Writing an effective resume is one of the most important aspects of finding a job as a derivatives analyst. A derivatives analyst is responsible for evaluating the performance and financial risk of investments, while also providing advice to clients on their financial decisions. This can make writing a derivatives analyst resume a difficult task, as it requires a strong skillset and experience to stand out from the competition. However, with the right guidance and examples, you can easily craft a resume that will help you land the job of your dreams. This guide will provide you with the best tips and strategies for writing a resume that will get you noticed by employers, as well as several helpful examples that you can use as references.

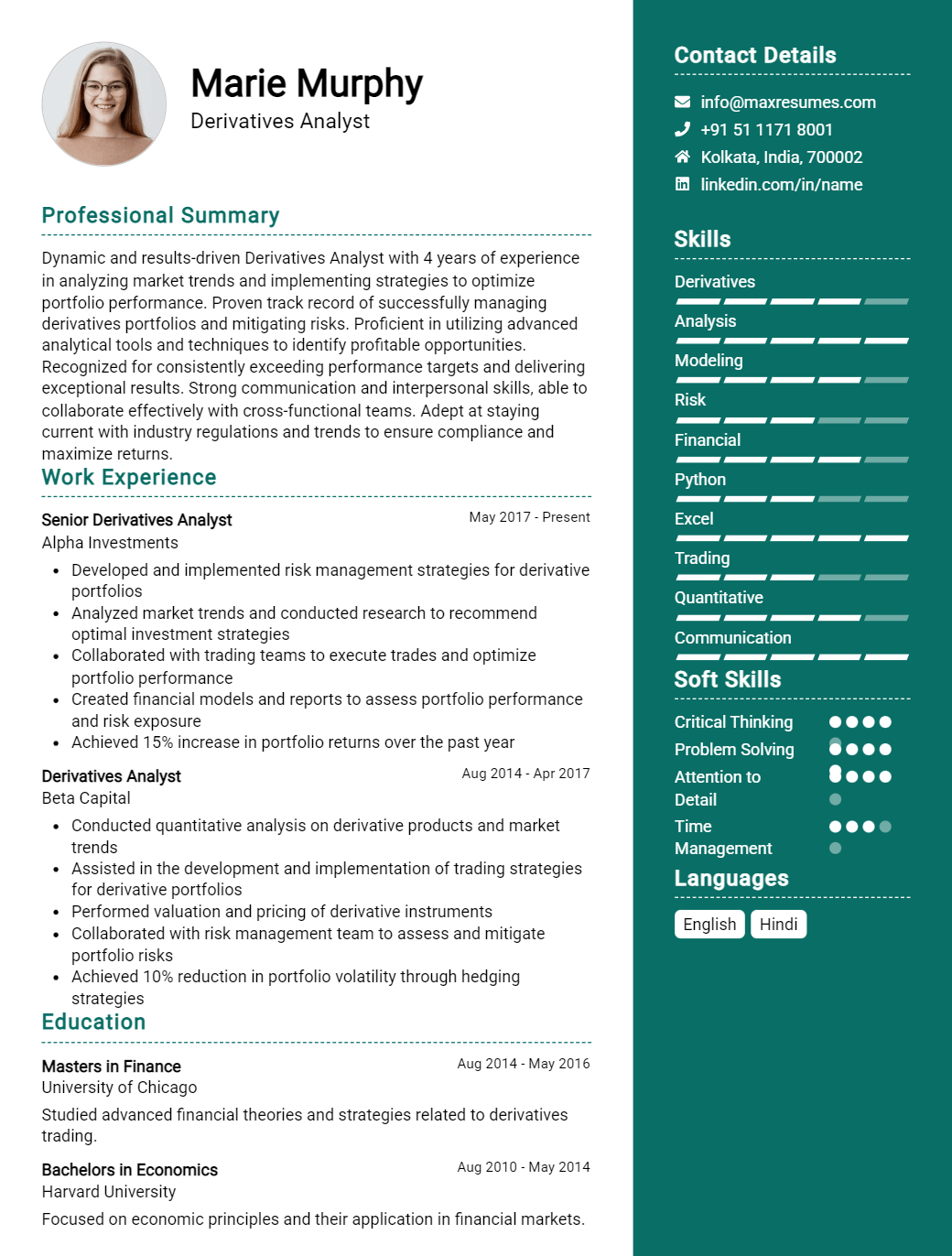

Derivatives Analyst Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Derivatives Analyst Resume Examples

John Doe

Derivatives Analyst

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

Highly experienced Derivatives Analyst with over 6 years of experience in financial services, risk management and quantitative analysis. Experienced in developing financial models, assessing risk of derivatives, building portfolio management strategies and assisting in their implementation. Strong communicator and collaborator, with excellent analytical and problem solving skills.

Core Skills:

- Financial Modeling

- Risk Management

- Quantitative Analysis

- Portfolio Management

- Derivatives Trading

- Structured Products

- Credit Analysis

- Capital Markets

- Bloomberg/Reuters/Factset

Professional Experience:

Derivatives Analyst, ABC Bank, April 2014 – Present

- Developed financial models for derivatives trading and portfolio management

- Conducted quantitative and qualitative analysis of derivatives to assess risk

- Created automated portfolio management strategies for derivatives trading

- Assisted in the implementation of new portfolio management strategies

- Monitored and analyzed the performance of derivatives trading portfolios

Derivatives Analyst, XYZ Company, June 2011 – April 2014

- Developed financial models and analyzed data to assess the risk of derivatives

- Assisted in the design and implementation of portfolio management strategies

- Evaluated the performance of derivatives trading portfolios on a regular basis

- Monitored capital markets to identify trends and develop strategies

Education:

MBA, Finance, ABC University, 2011

BBA, Finance, XYZ University, 2009

Derivatives Analyst Resume with No Experience

Recent graduate with a Bachelor’s degree in Finance and Economics, looking to break into the field of derivatives analysis. Highly analytical and detail- oriented with strong problem- solving, research and numerical analysis skills. Seeking an opportunity to use my knowledge of the derivatives market to apply analysis techniques and develop a career in derivatives analysis.

Skills

- Excellent quantitative and analytical skills

- Advanced knowledge of derivatives, securities and financial instruments

- Ability to develop financial models and calculations

- Experience with risk management techniques

- Excellent written and verbal communication skills

- Ability to work independently and as part of a team

- Proficient in Microsoft Office Suite (Excel, Word, PowerPoint)

Responsibilities

- Develop and maintain derivative pricing models

- Analyze derivatives and assess risk exposure

- Monitor and analyze market conditions

- Develop market strategies and models to understand and forecast the behavior of the derivatives market

- Research and analyze financial instruments, securities, and trends in the derivatives market

- Generate reports and provide recommendations on investment opportunities

- Collaborate with other analysts and financial professionals to develop strategies and analyze market conditions

Experience

0 Years

Level

Junior

Education

Bachelor’s

Derivatives Analyst Resume with 2 Years of Experience

Dynamic Derivatives Analyst with 2 years of experience working in the financial industry. Experienced with derivatives trading, analyzing market trends, and data research. Proven problem- solving and communication skills. Ability to work collaboratively and independently with accuracy and precision. Proficient with a variety of derivatives software, including CQG and Bloomberg.

Core Skills:

- Derivatives Trading

- Risk Analysis

- Market Research

- Bloomberg and CQG Software

- Problem- solving

- Financial Analysis

- Collaboration

- Attention to Detail

Responsibilities:

- Executed trades in derivatives instruments, such as stocks, futures, and options

- Analyzed market trends and risk to determine buying and selling strategies

- Prepared and compiled reports related to derivatives trading

- Developed financial models and software solutions to support derivatives trading

- Monitored portfolio performance and kept up to date with market news and developments

- Researched and recommended various derivatives instruments and strategies to enhance portfolio performance

- Utilized CQG and Bloomberg software to manage and track derivatives trading activity

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Derivatives Analyst Resume with 5 Years of Experience

Analytical Derivatives Analyst with 5+ years of experience in derivatives analytics, risk assessment, and financial modeling. Highly adept at performing complex quantitative calculations and working with multiple data sets. Proven track record of providing comprehensive and accurate analysis to senior team members.

Core Skills:

- Advanced knowledge of derivatives analytics

- Experience in risk assessment and financial modeling

- Ability to interpret and analyze large data sets

- Proficiency in Microsoft Office products (Word, Excel, PowerPoint)

- Strong organizational and communication skills

- Sound judgment and critical thinking skills

Responsibilities:

- Perform analysis of derivatives transactions, including pricing and risk assessment

- Develop and maintain financial and risk models for derivatives transactions

- Conduct research on derivatives markets, trends, and opportunities

- Create reports and presentations for senior management

- Present analysis to senior team members and stakeholders

- Provide ongoing support to internal teams to ensure accuracy and compliance

- Maintain detailed records of all derivatives transactions and analysis results

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Derivatives Analyst Resume with 7 Years of Experience

A results- oriented and analytical professional with over 7 years of experience in derivatives analysis, financial modeling and risk management. Experienced in constructing and analyzing complex financial products, such as futures, options and swaps. Skilled in analyzing markets and developing strategies to optimize investments, financial modeling, and risk management. Proven ability to effectively interpret and analyze financial data, formulate creative investment solutions and drive business results.

Core Skills:

- Derivatives analysis

- Financial modeling

- Risk management

- Market analysis

- Trading strategies

- Financial data interpretation

- Investment optimization

- Business result optimization

Responsibilities:

- Analyzed market trends and developed sophisticated trading strategies to optimize investments

- Constructed and analyzed complex financial products such as futures, options and swaps to ensure risk management

- Utilized financial data interpretation to assess current and potential investments

- Formulated creative investment solutions to drive business results

- Developed and maintained comprehensive financial models to analyze market conditions and make informed investment decisions

- Monitored the performance of portfolio investments and identified areas of improvement

- Collaborated with senior management to develop robust risk management processes and procedures

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Derivatives Analyst Resume with 10 Years of Experience

A highly accomplished Derivatives Analyst with 10 years of experience in the financial services industry. Skilled in analyzing derivative instruments, managing financial modeling, and developing strategies within a fast- paced, high- pressure environment. Excels at risk management, portfolio analysis, and derivatives operations. Proven ability to understand and implement new trading strategies and regulatory requirements. A committed and reliable professional dedicated to delivering strong financial performance.

Core Skills:

- Financial Modeling

- Risk Management

- Derivative Instruments

- Portfolio Analysis

- Strategy Implementation

- Regulatory Compliance

- Data Analysis

- Investment Research

- Project Management

- Business Development

Responsibilities:

- Developed and maintained financial models to analyze risk and investment opportunities in the derivatives market

- Monitored portfolios and conducted risk management for derivatives trading

- Developed strategies for derivatives trading, including hedging and arbitrage

- Analyzed and interpreted financial data to identify trends and opportunities in the derivatives market

- Performed investment research to identify and evaluate long- term investment opportunities

- Managed projects and initiatives related to derivatives trading

- Ensured compliance with all relevant regulations and guidelines

- Monitored market developments and identified new opportunities

- Provided business development support to identify new clients and partners

- Prepared weekly and monthly reports on derivative trading performance

- Assisted in the implementation of new trading strategies and processes.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Derivatives Analyst Resume with 15 Years of Experience

A highly experienced Derivatives Analyst with 15 years of experience in all facets of financial analysis. Skilled in developing and maintaining complex financial models, analyzing data from various sources, and providing actionable insights to clients. Experienced in providing financial advice on strategies to minimize risk and maximize profits. Able to work both independently and collaboratively, and to manage multiple tasks simultaneously with a high level of accuracy and efficiency.

Core Skills:

- Financial Analysis

- Financial Modeling

- Risk Management

- Derivatives Pricing

- Strategic Planning

- Data Manipulation

- Organizational Skills

- Communication

- Problem Solving

Responsibilities:

- Develop complex financial models to evaluate and analyze potential investments and strategies.

- Analyze data from multiple sources, including market research and financial statements, to develop actionable insights for clients.

- Perform pricing and risk management functions on derivatives instruments.

- Make recommendations to clients based on financial analysis and risk assessment.

- Assist in the development and implementation of financial strategies to minimize risk and maximize profits.

- Monitor and track financial performance, identify trends, and make recommendations for improvement.

- Provide support to colleagues in developing and managing complex financial models.

- Monitor market trends and evaluate the performance of investments.

- Communicate effectively with clients to ensure expectations are met.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Derivatives Analyst resume?

Derivatives Analyst resumes should include information about both the individual’s professional experience and their educational background. A Derivatives Analyst’s resume should highlight their knowledge of complex financial models and instruments, the ability to identify key risk indicators, and the use of sophisticated analytical software.

The following should be included in a Derivatives Analyst resume:

- Educational background, including related degrees, certifications, and any professional development courses or seminars

- Professional experience, including job titles and dates of employment, as well as details of specific tasks completed and accomplishments

- Knowledge of financial models and instruments, and experience in analyzing financial data

- Expertise in the use of financial software, including Bloomberg, Excel, and other analytical tools

- Comprehensive understanding of financial markets and financial products

- Experience with derivative pricing models and risk management strategies

- Excellent communication and problem-solving skills

By including this information in a Derivatives Analyst resume, an individual will be able to showcase their qualifications for the position and make a strong case for why they should be considered for the job.

What is a good summary for a Derivatives Analyst resume?

A Derivatives Analyst resume should provide a summary of the candidate’s qualifications and experience in the derivatives markets. It should include the candidate’s knowledge of financial analysis and risk management, as well as their understanding of financial instruments, derivatives markets, and their ability to analyze and interpret data. A good summary should also highlight the candidate’s education and relevant job experience, including their ability to identify and assess risk in complex derivatives transactions. The summary should also provide evidence of the candidate’s aptitude for developing and implementing strategies to maximize profits and minimize losses. Finally, a good summary should demonstrate the candidate’s proficiency in financial software, such as Excel, Bloomberg, and Risk Software.

What is a good objective for a Derivatives Analyst resume?

A Derivatives Analyst is responsible for analyzing and researching the financial markets, identifying trends and opportunities, and making sound financial investments. As a Derivatives Analyst, it is important to have a clear and concise objective statement on your resume that accurately reflects your goals and qualifications.

Here are a few examples of good objectives for a Derivatives Analyst resume:

- A highly motivated and knowledgeable Derivatives Analyst with 5+ years of experience in the financial markets, seeking a position to utilize my skills and expertise in deriving profitable strategies and investments.

- A seasoned Derivatives Analyst with a passion for the financial markets and a keen eye for lucrative opportunities, looking to join a fast-paced, dynamic team to contribute to the success of the organization.

- An experienced and detail-oriented Derivatives Analyst, with extensive knowledge of risk management and financial markets, seeking to join a leading financial institution where I can bring innovative strategies and help maximize profits.

- An organized and reliable Derivatives Analyst with a proven track record of success in the financial markets, eager to join a leading organization where I can use my skills and expertise to help create profitable investments.

Regardless of which objective statement you decide to use, it is important to make sure that it is concise and accurately reflects your qualifications. A well-written objective statement will help you stand out from other applicants and give you the best chance of getting your dream job as a Derivatives Analyst.

How do you list Derivatives Analyst skills on a resume?

When building your resume, it is important to focus on the skills that make you an ideal candidate for a Derivatives Analyst position. This means highlighting your analytical and problem-solving abilities, as well as your ability to accurately interpret data.

To properly list these skills on a resume, consider the following:

- Analytical Thinking: Demonstrate your ability to analyze complex financial data, identify trends and make sound predictions and recommendations.

- Financial Modeling: Showcase your ability to build financial models and analyze the results to provide insights.

- Risk Management: Demonstrate your understanding of risk management principles and your ability to develop appropriate strategies.

- Strategy Development: Demonstrate your ability to design and implement trading strategies.

- Communication: Demonstrate your ability to clearly and effectively communicate quantitative information to non-financial professionals.

- Trade Execution: Demonstrate your ability to accurately execute trades and monitor their performance.

- Problem Solving: Display your ability to solve complex problems and make decisions based on data-driven insights.

By properly listing Derivatives Analyst skills on your resume, you will be able to demonstrate to potential employers that you have what it takes to be successful in this role.

What skills should I put on my resume for Derivatives Analyst?

When applying for a position as a Derivatives Analyst, your resume should not only highlight your relevant work experience, but also the specific skills and abilities that make you a qualified candidate for the job. To maximize your chances of getting hired, here are some of the key skills to include on your resume for a Derivatives Analyst position:

- Financial Modeling: Derivatives analysts must be able to build and analyze financial models to determine the risk exposure of different derivative products and advise clients on the best strategies.

- Data Analysis: As a derivatives analyst, you should have strong data analysis skills and be able to assess large amounts of financial data to identify trends and patterns.

- Regulatory Knowledge: You should have a good understanding of the regulatory framework governing derivative products, such as banking regulations, securities laws and other relevant regulations.

- Risk Management: Derivatives analysts must be able to assess and manage risk in derivative products to protect their clients’ investments.

- Problem Solving: You should be able to think critically and analytically to identify problems, analyze data, and develop solutions.

- Communication: Derivatives analysts must be able to effectively communicate with clients, coworkers, and other professionals to ensure that all parties understand the risks and benefits involved in investing in derivative products.

- Organizational Skills: You should have strong organizational skills and be able to prioritize tasks and manage multiple projects at once.

By highlighting these skills on your resume, you’ll demonstrate to hiring managers that you possess the necessary qualifications for a Derivatives Analyst position.

Key takeaways for an Derivatives Analyst resume

For a derivatives analyst resume, there are several key takeaways that can help make the document stand out from the competition. First, ensure that the resume includes specific technical and analytical skills related to derivatives. This should include any relevant software or programming languages, as well as knowledge of financial instruments, such as options and futures. In addition, a derivatives analyst should highlight any experience with financial modeling, quantitative analysis, and any other quantitative skills.

Next, be sure to emphasize any professional qualifications or certifications that are relevant to the role of derivatives analyst. This can include certifications such as the Chartered Financial Analyst (CFA) or Financial Risk Manager (FRM) which demonstrate a commitment to the field.

Finally, it is important to highlight any successes or achievements that have been accomplished. This can include successful projects or investments, as well as awards or recognition. This helps demonstrate to employers that the applicant is a competent and knowledgeable individual who is capable of succeeding in the role.

By following these key takeaways, a derivatives analyst can create a resume that stands out and helps them to get their foot in the door.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder