Are you looking for a way to get your resume noticed by recruiters in the field of fixed-income analysis? Writing a strong resume for a fixed income analyst position can be challenging, but with the right tips and a few examples, you can create a resume that stands out from the competition. This guide will provide you with all the information you need to create a resume that will make a lasting impression on potential employers and get you to the next step in the recruitment process.

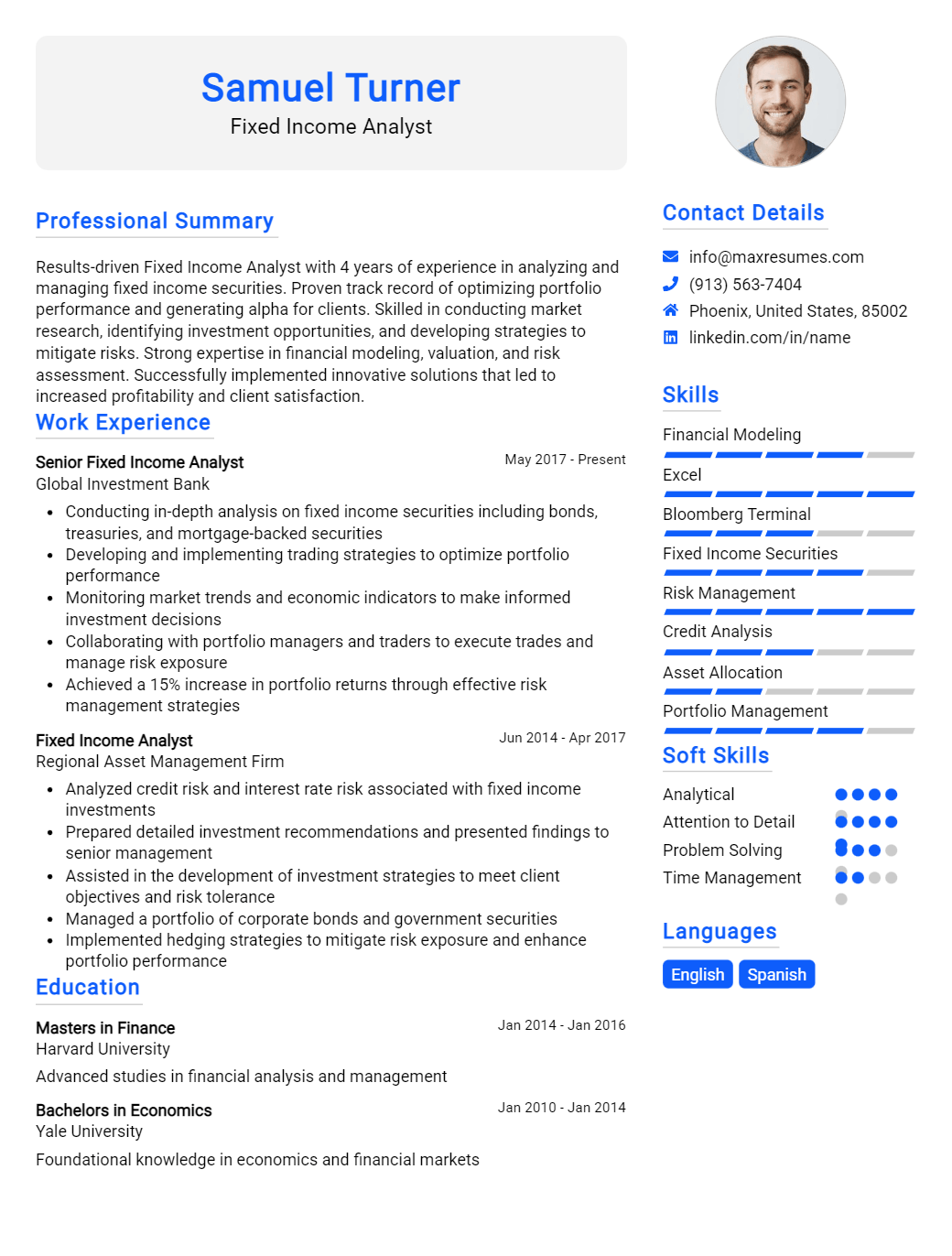

Fixed Income Analyst Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Fixed Income Analyst Resume Examples

John Doe

Fixed Income Analyst

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

Highly motivated and results- driven Fixed Income Analyst with 3+ years of experience in financial services and risk management. Proven track record of successfully managing and analyzing fixed income portfolios, developing strategies to optimize returns, and driving long- term growth of investments. Possesses excellent leadership, communication, and problem- solving skills, and is able to work independently or as part of a team.

Core Skills:

- Analyzing and evaluating fixed income portfolios

- Developing strategies to optimize returns

- Identifying potential risks and developing solutions

- Creating and managing financial models

- Conducting financial research and analysis

- Generating performance reports

- Interpreting financial data

- Identifying and resolving discrepancies

Professional Experience:

Fixed Income Analyst, XYZ Company, Los Angeles, CA

September 2017 – Present

- Analyze and evaluate fixed income portfolios to determine the best investments for clients

- Develop strategies to optimize returns and identify potential risks

- Create and manage financial models to accurately assess portfolio performance

- Conduct financial research and analysis to generate performance reports

- Interpret financial data to develop investment recommendations

- Identify discrepancies and resolve issues

Education:

Bachelor of Science in Finance, University of California, Los Angeles, CA, 2017

Fixed Income Analyst Resume with No Experience

Recent college graduate with excellent quantitative and problem- solving skills looking to join the Fixed Income Analyst team. Proven ability to learn quickly and work effectively in a team setting.

Skills

- Financial modeling

- Financial analysis

- Investment strategy

- Data analysis and interpretation

- Advanced Excel

- Time management

- Strong communication skills

Responsibilities

- Assist in the management of fixed income portfolios

- Perform analysis of fixed income investments

- Analyze and monitor market developments and economic trends

- Maintain and monitor investment strategies to ensure compliance with investment objectives

- Assist in the preparation of presentations, reports and analyses

- Analyze and interpret market data and financial statements

- Assist in the development and implementation of fixed income strategies

Experience

0 Years

Level

Junior

Education

Bachelor’s

Fixed Income Analyst Resume with 2 Years of Experience

Dynamic and driven Fixed Income Analyst with two years of experience in financial markets. Experienced in utilizing financial analysis and market research to provide in- depth trading and portfolio management support. Adept at analyzing data to develop robust investment strategies and providing portfolio oversight. Excellent communication, research and problem- solving skills.

Core Skills:

- Financial Analysis

- Risk Management

- Investment Strategies

- Portfolio Oversight

- Market Research

- Trading Support

- Problem Solving

Responsibilities:

- Developed a risk management system to ensure portfolios were consistently meeting risk management parameters.

- Monitored investment portfolios and made timely adjustments as necessary to ensure that performance objectives were met.

- Provided trading support and analysis in the development of investment strategies for fixed income portfolios.

- Assisted in the development of new strategies and products to meet clients’ needs.

- Analyzed client portfolios and suggested new opportunities to increase the value of investments.

- Conducted market research to identify new investments opportunities and trends.

- Utilized financial analysis to develop robust investment recommendations.

- Provided portfolio oversight to ensure performance objectives and risk parameters were met.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Fixed Income Analyst Resume with 5 Years of Experience

Dynamic and motivated Fixed Income Analyst with 5 years of experience in the financial services industry. Adept in providing comprehensive financial analysis, identifying profitable investment opportunities, and constructing models to assess the risk/return profile of various fixed income securities. Proven track record of success in completing projects in a timely and cost- efficient manner. Experienced in developing highly effective relationships with clients and ensuring client satisfaction.

Core Skills:

- Financial Analysis

- Portfolio Management

- Investment Research

- Data Analysis

- Risk/Return Analysis

- Client Relations

- Portfolio Performance Evaluation

Responsibilities:

- Developed models to analyze potential investments and assess the expected return, risk profile, and price sensitivity of fixed income securities.

- Created comprehensive reports detailing the analysis of fixed income investments and performed detailed portfolio risk/return analyses.

- Evaluated portfolio performance on a regular basis to ensure that goals were being met and took corrective action when needed.

- Researched and identified new investments opportunities to maximize portfolio performance.

- Developed relationships with clients to ensure client satisfaction and provided financial advice and support.

- Conducted financial analysis to evaluate the credit worthiness of potential investments.

- Identified discrepancies and assisted in the resolution of any issues.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Fixed Income Analyst Resume with 7 Years of Experience

Experienced Fixed Income Analyst with 7+ years of experience in market analysis, portfolio management and risk assessment. Possess strong knowledge of derivatives, quantitative analysis, financial products and corporate actions. Highly organized and detail- oriented professional, with a strong ability to identify and analyze trends and patterns to help inform future investments. Proven track record of delivering results in fast- paced and high- pressure environments.

Core Skills:

- Advanced knowledge of financial instruments and derivatives

- Expertise in market analysis, portfolio management and risk assessment

- Proficient in mathematical calculations and quantitative analysis

- Skilled in financial modeling, forecasting and budgeting

- Highly knowledgeable in corporate actions, accounting principles and reporting

- Proven ability to interpret data and identify market trends

- Excellent verbal and written communication skills

- Strong organizational and multitasking skills

Responsibilities:

- Conducted market analysis and identified trends and investment opportunities

- Developed financial models and performed risk assessment on different investments

- Managed portfolio and monitored the performance of investments

- Assessed corporate actions and made necessary adjustments to portfolio

- Monitored the performance of financial instruments and advised clients on investment strategies

- Conducted quantitative analysis and mathematical calculations to support investment decisions

- Liaised with clients to provide risk management advice and assist with portfolio performance

- Developed and maintained relationships with brokers and other financial institutions

- Prepared and presented financial reports and performance summaries to clients.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Fixed Income Analyst Resume with 10 Years of Experience

Seasoned fixed income analyst with 10 years of experience in researching, analyzing, and reporting on fixed income investments, commodities, and currency markets. Possess a deep understanding of quantitative and qualitative analysis techniques, as well as specialized knowledge of portfolio and risk management policies, procedures, and benchmarks. Possess a proven track record of successfully managing multiple complex projects and developing financial models to assess profitability and risk. Excellent communicator with strong problem- solving and critical thinking skills.

Core Skills:

- Financial Model Construction

- Quantitative & Qualitative Analysis

- Risk & Portfolio Management

- Spreadsheet & Database Management

- Market Research & Analysis

- Investment/Asset Valuation

- Compliance & Regulatory Knowledge

- Technical Writing & Presentation

- Strategic Planning & Implementation

Responsibilities:

- Analyzed fixed income investments, commodities, and currency markets utilizing quantitative and qualitative analysis techniques.

- Developed financial models to assess the profitability and risk associated with various investment opportunities.

- Conducted in- depth market research and analysis to identify and report on trends and key insights.

- Managed and monitored portfolios to ensure adherence to regulatory requirements, investment strategies, and risk management guidelines.

- Created and maintained spreadsheets and databases to document, track, and analyze financial data.

- Developed technical reports and provided presentations to shareholders and board members.

- Assisted with the development and implementation of effective strategies to ensure compliance with regulatory requirements.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Fixed Income Analyst Resume with 15 Years of Experience

A highly motivated and experienced Fixed Income Analyst with 15+ years of comprehensive knowledge in investments, financial analysis and fixed income securities. Possesses expertise in assessing the creditworthiness of corporate and government debt securities, analyzing risk, and developing investment strategies. Skilled in quantitative analysis and financial modeling, with the ability to successfully utilize both fundamental and technical analysis. Highly effective in team environments and capable of developing and maintaining relationships with clients.

Core Skills:

- Comprehensive knowledge of fixed income investments, financial analysis, and creditworthiness evaluation

- Expertise in financial modeling and quantitative analysis

- Possess strong working knowledge of fixed income instruments; bonds, MBS, structured products

- Excellent communication skills, both written and verbal

- Skilled in developing investment strategies and portfolio management

- Adept at managing multiple projects, meeting deadlines and working in high- pressure environments

Responsibilities:

- Develop and maintain relationships with clients to ensure satisfaction and meet sales goals

- Analyze the creditworthiness and performance of various corporate and government debt securities

- Evaluate the risk associated with investments and develop strategies to minimize risk

- Generate timely and accurate reports on the performance of fixed income portfolios

- Provide guidance and advice to clients on investments and risk management

- Perform quantitative analysis and financial modeling to support decision- making

- Utilize both fundamental and technical analysis to identify potential investment opportunities

- Conduct due diligence on new investments and review investment proposals

- Monitor financial markets, trends and news to identify potential investment opportunities

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Fixed Income Analyst resume?

Fixed-income analysts are responsible for researching and monitoring debt investments and providing advice to clients regarding their strategies. To become a successful analyst, you will need to have an impressive resume that outlines your skills and qualifications. Here are some key elements to include on your resume when applying for a fixed-income analyst position:

- Relevant Educational Background: List any and all degrees, certifications, and other qualifications you possess that are related to fixed income and investment analysis.

- Professional Experience: Demonstrate your experience in fixed income analysis by highlighting any prior positions you have held in the field. Be sure to include details on the scope of your responsibilities and the results of your work.

- Analytical Skills: Indicate your ability to analyze and interpret financial data and research trends in the market.

- Technical Knowledge: Demonstrate your technical knowledge in relevant software such as Excel, Bloomberg, and other financial analysis software.

- Financial Modeling Skills: Showcase your ability to analyze and create financial models for asset valuation, portfolio management, and other fixed-income related scenarios.

- Communication Skills: Demonstrate your ability to effectively communicate financial data and analysis to clients and other stakeholders in the investment process.

- Risk Management: Highlight your experience in managing risk in fixed income investments.

By including a comprehensive list of your qualifications and experience in fixed income analysis, you can demonstrate your potential and value to potential employers. With the right resume, you can land the job of your dreams.

What is a good summary for a Fixed Income Analyst resume?

A fixed income analyst is responsible for providing essential analysis and reporting of financial trends and portfolios through a variety of fixed income instruments. A good summary for a Fixed Income Analyst resume should highlight the candidate’s expertise in the fixed income markets, including knowledge of the relevant instruments and financial markets. It should emphasize the candidate’s ability to analyze financial trends, identify potential investment opportunities, and provide meaningful advice to clients. The summary should also focus on the candidate’s experience with portfolio management and risk management, as well as their strong communication and research skills. Finally, a good summary should emphasize the candidate’s dedication to providing high quality service and ensuring client satisfaction.

What is a good objective for a Fixed Income Analyst resume?

A Fixed Income Analyst is a financial professional responsible for analyzing investments in debt securities. As such, the objective of a Fixed Income Analyst resume should be focused on demonstrating the applicant’s ability to conduct investment analysis, develop strategies, and assess risk.

here are some examples of good objectives for a Fixed Income Analyst resume:

- Demonstrate extensive knowledge of financial instruments, investment analysis, and risk management

- Utilize strong analytical and problem-solving skills to develop and implement effective investment strategies

- Display strong interpersonal skills to collaborate closely with clients and colleagues

- Possess experience in reviewing financial statements and data to identify opportunities for optimization

- Utilize excellent communication and research skills to stay up-to-date on latest market trends and industry news

- Demonstrate proficiency in using various financial software applications such as Bloomberg and Reuters

How do you list Fixed Income Analyst skills on a resume?

Fixed income analysts work to assess and manage debt securities and other investments. To be successful in this role, you need a strong set of skills. When drafting your resume, make sure to list the most relevant skills that you have to the position you are aiming for. Here are some of the key skills to include in your resume when applying for a fixed income analyst role:

- Technical expertise: Fixed income analysts need to have a solid understanding of financial markets, financial instruments, and financial modeling tools. Demonstrating your knowledge in these areas will help demonstrate your competence in the role.

- Analytical skills: Analysts need to be able to interpret data accurately and develop meaningful insights from it. Make sure to highlight your ability to interpret market trends, use quantitative data to inform decisions, and identify opportunities for growth.

- Problem-solving skills: A fixed income analyst needs to be able to identify and address complex problems. Demonstrate your ability to think critically and develop solutions to complex financial issues.

- Communication skills: Analysts need to be able to communicate complex financial data and insights to a range of stakeholders. Highlight your ability to effectively communicate in both verbal and written media.

- Interpersonal skills: Analysts need to be able to build relationships with clients, colleagues, and other stakeholders. Make sure to include any customer service experience or team management experience.

Include these skills in your resume when applying for a fixed income analyst role to show hiring managers that you have the relevant skills to succeed in the role.

What skills should I put on my resume for Fixed Income Analyst?

A Fixed Income Analyst works with stocks, bonds, and other investments to determine future returns. As a result, they need to possess a range of analytical, organizational, and technical skills. When writing your resume for a Fixed Income Analyst, here are some of the key skills you should include:

- Investment Analysis: The ability to research, analyze, and evaluate potential investments, as well as understand macroeconomic trends and their potential impact on investment decisions.

- Risk Management: The ability to identify, quantify, and manage risk associated with different investments and portfolios.

- Financial Modeling: The ability to create accurate financial models using programs such as Excel and Bloomberg.

- Excel: The ability to use Excel to compile, analyze, and present data in meaningful ways.

- Market Research: The ability to conduct independent research on the markets and investments.

- Strong Communication: The ability to communicate complex financial concepts clearly and accurately.

- Teamwork: The ability to work collaboratively with other analysts and professionals to achieve common goals.

By including these skills on your resume, you can demonstrate to potential employers that you have the knowledge and experience necessary to succeed as a Fixed Income Analyst.

Key takeaways for an Fixed Income Analyst resume

A Fixed Income Analyst resume must showcase relevant experience and skills in order to be competitive in the job market. As a Fixed Income Analyst, you must be knowledgeable about the latest trends and regulations surrounding financial markets and instruments. To stand out from the competition, your resume must demonstrate a strong understanding of the principles of fixed income investing and the ability to effectively analyze and manage risk. Here are some key takeaways for creating a strong Fixed Income Analyst resume:

- Highlight Your Qualifications: When creating your Fixed Income Analyst resume, be sure to include any qualifications you have that demonstrate your knowledge and understanding of financial markets and instruments. Include any relevant certifications or degrees that you may have and any relevant work experience.

- Showcase Your Skills: Employers want to know what skills you have that make you stand out as an analyst. Demonstrate your analytical and quantitative skills by including examples of your experiences with financial models and databases.

- Include Relevant Projects: Showcase any relevant projects that you have completed on your resume. Include any successful investment strategies that you have implemented, as well as any reports you have written or presentations you have given.

- Demonstrate Your Knowledge of Regulations: Employers want to know that you understand the regulations that govern the financial markets and instruments. Include any relevant legal experience or any courses you have taken that demonstrate your knowledge of regulations.

- Showcase Your Communication Skills: As an analyst, you must be able to effectively communicate your analyses to other professionals. Highlight any experience you have working with teams or presenting information to clients.

By following these key takeaways, you can create a standout resume that will help you stand out from the competition and land you a job as a Fixed Income Analyst.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder