Writing a resume for a Credit Risk Analyst position can be quite daunting. After all, when writing a resume for such an important position, you want to make sure all of your professional experience, qualifications and skills are effectively communicated. As such, it is important to know the right way to write a resume to ensure that you submit a resume that will get you noticed. In this guide, we will provide expert tips and structure to create a resume that will showcase your professional experience and qualifications to demonstrate your capabilities as a Credit Risk Analyst. Examples are also provided to give you an idea of how to structure your resume.

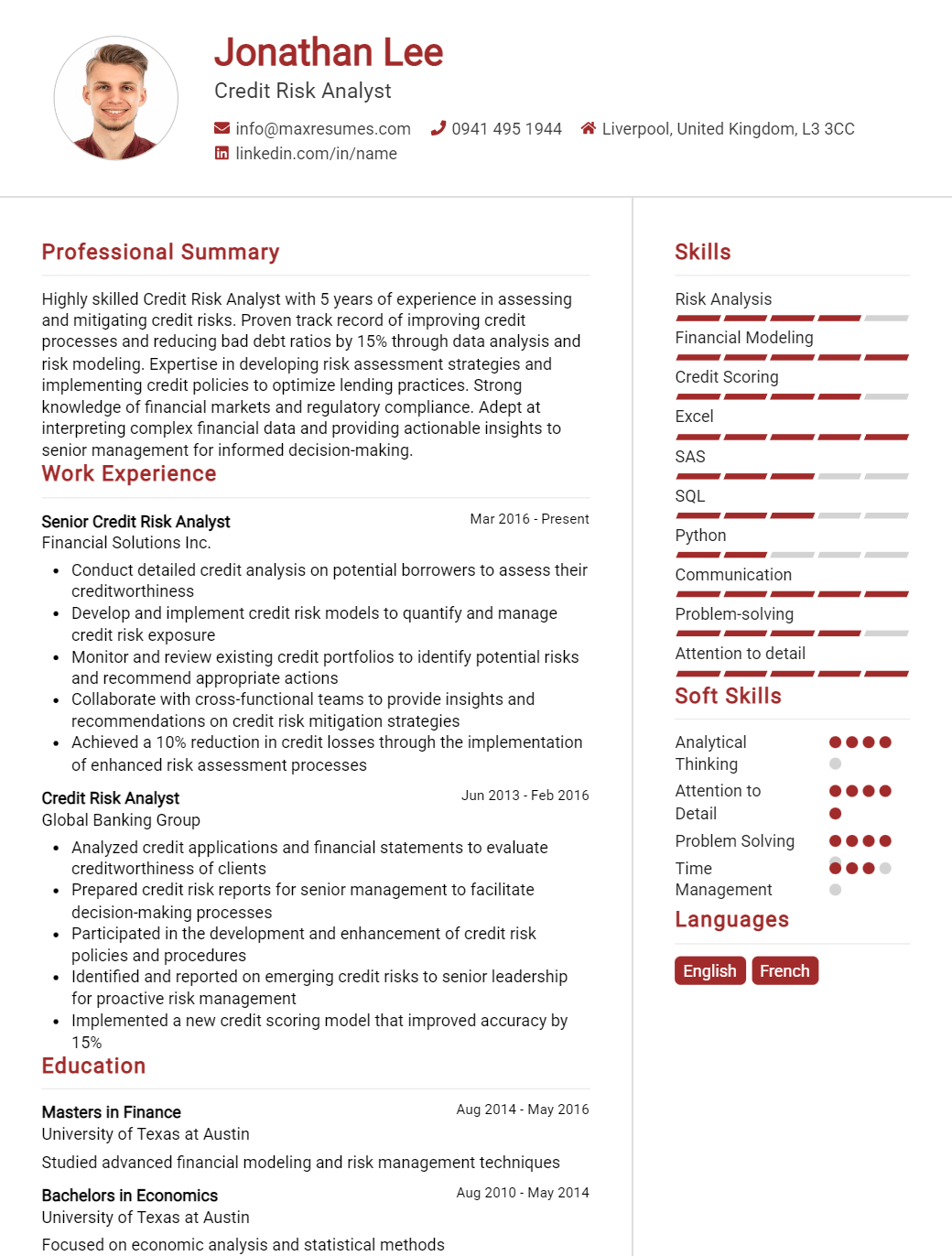

Credit Risk Analyst Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Credit Risk Analyst Resume Examples

John Doe

Credit Risk Analyst

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

I am an experienced Credit Risk Analyst with 5+ years of professional experience in the financial services industry. I have strong quantitative and analytical skills, advanced knowledge of credit risk management principles, and excellent communication and interpersonal skills. I am adept at analyzing financial statements, assessing the creditworthiness of customers, and developing risk management strategies. I am detail- oriented and have a proven ability to identify and mitigate credit risk.

Core Skills:

- Risk Analysis

- Credit Risk Management

- Financial Statement Analysis

- Data Analysis

- Quantitative Analysis

- Business Process Analysis

- Regulatory Compliance

- Credit Scoring

- Credit Portfolio Analysis

- Credit Policy Development

- Risk Mitigation

- Problem- Solving

Professional Experience:

Credit Risk Analyst, ABC Financial Services, 2019–Present

- Developed and implemented credit risk management strategies for consumer and commercial loan portfolios.

- Analyzed financial statements and credit reports to evaluate creditworthiness of customers and assess credit risk.

- Performed credit scoring and portfolio analysis to identify areas of risk.

- Developed and implemented credit policies and procedures in accordance with applicable regulations.

- Recommended risk mitigation strategies to reduce potential losses.

- Monitored changes in credit risk and proactively identified potential issues.

Credit Risk Analyst, XYZ Bank, 2016–2019

- Conducted detailed analysis of customer credit data to assess credit risk.

- Developed, implemented, and monitored credit risk management strategies and policies.

- Analyzed financial statements and credit reports to evaluate creditworthiness of customers and assess credit risk.

- Monitored changes in credit risk and proactively identified potential issues.

- Performed customer and transaction monitoring to ensure compliance with regulations.

Education:

Bachelor of Science in Finance, University of XYZ, 2016

Credit Risk Analyst Resume with No Experience

Recent college graduate with a strong analytical background and financial acumen seeking to leverage knowledge and skills in credit risk analysis.

Skills

- Strong Analytical Skills

- Financial Acumen

- Attention to Detail

- Problem Solving

- Time Management

- Research

- Data Analysis

- Data Validation

- Risk Identification

- Risk Mitigation

- Risk Management

Responsibilities

- Conduct credit risk assessments for potential and existing clients

- Perform financial analysis to identify any potential credit risk

- Analyze financial statements and other relevant documents to assess credit worthiness

- Identify and evaluate credit risks and provide recommendations for risk mitigation

- Develop and maintain credit policies and procedures

- Monitor credit risk levels and provide recommendations for improvement

- Maintain accurate and up- to- date records of credit risk assessments

Experience

0 Years

Level

Junior

Education

Bachelor’s

Credit Risk Analyst Resume with 2 Years of Experience

Highly experienced and motivated Credit Risk Analyst with 2 years of experience in financial and banking analysis. Expert in understanding banking regulations and credit risk management. Proven ability to identify and mitigate risk and increase profitability. Adept at analyzing financial statements, credit reports, and other business documents to identify potential issues. Possess a deep understanding of financial instruments, banking practices, and risk management strategies.

Core Skills:

- Credit Analysis

- Financial Risk Management

- Risk Mitigation

- Regulatory Compliance

- Financial Modeling

- Data Analysis

- Business Development

- Financial Forecasting

- Problem Solving

Responsibilities:

- Performed credit analysis of new and existing accounts, including analyzing data related to creditworthiness, financial performance, and risk potential

- Developed financial models to forecast expected losses and calculate capital requirements for risk mitigation

- Monitored changes in banking regulations, identified potential risks, and proposed strategies for compliance

- Analyzed financial statements and credit reports to identify potential issues and proposed countermeasures

- Evaluated loan applications, initiated credit investigations, and determined the creditworthiness of borrowers

- Recommended financial instruments, products, and services to increase profitability and minimize losses

- Collaborated with the sales team to identify potential business development opportunities and formulate strategies for successful execution

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Credit Risk Analyst Resume with 5 Years of Experience

An experienced and highly analytical Credit Risk Analyst with 5 years of experience from diverse banking and financial services backgrounds. Possesses a deep understanding of the principles and practices for assessing and managing risk and a proven track record of successfully applying credit risk analysis techniques. Highly skilled in creating complex financial models, interpreting and analyzing credit data, and developing credit strategies.

Core Skills:

- Risk Analysis and Management

- Credit Risk Modeling

- Regulation and Compliance

- Financial Modeling

- Data Analysis

- Credit Policies and Procedures

- Report Writing

- Relationship Management

Responsibilities:

- Conduct credit risk analyses using a variety of techniques, including financial statement analysis, cash flow evaluation, and Qualitative Assessment to assess risk and approving or denying credit requests

- Develop, maintain, and review complex financial models for risk identification and management

- Monitor customer credit risk and prepare timely reports on leveraged and non- leveraged credit portfolios

- Ensure compliance with all relevant regulations, policies, and procedures

- Review and recommend improved credit policies, procedures, and limit structures

- Prepare materials and present client credit decisions to senior management

- Develop and maintain strong relationships with clients and internal business partners

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Credit Risk Analyst Resume with 7 Years of Experience

A highly motivated Credit Risk Analyst with 7 years of experience in the banking and finance sector. Possessing strong technical and analytical skills with a deep understanding of financial risk and loss exposure. Experienced in utilizing data analysis and quantitative skills to identify, assess, and measure exposure in order to develop effective and efficient risk management strategies. Proven ability to develop strong relationships with internal and external stakeholders.

Core Skills:

- Financial Risk Analysis

- Regulatory Compliance

- Data Analytics

- Quantitative Analysis

- Loan Underwriting

- Credit Analysis

- Portfolio Risk Management

- Risk Identification

- Advanced Excel

Responsibilities:

- Analyzing and evaluating the creditworthiness of clients for loan applications

- Developing credit scorecards, risk models and simulations to measure and limit exposure to risk

- Monitoring financial performance of portfolios, assessing credit risk trends and providing appropriate recommendations

- Conducting financial reviews to identify and analyze any potential risks

- Performing research and analyzing financial data sets to assess potential credit losses

- Managing portfolios within established risk limits to ensure compliance with regulations

- Providing timely, accurate, and actionable credit risk reports to senior management

- Developing and implementing credit policies, procedures, and guidelines

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Credit Risk Analyst Resume with 10 Years of Experience

A highly experienced Credit Risk Analyst with over 10 years of experience in the banking and finance industry. Skilled in analyzing and evaluating credit risk in the underwriting, syndication, and trading of complex loans in the capital markets, as well as developing and implementing modular credit risk models. Experienced in using different strategies and tools to mitigate risk exposure and ensure credit stability. Proven ability to collaborate with stakeholders to ensure the delivery of high quality products and services.

Core Skills:

- Credit Risk Analysis

- Financial Modeling and Valuation

- Risk Mitigation Strategies

- Loan Documentation

- Regulatory Compliance

- Credit Portfolio Management

- Credit Risk Review and Reporting

- Financial Analysis and Reporting

- Risk Management Strategies

- Project Management and Leadership

Responsibilities:

- Developed and implemented credit risk models to identify and mitigate risk exposure.

- Analyzed and assessed credit risk in the underwriting, syndication, and trading of complex loans.

- Assisted in preparing credit memorandums and term sheets for loans.

- Facilitated loan reviews and conducted comprehensive risk analysis.

- Collaborated with stakeholders to ensure the delivery of high quality products and services.

- Developed and implemented risk management strategies and policies.

- Monitored credit portfolio and ensured compliance with regulatory standards.

- Assisted in preparing financial analysis and risk reports.

- Led teams to complete projects on time and within budget.

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Credit Risk Analyst Resume with 15 Years of Experience

Highly experienced Credit Risk Analyst with 15 years of experience in evaluating the credit risk of customers and large scale investments. Excels in risk recognition, communication and data analysis while possessing a deep comprehension of debt and lending services. A strategic problem- solver that utilizes analytical skills to evaluate, assess and manage risk. Willing to apply expertise to drive successful operations and debt management.

Core Skills:

- Risk recognition

- Data analysis

- Debt management

- Credit risk evaluation

- Financial evaluation

- Business strategy

- Communication

- Problem solving

Responsibilities:

- Analyzing, evaluating and assessing customer’s credit risk

- Evaluating large scale investments and their associated risk

- Establishing and developing credit risk strategies

- Providing meaningful feedback and financial advice to customers

- Developing and implementing policies and procedures to ensure efficient credit risk management

- Analyzing and reviewing financial data for reports

- Assisting in the development and implementation of debt management strategies

- Developing and managing internal and external relationships to ensure optimal debt management

- Monitoring and analyzing market trends to identify new opportunities and/or risks

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Credit Risk Analyst resume?

A Credit Risk Analyst’s resume can be a good tool for demonstrating your qualifications and experience to potential employers. When crafting your resume, there are several key elements to consider.

- Professional Summary: A brief, but comprehensive, professional summary is essential for any resume. It should explain your experience in the field of credit risk analysis and demonstrate your understanding of the principles of risk management and credit analysis.

- Education: Include all relevant education, such as degrees and certifications, that you have obtained or are working toward. If you have completed any additional training or courses, list them here as well.

- Skills: Credit Risk Analysts rely on a variety of different skills to be successful. Highlight your ability to interpret and analyze financial statements, create financial models, and identify financial risk. Additionally, showcase your knowledge of credit policies and regulations, as well as your experience in developing and executing credit strategies.

- Work Experience: Detail any past jobs or internships that have given you experience in the credit risk analysis field. Include the job title, name of organization, and dates of employment, as well as a brief description of the duties performed.

- Professional Affiliations: List any professional organizations or associations that you are a member of or have held a leadership position in.

- References: Provide the contact information for three professional references who can vouch for your abilities and experience in the field.

By incorporating these elements into your resume, you can create a compelling document that will help you stand out to potential employers.

What is a good summary for a Credit Risk Analyst resume?

A successful Credit Risk Analyst resume should highlight a candidate’s ability to analyze financial data and make informed decisions. Particular emphasis should be placed on an individual’s skills in financial modeling, risk assessment and analysis, and credit analysis. Additionally, a good resume should also demonstrate an individual’s knowledge of banking regulations, banking applications, and financial reporting. Finally, the resume should emphasize any previous experience in a banking or financial environment, such as previous work as a loan officer or analyst.

What is a good objective for a Credit Risk Analyst resume?

A Credit Risk Analyst is a financial professional who evaluates the creditworthiness of potential borrowers and oversees credit risk management practices. They are often employed by banks, financial institutions, and other businesses. Having a good objective on your credit risk analyst resume can help you get noticed by employers and show them why you are a great fit for the job.

Here are some of the objectives you can use on your credit risk analyst resume:

- To leverage my experience in financial analysis and risk management to help a company make sound credit decisions.

- To utilize my strong analytical and problem-solving skills to evaluate potential credit risks and mitigate them.

- To help a company reduce its financial losses due to bad credit risks by effectively assessing and managing them.

- To leverage my expertise in financial analysis and credit risk management to help a company make informed lending decisions.

- To contribute to the growth and success of an organization by effectively evaluating and managing credit risks.

How do you list Credit Risk Analyst skills on a resume?

Credit Risk Analysts are valuable members of a financial institution’s risk management team, assessing the risk of issuing credit to customers and developing strategies to reduce risk. A well-crafted resume should accurately reflect the depth of an individual’s Credit Risk Analyst experience. To ensure you create a resume that will stand out amongst the competition, include the following skills:

- Credit Risk Modeling: Experienced in developing, implementing, and validating credit risk models, such as the Basel I, II, and III capital adequacy framework, VAR, and PD/LGD models.

- Regulatory Compliance: Knowledgeable of credit risk regulations and their application to a financial institution’s risk management processes.

- Risk Assessment: Skilled in analyzing and evaluating customer creditworthiness, including reviewing financial statements, evaluating credit histories, and determining appropriate credit limits.

- Financial Analysis: Experienced in performing financial analysis on loan portfolios, developing risk mitigation strategies, and conducting stress tests.

- Data Management: Adept at using data management systems to track, analyze, and report on credit risk.

- Risk Mitigation: Proven ability to develop and implement strategies to reduce risk in loan portfolios.

- Communication: Able to effectively communicate risk management policies and procedures to all stakeholders.

By highlighting these Credit Risk Analyst skills on your resume, you will demonstrate that you possess the knowledge and expertise needed to be a successful Credit Risk Analyst.

What skills should I put on my resume for Credit Risk Analyst?

Once you have decided to start pursuing a career in credit risk analysis, it’s important to understand what to include on your resume to make yourself stand out as a candidate. A strong credit risk analyst resume should not only demonstrate your technical abilities, but also highlight your problem-solving, communication and organizational skills. Below are some of the key skills to consider adding to your resume:

- Mathematical & Statistical Knowledge: Credit risk analysts use mathematical and statistical principles to analyze and assess risk. Your resume should include knowledge of probability and statistical theories, financial modeling, and the ability to use quantitative methods for risk assessment.

- Data Analysis: Credit risk analysts must be able to analyze large amounts of data to assess the risk associated with a loan. Your resume should include skills in mining and analyzing data, understanding of data management systems, and proficiency in programming languages such as Python and R.

- Risk Management: Credit risk analysts are responsible for designing processes that minimize or eliminate risk. Your resume should include an understanding of risk management principles and experience in implementing risk management strategies.

- Communication Skills: As a credit risk analyst, you will need to be able to communicate complex concepts to other members of the team, as well as senior management. Your resume should demonstrate strong written and verbal communication skills.

- Problem-Solving: Credit risk analysts must be able to identify potential problems and devise solutions to mitigate risk. Your resume should demonstrate your ability to think critically and make decisions in difficult situations.

By including these skills on your resume, you can demonstrate to potential employers that you possess the knowledge and experience necessary to excel as a credit risk analyst.

Key takeaways for an Credit Risk Analyst resume

When you are an aspiring Credit Risk Analyst, it is important to highlight your qualifications and experience in your resume. It is equally important to showcase your technical knowledge and experience in the field of credit risk analysis. Here are some key takeaways to keep in mind when creating a resume for this position.

First, make sure to include all relevant experience and credentials that demonstrate your proficiency in the field of credit risk analysis. Your resume should list any certifications, degrees, or training in the area of credit risk analysis that you may have received. Highlight any specific projects or initiatives you have been involved in that demonstrate your effectiveness and ability to manage and analyze credit risk.

Second, emphasize the technical skills that you have developed in the field of credit risk analysis. These skills could include financial modeling, data analytics, quantitative analysis, and programming. It is also important to emphasize any experience in developing credit risk strategies and policies.

Third, make sure to include any specific software applications or tools you have used in your role as a Credit Risk Analyst. This could include software such as SAS, Python, and Excel.

Fourth, highlight your attention to detail and the ability to interpret complex data and make sound decisions. Your resume should demonstrate that you have the ability to effectively analyze credit risk and make decisions based on data.

Finally, emphasize your communication and interpersonal skills. As a Credit Risk Analyst, you will need to be able to clearly communicate your analysis and findings to key stakeholders.

By following these key takeaways, you will be able to create an effective resume that will demonstrate your qualifications and experience in the field of credit risk analysis.

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder