Writing a resume as a derivatives trader is a daunting task. It requires knowledge of the industry, understanding of the terms, and the ability to explain your experience in a concise and impactful way. It also requires that you stand out from the crowd – after all, you’re competing with other traders and financial professionals who have the same qualifications and the same goal. This guide is designed to help traders craft a resume that will give them an advantage in their search for a derivatives trading position. It will provide examples of how to effectively highlight your skills and qualifications, as well as tips for making your resume as attractive as possible. After reading this guide, you should have a good idea of how to create a standout derivatives trader resume.

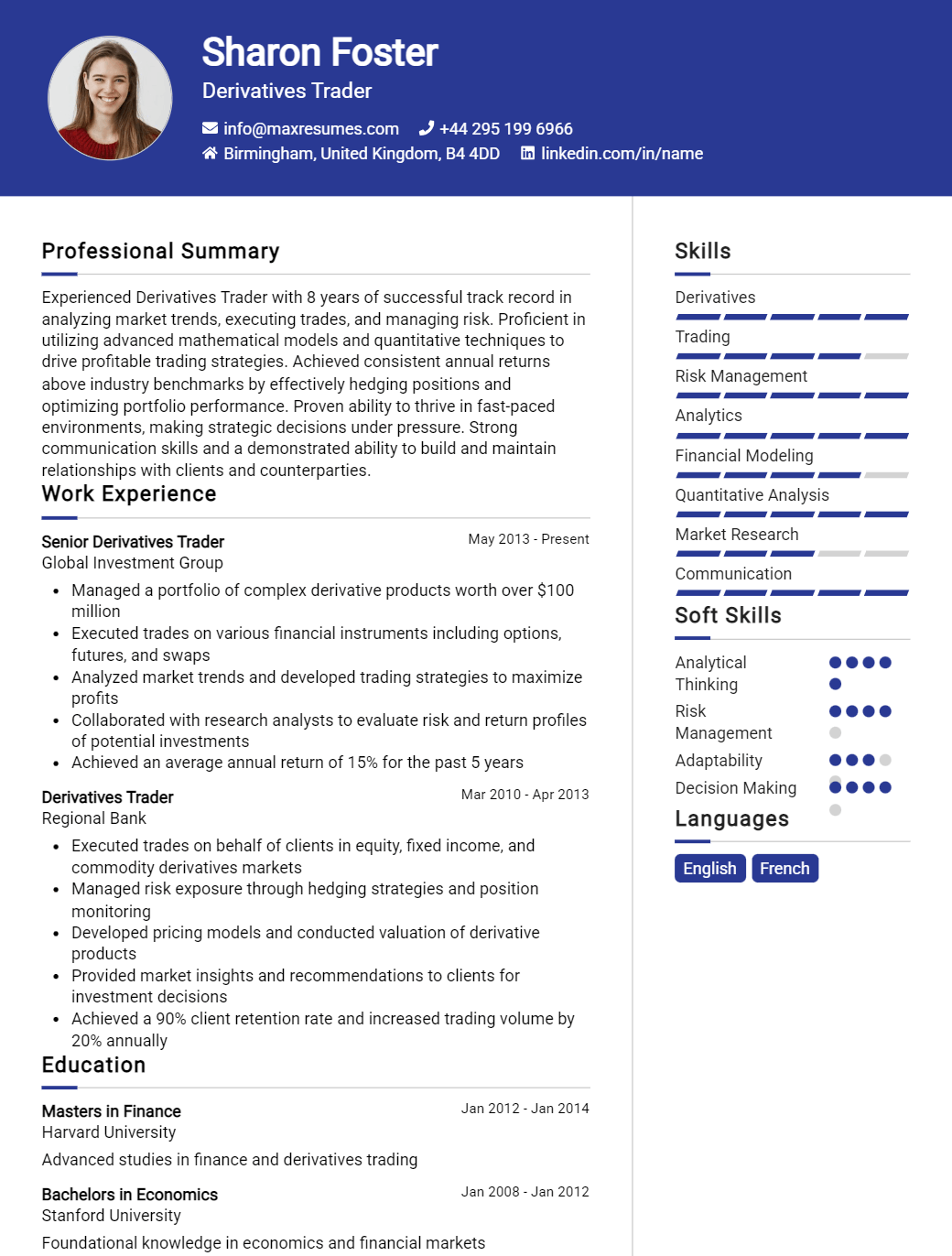

Derivatives Trader Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Derivatives Trader Resume Examples

John Doe

Derivatives Trader

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

Highly driven and motivated Derivatives Trader with 5 years of experience in the financial services industry. Proven ability to manage and execute trades for a variety of products, including equity derivatives, futures, and options on futures. Experienced in developing algorithms for high- frequency trading and market making. Adept at understanding complex financial instruments and taking advantage of market opportunities.

Core Skills:

- Equities Derivatives Trading

- Options Trading

- High Frequency Trading

- Market Making

- Algorithm Development

- Risk Management

- Financial Analysis

- Compliance

- Regulatory Knowledge

Professional Experience:

Derivatives Trader, ABC Bank, 2020- Present

- Execute trades for equity derivatives and futures, while taking into account market conditions, price, liquidity and timing

- Develop high frequency trading algorithms to identify and capitalize on market inefficiencies

- Research and analyze market data to identify trading opportunities

- Monitor portfolios to ensure optimal risk management and compliance with regulations

- Trade equity options on futures and other derivatives

Derivatives Trader, XYZ Bank, 2015- 2020

- Executed and monitored trades for equity derivatives, futures and options on futures

- Developed algorithmic trading strategies to identify and capitalize on market inefficiencies

- Monitored portfolios to ensure optimal risk management and compliance with regulations

- Research and analyzed market data to identify trading opportunities

- Traded equity options on futures and other derivatives

Education:

Bachelor of Science in Economics, ABC University, 2015

Derivatives Trader Resume with No Experience

A recent graduate looking to enter the finance world with a degree in Economics and an interest in trading derivatives. I am a determined and motivated individual who is eager to learn and take on new challenges.

Skills:

- Strong analytical and problem- solving skills

- Excellent communication and interpersonal skills

- Strong knowledge of derivatives markets

- Proficiency in Microsoft Office Suite

- Strong understanding of financial markets and instruments

- Ability to learn new concepts quickly

Responsibilities:

- Review markets and generate trading ideas

- Monitor markets and analyze market trends

- Execute trades on behalf of clients

- Conduct research on derivatives markets

- Maintain client relationships

- Monitor and manage risk exposure

- Review and analyze economic data

- Provide analysis and commentary on market trends

- Develop strategies for trading derivatives

Experience

0 Years

Level

Junior

Education

Bachelor’s

Derivatives Trader Resume with 2 Years of Experience

An experienced Derivatives Trader with 2 years of experience in managing large volumes of financial instruments and coordinating complex financial transactions. Possesses a comprehensive knowledge of various financial products, financial markets, and banking regulations. Possesses excellent analytical, communication, problem solving and project management skills. Able to work effectively in fast- paced environments and under pressure.

Core Skills:

- Financial Markets: Comprehensive knowledge of financial markets and banking regulations

- Financial Instruments: Experienced in managing large volumes of financial instruments

- Analytical Skills: Excellent analytical, problem solving and project management skills

- Communication: Exceptional verbal and written communication skills

- Interpersonal: Strong team player with excellent interpersonal and organizational skills

Responsibilities:

- Managed the portfolio of derivatives trading activity and monitored daily settlements

- Tracked and monitored market developments, potential opportunities, and risks

- Performed analysis of complex financial instruments and transactions

- Developed trading strategies to maximize profits and minimize losses

- Processed and cleared client orders in accordance with established procedures

- Communicated effectively with external stakeholders, regulators, and trading partners

- Monitored the foreign exchange market and identified any trading opportunities

- Maintained accurate records and updated the trading database accordingly

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Derivatives Trader Resume with 5 Years of Experience

Highly experienced Derivatives Trader with 5 years of expertise in trading options and futures, as well as analyzing and developing strategies to capitalize on market opportunities. Proven track record of success in consistently meeting or surpassing performance and profitability goals. Demonstrated ability to manage multiple portfolios and trades in a fast- paced environment. Skilled in the use of a variety of trading and analysis software.

Core Skills:

- Option and futures trading

- Profitable portfolio management

- Risk analysis and mitigation tactics

- Market analysis and strategy development

- Trading and analysis software proficiency

- Detail oriented

Responsibilities:

- Develop, implement and maintain trading strategies and portfolios

- Monitor, analyze and adjust portfolios to maximize performance and profitability

- Coordinate with brokers and other financial professionals to ensure optimal execution of trades

- Analyze market conditions and trends to identify potential trading opportunities

- Monitor financial news and updates to identify changing market conditions

- Monitor portfolio risk and adjust procedures accordingly

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Derivatives Trader Resume with 7 Years of Experience

An experienced Derivatives Trader with seven years of experience in developing trading strategies, conducting market analysis, and executing trades for a wide range of derivatives and securities. Proven ability to adopt market trends and capitalize on them in a timely manner, while minimizing risk. Excellent track record of creating innovative trading models and strategies to maximize profits. A problem solver with excellent communication and interpersonal skills, able to work both in a team environment and independently.

Core Skills:

- Strong knowledge of derivatives trading and market analysis

- Excellent problem solving and communication skills

- Ability to create innovative trading strategies and models

- Proficiency in market trends and capitalizing on them

- Ability to work both in a team environment or independently

Responsibilities:

- Developing trading strategies for derivatives and securities

- Executing trades for derivatives and securities

- Conducting market analysis and research

- Analyzing market trends and identifying opportunities

- Creating innovative trading models to maximize profits

- Monitoring trading positions and managing risk

- Reporting to senior management on trading performance

- Working with team members to create strategies and implement trades

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Derivatives Trader Resume with 10 Years of Experience

Highly motivated, results- driven professional with 10+ years of experience as a Derivatives Trader. Proven record of significant successes in the derivatives market including commodities, futures, options, and currency trading. Possesses a well- developed understanding of derivatives instruments and the ability to recognize profitable opportunities in a variety of markets. An excellent communicator and negotiator who can quickly analyze data and develop innovative strategies to maximize profits.

Core Skills:

- Derivatives Trading

- Risk Management

- Market Analysis

- Financial Modeling

- Data Interpretation

- Trading Software Utilization

- Portfolio Optimization

- Trading Strategies

- Regulatory Compliance

- Financial Reporting

Responsibilities:

- Managed a large portfolio of derivative contracts, including commodities, futures, options, and currencies.

- Developed and implemented trading strategies to capitalize on market inefficiencies and maximize profits.

- Utilized trading software to analyze market conditions, identify profitable opportunities, and execute trades.

- Implemented risk management strategies to protect the portfolio from market downturns and mitigate losses.

- Monitored market and economic conditions in order to adjust the trading strategy and portfolio as needed.

- Generated daily, weekly, and monthly financial reports to inform senior management of the portfolio’s performance.

- Ensured compliance with regulatory requirements and risk management policies.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Derivatives Trader Resume with 15 Years of Experience

A highly motivated and experienced Derivatives Trader with 15+ years of experience in banking and finance industry. Possesses a track record of consistently building and maintaining successful relationships with clients. Acknowledged for the ability to take on complex challenges and deliver optimal results. Skilled in risk assessment, analysis and trading of stocks, options, derivatives, and commodities.

Core Skills:

- Expertise in trading strategies and risk management

- Comprehensive understanding of derivatives and commodities

- Proven track record of successful client relations

- Skilled in financial analysis and market research

- Committed to maintain accurate records and paperwork

- Knowledgeable in banking and financial regulations

- Excellent communication and problem- solving skills

Responsibilities:

- Performed in- depth market research and analysis to identify profitable trading opportunities

- Developed and implemented risk management strategies to protect investments

- Negotiated and executed transactions for trading derivatives and commodities

- Monitored market movements and adjusted trading strategies as needed

- Developed relationships with clients and provided advice on investment options

- Assessed and managed risk exposure for investments

- Maintained accurate records and documents of trades and transactions

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Derivatives Trader resume?

A derivatives trader resume should include all the necessary details to demonstrate your experience and success as a trader. A comprehensive resume should cover:

- Professional summary outlining your experience as a derivatives trader

- Education and professional qualifications

- Detailed list of experience and accomplishments

- Financial analysis and risk management capabilities

- Understanding of the regulations and laws governing derivatives trading

- Technical skills such as software, programming, and Excel

- Knowledge of the derivatives market and trading strategies

- Ability to work independently and as part of a team

- Excellent communication and negotiation skills

- Time management and organizational skills

- Leadership capabilities and strategic decision-making skills

An ideal resume for a derivatives trader should showcase your technical skills, experience, and qualifications. It should also demonstrate your understanding of the market and trading strategies, as well as your ability to stay organized and work effectively with others. With a comprehensive, well-written resume, you can demonstrate to potential employers that you have what it takes to be a successful derivatives trader.

What is a good summary for a Derivatives Trader resume?

A derivatives trader resume should summarize the trader’s experience, accomplishments, qualifications, and education. It should make clear the trader’s overall experience in the industry, including any specialized knowledge and expertise in a particular asset class or financial instrument. It should also highlight the trader’s analytical skills and proficiency in financial software and trading tools. Finally, the resume should include any relevant certifications or licenses, as well as any achievements or awards that the trader has earned. All of this information should be presented in a succinct and clear manner, with a focus on demonstrating the candidate’s capability as a professional derivatives trader.

What is a good objective for a Derivatives Trader resume?

A good objective for a derivatives trader resume should demonstrate the individual’s knowledge, experience and qualifications to become a successful trader in the derivatives market. Here are some examples of objectives that can be included in a derivatives trader resume:

- To leverage my knowledge of financial markets, economics and derivatives to become a successful derivatives trader.

- To utilize my strong analytical skills and attention to detail in order to evaluate market trends and make informed trading decisions.

- To apply my understanding of risk management and market dynamics to maximize returns while minimizing risks.

- To take advantage of my expertise in derivatives and financial instruments to generate long-term, sustainable profitability.

- To develop a deep understanding of the various types of derivatives and their associated risks in order to be a successful derivatives trader.

- To use my knowledge of financial markets and instruments to make informed decisions in order to successfully execute trading strategies.

- To utilize my experience in trading derivatives to create viable trading strategies that are profitable in the long-run.

- To use my excellent communication skills to build relationships with clients and colleagues, and work collaboratively to achieve success.

By including these objectives (or similar ones) in your derivatives trader resume, you can demonstrate to employers that you have the necessary knowledge and skills to become a successful derivatives trader.

How do you list Derivatives Trader skills on a resume?

When writing a resume for a Derivatives Trader position, you want to show the hiring manager that you are experienced, knowledgeable, and the perfect candidate for the job. To do this, you must list your relevant skills, experiences, and qualifications in a way that will catch their attention.

When listing Derivatives Trader skills on a resume, you should include:

- Excellent knowledge of derivatives trading processes, regulations, and markets

- Ability to analyze market trends and create strategies

- Proven track record of successful trading

- Strong understanding of risk management principles and strategies

- Proficiency in using trading software and platforms

- Excellent computer and mathematical skills

- Familiarity with financial data analysis

- Excellent communication and interpersonal skills

- Ability to work well under pressure and meet deadlines

By including a range of skills and experiences on your resume, you will be able to show the hiring manager that you are the ideal candidate for the Derivatives Trader position.

What skills should I put on my resume for Derivatives Trader?

A derivatives trader is a professional tasked with analyzing and trading financial instruments known as derivatives. These instruments include stocks, commodities, options, and derivatives, among others. To be successful in this role, you’ll need a combination of technical and financial skills, as well as experience in the derivatives trading industry.

When crafting your resume for a derivatives trader role, it’s important to highlight the skills and experience necessary to excel in the role. Here’s what to include:

- Expertise in derivatives instruments: Having a comprehensive understanding of the various types of derivatives and how they work is essential. You should be familiar with the different types of derivatives markets, their instruments, pricing models, and regulatory requirements.

- Technical analysis: You’ll need to be able to interpret and analyze data related to derivatives trading. This includes skills in chart analysis, statistical analysis, and technical indicators.

- Risk management: As a derivatives trader, you’ll need to be able to assess and manage market risks. You should have a good understanding of the various forms of risk, such as price risk, liquidity risk, and counterparty risk.

- Trading strategy: The ability to develop and execute trading strategies is key for a derivatives trader. You should be able to analyze market conditions and develop strategies to maximize gains and minimize losses.

- Strong communication: You’ll need to be able to articulate your trading decisions to clients and colleagues. You should also be able to explain derivatives concepts to those with limited knowledge of the instruments.

- Financial acumen: You should have a good understanding of financial markets, financial instruments, and the global economy.

By highlighting these skills on your resume, you’ll be better prepared to land a job as a derivatives trader.

Key takeaways for an Derivatives Trader resume

When creating a resume for a derivatives trader, there are several key points to consider. Derivatives traders are typically responsible for analyzing and trading a variety of financial instruments, such as options, futures, and swaps, in order to increase profits, manage risk, and maximize return. As such, it is important that a derivatives trader’s resume showcase the necessary knowledge and skills to perform the job well.

Some key takeaways for a derivatives trader resume include:

- Demonstrate strong analytical skills. Derivatives traders must be able to interpret financial data and make sound decisions based on this information. Showcase your ability to interpret financial data, analyze market trends, and develop strategies that are based on this research.

- Showcase technical proficiency. Derivatives traders must be highly proficient with a variety of software programs, such as Excel, Bloomberg, and Reuters. Be sure to include any certifications or training you may have had in these programs.

- Highlight your ability to work independently. Derivatives traders are often required to work independently and make decisions without the help of others. Showcase how you can take initiative and be accountable for your decisions.

- Emphasize your risk management skills. Risk management is a key part of the job for derivatives traders. Showcase how you can develop strategies to manage risk and maximize return.

- Showcase your communication skills. Derivatives traders must be able to communicate effectively with their colleagues and clients. Demonstrate your ability to communicate clearly and concisely in both written and verbal form.

By showcasing these skills and qualifications, a derivatives trader will be able to demonstrate why they are the best fit for the job. By following these key takeaways, a derivatives trader can create a resume that will help them stand out from the competition and land the job.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder