Writing a resume as a financial risk analyst can be a challenging process – you need to make sure you highlight the most important, relevant information to attract hiring managers, while also keeping your resume short and succinct. Whether you are a recent graduate or a professional with years of experience in the field, this guide will provide you with tips and strategies for writing an effective financial risk analyst resume. In this guide, we will break down how to craft the perfect financial risk analyst resume, from highlighting your skills to writing a compelling summary. We will also provide resume examples for financial risk analysts to help you craft an impactful resume.

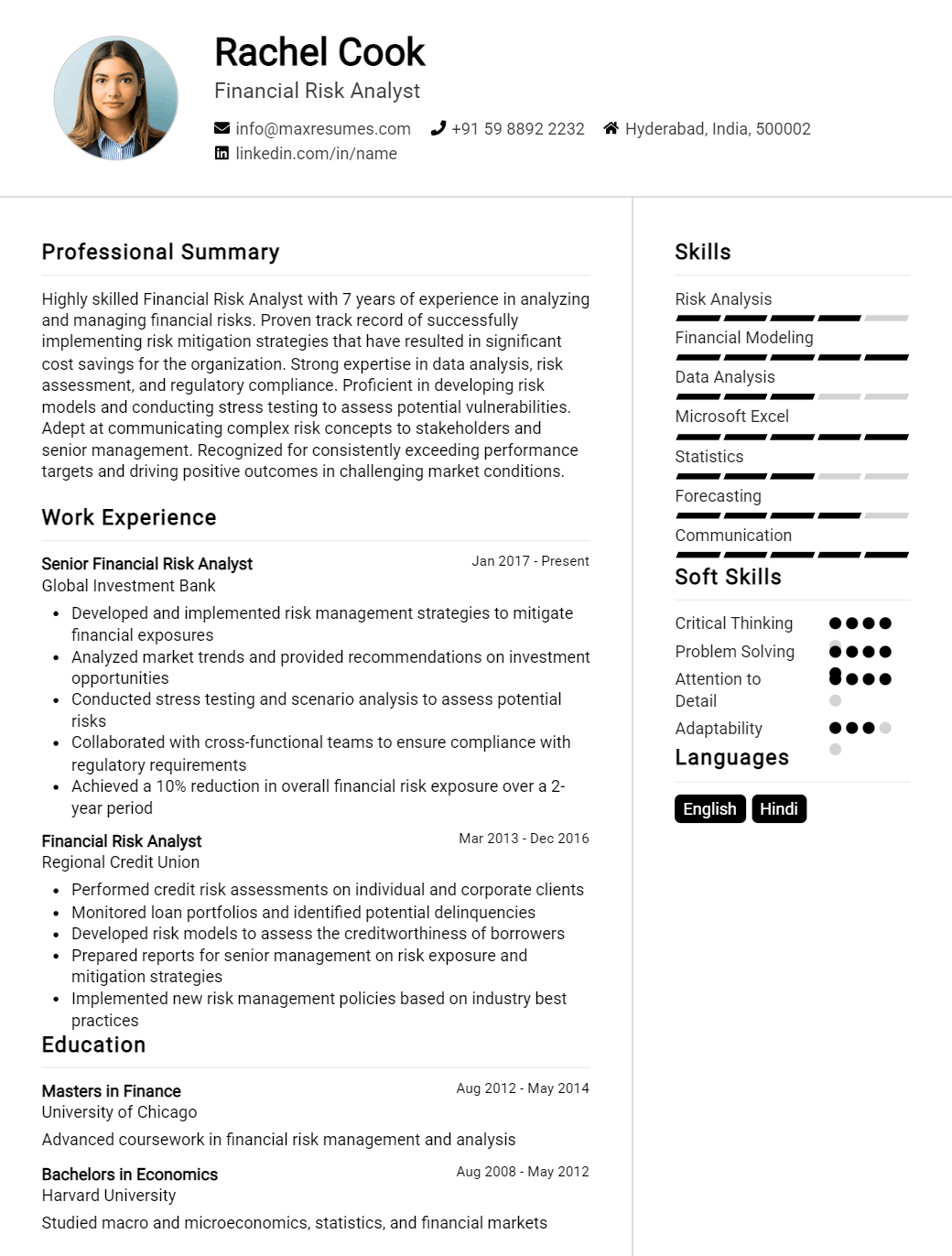

Financial Risk Analyst Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Financial Risk Analyst Resume Examples

John Doe

Financial Risk Analyst

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

A highly motivated and experienced Financial Risk Analyst with several years of experience in financial services and risk analysis. Possessing excellent analytical, technical and problem solving skills, I am passionate about the industry and eager to gain further knowledge and experience. I am confident I can provide a valuable contribution to any team in this field.

Core Skills:

- Strong knowledge of financial risk management techniques and systems

- Experience in preparing and analyzing financial statements

- Familiarity with financial and risk analysis models

- Excellent verbal and written communication skills

- Proficient in MS Office suite, including Excel, Word, and Access

- Knowledge of financial analysis tools, such as Bloomberg

- Strong analytical, problem solving and decision- making skills

Professional Experience:

Financial Risk Analyst, ABC Co. – July 2015 – Present

- Identified, analyzed, and monitored financial risks of the company

- Developed models to monitor and analyze financial risk

- Developed and implemented financial risk management strategies

- Advised Senior Management on risk profiles and proposed risk mitigation strategies

- Collaborated with other teams to ensure risk management policies and processes were implemented

Financial Analyst, XYZ Inc. – March 2012 – June 2015

- Analyzed financial data to support decision making

- Developed financial reports and presentations for management

- Reviewed financial statements for accuracy and completeness

- Prepared and analyzed financial forecasts and budgets

- Monitored and reported on financial performance against budget

Education:

Master’s Degree in Finance, University of XYZ – 2012

Bachelor’s Degree in Business Administration, University of ABC – 2010

Financial Risk Analyst Resume with No Experience

Recent college graduate with a Bachelor’s degree in Finance, experienced with financial concepts and analysis, seeking a position as a Financial Risk Analyst with no experience. Possesses strong analytical skills along with excellent communication and problem- solving skills.

Skills:

- Financial Analysis

- Risk Management

- Data Analysis

- Mathematical Modelling

- Financial Reporting & Statements

- Regulatory Compliance

- Project Management

- Problem- solving

- Communication

Responsibilities:

- Identify and assess potential risks in financial transactions

- Develop strategies to mitigate financial risks

- Monitor daily financial transactions to ensure compliance with regulations

- Analyze financial data and create detailed reports

- Create mathematical models to analyze complex financial data

- Provide guidance and advice to senior management on risk management strategies

- Liaise with external regulators to ensure compliance with laws and regulations

Experience

0 Years

Level

Junior

Education

Bachelor’s

Financial Risk Analyst Resume with 2 Years of Experience

Financial risk analyst with 2 years of experience in corporate finance and risk management. Expertise in financial and capital markets, financial modeling and analysis, and developing strategies for risk management and mitigation. Proficient in financial analysis software and programming languages. Possesses excellent communication and analytical skills.

Core Skills:

- Financial Analysis

- Risk Management

- Capital Markets

- Financial Modeling

- Strategic Planning

- Data Analysis

- Business Analysis

- Regulatory Compliance

- MS Office Suite

- Bloomberg

- Python Programming Language

Responsibilities:

- Analyzed financial and market data to identify trends and opportunities in the capital markets

- Developed financial models and reports to evaluate potential risk and return on investments

- Assisted in drafting financial statements, business plans, and budget proposals

- Monitored and reported on the financial performance of companies, including liquidity, solvency, and profitability

- Developed strategies for risk management and mitigation to ensure compliance with industry regulations

- Prepared presentations, reports, and analyses to present to senior management

- Conducted industry, competitor, and market analysis

- Recommending appropriate investment strategies and product offerings

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Financial Risk Analyst Resume with 5 Years of Experience

Dynamic and driven Financial Risk Analyst with five years of experience in analyzing financial markets and developing strategies to mitigate risk. Proven ability to work across financial instruments to identify and quantify risk at both the portfolio and individual security level. Track record of successful risk management activities that protect investments, improve capital adequacy, and strengthen liquidity. Highly adept in financial modeling and analytics, as well as developing and implementing risk monitoring tools and frameworks.

Core Skills:

- Financial Risk Analysis

- Portfolio Risk Management

- Regulatory Compliance

- Financial Modeling

- Market Risk Analysis

- Leverage Analysis

- Stress Testing

- Risk Mitigation Strategies

- Risk Monitoring

- Advanced Excel

- Software Development

Responsibilities:

- Developed and maintained financial risk models and frameworks to monitor risk within portfolios

- Utilized advanced Excel techniques to prepare complex financial and analytics models

- Conducted regular stress tests and leveraged analysis to identify and quantify risk

- Identified and implemented effective risk mitigation strategies to protect investments

- Worked closely with compliance and audit teams to ensure risk management activities remained compliant with regulations

- Developed software tools to automate risk monitoring and reporting processes

- Generated reports to clearly communicate risk assessment results to senior management

- Collaborated with other teams to support capital adequacy and liquidity needs

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Financial Risk Analyst Resume with 7 Years of Experience

Highly analytical and detail- oriented Financial Risk Analyst with 7 years of combined experience in banking, financial services, and consulting. Skilled in financial analysis, risk assessment and management, and developing predictive models for financial forecasting. Adept at identifying, analyzing and responding to financial risks, as well as identifying and implementing effective strategies to mitigate risks. Proven success in providing accurate, timely, and meaningful reports to senior management, as well as developing effective relationships with stakeholders.

Core Skills:

- Financial Analysis

- Risk Assessment and Management

- Financial Modeling and Forecasting

- Regulatory Compliance

- Report Generation

- Stakeholder Relations

- Strategic Planning

- Presentation

- Research

Responsibilities:

- Conducted comprehensive financial analysis and risk assessment of various banking and financial services transactions

- Developed and implemented strategies for mitigating potential financial risks

- Developed predictive models for financial forecasting and modeling

- Prepared reports for senior management regarding financial risk assessment and mitigation strategies

- Maintained compliance with applicable financial regulations and industry standards

- Established and maintained effective relationships with stakeholders

- Assessed current risk management practices to identify areas for improvement

- Generated presentations for senior management and stakeholders

- Conducted research on financial markets, industry trends, and new technologies

- Developed financial strategies for reducing risk and increasing profits

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Financial Risk Analyst Resume with 10 Years of Experience

A highly experienced Financial Risk Analyst with 10 years of experience in evaluating, forecasting, and managing financial risks. Skilled in quantitative analysis, financial modeling, and data visualization. Proven ability to assess risks and develop strategies for mitigating risk exposure. Strong analytical, problem- solving, and communication skills, with an excellent track record working in fast- paced, challenging environments.

Core Skills:

- Risk Assessment

- Financial Modeling

- Quantitative Analysis

- Data Visualization

- Forecasting

- Problem- Solving

- Communication

Responsibilities:

- Developed quantitative models to assess and manage financial risks.

- Analyzed data to identify potential risks and develop strategies for mitigating them.

- Prepared reports and presentations on financial risk analysis activities.

- Assisted in developing policies and procedures to ensure compliance with applicable regulations.

- Provided recommendations on the management of financial risks.

- Monitored markets and identified potential risks.

- Conducted research to identify and analyze economic trends and risks.

- Developed strategies for risk management and disaster recovery.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Financial Risk Analyst Resume with 15 Years of Experience

Dynamic and results- driven professional with over 15 years of success in financial risk management and operations. Skilled in financial and operational risk assessments, regulatory compliance, and risk mitigation strategies. Proven track record of success in assessing risks, identifying areas of opportunity, and driving process and system improvement initiatives. Possess excellent organizational, analytical, and problem- solving skills. Adept in developing and maintaining strong relationships by providing clear, concise, and timely information to internal and external stakeholders.

Core Skills:

- Financial Risk Assessment

- Risk Mitigation

- Regulatory Compliance

- Operational Risk Assessment

- Process Improvement

- System Improvement

- Problem Solving

- Analytical Thinking

- Written & Verbal Communication

Responsibilities:

- Conducted risk and financial analysis to identify potential opportunities and threats and to assess the impact of capital investments and financial decisions.

- Developed and implemented risk mitigation strategies to reduce exposure to financial losses.

- Evaluated and assessed the potential financial and operational risks associated with proposed projects.

- Established procedures and controls to ensure adherence to company’s risk management policies.

- Monitored regulatory environment and provided advice and guidance on compliance requirements.

- Liaised with senior management to ensure timely communication of risk issues.

- Prepared comprehensive financial management reports and presented findings to executive management.

- Developed and maintained strong relationships with internal and external stakeholders.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Financial Risk Analyst resume?

A Financial Risk Analyst resume should include the following:

- A concise summary of your relevant experience and qualifications, such as certification in financial risk analysis, experience with financial modeling, or knowledge of risk management systems.

- A detailed list of your technical and soft skills, such as analysis and problem-solving, ability to work in a team, and ability to communicate with clients and management.

- An organized list of your education, degrees, and any additional training related to the position.

- References from previous employers and colleagues who can vouch for your work ethic and skills.

- A list of any relevant certifications, such as Chartered Financial Analyst (CFA) or Financial Risk Manager (FRM).

- A portfolio of your previous work, such as financial models, risk management solutions, and reports.

- Examples of projects you have worked on, such as evaluating financial risk and developing strategies to mitigate it.

- A list of publications, presentations, and other professional activities.

- Contact information to ensure employers can easily reach out to you.

What is a good summary for a Financial Risk Analyst resume?

An effective summary for a Financial Risk Analyst resume should highlight a few key skills and qualifications related to the field such as experience in financial modeling, forecasting, and analyzing financial trends. Candidates should also emphasize their ability to identify potential areas of risk, implement strategies to reduce risk, and develop systems to monitor and report on risks. The summary should also note any specialties or certifications that a candidate has obtained to demonstrate their expertise in the field. Finally, employers want to see a track record of success in financial analysis, so candidates should make sure to include any relevant accomplishments that demonstrate their ability to manage financial risk.

What is a good objective for a Financial Risk Analyst resume?

A Financial Risk Analyst is a professional who evaluates risk and returns associated with investments, loans, and other financial instruments. In order to be successful in this role, a Financial Risk Analyst will need a well-crafted resume.

A good resume objective for a Financial Risk Analyst should be clear and concise, highlighting the candidate’s experience, skills, and qualifications. An objective should also provide a clear picture of the value the candidate will bring to the company.

Below are some examples of good objectives for a Financial Risk Analyst resume:

- Experienced Financial Risk Analyst with 5+ years of experience in financial risk management, quantitative analysis, and regulatory compliance.

- Skilled in identifying and mitigating financial risks and providing effective solutions to reduce potential losses.

- Highly knowledgeable in financial markets, financial products, and financial regulations.

- Proven ability to develop and implement sound risk management strategies.

- Motivated self-starter with excellent communication and problem-solving skills.

- Seeking to leverage experience and expertise to deliver financial stability and growth to a company.

By crafting a powerful and effective resume objective, a Financial Risk Analyst can demonstrate to potential employers their commitment to the role, and their ability to succeed in it.

How do you list Financial Risk Analyst skills on a resume?

When you’re writing a resume for a Financial Risk Analyst, it’s important to include the right skills to demonstrate your knowledge and abilities. Here are some of the skills that employers may be looking for:

- Experience with financial analysis and modeling techniques

- Knowledge of financial regulations, market dynamics, and risk management principles

- Ability to analyze and interpret financial data

- Excellent written and verbal communication skills

- Ability to develop and evaluate risk strategies

- Strong problem-solving and critical thinking skills

- Familiarity with financial software, such as Bloomberg and Excel

- Ability to develop and present financial reports

- Proficiency in financial planning, budgeting, and forecasting

- Attention to detail and accuracy

- Strong organizational skills and ability to multitask

- Knowledge of risk management principles and practices

Including these skills on your resume will help you stand out from other candidates and demonstrate your qualifications for the role. Employers are looking for Financial Risk Analysts who have the necessary skills and experience to ensure their organization’s financial stability and success.

What skills should I put on my resume for Financial Risk Analyst?

When applying for a Financial Risk Analyst position, it’s important to showcase the skills and qualifications that are relevant to the job. Your resume should demonstrate your expertise in the areas of financial risk analysis, risk management and finance. Here are some skills to include on your resume that will make you stand out as a Financial Risk Analyst.

- Financial Risk Analysis: As a Financial Risk Analyst, you should have an in-depth understanding of financial risk analysis methods, such as Value-at-Risk (VaR) and stress testing. You should also demonstrate an ability to develop and implement sophisticated models to measure risk.

- Risk Management: You should have a comprehensive grasp of risk management principles, such as identifying, assessing and mitigating risks. You should also showcase your ability to develop and implement risk management plans.

- Financial Analysis: Your resume should demonstrate your proficiency in financial analysis, including analyzing financial statements and creating financial models. You should be able to interpret financial data to identify trends and make sound decisions.

- Regulatory Compliance: You should have a solid understanding of financial regulations, such as Dodd-Frank and the Sarbanes-Oxley Act. You should be able to ensure that your organization is compliant with all applicable regulations.

- Problem Solving: As a Financial Risk Analyst, you should be able to identify problems and develop creative solutions. You should also showcase your ability to think critically and analytically to solve complex problems.

- Communication: Your resume should demonstrate your ability to communicate effectively with stakeholders. You should be able to clearly explain complex financial concepts to non-financial individuals.

By highlighting these skills and qualifications on your resume, you will be able to show employers that you have what it takes to be an effective Financial Risk Analyst.

Key takeaways for an Financial Risk Analyst resume

When writing the resume of a Financial Risk Analyst, there are several key takeaways to make sure you include.

First, it’s important to communicate your experience in financial risk analysis. You’ll want to highlight any relevant roles you’ve held, such as financial risk analyst or quantitative analyst, and emphasize your knowledge of financial risk metrics, models, and tools. Be sure to include any certifications you have related to risk analysis, such as FRM or CFA.

Second, you’ll want to emphasize your quantitative skills. Showcase any experience you have with data analysis, forecasting, and modeling. You’ll also want to highlight any programming languages you know, such as Python or R.

Third, be sure to include any success stories or projects you’ve worked on. Showing your potential employer that you can effectively identify and mitigate financial risks is critical.

Fourth,It’s important to demonstrate the ability to work independently and as part of a team. Demonstrating your communication, problem-solving, and critical thinking skills is key for a successful risk analyst.

Finally, make sure your resume is tailored to the specific role you’re applying for. Use the job description as your guide and make sure you’re emphasizing the skills and experience that are most relevant to the role.

By following these key takeaways, you’ll be sure to create an effective resume for a Financial Risk Analyst role.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder