Writing a resume as a day-trader is unique in many ways. Not only does it require you to have specific financial and stock-trading knowledge, but also strong communication, negotiation, and analytical skills. Day traders are responsible for making decisions that can have a major financial impact, so it’s important to include these skills on your resume. This guide will provide an overview of what to include in a day trader resume, as well as examples to help you craft an impactful resume.

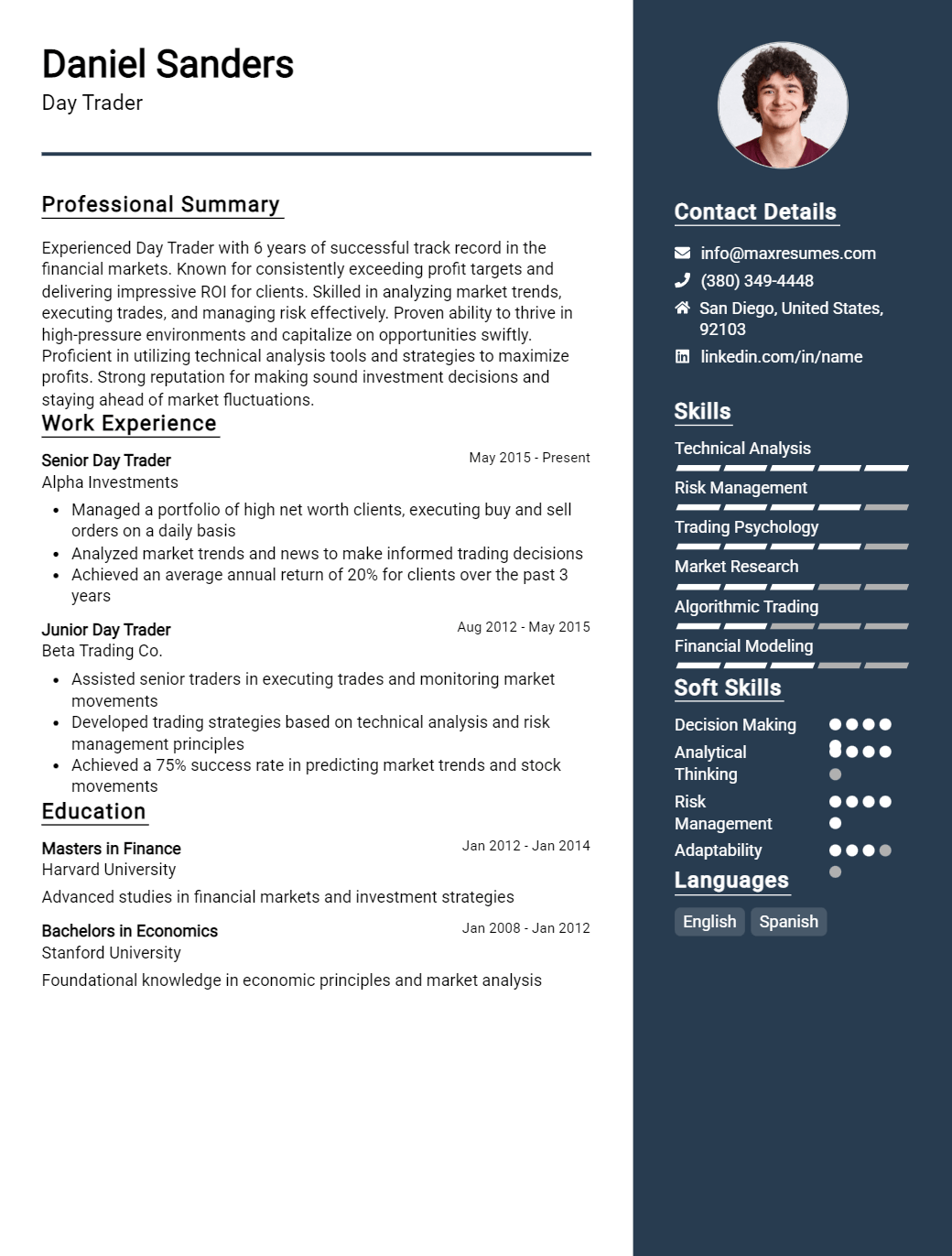

Day Trader Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Day Trader Resume Examples

John Doe

Day Trader

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am an experienced day trader with a passion for the financial markets. I have an excellent track record of buying and selling stocks, derivatives, bonds, and other financial instruments to maximize profits. My core skills include risk management, market analysis, and the ability to identify attractive trading opportunities. I have a strong background in trading and have been successful in making successful trades in volatile markets. I have a strong knowledge of the different types of financial instruments and am comfortable with a variety of trading strategies.

Core Skills:

- Risk Management

- Market Analysis

- Trading Strategies

- Interpretation of Financial Data

- Financial Instrument Knowledge

- Execution of Trades

Professional Experience:

- Day Trader at ABC Trading Company – 2012 to Present

- Monitor stock market movements and identify attractive trading opportunities

- Execute trades using options, futures, and other financial instruments

- Analyze financial data, assess risk levels and develop trading strategies

- Monitor open positions and take appropriate action to protect profits

- Conduct research to evaluate new markets and trading opportunities

Education:

- Bachelor of Business Administration, XYZ University – 2011

Day Trader Resume with No Experience

Recent college graduate with strong analytical and problem solving skills, looking to become a Day Trader with no prior experience. Possess a strong interest in the financial markets, with a good understanding of the trading process and its associated risks. Skilled in leveraging technology to achieve optimal performance in the market.

Skills:

- Strong analytical and problem- solving abilities

- Excellent understanding of the trading landscape and process

- Ability to make timely decisions and act on them

- In- depth knowledge of financial regulations and compliance

- Proficient in the use of trading platforms and software

- Ability to identify trading opportunities

Responsibilities:

- Analyze and monitor local and international markets for potential trading opportunities

- Perform technical and fundamental analysis on the stocks, currencies, commodities and other assets

- Execute trades in accordance with the pre- determined trading strategies

- Keep up- to- date with the latest financial news and market developments

- Ensure that all trades are executed in compliance with the regulations and policies

- Monitor and review the performance of the portfolio and make adjustments to optimize returns

Experience

0 Years

Level

Junior

Education

Bachelor’s

Day Trader Resume with 2 Years of Experience

I am a driven and ambitious Day Trader, with two years of experience in the financial industry. My passion for the stock market and trading puts me in a great position to provide consistent profits for my clients. I have a strong understanding of financial analysis, market indicators, and strategies, allowing me to make informed decisions when it comes to trading. I am highly attuned to global economic trends, allowing me to recognize the potential opportunities quickly and accurately. I am highly organized, efficient and motivated, and I bring a positive attitude to the workplace.

Core Skills:

- Financial Analysis

- Market Indicators & Strategies

- Global Economic Trends

- Risk Management

- Trading Platforms

- Portfolio Management

- Research & Development

- Attention to Detail

- Organization & Time Management

Responsibilities:

- Monitor and analyze market trends to determine trading opportunities

- Develop strategies to ensure profitable trades

- Execute trades in accordance with risk management strategies

- Execute buy/sell orders on various exchanges

- Monitor and analyze portfolio performance

- Research new trading opportunities

- Utilize financial analysis and research to identify trading opportunities

- Keep up to date with the latest market news and events

- Monitor and control risk levels with effective risk management strategies

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Day Trader Resume with 5 Years of Experience

I am a highly- motivated and knowledgeable Day Trader with 5 years of experience in actively trading on the stock market. I have a passion for upkeeping with market trends to maximize success within the day trading sector. My in- depth knowledge of investments and the financial market allow me to make smart and profitable investments. My ability to develop sound strategies, make well- informed decisions, and manage risk effectively has allowed me to be successful in this industry.

Core Skills:

- Financial market analysis

- Strategic planning

- Risk assessment

- Data analysis

- Investment portfolio management

- Strong communication skills

Responsibilities:

- Perform daily analysis of financial markets and make trades accordingly

- Develop sound strategies for profit maximizing and risk mitigation

- Manage a portfolio of investments to maximize return on investments

- Conduct research and stay up- to- date on market trends

- Assess risk associated with investments

- Analyze financial market data to make informed decisions

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Day Trader Resume with 7 Years of Experience

Highly- motivated and detail- oriented Day Trader with 7 years of experience in the Financial Markets. Proven ability to efficiently analyze financial data and make informed decisions quickly. Adept at trading a wide variety of financial instruments, developing trading strategies and effectively managing risk. Track record of building successful relationships with clients by providing superior customer service.

Core Skills:

- Financial Analysis

- Technical Analysis

- Trading Strategies

- Risk Management

- Client Relations

- Customer Service

Responsibilities:

- Evaluate financial markets, spot opportunities and make informed decisions to maximize returns on investments.

- Develop trading strategies and risk management systems to ensure profitable trades.

- Execute trades and manage positions in a timely manner.

- Analyze financial data to identify trends and make predictions.

- Maintain accurate records of all transactions and investments.

- Provide superior customer service to build strong relationships with clients.

- Stay up to date on market trends and industry regulations.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Day Trader Resume with 10 Years of Experience

A motivated and experienced day trader with 10+ years in both institutional and private trading. Possesses a strong quantitative background and excellent analytical, communication and time management skills. Proven track record of successful investments in the stock markets, options trading, and other financial instruments. Possesses an in- depth knowledge of market trends and analysis, as well as a keen eye for risk management and maximizing returns.

Core Skills:

- Sound knowledge of economic and market principles

- Extensive experience in day trading and financial instruments

- Excellent negotiation and communication skills

- Strong understanding of market analysis and trends

- Proficient in trading platforms and financial software

- Good understanding of risk management

- Proven ability to maximize returns on investments

- Proficiency in mathematics and quantitative analysis

Responsibilities:

- Analyzing financial data and trends in the stock market

- Making quick and accurate trading decisions

- Executing trades on behalf of clients

- Developing and implementing trading strategies

- Researching and assessing potential investments

- Monitoring market conditions and responding quickly to changes

- Negotiating and executing agreements with clients

- Keeping abreast of the latest news and developments in the financial markets

- Assessing and managing risk associated with investments

- Creating and managing portfolios for clients

- Working within established risk tolerance guidelines

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Day Trader Resume with 15 Years of Experience

Experienced day trader with over 15 years of experience in the stock market. Utilizing technical analysis and fundamental analysis to make informed trading decisions. Skilled at navigating multiple trading platforms and managing multiple trading accounts. Experienced in monitoring market news, analyzing financial information, and utilizing data analysis tools to identify potential trading opportunities.

Core Skills:

- Technical Analysis

- Fundamental Analysis

- Risk Management

- Data Analysis

- Market Research

- Trading Strategies

- Trading Platforms

- Portfolio Management

Responsibilities:

- Develop and execute trading strategies for long and short term investments.

- Analyze financial data to identify potential trading opportunities.

- Research and monitor stock market news and company financials.

- Execute trades based on technical analysis and fundamental analysis.

- Monitor and manage multiple trading accounts.

- Utilize data analysis tools to identify market trends and trading signals.

- Develop risk management strategies to minimize losses.

- Adjust portfolio allocations to maximize returns.

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Day Trader resume?

A Day Trader resume should include the following information:

- Relevant Experience: Outline relevant experience in day trading, such as any prior positions held in the financial field, or any experience trading stocks and commodities.

- Education: Include details about any educational qualifications related to day trading, such as a degree in finance or economics.

- Technical Skills: Describe any technical skills that may be relevant, such as familiarity with trading platforms, software and analytics tools.

- Trading Strategies: Describe any strategies and techniques employed to identify and execute profitable trades.

- Communication Skills: Demonstrate strong communication skills and the ability to work well with other traders, financial advisors, and brokers.

- Results: Include any notable performance results obtained during trading, such as positive return on investments, or successful trades.

- Awards and Accolades: List any awards or accolades earned while trading.

- Certifications: Include any certifications related to day trading, such as a Certified Financial Analyst designation.

- Professional Affiliations: Demonstrate any professional affiliations related to the financial field, such as membership in the National Association of Day Traders.

What is a good summary for a Day Trader resume?

A day trader resume should have a clear, concise summary that outlines the job seeker’s qualifications, experience, and areas of expertise. The summary should include a brief overview of the job seeker’s experience as a day trader, as well as any special skills, certifications, and qualifications related to the day trading profession. Additionally, the summary should indicate the job seeker’s technical expertise, including proficiency in software programs, financial analysis, and risk management. Finally, the summary should highlight any unique personal qualities or traits that might be beneficial to the day trader position. A well-crafted summary can help the job seeker stand out in a competitive field of day traders.

What is a good objective for a Day Trader resume?

A day trader resume should demonstrate knowledge of the financial markets, technical and analytical skills, and a commitment to professionalism. When crafting an objective statement for a day trader resume, focus on the essential qualities that make a successful day trader.

- Highlight your experience in day trading, with a particular emphasis on technical analysis and market understanding.

- Demonstrate your proficiency with technical indicators, charting software, and market analysis tools.

- Showcase your ability to stay organized and prepared in fast-paced trading environments.

- Mention your dedication to staying up to date with market trends and news.

- Emphasize your commitment to maintaining a high degree of professionalism.

- Describe your ability to manage risk, set goals, and remain focused on achieving them.

- Showcase your willingness to remain open to new ideas and strategies.

How do you list Day Trader skills on a resume?

Day trading is a career path that requires a certain set of skills to be successful. When listing your day trader skills on a resume, it is important to be specific and demonstrate that you have the knowledge and experience necessary to be successful. Here are some of the key skills employers are looking for when recruiting a day trader:

- Technical Analysis: Technical analysis is the process of analyzing historical price movements of a security in order to predict its future movements. Day traders need to be well-versed in technical analysis, including recognizing patterns and indicators.

- Risk Management: Day trading is a risky endeavor and it is important for day traders to understand how to manage risk in order to minimize losses. Risk management skills include understanding market volatility and how to set appropriate stop-loss and take-profit levels.

- Trading Psychology: Day trading involves the ability to make sound decisions quickly and with confidence. A day trader needs to be able to remain calm and composed during times of stress and be able to handle difficult market conditions.

- Regulation Knowledge: Regulations are constantly changing in the financial markets and day traders must stay up-to-date on the latest rules and regulations. Knowledge of the rules and regulations will help to ensure compliance and minimize risks.

- Time Management: Day trading requires the ability to quickly assess the markets and make decisions in a timely manner. Time management skills are essential for day traders in order to take advantage of the best trading opportunities.

What skills should I put on my resume for Day Trader?

Are you looking to land a job as a day trader? Having the right skills on your resume will help you get noticed. Here are some of the key skills you should include on your resume:

- Market Knowledge: Day traders need to have a good understanding of the stock market and how it works. Include knowledge of trading strategies, financial instruments, and market terminology.

- Technical Analysis: Being able to read stock charts and identify trends is important for day traders. Showing proof of your technical analysis skills will help you stand out.

- Risk Management: Day traders need to be able to manage risk in real time. Demonstrate your ability to manage risks and make sound decisions in rapidly changing markets.

- Discipline: Discipline is key when it comes to day trading. Show potential employers that you have the discipline to maintain trading rules and stick to your trading plan.

- Research Skills: Being able to quickly and accurately research stocks and financial news is essential for day traders. Make sure to highlight your research skills on your resume.

- Attention to Detail: Keeping track of multiple stocks at once requires intense attention to detail. Show employers that you can pay close attention to the market and make accurate trades.

These are some of the skills that you should focus on when building your day trader resume. Make sure to include any relevant skills that you have to show potential employers that you are the right person for the job.

Key takeaways for an Day Trader resume

Day trading is a highly competitive profession that requires a great deal of preparation and foresight. As such, having a strong resume is essential if you want to stand out from the competition.

When crafting your Day Trader resume, there are some key takeaways to keep in mind. Here are some of the most important points to consider:

- Make sure to highlight any experience or qualifications you have which are relevant to day trading. This might include any specialized knowledge you have of the markets, or your success rate with past trades.

- Demonstrate your understanding of the financial markets and trading strategies. Highlight any courses or other training you’ve taken which may help you succeed as a Day Trader.

- Showcase your communication skills. Day trading involves working with a wide variety of people, so being able to effectively communicate and collaborate is essential.

- Demonstrate your ability to handle stress and make quick decisions. Day trading requires you to react quickly to changing market conditions, so be sure to emphasize any experiences which showcase your ability to do this.

- Showcase your ability to stay organized. Day trading requires you to track a variety of data and information, so it’s important to be able to stay organized and on top of things.

By incorporating these key takeaways into your Day Trader resume, you’ll be well on your way to impressing potential employers. Good luck with your job search!

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder