As a financial professional, your resume is your ticket to work in the corporate world. It showcases your skills, experience, and accomplishments. A resume must be well-crafted and tailored to the job opportunity you’re applying for. A poorly written resume can contain errors in spelling, grammar, and formatting, and make it harder for potential employers to recognize your talents. To help you create a resume that will make a great impression, this blog post will provide an overview of resume writing, tips, and examples of effective financial professional resumes.

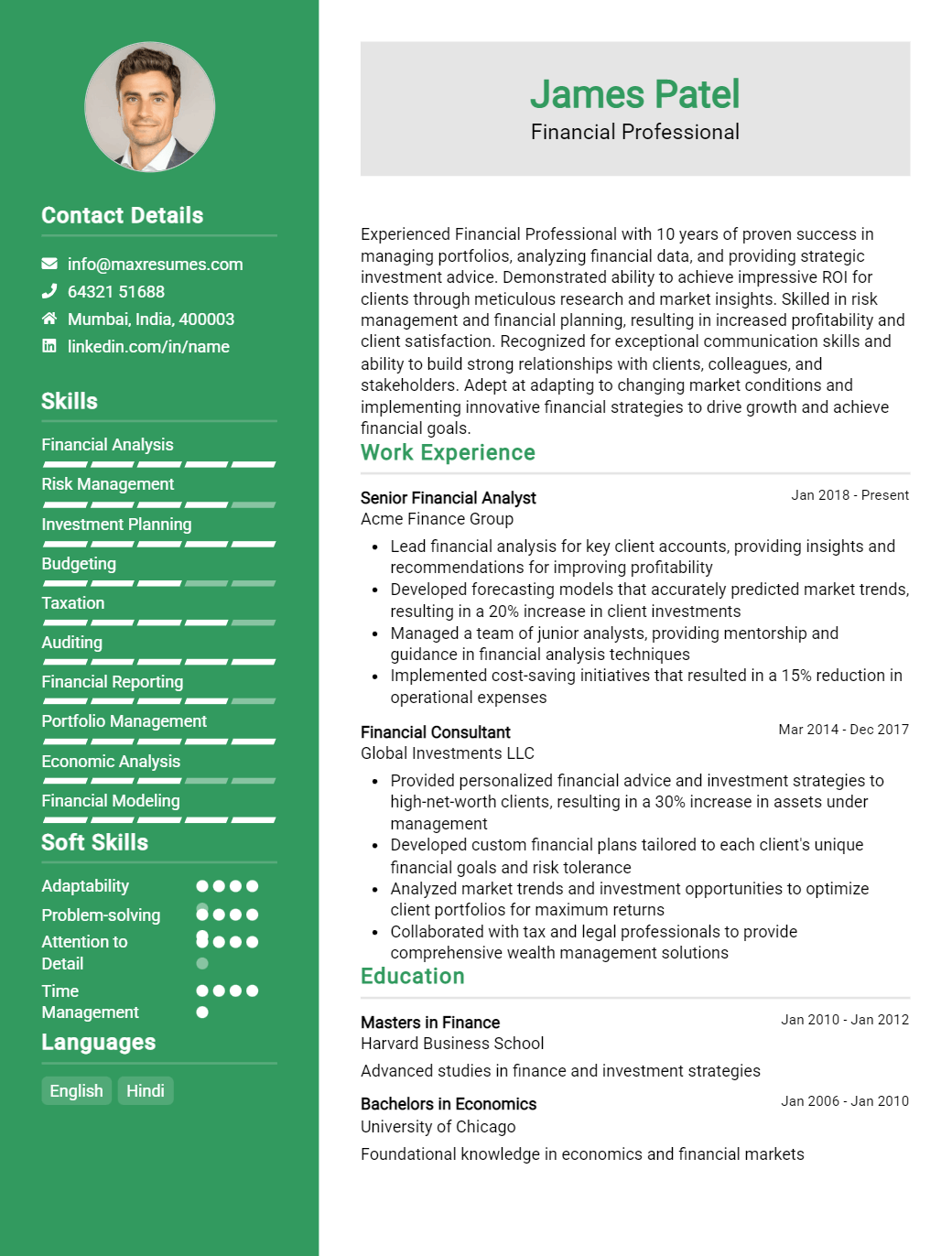

Financial Professional Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Financial Professional Resume Examples

John Doe

Financial Professional

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am an experienced Financial Professional with over 15 years of experience in the industry. I have a proven track record of success, including developing strategies for financial growth and improving organizational efficiency. My core skills include financial analysis, budgeting, forecasting, investment management and financial reporting. I have extensive experience working with clients in the public and private sectors on a variety of financial matters. I am a strong communicator and excel at translating complex financial concepts into easy- to- understand language.

Core Skills:

- Financial Analysis

- Budgeting

- Forecasting

- Investment Management

- Financial Reporting

- Client Management

- Business Planning

- Strategic Planning

- Data Analysis

- Risk Management

Professional Experience:

- Senior Financial Analyst, ABC Corporation, 2010- Present

- Developed financial plans and forecasts for annual operations

- Identified discrepancies in financial data and generated corrective actions

- Provided analysis and advice on tax, budgeting and investment strategies

- Managed the financial activities of assigned clients

- Prepared financial statements and reports for internal and external use

- Reviewed and ensured accuracy of financial information

- Participated in the development of new products and services

- Financial Analyst, XYZ Corporation, 2005- 2010

- Conducted financial analysis and provided data- driven business insights

- Developed and maintained financial models for budgeting and forecasting

- Created and presented comprehensive financial reports for senior management

- Performed financial analysis and evaluated investment opportunities

- Analyzed trends in cash flow, profitability and cost management

- Developed strategic plans for the organization’s financial growth

Education:

- Bachelor of Science in Business Administration, University of XYZ, 2002

- Certified Financial Analyst (CFA), Chartered Financial Analyst

Financial Professional Resume with No Experience

Recent college graduate with a strong interest in financial services, offering excellent communication and problem- solving skills. A motivated team player with a drive to learn and develop knowledge in the financial sector.

Skills

- Strong computer skills, including proficiency in Microsoft Office Suite

- Excellent analytical and mathematical skills

- Able to work independently and as part of a team

- Proficient in financial forecasting and budgeting

- Knowledge of financial principles and regulations

Responsibilities

- Analyze financial statements to identify discrepancies and discrepancies in data

- Assist in the preparation of financial reports and help develop strategies for financial planning

- Prepare financial projections and financial models for the company

- Provide support in the areas of budgeting, forecasting, and financial analysis

- Keep up- to- date with changes in the financial market and regulations

Experience

0 Years

Level

Junior

Education

Bachelor’s

Financial Professional Resume with 2 Years of Experience

Highly motivated financial professional with 2 years of experience in the banking and finance industry. Experienced in financial analysis, portfolio management, and investments. Proven ability to develop, review, and analyze financial data to provide accurate and efficient financial solutions. Skilled in collaborating with stakeholders to ensure the successful execution of tasks and projects. Possess strong technical and interpersonal skills and a demonstrated commitment to customer service.

Core Skills:

- Financial Analysis

- Investment Strategies

- Risk Management

- Financial Planning

- Portfolio Management

- Regulatory Compliance

- Data Analysis

- Report Preparation

- Relationship Building

- Problem Solving

- Team Collaboration

Responsibilities:

- Conducted financial analysis to evaluate performance of financial instruments and investments.

- Developed and implemented investment strategies to optimize returns and minimize risk.

- Monitored market trends and economic developments to identify investment opportunities.

- Managed portfolio to ensure that risks were in line with pre- defined guidelines.

- Prepared financial reports and presentations to communicate investment performance.

- Ensured compliance with relevant regulatory and legal requirements.

- Facilitated collaboration with different stakeholders to ensure successful execution of projects.

- Built strong relationships with clients to provide superior customer service.

- Researched and identified financial solutions to support client objectives.

- Leveraged data analysis to identify potential risks and opportunities.

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Financial Professional Resume with 5 Years of Experience

Talented and experienced Financial Professional with 5 years of dedicated experience in the financial services industry. Expert in analyzing financial data, preparing reports and overseeing financial projects. Proven ability to analyze complex financial statements and provide strategic solutions to financial issues. Skilled in developing and implementing innovative solutions to improve overall financial performance.

Core Skills:

- Financial Analysis

- Budget Management

- Project Management

- Risk Management

- Data Analysis

- Financial Planning & Forecasting

- Strategic Planning & Analysis

- Financial Reporting & Modeling

- Accounting & Auditing

- Compliance & Regulatory

- Process & Procedure Development

Responsibilities:

- Analyze financial data to identify trends and potential risks.

- Manage budget and analyze financial performance of projects.

- Develop and implement financial strategies and solutions.

- Monitor and assess the performance of financial investments.

- Prepare financial reports and analysis to present to senior management.

- Assess financial risks and provide solutions to address them.

- Ensure compliance with regulatory and financial standards.

- Develop and implement processes and procedures to streamline financial operations.

- Analyze and interpret financial data to provide insights and recommendations for improving financial performance.

- Identify opportunities to increase efficiency and reduce costs.

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Financial Professional Resume with 7 Years of Experience

Dedicated financial professional with 7 years of experience in the financial sector. Possess excellent analytical and problem- solving skills, coupled with strong communication and interpersonal abilities. Proven record of success in dealing with financial and accounting matters, managing financial risks and developing financial strategies.

Core Skills:

- Expert in financial statement analysis

- Ability to assess economic trends

- Excellent knowledge of accounting principles

- Proficient in financial modeling and forecasting

- Capacity to develop financial strategies and plans

- Experienced in developing, implementing and monitoring financial policies

- Skilled in risk management and financial system evaluation

- Proficient in MS Office applications (Excel, Word, Power Point, Access)

Responsibilities:

- Analyzed financial statements and identified risks, opportunities, and trends.

- Developed financial plans, models, and forecasts and evaluated their accuracy.

- Managed and monitored financial risks in order to minimize losses.

- Implemented financial policies and procedures to ensure compliance with standards.

- Designed and implemented financial systems for efficient management of resources.

- Provided financial advice to top management in order to make informed decisions.

- Monitored and evaluated financial performance of the organization.

- Assisted in the preparation of annual financial statements and budget.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Financial Professional Resume with 10 Years of Experience

A highly motivated and experienced Financial Professional with 10 years of experience in the finance and banking industry. Expertise in financial reporting, risk management, financial analysis, predicting market trends and policy development. Proven success in formulating strategies to improve financial performance, streamlining operations and introducing cost- cutting initiatives. Committed to providing exceptional customer service and providing financial advice to clients.

Core Skills:

- Financial Reporting

- Risk Management

- Financial Analysis

- Strategic Planning

- Policy Development

- Budgeting and Forecasting

- Compliance

- Banking

- Data Analysis

- Investment Management

Responsibilities:

- Analyze financial data and create detailed reports to provide insight into the performance of the business

- Develop and implement financial policies and procedures

- Identify and mitigate risk through risk management analysis

- Identify and evaluate financial opportunities for the organization

- Develop and present financial forecasts to management

- Provide expert advice on financial and investment decisions

- Monitor banking activities and ensure compliance with regulations

- Conduct financial due diligence and prepare financial documents

- Manage investments and portfolios to maximize returns

- Provide exceptional customer service to clients.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Financial Professional Resume with 15 Years of Experience

I am a financial professional with 15 years of experience in the financial industry, specializing in financial analysis, financial modeling, and investment management. I have a proven track record of success in driving financial results, leading projects, and creating best- in- class financial models. I have a passion for the financial industry and am highly organized with strong attention to detail. My experience includes working in banking, financial services, and investment management. I am an analytical problem solver and an innovative thinker who can work independently or collaboratively with a team.

Core Skills:

- Financial Analysis

- Financial Modeling

- Investment Management

- Business Analysis

- Data Analysis

- Project Management

- Risk Management

- Financial Planning

- Strategic Planning

- Financial Reporting

Responsibilities:

- Develop and implement financial models to support business decisions

- Conduct financial analysis to identify risks and opportunities

- Analyze financial data and develop financial forecasts

- Develop and monitor financial plans, budgets, and forecasts

- Manage investment portfolios and make recommendations to optimize returns

- Provide financial guidance and support to key stakeholders

- Conduct research and analysis to identify trends and opportunities

- Prepare and present financial reports to internal and external stakeholders

- Identify and evaluate new investment opportunities

- Provide risk management and compliance advice

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Financial Professional resume?

A financial professional’s resume should be tailored to the specific job they are applying for, as the exact skills and experiences required can vary greatly depending on the position. However, there are some common components that can be included in a financial professional’s resume that may help them stand out from the competition.

- Education: Highlight any relevant degrees or certifications in your financial field, such as a CPA designation, MBA or a financial planning certification.

- Work Experience: Include a timeline of your previous positions and any relevant accomplishments, successes or challenges you faced in each role.

- Relevant Skills: List any specific financial or technical skills that your current or previous employers have relied on you for.

- Awards & Recognition: Highlight any awards or recognition you have received for your work in the financial sector.

- Professional Organizations: Demonstrate your commitment to the field by outlining any memberships or affiliations you have with industry-related organizations.

- Volunteer or Leadership Experience: Show that you are an engaged professional by listing any volunteer roles or leadership positions you have held.

By taking the time to customize your resume to the job you are applying for and including the right information, you can set yourself up for success as a financial professional.

What is a good summary for a Financial Professional resume?

A good summary for a Financial Professional resume should be concise and highlight the candidate’s key skills and qualifications in the financial industry. It should provide an overview of the candidate’s experience, focus on their accomplishments, and demonstrate their breadth of knowledge. The summary should demonstrate the candidate’s comfort working with financial statements and data, their understanding of financial regulations and compliance, and their ability to identify and implement creative solutions. It should also show their ability to take on positions of increasing responsibility, and to develop and manage successful projects.

What is a good objective for a Financial Professional resume?

A good objective statement for a Financial Professional Resume should accurately reflect your career goals and provide the employer with an overview of your skills and qualifications. This statement should be specific and provide the employer with a clear understanding of why you are an ideal candidate for the position.

Here are some tips for creating an effective objective statement for a Financial Professional Resume:

- Highlight your expertise and experience in the financial industry: Be sure to include your knowledge and experience with financial products, concepts, and strategies.

- Display your professional strengths: Emphasize the skills and abilities that make you an ideal candidate for the position.

- Be concise: Keep your objective statement to two or three sentences.

- Include a call to action: Use the objective statement to encourage the employer to contact you for an interview.

- Be specific: Include keywords that are relevant to the position you are applying for.

- Be honest: Be sure to include only honest and accurate information in your objective statement.

By using these tips, you can create an effective objective statement that will help you stand out from other applicants and make a great first impression on potential employers.

How do you list Financial Professional skills on a resume?

When you’re creating a resume to showcase your financial professional skills, it’s important to show employers that you have the knowledge and experience necessary for success in the industry. The best way to showcase these qualifications is to create a comprehensive list of your financial skills on your resume. Here is a list of skills you should include:

- Financial Analysis: Demonstrate your ability to analyze market conditions and trends to make informed decisions.

- Risk Management: Show that you understand the principles of risk management and can apply them to optimize profitability.

- Investment Strategies: Highlight your expertise in developing and implementing investment strategies that maximize returns and minimize risks.

- Tax Planning: Include your experience in analyzing tax documents and preparing tax returns to help clients achieve their financial goals.

- Estate Planning: Demonstrate your knowledge of estate planning, trusts, and wills to help clients manage their assets.

- Accounting: Showcase your knowledge of accounting principles and your ability to reconcile accounts, prepare financial statements, and manage financial transactions.

- Financial Modeling: Illustrate your ability to create accurate financial models, including cash flow projections and profitability analyses.

- Financial Advising: List your experience in providing financial advice to clients to ensure their short- and long-term financial goals are achieved.

- Financial Technology: Demonstrate your proficiency in the use of financial technology, such as software programs and applications, to streamline financial processes.

- Regulatory Compliance: Demonstrate your understanding of the regulations and standards involved in financial services and your ability to ensure compliance.

What skills should I put on my resume for Financial Professional?

A financial professional is a role that requires in-depth knowledge of financial analysis, planning, and operations. To ensure that your resume clearly communicates the knowledge and experience you possess in this field, it is important to include the right information. When crafting your resume for a financial professional position, the following skills are essential to include:

- Financial Analysis: A financial professional must have the ability to assess complex financial information and identify trends. Demonstrate your ability in this area by including specific financial analysis projects you have worked on and the outcomes you achieved.

- Planning: Financial planning skills include the ability to create forecasts, analyze financial data, and develop strategies. Include any experience you have had in developing and executing financial plans.

- Operations: As a financial professional, you must have the ability to understand and manage financial operations. Include any experience you have had in developing and managing processes and procedures, leading initiatives, and overseeing financial operations.

- Risk Management: A financial professional must have the ability to identify and mitigate financial risks. Include any experience you have had in conducting risk assessments or developing risk management plans.

- Compliance: Ensure that you include any experience you have had in managing or assessing financial compliance. Include any involvement you have had in implementing or enforcing financial regulations.

- Software Skills: Include any knowledge or experience you have with financial software, such as Microsoft Excel, QuickBooks, or other similar systems.

These are the key skills to include on your resume when applying for a financial professional position. Ensure that you emphasize your experience and knowledge in these areas in order to demonstrate your capabilities to potential employers.

Key takeaways for an Financial Professional resume

A resume is one of the key documents in any job search, and a financial professional’s resume is no exception. The resume should include all of the relevant information needed to demonstrate your qualifications and accomplishments in the financial field. While there is no single formula for crafting the perfect resume, here are some key takeaways for creating an effective financial professional resume:

- Highlight Relevant Experience: Writing a financial professional resume is all about showcasing your qualifications and experience. Focus on the positions and areas of experience that are most pertinent to the job you’re applying for. Make sure to include any relevant industry certifications you may have.

- Emphasize Your Accomplishments: When it comes to a financial professional resume, it’s important to highlight your accomplishments. Showcase any awards or accolades you may have won, as well as any projects or initiatives you may have completed successfully.

- Use Relevant Keywords: Many companies use automated systems to scan resumes for keywords that are relevant to the job. Be sure to include key words and phrases that are related to the job and industry you’re applying for, as this can help you stand out from other applicants.

- Use a Sleek Design: It’s important to present yourself in the best way possible, so invest some time into creating a sleek and modern design for your resume. This will make it more attractive to prospective employers and help you stand out.

- Proofread Your Resume: Before submitting your resume, make sure to thoroughly proofread it for any typos or errors. Having a mistake on your resume can be a major red flag for employers, so double-check it for accuracy.

By following these key takeaways, you can create an effective and professional financial resume that will make you stand out from the competition. When done correctly, a resume can be a great way to showcase your qualifications and help

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder