Writing a resume for a credit union teller position is no easy feat. It requires a unique combination of experience and skill, as well as an ability to communicate and express those skills effectively. Your resume must be able to succinctly convey what sets you apart from the competition and demonstrate why you’re the best choice for the job. This guide provides specific advice and examples for writing an effective credit union teller resume, covering everything from formatting and content to tips and tricks. You’ll gain an understanding of how to make your resume stand out and secure your dream job.

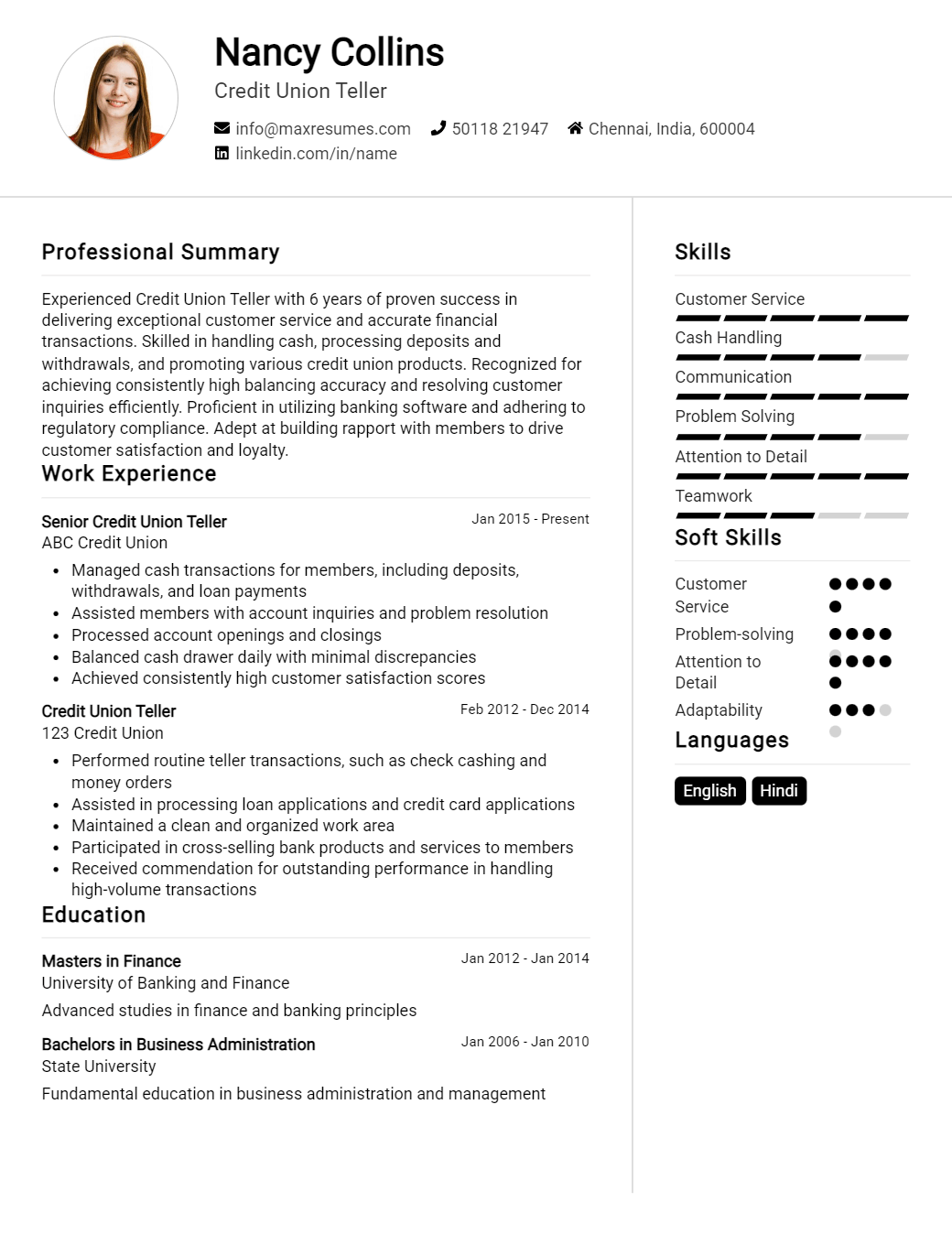

Credit Union Teller Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Credit Union Teller Resume Examples

John Doe

Credit Union Teller

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am a highly motivated credit union teller with a strong background in customer service and financial services. I am organized, detail- oriented and have excellent communication and problem solving skills. I have over five years of experience in cash handling and customer service in a financial institution, as well as experience in customer service in other industries. I am knowledgeable in all areas of credit union services, including loan origination, collections, new accounts, and general customer service. I am committed to providing exceptional customer service and have a strong commitment to building loyal customer relationships.

Core Skills:

- Professional customer service

- Cash handling

- Financial calculations

- Loan origination

- Collections

- New account opening

- Problem solving

- Telephone etiquette

- Knowledge of credit union services

Professional Experience:

- Credit Union Teller; ABC Credit Union; 2014 – Present

- Responsible for providing exceptional customer service, cash handling, loan origination, collections and new accounts openings

- Performed financial calculations for customers

- Processed deposits, withdrawals, payments, and transfers

- Maintained accuracy of daily transactions

- Resolved customer inquiries and complaints

- Promoted additional credit union products and services

Education:

- Bachelor of Science in Business; ABC University; 2012 – 2014

- Associate of Arts in Business; XYZ College; 2010 – 2012

Credit Union Teller Resume with No Experience

Recent college graduate passionate about providing excellent financial services to customers. Possesses strong communication skills and a keen attention to detail. Looking to leverage education and training to excel as a Credit Union Teller.

Skills

- Knowledge of financial services and products

- Cash handling experience

- Proficient in Microsoft Office

- Excellent customer service skills

- Detail- oriented

- Ability to maintain confidentiality

Responsibilities

- Greet and assist customers with banking transactions.

- Balance cash, checks, and vouchers throughout the day.

- Process deposits, withdrawals, transfers, and loan payments.

- Answer customer inquiries and provide accurate information.

- Assist with opening and closing of the credit union.

- Assist customers with ATM and debit card transactions.

- Process checks, money orders, and other payment forms.

- Follow bank policies and procedures.

- Maintain confidentiality of customer information at all times.

Experience

0 Years

Level

Junior

Education

Bachelor’s

Credit Union Teller Resume with 2 Years of Experience

A highly organized and reliable Credit Union Teller with two years of experience providing excellent customer service and developing relationships with members. Possesses excellent communication and interpersonal skills and is able to work independently or as part of a team. Proficient in Microsoft Office and Excel, as well as knowledgeable of various banking software programs.

Core Skills:

- Excellent customer service

- Proficiency in Microsoft Office and Excel

- Strong communication and interpersonal skills

- Detail- oriented

- Able to work independently and as part of a team

Responsibilities:

- Greet and assist members with transactions and questions

- Process withdrawals, deposits, transfers, and loan payments

- Issue ATM and debit/credit cards

- Cross sell products and services

- Balance cash drawer

- Verify member identification

- Maintain customer confidentiality

- Resolve customer disputes

- Provide exceptional customer service

- Answer questions and provide information

- Ensure compliance with banking policies and procedures

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Credit Union Teller Resume with 5 Years of Experience

A dynamic and experienced Credit Union Teller with more than 5 years of experience in providing exceptional service in financial institutions. Highly organized, detail and results- oriented with a strong customer service background. Capable of handling and resolving customer inquiries in a professional manner. Possess excellent communication skills, both verbal and written and the ability to deal with difficult customer situations.

Core Skills:

- Knowledge of banking and credit union operations

- Customer service and problem solving

- Cash handling and counting

- Mathematical and accounting skills

- Computer and software literacy

- Thoroughness and accuracy

- Strong organizational and multitasking skills

Responsibilities:

- Greet customers warmly and provide professional service

- Assist customers with their banking needs

- Process deposits, withdrawals, and loan payments

- Handle cash, check and credit transactions

- Balance the daily transactions

- Provide accurate financial advice to clients

- Maintain confidentiality of customer information

- Resolve customer complaints and inquiries

- Assist with opening and closing of accounts

- Ensure compliance with banking regulations

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Credit Union Teller Resume with 7 Years of Experience

Highly motivated Credit Union Teller with seven years of progressive experience in the banking industry. Possess a strong working knowledge of banking regulations and standards, as well as customer service best practices. Skilled in cash handling, loan processing, financial transactions, and problem- solving. Experienced in developing and maintaining relationships with both customers and colleagues. Proven track record of delivering excellent service and exceeding customer expectations.

Core Skills:

- Cash Handling

- Loan Processing

- Financial Transactions

- Problem- Solving

- Developing Relationships

- Customer Service

- Banking Regulations

Responsibilities:

- Conducted financial transactions for customers, including deposits, withdrawals, transfers, and loan payments.

- Ensured accuracy and security of all financial transactions.

- Handled customer inquiries, banking issues, and complaints.

- Assisted customers in opening new accounts and completing banking forms.

- Researched and resolved customer issues in a timely and professional manner.

- Balanced cash drawer on a daily basis and submitted daily reports of transactions.

- Maintained a high level of customer service and professionalism at all times.

- Participated in ongoing training and development activities to stay abreast of new banking products and services.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Credit Union Teller Resume with 10 Years of Experience

I am an experienced Credit Union Teller with over 10 years’ experience providing exceptional customer service in a fast- paced, demanding banking environment. I possess strong communication, problem solving, and organizational skills, enabling me to quickly identify customer needs and promptly deliver accurate and courteous service. I have extensive knowledge of banking regulations, products, and services, and I am adept at accurately processing transactions and successfully upselling. I am committed to providing customers with an efficient and positive experience.

Core Skills:

- Customer service

- Cash handling

- Problem solving

- Regulatory compliance

- Product knowledge

- Upselling

- Transaction processing

- Communication

- Organizational

Responsibilities:

- Greet customers and manage their inquiries

- Verify customer identification and authenticate transactions

- Process deposits, withdrawals, transfers and payments

- Provide customers with information regarding account balances and products and services

- Process cash advances and loan payments

- Ensure adherence to banking regulations and security procedures

- Balance cash drawers daily

- Identify sales opportunities and cross- sell services

- Assist with account openings and closings

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Credit Union Teller Resume with 15 Years of Experience

Highly experienced Credit Union Teller with 15 years of experience in the financial sector. Deep understanding of providing excellent customer service in a timely and professional manner. Skilled in accurately processing various forms of financial transactions including deposits, withdrawals, and transfers. Experienced in identifying customer needs and offering appropriate solutions. Committed to positively contributing to achieving bank’s goals and objectives.

Core Skills:

- Excellent customer service skills

- Solid understanding of banking regulations and policies

- Proficient with computers and other banking systems

- Accuracy and attention to detail

- Ability to build customer rapport

- Strong interpersonal and communication skills

Responsibilities:

- Greet customers and answer questions regarding banking services

- Assist customers in opening new accounts

- Process bank deposits, withdrawals, and transfers

- Reconcile customer accounts

- Balance the teller drawer at the end of the day

- Issue cashier’s checks, money orders, and other banking forms

- Provide excellent customer service to resolve customer inquiries and complaints

- Follow banking regulations, policies, and procedures

- Cross- sell bank products and services

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Credit Union Teller resume?

A Credit Union Teller is a vital position in any credit union and resumes should include certain key elements in order to make a good impression. A successful resume should include:

- A professional summary that outlines your experience and qualifications

- A list of the tasks you have performed in past positions

- Education and certifications that demonstrate a commitment to the role

- Knowledge of banking regulations and compliance

- Ability to work with customers in a professional and courteous manner

- Expertise in cash handling and customer service

- Knowledge of how to use computer systems and software

- Experience with different types of banking operations

- Familiarity with various banking products and services

- Ability to communicate effectively with customers

- Ability to quickly and accurately process transactions

- Ability to identify discrepancies in customer accounts

- Ability to troubleshoot minor operational issues

- Ability to work independently and as part of a team

- Detail-oriented and able to perform multiple tasks simultaneously

What is a good summary for a Credit Union Teller resume?

A great summary for a Credit Union Teller resume should highlight the candidate’s experience and knowledge of banking operations and customer service. The summary should demonstrate the candidate’s ability to handle customer inquiries, manage financial transactions, and maintain accurate records. It should also emphasize the candidate’s commitment to maintaining a high level of customer service satisfaction. A good summary should also showcase any certifications or additional training the candidate may have in related fields. Additionally, the summary should demonstrate the candidate’s willingness to go the extra mile to ensure that customers are satisfied.

What is a good objective for a Credit Union Teller resume?

A Credit Union Teller is responsible for providing customer service to clients, processing financial transactions, and ensuring the safety and security of the credit union. Writing a resume objective is an important part of creating an effective resume. A good objective will help you stand out and catch the attention of a potential employer.

- Demonstrate proven customer service and problem-solving skills

- Utilize strong interpersonal and communication skills

- Displays strong attention to detail and accuracy when processing transactions

- Proficient in using financial management software

- Ability to work with a diverse population

- Excel in a fast-paced environment

- Committed to providing excellent customer service

- Work with other departments to ensure goals are met

- Accurately handle cash transactions and balance daily transactions

- Adhere to banking policies and procedures

- Maintain confidentiality of customer information

How do you list Credit Union Teller skills on a resume?

When writing your resume, it is important to include the skills and qualifications necessary to be a successful Credit Union Teller. Credit Union Tellers provide customer service and assist members with their banking needs, so it is critical for them to have excellent communication, problem-solving, and customer service skills. Below are some key Credit Union Teller skills that should be included on your resume:

- Excellent customer service: Credit Union Tellers should be friendly, patient, and helpful when dealing with members, while also maintaining confidentiality.

- Knowledge of banking operations: This includes the ability to process deposits, withdrawals, and other transactions, as well as explain the products and services the Credit Union offers.

- Cash handling experience: Credit Union Tellers should be experienced in handling large sums of cash and their related security procedures.

- Attention to detail: Credit Union Tellers must be able to accurately record transactions and review customer accounts for accuracy.

- Computer proficiency: Credit Union Tellers must be knowledgeable about using computer systems to process transactions, maintain customer accounts, and troubleshoot any issues that may arise.

- Interpersonal skills: Credit Union Tellers must be able to interact with members in a professional manner and handle any conflicts that may arise.

Including these skills and qualifications on your resume will show potential employers that you are a qualified Credit Union Teller and help you stand out from the competition.

What skills should I put on my resume for Credit Union Teller?

When applying for a position as a credit union teller, there are certain skills and qualifications that employers look for in potential candidates. Knowing which skills to put on your resume can help you stand out from other applicants and demonstrate to employers why you are the best fit for the job. Below are some of the key skills and qualifications to include on your resume when applying for a credit union teller position.

- Excellent customer service skills: As a teller, it is important to be able to interact effectively with customers and provide friendly and helpful service. Be sure to include any customer service-related experience you have on your resume.

- Cash handling experience: Credit union tellers need to be comfortable handling large amounts of money and performing basic math calculations. Any experience you have with cash handling, such as working in a retail environment, should be included on your resume.

- Banking experience: Employers often prefer to hire tellers with prior experience working in the banking industry. If you have any banking-related experience, be sure to include it on your resume.

- Knowledge of banking products: Tellers need to have an understanding of banking products and services, such as loans, deposits, and investments. Make sure to mention any knowledge you have of banking products in your resume.

- Attention to detail: As a teller, it is important to be able to pay close attention to detail and follow instructions carefully. Include any experience you have that demonstrates your attention to detail.

- Computer skills: In today’s banking environment, tellers are often required to use computers to process customer transactions. Be sure to include any computer-related skills on your resume, such as knowledge of MS Office, data entry, and software applications.

By including these key skills and qualifications on your resume, you can demonstrate to employers that you have the skills and experience they are looking for in a credit union

Key takeaways for an Credit Union Teller resume

When it comes to crafting your resume as a Credit Union Teller, it’s important to highlight the skills and experience that are most relevant to the role. Here are some key takeaways to consider when writing your resume:

- Focus on customer service: As a Credit Union Teller, you will be responsible for interacting with customers on a daily basis. Be sure to highlight your customer service skills and experience, such as your ability to provide excellent customer service and resolve customer complaints in a timely manner.

- Emphasize your financial skills: A successful Credit Union Teller must have a strong understanding of financial concepts, including banking products and services. Be sure to showcase your knowledge of the banking industry and your ability to accurately identify and process customer transactions.

- Demonstrate your cash handling skills: As a Credit Union Teller, you will be responsible for handling large sums of money. Make sure to list your experience with cash handling, including counting cash, making deposits and withdrawals, and reconciling cash drawers.

- Highlight your communication abilities: Successful Credit Union Tellers possess excellent communication skills. Be sure to include any experience you have with communicating with customers, preparing written responses, and resolving customer issues.

By using these key takeaways, you can craft a resume that will impress potential employers and demonstrate your qualifications as a Credit Union Teller.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder