A Forex (FX) trader resume is an important document that outlines your professional background, qualifications, and experience. Writing a resume that accurately captures your skills and experience as an FX trader can be a challenging task. This guide will provide an overview of what to include in your resume and how to describe your career in FX trading. Additionally, this guide will provide examples of FX trader resumes to give you an idea of how other traders have crafted their resumes. By following this guide and applying the provided examples, you can create an effective FX trader resume that will help you stand out from the competition and increase your chances of landing the job.

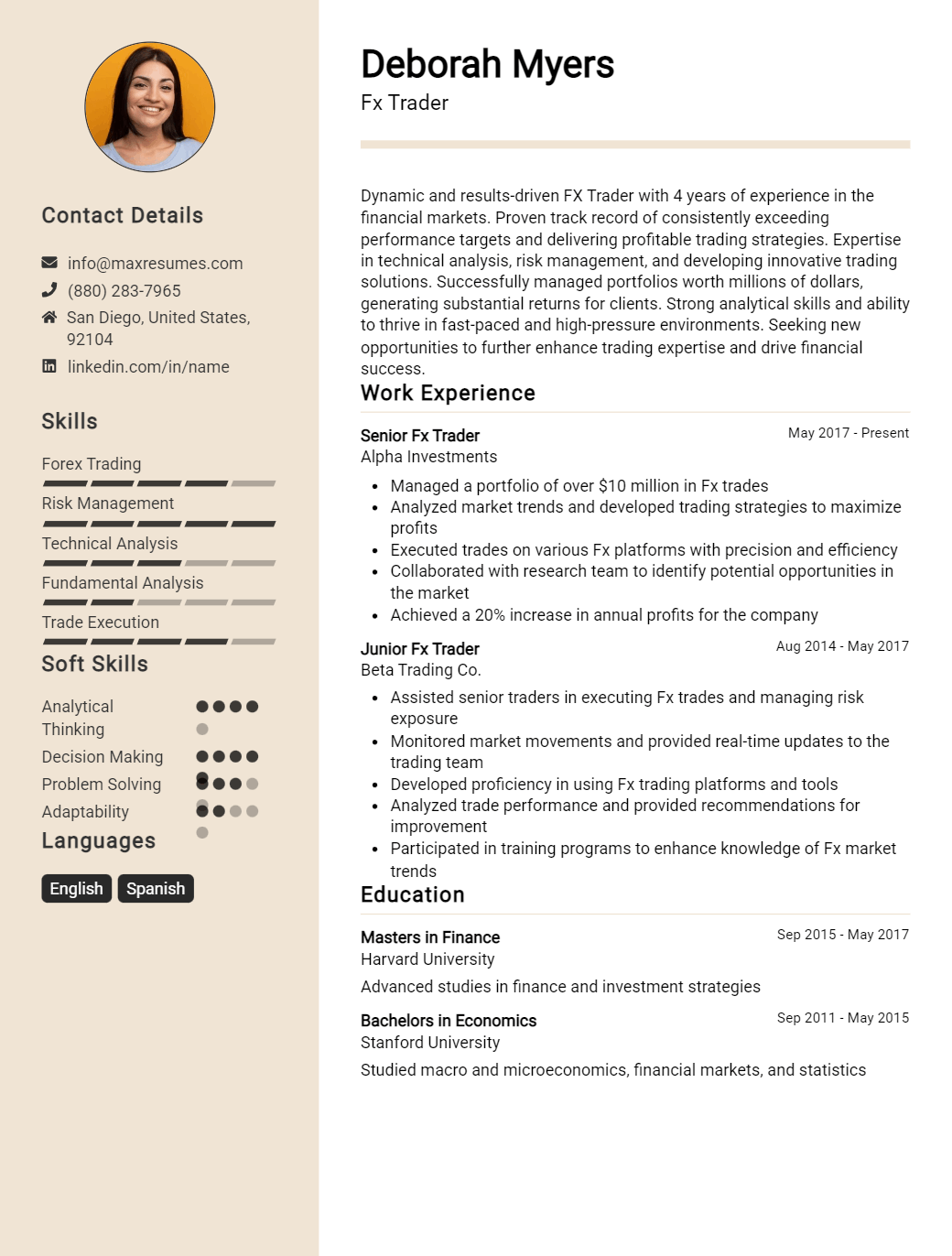

Fx Trader Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

FX Trader Resume Examples

John Doe

FX Trader

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am an experienced FX Trader with a deep understanding of the global markets and a proven track record of success. My career has spanned multiple countries and allowed me to develop my skills in both trading and analysis. Over the years I have consistently managed to generate consistent profits and have a comprehensive understanding of risk management, market analysis and forecasting. Additionally, I have an intuitive sense for the currency markets and have used this knowledge to identify and take advantage of investment opportunities.

Core Skills:

- Technical Analysis

- Risk Management

- Portfolio Management

- Market Forecasting

- Trading Strategies

- Financial Modeling

- Financial Analysis

- Data Analysis

Professional Experience:

- FX Trader, ABC Financial Group, New York, NY (2019 – Present)

- Managed an FX portfolio of $15 million, executing short- term trades with a focus on risk management and profit growth.

- Developed technical trading strategies with an emphasis on price action and trend analysis.

- Developed an in- depth understanding of foreign exchange markets and conducted extensive research on global macroeconomic trends.

- Maintained a comprehensive understanding of global political and economic events and how they impact currency markets.

- FX Analyst, XYZ Investment Group, London, UK (2015 – 2019)

- Monitored currency markets and conducted analysis to identify investment opportunities.

- Utilized financial modeling to analyze and forecast market trends.

- Provided clients with technical analysis and currency strategy advice.

- Developed and implemented risk management strategies to protect client investments.

Education:

- Bachelor of Science in Finance, XYZ University, London, UK (2009 – 2015)

- Certificate in International Finance, XYZ School of Finance, London, UK (2013)

FX Trader Resume with No Experience

Recent university graduate with a degree in finance, seeking to leverage my knowledge of market analysis, risk management and financial operations to excel as an FX Trader. Possess a highly collaborative and analytical mindset, as well as excellent communication and problem- solving skills.

Skills

- Strong understanding of financial operations and market analysis

- Proficient in risk management and financial analysis

- Excellent written and verbal communication skills

- Ability to manage multiple tasks and prioritize efficiently

- Highly competent in Microsoft Office, especially Excel

- Proficiency in a variety of financial and accounting software

Responsibilities

- Analyze and monitor currency markets to identify profitable trading opportunities

- Develop trading strategies based on market trends and financial analysis

- Execute trades and ensure that risk management protocols are in place

- Maintain and update records of trading activities and track financial performance

- Provide timely and accurate financial reports to management and clients

- Identify and analyze potential risks and make recommendations for risk mitigation

Experience

0 Years

Level

Junior

Education

Bachelor’s

FX Trader Resume with 2 Years of Experience

A motivated and experienced FX Trader with 2 years of experience in the financial sector. Possessing a strong knowledge of currency exchange markets and the ability to interpret, analyze and interpret data to execute profitable trades. Experienced in developing trading strategies, utilizing risk management tools and managing portfolios. Able to work independently with minimal supervision and under high pressure working environments.

Core Skills:

- Financial Market Knowledge

- Risk Management

- Portfolio Management

- Trading Strategies

- Data Analysis & Interpretation

- Problem Solving

- Time Management

- Organization

- Teamwork

Responsibilities:

- Developed trading strategies to ensure profitable trades

- Managed portfolios and executed trades in line with short and long- term investment strategies

- Analyzed data and interpreted economic indicators to make informed decisions

- Monitored and evaluated the performance of trading strategies

- Assessed and managed risk associated with individual trades and investments

- Utilized financial software to track, analyze and interpret market data

- Negotiated contracts with clients and other financial institutions

- Conducted market research to identify and capitalize on trading opportunities

- Built and maintained professional relationships with clients, colleagues and business partners

Experience

2+ Years

Level

Junior

Education

Bachelor’s

FX Trader Resume with 5 Years of Experience

Dynamic FX Trader with five years of experience in evaluating financial markets and executing trades for global clients. Deep understanding of various trading strategies and risk management principles. Proven track record of delivering consistently profitable results and leading a team of traders to success.

Core Skills:

- Financial Markets Analysis

- Trading Strategies

- Risk Management

- Trade Execution

- Portfolio Management

- Trading Tools & Platforms

- Team Leadership

Responsibilities:

- Monitor global financial markets and research macro- economic trends to identify trading opportunities.

- Utilize advanced trading strategies to capitalize on market movements and maximize profits.

- Develop and implement risk management principles to protect the trading portfolio.

- Execute trades in FX currencies, equities, and futures with speed and accuracy.

- Track and analyze trading performance to refine strategies and increase profitability.

- Lead and mentor a team of traders to attain organizational goals.

- Utilize trading tools and platforms to optimize trading activities.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

FX Trader Resume with 7 Years of Experience

Dynamic and highly experienced FX Trader with 7 years of experience in trading in the foreign exchange markets. Proven success in executing highly profitable trades, as well as a strong understanding of the markets and risk management. Possesses an in- depth knowledge of financial instruments, trading strategies, market trends, and analytic techniques. Highly adept at using automated trading systems, financial software, and analysis tools to maximize profits and minimize losses.

Core Skills:

- Advanced knowledge of the foreign exchange markets

- Excellent understanding of financial instruments, trading strategies, market trends, and analytics

- Excellent analytical and problem- solving skills

- Highly organized and detail- oriented

- Strong interpersonal and communication skills

- Proficient in automated trading systems, financial software, and analysis tools

- Possess a sound understanding of risk management

Responsibilities:

- Create, execute, and manage foreign exchange trades in accordance with established strategies

- Monitor and assess market trends and develop strategies to capitalize on market movements

- Analyze the impact of global economic events and news releases on the markets

- Develop and implement risk management strategies to maximize gains and minimize losses

- Perform comprehensive technical and fundamental analysis to identify profitable trading opportunities

- Utilize automated trading systems, financial software, and analysis tools to identify entry and exit points

- Execute trades in a timely manner to take advantage of favorable market conditions

Experience

7+ Years

Level

Senior

Education

Bachelor’s

FX Trader Resume with 10 Years of Experience

Highly motivated FX Trader with 10 years of experience in foreign exchange markets. Proven track record of making successful trades that deliver significant profits and return on investment. Detail- oriented and accurate in performing in- depth analysis of market trends and economic data. Excellent communicator and relationship builder with a passion for teaching and mentoring others.

Core Skills:

- Market Analysis & Research

- Money Management & Risk Management

- Trading Strategies & Tactics

- Financial Modeling & Forecasting

- Regulatory Compliance

- Communication & Relationship Building

Responsibilities:

- Analyze currency trends and identify trading opportunities

- Monitor the foreign exchange markets and news developments

- Evaluate market data and economic indicators to forecast the direction of exchange rates

- Execute complex trades and maximize profits

- Follow regulatory rules and guidelines

- Develop and maintain relationships with clients, brokers and bankers

- Educate and mentor junior traders on best practices and strategies for trading success

Experience

10+ Years

Level

Senior Manager

Education

Master’s

FX Trader Resume with 15 Years of Experience

A highly experienced FX Trader with over 15 years of experience in the financial industry. Proven track record of success in providing valuable trading advice and executing high- value trades. Skilled in market analysis, risk management, and portfolio diversification. Adept at building relationships and working collaboratively with clients and colleagues. Motivated and proactive in developing trading strategies and obtaining the best results for clients.

Core Skills:

- Market Analysis

- Risk Management

- Portfolio Diversification

- Trading Strategies

- Client Relationships

- Trading Advice

- Executing High- Value Trades

- Communication

Responsibilities:

- Analyzing and monitoring the currency markets to identify profitable investment opportunities

- Implementing trading strategies to maximize profits and minimize losses

- Work closely with clients to understand their investment goals and develop appropriate trading strategies

- Maintain relationships with clients and brokers to ensure smooth, profitable trades

- Execute trades on behalf of clients and monitor the performance of their investments

- Keep up to date with changes in the financial markets and regulatory environment

- Advise clients on trading strategies to suit their risk appetite and ensure their objectives are met

- Provide detailed reports to clients about their investments

- Develop relationships with banks and brokers to obtain the best exchange rates for clients

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a FX Trader resume?

Writing a resume as a foreign exchange (FX) trader can be a daunting task. With so many skills to include and highlight, it’s important to know what should and should not be included in the resume. This article will provide guidance on what should be included in an FX trader resume.

- Education and Certifications: List any education related to FX trading, such as a degree in economics, finance, or business. Also include any certifications or certifications that you have obtained related to FX trading.

- Trading Experience: Include any trading experience you may have in the FX market. This could be anything from internships to full-time positions.

- Proficiency in Platforms: Include any software platforms you are familiar with, such as Bloomberg, Thomson Reuters, or Metatrader.

- Knowledge of Strategies: Mention any strategies or techniques you have utilized in past trades. This could include scalping, momentum trading, or other methods.

- Risk Management: Demonstrate your knowledge of risk management and the strategies needed to manage potential losses.

- Market Knowledge: List any areas in the FX market where you have particular knowledge or experience.

- Analytical Skills: Demonstrate your analytical and problem solving skills, showing your ability to evaluate a situation and make decisions based on the data.

By including the components above in your FX trader resume, you will create a document that is effective and showcases your skills and experience in the field.

What is a good summary for a FX Trader resume?

A good summary for a FX Trader resume should highlight the candidate’s relevant experience and qualifications. It should also emphasize their knowledge of the foreign exchange market, their ability to make decisions quickly and accurately, and their experience in the financial industry. The summary should also showcase their ability to manage risk, their understanding of the global economic environment, and their ability to effectively communicate with trading partners. Finally, the summary should highlight any relevant certifications or qualifications unique to the field of foreign exchange trading. With the right summary, a FX Trader can demonstrate their skills, experience, and qualifications to potential employers and make the case for why they should be hired.

What is a good objective for a FX Trader resume?

A Forex (FX) Trader resume should demonstrate a candidate’s ability to analyze and manage the market, work in a team to develop strategies and make educated and timely trades. To land a successful FX Trader role, a candidate should be able to showcase the following skills and experiences in their resume:

- Proven track record of successful trading skills and strategies

- In-depth knowledge of trading systems and market analysis

- Ability to assess risk and develop strategies to maximize profits

- Excellent communication, organizational, and problem-solving skills

- Ability to work in a fast-paced, high-pressure environment

- Proficient with financial software and trading platforms

- Ability to stay up to date with industry news and events

By highlighting these skills, abilities and experiences, an FX Trader will be able to create a strong and compelling resume that will help them stand out from the competition and get noticed by potential employers.

How do you list FX Trader skills on a resume?

When applying for an FX Trader position, it is important to list the right skills on your resume. This will show employers that you have what it takes to be a successful trader. Here are some skills to highlight when creating your resume:

- Excellent understanding of Foreign Exchange markets, rates, and trends

- Strong analytical skills and ability to analyse market data

- Ability to develop, implement, and monitor trading strategies

- Experience with financial modelling tools and software

- Excellent risk management and decision-making skills

- Ability to use both fundamental and technical analysis to make trading decisions

- Ability to work independently and collaboratively in a team

- Proficiency in currency trading platforms, such as Meta Trader

- Excellent communication and interpersonal skills

- High level of discipline and self-motivation

- Ability to handle stress in a fast-paced environment

What skills should I put on my resume for FX Trader?

When you’re writing your resume for a job as an FX trader, it’s important to include the right skills and qualifications that demonstrate that you have what it takes to succeed in the role. Here are some of the key skills you should focus on when it comes to your FX trading resume:

- Knowledge of FX Markets: As an FX trader, you should have a comprehensive understanding of the FX markets, including the different currency pairs and their correlations, current market conditions, and trends.

- Technical Analysis Skills: Technical analysis is key to successful FX trading, so you should be proficient in using various methods for analyzing the markets, such as charting, trend lines, Fibonacci retracement, and other indicators.

- Risk Management Skills: You should be able to properly assess risk and manage your exposure in the FX markets. This includes having a sound understanding of risk management techniques such as stop-loss orders and position sizing.

- Trading Psychology: You need to have the right mindset when it comes to trading. This includes being able to remain calm and disciplined when the markets become volatile, as well as recognizing when to cut losses and take profits.

- Research Skills: A successful FX trader should be able to conduct their own independent research and analysis to gain an edge in the markets. This includes being able to analyze economic data, news and other relevant information.

By including these skills and qualifications on your FX trading resume, you can demonstrate to potential employers that you have the knowledge and experience needed to become a successful FX trader.

Key takeaways for an FX Trader resume

When it comes to landing a job as an FX trader, having a great resume is essential. A well-crafted resume will showcase your expertise in the field, as well as provide potential employers with an overview of your experience and skills. Here are some key takeaways for crafting an FX trader resume:

- Highlight Skills: Make sure to highlight any skills that are relevant to FX trading. Include any courses or certifications that you hold, as well as any software programs or platforms you’re familiar with.

- Focus On Experience: Include any past experience with FX trading in your resume. Include the number of years of experience, as well as any major achievements or successes you’ve had in the field.

- Use Job Descriptions: When listing job descriptions, be sure to include the specifics of your job duties and responsibilities. This will help to show potential employers that you are familiar with the intricacies of the FX trading field.

- List Education: Showcase any relevant educational backgrounds in the field. Include any degrees, diplomas, or certifications that you hold.

- Showcase Achievements: If you have any awards, certifications, or achievements in the FX trading industry, make sure to include them in your resume. This will help to showcase your expertise in the field.

By following these key takeaways for an FX trader resume, you can create a resume that will help you stand out from the competition and land the job you’re looking for. Good luck!

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder