Loss Mitigation Specialists are invaluable members of the financial services team. They help homeowners who are having trouble paying their mortgages, by negotiating with lenders on behalf of their clients. A strong Loss Mitigation Specialist resume is the key to getting the job you want. This guide will help you create a resume that highlights your unique skills and experience, so you can land the job you deserve. We will provide examples of Loss Mitigation Specialist resumes, advice on how to create a resume that stands out, and tips on what to include in your resume to ensure employers take notice.

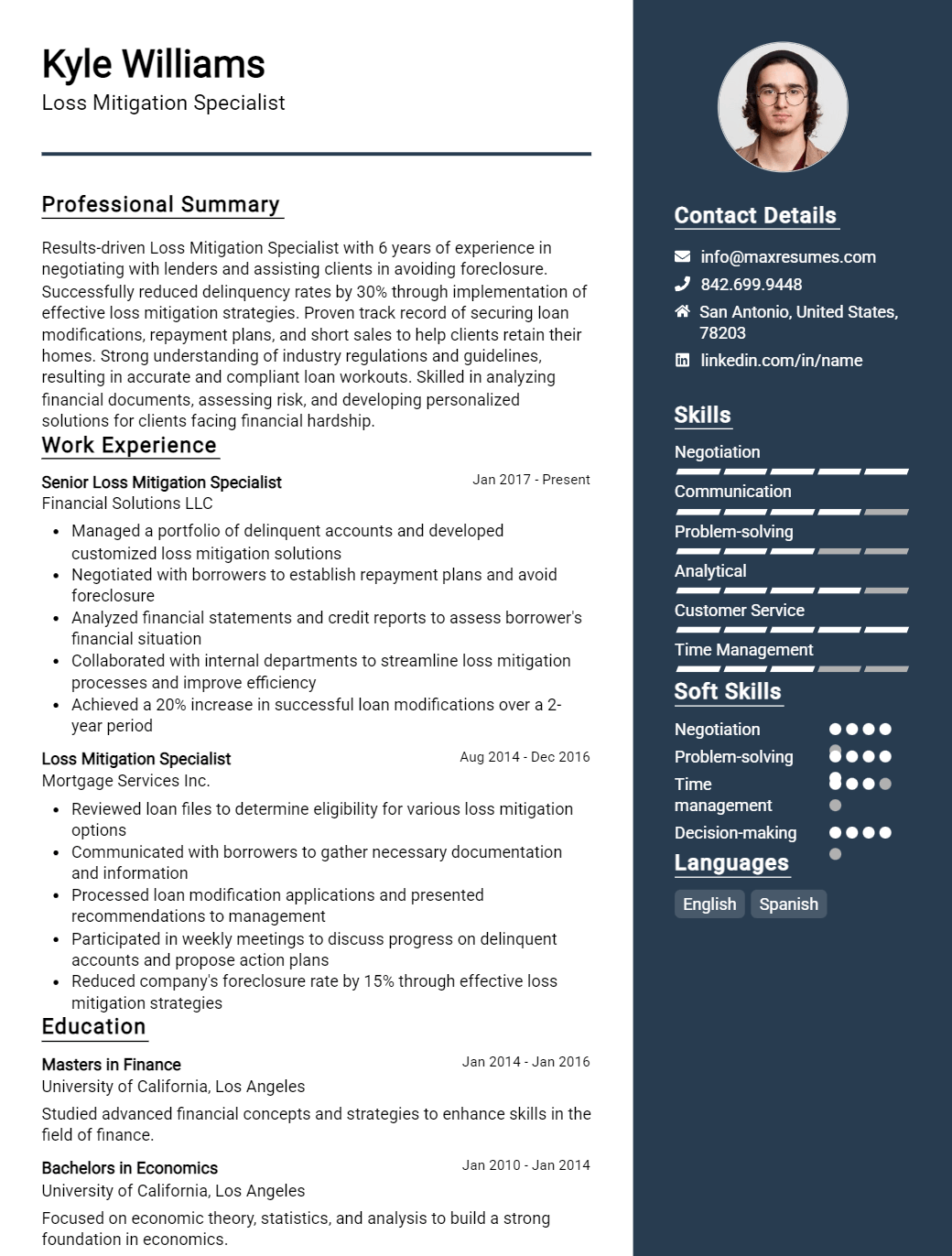

Loss Mitigation Specialist Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Loss Mitigation Specialist Resume Examples

John Doe

Loss Mitigation Specialist

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am a highly motivated Loss Mitigation Specialist with 6+ years of experience in the mortgage and banking industries. I specialize in helping borrowers and lenders navigate the loss mitigation process in order to avoid foreclosure and restructure loan agreements. My experience in the industry has given me the knowledge and skills needed to successfully assess borrowers’ abilities to repay their mortgages and work with loan servicers to find the most affordable solutions. I am well- versed in a variety of loss mitigation strategies, and am adept at quickly understanding a borrower’s financial situation in order to provide the best solution.

Core Skills:

- Loss Mitigation

- Foreclosure Avoidance

- Loan Agreement Restructuring

- Financial Assessments

- Negotiation

- Customer Service

- Risk Analysis

- Legal Compliance

- Data Entry

Professional Experience:

Loss Mitigation Specialist, XYZ Bank, San Francisco, CA (2015- Present)

- Analyze loan documents and borrower financials to evaluate loan options and risks.

- Coordinate with other departments to ensure loan is in compliance with state and federal regulations.

- Negotiate and restructure loan agreements with borrowers and loan servicers.

- Provide customer service to borrowers by answering questions and providing resources and information.

- Monitor loan performance to ensure timely payments and track progress on agreements.

Loan Processor, ABC Financial, Los Angeles, CA (2013- 2015)

- Reviewed and processed loan applications and documents to evaluate creditworthiness.

- Compiled financial information and data entry into loan processing software.

- Verified accuracy of loan documentation and performed necessary follow- up with customers.

- Provided excellent customer service to ensure borrowers had a positive experience.

Education:

B.A. in Business Administration, University of California, Los Angeles, CA (2009- 2013)

Loss Mitigation Specialist Resume with No Experience

Diligent and passionate Loss Mitigation Specialist, seeking to use customer service and problem solving skills to provide the best outcome for clients. Proven ability to address complex customer issues and build customer relationships.

Skills

- Excellent customer service and communication skills

- Strong problem solving and analytical thinking

- Attention to detail

- Proficient in Microsoft Office

- Knowledge of mortgage and loss mitigation

- Ability to work in a fast- paced environment

Responsibilities

- Listen to clients and understand their financial situation

- Analyze client portfolios and create customized solutions

- Provide guidance and resources to clients on mortgage and loss mitigation options

- Collaborate with internal and external teams to ensure successful completion of loss mitigation process

- Maintain client records and document progress

- Follow up with clients to ensure solutions are working and resolve any disputes

- Participate in ongoing training and professional development

- Ensure all laws and regulations are met according to industry standards

Experience

0 Years

Level

Junior

Education

Bachelor’s

Loss Mitigation Specialist Resume with 2 Years of Experience

Loss Mitigation Specialist with 2 years of experience providing financial counseling services to clients in a variety of situations. Possesses a deep understanding of debt management, workout solutions, and foreclosure prevention processes. Skilled in analyzing financial documents, developing loan modification plans, and mediating between lenders and borrowers. Proven ability to create win- win solutions that benefit both parties and minimize financial losses for lenders.

Core Skills:

- Debt management

- Foreclosure prevention

- Financial analysis

- Loan modifications

- Negotiation

- Communication

- Problem solving

- Organization

- Document preparation

Responsibilities:

- Analyzed the borrowers’ financial situation and determined possible repayment plans

- Provided financial counseling and advice to borrowers on how to better manage their debt

- Worked with lenders to negotiate loan modifications and workout solutions

- Drafted loan modification plans and communicated modifications to lenders

- Conducted assessments to determine eligibility for loan modifications

- Assisted borrowers with the completion of documents and applications

- Monitored and reported changes in borrowers’ financial status

- Processed paperwork and maintained accurate records at all times

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Loss Mitigation Specialist Resume with 5 Years of Experience

A passionate and experienced Loss Mitigation Specialist with over 5 years of experience in the financial services industry. Proven track record of successfully communicating with customers to discuss and process loan modifications, repayment plans, and loss mitigation options. Skilled at creating and executing optimal solutions to achieve win- win outcomes for both the customer and the company. Possess excellent organizational and problem- solving skills to identify and resolve customer issues.

Core Skills:

- Efficiently communicating with customers

- Developing loan modification and repayment plans

- Identifying and resolving customer issues

- Excellent organizational and problem- solving skills

- Proficient in MS Office Suite

- Able to multi- task with minimal supervision

- Understanding of financial service regulations

Responsibilities:

- Monitor customer accounts to identify potential delinquencies

- Provide customer support and assist with inquiries and disputes

- Develop and implement loss mitigation strategies

- Negotiate loan terms and modify loan payments as necessary

- Review customer financial statements to assess risk

- Provide recommendations to customers on loan repayment options

- Analyze and document customer accounts for review by senior management

- Research and analyze customer credit reports and debt profile

- Process loan modifications and repayment plans

- Maintain accurate documentation for all customer accounts

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Loss Mitigation Specialist Resume with 7 Years of Experience

Results- driven Loss Mitigation Specialist with 7 years’ extensive experience in the banking and financial services industry. Experienced in working with clients to assess their financial situations and develop strategies to help them overcome their hardships. Proven ability to negotiate with lenders, appraisers, and other third- party vendors to ensure rapid resolution of delinquencies. Knowledgeable of regulatory requirements and best practices in the industry to ensure timely and accurate loan processing.

Core Skills:

- Regulatory Compliance

- Loss Mitigation

- Loan Negotiation

- Financial Analysis

- Risk Analysis

- Customer Service

- Organizational Skills

- Data Analysis

Responsibilities:

- Developed and implemented loan modifications and loss mitigation strategies for distressed borrowers.

- Assessed borrower’s financial situations to determine eligibility for loan modifications, repayment plans, or forbearance.

- Reviewed loan documents for accuracy and completeness and followed up with lenders to ensure timely loan processing.

- Negotiated with lenders and other third- party vendors to resolve delinquencies on behalf of clients.

- Analyzed financial data to determine the risk of loss on loans and provided detailed reports.

- Provided excellent customer service and built strong customer relationships.

- Maintained up- to- date knowledge of best practices and regulatory requirements.

- Assisted with collection activities and handled customer inquiries regarding loan status.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Loss Mitigation Specialist Resume with 10 Years of Experience

A dedicated and knowledgeable Loss Mitigation Specialist with 10 years of experience working in the financial services and banking industry. Experienced in evaluating loan applications and mitigating potential losses, as well as providing customer service to borrowers. Possesses an excellent understanding of the loan modification process, with a passion for helping customers navigate their finances and create a successful budget. Highly organized and detail- oriented, capable of working with a variety of loan types, customer demographics and government programs.

Core Skills:

- Loan Modification Processes

- Financial Compliance

- Auditing

- Loss Mitigation Strategies

- Customer Service

- Regulatory Requirements

- Negotiation Strategies

- Debt Management

- Risk Analysis

- Problem Solving

Responsibilities:

- Conducted detailed analysis of loan applications to determine credit worthiness of potential borrowers.

- Assessed customer financial information and adjusted loan terms to reduce potential losses.

- Created and implemented loss mitigation strategies, such as loan modifications, forbearances and repayment plans.

- Provided excellent customer service, answering questions and addressing concerns.

- Ensured compliance with all applicable laws and regulations.

- Negotiated with borrowers to establish affordable loan terms.

- Advised customers on debt management strategies and budgeting techniques.

- Performed financial audits to detect suspicious activity and potential fraud.

- Identified potential risks and developed methods to mitigate losses.

- Developed and implemented policies and procedures regarding loan modification processes.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Loss Mitigation Specialist Resume with 15 Years of Experience

Loss Mitigation Specialist with 15 years of experience in analyzing and recommending ways to minimize financial losses. Adept at remaining on top of the ever- changing laws and regulations concerning loan modifications and foreclosures. Proven ability to develop and implement loss mitigation strategies to reduce losses, maintain customer relations, and protect the asset of the company.

Core Skills:

- In- depth knowledge of loan products, foreclosure and short sale processes

- Proficient in evaluating loan applications and determining eligibility for loan modification programs

- Excellent written and verbal communication skills

- Effective problem- solving and analytical skills

- Exceptional interpersonal skills and customer service

- Highly organized with strong attention to detail

Responsibilities:

- Analyzing customer financial information to determine eligibility for loan modification, loss mitigation strategies and foreclosure prevention

- Reviewing documents for accuracy and completeness to ensure compliance with federal and state laws

- Negotiating loan terms with borrowers to reduce losses for the company

- Researching and preparing options for loan modifications

- Providing customer service to borrowers concerning loan modification options

- Monitoring foreclosure proceedings to ensure adherence to state and federal laws

- Preparing and submitting loss mitigation reports to management

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Loss Mitigation Specialist resume?

A Loss Mitigation Specialist resume should include some key points that demonstrate a candidate’s ability to handle credit problems and get customers back on track with their payments. For example, the resume should include:

- Experience working with customers to negotiate resolutions for delinquent loans

- Expertise in loan modifications, short sales, and foreclosure prevention

- Knowledge of foreclosure laws and procedures

- Ability to develop and implement loss mitigation strategies

- Understanding of financial documents such as credit reports, income statements, and bank statements

- Proven ability to review and analyze loan documents

- Strong communication and customer service skills

- Excellent organizational and problem-solving skills

- Ability to work independently and as part of a team

- Proficiency with a variety of computer programs such as Microsoft Office

- Current Loss Mitigation Certification or similar

Having a resume that contains the qualifications above can give you an edge over the competition and make you a more attractive applicant to potential employers. A detailed and well-crafted Loss Mitigation Specialist resume can help you get your foot in the door and land an interview.

What is a good summary for a Loss Mitigation Specialist resume?

A Loss Mitigation Specialist is responsible for managing residential loan modifications, short sales, and other foreclosure prevention solutions. Because this is a highly specialized field, having a resume that effectively showcases your skills, experience, and qualifications is essential for landing a role in this field.

Begin the summary of your Loss Mitigation Specialist resume with a statement that emphasizes your knowledge of the foreclosure prevention industry, while also highlighting your excellent customer service skills and ability to work collaboratively. Mention any certifications or specialized training that you have, as well as any experience you have in areas related to loan modifications, short sales, or other loss mitigation solutions.

Next, mention any administrative or managerial skills that you possess – such as customer service, data analysis, problem solving, or project management – that could be beneficial in a Loss Mitigation Specialist role. Finally, describe your passion for helping customers resolve their financial issues and your commitment to making a positive impact.

By writing a compelling summary for your Loss Mitigation Specialist resume, you will demonstrate to potential employers that you are the ideal candidate for the role.

What is a good objective for a Loss Mitigation Specialist resume?

A Loss Mitigation Specialist is a professional who works with individuals or businesses facing foreclosure or insolvency. Their job is to research, analyze, and negotiate with lenders to find the best possible resolution for their clients. A great objective for a Loss Mitigation Specialist resume should focus on the skills and knowledge needed to successfully handle the job.

- Demonstrate strong understanding of foreclosure and insolvency laws and regulations

- Possess excellent communication and negotiation skills to resolve complex financial disputes

- Develop creative solutions to help clients save their homes or businesses

- Utilize organizational and time-management skills to efficiently manage multiple cases

- Compose professional written documents to present in court when needed

- Stay up-to-date on industry trends, news, and practices to make informed decisions

- Foster relationships with lenders to negotiate terms and agreements

- Show compassion and empathy when working with clients in difficult financial situations

How do you list Loss Mitigation Specialist skills on a resume?

Loss Mitigation Specialists assist financial institutions in reducing their risk exposure, by providing a range of services such as loan modifications and foreclosures. To be successful in this job, a Loss Mitigation Specialist must possess a variety of skills. Here are some of the skills a Loss Mitigation Specialist should highlight on their resume:

- Knowledge of foreclosure and bankruptcy laws: A Loss Mitigation Specialist needs to have a deep understanding of foreclosure and bankruptcy laws, regulations, and processes. This includes knowledge of government programs such as HAMP and HARP, as well as the ability to identify potential foreclosure alternatives for borrowers.

- Analytical skills: A Loss Mitigation Specialist must be able to analyze a variety of data quickly and accurately. This includes analyzing financial documents, such as credit reports and loan applications, as well as understanding and interpreting the financial implications of various foreclosure alternatives.

- Communication skills: A Loss Mitigation Specialist must have excellent verbal and written communication skills. This includes the ability to effectively explain complex foreclosure and bankruptcy policies to borrowers, as well as persuasively negotiate with creditors.

- Organizational skills: A Loss Mitigation Specialist must be able to organize and manage a large volume of documents and tasks. This includes being able to prioritize tasks and staying organized in order to meet tight deadlines.

- Negotiation skills: A Loss Mitigation Specialist must be able to negotiate with creditors on behalf of borrowers. This involves the ability to present and explain complicated financial information in a clear and concise manner, and to reach a mutually beneficial agreement between both parties.

By highlighting these skills on a resume, a Loss Mitigation Specialist can demonstrate their qualifications for the job and set themselves apart from other candidates.

What skills should I put on my resume for Loss Mitigation Specialist?

A resume for a Loss Mitigation Specialist should include skills that demonstrate the potential to effectively negotiate with lenders and borrowers, communicate with clients, process paperwork, and provide effective customer service. Below are some skills to consider adding to your resume:

- Strong knowledge of foreclosure laws and regulations

- Proficient in financial analysis and loan origination

- Ability to effectively negotiate with lenders and borrowers

- Demonstrated history of successful loan modification and loss mitigation strategies

- Ability to effectively communicate with clients and colleagues

- Excellent customer service skills

- Proficient with loan origination and processing

- Excellent problem-solving and organization skills

- Knowledge of banking and accounting practices

- Familiarity with the mortgage industry and loan documents

- Proficient in computer-based programs, such as Excel and Word

- Ability to work independently and as part of a team.

Key takeaways for an Loss Mitigation Specialist resume

If you are looking for a job as a Loss Mitigation Specialist, you have a great opportunity to showcase your skills and experience to prospective employers in your resume. Here are some key takeaways you should consider including in your resume:

- Demonstrate your ability to manage complex situations and handle multiple tasks effectively.

- Highlight your experience utilizing various software programs such as Excel and Access in order to analyze data and develop strategies.

- Demonstrate your expertise in loan processing, document reviews, and credit analysis.

- Showcase your understanding of the housing and foreclosure laws and regulations.

- Describe your experience in negotiating with lenders, attorneys, and other professionals in order to preserve assets.

- Detail your ability to develop and implement loss mitigation plans and strategies.

- Showcase your knowledge of loan modification, loan workouts and Short Sale transactions.

- Detail your ability to represent and advocate on behalf of the client’s best interest.

- Highlight your excellent problem-solving, communication and critical thinking skills.

By emphasizing the above key points, you can make your Loss Mitigation Specialist resume stand out from the competition. Good luck with your job search!

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder