When it comes to applying for a job as an investment accountant, having a well-written, up-to-date resume is essential. Your resume should showcase your qualifications and demonstrate to potential employers why you are the best candidate for the job. Crafting a resume that accurately portrays your skills and experience can be a challenging task, but with the right tips and strategies, you can create a compelling resume that will get you noticed. This guide will provide you with important tips and examples to help you create your own investment accountant resume.

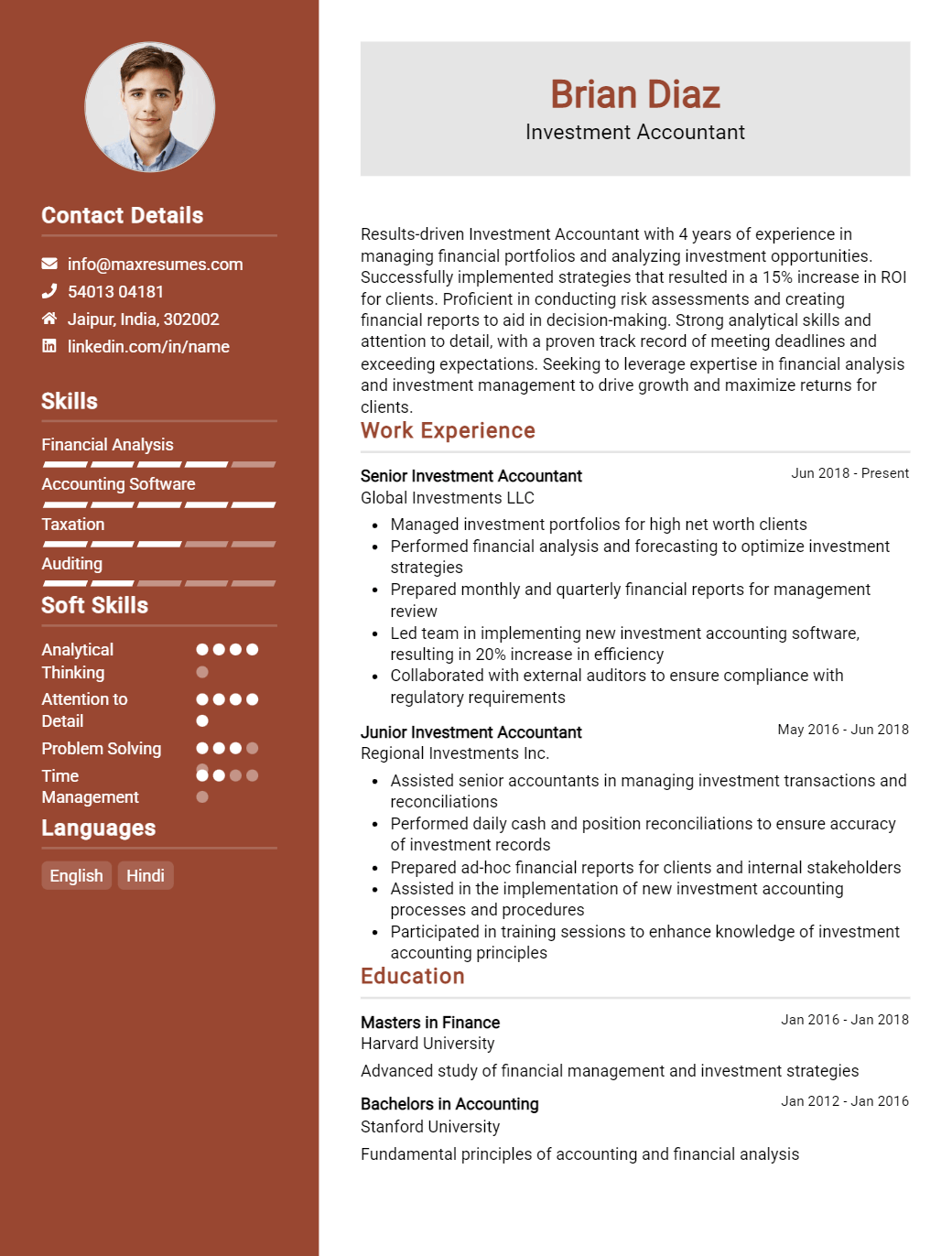

Investment Accountant Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Investment Accountant Resume Examples

John Doe

Investment Accountant

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

Highly motivated Investment Accountant with over five years of experience in the financial services sector. Proven track record of achieving results in highly demanding environments, including accurately preparing and analyzing financial statements, performing complex financial calculations, and providing financial advice to key stakeholders. Experienced in developing and implementing innovative strategies to maximize profitability and facilitate growth. Possess strong communication and problem- solving skills and a comprehensive understanding of accounting principles, financial analysis, and investments.

Core Skills:

- Advanced financial analysis and forecasting

- Preparation of financial statements

- Development and implementation of innovative strategies

- Management of complex financial projects

- Strong communication and problem- solving skills

- Experienced in investment banking and securities analysis

- Excellent organizational and time management skills

- Knowledge of accounting principles and practices

Professional Experience:

Investment Accountant, ABC Financial Services, 2015- present

- Responsible for maintaining and reconciling the general ledger, preparing financial statements, and analyzing financial data.

- Develop and implement innovative strategies to increase profitability and maximize investments.

- Manage complex projects and provide financial advice to executives.

- Analyze investments and perform financial calculations.

- Prepare detailed financial reports and presentations.

Investment Analyst, XYZ Financial Services, 2012- 2015

- Analyzed and managed investments in various markets.

- Performed financial analysis and calculations to provide recommendations to stakeholders.

- Provided financial advice and guidance to executives on investment decisions.

- Prepared and presented financial statements to the board of directors.

Education:

Bachelor of Science in Accounting, XYZ University, 2012

Investment Accountant Resume with No Experience

Recent college graduate eager to gain experience as an Investment Accountant. Knowledgeable in accounting principles and experienced working in a team environment. A highly motivated and organized individual with excellent communication and problem- solving skills.

Skills:

- Strong accounting background

- Organizational and analytical skills

- Excellent communication skills

- Proficiency in Microsoft Office Suite

- Ability to work independently and in a team environment

- Detail- oriented with the ability to multitask

Responsibilities:

- Maintain accurate financial records

- Perform data entry and reconciliation of accounts

- Assist in the preparation of financial statements

- Analyze financial data for accuracy and completeness

- Assist with the preparation of annual budgets

- Assist with research and analysis of investment opportunities

- Monitor investment performance and analyze financial markets

- Develop financial models and projections for investments

- Develop and maintain relationships with clients

- Provide administrative support for the investment team

Experience

0 Years

Level

Junior

Education

Bachelor’s

Investment Accountant Resume with 2 Years of Experience

Dynamic and experienced Investment Accountant with 2 years of experience in financial planning and analysis, capital budgeting, financial modeling, and risk management. Skilled in maintaining and reconciling complex financial transactions and ensuring accuracy. Proven track record of meeting tight deadlines, exercising sound judgment, and exceeding goals in a team- oriented environment.

Core Skills:

- Financial Planning & Analysis

- Capital Budgeting

- Financial Modeling

- Risk Management

- Data Analysis

- Account Reconciliation

- Project Management

- Team Collaboration

Responsibilities:

- Developed financial models to support strategic decisions, financial planning & analysis, capital budgeting, and risk management.

- Analyzed large data sets and generated & interpreted financial reports.

- Maintained and reconciled complex financial transactions & accounts.

- Ensured accuracy & completeness of financial records & accounts and identified potential discrepancies.

- Assisted in the development and implementation of internal control plans, policies, and procedures.

- Worked collaboratively with other departments to meet strategic objectives.

- Monitored accounts and generated reports for senior management.

- Prepared detailed financial reports for internal & external stakeholders.

- Participated in the planning and execution of short- term and long- term projects.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Investment Accountant Resume with 5 Years of Experience

Diligent and detail- oriented Investment Accountant with 5 years of experience in financial and accounting operations. Proven ability to monitor financial transactions in a timely and accurate manner. Knowledgeable in financial regulations and legislation that govern the transactions of investments. Possess an MBA with a concentration in Accounting.

Core Skills:

- Financial analysis

- Accounts reconciliations

- Record maintenance

- Regulatory compliance

- Budget forecasting

- Risk management

- Audit procedures

- Accounting principles

Responsibilities:

- Analyzed and monitored financial transactions for accuracy and compliance with established financial policies and procedures.

- Reconciled bank statements on a daily basis and maintained accurate records of all banking activities.

- Performed general ledger entries and generated monthly, quarterly and year end reports.

- Performed fluctuation and variance analysis to evaluate financial results in comparison to budget.

- Ensured compliance with legal regulations and legislation governing investments.

- Assisted in the preparation of financial statements and budgets.

- Conducted audit procedures to ensure the accuracy and completeness of financial records.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Investment Accountant Resume with 7 Years of Experience

A highly motivated and results- driven investment accountant with 7 years of experience in providing accurate financial reporting, account analysis, and general ledger maintenance. Demonstrated ability to use financial and analytical skills to identify trends, resolve complex accounting issues, and develop innovative solutions. Possess excellent communication skills, and the ability to collaborate with cross- functional teams and stakeholders.

Core Skills:

- Financial Reporting

- Account Analysis

- General Ledger Maintenance

- Budgeting

- Cash Flow Forecasting

- Account Reconciliation

- Auditing

- Tax Compliance

Responsibilities:

- Performed financial reporting, account analysis, and general ledger maintenance.

- Assisted in budgeting, forecasting cash flow, and reconciling accounts.

- Performed internal auditing and ensured compliance with applicable tax regulations.

- Developed innovative solutions to complex accounting issues.

- Researched and analyzed financial data to identify trends and recommend improvements.

- Assisted in preparing financial statements and other documents for management review.

- Collaborated with cross- functional teams to ensure accurate financial reporting.

- Provided assistance with billing and accounts receivable/payable processes.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Investment Accountant Resume with 10 Years of Experience

Accomplished and detail- oriented Investment Accountant with over 10 years of experience in the investment banking industry. Proven track record of effectively managing and reconciling financial accounts, ensuring accuracy and timeliness of all financial records. Skilled in assessing risks, performing financial analysis and developing reports. Possess excellent communication and problem solving skills.

Core Skills:

- Accounting and Taxation

- Financial Analysis

- Financial Reporting

- Risk Management

- Data Analysis

- Project Management

- Regulatory Knowledge

- Investment Banking

- Compliance

- Microsoft Office Suite

- Customer Service

Responsibilities:

- Managed and reconciled financial accounts and ensure accuracy of all financial records.

- Assessed risks and developed reports for client presentations.

- Performed financial analysis on individual investments and portfolios

- Prepared financial statements and tax returns for clients.

- Reviewed documents to ensure compliance with state and federal regulations.

- Provided customer service to clients, answering questions and resolving issues.

- Developed and implemented accounting procedures and processes.

- Managed projects, including budgeting and scheduling.

- Assisted with auditing and other special projects.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Investment Accountant Resume with 15 Years of Experience

Experienced Investment Accountant with fifteen years of experience in the accounting industry. Proven track record in handling complex financial situations, managing accounts, and providing insights into financial trends. Experienced in creating detailed reports and monitoring company accounts to ensure accuracy. Specializes in creating financial models and forecasting future investments.

Core Skills:

- Financial Modeling

- Forecasting

- Advanced Excel

- Accounting Principles

- Bookkeeping

- Analytical Thinking

- Budgeting

- Data Entry

- Report Writing

- Financial Analysis

Responsibilities:

- Performing financial analyses and creating detailed reports for large and small investments

- Developing and implementing financial models for forecasting investments

- Managing all accounts accurately and ensuring compliance to accounting principles

- Providing insights into financial trends and identifying profitable investments

- Creating, reviewing, and updating budgets for investments

- Performing data entry for all accounts and ensuring accuracy

- Writing detailed reports on investments and monitoring compliance to legal regulations

- Analyzing financial trends and providing recommendations to clients on potential investments

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Investment Accountant resume?

When writing an Investment Accountant resume, it is important to include key information that will show potential employers that you are the right fit for the job. Here are some of the items that should be included in a resume for an Investment Accountant:

- Contact Information: Make sure to include your name, address, phone number, and email address in your resume.

- Education: Include all relevant educational qualifications, such as degrees, certifications, and licenses.

- Work Experience: Include any prior experience in investments, accounting, or finance. List the companies you have worked for, the position you held, and the duration of the job.

- Skills: Highlight any skills that demonstrate your proficiency in investments and accounting. This can include software proficiency, financial analysis, and financial accounting.

- Achievements: List any awards, recognitions, or accomplishments that you have achieved in your field.

- References: Include a list of references that can vouch for your proficiency in investments and accounting.

These are just some of the items that should be included in an Investment Accountant resume. Make sure to tailor the resume to the position and the company you are applying for to best showcase your qualifications.

What is a good summary for a Investment Accountant resume?

A good summary for an Investment Accountant resume should include the applicant’s knowledge and experience in financial analysis, financial reporting, budgeting, forecasting, and tax compliance. It should also demonstrate their understanding of the principles of accounting, their ability to manage complex financial models, and their track record of minimizing financial risks. The summary should also highlight their ability to manage multiple tasks and deadlines and to provide clear, concise financial results. Finally, the summary should showcase their strong communication skills and their ability to work with clients and colleagues.

What is a good objective for a Investment Accountant resume?

A good objective for an Investment Accountant resume should highlight the key competencies, qualifications and experience the job seeker has to offer. Here are some examples of objectives that can be included on an Investment Accountant resume:

- Seeking an Investment Accountant role in a fast-paced, results-driven environment, where I can utilize my experience in financial analysis, financial reporting, and portfolio management

- A position as an Investment Accountant leveraging my expertise in financial planning and analysis, portfolio management, and risk management

- Looking for a challenging Investment Accountant position in a dynamic company, where I can apply my strong mathematical and analytical skills to optimize returns

- To secure an Investment Accountant role to utilize my experience in financial analysis, portfolio management, and financial modeling

- An Investment Accountant position to leverage my knowledge of financial regulations, accounting principles, and investment instruments to create wealth for clients

- To obtain an Investment Accountant position with a company that values my strategic thinking, problem-solving skills, and experience in financial and risk analysis

How do you list Investment Accountant skills on a resume?

Investment Accountants have an important role to play in the financial industry, and they must have a wide range of skills to be successful. Here are some key skills that should be included in an Investment Accountant resume:

- Excellent knowledge of accounting principles and financial instruments

- Strong analytical and problem-solving skills

- Ability to manage multiple tasks and prioritize assignments

- High proficiency with financial software programs such as Sage and Quickbooks

- Proficient in Microsoft Office Suite

- Ability to accurately interpret financial data

- Excellent communication and interpersonal skills

- Ability to work independently and with a team

- Attention to detail and accuracy when evaluating data

- Ability to think strategically and plan for the future

- Ability to identify and address potential issues

- Knowledge of legal and compliance regulations.

What skills should I put on my resume for Investment Accountant?

For those looking to break into the world of investment accounting, there are certain skills that need to be showcased on your resume. A successful investment accountant should possess knowledge of financial statements and accounting principles, as well as understanding of various asset classes and the ability to analyze complex financial data. Here are some important skills to include on your resume for Investment Accountant:

- Financial Statement Analysis: Investment accountants should have a firm understanding of financial statements and be able to analyze them for accuracy and understanding of the financial health of a company.

- Asset Management: Investment accountants must be able to effectively manage a portfolio of assets in order to achieve the highest return and minimize risk. This includes understanding the different asset classes and finding the optimal allocation of assets.

- Risk Management: Investment accountants need to be able to identify and assess potential risks in order to protect the portfolio from future losses.

- Regulatory Compliance: Investment accountants need to be familiar with all applicable laws and regulations in order to ensure that the portfolio is compliant and up to date.

- Tax Planning: Investment accountants must be knowledgeable of tax laws and regulations in order to provide tax planning advice and ensure that the portfolio is optimized for tax efficiency.

- Analytical Skills: Investment accountants must be able to analyze complex financial data in order to make informed decisions and provide valuable insights.

- Communication Skills: Investment accountants must be able to communicate information clearly and effectively in order to provide guidance and advice to clients.

Key takeaways for an Investment Accountant resume

The investment accountant profession is a highly specialized and important part of the financial industry. These professionals are responsible for analyzing and managing investments, calculating and filing taxes, and providing financial advice to clients. Having an effective resume can make a huge difference when applying for jobs and securing a career in this field. Here are some key takeaways for crafting an investment accountant resume:

- Highlight your financial and accounting expertise: Showcase your experience, knowledge, and certifications in accounting, finance, and investments. Make sure to include any specialized training or certifications you have, such as a Certified Public Accountant (CPA) accreditation or a Certified Financial Analyst (CFA) designation.

- Demonstrate your problem-solving skills: In this profession, you will be expected to be able to quickly identify and address any issues that arise. Show employers that you can accurately assess financial data and provide solutions to problems.

- Demonstrate your communication and interpersonal skills: Investment accountants need to be able to effectively communicate with their clients and present complex financial information in a clear way. Show employers that you have strong communication skills and can work with others in a professional manner.

- Showcase your ability to work with different software: Investment accountants need to be able to work with various financial software programs. Include any software you know how to use and have experience with, such as Microsoft Excel, Quickbooks, or Bloomberg.

By following these tips, you can create an effective resume that will help you stand out for any investment accountant position. Make sure to highlight your experience and qualifications, as well as your problem-solving, communication, and software skills. Employers will be impressed by your ability to accurately manage investments and present financial information in a clear and concise way.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder