Writing a resume for an income tax preparer job can seem like a daunting task. With so many qualifications and skills to showcase, there can be a lot of information to include. However, with a few tips and tricks, you can craft a resume that is sure to stand out and make a great impression on potential employers. In this post, we will provide a comprehensive guide on how to write a resume for an income tax preparer position, along with examples of resumes you can use as a template. With the help of this guide, you can create a resume that puts your best foot forward and displays your competencies in the best light possible.

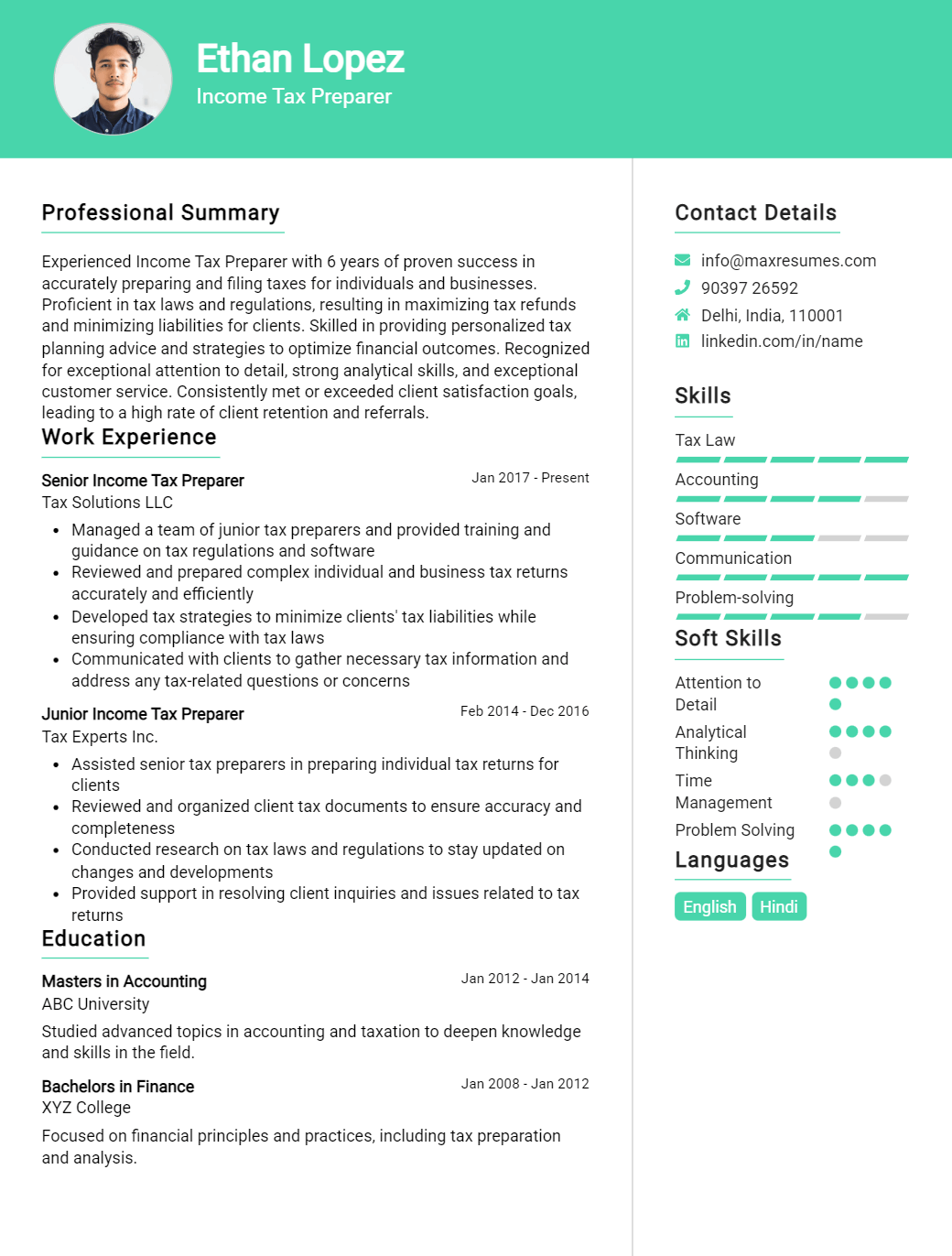

Income Tax Preparer Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Income Tax Preparer Resume Examples

John Doe

Income Tax Preparer

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am a certified public accountant and tax specialist with over five years of experience in preparing tax returns for small and medium- sized businesses and individuals. I am highly organized and detail- oriented, with a commitment to accuracy and timeliness. I strive to ensure that all clients receive the best possible tax preparation service and assistance.

Core Skills:

- Extensive Knowledge of Tax Laws and Regulations

- Proficient in Tax Preparation Software

- Strong Analytic and Math Skills

- Excellent Time Management

- Superior Attention to Detail

- Creative Problem Solving

Professional Experience:

Tax Preparer, XYZ Tax Service, 2017- Present

- Prepare and file federal and state income tax returns for individuals, businesses and trusts

- Develop strategies to reduce clients’ tax liabilities

- Communicate with clients to obtain accurate financial and personal information

- Provide tax advice and guidance to clients

- Verify accuracy of information and documents

Tax Consultant, ABC Accounting Firm, 2015- 2017

- Analyzed and interpreted tax regulations, laws and codes

- Prepared and filed corporate, partnership and individual income tax returns

- Researched tax law changes in order to advise clients

- Created tax- saving strategies for clients to maximize their deductions

- Developed various tax reports and documents

Education:

Masters in Taxation, University of California, 2014

Bachelor of Science in Accounting, University of California, 2012

Income Tax Preparer Resume with No Experience

Recent college graduate with a Bachelor’s degree in Accounting, seeking an entry- level position as an Income Tax Preparer with no prior experience. Possess excellent knowledge in accounting principles, as well as excellent organizational, communication and time management skills.

Skills

- Excellent knowledge of accounting principles

- Detail- oriented

- Problem- solving skills

- Strong organizational and time management skills

- Excellent communication skills

- Proficient in Microsoft Office Suite and other accounting software

Responsibilities

- Prepare and review income tax returns

- Ensure accuracy of taxes using knowledge of tax laws

- Manage and organize tax documents, including federal, state and local income tax forms

- Resolve client inquiries related to tax issues

- Keep up to date with tax regulations and changes in filing requirements

Experience

0 Years

Level

Junior

Education

Bachelor’s

Income Tax Preparer Resume with 2 Years of Experience

Dedicated and organized Income Tax Preparer with 2 years of experience offering a proven track record for providing accurate and timely income tax preparation for individuals and businesses. Possess a thorough understanding of IRS regulations and tax code, as well as a wide range of income tax software. Possess excellent problem- solving and communication skills and am comfortable working both independently and in a team environment.

Core Skills:

- Income Tax Preparation

- IRS regulations

- Tax codes

- Income Tax Software

- Problem- solving

- Organizational

- Communication

Responsibilities:

- Prepared individual and business tax returns in compliance with IRS regulations and tax codes.

- Ensured accurate calculations of deductions and credits.

- Analyzed data to identify discrepancies, errors, or incomplete information.

- Assisted clients with filing requirements, answering questions, and resolving issues.

- Investigated and clarified information to minimize potential tax liability.

- Maintained up- to- date knowledge of tax laws and changes in order to provide the most accurate advice and service.

- Provided guidance and assistance to clients regarding tax- related matters.

- Complied with all financial legal requirements by adhering to federal and state regulations.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Income Tax Preparer Resume with 5 Years of Experience

Highly motivated and organized Tax Preparer with 5 years of experience working for a large accounting firm. Experienced in conducting financial and tax preparation for individuals, small businesses, and corporations. Possesses advanced knowledge in filing taxes for all 50 states as well as federal taxes. In- depth experience in analyzing financial records, compiling data, and preparing detailed, accurate tax returns. Possesses a thorough understanding of IRS regulations and best practices for tax return preparation.

Core Skills:

- Detail- oriented and analytical

- Excellent knowledge of IRS regulations and tax laws

- Proficient in financial and tax software

- Able to meet deadlines in a timely manner

- Excellent communication and customer service skills

- Ability to analyze financial data and identify problems

Responsibilities:

- Prepare tax returns for individuals, small businesses, and corporations

- Analyze financial records and compile data for accurate tax return preparation

- Conduct research and resolve tax- related inquiries

- Consult with clients to discuss their financial situation and tax obligations

- Provide guidance to clients regarding tax deadlines and filing requirements

- Ensure compliance with federal and state tax laws and regulations

- Suggest strategies to reduce tax liabilities and maximize refund potential

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Income Tax Preparer Resume with 7 Years of Experience

A highly organized and committed tax professional with 7+ years of experience in preparing and filing taxes for individuals and businesses. Detail- oriented and well- versed in the use of tax software tools to ensure accuracy and efficiency in preparing tax returns. Able to effectively meet tight deadlines and continuously provide quality service for clients.

Core Skills:

- In- depth knowledge of tax codes and regulations

- Solid understanding of tax compliance and filing procedures

- Proficient in using modern tax preparation software

- Strong research and analytical skills

- Excellent time management and organizational skills

- Strong verbal and written communication skills

Responsibilities:

- Perform accurate and timely tax return preparation and filing

- Review client information and source documents to ensure accuracy of information

- Identify and resolve discrepancies between source documents and tax returns

- Ensure proper application of federal, state, and local tax laws and regulations

- Keep up with current changes in tax laws and regulations

- Provide clients with sound advice on tax planning and compliance issues

- Answer clients’ questions regarding their taxes and tax filing process

- Develop tax strategies to minimize clients’ tax liabilities

- Provide feedback to clients regarding their tax filings and assist in resolving tax- related issues

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Income Tax Preparer Resume with 10 Years of Experience

Experienced Income Tax Preparer with 10 years of experience in the preparation of individual and business income tax returns. I have expertise in medical and dental practices, high- end real estate deals, manufacturing and wholesale corporations, complex non- profit organizations and other businesses. I am an organized self- starter with the ability to prioritize, meet deadlines, and manage multiple assignments. I am knowledgeable in current tax laws and regulations, and strive to stay informed on the latest changes in the tax code.

Core Skills:

- Expertise in individual and business income tax preparation

- Knowledgeable in current tax laws and regulations

- Proficient with filing and reporting

- Strong attention to detail

- Excellent organizational and communication skills

- Ability to prioritize and manage multiple assignments

- Self- motivated and able to work independently

Responsibilities:

- Assessing and analysing financial information in order to accurately prepare tax returns

- Completing complex tax returns and filing returns in a timely manner

- Consulting with clients and providing advice on tax- related matters

- Identifying potential tax credits and deductions

- Assisting with tax audits, IRS notices and other inquiries

- Remaining current on changes to the tax laws and regulations and staying informed on the latest updates

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Income Tax Preparer Resume with 15 Years of Experience

A professional Income Tax Preparer with 15 years of experience seeking an opportunity to utilize my extensive knowledge and expertise in the field. During my career I have gained significant experience in the areas of tax return preparation, financial planning, and client relations. In addition, I have a strong ability to understand complex financial data and regulations, as well as excellent organizational and communication skills. I am committed to providing the highest standard of service to my clients and ensuring that their taxes are accurately prepared in a timely manner.

Core Skills:

- Tax Return Preparation

- Financial Planning

- Client Relations

- Financial Analysis and Reporting

- Problem- Solving

- Tax Law Knowledge

- Organization

- Attention to Detail

- Time Management

- Interpersonal Skills

Responsibilities:

- Prepare individual, trust, partnership and business tax returns

- Provide advice on tax planning to clients

- Analyze complex financial data and regulations

- Research tax laws and regulations

- Ensure the accuracy and timeliness of tax returns

- Manage client relations, including responding to client inquiries

- Evaluate and suggest tax strategies

- File paperwork to the Internal Revenue Service (IRS)

- Remain up- to- date on changes to the tax code

- Prepare estimates and payment plans for tax liabilities

- Assist with audit requests and inquiries

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Income Tax Preparer resume?

Writing a resume for a tax preparer position requires a specific approach. Income tax preparers must demonstrate their knowledge and experience in the field in order to get hired. You should make sure your resume is tailored to the position and contains all of the key components employers are looking for.

To create an effective resume for a tax preparer position, use the following guide.

- Include a professional summary: Start your resume with a summary that highlights your qualifications and experience in the field. Make sure to include the kind of job you are applying for and the specific skills you bring to the table.

- List relevant experience: Set yourself apart by showcasing your relevant experience in the field. Detail your knowledge of tax calculations, filing techniques, and other related subjects.

- Highlight technical skills: Tax preparers must work with a variety of software programs and databases. Make sure to list the relevant technical skills you have that demonstrate your ability to use various software and systems.

- Include certifications: Demonstrate your expertise in the field by listing any certifications you possess. Certified Public Accountants (CPAs) and other certification programs are great ways to prove your qualifications.

- Showcase additional skills: Tax preparers must have a variety of skills, including customer service, problem-solving, and organizational abilities. Showcase these essential skills by providing examples of how you have demonstrated them in the past.

By following the above tips and creating a resume tailored to the specific tax preparer position you are applying for, you can increase your chances of getting hired.

What is a good summary for a Income Tax Preparer resume?

A good summary for an income tax preparer resume should emphasize the candidate’s experience in financial and tax preparation, while also outlining any relevant certifications or qualifications they may possess. It should also include any skills or knowledge they have in tax law, accounting, and/or bookkeeping. Additionally, the summary should touch on the candidate’s ability to work well with clients, manage their time effectively, and keep up to date with the current tax laws and regulations. Ultimately, the summary should show that the candidate is a competent and professional income tax preparer who will be a valuable asset to any team.

What is a good objective for a Income Tax Preparer resume?

A job as an Income Tax Preparer requires a high degree of skill and attention to detail. An effective resume objective should demonstrate your ability to complete accurate and timely tax returns and keep up with the latest tax laws. Here are some good objectives for an Income Tax Preparer resume:

- Establish a successful career as an Income Tax Preparer while utilizing in-depth knowledge of tax laws and regulations.

- Offer advanced accounting skills and expertise in preparing complex individual and business tax returns.

- Demonstrate a commitment to accurate and detailed preparation of tax returns to ensure compliance with applicable laws.

- Possess excellent problem-solving and communication skills to effectively explain tax regulations and inform clients of potential deductions and payment plans.

- Utilize innovative technology to streamline tax preparation processes and increase accuracy.

- Remain current on changes to tax regulations to ensure accuracy and maximize customer satisfaction.

How do you list Income Tax Preparer skills on a resume?

Income tax preparers are professionals who are knowledgeable in preparing tax returns, understanding and using the latest tax laws, and filing taxes for individuals, businesses, and organizations. When listing skills on a resume, it is important to provide evidence that you are knowledgeable in the areas that you are claiming to be. Here are some of the key skills that employers look for in an income tax preparer:

- Understanding of the latest tax laws: Tax laws change frequently and it is essential to stay up to date on the latest regulations. This includes being able to interpret the new tax laws, understanding how to interpret and apply them to various tax returns, and being able to explain them to clients.

- Knowledge of tax preparation software: Tax preparation software is used to accurately prepare and file taxes for individuals, businesses, and organizations. The ability to use and understand the software is a must for any tax preparer.

- Attention to detail: As a tax preparer, it is your responsibility to ensure that all taxes are accurately filled out and filed on time. Attention to detail is essential to avoid costly mistakes and missed deadlines.

- Analytical and problem-solving skills: Tax preparers should be able to analyze and interpret financial data in order to determine the best tax strategy for clients. This includes being able to identify potential deductions and credits and assess the tax implications of various decisions.

- Good communication skills: Tax preparers need to be comfortable communicating with clients and other tax professionals. This includes being able to explain complex tax concepts in a clear and concise manner.

- Organization and time management skills: Tax preparers need to be able to manage their time effectively in order to meet client deadlines and stay on top of the latest tax laws. Organization is also essential in order to keep client information and records organized and up-to-date.

What skills should I put on my resume for Income Tax Preparer?

When creating a resume to apply for a role as an Income Tax Preparer, one must highlight their relevant skills and experiences in order to stand out from the competition.

Here are some of the most essential skills to include on your resume for an Income Tax Preparer role:

- Extensive knowledge of tax regulations and filing requirements: As an Income Tax Preparer, you must be well-versed in federal, state, and local tax regulations, as well as filing requirements, deadlines, and penalties.

- Attention to detail: The ability to review, analyze, and interpret tax documents and other financial data with accuracy and precision is key to success in this role.

- Communication skills: Being able to clearly explain complex tax regulations and procedures to clients in an easy-to-understand manner is a must.

- Strong organizational skills: Being able to stay organized and meet deadlines is key for success in this role.

- Proficiency with tax software: Experience using tax software such as TurboTax and TaxAct is essential when preparing tax returns.

By highlighting these key skills on your resume, you will be better positioned to secure an Income Tax Preparer role.

Key takeaways for an Income Tax Preparer resume

As an Income Tax Preparer, you have a specialized set of skills that can help other people with their taxes. Having a strong resume is key to finding the right job. Here are some key takeaways for crafting an effective Income Tax Preparer resume:

- Highlight Your Tax Preparation Skills: Make sure your resume prominently features any relevant tax preparation skills, such as filing taxes for individuals or businesses, preparing payroll taxes, or managing audit processes.

- Include Your Education: Your education is important for Income Tax Preparers, so make sure to include your relevant degree(s) and certifications.

- Show Your Professional Development: Include any courses, seminars, or workshops you’ve taken to stay current with changes in the tax code and industry trends.

- Demonstrate Your Success: Showcase any accomplishments or awards that you’ve earned in your career as an Income Tax Preparer.

- Include Your Soft Skills: Being an Income Tax Preparer often requires excellent people skills. Make sure to highlight your communication skills, problem-solving abilities, and customer service capabilities.

By following these key takeaways, you can create an effective and attractive Income Tax Preparer resume that will help you land the job you’ve been looking for.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder