Are you looking for the best tips on how to craft the perfect portfolio manager resume? Whether you are a seasoned professional looking for a new opportunity or someone just starting out in the portfolio management field, having a well-crafted resume is essential for getting noticed. This guide will provide you with the vital information for creating a strong resume, as well as a few examples to help get you on the right track. Read on to learn more about the different components of portfolio manager resumes and how to make yours stand out from the competition.

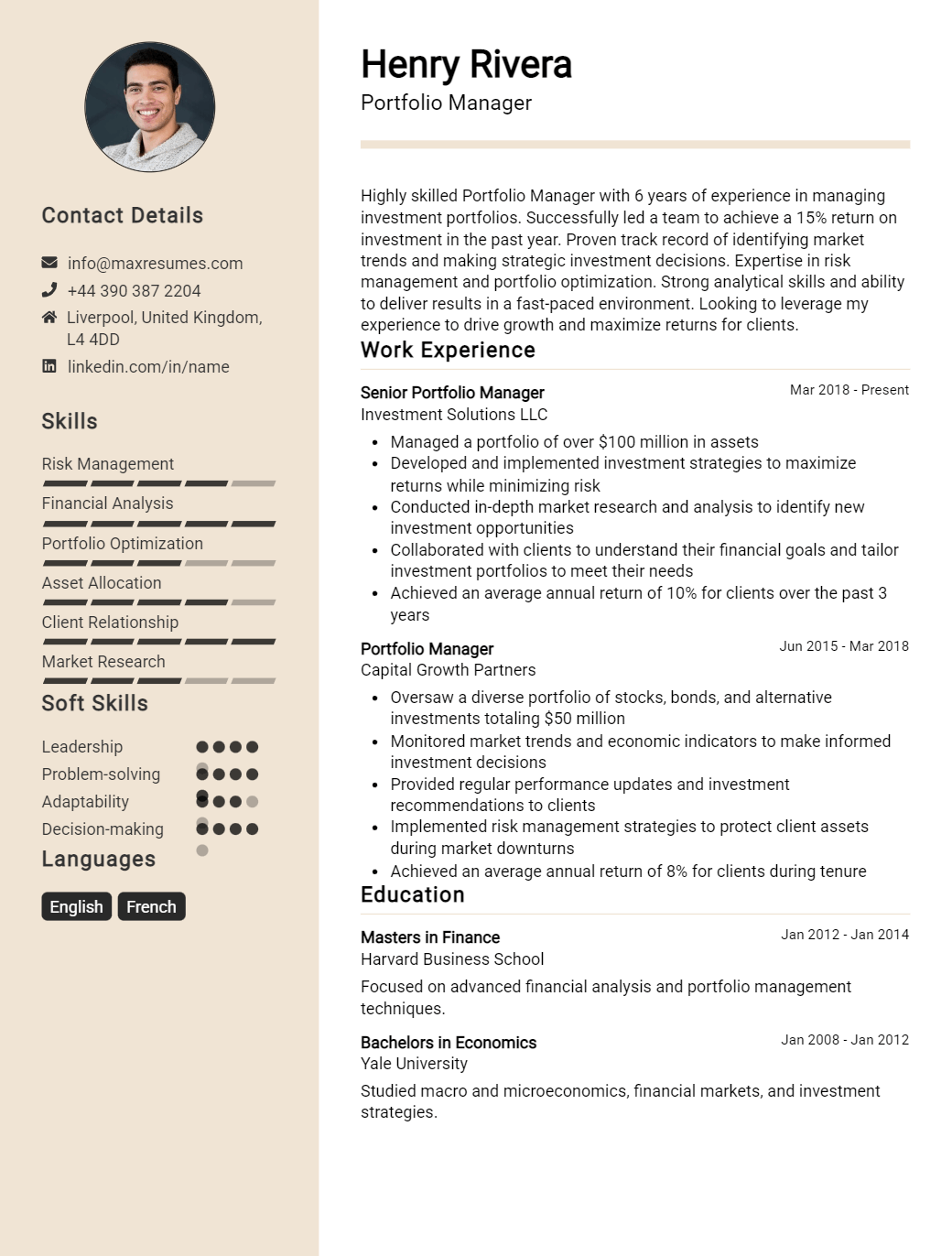

Portfolio Manager Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Portfolio Manager Resume Examples

John Doe

Portfolio Manager

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

Successful and experienced Portfolio Manager with 8 years of experience in the financial industry. Highly detail- oriented and able to analyze financial market trends and develop strategies to maximize returns in volatile markets. Proven track record of managing portfolios of diverse assets and achieving targeted returns. Adept in building and maintaining relationships with clients while adapting to industry trends and regulations.

Core Skills:

- Portfolio Management

- Investment Analysis

- Risk Management

- Financial Modeling

- Financial Planning

- Asset Allocation

- Data Analysis

- Client Relationships

- Regulatory Compliance

Professional Experience:

- Portfolio Manager, ABC Investment Firm, NY (2017- present)

- Manage portfolios of diverse assets, including stocks, bonds, and ETFs, for high- net worth clients

- Monitor and analyze global financial markets to identify areas of opportunity for portfolio returns

- Develop strategies for short- term and long- term investments

- Analyze and manage risk within the portfolio

- Monitor the performance of the portfolio and adjust portfolios as needed

- Prepare and present portfolio performance reports to clients

- Investment Analyst, XYZ Investment Firm, NY (2013- 2017)

- Conducted research and data analysis to identify investment opportunities

- Developed financial models to forecast potential returns on investments

- Collaborated with portfolio managers to develop and implement investment strategies

- Monitored and reported on portfolio performance

Education:

- Bachelor of Science in Finance, NYU (2013)

- Master of Science in Finance, NYU (2015)

Portfolio Manager Resume with No Experience

Recent finance graduate with a proven track record of success in financial analysis and portfolio management. Skilled in financial research, data analysis and creating effective strategies for portfolio growth. Possesses strong communication and organizational skills and a comprehensive understanding of investment strategies and portfolio management techniques. Dedicated to providing portfolio managers with the necessary tools to meet performance targets and maximize profits.

Skills

- Financial Analysis

- Data Analysis

- Portfolio Management

- Investment Strategies

- Risk Management

- Financial Research

- Strategy Development

- Communication

- Organization

Responsibilities

- Conduct financial analysis to identify investment trends and opportunities

- Develop and implement effective portfolio management strategies

- Research and analyze financial markets to identify investment opportunities

- Monitor and review economic and financial data to identify potential risks and opportunities

- Provide portfolio managers with the necessary tools to achieve performance targets

- Analyze and evaluate portfolio performance to ensure target objectives are met

- Work with portfolio managers to develop and implement investment strategies

- Monitor portfolio performance and provide timely recommendations to optimize portfolio growth

- Communicate effectively with portfolio managers, financial advisors and other stakeholders

- Ensure portfolio compliance with regulatory and legal requirements

Experience

0 Years

Level

Junior

Education

Bachelor’s

Portfolio Manager Resume with 2 Years of Experience

Portfolio Manager with over 2 years of experience in monitoring and analyzing investment portfolios for various clients. Adept in financial analysis, portfolio diversification, investment strategy, and risk management. Highly proficient in conducting research and developing customized financial plans that meet the objectives of the clients. Proven ability to communicate with clients and build strong relationships through professional services.

Core Skills:

- Advanced financial analysis

- Portfolio diversification

- Investment strategies development

- Risk management

- Client relationship management

- Industry research

- Financial advice

Responsibilities:

- Developed customized investment portfolios for clients based on their risk tolerance, financial goals and timeline

- Managed and monitored existing portfolios to ensure proper alignment with target objectives

- Conducted detailed industry research and analysis to identify suitable investment opportunities that meet clients’ risk/return requirements

- Established investment goals and milestones in accordance with clients’ short- and long- term objectives

- Applied advanced financial analysis techniques to measure portfolio risk and performance

- Developed and implemented strategies for portfolio diversification and risk management

- Monitored and updated clients on the current market conditions, investment trends and new investment opportunities

- Provided risk/return assessments based on portfolio performance and industry trends

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Portfolio Manager Resume with 5 Years of Experience

I am a highly motivated Portfolio Manager with 5 years of experience in financial services. I have a proven track record in managing portfolios for high net worth individuals, pension funds and other institutional investors. My expertise includes portfolio analysis, portfolio construction, portfolio monitoring, asset allocation, and security selection. I have strong knowledge in a variety of investment products, such as stocks, bonds, mutual funds and ETFs. I am detail- oriented and proficient in financial modeling and backtesting strategies. I am also well- versed in risk management, regulatory compliance and client service. I am passionate about helping my clients meet their financial goals and am committed to delivering results.

Core Skills:

- Portfolio Analysis

- Portfolio Construction

- Portfolio Monitoring

- Asset Allocation

- Security Selection

- Financial Modeling

- Backtesting Strategies

- Risk Management

- Regulatory Compliance

- Client Service

Responsibilities:

- Manage portfolios for high net worth individuals, pension funds and other institutional investors.

- Develop and implement investment strategies tailored to each client’s financial goals.

- Monitor and evaluate portfolio performance by analyzing investment data and market trends.

- Research and analyze financial instruments and make informed trading decisions.

- Make tactical changes to portfolios to adjust for changing market conditions.

- Prepare portfolio reports and presentations to discuss strategy and performance.

- Contribute to the development of investment products and services.

- Ensure compliance with regulatory and industry standards.

- Provide excellent customer service and build strong relationships with clients.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Portfolio Manager Resume with 7 Years of Experience

I am a highly experienced Portfolio Manager with 7 years in the finance industry. I specialize in creating, executing and managing asset portfolios that meet specific objectives. My extensive knowledge of the markets, investment strategies, and portfolio evaluation provide me with the tools and experience to make informed decisions while balancing potential returns and risk. I am adept at identifying potential areas of growth and have a proven track record of successful portfolio management. I am also highly adept at identifying and managing potential conflicts of interest.

Core Skills:

- Portfolio management

- Market analysis

- Investment strategies

- Financial modeling

- Risk management

- Conflict resolution

- Project management

Responsibilities:

- Develop and manage asset portfolios for clients with specific goals in mind

- Monitor and maintain portfolio performance

- Analyze the market and identify potential areas of growth

- Research and develop investment strategies

- Implement financial modeling and risk management techniques

- Monitor trends and changes in the market

- Manage potential conflicts of interest

- Liaise with other stakeholders to develop and implement portfolio strategies

- Create, monitor and adjust portfolio allocations to optimize returns

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Portfolio Manager Resume with 10 Years of Experience

Highly experienced and motivated Portfolio Manager with 10+ years of experience driving increased sales and profitability for well- known companies. Adept at finding creative solutions to challenging investment problems, developing successful portfolios, and providing guidance and leadership to team members. Skilled in quantitative analysis, efficient portfolio management, strategic planning, and process improvement. Passionate about creating and optimizing financial portfolios that are in line with the company’s goals and objectives.

Core Skills

- Financial Analysis

- Portfolio Management

- Portfolio Optimization

- Risk Management

- Strategic Planning

- Investment Solutions

- Team Leadership

- Process Improvement

- Asset Allocation

- Quantitative Analysis

- Financial Modeling

Responsibilities

- Developed robust portfolios for companies by conducting quantitative analysis, reviewing financial models, and evaluating market trends.

- Implemented strategies to optimize portfolios and mitigate risk while achieving maximum returns.

- Led team members to ensure successful portfolio management and decision- making.

- Coordinated with other departments to analyze and implement new investment solutions.

- Developed and maintained relationships with clients to ensure their portfolio needs were met.

- Monitored financial markets and identified opportunities for portfolio growth and optimization.

- Developed and implemented process improvements to streamline workflow and maximize efficiency.

- Ensured portfolios were in alignment with the company’s policies and procedures.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Portfolio Manager Resume with 15 Years of Experience

Highly experienced Portfolio Manager with over 15 years in the investment industry. Expertise in understanding financial markets and risk management. Skilled in developing and executing trading strategies, using strong quantitative and qualitative analysis to identify profitable opportunities. Proven track record of successful investments and earnings growth.

Core Skills:

- Extensive experience in portfolio management and risk management

- High- level proficiency in financial markets

- Advanced knowledge of investment strategies and techniques

- Proficient in quantitative and qualitative analysis

- Excellent communication and client relationship management skills

- Proven record in generating profitable investments

Responsibilities:

- Developed and implemented trading strategies in order to maximize returns on investments

- Conducted thorough research and analysis to identify profitable opportunities

- Managed portfolio of stocks, bonds, and other investments

- Monitored and reported on daily, monthly, and quarterly performance of investments

- Maintained relationships with clients and communicated with colleagues and external parties

- Executed trades in global markets and monitored daily movements and upheavals

- Negotiated deals with investment banks and other financial institutions

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Portfolio Manager resume?

A portfolio manager plays an incredibly important role in an organization, which is why having a well-crafted resume is essential. A portfolio manager’s resume should highlight their knowledge and experience in the field, their past successes, and their ability to manage different types of investments. Here are some key elements to include in a portfolio manager resume:

- Professional experience: List any positions you’ve held that are relevant to the portfolio management field, such as financial analyst or investment analyst. Include the title of the position, the organization you worked for, and the timeframe you were employed.

- Education: Include any degrees, certificates, or other credentials that are related to portfolio management.

- Skills: List any technical skills or soft skills you have that are related to the portfolio management field. Examples of technical skills may include data analysis, financial modeling, and market research. Soft skills may include communication, problem-solving, and leadership.

- Accomplishments: List any awards you have received, such as a CFA or CFP certification, or any achievements you’ve made in your portfolio management roles.

- Investment strategies: Describe any investment strategies you have successfully implemented in past roles.

- Investment portfolio performance: Provide any information you have about the performance of investments you’ve managed.

- References: Provide contact information for previous supervisors or colleagues who are willing to vouch for your work.

What is a good summary for a Portfolio Manager resume?

A portfolio manager resume should provide a brief but comprehensive overview of an individual’s background, qualifications, and experience. It should demonstrate their ability to manage financial portfolios and investments, as well as their professional accomplishments in this field. The summary should highlight any relevant education or credentials they possess, such as a master’s degree in finance or a financial certification, as well as any relevant experience or expertise they bring to the job. It should also provide an overview of their technical and quantitative skills, such as portfolio management software proficiency and financial market analysis. The summary should conclude with a brief summary of the individual’s professional goals and objectives. Ultimately, the resume should reflect a portfolio manager’s commitment to providing excellent portfolio management services and should demonstrate their commitment to helping their clients achieve their financial goals.

What is a good objective for a Portfolio Manager resume?

A portfolio manager is responsible for creating and managing investments. They develop financial strategies and plans, assess risks, and research the market to make decisions about investments. A portfolio manager should have strong analytical skills, knowledge of the financial market, and experience in financial planning.

When writing a resume for a portfolio manager position, a good objective is to showcase the skills and experience that make the applicant a qualified candidate for the job. Here are some points to consider when writing a portfolio manager resume objective:

- Demonstrate knowledge of financial markets, investments, and asset classes

- Showcase experience in financial planning and portfolio management

- Highlight strong analytical skills and the ability to make sound investment decisions

- Displays knowledge of applicable laws and regulations

- Illustrate an understanding of risk management and portfolio diversification

- Show passion and enthusiasm for the role

Overall, the objective of a portfolio manager resume should be to demonstrate the applicant’s qualifications and suitability for the position. Crafting a resume objective that captures the skills and experience needed for the job is essential in standing out from other applicants.

How do you list Portfolio Manager skills on a resume?

A portfolio manager plays a critical role in the success of an organization by managing various portfolios, overseeing investments, and providing strategic guidance. When applying for a portfolio manager role, it is important to highlight your portfolio management skills on your resume to stand out from the competition. Here are a few portfolio manager skills to include in your resume:

- Investment Analysis: Ability to analyze and evaluate investments to make informed decisions.

- Risk Management: Knowledge of risk management strategies and the ability to assess and mitigate risk.

- Financial Acumen: Understanding of financial markets, instruments, and strategies.

- Strategic Thinking: Ability to develop strategies and plans to meet organizational objectives.

- Leadership: Ability to lead and motivate others to achieve results.

- Communication: Possess excellent communication skills to interact with stakeholders.

- Research: Ability to conduct research and analyze data to develop insights.

- Organizational Skills: Possess strong organizational and time management skills.

- Problem Solving: Ability to identify, analyze, and solve complex problems.

What skills should I put on my resume for Portfolio Manager?

A Portfolio Manager is responsible for all aspects of an investment portfolio. They must have strong research and analytical skills, be able to interpret financial documents, and provide financial advice that meets the goals of the portfolio. When writing your resume, you should highlight the skills and experience that show you can meet these goals. Here are some key skills to include on your resume:

- Research and Analysis: Portfolio Managers must have a thorough understanding of markets and investing, and must be able to evaluate potential investments and make data-driven decisions. Demonstrate your ability to research and analyze investment markets and securities by outlining your experience in the field.

- Financial Management: A successful Portfolio Manager must be able to manage and optimize a portfolio’s performance. Showcase your skills in financial management by describing your experience in creating and managing investment plans and portfolios.

- Risk Management: Portfolio Managers need to be able to identify, measure, and manage the risks associated with investments. Showcase your risk management skills by providing examples of your experience in managing investments and managing risk.

- Communication: Portfolio Managers must be able to clearly explain their views and strategies to clients and other stakeholders. Showcase your communication skills by providing examples of your ability to present complex financial concepts in an easy-to-understand manner.

- Technology: Portfolio Managers must be able to use a variety of financial software programs and tools. Display your technology skills by providing a list of the programs and tools you’ve used and describing any specific experience you have with them.

By emphasizing these skills in your resume, you can demonstrate to potential employers your qualifications to be a successful Portfolio Manager.

Key takeaways for an Portfolio Manager resume

The job of a portfolio manager is a challenging one, requiring extensive knowledge of the stock markets and the ability to handle large amounts of financial data. A good portfolio manager resume should demonstrate that the applicant is knowledgeable about the stock markets and has the skills necessary to manage a portfolio successfully.

Here are some key takeaways for creating an effective portfolio manager resume:

- Highlight Your Skills and Experience: Your resume should demonstrate that you have the necessary skills and experience to be a successful portfolio manager. This includes knowledge of the stock markets, financial analysis, investment strategies, and portfolio management techniques. Be sure to list your qualifications, such as any degrees, certifications, or professional licenses that you may have.

- Demonstrate Your Understanding of the Markets: It is important to be able to articulate your understanding of the stock markets and the various investment strategies that portfolio managers use. Provide examples of investments you have made and how they have performed.

- Show Your Ability to Handle Financial Data: Portfolio managers must be able to accurately analyze financial data and make informed decisions. Be sure to show off your ability to understand and interpret financial data, such as tax returns, balance sheets, and financial statements.

- Provide Examples of Your Successes: A portfolio manager must not only be able to manage money, but also be able to show success in doing so. Your resume should include examples of the investments you have made and the profits you have earned from them.

- Showcase Your Leadership Skills: Portfolio management often involves leading a team of other financial professionals, so it is important to demonstrate your ability to be a good leader. Provide examples of how you have managed teams in the past, such as setting goals and providing guidance.

By following these key takeaways, you can create a portfolio manager resume that will stand out and help you land the job you are looking for.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder