Are you looking to create an equity analyst resume that stands out from competition? In today’s competitive job market, having a strong resume is essential to getting your foot in the door. A well-crafted resume can give you an advantage over other qualified candidates. This guide will provide useful tips and examples to help you create a resume that will get noticed by potential employers. By the end, you should have a resume that accurately showcases your skills and experience and that highlights your strengths and accomplishments.

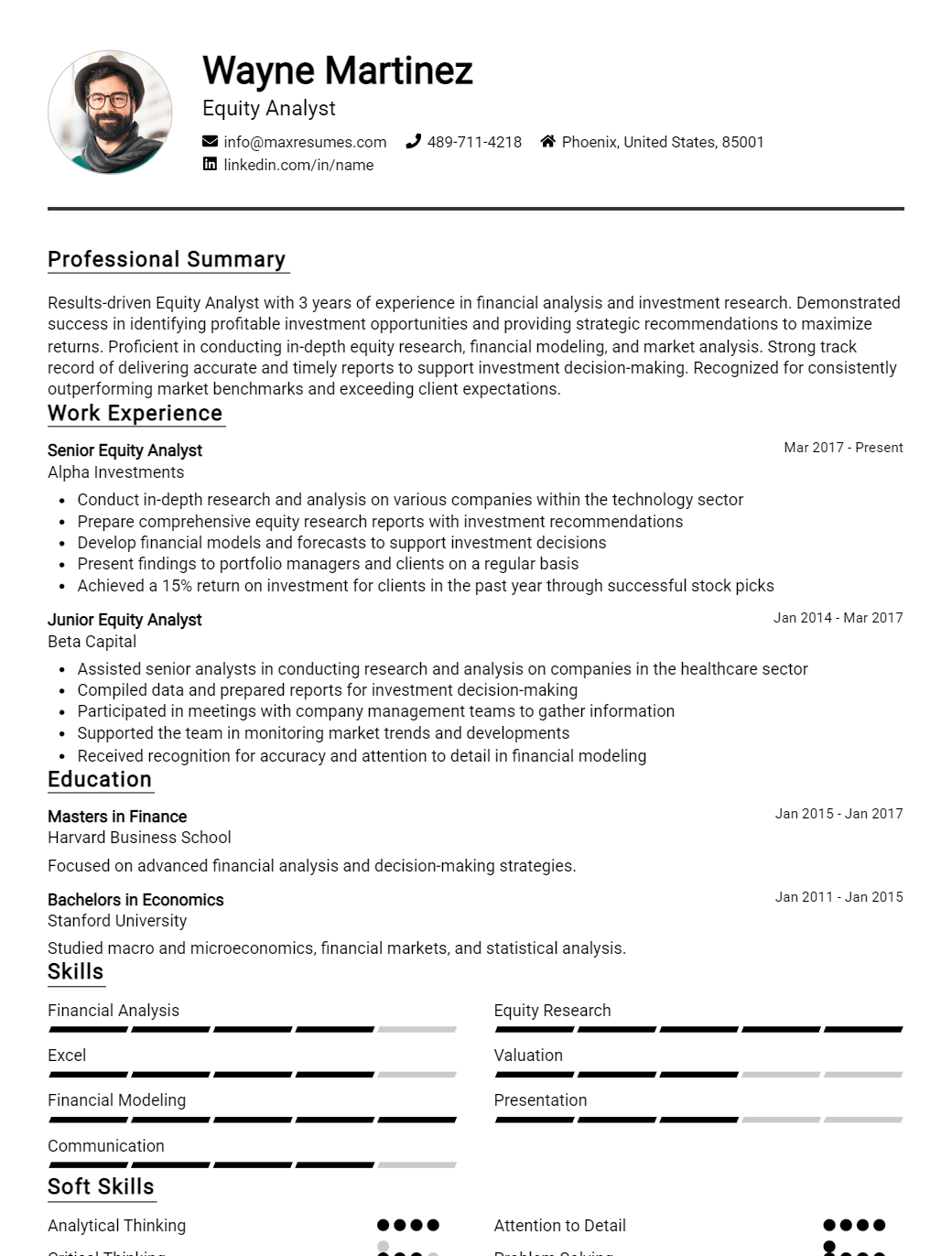

Equity Analyst Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Equity Analyst Resume Examples

John Doe

Equity Analyst

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am a motivated and highly analytical individual with a passion for understanding the performance of companies and helping investors make sound decisions. With a solid background in equity analysis, I possess the necessary skills to identify both positive and negative stock trends, form and articulate investment opinions, and build financial models in order to forecast potential earnings and risks. Having worked in the finance industry for over ten years, I bring a wealth of experience in financial analysis, market research and data analysis.

Core Skills:

- Financial Analysis

- Investment Valuation

- Equity Research

- Financial Modeling

- Financial Statement Analysis

- Market Research

- Data Analysis

- Profit & Loss Forecasting

Professional Experience:

Equity Analyst, XYZ Investment Bank, 2009 – Present

- Analyze financial statements and develop valuation models to assess the viability of potential investments

- Identify trends in financial markets and evaluate market conditions for new investment opportunities

- Perform financial modeling to develop forecasts for future earnings and cash flows

- Conduct industry research to identify competitive advantages and threats

- Write research reports, opinion pieces and recommendations for senior management

Equity Research Associate, ABC Investment Firm, 2004 – 2009

- Researched and analyzed financial markets and industries to identify investment opportunities

- Developed financial models to forecast earnings and assess potential risks

- Monitored companies and analyzed financial reports to track performance and make investment recommendations

- Prepared and presented research reports, investment recommendations and analysis to senior management

Education:

MBA in Finance, University of California, 2004

B.S. in Business Administration, University of California, 2001

Equity Analyst Resume with No Experience

Recent college graduate with a Bachelor’s degree in Business Administration and an eagerness to pursue a career as an Equity Analyst. Possesses strong analytical and problem- solving skills, a keen eye for detail and an ability to quickly identify areas of opportunity and risk. Adept at financial statement evaluation, portfolio management, and developing equity assessment models.

Skills

- Analytical & Problem Solving Skills

- Financial Modeling & Analysis

- Data Analysis & Interpretation

- Strong Knowledge of Fundamental Analysis

- Portfolio Management

- Financial Statement Evaluation

- Excellent Written & Verbal Communication

- Research & Report Writing

Responsibilities

- Develop equity assessment models and portfolios

- Analyze current and past financial data to assess risk and opportunity

- Assess the performance of stocks and bonds

- Develop financial models to assess the feasibility of investment opportunities

- Conduct research on securities and industries to identify trends and investment opportunities

- Monitor and review the performance of investments

- Develop and maintain client relationships

- Provide market and industry trend reports.

Experience

0 Years

Level

Junior

Education

Bachelor’s

Equity Analyst Resume with 2 Years of Experience

Dynamic and self- motivated Equity Analyst with two years of professional experience in the finance sector. Possesses strong research, analytical and problem- solving skills, adept at supporting investment decisions by collecting and studying financial and economic data. Proven ability to develop quantitative models, analyze financial statements and trends, and identify discrepancies. Skilled in developing financial statements and models to present data insights to stakeholders.

Core Skills:

- Expertise in equity research and financial analysis

- Advanced knowledge of financial statement analysis

- Experienced in developing financial models

- Proficient in quantitative skills and Excel

- Skilled in identifying discrepancies and recommending solutions

- Strong verbal and written communication skills

Responsibilities:

- Conducted financial statement analysis and identified discrepancies

- Developed financial models and analyzed trends

- Utilized quantitative skills and Excel to develop financial statements

- Examined economic data to identify gaps in the existing market and recommend solutions

- Assisted with creating presentations to present data insights to stakeholders

- Monitored stock market and prepared research reports for investors

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Equity Analyst Resume with 5 Years of Experience

Highly motivated and reliable Equity Analyst with 5 years of experience in financial analysis and portfolio management. Proven record of understanding the stock markets and making effective investment decisions. Experienced in developing comprehensive financial models, analyzing and interpreting financials, and conducting research and analysis on potential equity investments. Skilled in evaluating companies and industries and delivering insightful analysis to senior management.

Core Skills:

- Financial Modeling

- Equity Research

- Data Analysis

- Investment Strategies

- Portfolio Management

- Financial Analysis

- Market Research

Responsibilities:

- Assisting with capital raising, M&A, and divestitures

- Developing financial models to analyze potential investments

- Conducting detailed research and analysis of companies and industries

- Analyzing financial statements, market trends, and economic data

- Formulating investment strategies and making decisions on investments

- Monitoring and evaluating existing portfolio investments

- Presenting results of investment analysis to senior management

- Maintaining and updating financial databases and records

- Synthesizing and interpreting data to identify trends and potential opportunities

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Equity Analyst Resume with 7 Years of Experience

A highly motivated and detail- oriented Equity Analyst with 7 years of experience in financial analysis. Possesses a Bachelor’s degree in Finance and a Master’s degree in Economics. Skilled in conducting financial market research, interpreting financial data, and formulating investment strategies. Experienced in leveraging strong technical skills to analyze financial statements and financial markets. Results- oriented with the ability to critically analyze and interpret financial models, identify trends, and make effective recommendations.

Core Skills:

- Financial Modeling

- Investment Analysis

- Market Research

- Financial Statement Analysis

- Technical Analysis

- Risk Management

- Financial Reporting

Responsibilities:

- Conducted complex financial analysis of publicly- traded and private companies

- Developed financial models to predict company performance and identify investment opportunities

- Analyzed financial markets and formulated investment strategies

- Developed and maintained financial databases

- Created presentations on financial analysis results to share with clients

- Monitored portfolio performance, identified risk, and proposed corrective action

- Wrote reports and maintained records of financial transactions

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Equity Analyst Resume with 10 Years of Experience

Highly experienced Equity Analyst with 10 years of experience in the financial sector. Proven track record of successful stock market investment and portfolio management. Result- oriented and with a passion to identify and capitalize on profitable investment opportunities. Core competencies include technical and fundamental stock analysis, financial modeling and forecasting, portfolio management and risk management.

Core Skills:

- Extensive knowledge of financial markets and trading

- Strong analytical, problem solving and decision making skills

- Excellent communication and interpersonal skills

- Strong organizational and time management skills

- Proficient in financial modeling and forecasting

- In- depth understanding of financial statements and accounting principles

- Expertise in researching, evaluating, and analyzing financial data

Responsibilities:

- Develop and maintain corporate financial models for equity positions

- Perform technical and fundamental analysis to identify potential investments

- Analyze industry trends and make recommendations for investments

- Develop and maintain portfolio of investments in equities

- Create detailed financial reports and analyses of potential investments

- Monitor and review current portfolio performance and make necessary changes

- Identify and analyze risk management strategies

- Assist in the development of portfolio strategies for clients

- Provide research support to investment banking operations

- Develop and maintain relationships with brokers and other financial professionals

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Equity Analyst Resume with 15 Years of Experience

Highly experienced Equity Analyst with fifteen years of experience in the investment banking sector. Driven by a passion for financial analysis and market research, I have a proven track record of providing decision- making support to clients in making profitable investments and managing portfolio risks. I collaborate with other internal and external stakeholders to ensure successful implementation of client strategies. Equipped with strong quantitative, qualitative, and communication abilities, I am confident in my ability to understand the company objectives, anticipate market movements, and provide actionable recommendations to clients.

Core Skills:

- Financial Analysis

- Market Research

- Portfolio Management

- Strategic Risk Analysis

- Data Analytics

- Investment Banking

- Quantitative and Qualitative Analysis

- Client Relationship Management

- Communication

Responsibilities:

- Conduct comprehensive financial analysis to identify profitable investment opportunities

- Develop financial models to assess future market trends and help clients in setting up portfolio diversification strategies

- Analyze company performance, competitive landscape, and regulatory environment to make projections on the investments

- Identify and evaluate risk factors associated with investments to ensure long- term financial sustainability

- Provide actionable recommendations to clients and ensure successful implementation of investment strategies

- Enhance client relationships by keeping clients informed of new opportunities and industry developments

- Prepare presentations, reports, and other documents to communicate complex data points in a simple and clear manner

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Equity Analyst resume?

A resume for an Equity Analyst should highlight the skills and experience that make the applicant a great fit for the role. These should include:

- Strong analytical and problem-solving skills: Equity Analysts need to be able to quickly evaluate data and find solutions to complex financial issues.

- Knowledge of financial markets and regulations: Understanding the market and its rules is essential for an Equity Analyst.

- Proficiency with financial software: Equity Analysts need to be able to use software to identify trends, evaluate data, and make decisions.

- Excellent communication skills: Equity Analysts must be able to effectively communicate their findings and recommendations to clients and colleagues.

- Experience in financial analysis: Equity Analysts should be able to demonstrate their experience in financial analysis through prior projects or positions.

- Teamwork: Equity Analysts must be able to work as part of a team and collaborate with colleagues to reach successful outcomes.

- Ability to work independently: Equity Analysts must be able to take initiative and work independently to complete tasks.

- Attention to detail: Equity Analysts must be highly detail-oriented and be able to spot potential issues or risks.

What is a good summary for a Equity Analyst resume?

A good summary for an equity analyst resume should focus on the candidate’s strengths and experience in the field. It should demonstrate a deep knowledge of financial markets and the ability to develop and implement investment strategies. It should also highlight any relevant certifications and software programs that the candidate has used. The summary should also include any challenges that the candidate has faced in the past and how they overcame them. Finally, the summary should give a brief overview of the candidate’s track record and any awards they have earned.

What is a good objective for a Equity Analyst resume?

A good objective for an Equity Analyst resume should be clear, concise, and relevant to the job you’re applying for. It should be tailored to your skills and experience, and highlight your potential to be a successful analyst. Here are some tips on crafting a strong objective:

- Focus on the company you’re applying to. Your objective should reflect an understanding of the job and the company’s mission and goals.

- Highlight the skills you can bring to the team. Show that you have the technical, analytical, and communication skills necessary to be an effective analyst.

- Demonstrate your knowledge of the industry. Mention your familiarity with the industry’s trends and regulations, and your understanding of the stock market.

- Show that you have a track record of success. Use concrete examples of your achievements as an analyst to demonstrate that you can deliver results.

By crafting a meaningful and targeted objective, you will be able to show potential employers that you have the knowledge, skills, and experience to be a successful Equity Analyst.

How do you list Equity Analyst skills on a resume?

When applying for an Equity Analyst job, it is essential to showcase the right skills and abilities on your resume. Here are some skills that Equity Analysts should list on their resumes:

- Quantitative Analysis: Equity analysts are responsible for gathering and analyzing financial data, so having a strong quantitative analysis skill set is essential. This includes expertise in accounting, financial modeling, financial statement analysis, and macroeconomic analysis.

- Research: Equity analysts must be able to conduct independent research on stocks, bonds, and other financial instruments. Therefore, having knowledge in researching financial markets and having the ability to interpret research results should be highlighted.

- Knowledge of Investment Strategies: Equity analysts should be knowledgeable of the different investment strategies and their effects on a portfolio. This includes knowledge of short-term, mid-term, and long-term investments as well as understanding of various risk management strategies.

- Communication Skills: Equity analysts are also responsible for presenting their research results to clients and company executives. Therefore, having strong verbal and written communication skills are essential.

- Technical Skills: Equity analysts should have a strong understanding of industry software used for financial analysis such as Bloomberg and Microsoft Excel. They should also be familiar with database management and web-based research tools.

By including these skills on your resume, you can make sure that you stand out from other applicants and demonstrate your qualifications to potential employers.

What skills should I put on my resume for Equity Analyst?

A resume for an equity analyst should include a range of key skills that demonstrate to a potential employer the applicant’s expertise and ability to handle the job.

The most important skills to include on a resume for an equity analyst include:

- Fundamental Analysis: The ability to analyze financial statements and make informed decisions based on the results of that analysis.

- Technical Analysis: The ability to read charts and identify trends and patterns in the financial markets.

- Risk Management: The ability to manage risk associated with investments and to make sound decisions that minimize losses and maximize returns.

- Financial Modeling: The ability to build financial models to project the performance of investments under different scenarios.

- Reporting and Presentation: The ability to create presentations and reports that explain the results of financial analysis.

- Communication: The ability to effectively communicate complex financial analysis results and strategies to colleagues and clients.

- Problem Solving: The ability to identify complex problems and develop creative solutions.

By including these skills on a resume for an equity analyst position, potential employers will have a better understanding of the applicant’s abilities and qualifications.

Key takeaways for an Equity Analyst resume

When drafting an Equity Analyst resume, there are many key points to consider that will help you to stand out from other potential job applicants. Here are some key takeaways for constructing an effective Equity Analyst resume.

- Make sure to highlight your credentials. Equity Analysts have complex roles that require a deep understanding of financial markets, so make sure to include any relevant qualifications, certifications, or educational accomplishments that demonstrate your expertise in the field.

- Showcase your technical skills. Equity Analysts are expected to be highly proficient in the use of various software programs, such as Bloomberg and Excel. Make sure to list any relevant technical skills that you have acquired over the course of your experience.

- Highlight any relevant experience. Employers are looking for Equity Analysts who have significant experience in financial markets, so make sure to include any relevant projects or prior positions that you have held.

- Illustrate your problem-solving skills. Equity Analysts must be able to think critically and come up with innovative solutions to complex financial issues. Make sure to include examples of successful problem-solving techniques that you have employed in the past.

- Demonstrate your communication skills. Equity Analysts must be able to communicate effectively with a wide range of stakeholders, so make sure to include any evidence of your excellent communication skills.

By following these key takeaways, you can construct an effective Equity Analyst resume that will impress prospective employers and help you to secure the job that you are seeking.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder