If you are looking to become an investment specialist, you need to create a resume that stands out from the crowd. Crafting a resume that accurately reflects your professional background can be challenging. The best approach is to highlight your relevant qualifications, skills and experience in a way that will capture the attention of potential employers. In this blog post, we will provide you with an investment specialist resume writing guide, along with example resume templates to help you get started. Use these tips and examples to create a resume that shows why you are the ideal candidate for the job.

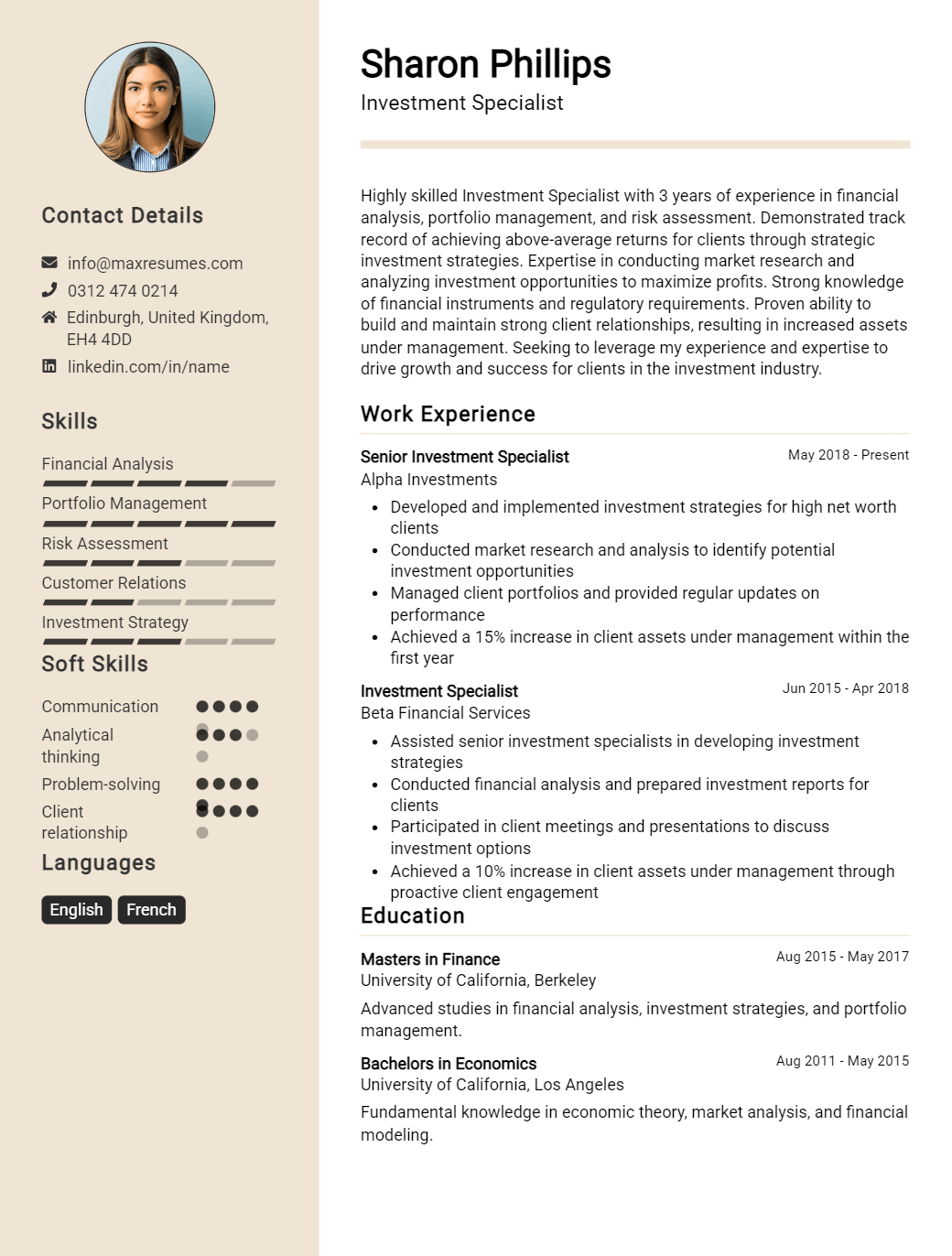

Investment Specialist Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Investment Specialist Resume Examples

John Doe

Investment Specialist

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am an experienced Investment Specialist with over 5 years of experience in the financial services industry. I have a strong analytical background and excellent communication skills. I possess a deep understanding of the financial markets and a keen eye for spotting investment opportunities. I am comfortable working with teams of financial advisors and have a proven track record of successful investments. I am looking forward to bringing my expertise and skill set to an organization where I can make an impact.

Core Skills:

- Investment Analysis

- Financial Modeling

- Portfolio Management

- Risk Analysis

- Valuation

- Quantitative Analysis

- Derivatives

- Financial Data Analysis

- Securities Trading

- Regulatory Compliance

Professional Experience:

- Senior Investment Specialist, XYZ Investment Bank, 2016- Present

- Analyze financial markets, identify potential investment opportunities and make recommendations

- Conduct research, build financial models and prepare reports

- Monitor portfolio performance and make adjustments as needed

- Prepare documents for regulatory compliance

- Manage the trading of securities and derivatives

- Supervise the work of junior analysts

Education:

- Bachelor of Science in Finance, ABC University, 2012- 2016

Investment Specialist Resume with No Experience

Recent college graduate looking to apply knowledge of macroeconomics and financial markets to a career in investment analysis and portfolio management. Possesses strong analytical and problem- solving skills with the ability to break down complex financial concepts.

Skills

- Financial Modeling

- Data Analysis

- Portfolio Management

- Research and Evaluation

- Investment Analysis

- Financial Risk Management

- Financial Reporting

- Economics

Responsibilities

- Evaluate financial statements and reports to identify trends

- Analyze asset allocation and performance of portfolios

- Recommend investment strategies to maximize returns

- Monitor economic and market developments to identify investment opportunities

- Research and analyze investments and markets to provide insight

- Develop and maintain financial models for portfolio performance analysis

- Assist in the execution of investment transactions

- Provide financial and market data and reports to assist in decision- making

Experience

0 Years

Level

Junior

Education

Bachelor’s

Investment Specialist Resume with 2 Years of Experience

A highly motivated and results- oriented Investment Specialist with 2 years of experience in the financial services industry. Track record of successfully analyzing financial trends and creating sound investment strategies to maximize returns and minimize risk. Possess excellent communication and interpersonal skills, proven ability to develop relationships with clients and colleagues. Experienced in researching and recommending investments to meet client objectives and goals.

Core Skills:

- Financial Modeling

- Financial Analysis

- Portfolio Management

- Investment Research

- Data Analysis

- Risk Management

- Client Relations

- Investment Strategies

Responsibilities:

- Conducted extensive research to identify potential investments with the highest return and lowest risk.

- Built complex financial models to evaluate and monitor current and potential investments.

- Developed investment strategies to meet client’s financial goals and objectives.

- Provided portfolio management advice and tailored investment plans to meet client’s individual needs.

- Analyzed economic and market conditions to identify potential areas of opportunity or risk.

- Conducted financial and investment analysis to ensure consistent and optimal performance.

- Built and maintained relationships with clients to ensure satisfaction and trust.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Investment Specialist Resume with 5 Years of Experience

An experienced and skilled Investment Specialist with five years of experience in analyzing and managing financial investments, analyzing and interpreting financial data, monitoring market trends, and developing investment strategies to maximize returns. Known for demonstrating strong conceptual and analytical skills and effectively communicating with clients, colleagues and stakeholders. Core competencies include financial analysis, portfolio management, and risk management.

Core Skills:

- Financial Analysis

- Portfolio Management

- Risk Management

- Investment Strategies

- Market Trends

- Data Analysis

- Investment Planning

- Financial Modeling

Responsibilities:

- Analyzed financial data, investment strategies and portfolio performance to determine potential areas of investment and projected returns

- Evaluated the financial markets and developed investment strategies to maximize returns

- Monitored market conditions and identified potential opportunities for investments

- Researched industry trends and developments to recommend suitable investments

- Developed financial models to forecast potential returns of investments

- Ensured compliance with internal and external regulations regarding investments

- Assisted in the preparation of presentations to communicate investment decisions and strategies to stakeholders

- Provided oversight and guidance to junior investment analysts

- Participated in meetings with clients and provided advice on investment decisions

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Investment Specialist Resume with 7 Years of Experience

Highly motivated and results- driven Investment Specialist with 7 years of extensive experience in the financial services industry. Experienced in providing specialized financial advice and services to clients in order to help them manage their investments and reach their financial goals. Adept at developing comprehensive strategic plans and making smart investment decisions. Possesses an impressive knowledge of financial products, markets, and regulations. Possesses excellent communication and interpersonal skills with the ability to build and maintain successful relationships with clients.

Core Skills:

- Financial services

- Investment advice

- Client relationship management

- Financial analysis

- Financial products

- Financial regulations

- Strategic planning

- Portfolio management

- Investment decisions

Responsibilities:

- Provided tailored advice on investments and financial services to individual and corporate clients

- Developed comprehensive financial strategies for clients with respect to their investment objectives

- Analyzed financial markets and identified investment opportunities

- Monitored existing investments and made necessary adjustments

- Assisted clients in setting up and managing their accounts

- Reviewed and updated knowledge of financial regulations

- Maintained and updated client profiles and kept up- to- date records of investments and transactions

- Provided clients with regular reports on their current and projected investments

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Investment Specialist Resume with 10 Years of Experience

Experienced Investment Specialist with 10 years of experience in managing portfolios, analysing market trends and formulating investment strategies. Possess a highly analytical approach and a keen eye for detail when evaluating financial data. Excellent communication and interpersonal skills, allowing for successful collaboration with clients and colleagues. Proven track record of success in developing and implementing efficient investment plans with a focus on long- term growth, profitability and risk management.

Core Skills:

- Investment Portfolio Management

- Financial Analysis

- Investment Strategies

- Market Trend Analysis

- Risk Management

- Client Relations

- Performance Evaluation

- Mathematical Modeling

- Trading Strategies

- Communication

Responsibilities:

- Detect and evaluate financial trends and patterns to identify potential investment opportunities.

- Research, analyze and monitor market conditions, economic changes, and industry trends.

- Create financial models utilizing mathematical and statistical techniques.

- Maintain relationships with clients to gain insight into their investment goals.

- Develop and execute investment strategies, manage portfolios, and meet client goals.

- Monitor performance of investments, analyze risk exposure and review portfolio allocations.

- Analyze financial statements, documents and reports to identify potential risks.

- Create presentations, reports and recommendations for executive level management.

- Liaise with other professionals such as financial advisors, brokers and bankers.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Investment Specialist Resume with 15 Years of Experience

Highly experienced Investment Specialist with over 15 years of experience in researching, investing, and managing a variety of portfolios. Proven track record of successful investments, with knowledge of tax, securities, and financial regulations. Skilled in delivering bespoke investment advice, asset allocation, and portfolio management services. Experienced in developing and managing investment strategies that align with clients’ goals and objectives.

Core Skills:

- Investment Research

- Portfolio Management

- Asset Allocation

- Financial Analysis

- Risk Management

- Tax and Securities Regulations

- Client Relationship Management

- Bespoke Investment Advice

Responsibilities:

- Conducted financial analysis to evaluate investment opportunities.

- Developed investment strategies according to clients’ goals and risk tolerance.

- Worked with clients to provide bespoke investment advice and asset allocation.

- Monitored portfolios to ensure investments were aligned with clients’ objectives.

- Negotiated contracts with financial institutions and brokers.

- Researched the financial markets for potential investment opportunities.

- Implemented risk management strategies to minimize potential losses.

- Kept up- to- date with changes in tax and securities regulations.

- Developed strong relationships with clients to increase customer satisfaction.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Investment Specialist resume?

Investment specialists are financial professionals who have the expertise to help clients make the best investment decisions. The job requires an understanding of financial markets, investment products and the ability to analyze financial data. The following details should be included in an Investment Specialist resume:

- Education: Include all relevant degrees, certifications and training that is related to investment or finance.

- Work History: Include a detailed description of past experience in the investment or finance industry.

- Skills: Highlight any specialized skills, such as the ability to evaluate financial statements and make sound investment decisions.

- Professional Memberships: Mention any professional associations related to the investment industry that you belong to.

- Analytical Skills: Demonstrate your ability to analyze information and make data-driven decisions.

- Achievements: Showcase any awards or accolades received related to your work in the finance or investment sector.

- Network: Demonstrate your ability to network and build relationships with key stakeholders in the investment industry.

- Technology: Highlight any experience with financial software or other technology related to the industry.

What is a good summary for a Investment Specialist resume?

A good summary for an Investment Specialist resume should succinctly explain the professional’s qualifications and experience. It should highlight their knowledge of financial markets, investment strategies, and analysis techniques. Additionally, the summary should demonstrate their ability to identify and solve complex problems and communicate effectively with customers, clients, and other financial professionals. Professional experience should also be listed, such as the number of years of experience in the field, the number of successful investments completed, and any notable awards or recognition received. Finally, the summary should list any certifications or licenses the professional has, such as a Chartered Financial Analyst (CFA) designation.

What is a good objective for a Investment Specialist resume?

- A good objective for a Investment Specialist resume should be tailored to the specific position and employer you are applying for.

- It should include a summary of your qualifications and experiences that make you the best candidate for the job.

- Your objective should also include specific skills and knowledge that you possess that are beneficial to the organization.

- Additionally, the objective should reflect your career goals and how you plan to use those skills to bring value to the company.

- A well-written objective should be concise, clear, and focused on the job description.

- It should also demonstrate your enthusiasm for the position, as well as your drive and motivation to be successful in it.

- Overall, a good objective for a Investment Specialist resume should highlight your qualifications and experience, while also expressing your skills and interests in the position.

How do you list Investment Specialist skills on a resume?

Investment specialists are financial professionals who specialize in investments, securities, and other related financial products. They are responsible for research, analysis, and management of investments and portfolios, as well as providing advice and guidance to clients on how to make the best investments. When writing a resume for a position as an Investment Specialist, it is important to highlight your skills and experience in this field.

Here are some skills to consider including in your resume:

- Knowledge of financial markets and instruments: Investment Specialists should have a solid knowledge of the financial markets and the instruments available to investors. Be sure to list any courses you’ve taken or certifications you’ve earned that demonstrate your knowledge in this area.

- Analytical and problem-solving skills: Investment Specialists must be able to analyze financial data and assess potential investments and their associated risks. Be sure to list any courses or certifications that demonstrate your analytical and problem-solving skills.

- Investment management and portfolio design: Investment Specialists must be able to manage investments and design portfolios that are tailored to the needs of their clients. List any experience you have in this area on your resume, such as internships or relevant coursework.

- Risk management: Investment Specialists must be able to assess and manage risks associated with investments. List any experience you have in this area, such as any courses you’ve taken in risk management, or any certifications you’ve earned.

- Client communication: Investment Specialists must be able to effectively communicate with clients and discuss investment ideas and strategies. Be sure to list any experience you have in client communication, such as any customer service or sales experience you may have.

- Knowledge of tax laws: Investment Specialists must be familiar with the tax laws related to investments and portfolios. List any experience you have with tax laws, such as any courses you’ve taken

What skills should I put on my resume for Investment Specialist?

A well-crafted resume is an essential part of any job application, and an Investment Specialist is no exception. When writing your resume, you’ll want to make sure the skills you list are relevant to the role of Investment Specialist and highlight your capabilities. Here are some skills to consider adding to your resume:

- Financial Analysis: An Investment Specialist needs strong financial analysis capabilities. You should be able to review financial documents and spot trends, risks, and opportunities.

- Investment Planning: The ability to plan and strategize investments is essential for Investment Specialists. You should be able to craft a plan that balances risk and reward.

- Market Knowledge: Investment Specialists must have a deep understanding of the markets they are involved with. They need to be able to identify the right investments for their clients.

- Decision Making: Investment Specialists must be able to make decisions quickly and accurately. They must be able to weigh the risks and rewards of various investments and make the best decision for their clients.

- Communication: Investment Specialists must have good communication skills and be able to explain complex investment decisions to their clients. They must also be able to work with other financial professionals.

- Problem Solving: Investing often involves complex problems, and Investment Specialists must be able to identify, analyze, and solve these problems.

These are just some of the skills that you should consider including on your resume for a position as an Investment Specialist. These skills demonstrate your capabilities and your commitment to the role. Make sure to tailor your skills to the specific job you’re applying for, as this will make your resume more effective.

Key takeaways for an Investment Specialist resume

When creating your resume as an Investment Specialist, there are several key takeaways you should keep in mind. Resume building is an ongoing process that requires ongoing attention, and your resume should be tailored to the job you are applying for. Here are some key takeaways you should keep in mind when constructing your resume:

- Highlight Your Education & Professional Certifications: Your resume should always include a section that details your academic and professional credentials. Make sure to list out any degrees, certificates, or credentials you have earned and give any relevant details about the courses you took.

- Detail Relevant Experience: When outlining your professional experience, be sure to include any applicable roles that you have held. Describe the job duties, responsibilities and any successes you achieved in the role.

- Showcase Your Contributions to a Team: A resume should also demonstrate your ability to work successfully in a team environment and provide evidence of your contributions to the team’s success. Include any awards or recognitions you have received from your team or supervisor.

- Incorporate Professional Interests: If you have any professional interests or areas of expertise, showcase them in your resume. This could be anything from working with a certain type of software or technologies to participating in professional organizations or conferences. Make sure to provide any evidence that can back up your claims.

- Format Correctly: Always make sure your resume follows the accepted formatting standard, such as including white space, bullet points, and clear headlines. This will make it easier for recruiters and hiring managers to quickly identify the most relevant information in your resume.

By following these key takeaways, you will be able to create an effective Investment Specialist resume that stands out from the competition. The goal is to show your potential employers that you have the skills, experience and knowledge to be a valuable asset to their organization.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder