Writing an effective resume for a credit manager position is an essential part of the job search process. Credit managers are responsible for a variety of tasks including managing the credit limits of customers, processing payments, and monitoring the creditworthiness of customers. In order to stand out from other candidates, it is important to create a resume that highlights your relevant experience and qualifications. This guide is designed to provide insight on how to craft a winning credit manager resume, from creating a targeted summary to showcasing your expertise with key words. With the help of this guide and some of the provided examples, you can create a resume that will make you stand out from the competition.

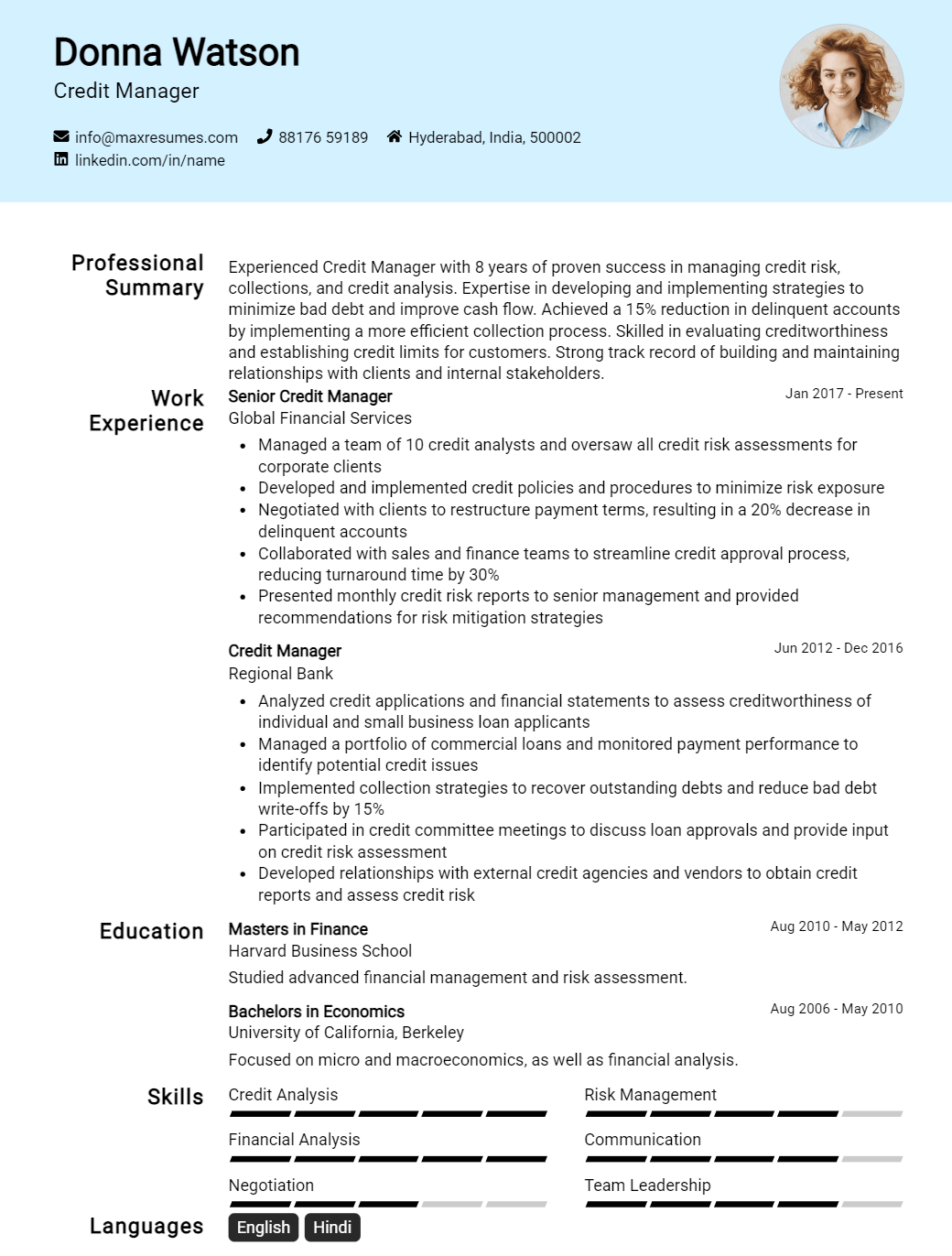

Credit Manager Resume Sample

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples.

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Credit Manager Resume Examples

John Doe

Credit Manager

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: john.doe@email.com

A credit manager with more than 5 years of experience in the banking and finance industry, I have a strong knowledge of credit policies, procedures, and regulations, as well as a proven record managing large portfolios of consumer and commercial credit accounts. I am highly organized, detail oriented, and have a keen eye for risk assessment. My ability to think strategically and execute effectively has enabled me to consistently meet and exceed goals. I am looking to use my expertise to take on new challenges and grow with a company.

Core Skills:

- Credit Risk Assessment

- Financial Analysis

- Credit and Portfolio Management

- Regulatory Compliance

- Credit Policies & Procedures

- Credit Underwriting

- Account Administration

- Team Leadership

Professional Experience:

- Credit Manager, ABC Bank – 2015- 2020

Managed a team of 8 credit analysts responsible for loan processing, underwriting and portfolio management of consumer and commercial credit accounts.

Developed and implemented credit policies, procedures and guidelines in accordance with regulatory compliance.

Performed credit risk analysis and provided recommendations on loan structure and interest rates to maximize risk- adjusted returns.

Analyzed financial statements, credit reports, and other documents to make informed credit decisions. - Credit Analyst, XYZ Bank – 2013- 2015

Reviewed loan documentation and credit applications to ensure accuracy and completeness.

Analyzed consumer and commercial credit accounts to assess creditworthiness and credit risk.

Assisted senior credit manager with portfolio management of consumer and commercial accounts.

Performed regular credit monitoring and reporting on portfolio performance.

Education:

- Bachelor of Science, Finance – ABC University – 2009- 2013

- Certified Credit Professional – XYZ Institute – 2013- 2014

Credit Manager Resume with No Experience

Recent college graduate looking to use organizational and problem- solving skills to excel in a credit manager role. Experienced in customer service and financial management through internships and part- time jobs.

Skills

- Strong analytical skills

- Attention to detail

- Highly organized

- Excellent verbal and written communication

- Proficient in Microsoft Office

- Proactive problem- solver

Responsibilities

- Manage customer credit and debt collection

- Analyze customer credit reports and financial information

- Develop and implement credit policies and procedures

- Monitor customer accounts for overdue payments and take appropriate action

- Maintain and update records of customer credit and debt

- Liaise with clients and internal teams to resolve any credit issues

- Identify and recommend ways to improve credit processes and procedures

- Provide timely and accurate financial information to management

- Prepare reports and presentations on credit activities

Experience

0 Years

Level

Junior

Education

Bachelor’s

Credit Manager Resume with 2 Years of Experience

A highly motivated and organized Credit Manager with over two years of experience in the banking and finance industry. Skilled in conducting financial analysis, assessing credit risk, and loan analysis. Good understanding of relevant regulations, policies and procedures, and ability to maintain effective relationship with lenders, customers, and colleagues. Possesses excellent communication and interpersonal skills, and the ability to manage multiple projects in a fast- paced environment.

Core Skills:

- Financial Analysis

- Credit Risk Analysis

- Loan Analysis

- Regulatory Compliance

- Relationship Management

- Project Management

- Interpersonal Skills

- Communication Skills

Responsibilities:

- Manage, organize, and assess credit risk on all loan operations

- Analyze and assess new and existing loan applications in line with loan approval process

- Develop and implement credit risk management strategies to reduce risk exposure

- Analyze financial statements and assess credit for loan approval

- Monitor credit limits and collateral values and review customer portfolios

- Maintain updated knowledge of government regulations and lending policies

- Monitor customer accounts, identify and investigate delinquent accounts

- Monitor loan performance and report to relevant stakeholders

Experience

2+ Years

Level

Junior

Education

Bachelor’s

Credit Manager Resume with 5 Years of Experience

I am an experienced Credit Manager with five years of experience in overseeing credit and financial operations. I have a deep knowledge of credit risk analysis and credit management, as well as a proven track record of managing high- volume loan portfolios and ensuring accuracy in loan documents. I have excellent communication and relationship management skills, as well as a high level of integrity, which allows me to develop strong working relationships with clients, lenders, and team members. My ability to analyze and interpret financial statements, as well as my problem- solving and decision- making skills, are integral in my successful management of credit and financial operations.

Core Skills:

- Credit Risk Analysis

- Financial Statement Analysis

- Loan Portfolio Management

- Client Relationship Management

- Problem Solving & Decision Making

- Loan Documentation Accuracy

- Team Collaboration & Leadership

Responsibilities:

- Oversee and coordinate credit and financial operations

- Analyze and interpret financial statements

- Analyze credit risks associated with loan portfolios

- Develop and maintain relationships with clients, lenders and internal teams

- Ensure accuracy in loan documents throughout the entire loan process

- Lead teams in developing and/or implementing credit management policies and procedures

- Develop and implement strategies to manage credit risk

- Resolve discrepancies or disputes regarding credit or financial operations

Experience

5+ Years

Level

Senior

Education

Bachelor’s

Credit Manager Resume with 7 Years of Experience

Results- oriented Credit Manager with 7 years of extensive experience in reviewing and evaluating credit applications to determine credit- worthiness. Experienced in developing credit policies and procedures, managing risk, and researching credit and financial information of potential clients. Adept in leading and motivating teams to meet performance targets. Outstanding communication, interpersonal, and problem- solving skills.

Core Skills:

- Credit Risk Management

- Financial Analysis

- Credit Policies and Procedures

- Risk Assessments

- Credit Reporting

- Team Leadership

- Customer Relationship Management

- Regulatory Compliance

Responsibilities:

- Developed and implemented credit policies and procedures to ensure efficient credit management

- Provided guidance and recommendations to the management team on credit- related issues and risks

- Analyzed and evaluated credit applications to determine credit- worthiness and approve or reject requests

- Monitored client portfolios and identified opportunities for risk mitigation

- Developed and maintained relationships with clients to facilitate the collection of credit payments

- Investigated and resolved customer credit disputes in a timely and professional manner

- Developed and maintained a credit information database and filing system

- Ensured compliance with local, state and federal regulations governing credit and lending activities.

Experience

7+ Years

Level

Senior

Education

Bachelor’s

Credit Manager Resume with 10 Years of Experience

A highly experienced and successful Credit Manager with 10+ years of experience in implementing and managing high- level credit portfolios and operations. Possessing strong organizational, analytical and problem- solving skills coupled with an impressive track record for improving customer service, reducing overdue debt and increasing payments collection. A highly motivated and confident individual who is comfortable in dealing with stakeholders at all levels and able to work to tight deadlines in a pressured environment.

Core Skills:

- Excellent knowledge of credit management and control

- Superior customer service and communication skills

- Highly organized and able to plan and prioritize workloads

- Proven ability to identify risks and take proactive measures

- Ability to assess, manage and monitor credit portfolios

- Skilled negotiator and decision- maker

- Strong knowledge of credit legislation and regulations

- Excellent numerical and financial analysis skills

Responsibilities:

- Reviewing credit applications, evaluating credit risk and making recommendations

- Maintaining up- to- date records of credit data and customer accounts

- Monitoring and managing overdue debt, including chasing payments

- Negotiating repayment plans and debt restructuring

- Liaising with customers, creditors and internal teams to resolve disputes

- Implementing credit control policies and procedures

- Analyzing financial data and making credit decisions

- Producing reports and recommendations for management

- Keeping abreast of changes and developments in the credit management industry

Experience

10+ Years

Level

Senior Manager

Education

Master’s

Credit Manager Resume with 15 Years of Experience

Talented and results- driven credit manager with 15 years of experience in credit, financial analysis and risk management. Possesses a strong track record of reducing financial losses and improving portfolio performance. Recognized as a leader in identifying and managing credit risk and developing innovative strategies to reduce credit losses. Proven ability to identify and mitigate potential risks, determine credit limits and manage loan portfolios.

Core Skills:

- Credit Analysis

- Credit and Risk Management

- Negotiation of Credit and Loan Terms

- Financial Planning and Analysis

- Project Management and Leadership

- Strategic Planning

- Budgeting and Forecasting

- Credit Scorecard and Portfolio Management

Responsibilities:

- Developed and maintained appropriate credit policies and procedures

- Evaluated credit applications, analyzed financial statements, and determined appropriate credit limits

- Monitored customer accounts on a regular basis and tracked customer’s payment patterns

- Developed, implemented and monitored credit scorecards and portfolio management strategies

- Conducted financial and market analysis of customer’s ability to pay

- Negotiated loan and credit terms with customers

- Collaborated with other departments to evaluate customer’s risk, approve credit applications and manage customer’s portfolio

- Developed and managed credit portfolio, budgets and forecasts

Experience

15+ Years

Level

Director

Education

Master’s

In addition to this, be sure to check out our resume templates, resume formats, cover letter examples, job description, and career advice pages for more helpful tips and advice.

What should be included in a Credit Manager resume?

A Credit Manager is responsible for overseeing the credit worthiness of customers and ensuring that the company’s credit policy is followed. The job requires a combination of financial, management and customer service skills. In order to make a strong impression with potential employers, it is important to include the following in a Credit Manager résumé:

- Professional summary: A brief summary of your experience and qualifications, including how many years of credit management experience you possess.

- Core competencies: List of the skills and knowledge that you possess, such as credit analysis, risk assessment and loan management.

- Education: List of any education or certifications related to credit management.

- Employment History: List of previous credit management jobs and a description of the duties you performed.

- Achievements: List any awards, certifications or other achievements you have earned while working in credit management.

- Additional skills: List of any other skills that are relevant to credit management, such as accounting, customer service, or sales.

Following these guidelines will help make your résumé stand out from the competition. A well-crafted résumé can help you land your dream job as a Credit Manager.

What is a good summary for a Credit Manager resume?

A good summary for a Credit Manager resume should highlight the candidate’s ability to monitor and manage credit limits, accounts receivable, and cash collection. It should also detail the candidate’s ability to evaluate credit applications and mitigate risk, as well as their expertise in developing and implementing credit policies. The summary should also mention any relevant experience in financial analysis, budgeting, and reporting. Finally, the summary should emphasize the candidate’s strong interpersonal and communication skills, as well as their ability to work collaboratively with other departments.

What is a good objective for a Credit Manager resume?

A Credit Manager is responsible for managing the credit and collections activities within a company. As such, the objective of a Credit Manager resume should be to demonstrate the applicant’s ability to manage the company’s credit and collections with accuracy, efficiency, and professionalism. Here are some good objectives for a Credit Manager resume:

- Establish and maintain a positive relationship with clients and customers

- Manage and analyze credit applications and credit data

- Monitor adherence to credit policies and procedures

- Manage accounts receivable and ensure timely collection

- Negotiate payment arrangements with customers

- Monitor outstanding invoices and accounts receivables

- Develop and implement credit and collections strategies

- Prepare monthly and quarterly reports for management

- Monitor credit trends and identify potential risks

- Handle customer disputes and complaints

How do you list Credit Manager skills on a resume?

When crafting a resume for a Credit Manager position, skill section is critical to showcase your qualifications. Knowing what skills to list can be tricky, as you don’t want to miss any important abilities while also not wanting to include irrelevant information. To help you plan and organize your resume, here are some key Credit Manager skills to consider when putting together your resume:

- Analytical Thinking: Credit Managers must be able to analyze financial documents and data quickly and accurately. This includes being able to detect any inconsistencies or irregularities that may indicate a potential problem.

- Financial Acumen: Credit Managers must have a deep understanding of various financial principles and how to apply them. This includes having a solid grasp of accounting, budgeting, and taxation.

- Problem Solving: A successful Credit Manager must be able to troubleshoot complex issues and come up with solutions in a timely manner.

- Decision Making: Credit Managers must be able to make sound decisions quickly while taking into account all relevant factors.

- Negotiating: Credit Managers must be able to negotiate with customers and other parties in order to achieve desired outcomes.

- Communication: Credit Managers must be able to communicate effectively both verbally and in writing. This includes being able to communicate complex concepts in a clear and concise manner.

- People Skills: Credit Managers must be able to interact with customers, colleagues, and other stakeholders in a professional manner.

By including these Credit Manager skills on your resume, you can demonstrate to potential employers that you have the knowledge and experience necessary for the role.

What skills should I put on my resume for Credit Manager?

When applying for a job as a Credit Manager, it is important to make sure that your resume contains the skills and qualifications that are necessary to be successful in the role. Here is a list of skills and qualifications that should be included on your resume when applying for a Credit Manager position:

- Financial Management: Experience with financial management and understanding of accounting principles, including budgeting, forecasting and financial statements.

- Credit Analysis: Knowledge of credit analysis techniques and abilities to review financial statements and credit reports.

- Risk Management: Understanding of risk management principles and processes, including credit scoring and risk assessment.

- Regulatory Compliance: Knowledge of relevant regulations and compliance standards to ensure that all activities are compliant with applicable laws and regulations.

- Relationship Management: Ability to build and maintain positive relationships with customers, vendors and other external stakeholders.

- Negotiation: Strong negotiation skills to ensure that mutually beneficial agreements are reached.

- Communication: Effective written and verbal communication skills to communicate with internal and external stakeholders.

- Problem Solving: Strong problem-solving skills to effectively identify and resolve any credit issues.

- Risk Mitigation: Ability to develop and implement strategies to mitigate credit risks.

- Decision Making: Ability to make sound and informed decisions based on analysis of data and credit reports.

Key takeaways for an Credit Manager resume

When it comes to crafting an effective resume, there are many elements to consider. As a credit manager, your resume should showcase your experience, as well as your technical, managerial and communication skills. Here are some key takeaways to help you create an effective credit manager resume.

- Highlight Your Education: Your resume should include any relevant educational qualifications, such as a degree in business, accounting or finance. In addition, you can also list any certifications or specialized training you may have completed.

- Showcase Your Professional Experience: An effective credit manager resume should include an overview of your professional experience. This should include any managerial roles you’ve held, as well as any relevant projects or initiatives you’ve been involved in.

- Detail Your Skills: As a credit manager, you need to demonstrate that you have the necessary skills and capabilities. In your resume, make sure to list any technical and managerial skills you possess, as well as any software programs you are familiar with.

- Describe Your Achievements: To stand out from the crowd, be sure to include any accomplishments or successes you have achieved in previous roles. This will help potential employers to get a better understanding of your abilities.

- Use Action-Oriented Language: To make your resume even more compelling, be sure to use action-oriented language throughout. Instead of simply stating your job duties, focus on the results you achieved.

Following these tips can help to ensure your credit manager resume is effective and stands out from the crowd. Make sure to include all relevant information, use action-oriented language and showcase your experience and skills. Good luck!

Let us help you build

your Resume!

Make your resume more organized and attractive with our Resume Builder