For any job seeker, writing a resume is one of the most important steps to take in the job search process. The resume is often the first impression a potential employer has of you, and you want to make sure it makes a positive one. If you’re looking for a job as a patient financial counselor, it’s important to craft a resume that demonstrates your experience and knowledge in the field. This guide provides tips and examples for writing a resume as a patient financial counselor, focusing on the most important elements to include and the best format for your resume.

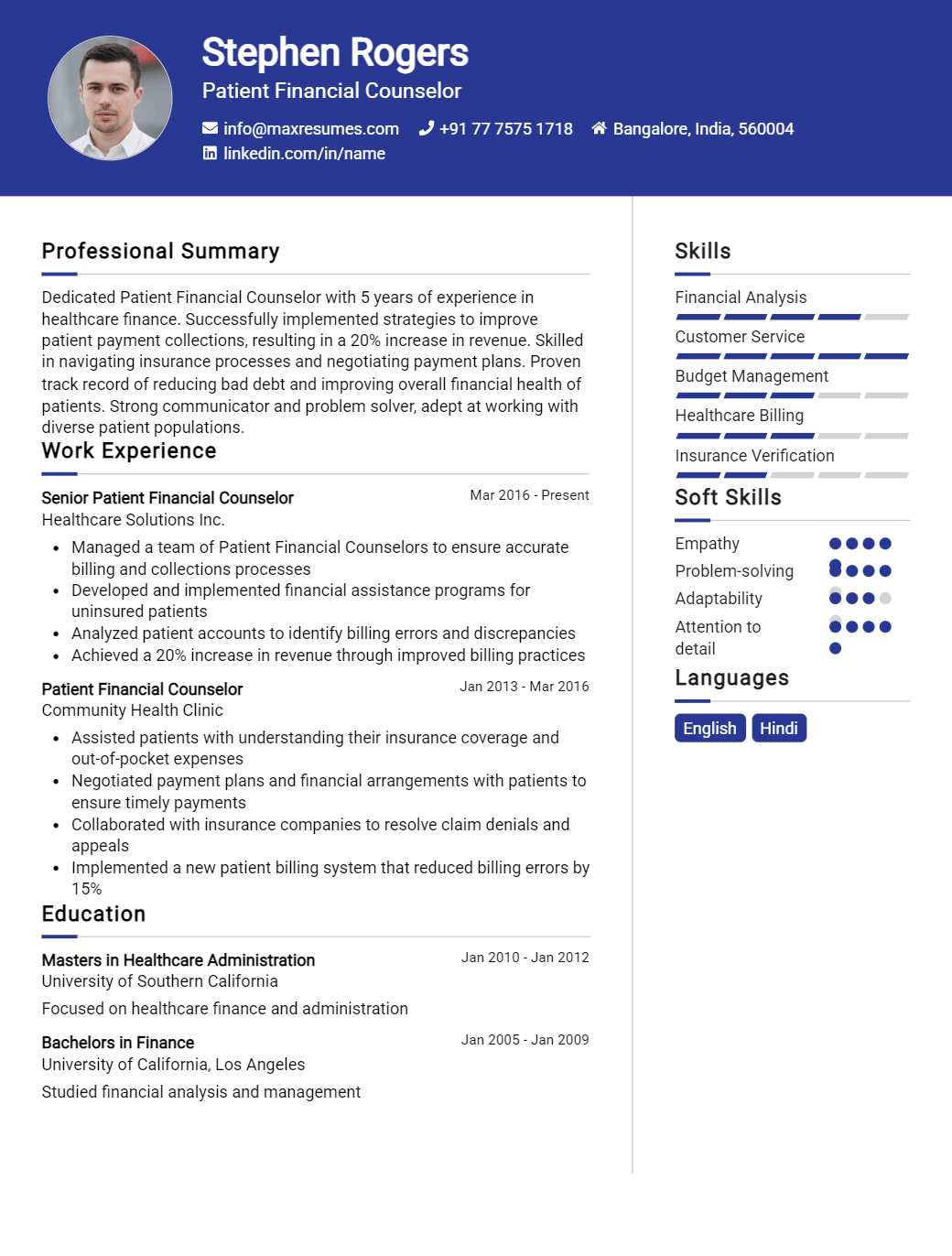

Patient Financial Counselor Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Patient Financial Counselor Resume Examples

John Doe

Patient Financial Counselor

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

A dedicated and knowledgeable Patient Financial Counselor with over 5 years of experience in helping patients understand complex financial matters and communicate effectively with insurance companies. Possess a stellar track record of providing support for patient payment issues, resolving difficult accounts, and helping patients access vital healthcare services. Skilled in assessing patient financial circumstances, providing personalized assistance, and managing account balances.

Core Skills:

- Patient Financial Counseling

- Insurance Billing and Collections

- Confidentiality and Data Security

- Eligibility Requirements Verification

- Financial Analysis and Reporting

- Regulatory Compliance and Documentation

- Customer Relations and Problem Solving

Professional Experience:

Patient Financial Counselor, ABC Healthcare, 2017- Present

- Provide high- quality financial counseling services to patients in accordance with policies and procedures

- Verify third- party payer eligibility, review guidelines, and help patients make informed decisions

- Analyze patient payment plans, identify potential issues, and develop comprehensive solutions

- Develop and maintain relationships with insurance companies to ensure timely payments and collection of receivables

- Ensure compliance with HIPAA, state, and federal regulations

- Educate patients on insurance benefits, payment options, and fee structures

Education:

Bachelor of Science in Health Administration, ABC University, 2017

Patient Financial Counselor Resume with No Experience

Recent college graduate with a Bachelor’s degree in Psychology and a passion for helping others. Looking to apply problem- solving and organizational skills in a role as a Patient Financial Counselor.

Skills

- Excellent communication and interpersonal skills

- Strong problem- solving and organizational abilities

- Proficient in Microsoft Office Suite

- Ability to multi- task and prioritize effectively

- Familiarity with medical billing systems

Responsibilities

- Provide financial counseling and guidance to patients

- Discuss payment options and help patients understand their billing statements

- Work with insurance companies to ensure coverage and payment on claims

- Maintain accurate records and keep up to date with changes in health care regulations

- Assist patients with resolving billing issues and disputes

Experience

0 Years

Level

Junior

Education

Bachelor’s

Patient Financial Counselor Resume with 2 Years of Experience

A highly analytical and organized financial counselor with 2 years of experience in providing sound financial advice and assistance to individuals and families. Proficient in interpreting financial documents, understanding investment strategies, and helping clients set and manage financial goals. Skilled in providing advice on retirement planning, budgeting, credit, debt, and investments. Demonstrated track record of providing clear, concise, and empathetic counseling to clients.

Core Skills:

- Knowledge of Financial Planning Principles

- Retirement Planning

- Budgeting and Debt Management

- Credit Analysis

- Investment Strategies

- Strong Interpersonal and Communication Skills

- Conflict Resolution and Negotiation

- Problem Solving and Analytical Thinking

Responsibilities:

- Assessed client’s financial situation and provided appropriate advice and recommendations

- Developed financial plans that met the needs and goals of clients

- Facilitated meetings with clients to review and discuss financial plans

- Analyzed and evaluated loan and investment portfolios to ensure optimal financial outcomes

- Researched and identified suitable financial products and services for client’s needs

- Educated clients on financial planning principles, budgeting, and debt management

- Developed effective strategies for debt consolidation and investment portfolio management

- Negotiated solutions with creditors and debtors for the benefit of clients

- Maintained accurate records of client financial transactions and plans

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Patient Financial Counselor Resume with 5 Years of Experience

Highly organized and motivated Patient Financial Counselor with 5 years of experience in the healthcare industry. Demonstrated ability to work with individuals and families to assess their financial circumstances, providing advice on budgeting, debt management, and healthcare benefits. Excellent interpersonal and communication skills, ability to work independently and as part of a team.

Core Skills:

- Knowledge of medical terminology and insurance

- Exceptional communication and customer service skills

- Ability to analyze financial data and provide solutions

- Proficiency in MS Office

- Ability to multi- task and prioritize tasks efficiently

- Ability to work with patients from diverse backgrounds

- Excellent problem- solving, organizational, and time management skills

Responsibilities:

- Provided financial counseling to patients and their families.

- Reviewed patient accounts for insurance coverage and payment of co- pays and deductibles.

- Processed insurance claim applications and reconciliation of insurance payments.

- Assisted patients with applications for government programs such as Medicare and Medicaid.

- Supplied financial advice to patients on budgeting, debt management, and other financial issues.

- Worked with other healthcare professionals to coordinate care plans with insurance providers.

- Monitored patient financial accounts, billing and payment status.

- Followed up with patients regarding unpaid balances and worked with them to arrange payment plans.

- Developed and maintained relationships with clients to ensure customer satisfaction.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Patient Financial Counselor Resume with 7 Years of Experience

Strong, experienced and service- oriented Patient Financial Counselor with 7 years of experience providing financial counseling services to healthcare patients. Adept at assessing and analyzing patient financial issues, gathering information and developing plans for resolving financial issues. Demonstrated ability to efficiently prioritize tasks and maintain accurate records. Exceptional communicator with the ability to establish and maintain effective relationships with patients and staff.

Core Skills:

- Patient Financial Services

- Analysis and Resolution

- Data Entry and Maintenance

- Accounts Payable and Receivable

- Communication and Interpersonal Skills

- Billing and Collections

Responsibilities:

- Assessed and analyzed patient financial issues, determining best resolution course of action.

- Gathered financial information to determine patient eligibility for financial assistance.

- Created and presented presentations to staff on financial services, new programs and compliance regulations.

- Ensured patient satisfaction with financial services by proactively addressing any complaints or issues.

- Provided patient education on insurance coverage and payment options.

- Collaborated with billing department to resolve unpaid accounts and ensure timely payment.

- Maintained accurate and up- to- date financial records.

- Provided financial counseling to patients regarding payment options and repayment plans.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Patient Financial Counselor Resume with 10 Years of Experience

A highly experienced Patient Financial Counselor with 10 years of experience in providing financial counseling to patients on hospital bills, insurance policies, and other hospital services. Possesses excellent communication and interpersonal skills to effectively interact with patients and their families, and to explain complex topics in simple terms. Possesses a deep understanding of billing codes, medical terminology and federal and state regulations.

Core Skills:

- Strong financial counseling experience

- Excellent communication and interpersonal skills

- Solid understanding of billing codes, medical terminology and federal and state regulations

- Ability to explain complex topics in simple terms to patients and their families

- Proficient in MS Office and other healthcare- related software

- Ability to effectively prioritize and manage multiple tasks

- Detail- oriented with excellent organizational and time management skills

Responsibilities:

- Provided financial counseling to patients and their families regarding hospital bills, insurance policies, and other hospital services

- Explained complex topics in simple terms to patients and answered all their questions

- Researched and analyzed billing codes, medical terminology, and federal and state regulations

- Prepared and presented reports to management on patient financial counseling activities

- Communicated with third- party payers and other insurance companies to resolve insurance claims

- Worked with other healthcare personnel to ensure that prescribed treatments and procedures are followed

- Provided detailed financial information to patient families and advised them on budgeting and financial management

- Assisted patients and families in navigating the healthcare system and obtaining resources

- Maintained accurate and up- to- date records of patient financial counseling activities.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Patient Financial Counselor Resume with 15 Years of Experience

A highly experienced Patient Financial Counselor with over 15 years of experience in assisting patients and families with their financial responsibilities. Extensive knowledge of insurance plans, hospital policies, and patient rights. Skilled in educating patients on their rights and options, providing clear explanations and advice, and resolving complex financial concerns. Proven success in increasing patient satisfaction and receiving positive feedback from patients and other healthcare professionals.

Core Skills:

- Patient Financial Counseling

- Insurance Plans

- Hospital Policies

- Patient Rights

- Financial Negotiations

- Customer Service

- Account Resolution

- Verbal & Written Communication

- Record Keeping

- Financial Reporting

Responsibilities:

- Counsel patients and families on their financial responsibilities

- Advise patients on insurance plans, hospital policies, and patient rights

- Education on various payment options, including loan payment plans, short and long term payment options, and payment exemptions

- Negotiate with insurance companies and other third- party vendors to establish payment terms

- Manage patient accounts, resolving discrepancies and ensuring payments are received

- Provide clear and concise verbal and written communication to patients and other healthcare professionals

- Accurately maintain patient records and generate financial reports

- Manage customer service inquiries, responding to requests in a timely manner

- Consistently exceed customer satisfaction goals, resulting in positive feedback from patients and healthcare professionals

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Patient Financial Counselor resume?

When applying for a Patient Financial Counselor position, it is important to be sure to include all of the necessary information in your resume. The following are some key items that should be included:

- Professional Summary: This is an overview of your experience, skills, and qualifications. It should provide a concise overview of why you are the ideal candidate for the position.

- Education: Include any relevant degrees and certifications that you hold.

- Experience: List all experience you have working as a Patient Financial Counselor, including the duties you performed and the results of your work.

- Skills: Highlight any special skills you possess that are necessary for the position.

- Professional Associations: List any professional associations you are affiliated with.

- Awards and Achievements: Include any awards or achievements you have earned that demonstrate your knowledge and capability.

- Community Involvement: List any involvement you have had in your community that places you as a leader in the field.

In addition to including the above items, it is also important to tailor your resume to the specific job description. Be sure to highlight the skills and experiences that are most relevant to the position. This will ensure that your specific qualifications are immediately visible to the hiring manager.

What is a good summary for a Patient Financial Counselor resume?

A Patient Financial Counselor resume should be a concise summary of the applicant’s qualifications, experience, and skills. It should highlight any relevant work experience in the field of patient financial counseling, such as working with insurance companies, healthcare providers, and patients to resolve financial issues. The resume should also emphasize any certifications, licenses, or other qualifications the applicant may have that are related to the role. Finally, the resume should include any relevant special skills and knowledge related to the job, such as knowledge of HIPAA laws and regulations, laws related to debt collection, and understanding of the ICD-10 coding system. With the right qualifications and experience, a Patient Financial Counselor resume can help an applicant stand out from the competition.

What is a good objective for a Patient Financial Counselor resume?

A Patient Financial Counselor resume should include an objective that effectively outlines the applicant’s goals and skills in order to present themselves well to potential employers. Here are some examples of good objectives for a Patient Financial Counselor resume:

- To obtain a Patient Financial Counselor position in a healthcare setting that will allow me to utilize my extensive knowledge of medical insurance policies, financial aid programs and patient billing

- Seeking a Patient Financial Counselor role with the aim of providing comprehensive counseling on financial and insurance options while ensuring compliance with all applicable regulations

- Highly motivated Patient Financial Counselor with experience in healthcare finance and a passion for helping others secure the financial assistance they need

- Experienced Patient Financial Counselor looking to bring my passion for healthcare finance and dedication to excellent customer service to a new organization.

- To leverage 10+ years of healthcare finance experience to provide comprehensive patient financial counseling and ensure patient satisfaction

With a strong objective, you can create a compelling resume that will impress potential employers and make you stand out from the competition.

How do you list Patient Financial Counselor skills on a resume?

When writing a resume, you should include any skills that you have that pertain to being a patient financial counselor. Listing these on your resume will provide potential employers with an understanding of how experienced and knowledgeable you are about providing financial counseling services for patients.

The below are some of the skills employers typically look for when it comes to patient financial counselors:

- Analytical Thinking: Being able to evaluate patient financial data and develop strategies and solutions for patients.

- Financial Literacy: Being knowledgeable and understanding of financial principles and laws that apply to patients.

- Verbal Communication: Having excellent communication skills to effectively explain financial services to patients.

- Problem-Solving: Demonstrating the ability to accurately assess problems and develop viable solutions.

- Negotiation: The ability to negotiate with insurance companies, hospitals, and other providers on behalf of patients.

- Interpersonal Skills: Demonstrating the ability to build and maintain relationships with patients.

- Computer Literacy: Being able to use computer programs to track financial information.

By listing these skills on your resume, you will show employers that you have the necessary skills to provide patient financial counseling services. Employers will be able to see the qualifications that you possess and how you could be an asset to their organization.

What skills should I put on my resume for Patient Financial Counselor?

As a patient financial counselor, it is essential to showcase the skills that demonstrate your qualifications for the position. Your resume should highlight your experience and qualifications in financial counseling, customer service, and data management. Here are some skills you can include on your resume for a patient financial counselor position:

- Financial Counseling: Demonstrate your ability to assess the financial needs of patients and provide financial counseling support. This includes knowledge of federal, state, and local laws and regulations related to healthcare finances and patient billing.

- Customer Service: Showcase your excellent customer service skills and ability to build relationships with patients. This includes the ability to provide helpful advice and solutions to patients with financial concerns.

- Data Management: Demonstrate your ability to manage patient information, including financial data. This includes expertise in patient record-keeping, data entry, and data analysis.

- Communication: Highlight your excellent communication skills and ability to explain complex financial concepts to patients.

- Organizational Skills: Showcase your ability to stay organized in a fast-paced environment and efficiently manage multiple tasks.

By including these skills on your resume, you will be able to demonstrate to employers that you are the ideal candidate for the role of patient financial counselor.

Key takeaways for an Patient Financial Counselor resume

A Patient Financial Counselor resume should showcase an individual’s ability to provide information and financial counseling to patients regarding their accounts, insurance plans, and other billing or financial services. As a Patient Financial Counselor, you should have a strong understanding of insurance plans, billing processes, and financial regulations. Your resume should clearly demonstrate your understanding of these concepts and highlight your experience in providing counseling.

Here are some key takeaways for a Patient Financial Counselor resume:

- Demonstrate your expertise in insurance plans, billing processes, and financial regulations.

- Highlight your experience in providing patient counseling services.

- Showcase your communication skills and ability to manage customer service inquiries.

- Note any certifications or professional development courses related to financial counseling.

- Describe how your skills have helped to improve patient satisfaction or reduce billing errors.

- Discuss any specialized knowledge you have related to medical billing and coding.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder