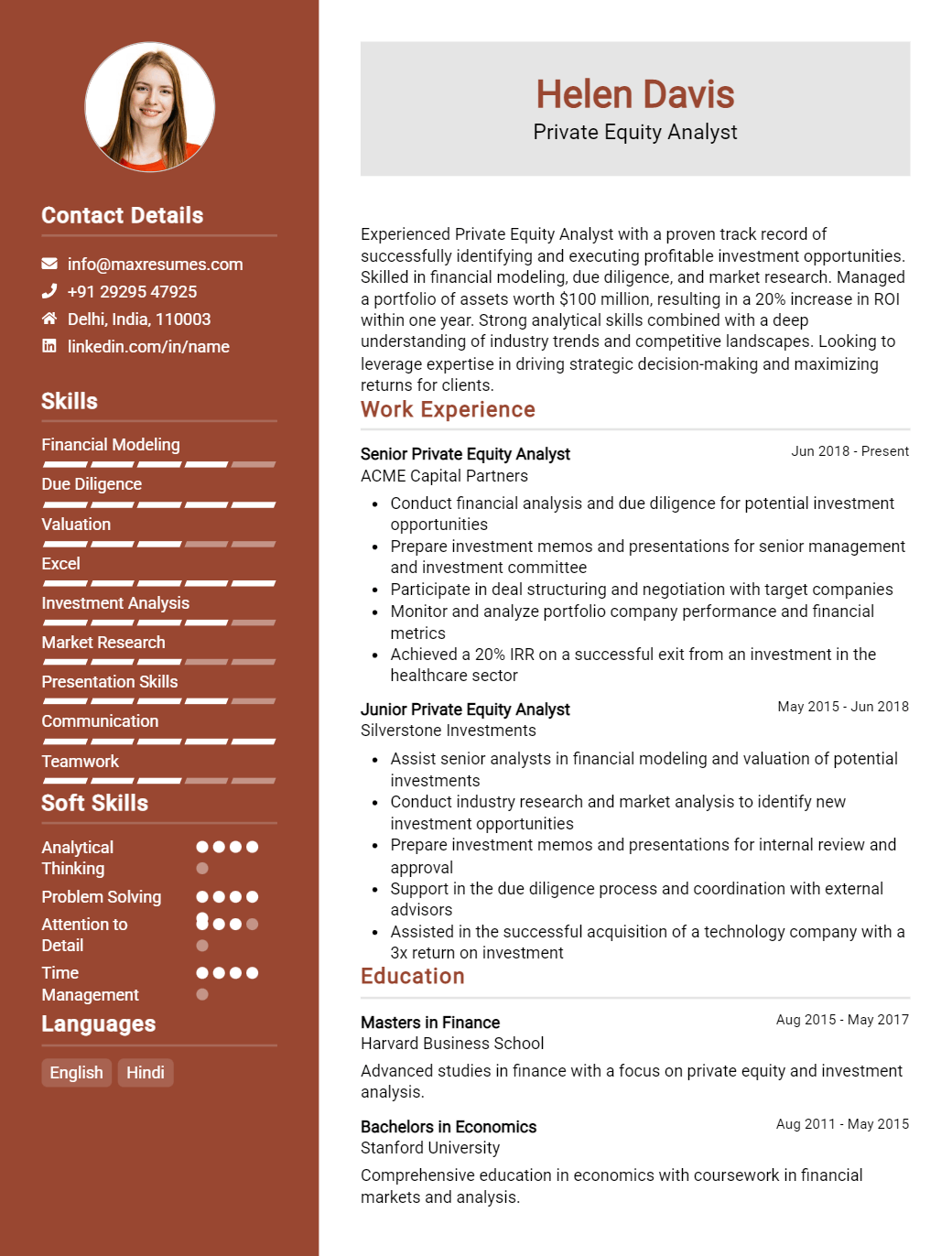

Private Equity Analyst Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Private Equity Analyst Resume Examples

John Doe

Private Equity Analyst

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

Recent graduate of a top- tier business school specializing in private equity and venture capital. Highly analytical with excellent communication and organizational skills and a passion for business and finance. Experienced in researching, analyzing, and interpreting financial data, managing projects, and developing investment strategies. Looking to join a private equity firm and use my knowledge and skills to help the firm reach its goals.

Core Skills:

- Financial Modeling

- Equity Valuation

- Due Diligence

- Capital Structure

- Financial Statement Analysis

- Investment Analysis

- Portfolio Management

- Risk Analysis

- Negotiation

- Team Leadership

Professional Experience:

Private Equity Intern, XYZ Ventures │ Jan – May 2020

- Evaluated potential investments in market sectors such as healthcare, real estate, and technology

- Constructed financial models with valuation and sensitivity analyses

- Performed in- depth due diligence and compiled detailed investment memorandum

- Participated in negotiations and portfolio management activities

- Conducted industry and company research by monitoring macroeconomic trends

Education:

Bachelor of Science in Business Administration, ABC University, May 2020

- Major in finance; Minor in accounting

- GPA 3.7/4.0

Private Equity Analyst Resume with No Experience

Recent college graduate with exceptional analytical and communication skills, seeking a position as a Private Equity Analyst. With a strong aptitude and interest in financial models, investments, and data analytics, I am confident that I can be an asset to any private equity firm.

Skills

- Financial Modeling and Valuation

- Investment Analysis

- Financial Statement Analysis

- Data analytics

- Financial Reporting

- Time Management

- Organizational Skills

- Strong Communication Skills

- Microsoft Office Suite

Responsibilities

- Analyze and interpret financial statements

- Develop and maintain financial models for investment evaluation

- Analyze and identify potential investments

- Research and monitor potential investments

- Prepare presentations for potential investors

- Monitor legal and regulatory developments for investments

- Coordinate with other departments and personnel to evaluate investment opportunities

- Assist in the due diligence process for potential investments

- Develop and maintain relationships with clients and partners

- Develop strategies to maximize returns on investments

- Review and analyze financial trends and market conditions

- Research and analyze industry trends and competitor activities

Experience

0 Years

Level

Junior

Education

Bachelor’s

Private Equity Analyst Resume with 2 Years of Experience

Highly motivated and analytical Private Equity Analyst with two years of experience in the financial services industry. Demonstrated expertise in developing financial models, conducting due diligence, and creating presentations to convey investment opportunities. Exceptional ability to analyze investment opportunities and understand complex financial concepts. Proven track record of securing and managing investments.

Core Skills:

- Financial Modeling

- Due Diligence

- Presentation Creation

- Investment Analysis

- Investment Management

- Data Analysis

- Risk Analysis

- Portfolio Management

Responsibilities:

- Developed financial models to evaluate and analyze potential investments.

- Conducted due diligence to identify and analyze financial risks associated with investments.

- Created presentations to convey investment opportunities to partners and investors.

- Assisted with the preparation of investment documents such as prospectuses and term sheets.

- Analyzed the performance of investments and the associated financial metrics.

- Managed investments including monitoring compliance and performance reviews.

- Reviewed portfolios and provided recommendations for further diversification.

- Conducted research to identify new investment opportunities.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Private Equity Analyst Resume with 5 Years of Experience

A highly motivated and experienced private equity analyst with 5 years of experience in financial analysis, due diligence and capital markets. Extensive knowledge of valuation and financial modeling, structuring and closing of investments, and portfolio management. Proven ability to analyze complex financial data, create presentations and meet tight deadlines. Results- driven professional with an entrepreneurial mindset and excellent communication skills.

Core Skills:

- Financial Analysis

- Valuation and Financial Modeling

- Due Diligence

- Capital Markets

- Portfolio Management

- Data Analysis

- Structuring and Closing of Investments

- Presentation Creation

- Time Management

- Communication Skills

- Entrepreneurial Thinking

Responsibilities:

- Conducted detailed financial analysis on prospective investments, managed portfolio companies and created detailed presentations

- Performed due diligence on potential investments, researched and evaluated market dynamics and trends, and estimated fair value of investments

- Developed financial models to support the analysis of investments and the valuation of portfolio companies

- Managed a portfolio of investments, supervised performance and reported on results

- Reviewed and monitored financial and operational performance of investments

- Prepared detailed reports and presentations for internal and external use

- Negotiated term sheets and other legal documents with external parties

- Collaborated with other teams to ensure efficient execution of transactions

- Fostered positive relationships with internal and external stakeholders.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Private Equity Analyst Resume with 7 Years of Experience

Dynamic Private Equity Analyst with 7 years of experience in investing and capitalizing the portfolios of high net worth individuals. Adept in researching and analyzing the financial performance of companies, creating and maintaining accurate financial models, and developing strategies for success. Possess excellent problem- solving and communication skills with the ability to work collaboratively in a team- oriented environment.

Core Skills:

- Financial Modeling

- Portfolio Management

- Investment Research

- Valuation Analysis

- Equity Investing

- Risk Management

- Database Management

Responsibilities:

- Conducted comprehensive analysis on financial information of target investments, including review of financial statements, cash flow analysis, and valuation models.

- Analyzed market trends and evaluated investments opportunities to create and maintain an optimal portfolio mix.

- Developed financial models to assess and monitor the financial performance of portfolio companies.

- Created and maintained detailed records of investments and portfolios.

- Collaborated with team members to develop successful investment strategies.

- Conducted due diligence of potential investments to identify risks and investment opportunities.

- Prepared executive presentations to communicate investment performance and recommendations.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Private Equity Analyst Resume with 10 Years of Experience

I am a highly experienced Private Equity Analyst with 10 years of experience in evaluating and analyzing private equity investments. I have a proven track record of success in the industry, having supported the successful completion of numerous transactions. I have in- depth knowledge of the private equity market, along with strong financial analysis, accounting and modeling skills. I am also highly proficient in Microsoft Excel, PowerPoint and Word. I have a strong collaborative approach to work, and I have the ability to build strong relationships with internal and external stakeholders.

Core Skills:

- Financial Analysis

- Accounting

- Financial Modeling

- Private Equity Market

- Microsoft Excel

- PowerPoint

- Word

- Collaborative Working

- Relationship Building

- Strong Analytic and Problem- Solving Ability

Responsibilities:

- Conducting financial analysis and modeling to support private equity transactions

- Evaluating potential investments in the private equity market

- Developing in- depth understanding of the private equity market

- Creating financial models to assess the potential returns on investments

- Assisting with due diligence processes for private equity transactions

- Reviewing and analyzing financial documents to assess the viability of investments

- Keeping abreast of changes in the private equity market and evaluating the impact on investments

- Liaising with internal and external stakeholders regarding financial and investment matters

- Developing reports, presentations and other documents as required

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Private Equity Analyst Resume with 15 Years of Experience

An accomplished Private Equity Analyst with 15 years of experience in conducting due diligence, financial modeling, and portfolio management. Able to develop, implement and maintain complex financial models and valuations to assess company performance and investment opportunities. Skilled in analyzing financial statements, market trends, and competitive analysis. Experienced in strategic planning, financial reporting, and developing financial forecasts. An excellent communicator, able to effectively collaborate with investors and portfolio companies.

Core Skills:

- Financial Modeling

- Due Diligence

- Portfolio Management

- Financial Forecasting

- Strategic Planning

- Financial Statements Analysis

- Competitive Analysis

- Market Analysis

- Investment Analysis

- Relationship Management

Responsibilities:

- Conducting due diligence and financial modeling to evaluate potential investments and investments risks

- Developing and maintaining complex financial models and valuations to assess company performance and investment opportunities

- Analyzing financial statements and market trends to identify investment opportunities

- Developing financial forecasts and performing competitive analysis to inform investment decisions

- Managing portfolio investments and managing relationships with investors and portfolio companies

- Assisting with the preparation of financial reports and presentations for investors and portfolio companies

- Developing and evaluating strategic plans and investments strategies to maximize returns and optimize risk

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Private Equity Analyst resume?

A Private Equity Analyst resume is a crucial part of any job application, as it is a prospective employer’s first impression of a candidate. As such, it is important to include all relevant skills, experience, and education in order to demonstrate the applicant’s ability to perform the job.

In order to craft an effective Private Equity Analyst resume, here are some key points to consider:

- Include a brief summary at the top of the resume that outlines the applicant’s experience and qualifications.

- List relevant job experience, including internships, and any related activities.

- Detail any research or analysis conducted.

- Highlight any accomplishments or awards.

- Include any relevant certifications, such as a CFA or MBA.

- Demonstrate knowledge of fundamental principles of private equity, such as valuation and financial modeling.

- Showcase any software proficiency.

- Outline any written or oral communication skills.

- Detail language knowledge, if applicable.

- Mention any volunteer or extracurricular activities.

By following these tips, a Private Equity Analyst resume can effectively demonstrate the applicant’s qualifications and make a strong first impression with a potential employer.

What is a good summary for a Private Equity Analyst resume?

A Private Equity Analyst resume should be a concise overview of the candidate’s experience and qualifications that is tailored to the particular position for which they are applying. The summary should highlight the candidate’s strengths in financial analysis, investment analysis, and portfolio management, as well as their ability to effectively communicate with team members and stakeholders. The summary should also include the candidate’s experience with portfolio management tools and methods, and their ability to assess and identify potential investments. Finally, the summary should also display the candidate’s past successes in evaluating and executing successful deals. By clearly summarizing the candidate’s qualifications and experience, a Private Equity Analyst resume can help an employer quickly identify the candidate’s strengths and determine if they are a good fit for the job.

What is a good objective for a Private Equity Analyst resume?

A Private Equity Analyst is an important member of a financial team that makes strategic investments and maintains portfolios. As such, a good objective for a Private Equity Analyst resume is to showcase the skills and knowledge that an individual has to help a firm become more successful.

A Private Equity Analyst should have an objective that shows their knowledge of investments and financial analysis. The objective should also demonstrate the ability to work in a team-oriented environment and to handle challenging projects. Here are some good objectives for a Private Equity Analyst resume:

- To leverage my financial analysis skills and knowledge of investments to benefit the firm’s growth and development

- To utilize my experience in financial modeling, data analysis, and portfolio management to help the firm make informed decisions

- To work in a team-oriented environment to develop and implement successful investment strategies

- To use my strong communication skills to effectively collaborate with other professionals to create positive outcomes

- To leverage my experience in financial analysis and investments to help maximize profits and minimize risks

- To use my in-depth understanding of the financial markets to help the firm make the best possible choices

How do you list Private Equity Analyst skills on a resume?

When creating a resume, it is important to accurately and concisely list your skills to ensure that the hiring manager knows you have the qualifications they are seeking. As a Private Equity Analyst, you will need to list a variety of technical and soft skills that demonstrate your expertise in the field. Here are some skills to consider including on your resume:

- Financial Analysis: The ability to quickly evaluate financial data and draw meaningful conclusions is essential to the role of a Private Equity Analyst. Listing this skill can demonstrate your understanding of the financial markets and your proficiency with analyzing financial information.

- Investment Analysis: Being able to analyze investment opportunities and compare the relative merits of different investments is a crucial part of the job. Highlighting your ability to weigh the risks and rewards of potential investments can show you are up to the challenge of the role.

- Strategic Thinking: A successful Private Equity Analyst must possess the ability to think strategically and plan for the future. Showing that you have the skills to develop long-term plans and anticipate potential challenges can set you apart from other candidates.

- Communication: Being able to effectively communicate your analysis and conclusions is an important part of the job. Demonstrating strong communication skills can show that you are able to convey complex information in a concise and understandable manner.

- Technical Proficiency: Having a firm grasp of technology and software programs is essential to the role. Highlighting your proficiency in programs such as Excel, Bloomberg, and FactSet can show that you are comfortable working with the necessary tools.

By including these key skills on your resume, you can demonstrate to the hiring manager that you are a qualified candidate for the Private Equity Analyst role.

What skills should I put on my resume for Private Equity Analyst?

Writing a resume for a Private Equity Analyst position? You should highlight a variety of skills and accomplishments, both to demonstrate your potential value as an employee and to demonstrate your relevant experience. Here are some of the top skills to include on your Private Equity Analyst resume:

- Financial Modeling: Private Equity Analysts are responsible for building complex financial models to assess investment opportunities. You should be prepared to demonstrate your financial modeling skills on your resume.

- Investment Analysis: Private Equity Analysts need to be able to analyze investments from all angles. This includes assessing risk, return potential, legal and regulatory factors, and much more.

- Data Analysis: Private Equity Analysts must be adept at interpreting data and using it to inform their investment decisions. Showcase your data analysis skills on your resume.

- Negotiation Skills: Private Equity Analysts must negotiate terms and conditions with potential investments. Make sure to mention your negotiation skills on your resume.

- Business Acumen: Private Equity Analysts need to understand the underlying businesses they are investing in and be able to assess their potential value. Demonstrate your business acumen on your resume.

- Communication: Private Equity Analysts must be able to effectively communicate their investment ideas and strategies to colleagues and executives. Mention your communication skills on your resume.

Key takeaways for an Private Equity Analyst resume

Aspiring private equity analysts should create a resume that demonstrates their experience, skills, and education in the industry. Writing a resume for a competitive investment position can be challenging, but there are key components that can help you stand out from the crowd. Here are some key takeaways for creating a winning resume for a private equity analyst position:

- Highlight Your Relevant Experience: Make sure to highlight your relevant experience in the private equity industry. Focus on any internships, positions, or special projects you’ve taken part in that demonstrate your knowledge and experience in the field.

- Demonstrate Your Analytical Skills: As a private equity analyst, you will be expected to have strong analytical skills. Include any quantitative skills you have such as financial analysis, data analysis, and project management.

- Showcase Your Education: Your education is important for a private equity analyst position. Include any relevant degrees, certifications or courses you’ve taken related to finance, economics or business.

- Demonstrate Your Networking Skills: Private equity analysts need to have strong networking skills. Showcase any networking events, conferences or other activities you’ve participated in that demonstrate your ability to build relationships and expand contacts.

- Include Any Additional Skills: Private equity analysts often take on a variety of tasks. Include any additional skills such as sales, marketing or programming that could be relevant to the position.

By following these key takeaways, you’ll create a strong resume that stands out from the competition. Demonstrate your experience, skills, and education in the private equity industry and showcase your networking abilities to make a great impression.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder