When you’re looking to land a job as a fixed income trader, having a well-crafted resume is essential. Not only does it provide you with an opportunity to showcase your qualifications, but it also gives prospective employers a peek into who you are as a professional and what type of value you can bring to their team. But knowing how to write a resume for a fixed income trader that grabs attention can be a challenge. That’s why we’ve put together this comprehensive guide to help you create a high-quality resume that’ll get you noticed by potential employers. We’ll cover everything from what to include in your resume to tips and examples to help your resume stand out.

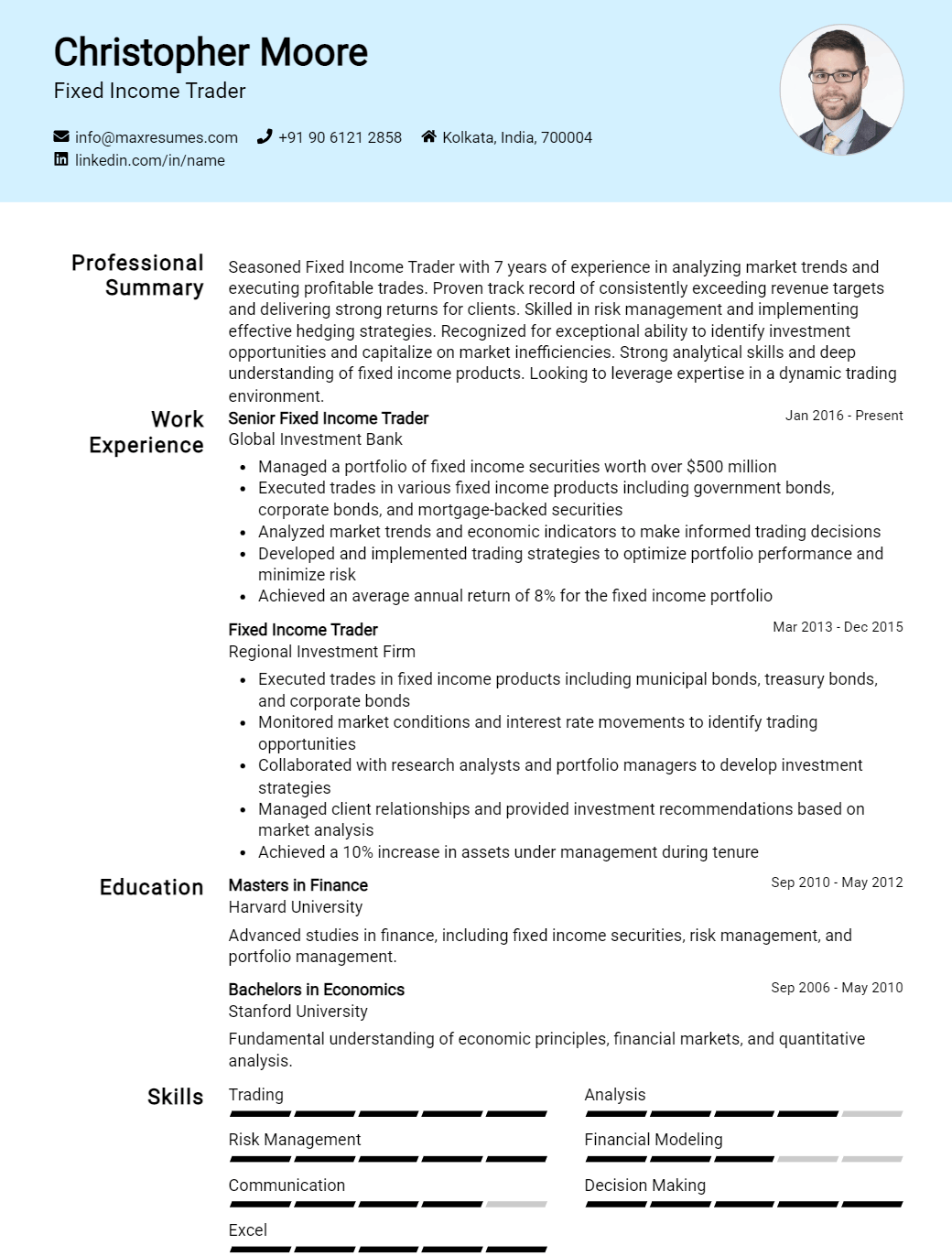

Fixed Income Trader Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Fixed Income Trader Resume Examples

John Doe

Fixed Income Trader

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

Highly experienced and motivated Fixed Income Trader looking to leverage over 10 years of experience in the financial industry. Track record of success in using derivatives and financial instruments to effectively manage and reduce risk exposure. Accomplished in identifying investment opportunities and developing trading strategies for success. Dedicated to providing excellent customer service and exceptional market analysis.

Core Skills:

- Risk Management

- Derivative Trading

- Financial Analysis

- Portfolio Management

- Execution of Strategies

- Market Research

Professional Experience:

- Fixed Income Trader, ABC Financial Corporation, New York, NY, 2008- 2018

- Monitored and traded fixed income securities, including corporate and government bonds.

- Conducted research on existing and new investments and analyzed their risk versus reward to determine trade viability.

- Collaborated with other departments to ensure all trades were in compliance.

- Developed and implemented tactical trading strategies to maximize profits and minimize risk.

- Oversaw the maintenance and execution of proprietary trading portfolios.

Education:

- Bachelor of Science, Finance, Columbia University, New York, NY, 2006

Fixed Income Trader Resume with No Experience

Recent college graduate with a degree in finance and a passion for trading. Knowledgeable in the fundamentals of fixed income securities and the ability to analyze financial data. Strong problem solving and communication skills, as well as a desire to learn and be part of a successful team.

Skills

- Analysis: Able to read and interpret financial data, understand economic and market conditions, and analyze trends and movements in the fixed income markets.

- Communication: Possesses excellent communication skills with the ability to effectively communicate with clients and team members.

- Problem Solving: Skilled in problem solving and decision making when making trades or evaluating financial information.

- Computer Skills: Proficient in the use of Microsoft Office Suite, including Excel and PowerPoint.

Responsibilities

- Analyze and monitor fixed income market conditions and trends to identify potential trading opportunities.

- Develop strategies and tactics for trading fixed income securities and other financial instruments.

- Execute trades in the fixed income markets on a daily basis.

- Track and analyze performance of the trades and make adjustments to strategies as needed.

- Research and stay abreast of changes in the fixed income markets that may affect trading strategies.

- Maintain accurate records of all trades and positions.

- Work with customers and brokers to ensure successful completion of trades.

- Provide reports and updates to management as needed.

Experience

0 Years

Level

Junior

Education

Bachelor’s

Fixed Income Trader Resume with 2 Years of Experience

Dynamic and results- oriented Fixed Income Trader with over two years of experience in developing and executing strategic trading plans. Skilled in efficiently researching and analyzing market data, maintaining up- to- date knowledge of market trends and government regulations, and identifying new opportunities to increase profits. A proven ability to build and manage successful relationships with clients, brokers, and colleagues.

Core Skills:

- Strong knowledge and understanding of fixed income trading products

- Advanced financial analysis, research, and market analysis techniques

- Excellent verbal and written communication skills

- Proficient in Microsoft Office Suite applications

- Strong organizational and problem- solving skills

- Ability to work independently and in a team environment

- Ability to work under pressure

Responsibilities:

- Developed and implemented trading strategies to maximize profits and minimize risks

- Monitored and adjusted the strategies to the changing market conditions

- Analyzed market trends and economic data to identify new opportunities

- Managed day- to- day trading activities, including risk management and foreign exchange

- Assisted in the development of risk management protocols

- Negotiated with clients and brokers to acquire new commission contracts

- Researched and maintained up- to- date knowledge of emerging markets and government regulations

- Communicated market analysis and strategizing to senior management

- Provided educational and investment advice to clients

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Fixed Income Trader Resume with 5 Years of Experience

Highly motivated and results- driven Fixed Income Trader with 5+ years of experience in financial markets and the trading of fixed income products. Expertise in developing and executing strategies for trading in bonds, treasuries, and other securities. Demonstrated skill in using sophisticated trading software, analyzing market trends, and making decisions based on sophisticated mathematical and risk models. Possesses excellent communication, problem- solving, and organizational skills.

Core Skills:

- Fixed income trading

- Bond and treasury trading

- Trading software

- Market analysis

- Risk models

- Mathematical models

- Communication

- Problem- solving

- Organization

Responsibilities:

- Develop and execute trading strategies for fixed income products

- Monitor and analyze market trends to identify potential trading opportunities

- Utilize sophisticated trading software to enter and manage trades

- Research and analyze complex financial instruments

- Follow and maintain compliance standards

- Perform detailed risk and reward analysis when making trading decisions

- Keep up to date with changes in the fixed income markets

- Monitor market conditions and adjust trading strategies as necessary

- Maintain a thorough understanding of trading regulations and industry standards

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Fixed Income Trader Resume with 7 Years of Experience

I am an experienced Fixed Income Trader with 7 years of experience in the capital markets space. I possess a keen understanding of credit markets, derivatives, and macro- economics and have demonstrated expertise in executing large and complex trades. My analytical and problem- solving skills have enabled me to develop and execute effective strategies to maximize profits and minimize risks. I am highly organized and manage multiple functions and tasks simultaneously with ease.

Core Skills:

- Strong knowledge of the capital markets

- Financial and credit analysis

- Risk management

- Trade execution

- Derivatives

- Portfolio management

- Proficient in Bloomberg and other trading platforms

- Strong communication and interpersonal skills

Responsibilities:

- Analyzed and evaluated market trends and opportunities to develop and execute effective trading strategies

- Monitored and analyzed market data in order to identify, capture and capitalize on trading opportunities

- Conducted independent research to form conclusions and make informed trading decisions in a timely manner

- Managed daily portfolio operations including trade execution, settlements and confirmations

- Ensured all trading activities adhered to risk management policies

- Developed and maintained relationships with clients and counterparties

- Developed effective strategies to accommodate customer needs while maximizing profits for the firm

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Fixed Income Trader Resume with 10 Years of Experience

Dynamic and experienced Fixed Income Trader with more than 10 years of experience in the finance and investment industry. Expert in developing and executing strategies for fixed income investment, maintaining a portfolio of fixed income investments, carrying out complex and sophisticated trades and investments, and providing sound analysis of market trends and data. Proven track record of successfully increasing returns in fixed income investments while managing associated risk.

Core Skills:

- Fixed Income Trading

- Portfolio Management

- Investment Analysis

- Risk Management

- Market Trends

- Financial Modeling

- Market Data Analysis

- Trading Strategies

- Negotiations

- Financial Reporting

Responsibilities:

- Analyzed financial data and market trends to develop effective trading strategies and portfolios

- Researched and evaluated various fixed income investments to identify opportunities for profitable returns

- Monitored the performance of investments and portfolios and ensured compliance with established risk management policies

- Conducted negotiations for trades and transactions, ensuring the most favorable terms for the organization

- Managed portfolios of fixed income investments to achieve maximum returns

- Collaborated with other team members to develop and recommend investment plans and strategies

- Prepared financial reports and presentations to present investment decisions to senior management

- Developed and maintained relationships with clients and investors to ensure successful trading activities

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Fixed Income Trader Resume with 15 Years of Experience

Seasoned Fixed Income Trader with 15+ years of experience in capital markets, offering expertise in global and domestic bonds, derivatives, commodities, and ETFs. Proven track record of success in achieving consistent returns and managing risks through analysis, research, and market sentiment. Committed to leveraging quantitative analysis, technical analysis, and market knowledge to identify, interpret, and capitalize on market opportunities.

Core Skills:

- Financial Modeling

- Risk Management

- Portfolio Analysis

- Market Research

- Trading Strategies

- Investment Analysis

- Quantitative Analysis

- Technical Analysis

- Financial Reporting

- Relationship Management

- Regulatory Compliance

Responsibilities:

- Monitor markets and develop trading strategies to maximize returns and minimize losses.

- Research and analyze macroeconomic, geopolitical, and industry trends to identify and capitalize on trading opportunities.

- Oversee portfolio management decisions to ensure compliance with company policies and regulations.

- Execute trades in bonds, commodities, ETFs, options, and futures to meet financial objectives.

- Assess the risks and rewards associated with investments, and maintain portfolio within risk boundaries.

- Analyze financial statements and regulatory filings to determine the financial health of companies.

- Foster strong relationships with clients and stakeholders to ensure a high level of customer satisfaction.

- Utilize financial modeling and quantitative analysis to evaluate potential investments and assess their potential returns.

- Stay abreast of industry trends and develop trading strategies to exploit market opportunities.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Fixed Income Trader resume?

Fixed income trading is one of the most important aspects of the financial markets. As such, it’s important that your resume reflects the knowledge and experience necessary to excel as a fixed income trader. Here are some key points to consider when creating a resume for a fixed income trader:

- Education: A degree in finance or economics is often seen as the most beneficial educational background to have as a fixed income trader. If you have an MBA or advanced degree in a related field, such as mathematics or quantitative finance, this should also be highlighted on your resume.

- Relevant Experience: Employers will want to know about your past experience working in the financial markets, and any experience you have trading fixed income securities. Any internships or job placements with financial institutions should be featured prominently on your resume.

- Technical Skills: As a fixed income trader, you’ll need to be able to use a variety of trading platforms and software packages. Make sure that you include any technical skills you have that are relevant to trading, such as proficiency with Bloomberg Terminal, Bloomberg Tradebook, or any other software you may have experience with.

- Industry Certifications: If you have any certifications, such as the Chartered Financial Analyst (CFA) or Financial Risk Manager (FRM), make sure these are featured prominently on your resume. These certifications demonstrate a level of expertise and commitment to the industry, and can help you stand out from other applicants.

- Working Knowledge of Financial Instruments: As a fixed income trader, you’ll need to have a thorough understanding of the different types of fixed income securities, such as bonds, notes, money markets, and derivatives. Make sure you showcase your knowledge of these instruments on your resume.

- Ability to Manage Risk: As a trader, you’ll need to be able to identify and manage risk, both in terms of market risk

What is a good summary for a Fixed Income Trader resume?

A Fixed Income Trader resume should give a detailed summary of an individual’s experience in the industry. It should include an overview of their qualifications, educational background, and any other relevant information. Additionally, it should highlight the specific expertise and experience they have in trading fixed income products. It should also emphasize their ability to analyze market trends and effectively manage risk. Finally, it should provide examples of successful trading strategies used by the individual in the past. A fixed income trader resume should strive to accurately represent the individual’s skills and experience, while being concise and succinct enough to capture the attention of potential employers.

What is a good objective for a Fixed Income Trader resume?

A Fixed Income Trader resume should have a clear and concise objective that outlines the experience and qualifications of the candidate. An effective objective for a Fixed Income Trader resume should include:

- Demonstration of expertise in all areas of fixed income trading, including interest rate derivatives, mortgage-backed securities, and bonds

- Proven track record of success in managing portfolios, balancing risk and maximizing returns

- Ability to analyze market conditions and identify trading opportunities

- Expertise in researching and analyzing financial data to develop trading strategies

- Experience in designing and executing hedging strategies to reduce risk

- Excellent communication and interpersonal skills to effectively collaborate with colleagues and clients.

How do you list Fixed Income Trader skills on a resume?

When writing a resume for a Fixed Income Trader position, it’s important to highlight relevant skills that are necessary for success in the job. Here are some of the key Fixed Income Trader skills to include on a resume:

- Strong knowledge of bond markets, trading concepts, and financial instruments: A Fixed Income Trader should be knowledgeable of different types of bond markets, including the corporate, treasury, municipal, and mortgage-backed security markets. They should be familiar with common trading concepts, such as hedging and arbitrage, as well as a range of financial instruments, such as options, swaps, and futures.

- Analytical and quantitative skills: Fixed Income Traders should have strong analytical and quantitative skills to make informed decisions about investments. They should be able to analyze financial data, understand trends in the markets, and make calculations accordingly. They should also be comfortable with using financial software and tools.

- Risk management and regulatory compliance: Fixed Income Traders must understand the risks associated with their investments and be able to manage them accordingly. They should also be aware of applicable regulations and laws and ensure their trading activities adhere to them.

- Excellent communication skills: Fixed Income Traders must have excellent communication skills to effectively communicate with clients and other financial professionals. They should also have excellent written communication skills for analyzing and documenting financial data.

- Strong problem-solving skills: Fixed Income Traders should have strong problem-solving skills to troubleshoot any issues that arise. They should also be able to think on their feet and come up with quick solutions to any problems.

By including these Fixed Income Trader skills on your resume, you will demonstrate to potential employers that you have the necessary skills and experience to be successful in the role.

What skills should I put on my resume for Fixed Income Trader?

A Fixed Income Trader is responsible for the sale and purchase of securities in the fixed income market, so it’s important to have the right skills listed on your resume. Here are some skills you should consider including on your resume for this type of position:

- Analytical Skills: A Fixed Income Trader needs to be able to assess financial data, interpret market trends, and identify investment opportunities.

- Technical Skills: A Fixed Income Trader needs to understand the use of technology, such as financial software and trading platforms, that are used in the market.

- Interpersonal Skills: A Fixed Income Trader needs to be able to communicate effectively with clients and colleagues, as well as build relationships with potential customers.

- Negotiation Skills: A Fixed Income Trader needs to be able to negotiate prices and terms on trades in order to get the best deals.

- Risk Management Skills: A Fixed Income Trader needs to be able to identify and manage risks associated with trading in the market.

- Attention to Detail: A Fixed Income Trader needs to be able to pay close attention to details in order to identify potential investment opportunities.

By including the above skills on your resume for a Fixed Income Trader position, you will demonstrate to potential employers that you have the expertise and experience necessary for this role.

Key takeaways for an Fixed Income Trader resume

If you’re looking to enter the world of fixed income trading, then one of the most important elements of your job search is creating a resume that stands out. This can be a tricky task, especially since there are so many different aspects to consider. Here are some key takeaways for creating an effective fixed income trader resume:

- Focus On Your Professional Experience: When crafting your resume, make sure to highlight your professional experience. Be sure to list the names of the companies you’ve worked for, your role within the company, and any key successes you’ve achieved. You should also include any relevant financial certifications or qualifications you have acquired.

- Showcase Your Qualifications: When creating your resume, make sure to showcase any qualifications you have. This includes any financial certifications or qualifications, as well as any awards or recognitions you may have received. This will help to give potential employers a better understanding of your qualifications and capabilities.

- Highlight Your Trading Strategy: When crafting your resume, make sure to include information about the trading strategies you employ. Explain how you approach risk management, and the strategies you employ to mitigate risk. Additionally, explain how you make decisions when trading. This will give employers an idea of your approach to trading.

- Make Your Resume Easy to Read: When creating your resume, make sure to keep it concise and easy to read. Avoid using overly long sentences, and try to use bullet points and succinct language when possible. This will help to make your resume easier to read and understand.

By following these tips, you should be able to create a fixed income trader resume that will help you stand out from the crowd. Good luck!

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder