If you’re looking to apply to a position as an investment officer, it’s important to have a resume that stands out from the competition and highlights your qualifications. Crafting an effective resume can be challenging, but with the right guidance and advice, you can create an impressive document that will help you get noticed by potential employers. This guide will provide you with valuable tips and examples for writing an investment officer resume that will help you land the job you want.

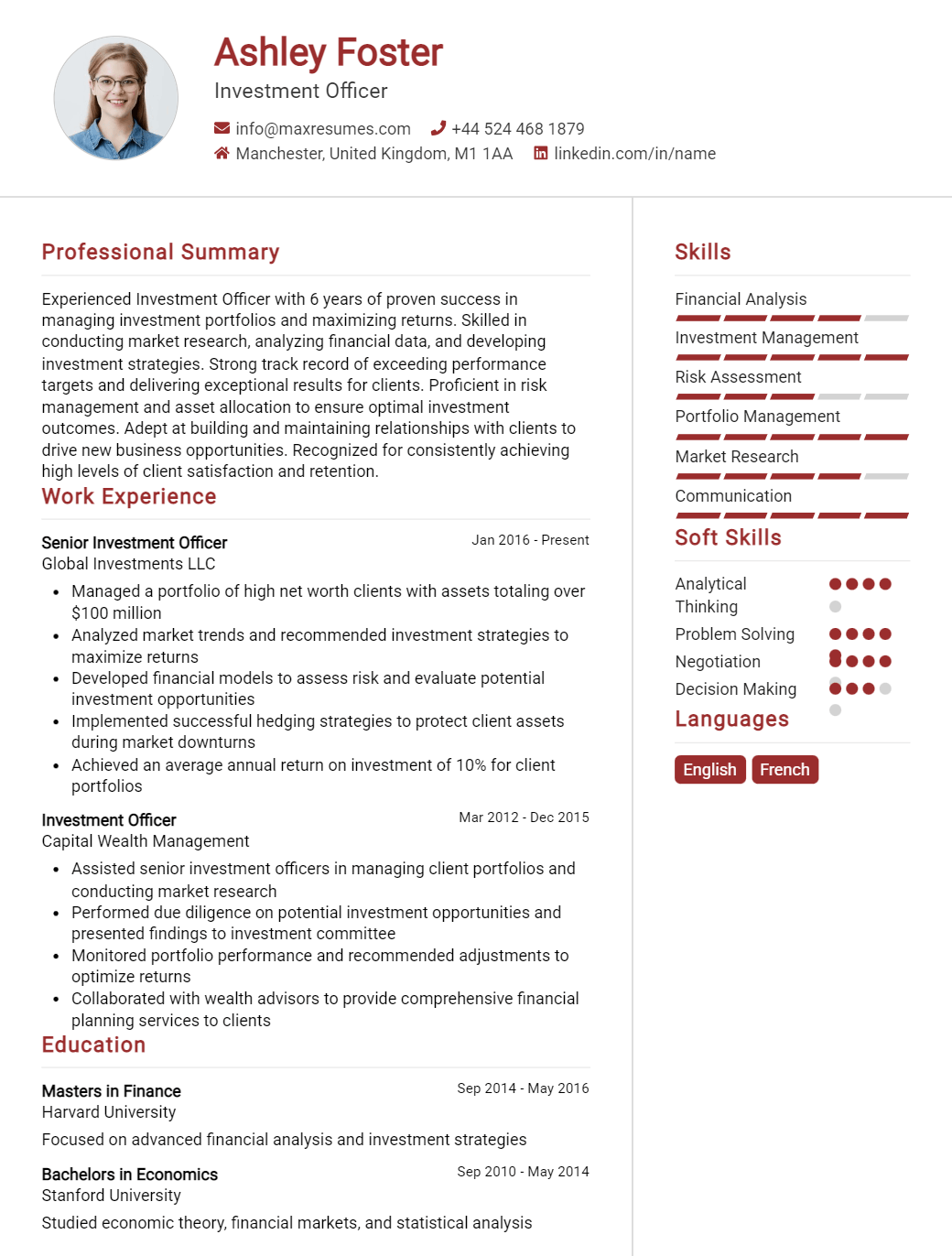

Investment Officer Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Investment Officer Resume Examples

John Doe

Investment Officer

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

Highly motivated and experienced Investment Officer with 8+ years of experience in investment banking, portfolio management, and risk management. Skilled in developing and executing investment strategies, conducting market and financial analysis, and managing relationships with clients. Proven ability to analyze financial markets and optimize portfolio performance by leveraging financial data and market insights. Adept at developing sound investment plans, communicating complex financial topics to clients, and developing innovative strategies for long- term growth and profit.

Core Skills:

- Investment Banking

- Portfolio Management

- Risk Management

- Financial Analysis

- Investment Strategies

- Market Analysis

- Relationship Management

- Financial Planning

- Strategic Thinking

- Data Analysis

- Communication

Professional Experience:

Investment Officer, ABC Bank, Miami, FL | October 2016 – Present

- Analyze, develop and execute investment strategies to maximize return and minimize risk

- Manage client relationships, including onboarding and ensuring compliance with regulatory standards

- Conduct market analysis and financial analysis to identify opportunities for investing and trading

- Prepare detailed reports on investment performance, portfolio risks, and financial market trends

- Develop and implement innovative strategies for long- term financial growth

- Collaborate with other departments to ensure smooth functioning of the organization

Investment Analyst, XYZ Bank, Miami, FL | March 2013 – October 2016

- Conducted research on industry trends and market conditions to identify investment opportunities

- Developed and implemented risk management strategies to minimize risk exposure

- Analyzed financial data and generated actionable insights for portfolio and risk management

- Monitored and reviewed investment performance and provided regular reports to senior management

- Provided guidance and advice to clients on investments and financial planning

- Prepared and monitored budgets and expenses related to investments

Education:

Bachelor of Science in Finance, Florida State University, Miami, FL | 2012

Investment Officer Resume with No Experience

Recent college graduate with a Bachelor of Science in Finance, eager to start a career as an Investment Officer with no experience. Possessing excellent knowledge of financial models and products, as well as strong problem- solving skills and analytical abilities. Collaborative and self- motivated with excellent communication and organizational skills.

Skills

- Financial modeling

- Financial products

- Investment analysis

- Financial analysis

- Problem- solving

- Analytical skills

- Communication

- Organizational skills

- Risk management

- Microsoft Office Suite

Responsibilities

- Analyzing investments and making recommendations based on financial data.

- Monitoring financial markets and providing reports.

- Establishing and maintaining relationships with clients.

- Developing and implementing investment strategies.

- Researching and analyzing financial markets and investments.

- Creating and managing portfolios.

- Evaluating investment opportunities.

- Monitoring financial investments and making adjustments as necessary.

- Providing analysis and reports to clients.

Experience

0 Years

Level

Junior

Education

Bachelor’s

Investment Officer Resume with 2 Years of Experience

Motivated and experienced Investment Officer with two years of hands- on experience in the financial services sector. Adept at working independently as well as in a team environment to research, analyze and predict economic trends and financial situations. Highly knowledgeable in financial instruments, portfolio management, and emerging markets. Possesses a Bachelor’s Degree in Finance from an accredited institution and is dedicated to developing long- term financial strategies for clients.

Core Skills:

- Investment Analysis

- Risk Management

- Financial Modeling

- Portfolio Management

- Financial Instruments

- Emerging Markets

- Trading Strategies

Responsibilities:

- Developed financial strategies based on analysis of market trends, industry developments and internal data

- Conducted research and analysis of financial instruments and investments, including stocks, bonds and derivatives

- Monitored and managed portfolios to maintain optimal performance, risk management, and compliance

- Performed financial and investment analysis, such as Monte Carlo simulations, to determine potential return on investments

- Generated reports to present data and trends to clients

- Developed investment strategies and recommendations

- Tracked and monitored performance of investments in order to maintain and maximize returns

- Provided clients with regular updates on their portfolios and investments

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Investment Officer Resume with 5 Years of Experience

Highly motivated and experienced Investment Officer with 5+ years of experience in developing client relationships, analyzing financial data, and managing investments. Skilled in identifying trends and developing strategies for investments including stocks, bonds, and mutual funds. Adept in researching and evaluating industry trends, economic conditions, and other market forces to predict the direction of the stock market. Possess excellent communication and interpersonal skills and ability to work effectively with business partners, stakeholders, and clients.

Core Skills:

- Investment Analysis

- Financial Modeling

- Relationship Building

- Portfolio Management

- Client Relations

- Regulatory Compliance

- Market Forecasting

- Equity & Debt Trading

Responsibilities:

- Conserved and managed investments and portfolios of clients in accordance with their objectives

- Developed and maintained relationships with clients to ensure timely and accurate information

- Developed and implemented investment strategies for clients in a variety of investment products including stocks, bonds, mutual funds, and other securities

- Performed comprehensive market analysis to assess and forecast potential risks, opportunities, and trends affecting investments

- Monitored markets and investments to ensure compliance with regulations, laws, and client objectives

- Generated financial reports and presentations for clients for monthly, quarterly, and annual reviews

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Investment Officer Resume with 7 Years of Experience

Results- oriented Investment Officer with 7 years of experience in financial analysis, portfolio management, and business development. Proven track record in complex financial problem- solving, strategic planning, and risk management. Utilize in- depth knowledge of the financial markets and business regulations to ensure portfolio integrity and maximize investor returns. Possess exceptional interpersonal and communication skills, with the ability to develop and maintain strong working relationships with clients and colleagues.

Core Skills:

- Financial Analysis

- Portfolio Management

- Risk Management

- Strategic Planning

- Business Development

- Regulatory Compliance

- Client Relations

- Data Analysis

Responsibilities:

- Performed financial analysis, including capital budgeting, portfolio management, and risk assessment.

- Developed financial strategies for portfolios and managed investments in accordance with clients’ objectives.

- Monitored market conditions and financial regulations to ensure portfolio integrity and investor returns.

- Advised clients on financial matters, such as investment opportunities, asset allocations, and portfolio diversification.

- Researched, evaluated, and recommended investments to clients based on their individual financial goals.

- Assisted with the preparation of client presentations, financial reports, and other materials.

- Developed business relationships with clients and other financial institutions.

- Maintained client records and ensured compliance with all applicable laws and regulations.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Investment Officer Resume with 10 Years of Experience

Highly motivated Investment Officer with 10 years of experience in the financial services sector. Proven track record of providing objective, high- level financial advice to clients. Assisted multiple clients in achieving their financial goals through prudent investments and investments strategies. Expert in analyzing and understanding financial markets, as well as developing financial plans.

Core Skills:

- Financial Management

- Investment Analysis

- Financial Modeling

- Risk Management

- Asset Allocation

- Portfolio Management

- Financial Planning

- Investment Strategies

Responsibilities:

- Performed comprehensive financial analysis of potential investments and provided accurate and objective recommendations

- Developed financial plans for clients to reach their financial goals

- Monitored the financial markets and prepared detailed analyses to inform decisions about potential investments

- Managed clients’ portfolios, including asset allocation, diversification, and risk management

- Negotiated and executed all types of investments, such as stocks, bonds, mutual funds, and real estate

- Produced detailed reports to summarize the performance of clients’ investments

- Advised clients on tax planning and estate planning strategies

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Investment Officer Resume with 15 Years of Experience

A highly motivated and detail- oriented Investment Officer with 15 years of experience in finance and accounting. Proven track record of success in assessing financial risks, formulating investment strategies and achieving desired results. Possesses an in- depth understanding of US securities regulations and investment portfolio management. Skilled in developing and maintaining relationships with clients, and able to quickly analyze and interpret financial data.

Core Skills:

- Investment portfolio management

- Risk assessment and management

- Accounting and financial analysis

- Securities regulations

- Relationship management

- Strategic planning

- Report compilation

- Financial data interpretation

- Excel and Word proficiency

Responsibilities:

- Analyzing financial data and investment trends to identify profitable opportunities

- Developing strategies to maximize returns on investments

- Monitoring the performance of securities and other investments

- Negotiating terms in contracts and ensuring compliance with regulations

- Supervising operations to ensure accuracy and efficiency in transactions

- Preparing and managing financial and investment reports

- Assisting in developing long- term investment goals and policies

- Maintaining effective communication with clients and other stakeholders

- Creating and reviewing complex financial models and projections

- Liaising with brokers, financial institutions, and third- party vendors.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Investment Officer resume?

A strong resume for an Investment Officer is a must when applying for a position in the finance industry. The Investment Officer resume should include the key qualifications and experiences that demonstrate your ability to work in this field. Here are some of the key elements to include in your Investment Officer resume:

- Education: Include any relevant academic qualifications or certifications related to the investment industry.

- Experience: List any previous experience that you have in the investment industry or related fields.

- Knowledge: Showcase your knowledge of the investment industry, including any specialized knowledge or certifications.

- Skills: Highlight any specialized skills related to investments and finance, such as portfolio management, data analysis, and risk management.

- Results: Showcase any positive results or outcomes that you have achieved as an Investment Officer.

- Achievements: Include any awards or recognition that you have received for your work in this field.

Including these elements in your Investment Officer resume will demonstrate to employers that you have the skills and experience required to excel in this position. Make sure to tailor your resume to the specific position you are applying for and showcase your qualifications in the best possible light.

What is a good summary for a Investment Officer resume?

A good summary for an Investment Officer resume should highlight the applicant’s experience in investment analysis and portfolio management. It should also emphasize the applicant’s knowledge of financial instruments, markets, and regulations. The summary should also detail the applicant’s ability to evaluate risks and identify profitable opportunities. The summary should also showcase the applicant’s ability to successfully execute investment strategies. Additionally, the summary should demonstrate the applicant’s excellent communication and interpersonal skills necessary for successful relationship management. Ultimately, a good summary for an Investment Officer resume should demonstrate that the applicant is an effective and reliable asset to any organization.

What is a good objective for a Investment Officer resume?

When writing a resume as an Investment Officer, it is important to have a well-defined objective that clearly outlines your qualifications and goals. A good objective should be succinct, specific, and focused on the particular job you are applying for. It should also explain why you are the best candidate for the job. Here are some examples of effective objectives for an Investment Officer resume:

- To leverage my extensive knowledge of financial markets and investment strategies to help financial institutions make sound investment decisions.

- Seeking a position as an Investment Officer to use my analytical and problem-solving skills to evaluate investments and provide insightful advice.

- To apply my knowledge of financial instruments to develop and execute investment strategies that are beneficial to the company.

- To use my experience in analyzing capital markets and macroeconomic trends to help financial institutions make prudent investment decisions.

- To use my knowledge of financial regulations and compliance standards to ensure investments adhere to all regulatory requirements.

- To leverage my expertise in financial analysis and financial modeling to help companies make informed investment decisions.

- To help financial institutions to maximize returns while minimizing risk with my proven track record of successful investments.

Having a well-crafted objective on your Investment Officer resume can help to make a strong impression on potential employers and set you apart from other applicants. Make sure to include any qualifications, skills, and experiences that make you a standout candidate and demonstrate why you are the best fit for the position.

How do you list Investment Officer skills on a resume?

Investment Officers are responsible for managing the finances of organizations and can play an important role in helping organizations make wise investments. When listing investment officer skills on a resume, it is important to highlight the strengths and experience that make you a desirable candidate.

- Knowledge of financial markets: Investment officers should have a good understanding of the various financial markets, including stock and bond markets. Additionally, they should be familiar with investment strategies, risk management, and portfolio diversification.

- Analytical skills: Investment officers must be able to analyze and interpret financial data in order to make sound decisions regarding investments. They should have strong analytical skills and be able to identify trends and patterns in the markets.

- Communication skills: Investment officers must be able to effectively communicate with stakeholders and clients about financial investments. They should be able to present complex financial data in a clear and concise way.

- Leadership skills: Investment officers need to have strong leadership skills in order to manage teams, delegate tasks, and make difficult decisions.

- Problem-solving skills: Investment officers must be able to identify problems and use creative solutions to find the best solution. This requires strong problem-solving skills and the ability to think outside the box.

- Research skills: Investment officers should be able to conduct research in order to stay up to date on financial markets and developments. They should be able to analyze industry news and financial statements to identify potential investment opportunities.

- Attention to detail: Investment officers should have a keen eye for detail and be able to spot errors in financial documents. They should be able to review data and ensure accuracy when making decisions.

What skills should I put on my resume for Investment Officer?

Having a strong resume is essential when applying for a position as an Investment Officer. Your resume should highlight the skills and experience that make you the right candidate for the job. Here are some of the key skills to include on your resume:

- Analytical Skills: Investment Officers must have strong analytical skills to be able to evaluate investment opportunities and make recommendations for their clients.

- Financial Knowledge: Investment Officers must have a strong understanding of financial markets, stocks, bonds, and other investments. They should understand the risks associated with different investments and be able to make informed decisions based on their knowledge.

- Negotiation Skills: Investment Officers should have effective negotiation skills to be able to secure the best possible returns for their clients.

- Communication Skills: Investment Officers should be able to effectively communicate investment strategies and results to their clients.

- Interpersonal Skills: Investment Officers should have strong interpersonal skills to develop and maintain relationships with clients and other stakeholders.

- Research Skills: Investment Officers should have strong research skills to be able to stay up-to-date on the latest developments and trends in the financial markets.

- Risk Management: Investment Officers should understand the risks associated with different investments and be able to manage them effectively.

By including these skills on your resume, you’ll be able to demonstrate to potential employers that you have the necessary skills and experience for the position.

Key takeaways for an Investment Officer resume

When writing an Investment Officer resume, there are certain key takeaways that employers look for to prove that you are the ideal candidate for the job. Investment Officers are responsible for researching investments, analyzing financial data and developing portfolios. To succeed in this role, you must demonstrate your financial acumen, your knowledge of the markets, and your ability to think strategically.

When crafting your Investment Officer resume, it is essential to highlight your key accomplishments, such as the portfolios you have developed, the successful investments you have made, and the financial strategies you have implemented. Showcase your financial expertise by providing in-depth descriptions of your skills and experience. Be sure to include your educational background, certifications, and any specialized training you have completed.

In addition to highlighting your qualifications, you should also include quantifiable data to demonstrate your success in previous roles. Showcase your knowledge of financial markets by outlining the types of investments you have made, the successes and failures of those investments, and any strategies you have used to mitigate risk. This data will help employers understand the impact you have made and help them to better assess your qualifications.

Finally, you should focus on how you can help the company reach its goals. Describe how you plan to use your expertise to create a profitable portfolio and exceed benchmarks. Showcase your ability to think strategically and offer ideas on how to improve the organization’s investments.

In summary, when crafting an Investment Officer resume, make sure to highlight your financial expertise, successes, experience, and strategies. Demonstrate your ability to think strategically and provide quantifiable data to show the impact you have made. Finally, focus on how you can help the company reach its goals. By doing these things, you will increase your chances of landing the job.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder